American Airlines Analysts Boost Their Forecasts After Better-Than-Expected Earnings

American Airlines Group Inc. AAL reported upbeat third-quarter financial results and updated its 2024 EPS outlook on Thursday.

The airline reported third-quarter total operating revenue growth of 1.2% year-over-year to $13.647 billion, beating the consensus of $13.471 billion. The adjusted operating margin stood at 4.7% compared to 5.4% a year ago. AAL reported adjusted EPS of 30 cents, down from 38 cents a year ago but above the consensus of 15 cents.

For 2024, American Airlines now expects an adjusted EPS of $1.35 – $1.60 (prior $0.70 – $1.30) versus the consensus of $1.21. It expects a 2024 operating margin of 4.5% to 5.5%

AAL shares gained 2.2% to trade at $13.06 on Friday.

These analysts made changes to their price targets on AAL following earnings announcement.

- JP Morgan analyst Jamie Baker maintained American Airlines with an Overweight and raised the price target from $15 to $20.

- B of A Securities analyst Andrew Didora maintained American Airlines with an Underperform and raised the price target from $9 to $10.

- TD Cowen analyst Thomas Fitzgerald maintained American Airlines with a Hold and raised the price target from $9 to $10.

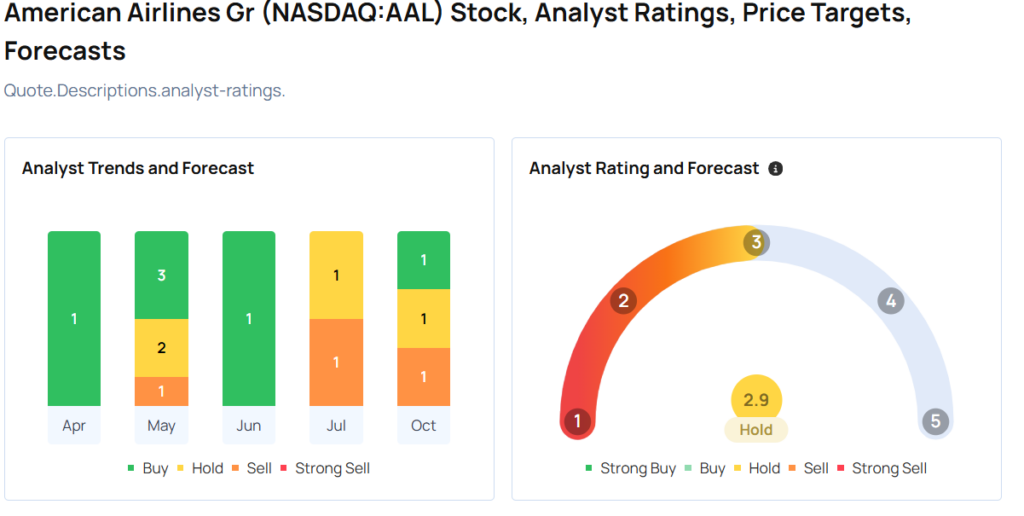

Considering buying AAL stock? Here’s what analysts think:

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply