Primis Financial Corp. Reports Earnings per Share for the Third Quarter of 2024

Announces Sale of Life Premium Finance Division

Announces Expansion of Mortgage Warehouse Lending Team

Declares Quarterly Cash Dividend of $0.10 Per Share

MCLEAN, Va., Oct. 24, 2024 /PRNewswire/ — Primis Financial Corp. FRST (“Primis” or the “Company”), and its wholly-owned subsidiary, Primis Bank (the “Bank”), today reported net income available to common shareholders of $1.2 million or $0.05 per diluted share for the quarter ended September 30, 2024, compared to a net loss available to common shareholders of $6.0 million or $0.24 per diluted share for the quarter ended September 30, 2023. For the year-to-date period in 2024, the Company reported earnings available to common and diluted earnings per share of $7.5 million and $0.30, respectively, compared to $0.3 million and $0.01, respectively, in the same period in 2023. Earnings for the three month and year-to-date periods are highly affected by the Company’s corrected accounting for a third-party originated consumer portfolio.

Earnings for the three month and year-to-date period in 2024 include $0.8 million and $2.2 million, respectively, or $0.03 and $0.09 per diluted share, respectively, of after-tax nonrecurring charges versus $11.3 million and $12.5 million, respectively, or $0.45 and $0.51 per diluted share, respectively in the comparable 2023 periods and inclusive of the goodwill impairment in the third quarter of 2023. Adjusting for these items, operating net income available to common shareholders was $2.0 million(1) or $0.08 per diluted share(1) for the quarter ended September 30, 2024, compared to net operating income available to common shareholders of $5.3 million(1) or $0.21 per diluted share(1) for the quarter ended September 30, 2023. For the year-to-date period in 2024 when adjusting for these items, earnings available to common and diluted earnings per share was $9.6 million(1) and $0.39(1), respectively, compared to $12.8 million(1) and $0.52(1), respectively, in the same period in 2023.

Sale of Life Premium Finance Division

On October 24, 2024, Primis Bank and EverBank, N.A. (“EverBank”) entered into a purchase and assumption agreement whereby EverBank will acquire the Life Premium Finance Division from Primis Bank including all the associated loans, except for a subset of mostly fixed rate and rate-capped loans retained by the Bank, and the operations of the division, including its employees, for a premium of $6.0 million. Primis Bank expects to record a pre-tax gain of $4.5 million net of advisory and legal fees in the fourth quarter of 2024.

On October 31, 2024, EverBank will acquire approximately $370 million of loans from the division with Primis Bank providing interim servicing until the transition of the business at the final closing which is expected on January 31, 2025. Between the first and second closings, EverBank will purchase loans generated by the division in ordinary course at par. After the second closing, EverBank will service the Bank’s retained portfolio for the duration of the portfolio.

Dennis J. Zember, Jr., President and Chief Executive Officer of Primis commented, “Three years ago we hired a set of professionals with a vision to build a tech-forward solution for life insurance premium finance. This platform has been widely accepted and used by the industry’s facilitators to such a degree that its opportunity is bigger than our balance sheet. EverBank is known for investing in scalable businesses with attractive risk-adjusted returns which makes our life premium finance team a perfect fit.”

Mortgage Warehouse Lending Team Expansion

In early October of 2024, Primis hired a seasoned team of mortgage warehouse lending professionals from a larger bank with a very successful track record in this space. While Primis Bank has had mortgage warehouse lending capabilities for some time, production had been limited while the Bank searched for the right leadership. Four key individuals have joined the Bank comprising sales, operations and portfolio management with another four to five support staff expected in the coming months.

Commented Mr. Zember, “Mortgage warehouse lending as an asset class has very attractive returns and limited losses. With several very large banks exiting the space and mortgage volumes projected to increase substantially, we believe this is a perfect time to expand our capabilities. Knowing the team we hired and having visited quite a few of their customers, I believe we can replace all of the life premium business we are selling with yields that are 125bps to 150bps higher. I expect the credit results and operating expense burdens to be similar so we believe the bottom-line impact will be significant as we scale this operation.”

Discussion of Results

The following table highlights selected financial data for the last five quarters:

|

3Q 2024 |

2Q 2024 |

1Q 2024 |

4Q 2023 |

3Q 2023 |

||||||

|

Return on average assets |

0.12 % |

0.39 % |

0.26 % |

(0.85 %) |

(0.62 %) |

|||||

|

Operating return on average assets(1) |

0.20 % |

0.50 % |

0.29 % |

(0.79 %) |

0.54 % |

|||||

|

Pre-tax pre-provision return on average assets(1) |

0.85 % |

0.78 % |

1.02 % |

0.96 % |

(0.33 %) |

|||||

|

Pre-tax pre-prov. operating return on average assets(1) |

0.95 % |

0.92 % |

1.05 % |

1.01 % |

(0.30 %) |

|||||

|

Return on average common equity |

1.28 % |

4.06 % |

2.62 % |

(8.43 %) |

(6.11 %) |

|||||

|

Operating return on average common equity(1) |

2.11 % |

5.18 % |

2.99 % |

(7.91 %) |

5.35 % |

|||||

|

Operating return on avg. tangible common equity(1) |

2.80 % |

6.93 % |

3.98 % |

(10.53 %) |

7.35 % |

|||||

|

Cost of funds |

3.25 % |

3.16 % |

2.97 % |

2.85 % |

2.75 % |

|||||

|

Net interest margin |

2.97 % |

2.72 % |

2.84 % |

2.86 % |

2.70 % |

|||||

|

Gross loans to deposits |

89.68 % |

98.95 % |

97.37 % |

98.45 % |

96.37 % |

|||||

|

Efficiency ratio |

83.22 % |

82.62 % |

77.41 % |

81.31 % |

108.50 % |

|||||

|

Operating efficiency ratio(1) |

80.35 % |

78.86 % |

76.17 % |

79.43 % |

75.17 % |

|||||

As disclosed in our recent filings with the SEC, the Company has corrected its method for accounting for a third-party originated and serviced consumer loan portfolio (the “Consumer Program”) and in which the separate agreements comprising the portfolio are treated as separate units of account (See “Critical Accounting Estimates and Policies” in the Company’s 2023 Form 10-K). A subset of the Consumer Program has promotional characteristics where interest is deferred during the promotional period and is waived if the customer pays off the loan prior to the period end. In that event, the third-party reimburses the Bank for the waived interest. Until the end of the promotional period, the Company is unable to accrue interest on the loan under GAAP but does record a derivative representing the fair value of expected interest reimbursements from the third-party. Credit costs are also fully included in the Company’s results, including estimated life of loan losses required by ASC 326 while potential credit enhancements from the Consumer Program are only reflected as received. Total outstanding balances in the Consumer Program were $180 million as of September 30, 2024 versus $194 million at June 30, 2024.

Net Interest Income

Net interest income increased approximately $3.2 million, or 13%, to $28.0 million during the third quarter of 2024 compared to the second quarter of 2024 largely due to increased interest recognition on previously deferring loans. For the third quarter of 2024, the Company reported a net interest margin of 2.97% versus 2.72% for the second quarter of 2024.

Interest income increased 9.4% to $57.1 million in the third quarter of 2024 compared to $52.2 million during the second quarter of 2024. At September 30, 2024, $60 million of loans were deferring interest due to a promotional feature. The Company recognized $3.0 million of interest in the third quarter of 2024 from promotional loans that were deferring interest and then began amortizing. In addition, in the third quarter of 2024, payoff of promotional loans triggered reimbursement of $2.5 million of deferred interest that was recognized in noninterest income. Promotional loan balances of $17 million and $21 million will reach the end of their promotional periods in the fourth quarter of 2024 and first quarter of 2025, respectively, after which loans with a promotional feature will decline to a nominal amount of the Bank’s portfolio by the end of 2025. Yield on earning assets and loans held for investment were 6.06% and 6.31%, respectively, in the third quarter of 2024 versus 5.72% and 5.91%, respectively, in the second quarter of 2024.

Interest expense increased $1.7 million to $29.1 million in the third quarter of 2024 compared to the second quarter of 2024 largely due to an increased reliance on FHLB funding during the third quarter. Cost of deposits increased 6 basis points to 3.04% in the third quarter of 2024 from 2.98% in the second quarter of 2024. Cost of funds was 3.25% in the third quarter of 2024, an increase of 9 basis points linked-quarter.

Noninterest Income

Noninterest income decreased during the third quarter of 2024 to $9.3 million compared to $11.2 million in the second quarter of 2024. Included in the second quarter of 2024 is approximately $0.9 million of bank-owned life insurance income due to a death benefit payout. Income from mortgage banking activity increased $0.4 million during the third quarter. Offsetting the increase in mortgage banking income was a reduction of $0.4 million in service fees and $1.2 million reduction in income related to the Consumer Program.

Noninterest Expense

Noninterest expense was $31.0 million for the third quarter of 2024, compared to $29.8 million for the second quarter of 2024. Noninterest expense also includes consolidated expenses from Panacea Financial Holdings (“PFH”). Management considers the core expense burden of the Bank that adjusts for certain items such as those that are volume dependent (e.g., mortgage banking related) or nonoperational (e.g., changes in the reserve for unfunded commitments). The following table illustrates the degree to which the Company has managed its operating expense burden during 2024:

|

3Q 2024 |

2Q 2024 |

1Q 2024 |

4Q 2023 |

3Q 2023 |

||||||

|

Reported Noninterest Expense |

31,045 |

29,786 |

27,538 |

27,780 |

36,950 |

|||||

|

PFH Consolidated Expenses |

(2,666) |

(2,347) |

(2,119) |

(2,813) |

– |

|||||

|

Noninterest Expense Excl. PFH |

28,379 |

27,439 |

25,419 |

24,967 |

36,950 |

|||||

|

Nonrecurring / Goodwill Impair. |

(1,352) |

(1,453) |

(438) |

(165) |

(11,350) |

|||||

|

Mortgage Expenses |

(6,436) |

(6,084) |

(5,122) |

(4,785) |

(5,108) |

|||||

|

Consumer Program Servicing Fee |

(699) |

(312) |

(312) |

(312) |

(312) |

|||||

|

Reserve for Unfunded Commitment |

(96) |

546 |

2 |

(554) |

257 |

|||||

|

Total Adjustments |

(8,583) |

(7,303) |

(5,870) |

(5,816) |

(16,513) |

|||||

|

Core Operating Expense Burden |

19,796 |

20,136 |

19,550 |

19,151 |

20,437 |

As noted above, the core expense burden decreased $0.3 million in the third quarter of 2024 from the second quarter of 2024. Core expense burden was $19.8 million, in line with the average for the last five quarters.

Loan Portfolio and Asset Quality

Loans held for investment decreased to $2.97 billion at September 30, 2024, compared to $3.30 billion at June 30, 2024. As noted above, the Bank has entered into an agreement to sell approximately $370 million of life premium finance loans and which have been reclassified to loans held for sale at September 30, 2024. Including these balances, loans held for investment would have increased 1.1% unannualized in the third quarter of 2024. The Panacea and Life Premium Finance divisions had loan growth of 4.4% and 11.1%, respectively, in the third quarter of 2024.

Nonperforming assets, excluding portions guaranteed by the SBA, were only 0.25% of total assets, or $10.2 million at September 30, 2024, compared to 0.25% or $9.9 million at June 30, 2024. Loans rated substandard were $47.6 million in the third quarter of 2024 compared to $15.5 million in the second quarter of 2024. The increase was largely driven by a single commercial credit that has experienced slower lease activity past its construction phase. Management evaluated and valued the property using conservative cap rates and lengthy times to lease and included the shortfall in its specific reserve. The Bank had no other real estate owned at the end of the third quarter of 2024.

The Company recorded a provision for loan losses of $7.5 million for the third quarter of 2024 versus $3.1 million for the second quarter of 2024. Of this provision, $4.0 million was due to Consumer Program activity. The remaining provision was due to specific reserves established on individually evaluated credits, approximately $2.2 million of which was tied to the commercial credit described above. As a percentage of loans, including life premium finance loans classified as held-for-sale at the end of the third quarter, the allowance for credit losses was 1.53% and 1.56% at the end of the third and second quarter of 2024, respectively.

Net charge-offs were $8.0 million for the third quarter of 2024, up from $5.0 million for the second quarter of 2024. Consumer Program net charge-offs were $6.7 million in the third quarter versus $4.4 million in the second quarter of 2024. Core net charge-offs, excluding those losses from the Consumer Program, were $1.3 million, or 0.15% of average loans, in the third quarter of 2024 compared to $0.6 million, or 0.07%, in the second quarter of 2024.

Deposits and Funding

Total deposits at September 30, 2024 decreased slightly to $3.31 billion from $3.34 billion at June 30, 2024. Importantly, noninterest bearing deposits were $421 million at September 30, 2024, up slightly from $420 million at June 30, 2024 and in the face of substantial remixing activity towards interest bearing accounts.

Deposit growth in the Bank continues to benefit from better technology and unique convenience factors. V1BE, the Bank’s proprietary invitation-only delivery tool, increased total users by 5% during the third quarter of 2024, and now has over 2,400 users on the platform as of September 30, 2024.

During the third quarter of 2024, the Bank opened approximately $32.5 million new deposit accounts on the digital platform with very modest marketing expenses. At quarter end, the Bank had over 17,000 digital accounts with $911 million in total deposits and average balances of approximately $53 thousand.

As of September 30, 2024, the Bank has $75.0 million of brokered CDs that mature at the end of 2024 and $165.0 million of short-term FHLB advances.

Lines of Business

The Panacea Financial Division continues to experience substantial growth alongside the development of the nationally-recognized Panacea Financial brand. The Panacea Financial Division finished the third quarter of 2024 with approximately $392 million in outstanding loans, an increase of $16.5 million from June 30, 2024. Panacea-related deposits were $90 million at September 30, 2024 with a weighted average cost of 2.00%. Panacea continues to roll out innovative technology capabilities that is expected to continue increasing the amount with which it self-funds its balance sheet.

Primis Mortgage had pre-tax income of $1.0 million in the third quarter of 2024 up from $0.9 million in the previous quarter. Locked loan volumes averaged $56.1 million per month in the third quarter of 2024, up from $52.0 million per month in the second quarter of 2024. Primis Mortgage continues to aggressively manage costs to preserve profitability in a lower volume environment while selectively adding talent to grow production.

Shareholders’ Equity

Book value per common share as of September 30, 2024 was $15.43, an increase of $0.20 from June 30, 2024. Tangible book value per common share(1) at the end of the third quarter of 2024 was $11.61, an increase of $0.21 from June 30, 2024. Common shareholders’ equity was $381 million, or 9.48% of total assets, at September 30, 2024. Tangible common equity(1) at September 30, 2024 was $287 million, or 7.30% of tangible assets(1). After-tax unrealized losses on the Company’s available-for-sale securities portfolio decreased by $6.0 million to $17.1 million due to decreases in market interest rates during the third quarter of 2024. The Company has the intent and ability to hold these securities until maturity or recovery of the value and does not anticipate realizing any losses on the investments.

The Board of Directors declared a dividend of $0.10 per share payable on November 22, 2024 to shareholders of record on November 8, 2024. This is Primis’ fifty-second consecutive quarterly dividend.

About Primis Financial Corp.

As of September 30, 2024, Primis had $4.0 billion in total assets, $2.9 billion in total loans held for investment and $3.3 billion in total deposits. Primis Bank provides a range of financial services to individuals and small- and medium-sized businesses through twenty-four full-service branches in Virginia and Maryland and provides services to customers through certain online and mobile applications.

|

Contacts: |

Address: |

|

Dennis J. Zember, Jr., President and CEO |

Primis Financial Corp. |

|

Matthew A. Switzer, EVP and CFO |

1676 International Drive, Suite 900 |

|

Phone: (703) 893-7400 |

McLean, VA 22102 |

|

Primis Financial Corp., NASDAQ Symbol FRST |

|

|

Website: www.primisbank.com |

Conference Call

The Company’s management will host a conference call to discuss its third quarter results on Friday, October 25, 2024 at 10:00 a.m. (ET). A live Webcast of the conference call is available at the following website: https://events.q4inc.com/attendee/853860984. Participants may also call 1-888-330-3573 and ask for the Primis Financial Corp. call. A replay of the teleconference will be available for 7 days by calling 1-800-770-2030 and providing Replay Access Code 4440924.

Non-GAAP Measures

Statements included in this press release include non-GAAP financial measures and should be read along with the accompanying tables. Primis uses non-GAAP financial measures to analyze its performance. The measures entitled net income adjusted for nonrecurring income and expenses; pre-tax pre-provision operating earnings; operating return on average assets; pre-tax pre-provision operating return on average assets; operating return on average equity; operating return on average tangible equity; operating efficiency ratio; operating earnings per share – basic; operating earnings per share – diluted; tangible book value per share; tangible common equity; tangible common equity to tangible assets; and core net interest margin are not measures recognized under GAAP and therefore are considered non-GAAP financial measures. We use the term “operating” to describe a financial measure that excludes income or expense considered to be non-recurring in nature. Items identified as non-operating are those that, when excluded from a reported financial measure, provide management or the reader with a measure that may be more indicative of forward-looking trends in our business. A reconciliation of these non-GAAP financial measures to the most comparable GAAP measures is provided in the Reconciliation of Non-GAAP Items table.

Management believes that these non-GAAP financial measures provide additional useful information about Primis that allows management and investors to evaluate the ongoing operating results, financial strength and performance of Primis and provide meaningful comparison to its peers. Non-GAAP financial measures should not be considered as an alternative to any measure of performance or financial condition as promulgated under GAAP, and investors should consider Primis’ performance and financial condition as reported under GAAP and all other relevant information when assessing the performance or financial condition of Primis. Non-GAAP financial measures are not standardized and, therefore, it may not be possible to compare these measures with other companies that present measures having the same or similar names.

Non-GAAP financial measures have limitations as analytical tools, and investors should not consider them in isolation or as a substitute for analysis of the results or financial condition as reported under GAAP.

Forward-Looking Statements

This press release and certain of our other filings with the Securities and Exchange Commission contain statements that constitute “forward-looking statements” within the meaning of, and subject to the protections of, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical fact are forward-looking statements. Such statements can generally be identified by such words as “may,” “plan,” “contemplate,” “anticipate,” “believe,” “intend,” “continue,” “expect,” “project,” “predict,” “estimate,” “could,” “should,” “would,” “will,” and other similar words or expressions of the future or otherwise regarding the outlook for the Company’s future business and financial performance and/or the performance of the banking industry and economy in general. These forward-looking statements include, but are not limited to, our expectations regarding our future operating and financial performance, including the preliminary estimated financial and operating information presented herein, which is subject to adjustment; our outlook and long-term goals for future growth and new offerings and services; our expectations regarding net interest margin; expectations on our growth strategy, expense management, capital management and future profitability; expectations on credit quality and performance; and the assumptions underlying our expectations.

Prospective investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve known and unknown risks and uncertainties which may cause the actual results, performance or achievements of the Company to be materially different from the future results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements are based on the information known to, and current beliefs and expectations of, the Company’s management and are subject to significant risks and uncertainties. Actual results may differ materially from those contemplated by such forward-looking statements. Factors that might cause such differences include, but are not limited to: the result of the “pre-clearance” process with the Office of the Chief Accountant of the SEC and the impact on the Company’s financial statements; the possibility that the Company is unable to regain compliance with, or thereafter continue to comply with, applicable Nasdaq Listing Rules, or experience violations of additional Nasdaq Listing Rules; the possibility that Nasdaq may deny the Company’s appeal and delist the Company’s securities; the Company’s ability to implement its various strategic and growth initiatives, including the sale of the Life Premium Finance Division and the impact on the Company’s operating results and its recently established Panacea Financial Division, digital banking platform, V1BE fulfillment service and Primis Mortgage Company; competitive pressures among financial institutions increasing significantly; changes in applicable laws, rules, or regulations, including changes to statutes, regulations or regulatory policies or practices; changes in management’s plans for the future; credit risk associated with our lending activities; the impact of current and future economic and market conditions generally (including seasonality) and in the financial services industry, nationally and within our primary market areas; changes in interest rates, inflation, loan demand, real estate values, or competition, as well as labor shortages and supply chain disruptions; changes in accounting principles, policies, or guidelines; adverse results from current or future litigation, regulatory examinations or other legal and/or regulatory actions; potential impacts of adverse developments in the banking industry highlighted by high-profile bank failures, including impacts on customer confidence, deposit outflows, liquidity and the regulatory response thereto; potential increases in the provision for credit losses; our ability to identify and address increased cybersecurity risks, including those impacting vendors and other third parties; fraud or misconduct by internal or external actors, which we may not be able to prevent, detect or mitigate; acts of God or of war or other conflicts, including the current Ukraine/Russia conflict and Israel/Hamas conflict, acts of terrorism, pandemics or other catastrophic events that may affect general economic conditions; and other general competitive, economic, political, and market factors, including those affecting our business, operations, pricing, products, or services.

Forward-looking statements speak only as of the date on which such statements are made. These forward-looking statements are based upon information presently known to the Company’s management and are inherently subjective, uncertain and subject to change due to any number of risks and uncertainties, including, without limitation, the risks and other factors set forth in the Company’s filings with the Securities and Exchange Commission, the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, under the captions “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors,” and in the Company’s Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. The Company undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made, or to reflect the occurrence of unanticipated events. Readers are cautioned not to place undue reliance on these forward-looking statements.

|

(1) |

Non-GAAP financial measure. Please see “Reconciliation of Non-GAAP Items” in the financial tables for more information and for a reconciliation to GAAP. |

|

Primis Financial Corp. |

|||||||||||

|

Financial Highlights (unaudited) |

|||||||||||

|

(Dollars in thousands, except per share data) |

For Three Months Ended: |

For Nine Months Ended: |

|||||||||

|

Selected Performance Ratios: |

3Q 2024 |

2Q 2024 |

1Q 2024 |

4Q 2023 |

3Q 2023 |

3Q 2024 |

3Q 2023 |

||||

|

Return on average assets |

0.12 % |

0.39 % |

0.26 % |

(0.85 %) |

(0.62 %) |

0.25 % |

0.01 % |

||||

|

Operating return on average assets(1) |

0.20 % |

0.50 % |

0.29 % |

(0.79 %) |

0.54 % |

0.33 % |

0.43 % |

||||

|

Pre-tax pre-provision return on average assets(1) |

0.85 % |

0.78 % |

1.02 % |

0.96 % |

(0.33 %) |

0.88 % |

0.48 % |

||||

|

Pre-tax pre-provision operating return on average assets(1) |

0.95 % |

0.92 % |

1.05 % |

1.01 % |

(0.30 %) |

0.98 % |

0.91 % |

||||

|

Return on average common equity |

1.28 % |

4.06 % |

2.62 % |

(8.43 %) |

(6.11 %) |

2.66 % |

0.11 % |

||||

|

Operating return on average common equity(1) |

2.11 % |

5.18 % |

2.99 % |

(7.91 %) |

5.35 % |

3.44 % |

4.32 % |

||||

|

Operating return on average tangible common equity(1) |

2.80 % |

6.93 % |

3.98 % |

(10.53 %) |

7.35 % |

4.60 % |

5.92 % |

||||

|

Cost of funds |

3.25 % |

3.16 % |

2.97 % |

2.85 % |

2.75 % |

3.13 % |

2.61 % |

||||

|

Net interest margin |

2.97 % |

2.72 % |

2.84 % |

2.86 % |

2.70 % |

2.85 % |

2.61 % |

||||

|

Gross loans to deposits |

89.68 % |

98.95 % |

97.37 % |

98.45 % |

96.37 % |

89.68 % |

96.37 % |

||||

|

Efficiency ratio |

83.22 % |

82.62 % |

77.41 % |

81.31 % |

108.50 % |

81.12 % |

86.30 % |

||||

|

Operating efficiency ratio(1) |

80.35 % |

78.86 % |

76.17 % |

79.43 % |

75.17 % |

78.49 % |

74.56 % |

||||

|

Per Common Share Data: |

|||||||||||

|

Earnings per common share – Basic |

$ 0.05 |

$ 0.15 |

$ 0.10 |

$ (0.33) |

$ (0.24) |

$ 0.30 |

$ 0.01 |

||||

|

Operating earnings per common share – Basic(1) |

$ 0.08 |

$ 0.20 |

$ 0.11 |

$ (0.31) |

$ 0.21 |

$ 0.39 |

$ 0.52 |

||||

|

Earnings per common share – Diluted |

$ 0.05 |

$ 0.15 |

$ 0.10 |

$ (0.33) |

$ (0.24) |

$ 0.30 |

$ 0.01 |

||||

|

Operating earnings per common share – Diluted(1) |

$ 0.08 |

$ 0.20 |

$ 0.11 |

$ (0.31) |

$ 0.21 |

$ 0.39 |

$ 0.52 |

||||

|

Book value per common share |

$ 15.43 |

$ 15.23 |

$ 15.16 |

$ 15.23 |

$ 15.30 |

$ 15.43 |

$ 15.30 |

||||

|

Tangible book value per common share(1) |

$ 11.61 |

$ 11.40 |

$ 11.31 |

$ 11.37 |

$ 11.42 |

$ 11.61 |

$ 11.42 |

||||

|

Cash dividend per common share |

$ 0.10 |

$ 0.10 |

$ 0.10 |

$ 0.10 |

$ 0.10 |

$ 0.30 |

$ 0.30 |

||||

|

Weighted average shares outstanding – Basic |

24,695,685 |

24,683,734 |

24,673,857 |

24,647,728 |

24,641,981 |

24,683,556 |

24,635,535 |

||||

|

Weighted average shares outstanding – Diluted |

24,719,920 |

24,708,484 |

24,707,113 |

24,687,993 |

24,641,981 |

24,710,345 |

24,635,535 |

||||

|

Shares outstanding at end of period |

24,722,734 |

24,708,234 |

24,708,588 |

24,693,172 |

24,686,764 |

24,722,734 |

24,686,764 |

||||

|

Asset Quality Ratios: |

|||||||||||

|

Non-performing assets as a percent of total assets, excluding SBA guarantees |

0.25 % |

0.25 % |

0.23 % |

0.20 % |

0.51 % |

0.25 % |

0.51 % |

||||

|

Net charge-offs (recoveries) as a percent of average loans (annualized) |

0.93 % |

0.60 % |

0.64 % |

0.61 % |

0.53 % |

0.52 % |

0.32 % |

||||

|

Core net charge-offs (recoveries) as a percent of average loans (annualized)(2) |

0.15 % |

0.07 % |

0.11 % |

0.24 % |

0.27 % |

(0.10 %) |

0.12 % |

||||

|

Allowance for credit losses to total loans |

1.72 % |

1.56 % |

1.66 % |

1.62 % |

1.13 % |

1.72 % |

1.13 % |

||||

|

Capital Ratios: |

|||||||||||

|

Common equity to assets |

9.48 % |

9.49 % |

9.63 % |

9.75 % |

9.84 % |

||||||

|

Tangible common equity to tangible assets(1) |

7.30 % |

7.27 % |

7.36 % |

7.46 % |

7.53 % |

||||||

|

Leverage ratio(3) |

8.06 % |

8.25 % |

8.38 % |

8.37 % |

8.60 % |

||||||

|

Common equity tier 1 capital ratio(3) |

8.98 % |

8.85 % |

8.97 % |

8.96 % |

9.36 % |

||||||

|

Tier 1 risk-based capital ratio(3) |

9.28 % |

9.14 % |

9.26 % |

9.25 % |

9.66 % |

||||||

|

Total risk-based capital ratio(3) |

12.66 % |

12.45 % |

12.61 % |

13.44 % |

13.05 % |

||||||

|

(1) |

See Reconciliation of Non-GAAP financial measures. |

|

(2) |

Excludes third-party charge-offs |

|

(3) |

Ratios are estimated and may be subject to change pending the final filing of the FR Y-9C. |

|

Primis Financial Corp. |

|||||||

|

(Dollars in thousands) |

As Of : |

||||||

|

Condensed Consolidated Balance Sheets (unaudited) |

3Q 2024 |

2Q 2024 |

1Q 2024 |

4Q 2023 |

3Q 2023 |

||

|

Assets |

|||||||

|

Cash and cash equivalents |

$ 77,274 |

$ 66,580 |

$ 88,717 |

$ 77,553 |

$ 93,865 |

||

|

Investment securities-available for sale |

242,543 |

232,867 |

230,617 |

228,420 |

216,875 |

||

|

Investment securities-held to maturity |

9,766 |

10,649 |

10,992 |

11,650 |

11,975 |

||

|

Loans held for sale |

467,325 |

94,644 |

72,217 |

57,691 |

66,266 |

||

|

Loans receivable, net of deferred fees |

2,965,120 |

3,300,562 |

3,227,665 |

3,219,414 |

3,173,788 |

||

|

Allowance for credit losses |

(51,132) |

(51,574) |

(53,456) |

(52,209) |

(35,862) |

||

|

Net loans |

2,913,988 |

3,248,988 |

3,174,209 |

3,167,205 |

3,137,926 |

||

|

Stock in Federal Reserve Bank and Federal Home Loan Bank |

20,875 |

16,837 |

14,225 |

14,246 |

12,796 |

||

|

Bank premises and equipment, net |

19,668 |

19,946 |

20,412 |

20,611 |

24,878 |

||

|

Operating lease right-of-use assets |

10,465 |

10,293 |

10,206 |

10,646 |

11,402 |

||

|

Goodwill and other intangible assets |

94,444 |

94,768 |

95,092 |

95,417 |

95,741 |

||

|

Assets held for sale, net |

3,898 |

5,136 |

6,359 |

6,735 |

3,115 |

||

|

Bank-owned life insurance |

67,010 |

66,578 |

67,685 |

67,588 |

67,176 |

||

|

Deferred tax assets, net |

25,582 |

25,232 |

24,513 |

22,395 |

24,179 |

||

|

Consumer Program derivative asset |

9,763 |

9,929 |

10,685 |

10,806 |

12,818 |

||

|

Other assets |

62,002 |

63,917 |

64,050 |

65,583 |

59,847 |

||

|

Total assets |

$ 4,024,603 |

$ 3,966,364 |

$ 3,889,979 |

$ 3,856,546 |

$ 3,838,859 |

||

|

Liabilities and stockholders’ equity |

|||||||

|

Demand deposits |

$ 421,231 |

$ 420,241 |

$ 463,190 |

$ 472,941 |

$ 490,719 |

||

|

NOW accounts |

748,833 |

793,608 |

771,116 |

773,028 |

803,276 |

||

|

Money market accounts |

835,099 |

831,834 |

834,514 |

794,530 |

800,951 |

||

|

Savings accounts |

873,810 |

866,279 |

823,325 |

783,758 |

746,608 |

||

|

Time deposits |

427,458 |

423,501 |

422,778 |

445,898 |

451,850 |

||

|

Total deposits |

3,306,431 |

3,335,463 |

3,314,923 |

3,270,155 |

3,293,404 |

||

|

Securities sold under agreements to repurchase – short term |

3,677 |

3,273 |

3,038 |

3,044 |

3,838 |

||

|

Federal Home Loan Bank advances |

165,000 |

80,000 |

25,000 |

30,000 |

– |

||

|

Secured borrowings |

17,495 |

21,069 |

21,298 |

20,393 |

29,649 |

||

|

Subordinated debt and notes |

95,808 |

95,737 |

95,666 |

95,595 |

95,524 |

||

|

Operating lease liabilities |

11,704 |

11,488 |

11,353 |

11,686 |

12,347 |

||

|

Other liabilities |

27,168 |

24,777 |

24,102 |

28,080 |

26,487 |

||

|

Total liabilities |

3,627,283 |

3,571,807 |

3,495,380 |

3,458,953 |

3,461,249 |

||

|

Total Primis common stockholders’ equity |

381,352 |

376,393 |

374,577 |

376,161 |

377,610 |

||

|

Noncontrolling interest |

15,968 |

18,164 |

20,022 |

21,432 |

– |

||

|

Total stockholders’ equity |

397,320 |

394,557 |

394,599 |

397,593 |

377,610 |

||

|

Total liabilities and stockholders’ equity |

$ 4,024,603 |

$ 3,966,364 |

$ 3,889,979 |

$ 3,856,546 |

$ 3,838,859 |

||

|

Tangible common equity(1) |

$ 286,908 |

$ 281,625 |

$ 279,485 |

$ 280,744 |

$ 281,869 |

||

|

Primis Financial Corp. |

|||||||||||

|

(Dollars in thousands) |

For Three Months Ended: |

For Nine Months Ended: |

|||||||||

|

Condensed Consolidated Statement of Operations (unaudited) |

3Q 2024 |

2Q 2024 |

1Q 2024 |

4Q 2023 |

3Q 2023 |

3Q 2024 |

3Q 2023 |

||||

|

Interest and dividend income |

$ 57,112 |

$ 52,199 |

$ 50,345 |

$ 50,163 |

$ 48,027 |

$ 159,656 |

$ 142,485 |

||||

|

Interest expense |

29,089 |

27,346 |

25,076 |

24,437 |

23,697 |

81,511 |

69,499 |

||||

|

Net interest income |

28,023 |

24,853 |

25,269 |

25,726 |

24,330 |

78,145 |

72,986 |

||||

|

Provision for credit losses |

7,511 |

3,119 |

6,508 |

21,310 |

1,616 |

17,138 |

11,231 |

||||

|

Net interest income after provision for credit losses |

20,512 |

21,734 |

18,761 |

4,416 |

22,714 |

61,007 |

61,755 |

||||

|

Account maintenance and deposit service fees |

1,468 |

1,861 |

1,393 |

1,518 |

1,534 |

4,722 |

4,215 |

||||

|

Income from bank-owned life insurance |

431 |

1,327 |

564 |

420 |

787 |

2,322 |

1,601 |

||||

|

Mortgage banking income |

6,803 |

6,402 |

5,574 |

3,210 |

4,922 |

18,779 |

14,435 |

||||

|

Gain (loss) on sale of loans |

– |

(29) |

336 |

526 |

217 |

307 |

268 |

||||

|

Consumer Program derivative |

79 |

1,272 |

2,041 |

2,886 |

2,033 |

3,392 |

15,233 |

||||

|

Gain (loss) on other investments |

51 |

136 |

206 |

190 |

30 |

393 |

(6) |

||||

|

Gain (loss) on bank premises and equipment |

352 |

124 |

– |

(478) |

2 |

476 |

2 |

||||

|

Other |

99 |

105 |

193 |

169 |

201 |

397 |

584 |

||||

|

Noninterest income |

9,283 |

11,198 |

10,307 |

8,441 |

9,726 |

30,788 |

36,332 |

||||

|

Employee compensation and benefits |

16,764 |

16,088 |

15,735 |

14,645 |

13,809 |

48,587 |

44,120 |

||||

|

Occupancy and equipment expenses |

3,071 |

3,099 |

3,106 |

2,982 |

3,170 |

9,276 |

9,637 |

||||

|

Amortization of intangible assets |

318 |

317 |

317 |

317 |

317 |

952 |

952 |

||||

|

Goodwill impairment |

– |

– |

– |

– |

11,150 |

– |

11,150 |

||||

|

Virginia franchise tax expense |

631 |

632 |

631 |

849 |

849 |

1,894 |

2,546 |

||||

|

Data processing expense |

2,552 |

2,347 |

2,231 |

2,216 |

2,250 |

7,130 |

7,329 |

||||

|

Marketing expense |

449 |

499 |

459 |

352 |

377 |

1,407 |

1,467 |

||||

|

Telecommunication and communication expense |

330 |

341 |

346 |

358 |

356 |

1,017 |

1,149 |

||||

|

Professional fees |

2,914 |

2,976 |

1,365 |

1,586 |

1,118 |

7,255 |

3,055 |

||||

|

Miscellaneous lending expenses |

1,098 |

285 |

451 |

1,128 |

424 |

1,834 |

1,878 |

||||

|

Other expenses |

2,918 |

3,202 |

2,897 |

3,347 |

3,130 |

9,017 |

11,060 |

||||

|

Noninterest expense |

31,045 |

29,786 |

27,538 |

27,780 |

36,950 |

88,369 |

94,343 |

||||

|

Income (loss) before income taxes |

(1,250) |

3,146 |

1,530 |

(14,923) |

(4,510) |

3,426 |

3,744 |

||||

|

Income tax expense (benefit) |

(304) |

1,265 |

718 |

(4,472) |

1,519 |

1,679 |

3,405 |

||||

|

Net Income (loss) |

(946) |

1,881 |

812 |

(10,451) |

(6,029) |

1,747 |

339 |

||||

|

Noncontrolling interest |

2,158 |

1,901 |

1,654 |

2,280 |

– |

5,713 |

– |

||||

|

Net income (loss) attributable to Primis’ common shareholders |

$ 1,212 |

$ 3,782 |

$ 2,466 |

$ (8,171) |

$ (6,029) |

$ 7,460 |

$ 339 |

||||

|

(1) |

See Reconciliation of Non-GAAP financial measures. |

|

Primis Financial Corp |

|||||||

|

(Dollars in thousands) |

As Of: |

||||||

|

Loan Portfolio Composition |

3Q 2024 |

2Q 2024 |

1Q 2024 |

4Q 2023 |

3Q 2023 |

||

|

Loans held for sale |

$ 467,325 |

$ 94,644 |

$ 72,217 |

$ 57,691 |

$ 66,266 |

||

|

Loans secured by real estate: |

|||||||

|

Commercial real estate – owner occupied |

463,848 |

463,328 |

458,026 |

455,397 |

432,367 |

||

|

Commercial real estate – non-owner occupied |

609,743 |

612,428 |

577,752 |

578,600 |

605,508 |

||

|

Secured by farmland |

4,356 |

4,758 |

4,341 |

5,044 |

5,082 |

||

|

Construction and land development |

105,541 |

104,886 |

146,908 |

164,742 |

170,849 |

||

|

Residential 1-4 family |

607,313 |

608,049 |

602,124 |

606,226 |

600,389 |

||

|

Multi-family residential |

169,368 |

171,512 |

128,599 |

127,857 |

129,586 |

||

|

Home equity lines of credit |

62,421 |

62,138 |

57,765 |

59,670 |

59,996 |

||

|

Total real estate loans |

2,022,590 |

2,027,099 |

1,975,515 |

1,997,536 |

2,003,777 |

||

|

Commercial loans |

526,772 |

619,365 |

623,804 |

602,623 |

603,637 |

||

|

Paycheck Protection Program loans |

1,941 |

1,969 |

2,003 |

2,023 |

2,105 |

||

|

Consumer loans |

408,378 |

646,590 |

620,745 |

611,583 |

558,277 |

||

|

Total Non-PCD loans |

2,959,681 |

3,295,023 |

3,222,067 |

3,213,765 |

3,167,796 |

||

|

PCD loans |

5,439 |

5,539 |

5,598 |

5,649 |

5,992 |

||

|

Total loans receivable, net of deferred fees |

$ 2,965,120 |

$ 3,300,562 |

$ 3,227,665 |

$ 3,219,414 |

$ 3,173,788 |

||

|

Loans by Risk Grade: |

|||||||

|

Pass, not graded |

$ – |

$ – |

$ – |

$ – |

$ – |

||

|

Pass Grade 1 – Highest Quality |

820 |

692 |

633 |

875 |

851 |

||

|

Pass Grade 2 – Good Quality |

169,285 |

488,728 |

412,593 |

405,019 |

383,306 |

||

|

Pass Grade 3 – Satisfactory Quality |

1,509,280 |

1,503,918 |

1,603,053 |

1,626,380 |

1,632,256 |

||

|

Pass Grade 4 – Pass |

1,184,671 |

1,204,268 |

1,177,065 |

1,154,971 |

1,095,264 |

||

|

Pass Grade 5 – Special Mention |

53,473 |

87,471 |

19,454 |

14,930 |

33,299 |

||

|

Grade 6 – Substandard |

47,591 |

15,485 |

14,867 |

17,239 |

28,812 |

||

|

Grade 7 – Doubtful |

– |

– |

– |

– |

– |

||

|

Grade 8 – Loss |

– |

– |

– |

– |

– |

||

|

Total loans |

$ 2,965,120 |

$ 3,300,562 |

$ 3,227,665 |

$ 3,219,414 |

$ 3,173,788 |

||

|

(Dollars in thousands) |

As Of or For Three Months Ended: |

||||||

|

Asset Quality Information |

3Q 2024 |

2Q 2024 |

1Q 2024 |

4Q 2023 |

3Q 2023 |

||

|

Allowance for Credit Losses: |

|||||||

|

Balance at beginning of period |

$ (51,574) |

$ (53,456) |

$ (52,209) |

$ (35,862) |

$ (38,541) |

||

|

Provision for for credit losses |

(7,511) |

(3,119) |

(6,508) |

(21,310) |

(1,616) |

||

|

Net charge-offs |

7,953 |

5,001 |

5,261 |

4,963 |

4,295 |

||

|

Ending balance |

$ (51,132) |

$ (51,574) |

$ (53,456) |

$ (52,209) |

$ (35,862) |

||

|

Reserve for Unfunded Commitments: |

|||||||

|

Balance at beginning of period |

$ (1,031) |

$ (1,577) |

$ (1,579) |

$ (1,025) |

$ (1,282) |

||

|

(Expense for) / recovery of unfunded loan commitment reserve |

(96) |

546 |

2 |

(554) |

257 |

||

|

Total Reserve for Unfunded Commitments |

$ (1,127) |

$ (1,031) |

$ (1,577) |

$ (1,579) |

$ (1,025) |

||

|

As Of: |

|||||||

|

Non-Performing Assets: |

3Q 2024 |

2Q 2024 |

1Q 2024 |

4Q 2023 |

3Q 2023 |

||

|

Nonaccrual loans |

$ 14,424 |

$ 11,289 |

$ 10,139 |

$ 9,095 |

$ 20,171 |

||

|

Accruing loans delinquent 90 days or more |

1,714 |

1,897 |

1,714 |

1,714 |

1,625 |

||

|

Total non-performing assets |

$ 16,138 |

$ 13,186 |

$ 11,853 |

$ 10,809 |

$ 21,796 |

||

|

SBA guaranteed portion of non-performing loans |

$ 5,954 |

$ 3,268 |

$ 3,095 |

$ 3,115 |

$ 2,290 |

||

|

Primis Financial Corp. |

|||||||||||

|

(Dollars in thousands) |

For Three Months Ended: |

For Nine Months Ended: |

|||||||||

|

Average Balance Sheet |

3Q 2024 |

2Q 2024 |

1Q 2024 |

4Q 2023 |

3Q 2023 |

3Q 2024 |

3Q 2023 |

||||

|

Assets |

|||||||||||

|

Loans held for sale |

$ 98,110 |

$ 84,389 |

$ 58,896 |

$ 48,380 |

$ 55,775 |

$ 80,530 |

$ 43,384 |

||||

|

Loans, net of deferred fees |

3,324,157 |

3,266,651 |

3,206,888 |

3,208,295 |

3,193,236 |

3,266,111 |

3,099,225 |

||||

|

Investment securities |

242,631 |

244,308 |

241,179 |

228,335 |

234,601 |

242,706 |

240,525 |

||||

|

Other earning assets |

83,405 |

73,697 |

77,067 |

79,925 |

93,159 |

78,076 |

348,831 |

||||

|

Total earning assets |

3,748,303 |

3,669,045 |

3,584,030 |

3,564,935 |

3,576,771 |

3,667,423 |

3,731,965 |

||||

|

Other assets |

243,972 |

243,200 |

248,082 |

262,977 |

268,038 |

244,913 |

260,474 |

||||

|

Total assets |

$ 3,992,275 |

$ 3,912,245 |

$ 3,832,112 |

$ 3,827,912 |

$ 3,844,809 |

$ 3,912,336 |

$ 3,992,439 |

||||

|

Liabilities and equity |

|||||||||||

|

Demand deposits |

$ 421,908 |

$ 433,315 |

$ 458,306 |

$ 473,750 |

$ 472,485 |

$ 440,172 |

$ 500,459 |

||||

|

Interest-bearing liabilities: |

|||||||||||

|

NOW and other demand accounts |

748,202 |

778,458 |

773,943 |

782,305 |

806,339 |

766,800 |

785,480 |

||||

|

Money market accounts |

859,988 |

823,156 |

814,147 |

790,971 |

850,892 |

832,531 |

844,752 |

||||

|

Savings accounts |

866,375 |

866,652 |

800,328 |

783,432 |

703,809 |

844,531 |

775,024 |

||||

|

Time deposits |

425,238 |

423,107 |

431,340 |

451,521 |

460,961 |

426,557 |

481,813 |

||||

|

Total Deposits |

3,321,711 |

3,324,688 |

3,278,064 |

3,281,979 |

3,294,486 |

3,310,591 |

3,387,528 |

||||

|

Borrowings |

238,994 |

158,919 |

120,188 |

120,213 |

119,797 |

172,942 |

172,662 |

||||

|

Total Funding |

3,560,705 |

3,483,607 |

3,398,252 |

3,402,192 |

3,414,283 |

3,483,533 |

3,560,190 |

||||

|

Other Liabilities |

36,527 |

34,494 |

34,900 |

39,056 |

39,303 |

35,344 |

35,457 |

||||

|

Total liabilites |

3,597,232 |

3,518,101 |

3,433,152 |

3,441,248 |

3,453,586 |

3,518,877 |

3,595,647 |

||||

|

Primis common stockholders’ equity |

377,595 |

374,735 |

378,008 |

384,332 |

391,223 |

374,189 |

396,792 |

||||

|

Noncontrolling interest |

17,448 |

19,409 |

20,952 |

2,332 |

– |

19,270 |

– |

||||

|

Total stockholders’ equity |

395,043 |

394,144 |

398,960 |

386,664 |

391,223 |

393,459 |

396,792 |

||||

|

Total liabilities and stockholders’ equity |

$ 3,992,275 |

$ 3,912,245 |

$ 3,832,112 |

$ 3,827,912 |

$ 3,844,809 |

$ 3,912,336 |

$ 3,992,439 |

||||

|

Net Interest Income |

|||||||||||

|

Loans held for sale |

$ 1,589 |

$ 1,521 |

$ 907 |

$ 842 |

$ 873 |

$ 4,017 |

$ 1,964 |

||||

|

Loans |

52,707 |

48,032 |

46,825 |

46,723 |

44,439 |

147,564 |

123,289 |

||||

|

Investment securities |

1,799 |

1,805 |

1,715 |

1,645 |

1,593 |

5,319 |

4,728 |

||||

|

Other earning assets |

1,017 |

841 |

898 |

953 |

1,122 |

2,756 |

12,504 |

||||

|

Total Earning Assets Income |

57,112 |

52,199 |

50,345 |

50,163 |

48,027 |

159,656 |

142,485 |

||||

|

Non-interest bearing DDA |

– |

– |

– |

– |

– |

– |

– |

||||

|

NOW and other interest-bearing demand accounts |

4,630 |

4,827 |

4,467 |

4,334 |

4,460 |

13,924 |

11,070 |

||||

|

Money market accounts |

7,432 |

6,788 |

6,512 |

6,129 |

6,555 |

20,732 |

17,587 |

||||

|

Savings accounts |

8,918 |

8,912 |

8,045 |

7,860 |

6,760 |

25,876 |

21,915 |

||||

|

Time deposits |

4,371 |

4,095 |

3,990 |

3,964 |

3,801 |

12,455 |

10,831 |

||||

|

Total Deposit Costs |

25,351 |

24,622 |

23,014 |

22,287 |

21,576 |

72,987 |

61,403 |

||||

|

Borrowings |

3,738 |

2,724 |

2,062 |

2,150 |

2,121 |

8,524 |

8,096 |

||||

|

Total Funding Costs |

29,089 |

27,346 |

25,076 |

24,437 |

23,697 |

81,511 |

69,499 |

||||

|

Net Interest Income |

$ 28,023 |

$ 24,853 |

$ 25,269 |

$ 25,726 |

$ 24,330 |

$ 78,145 |

$ 72,986 |

||||

|

Net Interest Margin |

|||||||||||

|

Loans held for sale |

6.44 % |

7.25 % |

6.19 % |

6.90 % |

6.21 % |

6.66 % |

6.05 % |

||||

|

Loans |

6.31 % |

5.91 % |

5.87 % |

5.78 % |

5.52 % |

6.04 % |

5.32 % |

||||

|

Investments |

2.95 % |

2.97 % |

2.86 % |

2.86 % |

2.69 % |

2.93 % |

2.63 % |

||||

|

Other Earning Assets |

4.85 % |

4.59 % |

4.69 % |

4.73 % |

4.78 % |

4.72 % |

4.79 % |

||||

|

Total Earning Assets |

6.06 % |

5.72 % |

5.65 % |

5.58 % |

5.33 % |

5.82 % |

5.10 % |

||||

|

NOW |

2.46 % |

2.49 % |

2.32 % |

2.20 % |

2.19 % |

2.43 % |

1.88 % |

||||

|

MMDA |

3.44 % |

3.32 % |

3.22 % |

3.07 % |

3.06 % |

3.33 % |

2.78 % |

||||

|

Savings |

4.10 % |

4.14 % |

4.04 % |

3.98 % |

3.81 % |

4.09 % |

3.78 % |

||||

|

CDs |

4.09 % |

3.89 % |

3.72 % |

3.48 % |

3.27 % |

3.90 % |

3.01 % |

||||

|

Cost of Interest Bearing Deposits |

3.48 % |

3.42 % |

3.28 % |

3.15 % |

3.03 % |

3.40 % |

2.84 % |

||||

|

Cost of Deposits |

3.04 % |

2.98 % |

2.82 % |

2.69 % |

2.60 % |

2.94 % |

2.42 % |

||||

|

Other Funding |

6.22 % |

6.89 % |

6.90 % |

7.10 % |

7.02 % |

6.58 % |

6.27 % |

||||

|

Total Cost of Funds |

3.25 % |

3.16 % |

2.97 % |

2.85 % |

2.75 % |

3.13 % |

2.61 % |

||||

|

Net Interest Margin |

2.97 % |

2.72 % |

2.84 % |

2.86 % |

2.70 % |

2.85 % |

2.61 % |

||||

|

Net Interest Spread |

2.37 % |

2.12 % |

2.22 % |

2.27 % |

2.13 % |

2.24 % |

2.49 % |

||||

|

Primis Financial Corp. |

|||||||||||

|

(Dollars in thousands, except per share data) |

For Three Months Ended: |

For Nine Months Ended: |

|||||||||

|

Reconciliation of Non-GAAP items: |

3Q 2024 |

2Q 2024 |

1Q 2024 |

4Q 2023 |

3Q 2023 |

3Q 2024 |

3Q 2023 |

||||

|

Net income (loss) attributable to Primis’ common shareholders |

$ 1,212 |

$ 3,782 |

$ 2,466 |

$ (8,171) |

$ (6,029) |

$ 7,460 |

$ 339 |

||||

|

Non-GAAP adjustments to Net Income: |

|||||||||||

|

Branch Consolidation / Other restructuring |

– |

– |

– |

449 |

– |

– |

1,488 |

||||

|

Loan officer fraud, operational losses |

– |

– |

– |

– |

200 |

– |

200 |

||||

|

Professional fee expenses related to the SEC pre-clear process and financial reporting restatements |

1,352 |

1,453 |

438 |

– |

– |

3,243 |

– |

||||

|

Professional fee expenses related to Panacea investment |

– |

– |

– |

194 |

– |

– |

– |

||||

|

Goodwill impairment |

– |

– |

– |

– |

11,150 |

– |

11,150 |

||||

|

Gains on sale of closed bank branch buildings |

(352) |

(124) |

– |

– |

– |

(476) |

– |

||||

|

Income tax effect |

(216) |

(287) |

(95) |

(139) |

(44) |

(598) |

(365) |

||||

|

Net income (loss) attributable to Primis’ common shareholders adjusted for nonrecurring income and expenses |

$ 1,996 |

$ 4,824 |

$ 2,809 |

$ (7,667) |

$ 5,277 |

$ 9,629 |

$ 12,813 |

||||

|

Net income (loss) attributable to Primis’ common shareholders |

$ 1,212 |

$ 3,782 |

$ 2,466 |

$ (8,171) |

$ (6,029) |

$ 7,460 |

$ 339 |

||||

|

Income tax expense (benefit) |

(304) |

1,265 |

718 |

(4,472) |

1,519 |

1,679 |

3,405 |

||||

|

Provision for credit losses (incl. unfunded commitment expense) |

7,607 |

2,573 |

6,506 |

21,864 |

1,359 |

16,686 |

10,685 |

||||

|

Pre-tax pre-provision earnings |

$ 8,515 |

$ 7,620 |

$ 9,690 |

$ 9,221 |

$ (3,151) |

$ 25,825 |

$ 14,429 |

||||

|

Effect of adjustment for nonrecurring income and expenses |

1,000 |

1,329 |

438 |

643 |

11,350 |

2,767 |

12,838 |

||||

|

Pre-tax pre-provision operating earnings |

$ 9,515 |

$ 8,949 |

$ 10,128 |

$ 9,864 |

$ 8,199 |

$ 28,592 |

$ 27,267 |

||||

|

Return on average assets |

0.12 % |

0.39 % |

0.26 % |

(0.85 %) |

(0.62 %) |

0.25 % |

0.01 % |

||||

|

Effect of adjustment for nonrecurring income and expenses |

0.08 % |

0.11 % |

0.04 % |

0.05 % |

1.17 % |

0.07 % |

0.42 % |

||||

|

Operating return on average assets |

0.20 % |

0.50 % |

0.29 % |

(0.79 %) |

0.54 % |

0.33 % |

0.43 % |

||||

|

Return on average assets |

0.12 % |

0.39 % |

0.26 % |

(0.85 %) |

(0.62 %) |

0.25 % |

0.01 % |

||||

|

Effect of tax expense |

(0.03 %) |

0.13 % |

0.08 % |

(0.46 %) |

0.16 % |

0.06 % |

0.11 % |

||||

|

Effect of provision for credit losses (incl. unfunded commitment expense) |

0.76 % |

0.26 % |

0.68 % |

2.27 % |

0.14 % |

0.57 % |

0.36 % |

||||

|

Pre-tax pre-provision return on average assets |

0.85 % |

0.78 % |

1.02 % |

0.96 % |

(0.33 %) |

0.88 % |

0.48 % |

||||

|

Effect of adjustment for nonrecurring income and expenses and expenses |

0.10 % |

0.14 % |

0.04 % |

0.05 % |

0.02 % |

0.09 % |

0.43 % |

||||

|

Pre-tax pre-provision operating return on average assets |

0.95 % |

0.92 % |

1.05 % |

1.01 % |

(0.30 %) |

0.98 % |

0.91 % |

||||

|

Return on average common equity |

1.28 % |

4.06 % |

2.62 % |

(8.43 %) |

(6.11 %) |

2.66 % |

0.11 % |

||||

|

Effect of adjustment for nonrecurring income and expenses |

0.83 % |

1.12 % |

0.37 % |

0.52 % |

11.47 % |

0.77 % |

4.20 % |

||||

|

Operating return on average common equity |

2.11 % |

5.18 % |

2.99 % |

(7.91 %) |

5.35 % |

3.44 % |

4.32 % |

||||

|

Effect of goodwill and other intangible assets |

0.69 % |

1.75 % |

0.99 % |

(2.61 %) |

2.00 % |

1.17 % |

1.60 % |

||||

|

Operating return on average tangible common equity |

2.80 % |

6.93 % |

3.98 % |

(10.53 %) |

7.35 % |

4.60 % |

5.92 % |

||||

|

Efficiency ratio |

83.22 % |

82.62 % |

77.41 % |

81.31 % |

108.50 % |

81.12 % |

86.30 % |

||||

|

Effect of adjustment for nonrecurring income and expenses |

(2.87 %) |

(3.76 %) |

(1.23 %) |

(1.88 %) |

(33.33 %) |

(2.63 %) |

(11.74 %) |

||||

|

Operating efficiency ratio |

80.35 % |

78.86 % |

76.17 % |

79.43 % |

75.17 % |

78.49 % |

74.56 % |

||||

|

Earnings per common share – Basic |

$ 0.05 |

$ 0.15 |

$ 0.10 |

$ (0.33) |

$ (0.24) |

$ 0.30 |

$ 0.01 |

||||

|

Effect of adjustment for nonrecurring income and expenses |

0.03 |

0.05 |

0.01 |

0.02 |

0.45 |

0.09 |

0.51 |

||||

|

Operating earnings per common share – Basic |

$ 0.08 |

$ 0.20 |

$ 0.11 |

$ (0.31) |

$ 0.21 |

$ 0.39 |

$ 0.52 |

||||

|

Earnings per common share – Diluted |

$ 0.05 |

$ 0.15 |

$ 0.10 |

$ (0.33) |

$ (0.24) |

$ 0.30 |

$ 0.01 |

||||

|

Effect of adjustment for nonrecurring income and expenses |

0.03 |

0.05 |

0.01 |

0.02 |

0.45 |

0.09 |

0.51 |

||||

|

Operating earnings per common share – Diluted |

$ 0.08 |

$ 0.20 |

$ 0.11 |

$ (0.31) |

$ 0.21 |

$ 0.39 |

$ 0.52 |

||||

|

Book value per common share |

$ 15.43 |

$ 15.23 |

$ 15.16 |

$ 15.23 |

$ 15.30 |

$ 15.43 |

$ 15.30 |

||||

|

Effect of goodwill and other intangible assets |

(3.82) |

(3.83) |

(3.85) |

(3.86) |

(3.88) |

(3.82) |

(3.88) |

||||

|

Tangible book value per common share |

$ 11.61 |

$ 11.40 |

$ 11.31 |

$ 11.37 |

$ 11.42 |

$ 11.61 |

$ 11.42 |

||||

|

Total Primis common stockholders’ equity |

$ 381,352 |

$ 376,393 |

$ 374,577 |

$ 376,161 |

$ 377,610 |

$ 381,352 |

$ 377,610 |

||||

|

Less goodwill and other intangible assets |

(94,444) |

(94,768) |

(95,093) |

(95,417) |

(95,741) |

(94,444) |

(95,741) |

||||

|

Tangible common equity |

$ 286,908 |

$ 281,625 |

$ 279,484 |

$ 280,744 |

$ 281,869 |

$ 286,908 |

$ 281,869 |

||||

|

Common equity to assets |

9.48 % |

9.49 % |

9.63 % |

9.75 % |

9.84 % |

9.48 % |

9.84 % |

||||

|

Effect of goodwill and other intangible assets |

(2.18 %) |

(2.22 %) |

(2.27 %) |

(2.29 %) |

(2.31 %) |

(2.18 %) |

(2.31 %) |

||||

|

Tangible common equity to tangible assets |

7.30 % |

7.27 % |

7.36 % |

7.46 % |

7.53 % |

7.30 % |

7.53 % |

||||

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/primis-financial-corp-reports-earnings-per-share-for-the-third-quarter-of-2024-302286204.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/primis-financial-corp-reports-earnings-per-share-for-the-third-quarter-of-2024-302286204.html

SOURCE Primis Financial Corp.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

US Government Hacked For $20M In Cryptocurrencies Including Ethereum, Says On-Chain Intelligence Platform — Attacker Reportedly Laundering Funds

Nearly $20 million in cryptocurrencies has been reportedly drained out of U.S. government-linked wallets holding funds seized from the Bitfinex cryptocurrency exchange hack.

What Happened: About $14 million in the Aave USDC (AUSDC) stablecoin, $5.4 million in USD Coin USDC/USD, $1.1 million in Tether USDT/USD, and nearly $450,000 in Ethereum ETH/USD were “suspiciously” transferred to an unknown wallet, according to on-chain analytics firm Arkham Intelligence.

After receiving the tokens, the wallet began selling them for ETH, raising concerns about potential money laundering.

“We believe the attacker has already begun laundering the proceeds through suspicious addresses linked to a money laundering service,” Arkham said.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Benzinga simplifies the market for smarter investing

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.

Why QuantumScape Stock Rocketed Higher Today

Electric-vehicle (EV) battery technology company QuantumScape (NYSE: QS) gave investors a reason to cheer with its third-quarter report last night, and its shares are surging as a result. The stock popped nearly 36% in early morning trading. As of 11:38 a.m. ET, it was still up by 21.6%.

The company announced it has achieved an important milestone in its work to develop commercially viable solid-state batteries for EV makers. It has shipped samples planned for its first commercial product to automakers and other original equipment manufacturers (OEMs) for testing. That was one of QuantumScape’s major goals for 2024.

QuantumScape has a two-stage plan to mass produce the parts required for its solid-state EV battery. The first stage “Raptor” process has been used to produce low-volume prototypes.

The company announced that the first low-volume B-sample battery cells from its Raptor production process have been shipped for automotive customer testing. The next “Cobra” stage of production is set to begin in 2025.

The samples from its first commercial product, QSE-5, are designed to meet the requirements of automotive applications and provide EV buyers with better battery technology. The samples, made with separators and now being tested by automakers, feature high energy density and provide a less-than-15-minute fast-charging capability for EV owners. The batteries are safer and designed to operate over the full automotive temperature range.

In the earnings release, the company stated, “[T]o the best of our knowledge, these cells are the first anode-free solid-state lithium-metal cell design ever produced for automotive applications.” While the testing process will still take months to complete, it’s an important step for QuantumScape.

Investors reacted by jumping into the stock today. Shares are still down by more than 20% over the last six months, though. For those who can tolerate the risks and believe the company can successfully manufacture its commercial product at scale, it isn’t too late to buy the stock.

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

Cathie Wood's Ark Sells $22M Worth Of Tesla Shares Following Blockbuster Q3 Rally

On Thursday, Cathie Wood-led Ark Invest made a series of trades, with the most prominent being the sale of Tesla Inc TSLA shares.

The TSLA Trade

Ark Invest sold 85,456 Tesla shares from its ARK Innovation ETF ARKK and ARK Autonomous Technology & Robotics ETF ARKQ, a transaction valued at $22.22 million based on Tesla’s closing price of $260.48 per share. On Thursday, Tesla stock skyrocketed 21.9%. The sale comes amidst Tesla’s surprising third-quarter earnings, which beat estimates and showed improving margins. The electric vehicle giant also shared a strong vehicle delivery outlook for 2025, which was among the highlights for analysts. This information was disclosed during the earnings call, where Tesla CEO Elon Musk shared more details than usual.

Earlier in July, Musk had endorsed Ark Invest’s $5 trillion valuation forecast for Tesla, suggesting it may be conservative. He cited the potential of the Optimus humanoid robot, estimating a global demand of over 20 billion units for both consumer and industrial applications.

Notably, in August, Ark Invest had unloaded $21million worth of Tesla stock.

See Also: Peter Schiff Warns Investors Against Keeping $20K In Cash: ‘One Of The Riskiest Bets You Can Make’

Other Key Trades:

Ark Invest’s ARKG ETF sold shares of Vertex Pharmaceuticals Inc (VRTX). Both ARKG and ARKK ETFs bought shares of CRISPR Therapeutics AG (CRSP).

Intellia Therapeutics Inc (NTLA) shares were also bought by ARKG and ARKK. ARKG bought shares of Cerus Corp (CERS). ARKK and ARKQ ETFs bought shares of Teradyne Inc (TER).

Read Next:

This story was generated using Benzinga Neuro and edited by Shivdeep Dhaliwal

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Analyst Report: Lam Research Corp.

Analyst Profile

James Kelleher, CFA

Director of Research & Senior Analyst Technology

Jim has worked in the financial services industry for over 25 years and joined Argus in 1993. He is director of research at Argus and a member of the Investment Policy Committee. Jim has been instrumental in building Argus’ proprietary valuation models, which are a key part of the proprietary Argus Six-Point Rating System. He also oversees Argus’ technical analysis products; writes the Portfolio Selector report and other publications; and manages several Argus model portfolios. As a Senior Analyst, Jim covers Communications Equipment, Semiconductors, Information Processing and Electronic Manufacturing Services companies. he is a CFA charter-holder, and is a three-time winner in The Wall Street Journal’s “Best on the Street” All-Star Analyst Survey. In July 2010, McGraw-Hill Professional published Jim’s book, “Equity Valuation for Analysts & Investors.” The book, a single-volume treatment of financial modeling and valuation process, introduces the Argus proprietary valuation methodology known as Peer Derived Value.

Google's $2B Investment in Anthropic Under Scrutiny, UK Opens Competition Inquiry

U.K. antitrust officials announced they are investigating whether Alphabet Inc GOOG GOOGL Google’s investment in AI startup Anthropic could harm competition. This is a setback for Google after British regulators recently approved a similar partnership between Amazon and Anthropic.

The Competition and Markets Authority (CMA) began reviewing Google’s investment in July and has opened a merger inquiry.

Also Read: Intel Triumphs In 15-Year Legal Battle, EU Court Rejects Record Antitrust Penalty

A decision on whether further investigation is needed is expected by December 19.

Since OpenAI’s ChatGPT launch in late 2022, tech giants have heavily invested in AI startups.

The U.K.’s competition regulator recently approved the partnership between Amazon.Com Inc AMZN and Jeff Bezos-backed AI startup Anthropic, despite Amazon’s significant $4 billion investment in the company.

Britain’s Competition and Markets Authority (CMA) confirmed the partnership does not fall under its jurisdiction.

In 2023, Google committed up to $2 billion to Anthropic to bolster its position in the AI race, competing with Microsoft, OpenAI, and Amazon.

A Google spokesperson affirmed the company’s commitment to building an open AI ecosystem to the Wall Street Journal. Anthropic stated it would cooperate with the CMA and emphasized its independence in strategic decision-making.

The U.S. Big Techs are amid intense global scrutiny over their AI investments.

Microsoft relinquished its board observer role at OpenAI amid rising regulatory scrutiny after its $10 billion investment in the AI startup.

The company stepped down from the non-voting observer seat, which provided access to board meetings, as OpenAI’s governance reportedly improved.

Price Action: GOOGL stock is down 0.03% at $162.74 at the last check on Thursday.

Also Read:

Photo: gguy/Shutterstock.com

This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

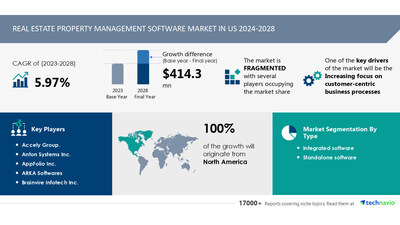

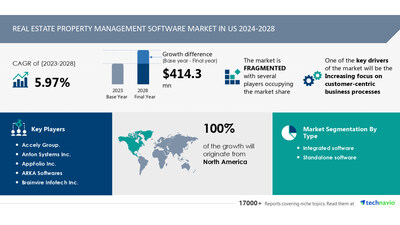

Real Estate Property Management Software Market to Grow by USD 414.3 Million from 2024-2028, Driven by Customer-Centric Business Focus and AI Redefining the Market – Technavio

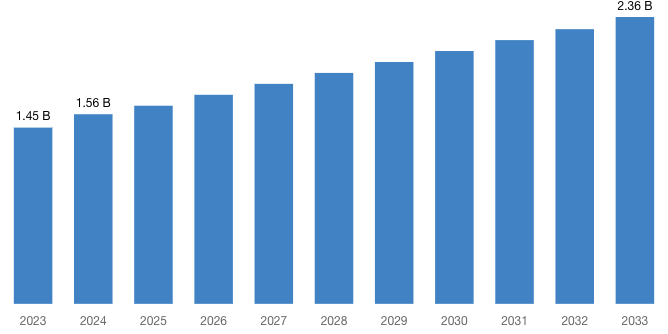

NEW YORK, Oct. 24, 2024 /PRNewswire/ — Report with market evolution powered by AI – The Global Real Estate Property Management Software Market size is estimated to grow by USD 414.3 million from 2024-2028, according to Technavio. The market is estimated to grow at a CAGR of 5.97% during the forecast period. Increasing focus on customer-centric business processes is driving market growth, with a trend towards increasing use of big data analytics. However, threat of open-source real estate property management software poses a challenge.Key market players include Accely Group. , Anton Systems Inc., AppFolio Inc., ARKA Softwares, Brainvire Infotech Inc., Chetu Inc., CoreLogic Inc., Entrata Inc., Fingent, Infor Inc., ManageCasa, Matellio Inc., MRI Software LLC, Planon Group, RealPage Inc., Rentec Direct, Salesforce Inc., TenantCloud LLC, Yardi Systems Inc., and Zillow Group Inc..

AI-Powered Market Evolution Insights. Our comprehensive market report ready with the latest trends, growth opportunities, and strategic analysis- View your snapshot now

|

Forecast period |

2024-2028 |

|

Base Year |

2023 |

|

Historic Data |

2018 – 2022 |

|

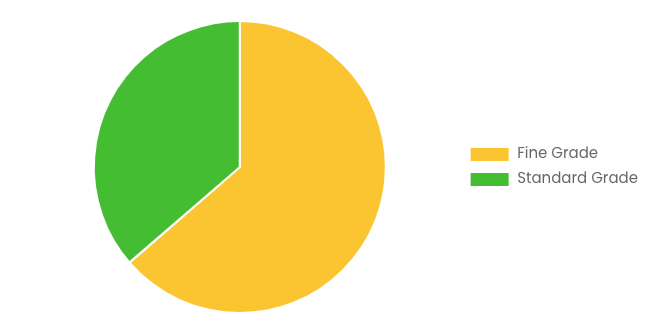

Segment Covered |

Type (Integrated software and Standalone software), Deployment (Cloud based and On premises), Application (Residential, Commercial, and Industrial), and Geography (North America) |

|

Region Covered |

US |

|