This Is What Whales Are Betting On PureCycle Technologies

Deep-pocketed investors have adopted a bullish approach towards PureCycle Technologies PCT, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in PCT usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 26 extraordinary options activities for PureCycle Technologies. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 42% leaning bullish and 38% bearish. Among these notable options, 2 are puts, totaling $80,209, and 24 are calls, amounting to $1,274,958.

What’s The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $2.5 to $20.0 for PureCycle Technologies over the recent three months.

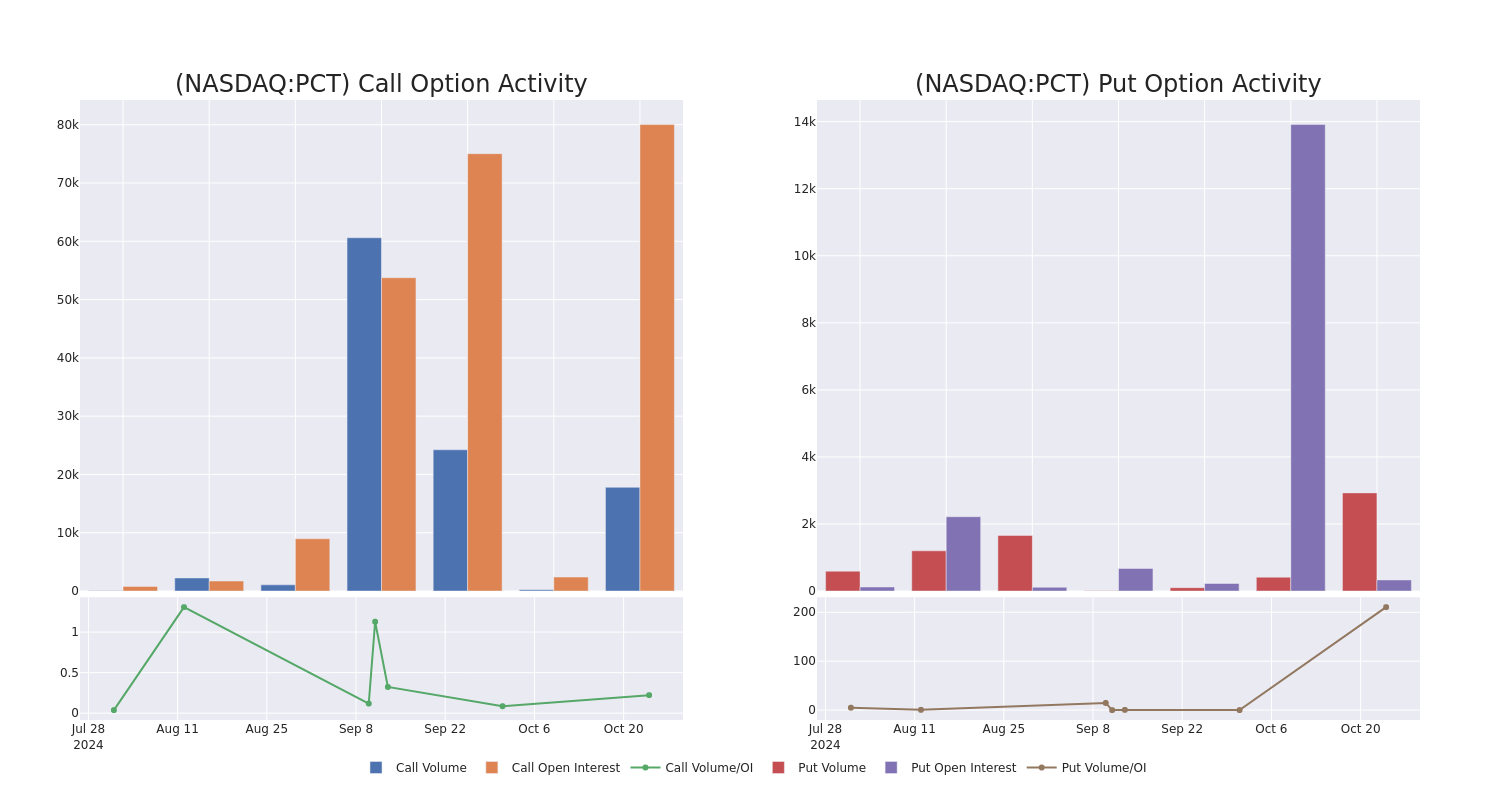

Volume & Open Interest Trends

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for PureCycle Technologies’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across PureCycle Technologies’s significant trades, within a strike price range of $2.5 to $20.0, over the past month.

PureCycle Technologies Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PCT | CALL | SWEEP | BEARISH | 01/17/25 | $1.5 | $1.35 | $1.35 | $15.00 | $146.0K | 5.0K | 1.5K |

| PCT | CALL | SWEEP | BULLISH | 12/20/24 | $1.3 | $1.15 | $1.3 | $14.00 | $136.3K | 7 | 1.0K |

| PCT | CALL | SWEEP | BEARISH | 01/17/25 | $2.5 | $2.3 | $2.3 | $12.00 | $115.0K | 8.5K | 528 |

| PCT | CALL | SWEEP | BULLISH | 11/15/24 | $2.1 | $2.1 | $2.1 | $11.00 | $84.0K | 4.3K | 477 |

| PCT | CALL | TRADE | BULLISH | 07/18/25 | $3.1 | $2.7 | $3.1 | $15.00 | $77.5K | 66 | 500 |

About PureCycle Technologies

PureCycle Technologies Inc holds a license to commercialize the only patented solvent-based purification recycling technology, developed by The Procter & Gamble Company (P&G), for restoring waste polypropylene (PP) into a virgin-like resin. The proprietary process removes color, odor, and other contaminants from recycled feedstock resulting in virgin-like polypropylene suitable for any PP market.

Following our analysis of the options activities associated with PureCycle Technologies, we pivot to a closer look at the company’s own performance.

PureCycle Technologies’s Current Market Status

- With a trading volume of 11,445,452, the price of PCT is up by 28.08%, reaching $14.14.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 14 days from now.

Professional Analyst Ratings for PureCycle Technologies

In the last month, 1 experts released ratings on this stock with an average target price of $14.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* In a cautious move, an analyst from Cantor Fitzgerald downgraded its rating to Overweight, setting a price target of $14.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest PureCycle Technologies options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply