Atlantic Union Bankshares To Acquire Sandy Spring Bancorp For $1.6B, Creating $39B Regional Banking Powerhouse

Atlantic Union Bankshares Corp AUB has announced its acquisition of Sandy Spring Bancorp Inc SASR for $1.6 billion, marking the fourth regional bank deal exceeding $1 billion this year.

What Happened: The all-stock transaction will enhance Atlantic Union’s presence in Northern Virginia and Maryland, creating a regional powerhouse with $39.2 billion in assets, Reuters reported.

Sandy Spring shareholders will receive 0.90 shares of Atlantic for each share held, valuing Sandy Spring at $34.93 per share, a 7.1% premium. The deal is expected to boost Atlantic’s earnings per share by 23% by the end of 2026, with completion anticipated by the third quarter of 2025.

Price Action: Atlantic Union Bankshares closed at $36.81 on Wednesday, gaining 1.02% during the day. Year to date, the stock has risen by 0.99%. Meanwhile, Sandy Spring Bancorp stock finished at $32.36 on the same day, up 1.00%. Year to date, Sandy Spring has seen an increase of 18.27%, according to data from Benzinga Pro.

Read Next:

Image Via Shutterstock

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Where Will Super Micro Computer Stock Be in 3 Years?

Alongside Nvidia, few companies benefited as much from the AI hardware boom as Supermicro Computer (NASDAQ: SMCI), a company that also specializes in data center equipment. But unlike Nvidia, Supermicro’s boom came to an abrupt end — sending the shares down by a whopping 61% from their all-time high of $119 reached in March.

Is the recent decline the beginning of the end for Supermicro, or is it a long-term buying opportunity? Let’s dig deeper to see what the next three years could have in store for this beaten-down stock.

Supermicro’s stock began to collapse in April, the same month it reported fiscal third-quarter earnings. While the company’s revenue jumped 200% year over year to $3.85 billion, investors were alarmed by its gross margins, which narrowed to 15.4% from 17.6% in the prior-year period.

Gross margin represents the revenue remaining from selling a product after accounting for direct production and selling costs. And the negative trend continued in the fourth quarter when Supermicro’s gross margin fell even further to 11.2% — below analysts’ expectations of 14.1%.

Gross margin can help investors measure a company’s economic moat. Businesses with stronger moats tend to be able to charge higher prices and pass on more of their costs to consumers. A great example of this is Nvidia, which saw its gross margin widen from 75% to 78.4% in its most recent quarterly filing — a sign that its customers don’t have many good alternatives to its cutting-edge graphics processing units (GPUs).

Supermicro sells computer servers and liquid cooling systems that help turn these GPUs into data center-ready systems for consumers. It shares this business model with rivals like Dell and Hewlett Packard Enterprise.

Supermicro’s management blames the margin erosion on competition and a tight inventory of key components. However, while it expects the supply chain constraints to ease by the end of fiscal 2025, investors should take that forecast with a grain of salt because this wouldn’t fix Supermicro’s more fundamental problem of a weak moat. It also won’t address the growing legal uncertainty surrounding the company.

On Aug. 27, the well-known short-seller Hindenburg Research published an alarming report accusing Supermicro of several misdeeds, including accounting irregularities and dodging sanctions related to selling technology products to Russia amid its war with Ukraine. (Short sellers hope to profit by borrowing shares from a broker, selling them in the open market and profiting by buying them back for less to repay the loan.) Hindenburg cites international customs records and senior employee interviews.

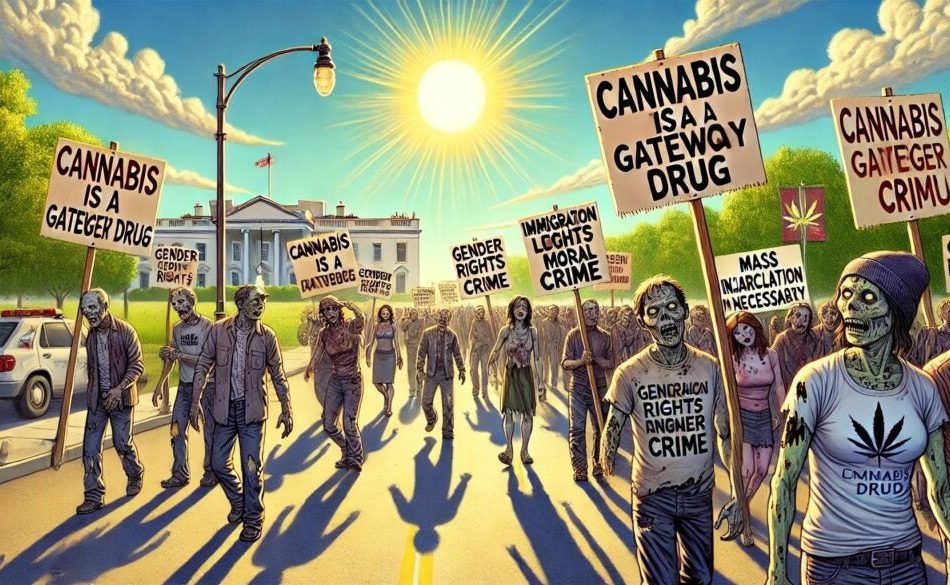

Weed, Fear And Control This Halloween: Conservatives Revive Zombie Myths To Hijack The Debate

As cannabis legalization spreads across the U.S., a conservative narrative is transforming the debate, turning cannabis into a tool for broader political battles. By linking it to divisive issues like immigration and gender rights, conservatives across states are shifting attention away from the tangible benefits of legalization.

Instead, they push viral, fear-based storytelling designed to evoke outrage and control. This strategy isn’t incidental—it’s calculated to exploit social media’s monetization model, where emotionally charged content spreads rapidly and dominates the conversation.

In this environment, cannabis becomes more than a public health or economic issue—it’s a symbol in a larger culture war. These viral narratives sustain policies that disproportionately affect marginalized communities, keeping them trapped in cycles of incarceration and poverty.

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. You can’t afford to miss out if you’re serious about the business.

Weaponizing Cannabis To Strip Rights

In an amicus brief to the U.S. Supreme Court, ten Republican governors, led by South Carolina Gov. Henry McMaster, drew a parallel between state flexibility in legalizing cannabis and their desire for similar autonomy in banning gender-affirming care for minors.

The governors argue that just as states have the right to create their own cannabis policies despite federal prohibition, they should also have the authority to restrict transgender healthcare practices.

The case, United States v. Skrmetti, brought by transgender youth challenging a Tennessee law, uses cannabis legalization as an example to support their stance on local governance over controversial medical issues.

This selective framing of cannabis policy as a justification for restricting transgender rights highlights how the issue of legalization is being co-opted into a broader conservative agenda. By intertwining cannabis with highly charged topics, the GOP’s conservative narrative aims to divert the conversation from cannabis’ health or economic benefits and instead push it into cultural battlegrounds.

Read Also: DEA’s 50-Year $1 Trillion Drug War: Why Were There 250K Marijuana Arrests In 2022?

Pot, Papers And Panic: Arkansas Conservatives Tie Medical Cannabis To Immigration Fears

Meanwhile, in Arkansas, a conservative nonprofit is using similar tactics to oppose a proposed medical marijuana reform. The Family Council Action Committee claims that the amendment would turn the state into a “drug use destination” for undocumented immigrants.

Jerry Cox, the group’s executive director, has tied medical marijuana access to immigration fears, warning that the proposed law could allow “illegal immigrants” to obtain medical cannabis cards, despite safeguards requiring valid state identification.

Supporters of the measure, including the group Arkansans for Patient Access, have denounced these claims as baseless fear-mongering, pointing out that 24 other states allow recreational cannabis without similar consequences.

They argue that the amendment is focused on expanding access for rural and low-income residents and that linking cannabis reform to immigration is a deliberate attempt to inflame public sentiment.

Locked Up And Loaded: How Conservative Fear-Mongering On Cannabis Keeps Jails Full And Progress Stalled

These examples illustrate a broader trend in conservative media: reframing cannabis as a proxy for politically charged debates on immigration and gender rights while hiding the real economic and social consequences.

By shifting attention to issues that evoke fear and moral panic, these narratives perpetuate policies that disproportionately affect marginalized communities. The rhetoric around cannabis in conservative circles is not just about cultural values, it helps uphold a political economy that thrives on mass incarceration and structural poverty.

Cannabis criminalization has long been a tool used to incarcerate Black and Latino communities. Even as some states legalize cannabis, many people remain behind bars for non-violent cannabis offenses, trapped in a system that blocks access to housing, employment, and education.

Read Also: It’s Your Constitutional Right: How You Can Break The Senate’s Block On Cannabis Legalization

Trapped In The Loop: How Conservative Narratives Sustain Inequality

These conservative narratives help maintain this cycle by deflecting from the root issues – poverty, systemic racism, and over-policing – that keep people incarcerated and economically marginalized.

Conservative media benefits from this framing by generating content that plays well in algorithms, creating fear-based stories that spread quickly and keep their audience engaged.

Meanwhile, the policies they support ensure that a legal system dependent on incarceration continues to thrive, preserving the structural inequalities that keep poor and minority populations in jail and out of economic opportunity.

Much like how the NRA has rebranded the AR-15 as a “modern sporting rifle,” emphasizing its use in hunting and sport to soften its image, cannabis is similarly being pulled into a signifier-signified game. Despite this harmless rebranding, AR-15s have been at the center of many tragic mass shootings.

Beyond academic theory—it’s how communication operates in media today. By linking cannabis to hot-button issues, conservative voices aim to delay legalization by making it part of a larger culture war, ultimately slowing progress while profiting from the viralization of these debates.

Read Next: Medical Marijuana Dispensaries Near Preschools In Arizona? Court of Appeals Says Yes

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

How Much Will Altria Group Pay Out in Dividends in 2025?

Altria Group (NYSE: MO) is an income investor’s dream come true. The stock pays a quarterly dividend of $1.02, which works out to an annual dividend of $4.08 per share. As of this writing, the stock’s yield (dividend payment divided by stock price) is 8.2%. That could make it an excellent choice for anyone focused on generating income from their stock portfolio.

Overall, the company is expected to pay out roughly $7 billion worth of dividends this year and in 2025. However, some developments could change that.

When the company announced its most recent dividend increase in August 2024, it represented the 59th such increase in the last 55 years for Altria (the company formerly known as Phillip Morris).

Indeed, dating back to 1985, Altria has increased its dividend by more than 2,300%. Further, that includes the significant dividend cut that occurred when it spun off its Philip Morris International business and sold its majority stake in food giant Kraft (which later became part of Kraft Heinz).

Crucially, for a deep-value stock like Altria, the company’s dividend looks stable. Altria has a payout ratio of 68% — meaning that about two-thirds of its profits go toward covering dividends. Generally speaking, income-seeking investors prefer payout ratios below 75%. If a company needs to use more of its profits than that to cover its dividend obligations, management could find itself unable to make further hikes, and might even need to cut the payouts.

That said, investors interested in Altria stock should monitor its payout ratio. Altria’s appealing dividend could be at risk if it rises too high.

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,365!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,619!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $412,148!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 21, 2024

Pharming Group reports third quarter 2024 financial results and provides business update

- Third quarter 2024 total revenues increased by 12% to US$74.8 million, compared to the third quarter 2023, driven by continued strong RUCONEST® and Joenja® revenue growth

- RUCONEST® third quarter revenue increased by 6% to US$63.6 million, compared to the third quarter 2023

- Joenja® (leniolisib) third quarter revenue increased by 72% to US$11.2 million, compared to the third quarter 2023

- First nine months total revenues increased by 25% to US$204.5 million, compared to the first nine months 2023

- On track for 2024 total revenue guidance of US$280 million – US$295 million (14 – 20% growth)

- Third quarter operating profit increased to US$4.1 million from US$1.9 million in the third quarter 2023

- Overall cash and marketable securities increased to US$173.3 million at the end of the third quarter 2024 from US$161.8 million at the end of the second quarter 2024

- Sijmen de Vries, our Executive Director/Chief Executive Officer, has informed the Board of Directors that he will not be available for reappointment at the next Annual General Meeting of Shareholders in May 2025

- Pharming to host a conference call today at 13:30 CEST (7:30 am EDT)

Leiden, the Netherlands, October 24, 2024: Pharming Group N.V. (“Pharming” or “the Company”) PHAR presents its preliminary, unaudited financial report for the three months ended September 30, 2024.

Chief Executive Officer, Sijmen de Vries, commented:

“Pharming has delivered an excellent third quarter, increasing quarterly revenues by 12% to a record-high US$74.8 million and also achieving record revenues of US$204.5 million for the first nine months of the year. The combination of strong revenue performance, combined with reduced operating expenses compared to the previous quarter, enabled us to realize a positive operating profit in the third quarter. We are firmly on track to meet our 2024 total revenue guidance of US$280 million – US$295 million (14 – 20% growth).

The third quarter demonstrated Pharming’s ability to deliver continued growth for RUCONEST® in the competitive U.S. HAE market, with strength in underlying demand including new patient enrollments. Third quarter revenue for this product increased by 6% compared to the same quarter in 2023.

For Joenja®, we continue to both increase the number of patients on therapy quarter-on-quarter and to maintain high adherence rates for these patients. We received U.K. approval for Joenja® (leniolisib) in September, demonstrating our active efforts with regulatory authorities to make this medicine available to as many patients as possible, and now look forward to the results of the reimbursement evaluation over the coming quarters and to a subsequent commercial launch.

In October 2024, we announced the start of a Phase II, proof of concept, clinical trial evaluating leniolisib in primary immunodeficiencies (PIDs) with immune dysregulation linked to PI3Kẟ signaling. This is an important step for Pharming as this trial will include patients with various PIDs with significant unmet medical need and much higher overall prevalence than APDS, including ALPS-FAS, CTLA4 haploinsufficiency, NFKB1 haploinsufficiency and PTEN deficiency. With prevalence of approximately seven patients per million, these PIDs represent a potential five-fold increase in the commercial opportunity for leniolisib, thereby ensuring Pharming is delivering on its mission to serve the unserved rare disease patient.

I have informed the Board of Directors that I will not be available, after a 16 year tenure at the helm of Pharming, for reappointment as Executive Director/Chief Executive Officer. Our company is in great shape today. So this is the right moment for me to make way for a successor to lead Pharming into the next chapter of its strategy for growth, building on the achievements of the past years. I am proud of all these achievements and grateful for the trust put in me by our patients, employees and investors over the years. I will continue to dedicate myself fully to Pharming until my successor has been appointed and will do everything in my power to ensure a smooth hand-over.”

Chairman of the Board of Directors, Dr. Richard Peters, commented:

“On behalf of the entire Board of Directors, I would like to thank Sijmen de Vries for his high commitment to Pharming over the past 16 years and for the way he has created the company that it is today, serving patients and paving the way for the delivery on the company’s strategy for growth.

The Board of Directors has engaged a leading global executive search firm for the search of a successor. Further announcements will be made when appropriate.

We will of course take time to celebrate Sijmen’s tenure as our CEO in the coming months.”

Third quarter highlights

Commercialized products

RUCONEST® marketed for the treatment of acute HAE attacks

RUCONEST® continued to perform well in the third quarter of 2024, with revenues of US$63.6 million, a 6% increase compared to the third quarter of 2023. Revenue for the first nine months of 2024 was US$172.6 million, a 12% increase compared to the same period in 2023.

The U.S. market contributed 97% of third quarter revenues, while the EU and Rest of World contributed 3%.

In the U.S. market, we saw continued strength in the third quarter in underlying in-market demand, including approximately 100 new patient enrollments. We achieved strong overall performance in the third quarter in other leading key revenue indicators including the number of prescribers, the total number of patients on therapy, and vials shipped to patients. Increasing enrollments helped to drive a sharp increase in unique patient shipments in the third quarter.

Joenja® (leniolisib) marketed for the treatment of APDS

Joenja® revenues increased to US$11.2 million in the third quarter of 2024, a 72% increase compared to the third quarter of 2023. This increase was mostly driven by higher volume from the 50% increase in patients on paid therapy in the U.S. compared to the third quarter of 2023, and revenues from EU and Rest of World which are from product provided on a named patient basis. Revenue for the first nine months of 2024 was US$31.9 million, compared to US$10.3 million for the same period in 2023.

As of September 30, 2024, we have 93 patients on paid therapy in the U.S. and an additional five patients enrolled and pending authorization, representing an increase of both active and pending patients during the third quarter and continued progress enrolling and moving eligible patients to paid therapy.

Joenja® (leniolisib) development updates

Leniolisib for APDS

Pharming made continued progress in the third quarter of 2024 on leniolisib regulatory filings for APDS patients 12 years of age and older in key global markets. Pharming is on track to complete the manufacturing activities requested by the European Medicines Agency’s (EMA) Committee for Human Medicinal Products (CHMP) and submit a response prior to the January 2026 deadline. In addition, Pharming progressed ongoing clinical trials to support regulatory filings for approval in Japan and pediatric label expansion beginning in 2025. Data readout from the clinical trial for children ages 4 to 11 years old is expected in the fourth quarter of 2024.

In total, there are currently 164 patients in a leniolisib Expanded Access Program (compassionate use), an ongoing clinical study, or a named patient program.

United Kingdom

On September 25, 2024, the U.K. Medicines and Healthcare products Regulatory Agency (MHRA) granted marketing authorization for Joenja® (leniolisib) for the treatment of APDS in adult and pediatric patients 12 years of age and older. Joenja® was the first new medicine approved by the MHRA via the International Recognition Procedure (IRP) using the U.S. FDA as reference regulator. Leniolisib is currently under evaluation by the National Institute for Health and Care Excellence (NICE) regarding reimbursement within the National Health Service (NHS) in England.

Leniolisib for additional indications (PI3Kδ platform) – Primary immunodeficiencies (PIDs) beyond APDS

On October 10, 2024, Pharming announced the start of a Phase II, proof of concept, clinical trial evaluating leniolisib in PIDs with immune dysregulation linked to PI3Kẟ signaling in lymphocytes, with similar clinical phenotypes and unmet medical needs to APDS. The first patient is expected to be enrolled in the study in the coming weeks. The clinical trial will include PID patients with ALPS-FAS, CTLA4 haploinsufficiency, NFKB1 haploinsufficiency and PTEN deficiency, among others. Epidemiology suggests a prevalence of approximately seven patients per million in this targeted PID population, compared to one to two patients per million for APDS.

The Phase II clinical trial is a single arm, open-label, dose range-finding study to be conducted in approximately 12 patients. The objectives for the trial will be to assess safety and tolerability, pharmacokinetics, pharmacodynamics, and explore clinical efficacy of leniolisib in the targeted PID population. The trial has been designed to inform a subsequent Phase III program.

Pharming has also prioritized development of leniolisib for an additional PID indication. Pharming will provide further updates and details on our plans, including the proposed clinical development plan, later this year.

Organizational update

Sijmen de Vries, our Executive Director/Chief Executive Officer, has informed the Board of Directors that he will not be available for reappointment at the Company’s next Annual General Meeting of Shareholders (AGM) in May 2025. The mandate of Sijmen de Vries is scheduled to expire at the closing of the AGM to be held in May 2025. Further announcements on the search of a successor will be made when appropriate.

Financial Summary

| Consolidated Statement of Income | 3Q 2024 | 3Q 2023 | 9M 2024 | 9M 2023 |

| Amounts in US$m except per share data | ||||

| Total Revenues | 74.8 | 66.7 | 204.5 | 164.1 |

| Cost of sales | (6.8) | (8.3) | (23.2) | (18.1) |

| Gross profit | 68.0 | 58.4 | 181.3 | 146.0 |

| Other income | 0.8 | 0.3 | 2.1 | 22.8 |

| Research and development | (20.7) | (20.8) | (60.8) | (57.3) |

| General and administrative | (15.3) | (10.9) | (46.0) | (31.9) |

| Marketing and sales | (28.7) | (25.1) | (91.9) | (86.1) |

| Other Operating Costs | (64.7) | (56.8) | (198.7) | (175.3) |

| Operating profit (loss) | 4.1 | 1.9 | (15.3) | (6.5) |

| Finance income (expense) and share of net profits in associates | (2.6) | 1.4 | 0.1 | (3.5) |

| Profit (loss) before tax | 1.5 | 3.3 | (15.2) | (10.0) |

| Income tax credit (expense) | (2.5) | 0.2 | 0.5 | 2.6 |

| Profit (loss) for the period | (1.0) | 3.5 | (14.7) | (7.4) |

| Share Information | ||||

| Basic earnings per share (US$) | (0.002) | 0.005 | (0.022) | (0.011) |

| Diluted earnings per share (US$) | (0.002) | 0.005 | (0.022) | (0.011) |

| Segment information – Revenues | 3Q 2024 | 3Q 2023 | 9M 2024 | 9M 2023 |

| Amounts in US$m | ||||

| Revenue – RUCONEST® (US) | 62.0 | 58.4 | 168.4 | 149.3 |

| Revenue – RUCONEST® (EU and RoW) | 1.6 | 1.8 | 4.2 | 4.5 |

| Total Revenues – RUCONEST® | 63.6 | 60.2 | 172.6 | 153.8 |

| Revenue – Joenja® (US) | 10.0 | 6.5 | 28.7 | 10.3 |

| Revenue – Joenja® (EU and RoW) | 1.2 | — | 3.2 | — |

| Total Revenues – Joenja® | 11.2 | 6.5 | 31.9 | 10.3 |

| Total Revenues – US | 72.0 | 64.9 | 197.1 | 159.6 |

| Total Revenues – EU and RoW | 2.8 | 1.8 | 7.4 | 4.5 |

| Total Revenues | 74.8 | 66.7 | 204.5 | 164.1 |

| Consolidated Balance Sheet | September 30, 2024 | December 31, 2023 |

| Amounts in US$m | ||

| Cash and cash equivalents, restricted cash and marketable securities | 173.3 | 215.0 |

| Current assets | 282.2 | 316.3 |

| Total assets | 425.5 | 462.9 |

| Current liabilities | 79.8 | 78.0 |

| Equity | 225.8 | 218.8 |

Financial highlights

Third quarter 2024

For the third quarter of 2024, total revenues increased by US$8.2 million, or 12%, to US$74.8 million, compared to US$66.7 million in the third quarter of 2023. RUCONEST® revenues amounted to US$63.6 million, a 6% increase compared to the third quarter of 2023. The volume increase in the U.S., and a U.S. price increase in line with CPI, were the primary factors behind this increase in RUCONEST® revenues. Joenja® revenues amounted to US$11.2 million in the third quarter of 2024, a 73% increase compared to the third quarter of 2023. This increase was primarily driven by an increase in volume.

Gross profit increased by US$9.7 million or 17% to US$68.0 million (3Q 2023: US$58.4 million), mainly due to the increase in revenues.

The operating profit amounted to US$4.1 million compared to an operating profit of US$1.9 million in the third quarter of 2023. This increase was primarily due to the increase in gross profit mentioned above, offset by the increase in operating expenses from US$56.8 million in the third quarter of 2023 to US$64.7 million. The increase in operating expenses compared to the same quarter in 2023 was caused by a combination of continuing investments in Joenja® in the U.S., launch preparation for leniolisib outside of the U.S., increasing R&D investments to expand the leniolisib franchise and increased payroll expenses due to business growth. Third quarter 2024 operating expenses decreased 8% from US$70.1 million in the second quarter of 2024.

The net finance result amounted to a loss of US$2.2 million compared to a gain of US$1.9 million in the third quarter of 2023. This was primarily driven by unfavorable EUR/USD exchange rate developments, resulting in a foreign currency loss of US$1.5 million compared to a gain of US$1.7 million in the third quarter of 2023. Additionally, interest expense increased by US$1.0 million in the third quarter of 2024 compared to the previous year, following the convertible bond issuance in the second quarter of 2024.

The Company had a net loss of US$1.0 million, compared to a net profit of US$3.5 million in the third quarter of 2023. This change was mainly due to higher finance expense resulting from unfavorable EUR/USD exchange rate developments and higher income tax expenses, despite higher operating profit. While the exchange rate fluctuations resulted in a foreign currency loss in the income statement, currency translation differences in other comprehensive income led to a positive result of US$2.9 million, compared to a negative result of US$5.2 million in the third quarter of 2023. This outcome was driven by the Company’s predominantly euro-denominated assets, including the vast majority of the cash and marketable securities position.

Cash and cash equivalents, including restricted cash and marketable securities, increased from US$161.8 million at the end of second quarter of 2024 to US$173.3 million at the end of the third quarter of 2024. This increase was primarily driven by positive cash flows from operations of US$9.7 million (3Q 2023: US$3.5 million), which includes a deduction of US$9.1 million in paid taxes (3Q 2023: US$0.0 million).

Nine months 2024

Total revenues increased 25% during the first nine months of 2024 to US$204.5 million, versus US$164.1 million during the first nine months of 2023. Total RUCONEST® revenues were 12% higher at US$172.6 million, compared to revenues of US$153.8 million for the first nine months of 2023. Joenja® revenues amounted to US$31.9 million in the first nine months of 2024, a 210% increase compared to the first nine months of 2023 (first sales commenced at the start of the second quarter of 2023). This increase was primarily driven by an increase in volume.

Gross profit increased by US$35.3 million or 24% to US$181.3 million (9M 2023: US$146.0 million), mainly due to the increase in revenues.

Other income decreased to US$2.0 million compared to US$22.8 million in the first nine months of 2023. Other income in the first nine months of 2023 was supported by the sale of the Rare Pediatric Disease Priority Review Voucher (PRV) to Novartis for a pre-agreed, one-time payment of US$21.1 million.

The operating loss amounted to US$15.3 million compared to an operating loss of US$6.5 million in the first nine months of 2023. This change was mainly due to the decrease in other income and the expected increase in operating expenses from US$175.3 million in the first nine months of 2023 to US$198.7 million, offset by the above mentioned increase in gross profit in the first nine months of 2024. The first nine months of 2023 operating expenses included milestone payments for Joenja® of US$10.5 million in the second quarter. The increase in operating expenses in the first nine months of 2024 was caused by a combination of continuing investments in Joenja® in the U.S., launch preparation for leniolisib outside of the U.S., increasing R&D investments to expand the leniolisib franchise and increased payroll expenses due to business growth. Excluding the one time proceeds from the PRV sale and the milestone payment expenses for Joenja® in the first nine months of 2023, the operating loss decreased from US$17.1 million to US$15.3 million in the first nine months of the current year.

The net finance result amounted to a gain of US$1.4 million compared to a loss of US$2.6 million in the first nine months of 2023. This was primarily driven by a fair value gain of US$5.2 million upon the reclassification of the convertible bond-related derivative to equity. This fair value gain was a result of the decrease in value of the option component classified as a derivative from issuance until the physical settlement date of the newly issued convertible bond. In addition, interest income from investments in marketable securities, which commenced in the second quarter of 2023, increased by US$1.7 million. These positive results were partially offset by US$1.1 million higher interest expense on the 2024 issued convertible bond and unfavorable EUR/USD exchange rate developments, which led to a foreign currency loss of US$1.3 million compared to a loss of US$0.1 million in the first nine months of 2023.

The Company had a net loss of US$14.7 million, compared to a net loss of US$7.4 million in the first nine months of 2023. In addition to the support in other income from the PRV and the milestone payments for Joenja® in the first nine months of 2023, the change was mainly due to an increase in gross profit, higher interest income and the fair value gain upon the reclassification of the convertible bond-related derivative to equity, offset by an increase in operating expenses, unfavorable EUR/USD exchange rate developments and higher interest expenses on the 2024 issued convertible bond.

Cash and cash equivalents, including restricted cash and marketable securities, decreased from US$215.0 million at the end of 2023 to US$173.3 million at the end of September 2024. This decrease was primarily driven by the repurchase of the outstanding convertible bonds amounting to US$134.9 million and paid taxes of US$13.9 million, offset by net proceeds of US$104.5 million for newly issued convertible bonds.

On 5 October 2023, Orchard Therapeutics Plc. (Orchard) announced it had entered into a definitive agreement with Japanese company Kyowa Kirin Co. LTD for the acquisition of Orchard. During the first nine months of 2024, Pharming received US$2.0 million in cash for its shares held in Orchard. Pharming has terminated the research collaboration & licensing agreement with Orchard Therapeutics and discontinued the OTL-105 program.

Outlook/Summary

For the remainder of 2024 and the full year, the Company anticipates:

- Total revenues between US$280 million and US$295 million (14% to 20% growth).

- Continued progress finding additional APDS patients in the U.S., supported by family testing and VUS validation efforts, and subsequently converting patients to paid Joenja® (leniolisib) therapy.

- Increasing leniolisib ex-U.S. revenues – through our Named Patient Program and other funded early access programs in key global markets.

- Completion of leniolisib clinical trials to support regulatory filings for approval in Japan and pediatric label expansion in key global markets.

- Progress towards regulatory approvals for leniolisib in the EEA, Canada and Australia.

- Advancing the Phase II clinical trial for leniolisib in PIDs with immune dysregulation linked to PI3Kδ signaling to significantly expand the long-term commercial potential of leniolisib.

- Continued focus on potential acquisitions and in-licensing of clinical stage opportunities in rare diseases. Financing, if required, would come via a combination of our strong balance sheet and access to capital markets.

No further specific financial guidance for 2024 is provided.

Additional information

Presentation

The conference call presentation is available on the Pharming.com website from 07:30 CEST today.

Conference Call

The conference call will begin at 13:30 CEST/07:30 EDT on Thursday, October 24. A transcript will be made available on the Pharming.com website in the days following the call.

Please note, the Company will only take questions from dial-in attendees.

Webcast Link:

https://edge.media-server.com/mmc/p/yotjk8ib

Conference call dial-in details:

https://register.vevent.com/register/BId118ac68d9124f67b1a83e3769559100

Additional information on how to register for the conference call/webcast can be found on the Pharming.com website.

For further public information, contact:

Pharming Group N.V., Leiden, the Netherlands

Michael Levitan, VP Investor Relations & Corporate Communications

T: +1 (908) 705 1696

E: investor@pharming.com

FTI Consulting, London, UK

Victoria Foster Mitchell/Alex Shaw

T: +44 203 727 1000

LifeSpring Life Sciences Communication, Amsterdam, the Netherlands

Leon Melens

T: +31 6 53 81 64 27

E: pharming@lifespring.nl

About Pharming Group N.V.

Pharming Group N.V. PHAR is a global biopharmaceutical company dedicated to transforming the lives of patients with rare, debilitating, and life-threatening diseases. Pharming is commercializing and developing an innovative portfolio of protein replacement therapies and precision medicines, including small molecules and biologics. Pharming is headquartered in Leiden, the Netherlands, and has employees around the globe who serve patients in over 30 markets in North America, Europe, the Middle East, Africa, and Asia-Pacific.

For more information, visit www.pharming.com and find us on LinkedIn.

Auditor’s involvement

The Condensed Consolidated Interim Financial Statements have not been audited by the Company’s statutory auditor.

Forward-looking Statements

This press release may contain forward-looking statements. Forward-looking statements are statements of future expectations that are based on management’s current expectations and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance, or events to differ materially from those expressed or implied in these statements. These forward-looking statements are identified by their use of terms and phrases such as “aim”, “ambition”, ‘‘anticipate”, ‘‘believe”, ‘‘could”, ‘‘estimate”, ‘‘expect”, ‘‘goals”, ‘‘intend”, ‘‘may”, “milestones”, ‘‘objectives”, ‘‘outlook”, ‘‘plan”, ‘‘probably”, ‘‘project”, ‘‘risks”, “schedule”, ‘‘seek”, ‘‘should”, ‘‘target”, ‘‘will” and similar terms and phrases. Examples of forward-looking statements may include statements with respect to timing and progress of Pharming’s preclinical studies and clinical trials of its product candidates, Pharming’s clinical and commercial prospects, and Pharming’s expectations regarding its projected working capital requirements and cash resources, which statements are subject to a number of risks, uncertainties and assumptions, including, but not limited to the scope, progress and expansion of Pharming’s clinical trials and ramifications for the cost thereof; and clinical, scientific, regulatory, commercial, competitive and technical developments. In light of these risks and uncertainties, and other risks and uncertainties that are described in Pharming’s 2023 Annual Report and the Annual Report on Form 20-F for the year ended December 31, 2023, filed with the U.S. Securities and Exchange Commission, the events and circumstances discussed in such forward-looking statements may not occur, and Pharming’s actual results could differ materially and adversely from those anticipated or implied thereby. All forward-looking statements contained in this press release are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. Readers should not place undue reliance on forward-looking statements. Any forward-looking statements speak only as of the date of this press release and are based on information available to Pharming as of the date of this release. Pharming does not undertake any obligation to publicly update or revise any forward-looking statement as a result of new information, future events or other information.

Inside Information

This press release relates to the disclosure of information that qualifies, or may have qualified, as inside information within the meaning of Article 7(1) of the EU Market Abuse Regulation.

Pharming Group N.V.

Condensed Consolidated Interim Financial Statements in US Dollars (unaudited)

For the period ended September 30, 2024

- Condensed consolidated interim statement of income

- Condensed consolidated interim statement of comprehensive income

- Condensed consolidated interim balance sheet

- Condensed consolidated interim statement of changes in equity

- Condensed consolidated interim statement of cash flows

| CONDENSED CONSOLIDATED INTERIM STATEMENT OF INCOME | ||||

| For the period ended September 30 | ||||

| Amounts in US$ ‘000 | 3Q 2024 | 3Q 2023 | 9M 2024 | 9M 2023 |

| Revenues | 74,849 | 66,661 | 204,528 | 164,099 |

| Costs of sales | (6,819) | (8,295) | (23,186) | (18,094) |

| Gross profit | 68,030 | 58,366 | 181,342 | 146,005 |

| Other income | 777 | 304 | 2,034 | 22,811 |

| Research and development | (20,721) | (20,753) | (60,839) | (57,287) |

| General and administrative | (15,292) | (10,886) | (45,999) | (31,849) |

| Marketing and sales | (28,686) | (25,123) | (91,863) | (86,136) |

| Other Operating Costs | (64,699) | (56,762) | (198,701) | (175,272) |

| Operating profit (loss) | 4,108 | 1,908 | (15,325) | (6,456) |

| Fair value gain (loss) on revaluation | 21 | — | 5,159 | — |

| Other finance income | 825 | 1,251 | 3,760 | 2,050 |

| Other finance expenses | (2,998) | 633 | (7,488) | (4,621) |

| Finance result, net | (2,152) | 1,884 | 1,431 | (2,571) |

| Share of net profits (loss) in associates using the equity method | (442) | (485) | (1,276) | (954) |

| Profit (loss) before tax | 1,514 | 3,307 | (15,170) | (9,981) |

| Income tax credit (expense) | (2,548) | 157 | 470 | 2,556 |

| Profit (loss) for the period | (1,034) | 3,464 | (14,700) | (7,425) |

| Basic earnings per share (US$) | (0.002) | 0.005 | (0.022) | (0.011) |

| Diluted earnings per share (US$) | (0.002) | 0.005 | (0.022) | (0.011) |

| CONDENSED CONSOLIDATED INTERIM STATEMENT OF COMPREHENSIVE INCOME | ||||

| For the period ended September 30 | ||||

| Amounts in US$ ‘000 | 3Q 2024 | 3Q 2023 | 9M 2024 | 9M 2023 |

| Profit (loss) for the period | (1,034) | 3,464 | (14,700) | (7,425) |

| Currency translation differences | 2,883 | (5,158) | (1,352) | (2,079) |

| Items that may be subsequently reclassified to profit or loss | 2,883 | (5,158) | (1,352) | (2,079) |

| Fair value remeasurement investments | 1 | 281 | 79 | 419 |

| Items that shall not be subsequently reclassified to profit or loss | 1 | 281 | 79 | 419 |

| Other comprehensive income (loss), net of tax | 2,884 | (4,877) | (1,273) | (1,660) |

| Total comprehensive income (loss) for the period | 1,850 | (1,413) | (15,973) | (9,085) |

| CONDENSED CONSOLIDATED INTERIM BALANCE SHEET | ||

| Amounts in US$ ‘000 | September 30, 2024 | December 31, 2023 |

| Non-current assets | ||

| Intangible assets | 67,096 | 71,267 |

| Property, plant and equipment | 8,692 | 9,689 |

| Right-of-use assets | 21,975 | 23,777 |

| Long-term prepayments | 93 | 92 |

| Deferred tax assets | 36,752 | 29,761 |

| Investment accounted for using the equity method | 1,016 | 2,285 |

| Investments in equity instruments designated as at FVTOCI | — | 2,020 |

| Investment in debt instruments designated as at FVTPL | 6,150 | 6,093 |

| Restricted cash | 1,548 | 1,528 |

| Total non-current assets | 143,322 | 146,512 |

| Current assets | ||

| Inventories | 62,227 | 56,760 |

| Trade and other receivables | 48,199 | 46,158 |

| Marketable securities | 111,104 | 151,683 |

| Cash and cash equivalents | 60,662 | 61,741 |

| Total current assets | 282,192 | 316,342 |

| Total assets | 425,514 | 462,854 |

| Equity | ||

| Share capital | 7,750 | 7,669 |

| Share premium | 487,079 | 478,431 |

| Other reserves | 9,334 | (2,057) |

| Accumulated deficit | (278,371) | (265,262) |

| Shareholders’ equity | 225,792 | 218,781 |

| Non-current liabilities | ||

| Convertible bonds | 92,099 | 136,598 |

| Lease liabilities | 27,784 | 29,507 |

| Total non-current liabilities | 119,883 | 166,105 |

| Current liabilities | ||

| Convertible bonds | 3,319 | 1,824 |

| Trade and other payables | 72,638 | 72,528 |

| Lease liabilities | 3,882 | 3,616 |

| Total current liabilities | 79,839 | 77,968 |

| Total equity and liabilities | 425,514 | 462,854 |

| CONDENSED CONSOLIDATED INTERIM STATEMENT OF CHANGES IN EQUITY | |||||

| For the period ended September 30 | |||||

| Attributable to owners of the parent | |||||

| Amounts in US$ ‘000 | Share capital | Share premium | Other reserves | Accumulated deficit | Total equity |

| Balance at January 1, 2023 | 7,509 | 462,297 | (8,737) | (256,431) | 204,638 |

| Profit (loss) for the period | — | — | — | (7,425) | (7,425) |

| Reserves | — | — | — | — | — |

| Other comprehensive income (loss) for the period | — | — | (1,660) | — | (1,660) |

| Total comprehensive income (loss) for the period | — | — | (1,660) | (7,425) | (9,085) |

| Other reserves | — | — | (518) | 518 | — |

| Income tax benefit from excess tax deductions related to share-based payments | — | — | — | 574 | 574 |

| Share-based compensation | — | — | — | 5,935 | 5,935 |

| Options exercised / LTIP shares issued | 141 | 13,686 | — | (5,947) | 7,880 |

| Value of conversion rights of convertible bonds | — | — | — | — | — |

| Total transactions with owners, recognized directly in equity | 141 | 13,686 | (518) | 1,080 | 14,389 |

| Balance at September 30, 2023 | 7,650 | 475,983 | (10,915) | (262,776) | 209,942 |

| Balance at January 1, 2024 | 7,669 | 478,431 | (2,057) | (265,262) | 218,781 |

| Profit (loss) for the period | — | — | — | (14,700) | (14,700) |

| Reserves | — | — | 1,560 | (1,560) | — |

| Other comprehensive income (loss) for the period | — | — | (1,273) | — | (1,273) |

| Total comprehensive income (loss) for the period | — | — | 287 | (16,260) | (15,973) |

| Other reserves | — | — | (31) | 31 | — |

| Income tax benefit from excess tax deductions related to share-based payments | — | — | — | (241) | (241) |

| Share-based compensation | — | — | — | 8,605 | 8,605 |

| Options exercised / LTIP shares issued | 81 | 8,648 | — | (5,244) | 3,485 |

| Value of conversion rights of convertible bonds | — | — | 11,135 | — | 11,135 |

| Total transactions with owners, recognized directly in equity | 81 | 8,648 | 11,104 | 3,151 | 22,984 |

| Balance at September 30, 2024 | 7,750 | 487,079 | 9,334 | (278,371) | 225,792 |

| CONDENSED CONSOLIDATED INTERIM STATEMENT OF CASH FLOWS | ||||

| For the period ended September 30 | ||||

| Amounts in $’000 | 3Q 2024 | 3Q 2023 | 9M 2024 | 9M 2023 |

| Profit (loss) before tax | 1,514 | 3,307 | (15,170) | (9,981) |

| Adjustments to reconcile net profit (loss) to net cash used in operating activities: | ||||

| Depreciation, amortization, impairment of non-current assets | 2,743 | 2,902 | 8,371 | 8,370 |

| Equity settled share based payments | 2,918 | 1,965 | 8,605 | 5,935 |

| Fair value loss (gain) on revaluation | (21) | — | (5,159) | — |

| Gain on disposal from PRV sale | — | — | — | (21,080) |

| Other finance income | (182) | (1,251) | (3,117) | (2,050) |

| Other finance expenses | 2,315 | (633) | 6,765 | 4,621 |

| Share of net result in associates using the equity method | 442 | 485 | 1,276 | 954 |

| Other | — | 1,055 | — | (1,130) |

| Operating cash flows before changes in working capital | 9,729 | 7,830 | 1,571 | (14,361) |

| Changes in working capital: | ||||

| Inventories | (2,133) | (396) | (5,248) | (11,113) |

| Trade and other receivables | 2,919 | (7,363) | (2,044) | (12,902) |

| Payables and other current liabilities | 6,560 | 3,242 | 4,305 | 8,075 |

| Restricted cash | — | (47) | — | 363 |

| Total changes in working capital | 7,346 | (4,563) | (2,987) | (15,577) |

| Interest received | 1,784 | 260 | 4,154 | 1,059 |

| Income taxes received (paid) | (9,117) | — | (13,864) | — |

| Net cash flows generated from (used in) operating activities | 9,742 | 3,527 | (11,126) | (28,879) |

| Capital expenditure for property, plant and equipment | (366) | (147) | (660) | (1,133) |

| Proceeds on PRV sale | — | — | — | 21,080 |

| Investment intangible assets | — | 23 | — | 23 |

| Disposal of investment designated as at FVOCI | 8 | — | 1,972 | — |

| Purchases of marketable securities | (109,796) | (144,554) | (222,249) | (231,901) |

| Proceeds from sale of marketable securities | 114,504 | 86,451 | 262,345 | 86,451 |

| Net cash flows generated from (used in) investing activities | 4,350 | (58,227) | 41,408 | (125,480) |

| Payment of lease liabilities | (918) | (1,007) | (2,485) | (3,022) |

| Interests on lease liabilities | (258) | (270) | (784) | (825) |

| Net proceeds of issued convertible bonds | (263) | — | 104,539 | — |

| Repurchase of convertible bonds | (9) | — | (134,931) | — |

| Interests on convertible bonds | (8) | (2,029) | (2,032) | (4,052) |

| Settlement of share based compensation awards | 23 | 8,546 | 3,485 | 7,880 |

| Net cash flows generated from (used in) financing activities | (1,433) | 5,240 | (32,208) | (19) |

| Increase (decrease) of cash | 12,659 | (49,460) | (1,926) | (154,378) |

| Exchange rate effects | 861 | (913) | 847 | 1,689 |

| Cash and cash equivalents at the beginning of the period | 47,142 | 105,026 | 61,741 | 207,342 |

| Total cash and cash equivalents at September 30 | 60,662 | 54,653 | 60,662 | 54,653 |

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Frontenac Mortgage Investment Corporation Announces Special Meeting of Shareholders, Proposes Wind-Up and Provides Dividend Update, including Announcement of September Dividend of $0.0383781 Per Share

SHARBOT LAKE, ON, Oct. 23, 2024 /CNW/ –

Special Meeting

Frontenac Mortgage Investment Corporation (“FMIC” or the “Company“) announces that it proposes to call a special meeting of shareholders to be held on December 18, 2024 (the “Meeting“) in anticipation of the completion of its previously announced strategic review of alternatives that may be available to the Company to maximize value for shareholders and other stakeholders of the Company (the “Strategic Review“).

In connection with the Company’s ongoing Strategic Review, the Board of Directors of FMIC (the “Board“) intends to propose an orderly wind-up of the Company to shareholders for approval at the Meeting. The Board believes that the orderly wind-up will facilitate a return of capital to shareholders in a timely manner and is in the best interests of shareholders. Further details on the orderly wind-up and other matters to be heard at the Meeting will be set out in the management information circular to be sent to shareholders in connection with the Meeting. The record date for receiving notice of and voting at the Meeting is October 31, 2024.

Dividends Update

FMIC is also pleased to confirm that its Board has approved and declared a dividend of $0.0383781 per share, payable on October 24, 2024 to shareholders of record as of September 30, 2024. The dividend represents FMIC’s approximate net income calculated for September 2024. The dividend reinvestment program will not be available for this dividend so all shareholders will receive this dividend in cash.

More information about FMIC is available under FMIC’s profile on SEDAR+ at www.sedarplus.ca.

Forward-Looking Statements

This press release contains certain forward-looking statements and forward-looking information (collectively referred to herein as “forward-looking statements“) within the meaning of applicable Canadian securities laws, which may include, but are not limited to, information and statements regarding or inferring the future business, operations, financial performance, prospects, and other plans, intentions, expectations, estimates, and beliefs of the Corporation. All statements other than statements of present or historical fact are forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as “anticipate”, “achieve”, “could”, “believe”, “plan”, “intend”, “objective”, “continuous”, “ongoing”, “estimate”, “outlook”, “expect”, “may”, “will”, “project”, “should” or similar words, including negatives thereof, suggesting future outcomes.

Forward-looking statements involve and are subject to assumptions and known and unknown risks, uncertainties, and other factors beyond FMIC’s ability to predict or control which may cause actual events, results, performance, or achievements of FMIC to be materially different from future events, results, performance, and achievements expressed or implied by forward-looking statements herein. Forward-looking statements are not a guarantee of future performance. Although FMIC believes that any forward-looking statements herein are reasonable, in light of the use of assumptions and the significant risks and uncertainties inherent in such statements, there can be no assurance that any such forward-looking statements will prove to be accurate. Actual results may vary, and vary materially, from those expressed or implied by the forward-looking statements herein. Accordingly readers are advised to rely on their own evaluation of the risks and uncertainties inherent in forward-looking statements herein and should not place undue reliance upon such forward-looking statements. All forward-looking statements herein are qualified by this cautionary statement. Any forward-looking statements herein are made only as of the date hereof, and except as required by applicable laws, FMIC assumes no obligation and disclaims any intention to update or revise any forward-looking statements herein or to update the reasons that actual events or results could or do differ from those projected in any forward-looking statements herein, whether as a result of new information, future events or results, or otherwise.

SOURCE Frontenac Mortgage Investment Corporation

![]() View original content: http://www.newswire.ca/en/releases/archive/October2024/23/c2312.html

View original content: http://www.newswire.ca/en/releases/archive/October2024/23/c2312.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Ipsos: Slowdown in activity in a more difficult business climate

Slowdown in activity in a more difficult business climate

Paris, October 24, 2024 – Ipsos, one of the world’s leading market research companies, achieved a revenue of 591 million euros in the third quarter, with a growth of 0.5%, including -0.1% organic growth, 2.8% from acquisitions, and -2.2% from currency effects. Over the first nine months of the year, revenue amounted to 1,730 million euros, up by 3.3%, including 2.4% organic growth. Performance has been mixed across different markets and hampered by an uncertain macroeconomic and geopolitical context.

Ben Page, CEO of Ipsos, stated: “Despite the slowdown in growth, we remain confident in the robustness of our operational model and continue to invest in future technologies and Artificial Intelligence. The improvement in gross margin and effective management of our operating costs allow us to maintain, for the fourth consecutive year, our operating margin target of around 13%.”

PERFORMANCE BY QUARTER

| 2024 vs. 2023 | |||

| In millions of euros |

2024 Revenue |

Total growth |

Organic Growth |

| 1st quarter | 557.5 | 4.8 % | 4.5 % |

| 2nd quarter | 581.0 | 4.7 % | 3.1 % |

| 3rd quarter | 591.0 | 0.5 % | -0.1 % |

| Revenue | 1 729.6 | 3.3 % | 2.4 % |

PERFORMANCE BY REGION

| In millions of euros |

2024 9 months revenue |

Contribution | Q3 Organic growth |

Organic growth over 9 months |

| EMEA | 793.1 | 46 % | 4.9 % | 6.7 % |

| Americas | 638.6 | 37 % | -5.9 % | -2.5 % |

| Asia-Pacific | 297.8 | 17 % | 1.4 % | 3.1 % |

| Revenue | 1 729.6 | 100 % | -0.1 % | 2.4 % |

Activity in the EMEA region continues to show strong performance with 4.9% organic growth in the third quarter, and 6.7% over the first nine months of the year. The Middle East recorded double-digit organic growth. In Continental Europe, some countries like Germany and Italy show very good results. Conversely, a climate of uncertainty has persisted since the summer in France, slowing client decisions and spending.

Latin America has recorded solid growth since the beginning of the year, but the Americas region is penalized by an unfavorable situation in the United States. Ipsos’ situation is not isolated, and other major players in the market research sector face difficulties in this area. Furthermore, the performance of our service lines is uneven in the United States: while activities with consumer goods players show good results, others are in sharp decline, such as Public Affairs and Health. The situation should improve in 2025 when the measures taken by the new management team bear fruit and political uncertainties dissipate. Excluding the United States, the Group’s organic growth stands at 5.6% since the beginning of the year and 4.0% in the third quarter alone.

Finally, the Asia-Pacific region shows organic growth of 3.1% over the first nine months of the year, including 1.4% in the third quarter. While the economic context in China remains sluggish, the rest of the region is also affected by the deterioration of the global context among major international clients, who slowed spending.

PERFORMANCE BY AUDIENCE

| In millions of euros |

2024 9 months revenue |

Contribution | Q3 Organic growth | Organic growth over 9 months |

| Consumers 1 | 846.8 | 49 % | 2.1 % | 6.0 % |

| Customers and employees 2 | 358.4 | 21 % | 2.4 % | 1.1 % |

| Citizens 3 | 273.6 | 16 % | -6.4 % | -1.6 % |

| Doctors and patients4 | 250.7 | 14 % | -4.2 % | -3.1 % |

| Revenue | 1 729.6 | 100 % | -0.1 % | 2.4 % |

Breakdown of Service Lines by audience segment:

1- Brand Health Tracking, Creative Excellence, Innovation, Ipsos UU, Ipsos MMA, Market Strategy & Understanding, Observer (excl. public sector), Ipsos Synthesio, Strategy3

2- Automotive & Mobility Development, Audience Measurement, Customer Experience, Channel Performance (Mystery Shopping and Shopper), Media development, ERM, Capabilities

3- Public Affairs, Corporate Reputation

4- Pharma (quantitative et qualitative)

Our consumer research activities are driving the Group’s growth. This reflects the strong performance of our service lines related to innovation, customer experience, and advertising creation.

The citizens, doctors and patients work is particularly hampered by the difficult situation in the United States.

Finally, our new services (platforms, ESG offerings, data analytics and advisory), which account for 22% of the Group’s revenue, achieved 10% organic growth over the first nine months of the year. This growth is driven by Ipsos.Digital, our DIY solution, which shows a 32% increase over the same period.

PERSPECTIVES

As we announced on October 15, we now anticipate organic growth of around 1% for this year.

The rise in gross margin, combined with good financial discipline, allows us to maintain our annual operating margin target of around 13%.

At the same time, the Group continues to invest in the development of platforms and solutions using generative AI, as well as in digital data collection processes, which are at the core of our business. The development of Ipsos Facto, our secured Generative AI platform, continues. As of today, 70% of our employees are using it regularly. Generative AI is letting create new solutions for our clients’ evolving needs. This includes innovative work with synthetic data and advanced solutions such as persona bots and digital twins that are being piloted for product testing and other applications.

The acceleration of our acquisitions has strengthened our leadership position in several markets, notably in Public Affairs. At the end of August, Ipsos launched a voluntary public takeover bid for infas, a leader in public sector research in Germany, to become one of the main players in the sector in that country. To date, the operation has received approval from 89.6% of shareholders.

Additionally, the Lac1 fund, managed by Bpifrance, became a major shareholder of Ipsos in September. This partnership reflects confidence in the Group’s long-term growth potential and supports its development ambitions.

Our strategic review, Horizons 2030, is now well underway and we will announce our new plans before summer 2025.

ABOUT IPSOS

Ipsos is one of the largest market research and polling companies globally, operating

in 90 markets and employing nearly 20,000 people.

Our passionately curious research professionals, analysts and scientists have built unique multi-specialist capabilities that provide true understanding and powerful insights into the actions, opinions and motivations of citizens, consumers, patients, customers or employees. Our 75 business solutions are based on primary data from our surveys, social media monitoring, and qualitative or observational techniques.

“Game Changers” – our tagline – summarizes our ambition to help our 5,000 clients navigate with confidence our rapidly changing world.

Founded in France in 1975, Ipsos has been listed on the Euronext Paris since July 1, 1999. The company is part of the SBF 120, Mid-60 indices, STOXX Europe 600 and is eligible for the Deferred Settlement Service (SRD).

ISIN code FR0000073298, Reuters ISOS.PA, Bloomberg IPS:FP

www.ipsos.com

35 rue du Val de Marne

75 628 Paris, Cedex 13 France

Tel. +33 1 41 98 90 00

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

AGNC Investment Sees a Big Change Ahead. Here's What That Could Mean for its Nearly 14%-Yielding Dividend.

AGNC Investment (NASDAQ: AGNC) is a leader in investing in the Agency residential mortgage-backed securities (MBS) market (i.e., MBS protected from credit losses by government agencies like Fannie Mae). The company has a massive MBS portfolio (over $71.8 billion). It also has extensive experience navigating the MBS market and can tell when changes are in the air.

It sees the Federal Reserve’s recent rate cut as a catalyst for a big change in the MBS market. Here’s what it sees ahead and how that might affect the mortgage REIT’s monster dividend that currently yields nearly 14%.

AGNC Investment’s CEO, Peter Federico, commented on the changes occurring in the MBS market in the company’s third-quarter earnings press release, noting:

The long-awaited monetary policy pivot by the Fed occurred at its September meeting, with an initial 50-basis-point rate cut. Consistent with historical experience, the Fed is expected to return the federal funds rate to a neutral level over the next 12 to 24 months, which would typically be accompanied by a steepening of the yield curve and growing demand for high-quality fixed-income instruments such as Agency MBS. Although the path of financial markets is never perfectly linear and periods of volatility are inevitable, the outlook for Agency MBS today is decidedly better than it was in 2022 and 2023 as a result of the positive direction of the broader economy, the accommodative Fed monetary policy stance, and the stability of Agency MBS spreads at these historically favorable levels.

After keeping rates high for the past several years to combat inflation, the Federal Reserve instituted a policy change by cutting interest rates last month. It will likely continue to reduce rates for the next one to two years.

In the past, a Fed policy change to lower rates has historically had two notable benefits for a mortgage REIT, such as AGNC Investment. First, it reduces the REIT’s borrowing costs. Mortgage REITs borrow money on the short-term market (which is what a Federal Reserve rate cut influences most) to invest in longer-duration MBS.

On top of that, lower rates tend to drive more stability in the MBS market. Because of that, the REIT should be able to earn a very favorable spread between its borrowing costs and MBS investments. That higher spread or profit margin will enable it to make more money to cover its lucrative dividend.

The improvement in market conditions was already apparent in the third quarter. Federico noted that AGNC Investment generated a “very strong economic return of 9.3%” in the quarter, driven by a significant $0.42-per-share increase in its tangible book value and its $0.36 per share in dividend payments during the quarter. The REIT generated $0.63 per share of comprehensive net income in the quarter, easily covering its monster dividend.

Tesla Delivers Blowout Quarter, Lays Out Bold Ambitions for 2025

(Bloomberg) — Tesla Inc. shares climbed in early trading after the carmaker reported surprisingly strong earnings and forecast as much as 30% growth in vehicle sales next year.

Most Read from Bloomberg

Third-quarter results were buoyed by Tesla turning a corner with the Cybertruck, which contributed to profit for the first time. Lower material costs, an expanding energy business and sales of regulatory credits to automakers that need help complying with emissions standards also contributed to Tesla’s biggest quarterly profit in more than a year.

Chief Executive Officer Elon Musk offered an upbeat outlook for next year, driven by the rollout of more affordable models that Tesla has yet to identify. “Something like 20% to 30% growth next year is my best guess,” he said on a call with analysts.

Tesla shares jumped 11% as of 5 a.m. Thursday in New York, before the start of regular trading. The stock had fallen 14% this year through the close Wednesday, having slumped in the weeks since Musk unveiled self-driving taxi and van prototypes.

Musk is betting Tesla’s future on autonomy, having scrapped plans for a new vehicle that was going to be cheaper than the Model 3 sedan. By reporting an uptick in profitability and optimism about next year, the CEO assuaged concerns that Tesla’s core business will continue slipping while he prioritizes a years-long pursuit of self-driving technology.

“Investors who wanted something today got better-than-expected profit and guidance for growth in deliveries,” said Gene Munster, managing partner of growth-investment firm Deepwater Asset Management. “The long-term investors got the golden carrot.”

Musk spent a brief portion of the earnings call floating what he might do in a second Trump administration.

After calling for a federal approval process for autonomous vehicles, the Tesla CEO said he would “try to make that happen” if appointed to a government-efficiency role that he and Republican nominee Donald Trump first discussed in August. The billionaire has backed the candidate by pouring $75 million into a super political action committee he created earlier this year.

Tesla projected “slight growth” in vehicle deliveries this year, which will require a record showing in the fourth quarter after sales slumped in the first half.

North Korean Troops Land In Russia, Sparking Fears Of Escalation In Ukraine Conflict

In a recent development, approximately 3,000 North Korean soldiers have been reported to arrive in Russia this month. This sudden movement has stirred concerns about a potential escalation in the ongoing Ukraine conflict, as per the White House.

What Happened: The North Korean soldiers were relocated from North Korea to eastern Russia in the early to mid-October, reported CNN on Wednesday. The exact role these troops are to play is still unclear, but there is a “highly concerning probability” they may join the fight against Ukraine, stated National Security Council spokesman John Kirby.

Lloyd Austin, the Secretary of Defense, confirmed the deployment of North Korean troops to Russia, while also noting that their exact activities are yet to be determined. The US does not believe these troops have reached Ukraine, but their movement has caused significant concern.

“If they’re a co-belligerent, their intention is to participate in this war on Russia’s behalf, that is a very, very serious issue,” Austin stated. He also mentioned that this could impact not only Europe but also the Indo Pacific region.

The US has briefed the Ukrainian government and is in close consultation with allies and partners. The training and potential preparation of North Korean soldiers to fight in Ukraine is seen as a sign of desperation on Russia’s part.

The deepening military partnership between Moscow and Pyongyang, especially their anti-US stance, has alarmed officials in Kyiv and Washington.

Why It Matters: ABC News reported on Thursday that the US has evidence of North Korean troops in Russia, as confirmed by Defense Secretary Lloyd Austin. The exact activities of these troops remain uncertain, but their presence in Russia is seen as a “very” serious issue.

This development indicates a potential shift in the dynamics of the Ukraine conflict, with the involvement of North Korean troops possibly escalating the situation.

Did You Know?

Engineered by

Benzinga Neuro, Edited by

Jae Hur

The GPT-4-based Benzinga Neuro content generation system exploits the

extensive Benzinga Ecosystem, including native data, APIs, and more to

create comprehensive and timely stories for you.

Learn more.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.