Soft Tissue Repair Market Size to Worth USD 12.78 Billion by 2034 With 5.6% CAGR | Fact.MR Report

Rockville, MD, Oct. 24, 2024 (GLOBE NEWSWIRE) — According to a new industry report released by Fact.MR, the global soft tissue repair market size is expected to reach a size of US$ 7.39 billion in 2024 and further expand at 5.6% CAGR, to reach a value of US$ 12.78 billion by the end of 2034.

Because of the increasing aging population, demand for orthopedic procedures is increasing at a significant pace, offering lucrative prospects for soft tissue repair solution providers. Chronic conditions like diabetes-related gangrene, osteoarthritis, and peripheral vascular disease are boosting the demand for orthopedic procedures, including amputations. Consequently, there is a surge in overall sales within the soft tissue repair market.

Increased investment in soft tissue repair research and development fuels market expansion, fostering the introduction of novel products and technological advancements. This market is experiencing substantial growth, offering substantial opportunities for the healthcare sector.

For More Insights into the Market, Download a Sample of this Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=10115

Key Takeaways from Market Study

- The market is forecasted to expand at a CAGR of 6% from 2024 to 2034.

- Sales of soft tissue repair products in the United States are placed to reach US$ 3.05 billion in 2024.

- Brazil is set to occupy 6% market share in East Asia in 2024.

- The market in Canada is estimated to reach a value of US$ 511 million in 2024.

- The North American market is forecasted to expand at a CAGR of 9% from 2024 to 2034.

“Development of products for soft tissue repair has resulted from the growing preference for minimally invasive procedures. Increasing prevalence of sports-related injuries is an additional factor driving market growth,” says a Fact.MR analyst.

Leading Players Driving Innovation in the Soft Tissue Repair Market:

Smith & Nephew Plc.; Medtronic Plc.; Arthrex, Inc.; Medprin Biotech; Zimmer Biomet; Stryker Corporation; Baxter International, Inc.; Stryker; Medtronic; Acera Surgical Inc.; Arthrex Inc.; Integra LifeSciences; Acelity L.P. Inc.; Aroa Biosurgery Limited; Becton, Dickinson and Company; Conmed.

Rising Awareness of Injury Prevention and Rehabilitation in United Kingdom

The United Kingdom is a key player in the soft tissue repair market due to its extensive healthcare system and active population. Due to the increasing awareness of the importance of sports injury prevention and rehabilitation, the country is seeing notable advancements in this field. Prominent healthcare providers and medical equipment manufacturers also benefit the UK market. These companies continually bring innovative soft tissue repair products and methods to the market, which helps it grow. Due to its commitment to healthcare research and development, which fosters the development of cutting-edge soft tissue repair technologies, the United Kingdom is a major player in the global market.

Soft Tissue Repair Industry News:

- Theradaptive, a biopharmaceutical company leading the way in regenerative treatments, and 3D Systems, a prominent developer of additive manufacturing technology, signed a partnership designating 3D Systems as Theradaptive’s 3D printing partner. The main goal of the firms was to offer a new method of promoting bone and tissue growth by using medical devices from 3D Systems and unique Theradaptive material binding variants.

- In December 2022, Stryker debuted the Citrefix suture anchor system, designed specifically for foot and ankle surgery. The invention features a disposable suture anchor system and a resorbable biomimetic anchor body, in contrast to traditional anchor systems.

- In May 2022, Paragon 28 Inc. released the Grappler Suture Anchor System, which significantly eased the challenges related to ligament restoration and soft tissue tensioning in acute foot and ankle surgeries.

Get Customization on this Report for Specific Research Solutions: https://www.factmr.com/connectus/sample?flag=S&rep_id=10115

More Valuable Insights on Offer

Fact.MR, in its new offering, presents an unbiased analysis of the soft tissue repair market for 2019 to 2023 and forecast statistics for 2024 to 2034.

The study divulges the soft tissue repair market based on product type (synthetic, allograft, xenograft, alloplast), application (breast reconstruction, hernia, dermatology, orthopedics, dental problems, vaginal sling), and end user (hospitals, ambulatory surgical centers, clinics) across seven major regions of the world (North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and MEA).

Checkout More Related Studies Published by Fact.MR Research:

Soft Tissue Allografts Market Analysis by Cartilage Allografts, Tendon Allografts, Meniscus Allografts, Dental Allografts, and Others for Hospitals, Aesthetic Centers, and Others from 2023 to 2033

Soft Tissue Anchor Market Study by Absorbable and Non-Absorbable Metallic Suture Anchors, Bio-absorbable Suture Anchors, PEEK Sutures, All Suture, and Bio-composite Suture Anchors from 2024 to 2034

Tissue Processing System Market Study by Small Volume Tissue Processors, Medium Volume Tissue Processors, Rapid High Volume Tissue Processors from 2024 to 2034

Tissue Glue and Bio-adhesive Sealant Market Study by Protein-based, Collagen-based, Thrombin-based, Fibrin, and Gelatin-based Sealants from 2024 to 2034

Hemostasis and Tissue Sealing Agents Market Analysis By Product (Topical Hemostats, Adhesive & Tissue Sealants), By End User (Hospitals, Ambulatory Surgery Centers, Home Care Settings, Others), & By Region – 2024 to 2034.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning. With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay ahead in the competitive landscape.

Contact:

US Sales Office:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team : sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Aventon Companies Breaks Ground on Aventon Holly Hill

Aventon Holly Hill is Aventon’s Newest Community in the Orlando Metro Region

ORLANDO, Fla., Oct. 24, 2024 /PRNewswire/ — Aventon Companies, a prominent multifamily developer and general contractor with active projects throughout the Mid-Atlantic and Southeast, announces that construction has begun on its newest Orlando area development Aventon Holy Hill. The three-story, garden-style community will open in the second half of 2025.

With Aventon Holly Hill marking Aventon Companies’ sixth project in the Orlando submarket, it remains committed to the flourishing metro area. One, two and three-bedroom options will comprise 288 units spread across 14.5 acres. Each apartment will be outfitted with the firm’s signature best-in-class finishes and attention to detail. With a focus on creating a sense of community, shared amenities will include a business lounge, fitness center, game room, resort-style pool, and an on-site pet spa. The community’s prime location on U.S. Route 27 also offers easy commuting access to major area employers within the Orlando Commercial Corridor and to local attractions like Disney World.

“Data indicates that Orlando is one of the fastest growing areas in the entire country with over 1,500 new residents added to the population every week,” said Sean Flanagan, Senior Development Director for Aventon Companies. “Aventon Holly Hill is designed to fulfill the growing desire for luxury living in the heart of it all.”

The overall design of Aventon Holly Hill was created by Watts Leaf Architects, with interiors curated by Studio 5 Interiors. The property will be located at the intersection of Holly Hill Grove Road and U.S. Route 27 in the city of Davenport. Since 2019, Aventon Companies has assembled an impressive $2 billion portfolio of ground-up developments bringing nearly 9,000 Aventon-branded apartment homes to Florida, Georgia, the Carolinas, and the Mid-Atlantic.

About Aventon Companies

Aventon Companies acquires, develops, constructs, and asset manages multifamily communities in Florida, Georgia, the Carolinas and the Mid-Atlantic with regional offices in West Palm Beach, FL, Tampa, FL, Orlando, FL, Raleigh, NC and Bethesda, MD. To learn more, visit www.aventoncompanies.com.

Media Contact:

Kristen Skladd

586-222-2423

kristen@andersoncollaborative.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/aventon-companies-breaks-ground-on-aventon-holly-hill-302285397.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/aventon-companies-breaks-ground-on-aventon-holly-hill-302285397.html

SOURCE Aventon Companies

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

What's Going On With Meta Platforms Stock Ahead Of Q3 Earnings?

Meta Platforms Inc META shares are up nearly 25% over the past quarter. The company is gearing up to report earnings again next week. Here’s a look at what you need to know ahead of the report.

What To Know: Meta is scheduled to report third-quarter financial results after the market close on Oct. 30. The company is expected to report earnings of $5.24 per share and revenue of $40.253 billion, according to estimates from Benzinga Pro.

Meta has exceeded analyst estimates on the top and bottom lines in six consecutive quarters heading into the third-quarter print.

Last quarter, Meta beat analyst estimates as revenue jumped 11% year-over-year and daily actives climbed 7%. The company noted at the time that Meta AI was on track to be the most used AI assistant in the world by the end of the year.

“We had a good quarter. We continue to see strong engagement across our apps and we have the most exciting roadmap I’ve seen in a while with Llama 2, Threads, Reels, new AI products in the pipeline, and the launch of Quest 3 this fall,” CEO Mark Zuckerberg said in the second-quarter earnings release.

Check This Out: Meta’s Reels Monetization and AI Innovations Drive Top AI Pick: Analyst

Several analysts have already released positive updates ahead of earnings next week. BofA Securities maintained a Buy rating and price target of $630 earlier this week, calling Meta a top AI pick. The analyst firm expects Meta’s quarterly results to exceed consensus estimates.

Jefferies also maintained a Buy rating on Meta this week and lifted the price target from $600 to $675. Other recent analyst changes include a price target increase to $675 by TD Cowen, an Overweight reiteration from Cantor Fitzgerald and a price target bump to $650 from Mizuho.

Mizuho analyst James Lee maintained an Outperform rating on the stock heading into earnings as he anticipates a beat-and-raise quarter from the tech giant next week.

Ad agency checks showed that ad spending is ahead of consensus estimates and at the high-end of Meta’s guidance for 20% growth year-over-year, the analyst said.

“Although the stock is a crowded trade into the print, we believe it is the only big tech internet name that could beat and raise with substantial optionality in messaging and Gen-AI for creative,” Lee said.

Meta will hold a conference call at 5 p.m. ET next Wednesday to discuss the company’s quarterly performance with analysts and investors.

META Price Action: Meta shares are up approximately 60% year-to-date heading into the report. The stock was up 0.54% at $566.74 the time of publication Thursday, according to Benzinga Pro.

Photo: Shutterstock.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

3 Outstanding Dividend Stocks That Are Too Cheap to Ignore

When dividend-paying companies go on sale, their yields increase, which can make them juicy passive income opportunities. But a dividend is only as good as the company paying it; meaning if you’re going to invest in a beaten-down dividend-paying company, it has to be able to overcome whatever challenges it is going through.

United Parcel Service (NYSE: UPS) and Devon Energy (NYSE: DVN) are far from firing on all cylinders, but both companies have what it takes to find their footing. Meanwhile, the stock of Kinder Morgan (NYSE: KMI) just hit an eight-year high and could still be a great value.

Here’s what makes all three dividend stocks great buys now, according to these Motley Fool contributors.

Daniel Foelber (United Parcel Service): UPS has a 22.2 price-to-earnings ratio (P/E) and a dividend yield of 4.8%. So right off the bat, it stands out as an intriguing high-yield value stock. But when a well-known industry leader has a depressed valuation or inflated yield, it is usually for good reasons.

UPS has seen a significant reduction in its sales growth and profitability in the past couple of years. As you can see in the following chart, it enjoyed a surge in sales and margins during the pandemic, but now the business is arguably worse off than it was pre-pandemic. Past success means little to investors, who tend to care more about where a company is headed than where it has been.

In March, UPS outlined a three-year plan to get back on course, with an emphasis on increasing delivery volumes in 2024 and operating margins in 2025 and 2026. It has made some progress on that plan, with higher delivery volumes in the second quarter, but it needs to sustain that momentum to impress investors.

The good news is that UPS remains highly committed to its dividend, although raises may be small for the foreseeable future until the company can show meaningful earnings growth, and thus justify a higher payout. But at a 4.8% yield, it is already offering income investors something to like, making it a worthwhile dividend stock to consider buying now.

Scott Levine (Devon Energy): For those looking to procure steady passive income, it can be incredibly exciting to find a compelling dividend stock.

But to find one sitting in the bargain bin? That’s the icing on the cake — and it’s an opportunity that is available with Devon Energy, which offers a juicy forward dividend yield of 4.9%. Currently, shares of this leading oil stock trade at 3.8 times operating cash flow, representing a discount to the five-year average cash flow multiple of 4.

Looking At Bank of America's Recent Unusual Options Activity

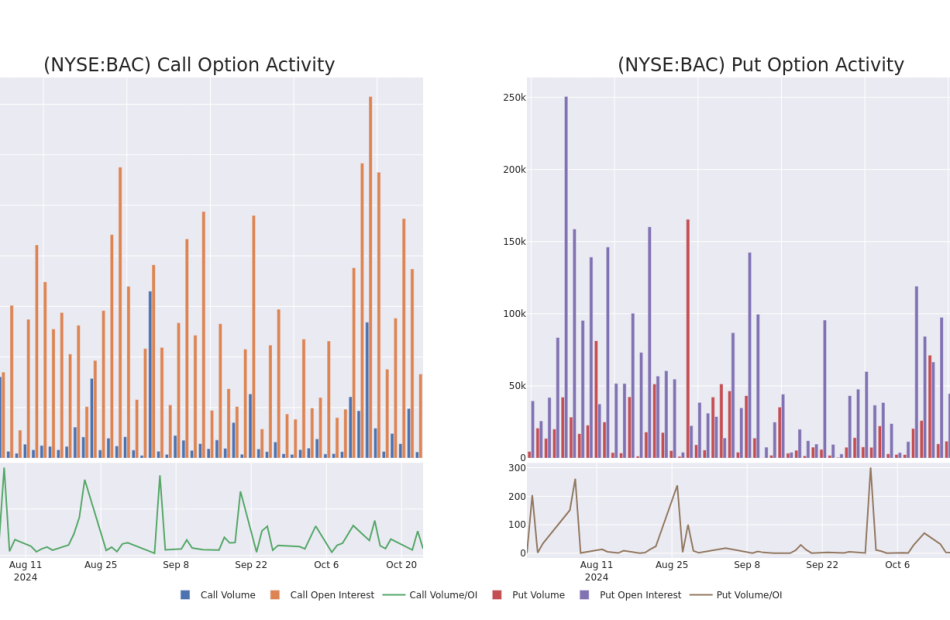

Financial giants have made a conspicuous bearish move on Bank of America. Our analysis of options history for Bank of America BAC revealed 37 unusual trades.

Delving into the details, we found 45% of traders were bullish, while 48% showed bearish tendencies. Out of all the trades we spotted, 25 were puts, with a value of $1,600,134, and 12 were calls, valued at $408,606.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $20.0 to $48.0 for Bank of America during the past quarter.

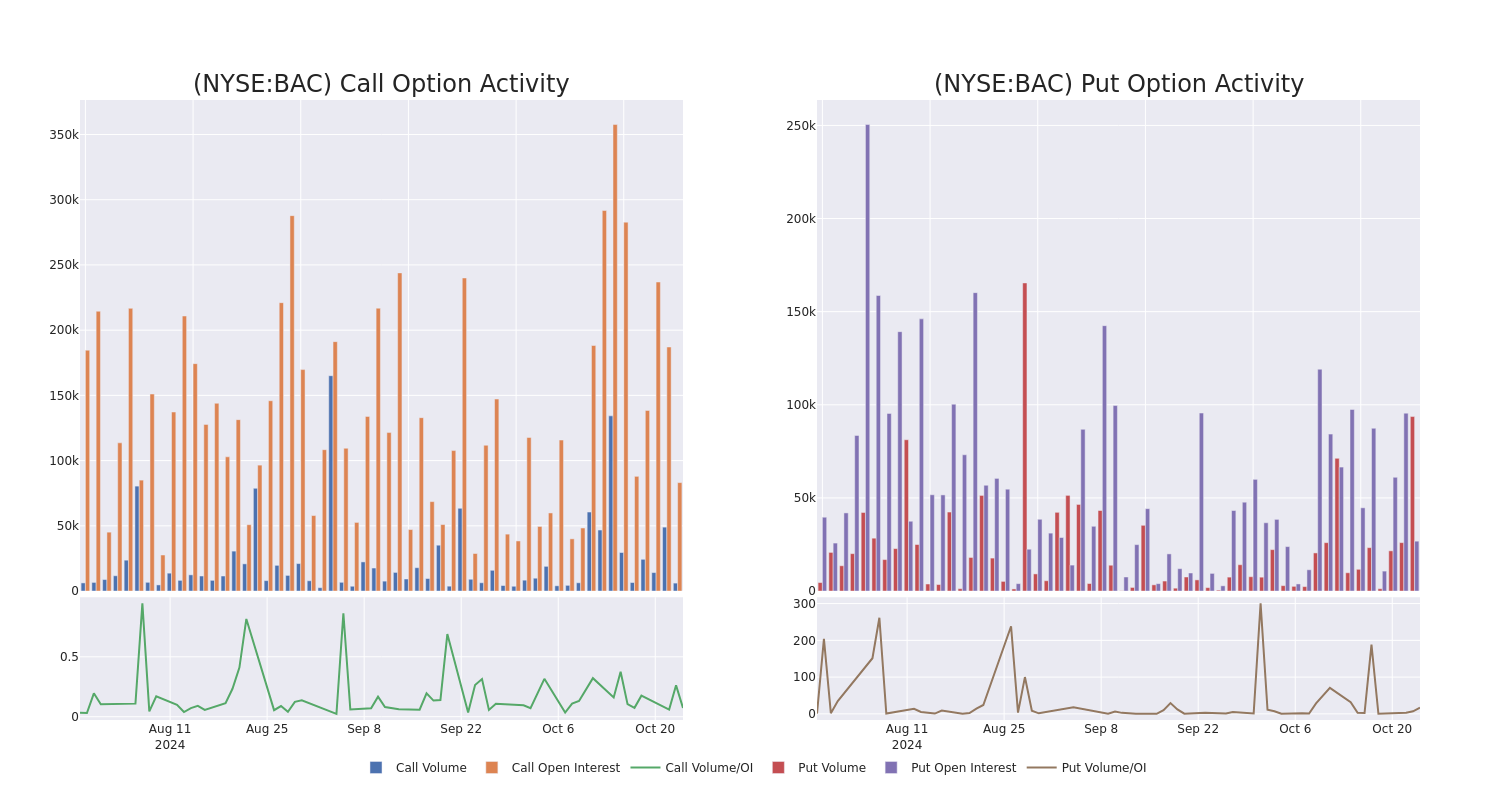

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for Bank of America options trades today is 9159.25 with a total volume of 99,774.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Bank of America’s big money trades within a strike price range of $20.0 to $48.0 over the last 30 days.

Bank of America Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BAC | PUT | SWEEP | BULLISH | 01/17/25 | $2.42 | $2.4 | $2.4 | $43.00 | $79.9K | 5.4K | 4.0K |

| BAC | CALL | SWEEP | BEARISH | 12/20/24 | $22.5 | $22.4 | $22.43 | $20.00 | $76.2K | 15 | 0 |

| BAC | PUT | SWEEP | BULLISH | 01/17/25 | $2.37 | $2.34 | $2.34 | $43.00 | $76.0K | 5.4K | 6.2K |

| BAC | PUT | SWEEP | BULLISH | 01/17/25 | $2.35 | $2.33 | $2.33 | $43.00 | $73.3K | 5.4K | 6.2K |

| BAC | PUT | SWEEP | BULLISH | 01/17/25 | $2.43 | $2.41 | $2.41 | $43.00 | $72.3K | 5.4K | 3.7K |

About Bank of America

Bank of America is one of the largest financial institutions in the United States, with more than $3.0 trillion in assets. It is organized into four major segments: consumer banking, global wealth and investment management, global banking, and global markets. Bank of America’s consumer-facing lines of business include its network of branches and deposit-gathering operations, retail lending products, credit and debit cards, and small-business services. The company’s Merrill Lynch operations provide brokerage and wealth-management services, as does its private bank. Wholesale lines of business include investment banking, corporate and commercial real estate lending, and capital markets operations. Bank of America has operations in several countries but is primarily US-focused.

In light of the recent options history for Bank of America, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of Bank of America

- Trading volume stands at 15,957,725, with BAC’s price down by -0.09%, positioned at $42.3.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 84 days.

Expert Opinions on Bank of America

5 market experts have recently issued ratings for this stock, with a consensus target price of $48.2.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Morgan Stanley has decided to maintain their Overweight rating on Bank of America, which currently sits at a price target of $48.

* An analyst from RBC Capital has revised its rating downward to Outperform, adjusting the price target to $46.

* An analyst from Morgan Stanley persists with their Overweight rating on Bank of America, maintaining a target price of $47.

* An analyst from Keefe, Bruyette & Woods persists with their Outperform rating on Bank of America, maintaining a target price of $50.

* Consistent in their evaluation, an analyst from Oppenheimer keeps a Outperform rating on Bank of America with a target price of $50.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Bank of America options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

What's Next: Stellar Bancorp's Earnings Preview

Stellar Bancorp STEL is set to give its latest quarterly earnings report on Friday, 2024-10-25. Here’s what investors need to know before the announcement.

Analysts estimate that Stellar Bancorp will report an earnings per share (EPS) of $0.48.

The announcement from Stellar Bancorp is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It’s worth noting for new investors that guidance can be a key determinant of stock price movements.

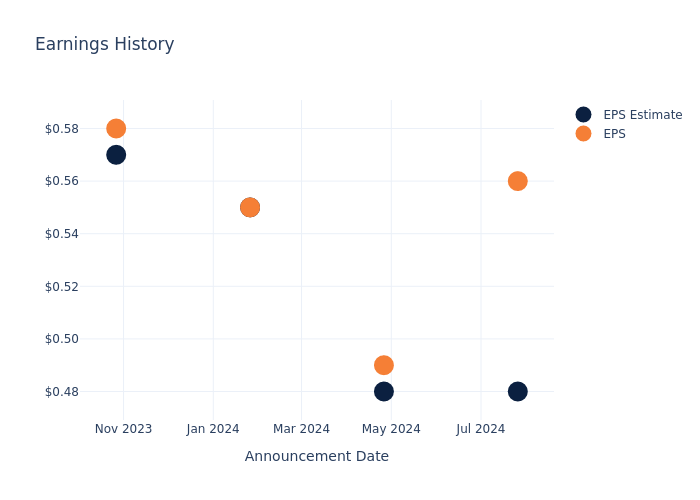

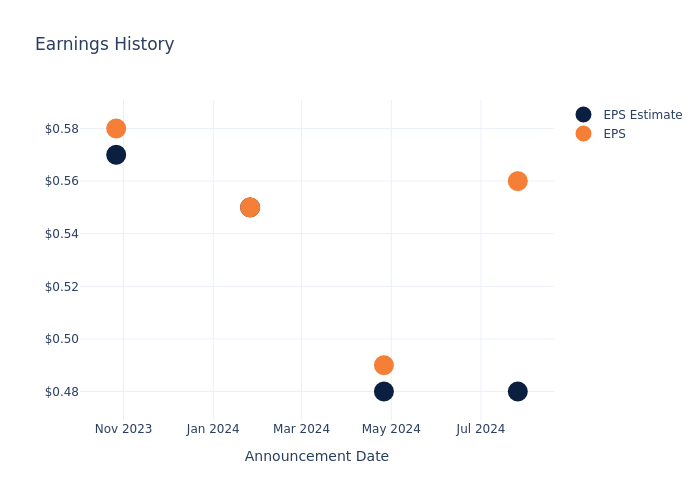

Historical Earnings Performance

The company’s EPS beat by $0.08 in the last quarter, leading to a 0.0% drop in the share price on the following day.

Here’s a look at Stellar Bancorp’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.48 | 0.48 | 0.55 | 0.57 |

| EPS Actual | 0.56 | 0.49 | 0.55 | 0.58 |

| Price Change % | 1.0% | -6.0% | 0.0% | -3.0% |

Tracking Stellar Bancorp’s Stock Performance

Shares of Stellar Bancorp were trading at $26.19 as of October 23. Over the last 52-week period, shares are up 20.93%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

To track all earnings releases for Stellar Bancorp visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

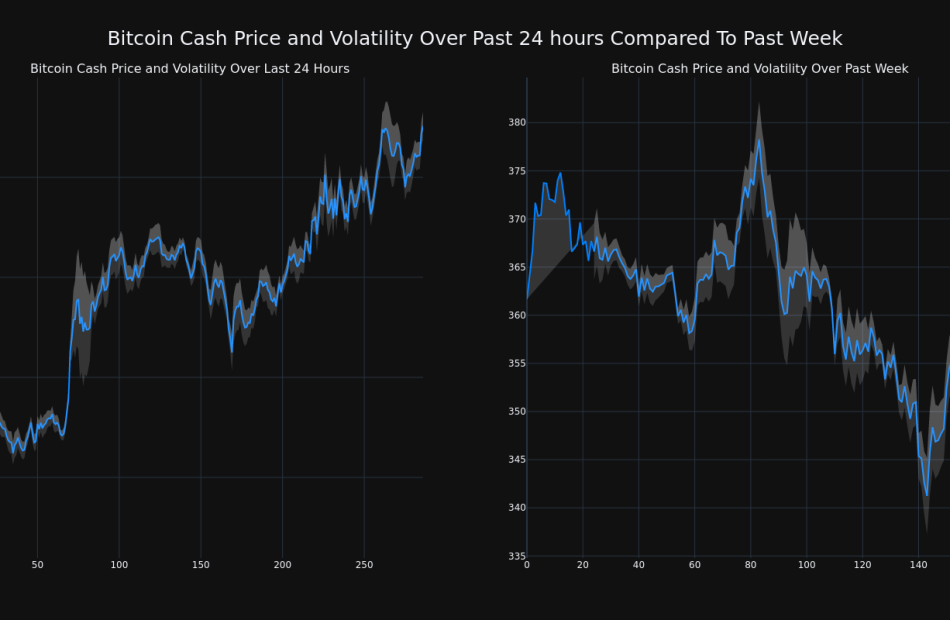

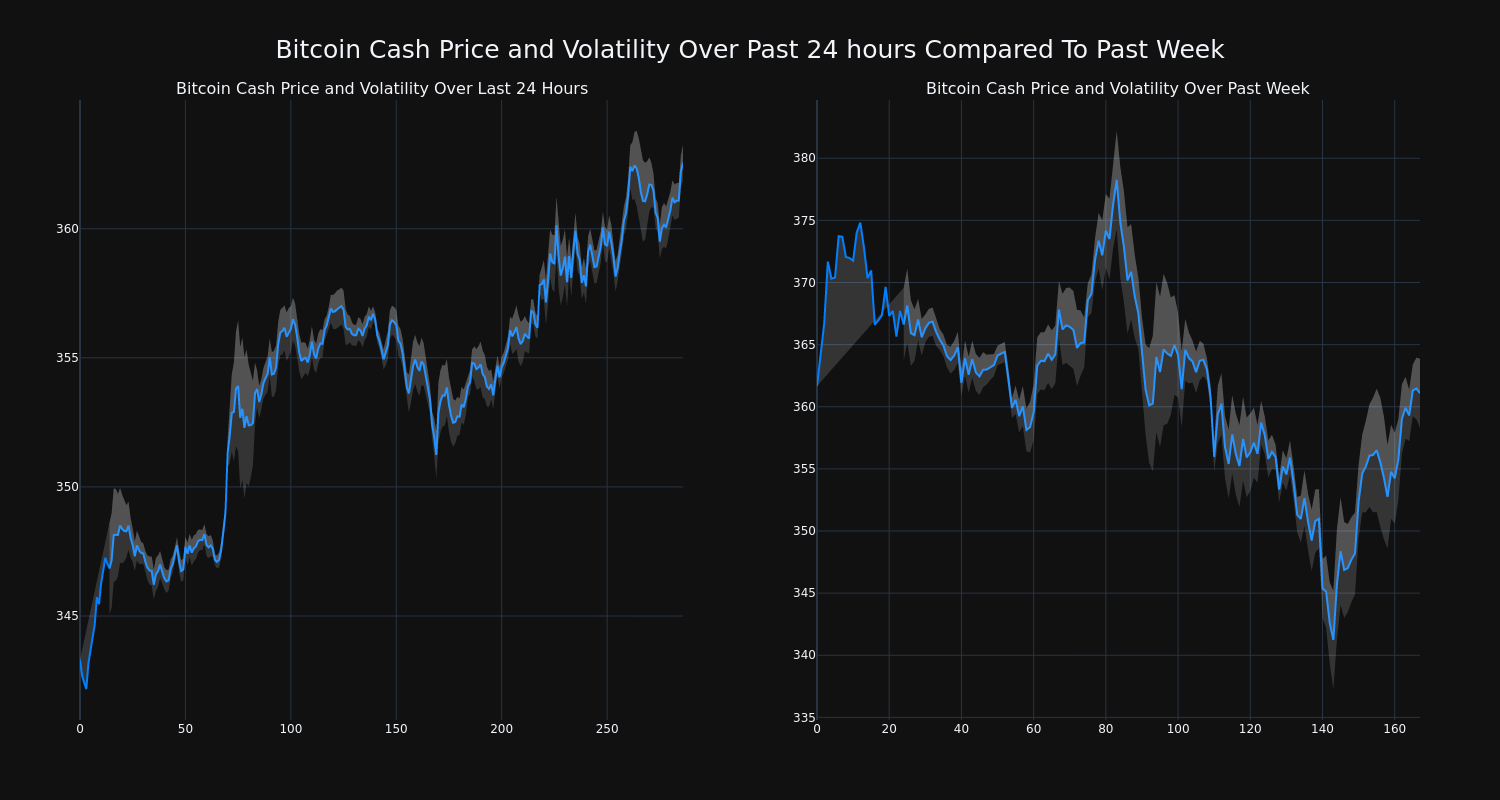

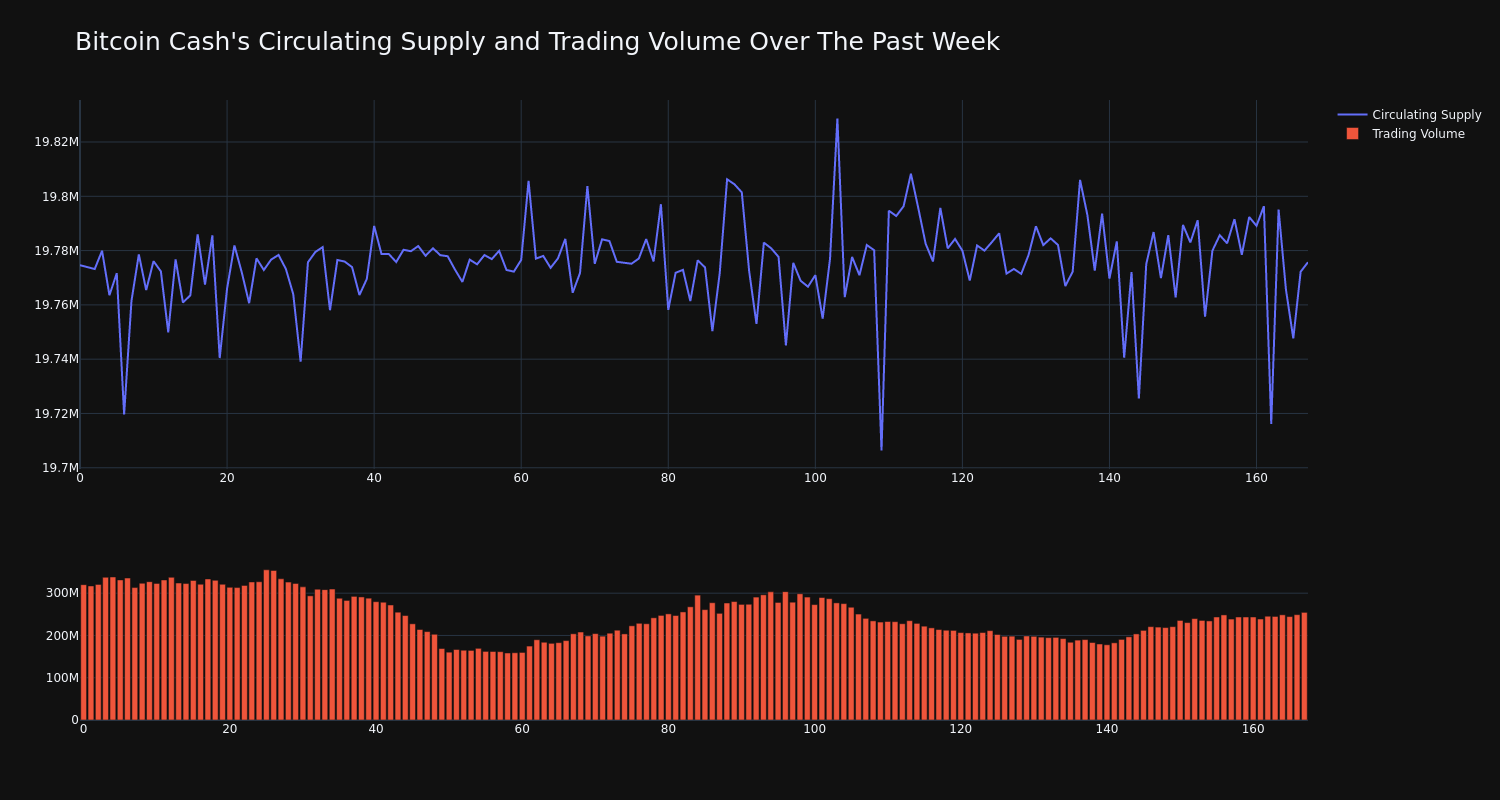

Bitcoin Cash's Price Increased More Than 5% Within 24 hours

Bitcoin Cash’s BCH/USD price has increased 5.65% over the past 24 hours to $362.7, which is in the opposite direction of its trend over the past week, where it has experienced a 0.0% loss, moving from $361.67 to its current price. As it stands right now, the coin’s all-time high is $3,785.82.

The chart below compares the price movement and volatility for Bitcoin Cash over the past 24 hours (left) to its price movement over the past week (right). The gray bands are Bollinger Bands, measuring the volatility for both the daily and weekly price movements. The wider the bands are, or the larger the gray area is at any given moment, the larger the volatility.

The trading volume for the coin has tumbled 20.0% over the past week while the circulating supply of the coin has risen 0.01%. This brings the circulating supply to 19.78 million, which makes up an estimated 94.18% of its max supply of 21.00 million. According to our data, the current market cap ranking for BCH is #19 at $7.18 billion.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

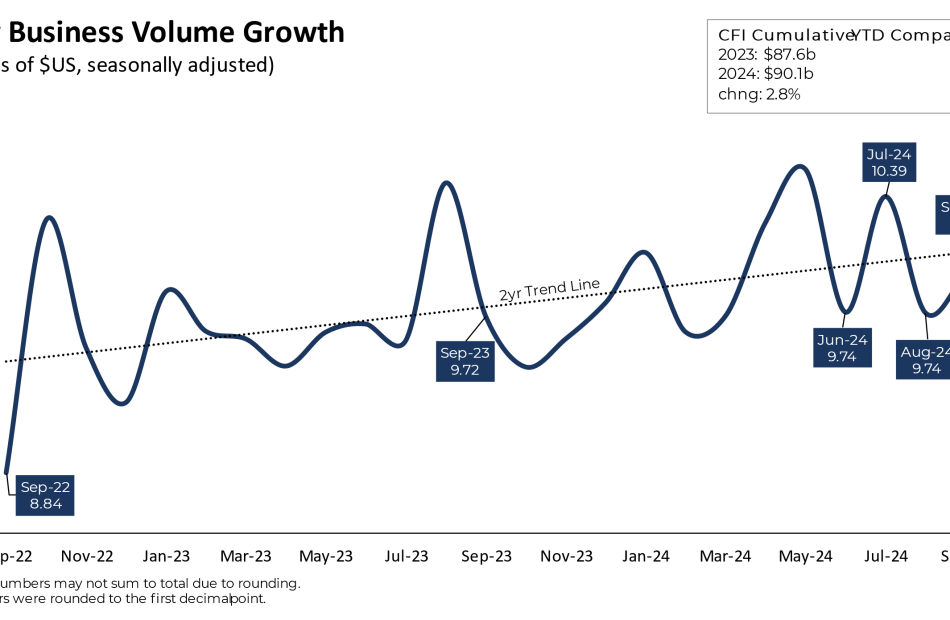

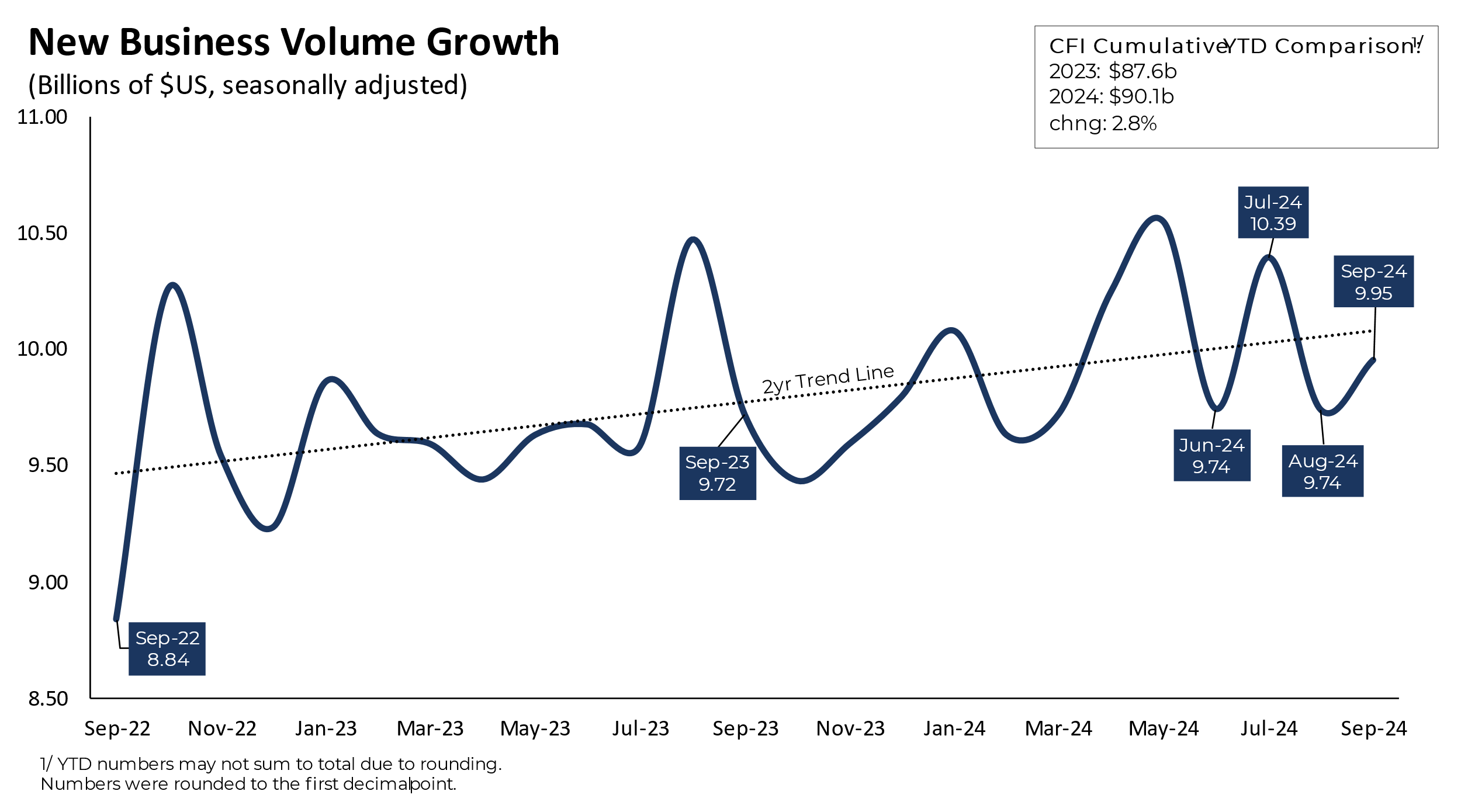

Equipment Leasing and Finance Association CapEx Finance Index: September 2024

********************************************************************************************************

Note to readers: ELFA has updated the name of the Monthly Leasing and Finance Index (MLFI-25) to the CapEx Finance Index (CFI) to better reflect what it measures and how it impacts the broader U.S. economy.

********************************************************************************************************

WASHINGTON, Oct. 24, 2024 (GLOBE NEWSWIRE) —

Demand for equipment picked up. New business volume grew by $10.0 billion from August to September, a monthly increase of 2.2% before rounding. Growth in business volume has been uneven in 2024 but continues to hover around historic highs. The September release suggests that equipment investment continued to expand at a healthy pace at the end of the third quarter.

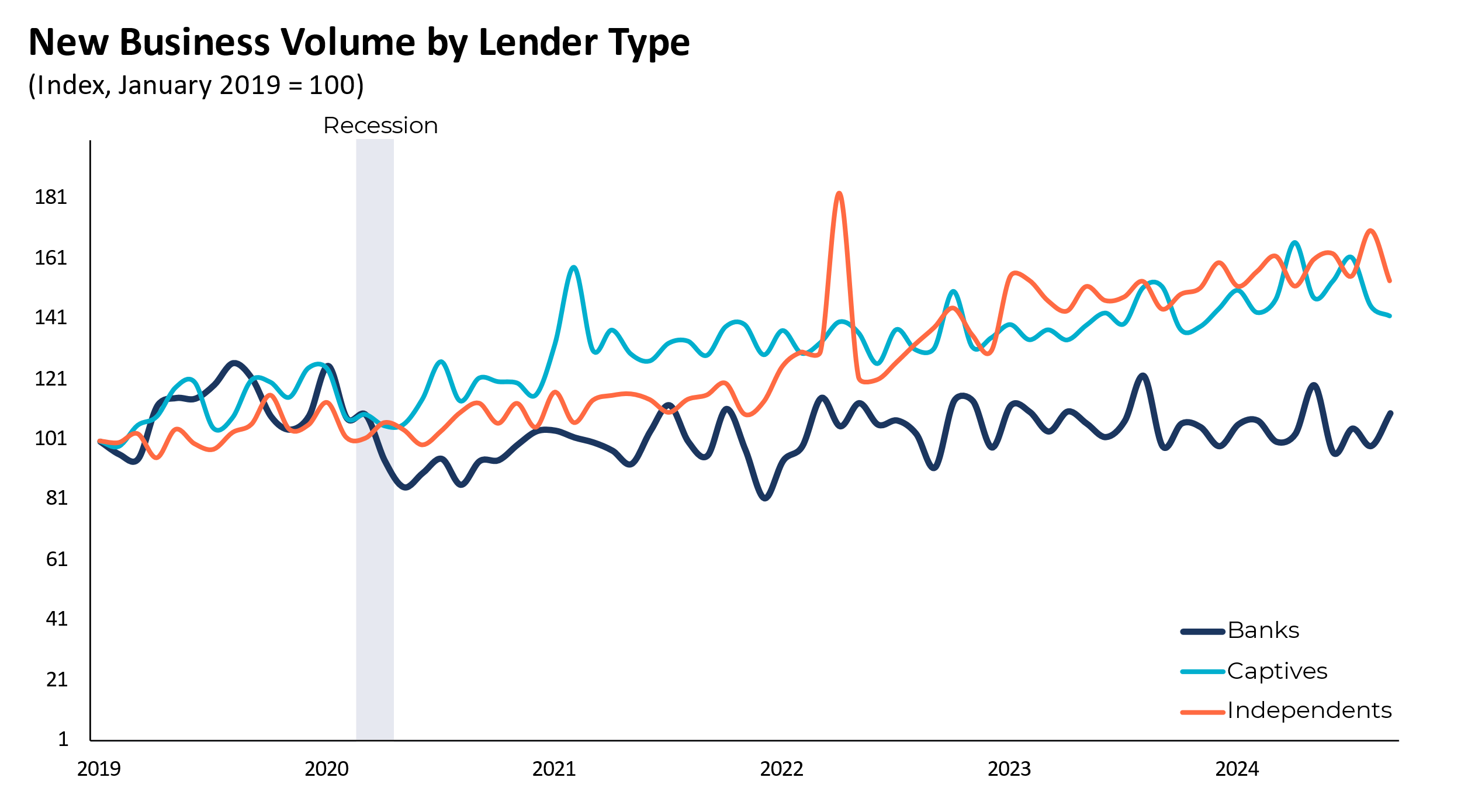

Bank lending drove new business growth. The sub-index for business volume at banks grew by 10.9% from August to September, which was more than enough to offset the contraction in activity at captives and independents, which declined by 2.3% and 9.8%, respectively. The figure below shows that bank activity has lagged other sources over the last few years, but the latest data suggests that banks may be easing back into the lending and leasing market.

Lenders continue to add headcount. The 12-month change in employment was just over 1.0%, slightly slowing from the 1.2% pace recorded in August. Employment has been a source of strength this year, following nearly five years of persistent declines in headcount.

Credit approvals remained steady. The percentage of credit applications approved ticked down 0.7 percentage points to 75.6%. The approval rate has been hovering around 75% for most of 2024.

Lender balance sheets improved for a second consecutive month. The percentage of credit lines over 30 days past due and charge-offs declined. Both have been trending up over the last two years as borrowing conditions tightened due to the rapid increase in interest rates.

Industry Confidence

The Monthly Confidence Index from ELFA’s affiliate, the Equipment Leasing & Finance Foundation, is 61.8 in October, steady with the September index of 61.9, which was the highest level since January 2022.

Industry Voices

“Our latest CapEx Finance Survey showed that equipment demand continued to defy high interest rates in September. The uptick in bank lending was particularly encouraging and is something I will be watching closely as we approach the end of the year. I wouldn’t be surprised if the next few surveys show a cooling in lending volumes as election uncertainty peaks and some businesses wait for rates to drop further. That said, balance sheets continued to improve, and the percentage of approved new credit applications remained healthy, signs that lenders and borrowers are in a great position to weather any gusts that might come along in the fourth quarter.”

ELFA President and CEO, Leigh Lytle

“A healthy increase in YOY business volume, especially in August and September, validates our 12-month increase in headcount as we continue strengthening our value proposition for all of CEFI’s stakeholders. A decreasing interest rate environment driving increased business volume and net interest margin will enhance bottom-line returns for CEFI and the industry until competitors become more aggressive.” Ricardo E. Rios, CFA, CLFP, President & COO, Commercial Equipment Finance, Inc (CEFI)

About ELFA’s CFI

The CFI is the only near-real-time index that reflects capex, or the volume of commercial equipment financed in the U.S. It is released monthly from Washington, D.C., one day before the U.S. Department of Commerce’s durable goods report. This financial indicator complements reports like the Institute for Supply Management Index, providing a comprehensive view of productive assets in the U.S. economy—equipment produced, acquired and financed. The CFI consists of two years of business activity data from 25 participating companies. For more details, including methodology and participants, visit www.elfaonline.org/CFI.

About ELFA

The Equipment Leasing and Finance Association (ELFA) represents financial services companies and manufacturers in the $1 trillion U.S. equipment finance sector. ELFA’s 575 member companies provide essential financing that helps businesses acquire the equipment they need to operate and grow. Learn how equipment finance contributes to businesses’ success, U.S. economic growth, manufacturing and jobs at http://www.elfaonline.org.

Media/Press Contact: Amy Vogt, Vice President, Communications and Marketing, ELFA, avogt@elfaonline.org

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/cee789e6-c777-4190-9b5d-4361b6712379

https://www.globenewswire.com/NewsRoom/AttachmentNg/721cf1e0-33c3-4767-882b-bceb720b01b1

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Aviation Actuator System Market Size & Share to Surpass USD 3.1 billion by 2031, Rising at a CAGR of 6.8% | Analysis by Transparency Market Research, Inc.

Wilmington, Delaware, United States, Transparency Market Research Inc. -, Oct. 24, 2024 (GLOBE NEWSWIRE) — The aviation actuator system market (항공 액추에이터 시스템 시장) was worth US$ 1.7 billion in 2022. A CAGR of 6.8% is predicted from 2023 to 2031, leading to a market value of US$ 3.1 billion by 2031. Actuators are being replaced by electric actuators in the aviation industry as hydraulic actuators and pneumatic actuators become obsolete. Electric actuators provide power efficiency, are lightweight, compact, fuel-efficient, and reliable, and are highly advantageous.

Electric actuation systems, which address issues pertaining to fluid control, cleaning, heating, and control, are expected to improve aircraft performance. Aviation actuator systems are a beneficial component of sustainable electric aircraft, contributing to the development of eco-friendly aircraft. Electronic systems are becoming increasingly important to aircraft as they become more dependent on electronic systems.

With the development of the next generation of aircraft, more electronic systems will be used, which will require high reliability. Increasing demand for advanced electronic components will lead to the popularity of electronic actuator systems in the aviation industry. Dispatch systems offer benefits such as greater efficiency and improved dispatch availability, which will increase demand for the services.

Download sample PDF copy of report: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=51987

Key Findings of the Market Report

- Based on the actuator type, electric actuators are expected to be in high demand in aviation actuator systems.

- In terms of application, the flight control segment is predicted to drive demand for aviation actuator systems.

- The demand for aviation actuator systems is primarily driven by commercial aviation.

- Asia Pacific accounted for a significant share of the global market in 2022.

Global Aviation Actuator System Market: Growth Drivers

- Global air travel demand has become a major driving force in the aviation industry. To meet this demand, airlines are increasing their fleets to meet an increasing demand for advanced and efficient actuator systems.

- As aircraft technology advances, such as introducing more electric aircraft (MEAs) and fly-by-wire systems, sophisticated actuator systems are in increasing demand. In addition to improving performance and efficiency, these systems are lighter and more efficient.

- The aviation industry is subject to strict safety regulations. Various aircraft components, including control surfaces and landing gear, rely heavily on actuator systems to ensure their safe and reliable operation. Safety regulations and standards may contribute to the demand for high-performance actuators.

- Aviation manufacturers are developing more fuel-efficient and environmentally friendly aircraft as sustainability and fuel efficiency become more important. Advanced actuator systems can optimize aircraft performance and reduce fuel consumption.

- Modern military aircraft incorporate advanced technologies for better agility, stealth, and performance, which also drives demand for advanced actuator systems. Next-generation military aircraft and increased defense budgets can boost the aviation actuator market.

- Aerospace researchers and engineers continue to develop advanced materials, sensors, and actuation mechanisms through ongoing research and development efforts. These innovations will likely make actuator systems more efficient and newer.

Global Aviation Actuator System Market: Regional Landscape

- Aviation actuator systems are expected to be a significant market in Asia Pacific. A significant increase in air travel demand has been observed in Asia, along with economic growth and rising incomes. As passenger traffic increases, new aircraft are needed, creating a demand for aviation actuator systems.

- Several Asia Pacific countries have seen a rise in air travel due to their burgeoning middle-class population. People with higher incomes are able to fly more often, resulting in an expansion of airline fleets in the region, driving the demand for advanced aviation technologies, such as actuators.

- Commercial and military fleets in several Asia Pacific countries are being modernized. Modernization often involves improving aircraft performance, safety, and reliability by adopting new and more efficient actuator systems.

- As defense budgets in the Asia Pacific region have increased, new military aircraft have been purchased. Advanced actuator systems are often integrated into modern military aircraft to ensure maneuverability and precise control.

Unlock Growth Potential in Your Industry! Download PDF Brochure: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=51987

Global Aviation Actuator System Market: Competitive Landscape

Technology advancements and advanced materials incorporated into aviation actuator system design have created substantial growth opportunities for companies in this field. Leading players are launching new devices to enhance their product portfolios, and a business expansion is being invested to increase profitability and productivity.

Key Players Profiled

- Aero Space Controls Corporation

- General Electric

- Honeywell International Inc.

- ITT INC.

- Microsemi

- Moog Inc.

- PARKER HANNIFIN CORP

- Collins Aerospace

- Safran

- SAM GmbH

- Crissair, Inc.

- Woodward Inc.

Key Developments

- In October 2022, Moog Inc., which manufactures, integrates, and designs discrete and integrated control systems, launched and retrieved an X-61A Gremlins Air Vehicle (GAV) on its fourth flight test. With three GAVs, Gremlins conducted four individual flight sorties, including an airborne recovery mission that lasted 1.4 hours.

- In July 2023, Safran acquired Collins Aerospace’s actuation and flight control business. By acquiring ATA27, Safran gained global leadership in flight control (ATA27) and actuation.

Global Aviation Actuator System Market: Segmentation

By Actuator Type

- Mechanical Actuator

- Hydraulic Actuator

- Electric Actuator

- Others (Including Piezoelectric Actuator, Pneumatic Actuator, and Electrohydrostatic Actuator)

By Application

- Flight Control

- Auxiliary Control

- Utility Actuation

- Others (Including Weapons Bay Door Drive)

By End Use

- Commercial Aviation

- Defense

By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Buy this Premium Research Report: https://www.transparencymarketresearch.com/checkout.php?rep_id=51987<ype=S

More Trending Reports by Transparency Market Research –

AI in Aviation Market (航空市場における AI)- The industry was valued at US$ 713.3 Mn in 2022 and it is projected to grow at a CAGR of 37.0% from 2023 to 2031 and reach more than US$ 12.1 Bn by the end of 2031

Sustainable Aviation Fuel Market (Markt für nachhaltigen Flugtreibstoff)- The global industry was valued at US$ 186.6 Mn in 2022 and it is projected to grow at a CAGR of 26.2% from 2023 to 2031 and reach more than US$ 402.0 Bn by the end of 2031

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

ServiceNow Sales Growth Fails to Impress AI-Hungry Investors

(Bloomberg) — ServiceNow Inc. reported strong third-quarter sales and bookings as the software company expands its suite of AI tools.

Most Read from Bloomberg

Subscription sales, which account for the bulk of ServiceNow’s revenue, increased 23% to $2.7 billion in the period, the company said Wednesday in a statement. Current remaining performance obligation, a measure of booked sales, increased 26% in the period ending Sept. 30. Both exceeded analysts’ estimates.

The Santa Clara, California-based company makes applications that help companies organize and automate their personnel and information technology operations. Like its peers, ServiceNow is baking generative AI features into its products and offers a pricier tier with those tools.

The company’s main generative AI assistant product, Now Assist, is the fastest-growing in company history, Chief Executive Officer Bill McDermott said in an interview. The average contract premium for users of Now Assist is 30%, he added.

The shares hit a record high Thursday in New York, jumping about 6%. Investors were initially unimpressed with the results, with the stock trading down Wednesday evening. The shares had increased 28% this year through Wednesday’s close. That’s more than twice the rally seen in the iShares Expanded Software ETF, which is often used as a sector benchmark.

The results “validate the company’s rare standing in enterprise software,” wrote Tyler Radke, an analyst at Citigroup. He cited strong execution in a tough environment for tech spending and early monetization of generative AI.

In recent weeks, ServiceNow and software peers like Salesforce Inc. and Microsoft Corp. have begun emphasizing AI “agents” that can complete tasks without user supervision. Some customers are already trying ServiceNow’s agents, which will be released more broadly next month, McDermott said. Once the agents are fully rolled out, they’ll be priced differently from other products, McDermott added.

For the current quarter ending in December, ServiceNow projected subscription revenue of about $2.88 billion, just ahead of analyst estimates. The company expects near-term bookings to rise 21.5%.

This bookings guidance was effectively “good, but not great,” Kirk Materne, an analyst at Evercore ISI, said in a note. He added that the company tends to issue conservative forecasts for the fourth quarter.