Harmonic's Earnings: A Preview

Harmonic HLIT is gearing up to announce its quarterly earnings on Monday, 2024-10-28. Here’s a quick overview of what investors should know before the release.

Analysts are estimating that Harmonic will report an earnings per share (EPS) of $0.22.

Anticipation surrounds Harmonic’s announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

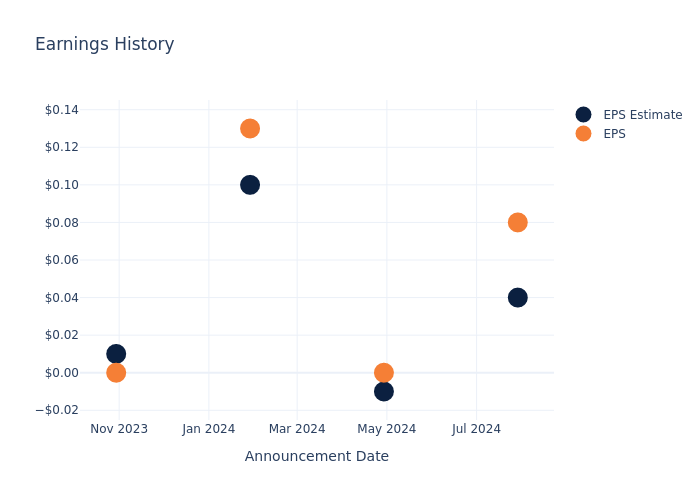

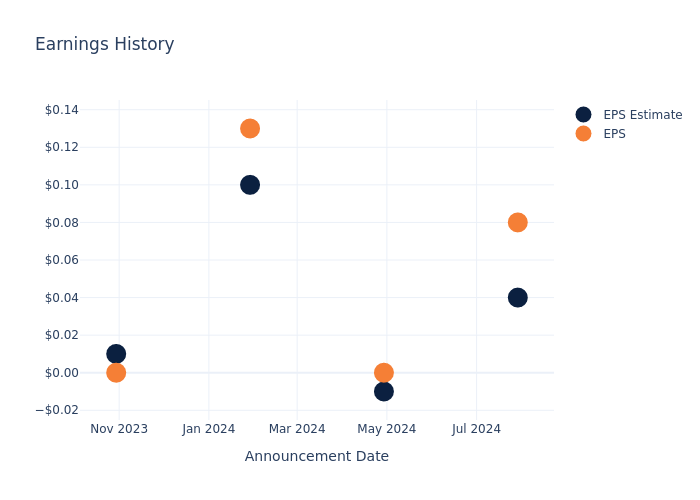

Earnings Track Record

In the previous earnings release, the company beat EPS by $0.04, leading to a 21.19% increase in the share price the following trading session.

Here’s a look at Harmonic’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.04 | -0.01 | 0.10 | 0.01 |

| EPS Actual | 0.08 | 0 | 0.13 | 0 |

| Price Change % | 21.0% | 14.000000000000002% | 2.0% | 11.0% |

Market Performance of Harmonic’s Stock

Shares of Harmonic were trading at $14.7 as of October 24. Over the last 52-week period, shares are up 51.9%. Given that these returns are generally positive, long-term shareholders should be satisfied going into this earnings release.

Analyst Observations about Harmonic

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Harmonic.

A total of 3 analyst ratings have been received for Harmonic, with the consensus rating being Buy. The average one-year price target stands at $18.67, suggesting a potential 27.01% upside.

Peer Ratings Comparison

In this analysis, we delve into the analyst ratings and average 1-year price targets of Infinera, Extreme Networks and Viavi Solutions, three key industry players, offering insights into their relative performance expectations and market positioning.

- For Infinera, analysts project an Buy trajectory, with an average 1-year price target of $6.43, indicating a potential 56.26% downside.

- As per analysts’ assessments, Extreme Networks is favoring an Buy trajectory, with an average 1-year price target of $16.75, suggesting a potential 13.95% upside.

- The prevailing sentiment among analysts is an Buy trajectory for Viavi Solutions, with an average 1-year price target of $9.5, implying a potential 35.37% downside.

Key Findings: Peer Analysis Summary

The peer analysis summary presents essential metrics for Infinera, Extreme Networks and Viavi Solutions, unveiling their respective standings within the industry and providing valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Harmonic | Buy | -11.04% | $73.46M | -3.13% |

| Infinera | Buy | -8.90% | $135.59M | -32.95% |

| Extreme Networks | Buy | -29.47% | $114.62M | -120.13% |

| Viavi Solutions | Buy | -4.40% | $145.60M | -3.13% |

Key Takeaway:

Harmonic is at the bottom for Revenue Growth and Gross Profit, with negative percentages. It is also at the bottom for Return on Equity, with a negative percentage.

About Harmonic

Harmonic Inc designs and manufactures video infrastructure products and system solutions to deliver video and broadband services to consumer devices. The firm operates in two segments: Video, which sells video processing, production, and playout solutions to cable operators and satellite and telecommunications providers; and Broadband which sells broadband access solutions and related services. Majority of the revenue generated from the company is from United States.

Key Indicators: Harmonic’s Financial Health

Market Capitalization: Indicating a reduced size compared to industry averages, the company’s market capitalization poses unique challenges.

Decline in Revenue: Over the 3 months period, Harmonic faced challenges, resulting in a decline of approximately -11.04% in revenue growth as of 30 June, 2024. This signifies a reduction in the company’s top-line earnings. When compared to others in the Information Technology sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Harmonic’s net margin excels beyond industry benchmarks, reaching -9.03%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Harmonic’s ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of -3.13%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): The company’s ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of -1.72%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.38.

To track all earnings releases for Harmonic visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply