Fourth Avenue Capital breaks ground on 240 apartments in Liberty Lake, WA

SEATTLE, Oct. 24, 2024 /PRNewswire/ — Garden-Style Community to Add 240 Apartment Homes to Liberty Lake’s Meadowwood Technology Campus.

Fourth Avenue Capital has commenced construction on Signal Point Apartment Homes, a luxury suburban apartment community within the mixed-use Meadowwood Technology Campus in Liberty Lake, WA.

This new development will feature 240 apartment homes, complemented by an expansive resident clubhouse, gym, and leasing center. Set in a tranquil, park-like environment, Signal Point is just minutes from the town center, with easy access to major highways. The first move-ins are projected for mid-2025.

“Liberty Lake continues to be one of the most sought-after markets in the Spokane metro area,” said Chris Rossman, Managing Partner of Fourth Avenue Capital. “Its excellent schools, small-town charm, and abundant recreational opportunities make it an ideal location for Signal Point.”

Located at 24085 E Mission Ave, Signal Point is perfectly situated to take advantage of Liberty Lake’s many amenities. As part of the Meadowwood Technology Campus, residents will enjoy access to a wide range of services and amenities within the master-planned community. Nearby recreational spots such as Liberty Lake, Liberty Lake Golf Course, Meadowwood Golf Course, and Rocky Hill Park are all within a mile and a half of the property.

“Our goal was to blend top-tier suburban living amenities with the natural beauty of the area,” Rossman added. “Signal Point will offer residents the modern conveniences they expect, while providing the open spaces and outdoor features of a garden-style community.”

Signal Point will offer a mix of one-, two-, and three-bedroom apartment homes, ranging from 733 to 1,318 square feet. Each unit will be outfitted with high-end finishes, including quartz countertops, stainless steel appliances, under-cabinet lighting, wood-style flooring, and oversized windows. Many homes will also include walk-in closets and extra storage space.

The community will be rich in amenities, including an oversized clubhouse with entertainment areas, social spaces, and private workstations. Fitness enthusiasts will appreciate the full-size gym, equipped with cardio machines, free weights, and CrossFit options, all overlooking the pool area and lawn, where residents can extend their workouts outdoors. Additional outdoor amenities include a spacious living area with a dining section and fireplace, a pool and spa, barbecue grills, lounging spaces, and a dog park.

Signal Point is designed to offer the perfect blend of modern luxury and suburban comfort, making it a standout option for those seeking a high-quality living experience in Liberty Lake.

About Fourth Avenue Capital

Fourth Avenue Capital is a real estate investment, development, and operating company headquartered in Seattle and Spokane, Washington focused on middle market multifamily assets in the Pacific Northwest. FAC has acquired over 1,000 units/ beds to date and a development pipeline exceeding 500 units and $150MM cost. FAC’s existing assets under management total more than $300M.

Fourth Avenue Capital plans to expand its portfolio through strategic acquisitions, leveraging strong relationships with industry partners and its ability to identify attractive investment opportunities. By aligning investor interests and implementing sustainable practices, the company aims to create lasting value while making a positive impact on the communities it serves.

For more information about Fourth Avenue Capital, please visit www.fourthavecapital.com

Media Contact:

Fourth Avenue Capital

investors@fourthavecapital.com

www.fourthavecapital.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/fourth-avenue-capital-breaks-ground-on-240-apartments-in-liberty-lake-wa-302285151.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/fourth-avenue-capital-breaks-ground-on-240-apartments-in-liberty-lake-wa-302285151.html

SOURCE Fourth Avenue Capital

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Redwood's Fall 2024 Sustainability in Logistics Report: 97% of Companies Considering a Digital Solution to Deliver on Scope 3 Decarbonization goals

—Research indicates that decarbonization efforts bring companies

$200M in annual net benefits—

CHICAGO, Oct. 24, 2024 (GLOBE NEWSWIRE) — Redwood’s Fall 2024 Sustainability in Logistics Report, informed by recent Gartner and Boston Consulting Group research, as well as Redwood’s recent Sustainability in Logistics event, has indicated significant momentum for companies’ investment in decarbonization and sustainability practices.

The Gartner Market Guide for Logistics Carbon Accounting and Management Solutions, featuring Redwood as a Representative Vendor, reported that: “The adoption of logistics carbon accounting and management solutions (LCAMSs), which enables evaluation of logistics greenhouse gas (GHG) sustainability performance, is accelerating. According to a study conducted by the Scope 3 Peer Group, 97% of responding organizations consider the use of a digital solution to help them deliver on their company’s Scope 3 decarbonization goals to be very or extremely important.”

At the Redwood Sustainability in Logistics event, UNVR’s Travis Vedral, Sr. Director Transportation Strategy, identified three core pillars for the transportation industry that can be acted upon today without significant tech investment. Those include minimizing miles, implementing efficient equipment, and targeted training of staff so they understand the role they play in turning the tide.

“For an effective sustainability plan to come to fruition, you have to start with an effective team centered around research, collaboration and education,” added Vedral. “UNVR’s research as well as market research indicates that tech investment is seen as a barrier to entry, especially in transportation. However, any company can act now without having to implement any new technology. The only thing they must be willing to invest in is internal assessment and research.”

In addition, results from the Boston Consulting Group’s fourth annual Carbon Emissions Survey, announced Sept. 17, revealed that decarbonization efforts bring companies $200M in annual net benefits. From the report:

“Climate leaders in our survey have realized significant value from their decarbonization efforts, including financial benefits equal to more than 7% of their revenues—for an average net benefit of $200 million a year. To achieve these financial benefits, leading companies are stepping beyond foundational actions, such as measuring and reporting emissions, and adopting more advanced actions—including using AI in their climate efforts and calculating product-level emissions—to support their decarbonization journeys.”

Redwood offers companies at any step in their sustainability journey a solution in Redwood Hyperion, which delivers logistics carbon visibility for all shipments moved with Redwood’s brokerage, or using shipment data sourced through Redwood’s proprietary integration platform, RedwoodConnect® which integrates directly with customers’ Transportation Management System (TMS), Supply Chain Management (SCM) or Enterprise Resource Planning (ERP).

“The evolution of decarbonization and sustainability efforts in 2024 is intertwined with Scope 3 regulations, creating new challenges and opportunities,” added Nate Greensphan, Director of Product, Redwood. “While tech investment isn’t necessary to get started on a sustainability journey, it can certainly help to kickstart the process and is essential for companies that have more evolved plans. We are the only 4PL – or 3PL- provider included in the Market Guide offering these digital sustainability solutions to the transportation industry and shippers at large.”

As a leading 4PL provider, Redwood is uniquely positioned to assist shippers as they strive to meet these upcoming challenges. Redwood Hyperion automates detailed load-by-load emissions calculations, provides supply chain emissions metrics & analytics, and supports carbon neutral initiatives by facilitating carbon credit purchases toward verified projects.

Redwood Hyperion calculates carbon emissions through sourced shipment data including weight, distance, mode and vehicle type, which is then cleansed, normalized and calculated to freight-based emissions using GLEC-supplied emission factors for all mode types. Reports can be viewed or downloaded from Hyperion or the data can be extracted into any internal tool for further analysis or utilization.

Additional resources:

About Redwood Logistics

Redwood Logistics, a leading logistics platform company and modern 4PL headquartered in Chicago, has provided solutions for moving and managing freight for more than 21 years. The company’s diverse portfolio includes digital freight brokerage and flexible freight management all wrapped into a revolutionary logistics and technology strategy, a modern 4PL. Redwood’s 4PL strategy utilizes an open platform for digital logistics that empowers shippers to seamlessly mix-and-match partners, technologies and solutions into their own unique digital supply chain fingerprint. Redwood connects a wide range of customers to the power of supply chain management, technology and the industry’s brightest minds. For more information, visit www.redwoodlogistics.com.

Media Contact:

Tyler Thornton

LeadCoverage

tyler@leadcoverage.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Want $300 in Dividends Every Month? Invest $20,000 in Each of These 3 Stocks

Recurring dividend income can help boost your savings, help pay bills, and/or potentially even allow you to retire early. There’s a significant incentive for building up a strong portfolio of high-yielding dividend stocks as the payoff could be huge in the long run.

And while most dividend stocks only pay you every three months, you can create a stream of recurring monthly income by investing in at least three of them that pay at different times within the quarter. If you invest $20,000 into Verizon Communications (NYSE: VZ), Organon & Co. (NYSE: OGN), and Bank of Nova Scotia (NYSE: BNS), you can build up a diverse portfolio while collecting $300 in dividends in every month of the year.

Investing in a top telecom provider like Verizon can be a great move for dividend investors. These businesses tend to generate a steady stream of revenue from their subscribers. While customers may switch back and forth between telecom companies, the bigger players know what levels to push to ensure long-term stability in their operations. Verizon is definitely no exception to that.

While there may be short-term volatility on occasion, historically, this has made for a fairly sound business to invest in. In each of the past three years, the company has generated more than $130 billion in revenue, and its operating profits are normally more than 20% of its top line.

Last month, Verizon increased its dividend for the 18th consecutive year. And with the increase, the stock is now yielding 6.2%. On a $20,000 investment, you’d be collecting a quarterly dividend of $310 every time the company makes a payment — February, May, August, and November.

Organon is a healthcare company that focuses on women’s health. It spun off from Merck in 2021, and since then it has been operating on its own.

Like Verizon, it too has made for a stable business to invest in, with annual revenue normally above $6 billion. Its operating margins are also fairly strong at more than 20%. This year the company expects revenue to come in within a range of $6.2 billion and $6.5 billion.

While Organon doesn’t have a long track record of paying dividends, that is already a key reason investors may want to hold this stock in their portfolios. At 6.4%, it offers a yield that is close to five times the S&P 500 average of around 1.3%.

With its current yield, investing $20,000 into the stock would produce approximately $320 every quarter. Organon typically makes dividend payments every March, June, September, and December.

Analyst Report: General Motors Company

Summary

General Motors, one of the world’s largest automakers, traces its roots back to 1908. GM and its strategic partners produce cars and trucks in 31 countries and sell and service these vehicles through the following brands: Buick, Cadillac, Chevrolet, FAW, GMC, Daewoo, Holden, Jiefang, Opel, Vauxhall, and Wuling. GM’s largest national market is China, followed by the United States, Brazil, Germany, the United K

Upgrade to begin using premium research reports and get so much more.

Exclusive reports, detailed company profiles, and best-in-class trade insights to take your portfolio to the next level

This Sam Altman-Backed Nuclear Stock Just Doubled in a Week. Is It Too Late to Buy?

Move over, AI stocks. Nuclear stocks are becoming the next big thing.

Investors have caught on to tech powerhouses like Nvidia that are capitalizing on demand for artificial intelligence (AI) chip components, but the data centers running AI applications like ChatGPT require tremendous amounts of power, and the big question facing investors now is which companies are going to power these “AI factories.”

That’s the main reason why utilities have been one of the hottest stock market sectors this year, up 28% at recent prices, and Vistra, an unregulated power company, is the top stock on the S&P 500, with gains of 227% through Wednesday’s close.

In particular, investors have sharpened their focus on nuclear stocks in the last few weeks as a number of new deals have shown that big tech companies are counting on nuclear power as a source of clean energy to power the AI revolution. Microsoft recently signed an agreement with Constellation Energy to restart the Three Mile Island nuclear plant in Pennsylvania. Alphabet ordered several small nuclear reactors from Kairos Power, and Amazon just signed several agreements for nuclear power.

One little-known nuclear stock capitalizing on the surge is Oklo (NYSE: OKLO), a developer of fission-power plants and a provider of nuclear fuel recycling services. It also has plenty of AI credibility, as OpenAI CEO Sam Altman has been the chairman of the board since 2015, shortly after its founding in 2013.

In the five-day span ending Oct. 21, Oklo shares jumped an incredible 115%, surging in nearly every session during that period, as the chart below shows.

In fact, even after a pullback on Wednesday, the stock was still trading for twice its closing price on Oct. 11.

So why is Oklo suddenly surging? Let’s take a look at the scorching-hot nuclear stock first, and then we’ll discuss whether it’s a buy.

There hasn’t been much company-specific news out on Oklo over the past week. The Department of Energy approved its Conceptual Safety Design Report for a fuel-fabrication facility in Idaho. However, that’s more of a routine development for the stock.

Instead, the jump in Oklo was driven by the broader interest in the sector sparked by the moves by Amazon and Alphabet, though no company has specifically contracted with Oklo. The reaction is based on the general interest in nuclear energy. Peers like Nuscale Power jumped 34% during that period, and Nano Nuclear Energy was up 39%.

Part of the gains in Oklo shares are likely related to Sam Altman, who owns roughly 6% of the company. Oklo went public in May through a special purpose acquisition company (SPAC) created by Altman, and its performance had been mediocre before last week’s breakout.

Flow Chemistry Market Expected to Register CAGR of 7.1% by 2031: SkyQuest Technology

Westford, US, Oct. 24, 2024 (GLOBE NEWSWIRE) — SkyQuest projects that the Global Flow Chemistry Market size will reach a value of USD 3.32 Billion by 2031, with a CAGR of 7.1% during the forecast period (2024-2031). The global flow chemistry market is witnessing an enormous transformation and growth with the increased demand for sustainable and efficient production processes by the chemical and pharmaceutical industries. Benefits have been more widely compared with batch operations in a continuous flow chemistry, also known as microreactor technology, including improved control over the reaction, safety, waste generation, and efficiency.

Flow chemistry, for instance, provides appropriate control over reaction parameters such as temperature, pressure, and residence time to enhance even the quality of products and their yields. In the future, the global market will experience rapid growth due to increasing attention towards process optimization, sustainability, and cost efficiency.

Request Sample of the Report: https://www.skyquestt.com/sample-request/flow-chemistry-market

North America Led the Market Due to Growing Investments in R&D of Flow Chemistry

Due to the presence of major players in North America, it led the market to grow significantly in the region. Some of the prime drivers for the industrial growth in the region are the increase in the investments in the research and development of flow chemistry, particularly continuous processes, and expansion in the chemicals and pharmaceuticals manufacturing sector. The US market stands atop in North America as of 2023, with over 75% revenue share. The demand for flow chemistry products during the foreseeable projection period is expected to be led by the increasing domestic production and manufacturing capacity of the US.

Flow Chemistry Market Report Overview:

| Report Coverage | Details |

| Market Revenue in 2023 | USD 1.61 Billion |

| Estimated Value by 2031 | USD 3.32 Billion |

| Growth Rate | Poised to grow at a CAGR of 7.1% |

| Forecast Period | 2024–2031 |

| Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Type, Application, and Region |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa |

| Report Highlights | Flow Chemistry and its Growing Applications |

| Key Market Opportunities | Green Chemistry Initiatives |

| Key Market Drivers | Increasing Demand for Efficient and Sustainable Manufacturing |

Get Customized Reports with your Requirements: https://www.skyquestt.com/speak-with-analyst/flow-chemistry-market

CSTR Dominance Due to Its Rising Applications in Wastewater and Water Applications

The continuous stirred tank reactors (CSTR) segment in 2023 had the market leader, which captured roughly over 36.4% of overall revenue. This comes as no surprise given its wide applications, ease to construct, efficient temperature control, cost-effectiveness, and flexibility in handling two-phase lines. Increasing applications of CSTRs in wastewater treatment and water processing are also envisaged to be among the future growth drivers for this industry. The increasing demand for efficient and reliable mixing solutions from the industries will further augment the demand for the technology.

Pharmaceutical Applications Segment is Expected to Grow Due to Need for Increasing Time of Drug Launch

Market contribution toward flow chemistry pharmaceutical application is expected to contribute significantly in terms of CAGR during the forecast period. The forward movement driving this is the need to accelerate the time of drug launch and the ever-increasing demand for process development in drug development. Flow chemistry can make the synthesis of pharmaceutical molecules fast and efficient and help researchers try lots of different formulation combinations and optimize reaction conditions. The process enables continuous processing, thereby increasing scalability and reducing waste. Large prospects exist in the pharmaceutical industry to increase flow chemistry systems immensely with its searches towards an enhancement of their R&D capacity and to meet regulatory requirements.

Is this report aligned with your requirements? Buy Now: https://www.skyquestt.com/buy-now/flow-chemistry-market

Flow Chemistry Market Drivers

- Increasing Demand for Efficient and Sustainable Manufacturing

- Safety Improvements

- Integration with Automation

Flow Chemistry Market Restraints

- High Initial Investment

- Complexity of Equipment

- Limited Market Awareness

Flow Chemistry Market Key Players

- Am Technology

- Asahi Glassplant Inc.

- METTLER TOLEDO

- Vapourtec Ltd.

- ThalesNano Inc.

- H.E.L. Group

- Uniqsis Ltd.

- Ehrfeld Mikrotechnik BTS

- Future Chemistry Holding BV

- Corning Incorporated

Key Questions Covered in the Flow Chemistry Market Report

- What are the factors driving the growth of the global flow chemistry market?

- Which is the fastest-growing sub-segment within the application category?

- Till 2031, what will be the growth rate of the market?

This report provides the following insights:

Analysis of key drivers (safety improvements, integration with automation), restraints (high initial investment, complexity of equipment), opportunities (green chemistry initiatives, emerging markets), and challenges (skill gap, economic factors) influencing the growth of the flow chemistry market.

- Market Penetration: Comprehensive information on the product portfolios offered by the top players in the flow chemistry market.

- Product Development/Innovation: Detailed insights on the upcoming trends, R&D activities, and product launches in the flow chemistry market.

- Market Development: Comprehensive information on lucrative emerging regions.

- Market Diversification: Exhaustive information about new products, growing geographies, and recent developments in the market.

- Competitive Assessment: In-depth assessment of market segments, growth strategies, revenue analysis, and products of the leading market players.

Related Reports:

Ammonia Market: Global Opportunity Analysis and Forecast, 2024-2031

Bioplastics Market: Global Opportunity Analysis and Forecast, 2024-2031

Waste Management Market: Global Opportunity Analysis and Forecast, 2024-2031

Pharmaceutical Packaging Market: Global Opportunity Analysis and Forecast, 2024-2031

Beverage Packaging Market: Global Opportunity Analysis and Forecast, 2024-2031

About Us:

SkyQuest is an IP focused Research and Investment Bank and Accelerator of Technology and assets. We provide access to technologies, markets and finance across sectors viz. Life Sciences, CleanTech, AgriTech, NanoTech and Information & Communication Technology.

We work closely with innovators, inventors, innovation seekers, entrepreneurs, companies and investors alike in leveraging external sources of R&D. Moreover, we help them in optimizing the economic potential of their intellectual assets. Our experiences with innovation management and commercialization have expanded our reach across North America, Europe, ASEAN and Asia Pacific.

Contact:

Mr. Jagraj Singh

SkyQuest Technology

1 Apache Way,

Westford,

Massachusetts 01886

USA (+1) 351-333-4748

Email: sales@skyquestt.com

Visit Our Website: https://www.skyquestt.com/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Propylene Glycol Methyl Ether Acetate Market is Projected to Reach US$ 2.08 Billion by 2034 | Fact.MR Report

Rockville, MD , Oct. 24, 2024 (GLOBE NEWSWIRE) — Methyl ether acetates play a vital role in the electronics industry, covering both polar and non-polar substances. The global Propylene Glycol Methyl Ether Acetate Market is valued at US$ 980.6 million in 2024 with projections for expansion at a CAGR of 7.8% from 2024 to 2034.

PMA/PGMA is widely used in several industrial materials such as paints, printing inks, and polymers such as nitrocellulose, acrylic acid, and epoxy resin, serving as coloring agents too. Applications include photoresist removal, stripping agents, TFT-LCD photo-resistance diluents, and IC detergents.

Propylene glycol methyl ether acetate functions well as a solvent in battery management ICs and electronic chips due to its non-corrosive nature. Its market share has risen due to its cost-effectiveness and versatility. Manufacturers are recognizing its potential through intense research, thus driving its popularity and cushioning market growth. This chemical is favored for its ability to act as a colorless solvent in various environments, both aqueous and organic.

For More Insights into the Market, Request a Sample of this Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=9982

Key Takeaways from Market Study:

- The global propylene glycol methyl ether acetate market is projected to expand at a CAGR of 7.8% through 2034.

- Global sales of PGMEA are estimated at US$ 980.6 million in 2024.

- The market is forecasted to reach US$ 2.08 billion by 2034-end.

- The North American market is forecasted to expand at a CAGR of 7.9% through 2034.

- Metal finishing accounts for 23.3% market share in 2024.

- East Asia is projected to account for 38.4% of the global market share by 2034.

“Propylene glycol methyl ether acetate is a versatile industrial solvent, valued for its low toxicity, strong solubility, and diverse applications across various sectors. The non-corrosive nature of PGMEA is driving its widespread use in electronics manufacturing,” says a Fact.MR analyst.

Leading Players Driving Innovation in the Propylene Glycol Methyl Ether Acetate Market:

Chang Chun Group, Shiny Chemical Industrial Company Ltd, KH Neochem Co., Dow Chemical Company, Eastman Chemical Company, Royal Dutch Shell Plc, Yancheng Super Chemical, LyondellBasell

Market Competition:

Prominent players in the propylene glycol methyl ether acetate market, like Chang Chun Group, Shiny Chemical Industrial Company Ltd., and KH Neochem Co., have established themselves through geographical expansions and collaborations with counterparts. Industry participants are focusing on comprehending the challenges posed by these acetates and converting those challenges into lucrative possibilities.

Country-wise Evaluation:

The United States has an extensive road network and well-designed skyscrapers as part of its well-developed infrastructure. Because of its coating qualities, propylene glycol methyl ether acetate is employed in building. It facilitates construction for field workers by effectively diluting a variety of components, including sand, concrete, and cement blocks.

In addition to infrastructure, the nation is home to well-known industrial facilities that bring in large sums of money. Because of its exceptional capabilities, a large number of these industries are investing in the propylene glycol methyl ether acetate market. PGMEA suppliers now have a chance to take control of the US market and develop their presence.

Get Customization on this Report for Specific Research Solutions: https://www.factmr.com/connectus/sample?flag=S&rep_id=9982

More Valuable Insights on Offer:

Fact.MR, in its new offering, presents an unbiased analysis of the propylene glycol methyl ether acetate market for 2018 to 2023 and forecast statistics for 2024 to 2034.

The study divulges essential insights into the market based on application (solvents, cleaners, electronics, metal finishing, pesticides) and purity (99.5%, 99.9%), across six major regions of the world (North America, Latin America, Europe, East Asia, South Asia & Oceania, and MEA).

Key Segments of Propylene Glycol Methyl Ether Acetate Market Research:

- By Application :

- Solvents

- Cleaners

- Electronics

- Metal Finishing

- Pesticides

- By Purity :

Checkout More Related Studies Published by Fact.MR Research:

Propylene Glycol Market: The global propylene glycol market size has been valued at US$ 4.66 billion in 2024, as revealed in the recently updated research study by Fact.MR. Worldwide sales of propylene glycol are analyzed to rise at a CAGR of 4.2% and reach US$ 7.03 billion by the end of 2034.

Dipropylene Glycol N-Propyl Ether Market: The global dipropylene glycol n-propyl ether market is projected to evolve at an impressive CAGR of 9% and touch a valuation of US$ 9.5 million by 2033, up from US$ 4 million in 2023.

Propylene Glycol Ether Market: The global propylene glycol ether market size is forecasted to increase from a valuation of US$ 2.03 billion in 2024 to US$ 2.75 billion by 2034-end, expanding at a CAGR of 3.1% over the study period of 2024 to 2034.

Methyl Tertiary-Butyl Ether Market: The global methyl tertiary-butyl ether market has been forecasted to reach US$ 25.06 billion by the end of 2034, up from a value of US$ 15.98 billion in 2024. Worldwide demand for methyl tertiary-butyl ether (MTBE) is evaluated to increase at a CAGR of 4.6% from 2024 to 2034.

Mono Methyl Ether of Hydroquinone (MEHQ) Market: The utilization of MEHQ in dermatology can be the leading driver for its significant growth in the market. MEHQ is usually added as an inhibitor to acrylonitrile in the monomer and needs to be regulated to avoid spontaneous polymerization.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning.

With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay ahead in the competitive landscape.

Contact:

US Sales Office:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team: sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

US Stocks Set To Open Higher As Tesla's Strong Profit Margins Win Over Wall Street: Wharton Economist Says 'Under-Loved' Bull Market Could See 'Significant Upside'

Investors could see some respite on Wall Street as the index futures point to a positive start on Thursday after three straight days of losses. EV giant Tesla Inc. TSLA blew past expectations in terms of margins and earnings per share (EPS), although it missed revenue expectations.

Dow Jones experienced its worst session in over a month, while megacap stocks like Nvidia Corp. NVDA and Apple Inc. AAPL fell by over 2%. Amid this, Nvidia supplier SK Hynix reported a record quarterly profit on the back of a boom in artificial intelligence.

Boeing Co. BA reported a loss in its third quarter, while AT&T T posted better-than-expected earnings.

Tesla will be among the stocks in focus today. Dow Inc. DOW, American Airlines Group Inc. AAL, United Parcel Service Inc. UPS, Honeywell International Inc. HON, Northrop Grumman Corp. NOC, and Southwest Airlines Co. LUV are scheduled to announce their earnings today.

Investors will also keep a close eye on Boeing after its machinists rejected a 35% wage hike deal and extended their ongoing strike against the company. Workers were dissatisfied with the pension plan and wanted a bigger hike to deal with a rise in the cost of living.

| Futures | Performance (+/-) |

| Nasdaq 100 | 0.75% |

| S&P 500 | 0.40% |

| Dow Jones | -0.11% |

| R2K | 0.43% |

In premarket trading on Thursday, the SPDR S&P 500 ETF Trust SPY rose 0.42% to $580.42 and the Invesco QQQ ETF QQQ surged 0.77% to $492.14, according to Benzinga Pro data.

Cues From Last Session:

Along with the Dow, the Nasdaq Composite recorded its third straight session in the red, dragged down by tech stocks.

Most sectors on the S&P 500 closed on a negative note, with consumer discretionary, information technology, and communication services stocks recording the biggest losses on Wednesday. However, real estate and utilities stocks bucked the overall market trend, closing the session higher.

Rising treasury yields and the possible outcome of the Nov. 5 presidential election results played on the minds of investors.

| Index | Performance (+/-) | Value |

| Nasdaq Composite | -1.60% | 18,276.65 |

| S&P 500 | -0.92% | 5,797.42 |

| Dow Jones | -0.96% | 42,514.95 |

| Russell 2000 | -0.79% | 2,213.84 |

Insights From Analysts:

Following six consecutive weeks of gains, the markets have remained gloomy this week, with tech stocks offering some respite amid sideways movements in most other sectors.

Benchmark US 10-year treasury yields remain in focus, which rose to their highest mark since July.

On the economic data front, U.S. existing home sales declined 1% from the previous month to an annualized rate of 3.84 million in September.

The International Monetary Fund, though, expects U.S. growth to remain strong. According to its latest World Economic Outlook report, the IMF revised its projected U.S. GDP growth rate to 2.8%, up from its previous projection of 2.6%.

“On the equity front, corporate earnings are strong and with the VIX (the CBOE’s volatility index) still elevated around 20, this is not the backdrop for the start of a bear market,” explained WisdomTree and Wharton School economist Jeremy Siegel.

“The current under-loved bull market could see significant upside. While I’m not predicting a ‘melt-up,’ it is important to acknowledge the market’s upward momentum could continue as fundamentals remain supportive,” Siegel added.

See Also: Best Futures Trading Software

Upcoming Economic Data:

- Data on initial jobless claims is scheduled to be released at 8:30 a.m. ET.

- Cleveland Fed President Beth Hammack is scheduled to speak at 8:45 a.m. ET.

- New home sales data is scheduled to be released at 10 a.m. ET.

Stocks In Focus:

- Tesla will stay in focus after beating margin and EPS estimates in its third-quarter earnings.

- IBM IBM missed third-quarter revenue estimates on account of a drag in consulting revenue.

- AT&T added over 403,000 new monthly subscribers in the third quarter, reporting $30.2 billion in revenue.

Commodities, Bonds And Global Equity Markets:

Crude oil futures rose in the early New York session, surging over 1.5% as data showed a rise in spot demand.

The 10-year Treasury note yield fell marginally to 4.192%.

Asian markets were mixed on Thursday, with Chinese markets edging lower while Japan’s Nikkei 225 rose.

European stocks moved past tentativeness in early trading, surging after a gloomy week so far.

Read Next:

Image generated using AI tools

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

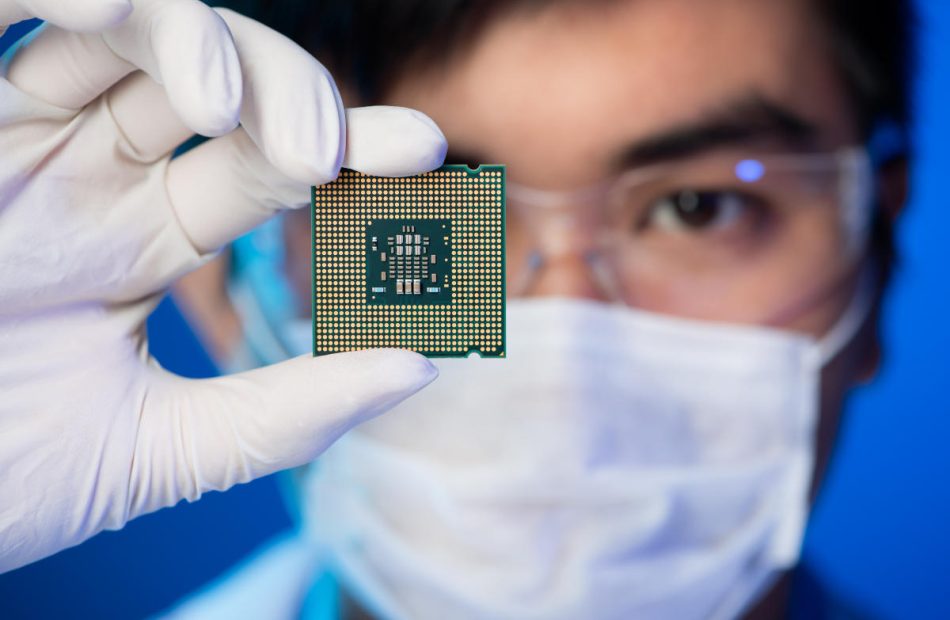

1 Incredibly Cheap Semiconductor Stock That Could Start Soaring After Nov. 4 (Hint: It's Not Nvidia)

Nvidia stock has been in stellar form on the market over the past couple of years thanks to the proliferation of artificial intelligence (AI), as the robust demand for the company’s graphics cards that are deployed in data centers has led to outstanding growth in its revenue and earnings.

Nvidia’s dominant position in the AI chip market explains why its shares have shot up a whopping 1,000% in the past two years. The good part is that Nvidia seems to be in a solid position to sustain its AI-powered growth, driven by the arrival of a new generation of chips that are likely to help it extend its technological lead over rivals.

But at the same time, investors should note that there are other AI chip stocks that are taking advantage of the growing adoption of AI in other areas. Cirrus Logic (NASDAQ: CRUS) is one such company. Known for supplying smartphone chips to Apple (NASDAQ: AAPL), Cirrus stock stitched impressive gains of 43% so far in 2024.

The company is set to release its fiscal 2025 second-quarter earnings on Nov. 4, and there is a good chance that its rally could get a nice boost. Let’s look at the reasons why.

Apple has a massive influence on Cirrus Logic’s business. That’s because the tech giant accounts for 88% of Cirrus’ top line. More specifically, Apple taps Cirrus for the latter’s audio chips and power amplifier chips. For instance, Apple’s latest iPhone 16 lineup boasts a number of chips from Cirrus Logic.

A teardown of the iPhone 16 Pro suggests that Cirrus is supplying three audio chips and one power management module to Apple. The plain iPhone 16 models, on the other hand, have at least three Cirrus Logic audio chips in them. Now, reliance on a single customer for such a big chunk of the business isn’t ideal, as Cirrus’ business could come crashing down if Apple decides to build chips in-house or moves to a different supplier.

However, both companies have been in a tight relationship for a very long time. More importantly, Cirrus has been gaining more business from Apple, as it was earlier known for supplying only audio chips to the iPhone maker. Cirrus’ diversification beyond its core audio market into high-performance mixed-signal offerings such as camera controllers, haptics, and power management tools allowed it to win more business with its largest client.

KeyBanc analysts believe that Cirrus could also supply camera parts to Apple for its latest iPhone generation, while the addition of the new camera control button suggests that the chipmaker could also supply the haptics driver to its largest customer. The good news for Cirrus Logic investors is that Apple’s iPhone 16 lineup seems to have gotten off to a nice start as far as sales are concerned.

Analyst Report: Regions Financial Corp.

Summary

Based in Birmingham, Alabama, Regions Financial provides a range of retail and commercial banking, residential mortgage lending, and asset management services. The company has 1,300 banking offices and ov

Upgrade to begin using premium research reports and get so much more.

Exclusive reports, detailed company profiles, and best-in-class trade insights to take your portfolio to the next level