A Peek at Ultra Clean Hldgs's Future Earnings

Ultra Clean Hldgs UCTT is set to give its latest quarterly earnings report on Monday, 2024-10-28. Here’s what investors need to know before the announcement.

Analysts estimate that Ultra Clean Hldgs will report an earnings per share (EPS) of $0.32.

The market awaits Ultra Clean Hldgs’s announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It’s important for new investors to understand that guidance can be a significant driver of stock prices.

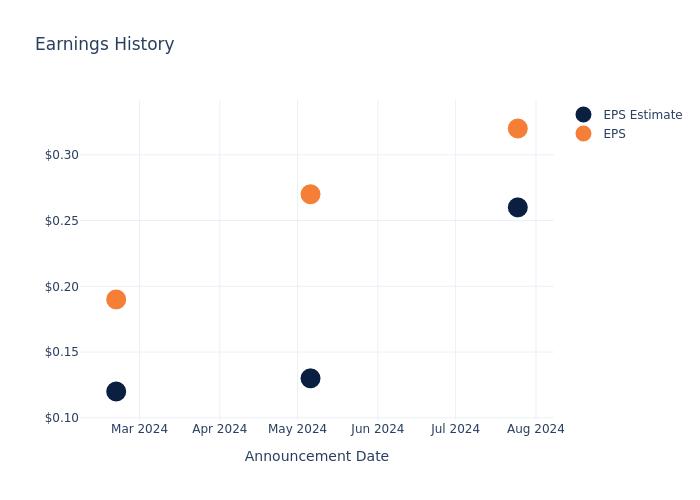

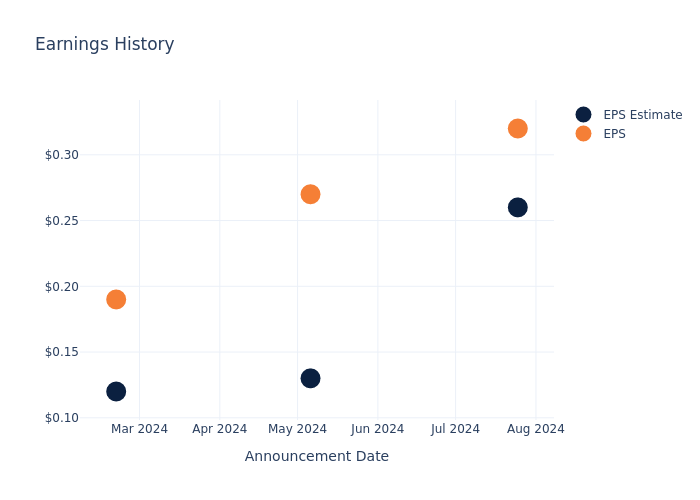

Earnings Track Record

Last quarter the company beat EPS by $0.06, which was followed by a 1.51% increase in the share price the next day.

Here’s a look at Ultra Clean Hldgs’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.26 | 0.13 | 0.12 | 0.10 |

| EPS Actual | 0.32 | 0.27 | 0.19 | 0.04 |

| Price Change % | 2.0% | 3.0% | 5.0% | 2.0% |

Market Performance of Ultra Clean Hldgs’s Stock

Shares of Ultra Clean Hldgs were trading at $35.07 as of October 24. Over the last 52-week period, shares are up 49.37%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Opinions on Ultra Clean Hldgs

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Ultra Clean Hldgs.

With 1 analyst ratings, Ultra Clean Hldgs has a consensus rating of Outperform. The average one-year price target is $70.0, indicating a potential 99.6% upside.

Peer Ratings Overview

The analysis below examines the analyst ratings and average 1-year price targets of and Veeco Instruments, three significant industry players, providing valuable insights into their relative performance expectations and market positioning.

- The consensus outlook from analysts is an Buy trajectory for Veeco Instruments, with an average 1-year price target of $44.75, indicating a potential 27.6% upside.

Insights: Peer Analysis

The peer analysis summary offers a detailed examination of key metrics for and Veeco Instruments, providing valuable insights into their respective standings within the industry and their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Ultra Clean Hldgs | Outperform | 22.44% | $88.50M | 2.27% |

| Veeco Instruments | Buy | 8.81% | $75.39M | 2.20% |

Key Takeaway:

Ultra Clean Hldgs ranks higher in Revenue Growth compared to its peers. It also outperforms in Gross Profit margin. However, it lags behind in Return on Equity. Overall, Ultra Clean Hldgs is positioned favorably among its peers based on the provided metrics.

All You Need to Know About Ultra Clean Hldgs

Ultra Clean Holdings Inc, through its subsidiaries, manufactures and supplies production tools, modules, and subsystems for the semiconductor capital equipment industry. The product includes precision robotic solutions, gas delivery systems, and a variety of industrial and automation production equipment products; subsystems include wafer cleaning subsystems, chemical delivery modules, top-plate assemblies, frame assemblies, and process modules. Its customer base includes firms in the semiconductor capital equipment industry, medical, energy, industrial, flat panel, and research equipment industries. It has two segments Products and Services. Its principal markets are North America, Asia, and Europe.

Unraveling the Financial Story of Ultra Clean Hldgs

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Positive Revenue Trend: Examining Ultra Clean Hldgs’s financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 22.44% as of 30 June, 2024, showcasing a substantial increase in top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Information Technology sector.

Net Margin: Ultra Clean Hldgs’s net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of 3.7%, the company may face hurdles in effective cost management.

Return on Equity (ROE): The company’s ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of 2.27%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): Ultra Clean Hldgs’s ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of 1.0%, the company may face hurdles in achieving optimal financial performance.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 0.78, caution is advised due to increased financial risk.

To track all earnings releases for Ultra Clean Hldgs visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply