Nabors Industries's Options Frenzy: What You Need to Know

Deep-pocketed investors have adopted a bullish approach towards Nabors Industries NBR, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in NBR usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 12 extraordinary options activities for Nabors Industries. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 50% leaning bullish and 41% bearish. Among these notable options, 7 are puts, totaling $310,700, and 5 are calls, amounting to $177,650.

What’s The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $55.0 to $90.0 for Nabors Industries over the last 3 months.

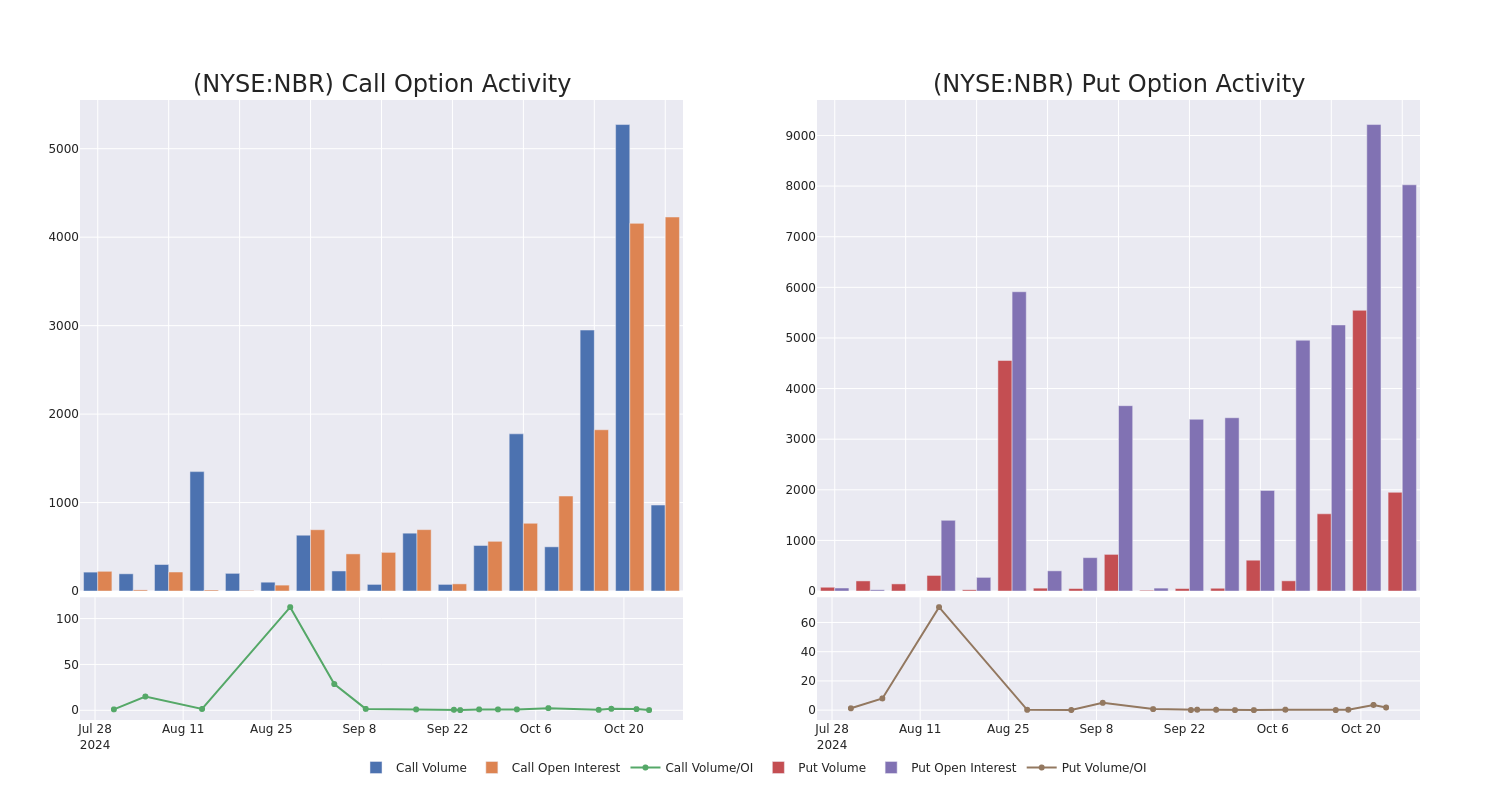

Volume & Open Interest Trends

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Nabors Industries’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Nabors Industries’s whale activity within a strike price range from $55.0 to $90.0 in the last 30 days.

Nabors Industries Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NBR | PUT | TRADE | BULLISH | 01/17/25 | $12.4 | $11.9 | $12.1 | $75.00 | $121.0K | 7.4K | 228 |

| NBR | CALL | TRADE | NEUTRAL | 11/15/24 | $2.1 | $1.65 | $1.9 | $80.00 | $38.0K | 2.4K | 200 |

| NBR | PUT | TRADE | BULLISH | 04/17/25 | $7.9 | $7.4 | $7.6 | $60.00 | $38.0K | 276 | 180 |

| NBR | CALL | TRADE | BEARISH | 04/17/25 | $7.3 | $7.0 | $7.03 | $90.00 | $35.1K | 1.2K | 131 |

| NBR | CALL | TRADE | BEARISH | 12/20/24 | $3.7 | $3.5 | $3.5 | $85.00 | $35.0K | 540 | 215 |

About Nabors Industries

Nabors Industries Ltd owns and operates land-based drilling rig fleets and is a provider of offshore platform rigs in the United States and international markets. It also provides performance tools, directional drilling services, tubular running services, and innovative technologies. It has operations in over 15 countries, 291 actively marketed rigs for land-based drilling operations and 28 actively marketed rigs for offshore platform drilling operations in the United States and multiple international markets. The company has five reportable segments: U.S. Drilling, Canada Drilling, International Drilling, Drilling Solutions, and Rig Technologies. The key revenue of the company is generated from International Drilling.

Having examined the options trading patterns of Nabors Industries, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Nabors Industries

- Trading volume stands at 428,872, with NBR’s price up by 3.96%, positioned at $72.95.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 103 days.

What The Experts Say On Nabors Industries

4 market experts have recently issued ratings for this stock, with a consensus target price of $88.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Susquehanna persists with their Neutral rating on Nabors Industries, maintaining a target price of $77.

* Consistent in their evaluation, an analyst from Barclays keeps a Equal-Weight rating on Nabors Industries with a target price of $88.

* An analyst from RBC Capital has revised its rating downward to Sector Perform, adjusting the price target to $102.

* An analyst from Evercore ISI Group persists with their In-Line rating on Nabors Industries, maintaining a target price of $85.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Nabors Industries options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply