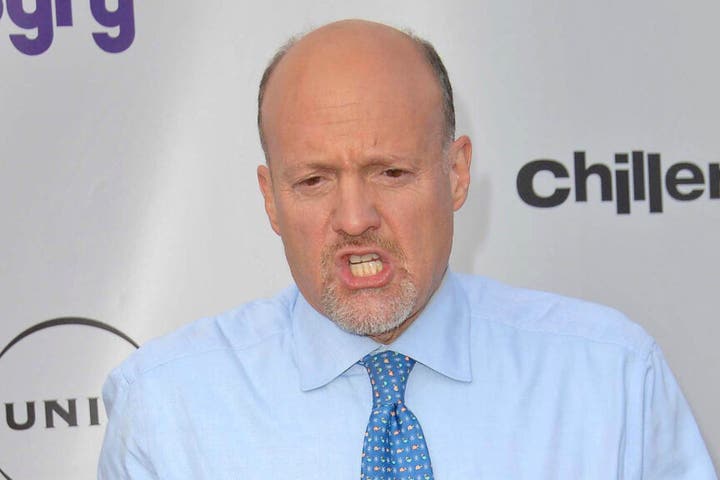

Jim Cramer Says 'Hold On' To Palantir, 'Let Them Walk It Up'; Warns That Travere Therapeutics Is Losing A 'Ton Of Money'

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

On CNBC’s “Mad Money Lightning Round,” Jim Cramer said Travere Therapeutics, Inc. (NASDAQ:TVTX) is losing a “ton of money.”

Travere Therapeutics will report third-quarter financial results before the opening bell on Thursday, Oct. 31. Analysts expect the company to report a quarterly loss of 66 cents per share, compared to a year-ago profit of $1.97 per share.

“There is no level that the buyers won’t take this stock higher. So I’m going to tell you that I would hold on to it as a spec and let them walk it up,” Cramer said when asked about Palantir Technologies Inc. (NYSE:PLTR).

Don’t Miss:

Palantir Technologies will release results for its third quarter ended Sept. 30, on Monday, Nov. 4, after the closing bell. Analysts expect the company to report quarterly earnings at 9 cents per share, up from 7 cents per share in the year-ago period. The company projects to report revenue of $701.13 million for the quarter.

“I don’t think Stanley Black & Decker (NYSE:SWK) is going to give you a discouraging forecast,” Cramer said.

On Tuesday, Stanley Black & Decker said its board of directors approved a regular fourth quarter cash dividend of 82 cents per common share. The company also appointed John L. Garrison, Jr, former chairman, president, and chief executive officer of Terex Corporation to its board of directors.

Lower interest rates mean some investments won’t yield what they did in months past, but you don’t have to lose those gains. Certain private market real estate investments are giving retail investors the opportunity to capitalize on these high-yield opportunities.

Arrived Homes, the Jeff Bezos-backed investment platform, offers a Private Credit Fund. This fund provides access to a pool of short-term loans backed by residential real estate with a target of 7% to 9% net annual yield paid to investors monthly. The best part? Unlike other private credit funds, this one has a minimum investment of only $100.

Wondering if your investments can get you to a $5,000,000 nest egg? Speak to a financial advisor today. SmartAsset’s free tool matches you up with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you.

Leave a Reply