US Stocks Set To Rise As Treasury Yields Ease, Tesla, Spirit Airlines Among Stocks In Focus: Fund Manager Says Despite Elon Musk's Company 'Firing On All Cylinders,' It's Still Not A 'Good Time To Buy'

Investors could see a second straight day of an opening in the green on Wall Street as the index futures point to a positive start on Friday. Treasury yields started cooling again after scaling three-month highs.

While Friday is a little light on the earnings side, consumer sentiment data and a speech by Boston Fed President Susan Collins could set the tone for the markets for the last day of the week.

All three major indices could close in the red for this week after surging for six consecutive weeks.

| Futures | Performance (+/-) |

| Nasdaq 100 | 0.27% |

| S&P 500 | 0.26% |

| Dow Jones | 0.23% |

| R2K | 0.56% |

In premarket trading on Thursday, the SPDR S&P 500 ETF Trust SPY rose 0.30% to $580.95 and the Invesco QQQ ETF QQQ surged 0.32% to $493.91, according to Benzinga Pro data.

Cues From Last Session:

EV giant Tesla Inc.’s TSLA shares witnessed their best single-day gain in over a decade after the Elon Musk-led EV giant blew past expectations.

A tightly packed week of earnings is now drawing to a close, with nearly a third of S&P 500 companies having reported their results. According to FactSet data, more than 70% of these companies have managed to beat expectations in terms of profits.

The S&P 500 ended its 3-day losing streak while the Nasdaq Composite maintained its momentum on the back of Tesla and other tech stocks.

On the economic data front, U.S. initial jobless claims declined by 15,000 from the prior week to 227,000 during the period ending Oct. 19, compared to market estimates of 242,000.

Most sectors on the S&P 500 closed on a negative note, with materials, industrials, and utilities stocks recording the biggest losses on Thursday. However, consumer discretionary and communication services stocks bucked the overall market trend, closing the session higher.

| Index | Performance (+/-) | Value |

| Nasdaq Composite | 0.76% | 18,415.49 |

| S&P 500 | 0.21% | 5,809.86 |

| Dow Jones | -0.33% | 42,374.36 |

| Russell 2000 | 0.23% | 2,218.92 |

Insights From Analysts:

Following six consecutive weeks of gains, the markets have remained gloomy this week, with tech stocks offering some respite amid sideways movements in most other sectors.

Benchmark US 10-year treasury yields continued to cool down after scaling three-month highs.

On the economic data front, the S&P Global flash manufacturing PMI rose to 47.8 in October versus a 15-month low level of 47.3 in September, while services PMI increased to 55.3 in October from 55.2 in the prior month.

“The election itself can be a bit of a hairy situation. I think right now, although the market sort of has been pricing in some Trump trades, I think the polls are still telling you that it’s a coin toss,” Interactive Brokers chief strategist Steve Sosnick said in an interview with Market Domination.

On the other hand, despite the Tesla stock “firing on all cylinders” and turning positive year-to-date after Thursday’s rally, fund manager Louis Navellier thinks the EV giant still has to improve its fundamentals before going long on the stock.

“Now is not a good time to buy Tesla. I would wait for its fundamentals to improve further before investing in the company.”

See Also: Best Futures Trading Software

Upcoming Economic Data:

- Data on durable goods orders is scheduled to be released at 8:30 a.m. ET.

- Data on consumer sentiment is scheduled to be released at 10 a.m. ET.

- University of Michigan (UoM) is scheduled to release one and five-year inflation expectations at 10 a.m. ET.

- Boston Fed President Susan Collins is scheduled to speak at 11 a.m. ET.

Stocks In Focus:

- Tesla will stay in focus after the stock registered its best single-day gains in over a decade, a day after beating margin and EPS estimates in its third-quarter earnings.

- Capri Holdings Ltd. CPRI tumbled over 46% in premarket trading after a judge blocked its acquisition by fashion group Tapestry Inc. TPR.

- Spirit Airlines Inc. SAVE stock surged over 11% in premarket trading after the carrier announced the sale of 23 Airbus A320 aircraft worth $519 million. It also announced job cuts.

Investors are awaiting earnings results from AutoNation, Inc. AN, Colgate-Palmolive Company CL, and HCA Healthcare Inc. HCA today.

Commodities, Bonds And Global Equity Markets:

Crude oil futures rose in the early New York session, surging nearly 0.7% as data showed a rise in spot demand.

The 10-year Treasury note yield eased marginally to 4.198%.

Asian markets were mixed on Thursday, with Chinese markets rising marginally while Japan’s Nikkei 225 registering a decline.

European stocks remained tentative in early trading, concluding what has been a gloomy week so far.

Read Next:

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

A Peek at Ultra Clean Hldgs's Future Earnings

Ultra Clean Hldgs UCTT is set to give its latest quarterly earnings report on Monday, 2024-10-28. Here’s what investors need to know before the announcement.

Analysts estimate that Ultra Clean Hldgs will report an earnings per share (EPS) of $0.32.

The market awaits Ultra Clean Hldgs’s announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It’s important for new investors to understand that guidance can be a significant driver of stock prices.

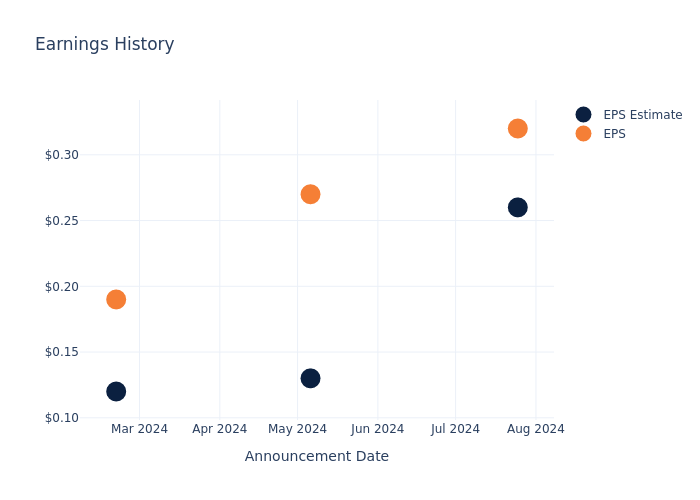

Earnings Track Record

Last quarter the company beat EPS by $0.06, which was followed by a 1.51% increase in the share price the next day.

Here’s a look at Ultra Clean Hldgs’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.26 | 0.13 | 0.12 | 0.10 |

| EPS Actual | 0.32 | 0.27 | 0.19 | 0.04 |

| Price Change % | 2.0% | 3.0% | 5.0% | 2.0% |

Market Performance of Ultra Clean Hldgs’s Stock

Shares of Ultra Clean Hldgs were trading at $35.07 as of October 24. Over the last 52-week period, shares are up 49.37%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Opinions on Ultra Clean Hldgs

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Ultra Clean Hldgs.

With 1 analyst ratings, Ultra Clean Hldgs has a consensus rating of Outperform. The average one-year price target is $70.0, indicating a potential 99.6% upside.

Peer Ratings Overview

The analysis below examines the analyst ratings and average 1-year price targets of and Veeco Instruments, three significant industry players, providing valuable insights into their relative performance expectations and market positioning.

- The consensus outlook from analysts is an Buy trajectory for Veeco Instruments, with an average 1-year price target of $44.75, indicating a potential 27.6% upside.

Insights: Peer Analysis

The peer analysis summary offers a detailed examination of key metrics for and Veeco Instruments, providing valuable insights into their respective standings within the industry and their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Ultra Clean Hldgs | Outperform | 22.44% | $88.50M | 2.27% |

| Veeco Instruments | Buy | 8.81% | $75.39M | 2.20% |

Key Takeaway:

Ultra Clean Hldgs ranks higher in Revenue Growth compared to its peers. It also outperforms in Gross Profit margin. However, it lags behind in Return on Equity. Overall, Ultra Clean Hldgs is positioned favorably among its peers based on the provided metrics.

All You Need to Know About Ultra Clean Hldgs

Ultra Clean Holdings Inc, through its subsidiaries, manufactures and supplies production tools, modules, and subsystems for the semiconductor capital equipment industry. The product includes precision robotic solutions, gas delivery systems, and a variety of industrial and automation production equipment products; subsystems include wafer cleaning subsystems, chemical delivery modules, top-plate assemblies, frame assemblies, and process modules. Its customer base includes firms in the semiconductor capital equipment industry, medical, energy, industrial, flat panel, and research equipment industries. It has two segments Products and Services. Its principal markets are North America, Asia, and Europe.

Unraveling the Financial Story of Ultra Clean Hldgs

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Positive Revenue Trend: Examining Ultra Clean Hldgs’s financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 22.44% as of 30 June, 2024, showcasing a substantial increase in top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Information Technology sector.

Net Margin: Ultra Clean Hldgs’s net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of 3.7%, the company may face hurdles in effective cost management.

Return on Equity (ROE): The company’s ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of 2.27%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): Ultra Clean Hldgs’s ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of 1.0%, the company may face hurdles in achieving optimal financial performance.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 0.78, caution is advised due to increased financial risk.

To track all earnings releases for Ultra Clean Hldgs visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

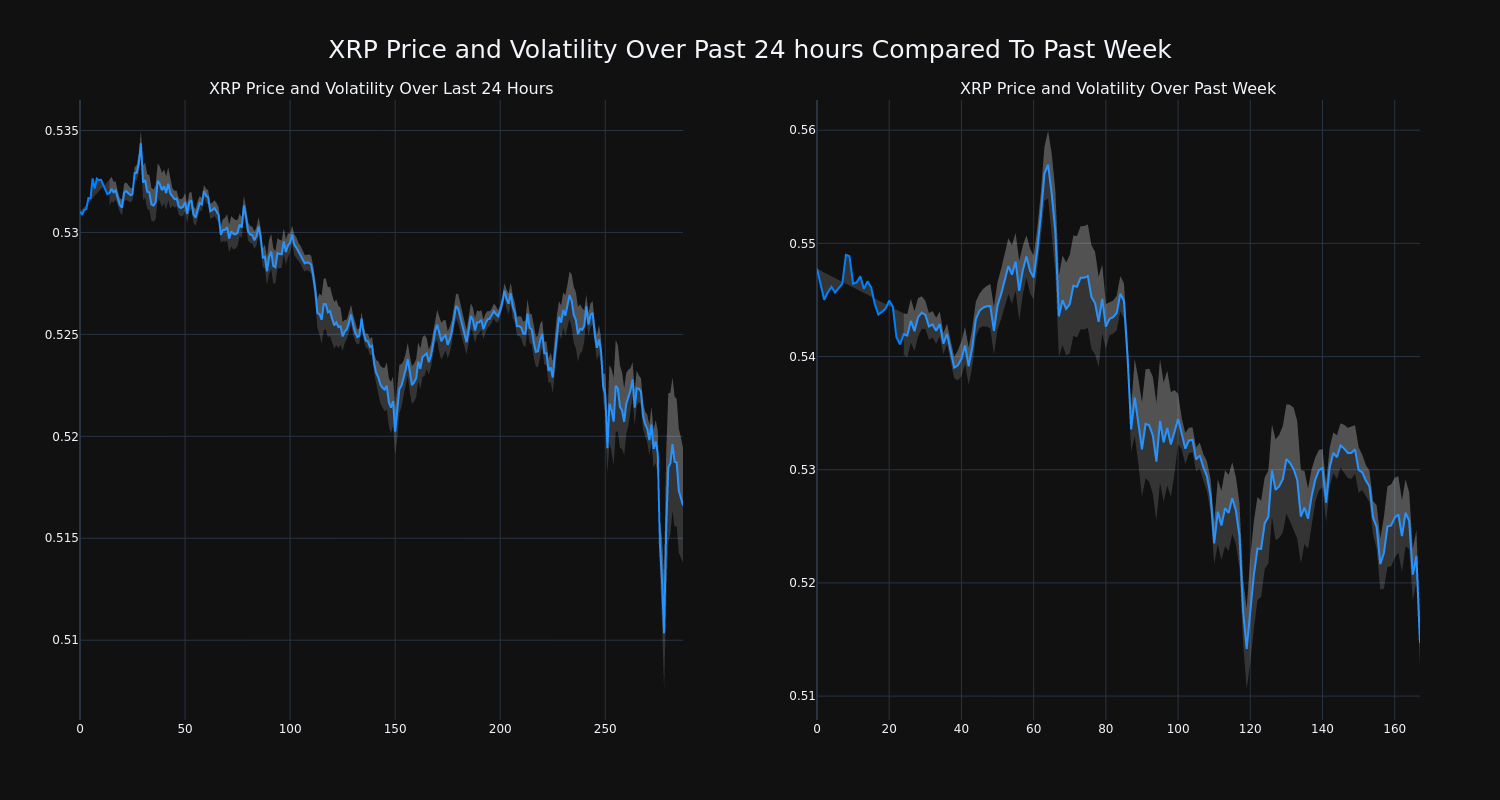

XRP Falls More Than 3% In 24 hours

Over the past 24 hours, XRP’s XRP/USD price has fallen 3.03% to $0.51. This continues its negative trend over the past week where it has experienced a 6.0% loss, moving from $0.55 to its current price.

The chart below compares the price movement and volatility for XRP over the past 24 hours (left) to its price movement over the past week (right). The gray bands are Bollinger Bands, measuring the volatility for both the daily and weekly price movements. The wider the bands are, or the larger the gray area is at any given moment, the larger the volatility.

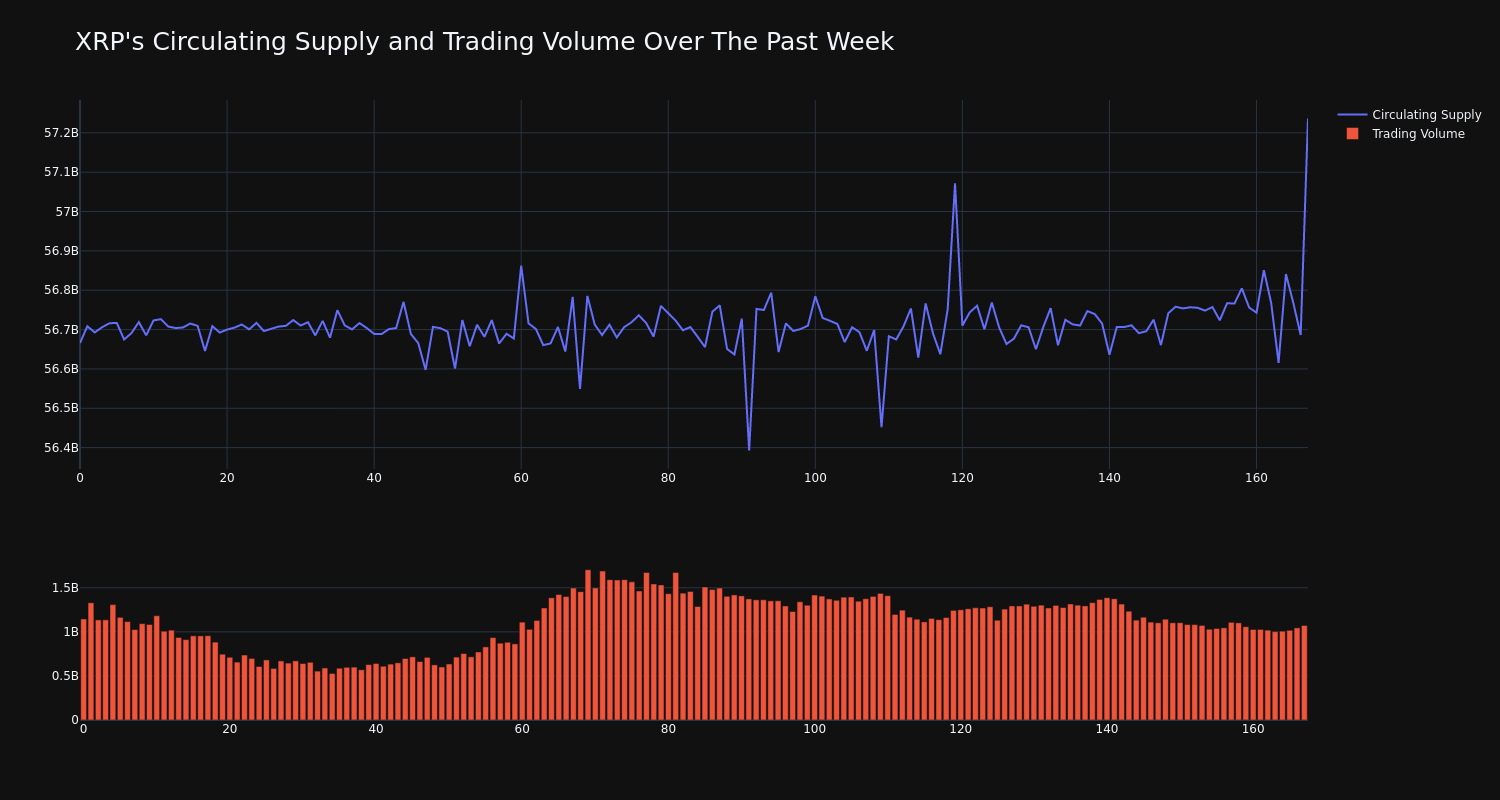

The trading volume for the coin has fallen 6.0% over the past week which is opposite, directionally, with the overall circulating supply of the coin, which has increased 1.01%. This brings the circulating supply to 56.76 billion, which makes up an estimated 56.76% of its max supply of 100.00 billion. According to our data, the current market cap ranking for XRP is #7 at $29.28 billion.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

OpenAI Set To Launch 100X More Powerful AI Model In December? Sam Altman Calls Report 'Fake News'

OpenAI is gearing up to launch its latest artificial intelligence model, Orion, in December. The model, which is expected to be significantly more powerful than its predecessor, will initially be available to select partners.

What Happened: OpenAI is set to release the Orion AI model in December. Unlike its previous models, GPT-4o and o1, Orion will not be widely available through ChatGPT at first, according to a report by The Verge on Wednesday, which cited a source familiar with the plan. Instead, OpenAI will grant select partners access to develop their own products and features.

Microsoft Corp., OpenAI’s primary partner for deploying AI models, is reportedly preparing to host Orion on Azure as early as November. Although Orion is seen as the successor to GPT-4 within OpenAI, it is uncertain whether the company will publicly refer to it as GPT-5. The release plan is subject to change, and both OpenAI and Microsoft have declined to comment.

The Orion model is expected to be up to 100 times more powerful than GPT-4, according to an OpenAI executive. This model is separate from the o1 reasoning model released in September. OpenAI’s long-term goal is to merge its LLMs to create an even more capable model, potentially leading to the development of artificial general intelligence, according to the report.

OpenAI’s CEO Sam Altman, wrote, “fake news out of control,” responding to The Verge report.

OpenAI did not immediately respond to Benzinga‘s request for comment.

OpenAI’s announcement comes at a crucial time for the company, as it recently closed a record $6.6 billion funding round and is undergoing significant staff turnover.

Why It Matters: The AI industry is witnessing a flurry of activity, with companies like OpenAI and its rivals making significant strides. Just days before this announcement, Jack Altman, the brother of OpenAI CEO, predicted that AI voice technology could be as big or even bigger than AI text.

Meanwhile, OpenAI’s rival, Anthropic, has unveiled an upgrade to its AI model Claude 3.5 Sonnet, allowing it to interact with computers in a human-like manner.

Furthermore, OpenAI’s recent transition from a non-profit to a for-profit entity has added complexity to its discussions with equity investors, including Microsoft. This transition, along with the company’s recent funding round, underscores the high stakes involved in the AI industry.

Amid these developments, Nvidia Corp has introduced a new AI model that reportedly outperforms OpenAI’s GPT-4o and Anthropic’s Claude 3.5 Sonnet.

Read Next:

Image Via Shutterstock

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

/R E P E A T — MEDIA ADVISORY – GOVERNMENT OF CANADA AND CITY OF MONTRÉAL TO MAKE HOUSING-RELATED ANNOUNCEMENT IN MONTRÉAL/

MONTRÉAL, Oct. 24, 2024 /CNW/ – Media are invited to join the Honourable Steven Guilbeault, Minister of Environment and Climate Change and Member of Parliament for Laurier—Sainte-Marie, on behalf of the Honourable Sean Fraser, Minister of Housing, Infrastructure and Communities, Benoit Dorais, borough mayor for Le Sud-Ouest, and Valérie Plante, mayor of Montréal for the announcement.

Journalists, photographers and cameramen are required to register at relationsmedias@montreal.ca before October 25, at 9:30 am (ET).

|

Date: |

October 25, 2024 |

|

Time: |

10:30 am ET |

|

Location: |

The address will be confirmed upon registration. |

SOURCE Canada Mortgage and Housing Corporation (CMHC)

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2024/25/c6992.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2024/25/c6992.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Regency Centers's Earnings Outlook

Regency Centers REG is set to give its latest quarterly earnings report on Monday, 2024-10-28. Here’s what investors need to know before the announcement.

Analysts estimate that Regency Centers will report an earnings per share (EPS) of $1.04.

The announcement from Regency Centers is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It’s worth noting for new investors that guidance can be a key determinant of stock price movements.

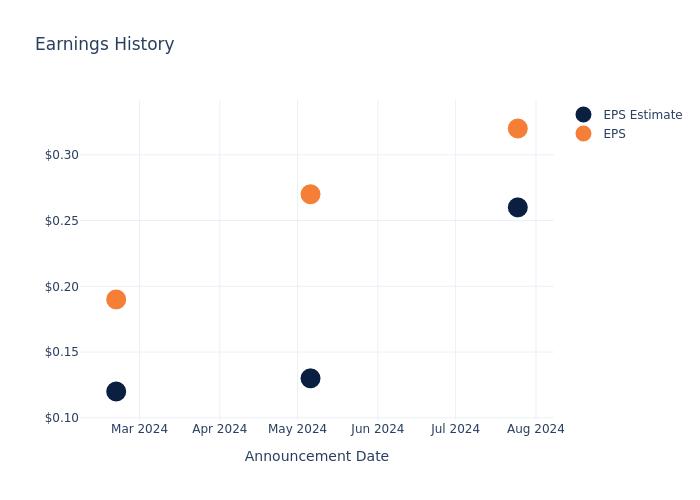

Earnings History Snapshot

In the previous earnings release, the company beat EPS by $0.04, leading to a 2.52% increase in the share price the following trading session.

Here’s a look at Regency Centers’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 1.02 | 1.03 | ||

| EPS Actual | 1.06 | 1.08 | 1.02 | 1.02 |

| Price Change % | 3.0% | -2.0% | -1.0% | 1.0% |

Regency Centers Share Price Analysis

Shares of Regency Centers were trading at $72.0 as of October 24. Over the last 52-week period, shares are up 22.73%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Opinions on Regency Centers

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Regency Centers.

With 10 analyst ratings, Regency Centers has a consensus rating of Outperform. The average one-year price target is $76.4, indicating a potential 6.11% upside.

Peer Ratings Comparison

The analysis below examines the analyst ratings and average 1-year price targets of Kimco Realty, Federal Realty Investment and NNN REIT, three significant industry players, providing valuable insights into their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for Kimco Realty, with an average 1-year price target of $24.21, suggesting a potential 66.38% downside.

- For Federal Realty Investment, analysts project an Outperform trajectory, with an average 1-year price target of $123.5, indicating a potential 71.53% upside.

- For NNN REIT, analysts project an Neutral trajectory, with an average 1-year price target of $48.4, indicating a potential 32.78% downside.

Insights: Peer Analysis

The peer analysis summary presents essential metrics for Kimco Realty, Federal Realty Investment and NNN REIT, unveiling their respective standings within the industry and providing valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Regency Centers | Outperform | 13.68% | $252.28M | 1.49% |

| Kimco Realty | Neutral | 12.96% | $342.07M | 1.05% |

| Federal Realty Investment | Outperform | 5.48% | $201.87M | 3.93% |

| NNN REIT | Neutral | 6.99% | $210.06M | 2.54% |

Key Takeaway:

Regency Centers ranks highest in Revenue Growth among its peers. It also leads in Gross Profit. However, it has the lowest Return on Equity.

Unveiling the Story Behind Regency Centers

Regency Centers is one of the largest shopping center-focused retail REITs. The company’s portfolio includes an interest in 482 properties, which includes nearly 57 million square feet of retail space following the completion of the Urstadt Biddle acquisition in August 2023. The portfolio is geographically diversified with 22 regional offices and no single market representing more than 12% of total company net operating income. Regency’s retail portfolio is primarily composed of grocery-anchored centers, with 80% of properties featuring a grocery anchor and grocery stores representing 20% of annual base rent.

Financial Insights: Regency Centers

Market Capitalization Highlights: Above the industry average, the company’s market capitalization signifies a significant scale, indicating strong confidence and market prominence.

Revenue Growth: Over the 3 months period, Regency Centers showcased positive performance, achieving a revenue growth rate of 13.68% as of 30 June, 2024. This reflects a substantial increase in the company’s top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Real Estate sector.

Net Margin: Regency Centers’s net margin lags behind industry averages, suggesting challenges in maintaining strong profitability. With a net margin of 27.78%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Regency Centers’s ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of 1.49%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): Regency Centers’s ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of 0.79%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: Regency Centers’s debt-to-equity ratio is below the industry average at 0.76, reflecting a lower dependency on debt financing and a more conservative financial approach.

To track all earnings releases for Regency Centers visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Crude Oil Surges Over 2%; Newell Brands Shares Spike Higher

U.S. stocks traded mixed toward the end of trading, with the Dow Jones index falling around 200 points on Friday.

The Dow traded down 0.49% to 42,166.64 while the NASDAQ rose 0.69% to 18,543.06. The S&P 500 also rose, gaining, 0.12% to 5,816.55.

Check This Out: Wall Street’s Most Accurate Analysts Give Their Take On 3 Real Estate Stocks Delivering High-Dividend Yields

Leading and Lagging Sectors

Communication services shares rose by 0.7% on Thursday.

In trading on Thursday, utilities shares fell by 1.2%.

Top Headline

The total number of active U.S. oil rigs fell by two to 480 rigs this week, Baker Hughes Inc reported.

Equities Trading UP

- Upexi, Inc. UPXI shares shot up 255% to $10.65 after the company said it is currently reviewing trading activity to determine if recent activity involved possible stock manipulation.

- Shares of Newell Brands Inc. NWL got a boost, surging 21% to $8.71 after the company reported third-quarter financial results and raised its 2024 guidance.

- Tapestry, Inc. TPR shares were also up, gaining 13% to $50.07 following a report alleging that a judge blocked the company’s proposed acquisition of Capri. The company issued a statement on the ruling saying it intends to appeal the decision.

Equities Trading DOWN

- Joby Aviation, Inc. JOBY shares dropped 16% to $5.08 after the company priced its $202 million public offering of 40 million common shares at $5.05 per share.

- Shares of Capri Holdings Limited CPRI were down 48% to $21.42 following a report alleging that a judge blocked the company from being acquired by Tapestry. The company intends to jointly file Tapestry a notice of appeal regarding the court’s decision.

- Evolv Technologies Holdings, Inc. EVLV was down, falling 43% to $2.3550 after the company announced that shareholders and others should not rely upon certain of the Company’s previously issued financial statements and that it will delay filing its Quarterly Report.

Commodities

In commodity news, oil traded up 2.3% to $71.80 while gold traded up 0.3% at $2,757.10.

Silver traded up 0.3% to $33.880 on Friday, while copper rose 0.4% to $4.3675.

Euro zone

European shares closed mixed today. The eurozone’s STOXX 600 slipped 0.03%, Germany’s DAX gained 0.11% and France’s CAC 40 fell 0.08%. Spain’s IBEX 35 Index fell 0.23%, while London’s FTSE 100 fell 0.25%.

Asia Pacific Markets

Asian markets closed mixed on Friday, with Japan’s Nikkei 225 falling 0.60%, Hong Kong’s Hang Seng Index gaining 0.49%, China’s Shanghai Composite Index gaining 0.59% and India’s BSE Sensex falling 0.83%.

Foreign exchange reserves held by the Reserve Bank of India declined to $688 billion as of Oct. 18, from $704.9 billion in the final week of September.

Economics

- The University of Michigan consumer sentiment for the US rose to 70.5 in October compared to a preliminary reading of 68.9.

- U.S. durable goods orders fell by 0.8% to $284.8 billion in September compared to a revised 0.8% fall in August.

- The total number of active U.S. oil rigs fell by two to 480 rigs this week, Baker Hughes Inc reported.

Now Read This:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Apple Q4 Earnings Preview: Goldman Sachs Analyst Anticipates Big Earnings Beat, Resilient iPhone 16 Demand

A Goldman Sachs analyst has forecasted stronger-than-expected fourth-quarter results for Apple Inc AAPL ahead of its Oct. 31 release.

The Apple Analyst: Analyst Michael Ng reiterated a Buy rating on Apple and maintained its price target at $275.

Earnings Preview: Ng is bullish on Apple’s potential to beat earnings expectations in the short term. For the quarter, the analyst projects earnings-per-share of $1.61, higher than Wall Street’s consensus of $1.57. Ng also projects revenue of $94.5 billion, higher than the consensus $93.6 billion.

iPhone Takeaways: Ng cited the continued demand for older models of the iPhone as a plus. He also mentioned the demand for the newly released iPhone 16 as perhaps better than initially thought.

“iPhone 16 demand has been relatively stable year-over-year and better-than-feared given more cautious data points around shorter lead-times relative to year-ago and production cuts,” the analyst said.

Also Read: Nvidia Back On Top: Edges Out Apple As AI Demand Drives Market Surge

Apple Intelligence Takeaways: Ng sees Apple’s foray into artificial intelligence as a “long-term demand driver.” Apple has opted for a slow rollout of Apple Intelligence.

“We believe that as more features exclusive to 15 Pro/Pro Max and the 16-series get released, users should be driven to upgrade their iPhones,” Ng said.

Services Takeaways: Apple’s strength in its services segment serves as justification for Ng’s bullishness on the company.

The analyst acknowledged that product revenue growth has slowed but insisted that the market is underestimating the continued viability of the Apple ecosystem.

“Apple’s installed base growth, secular growth in services, and new product innovation should more than offset cyclical headwinds to product revenue, such as a reduced iPhone unit demand due to a lengthening replacement cycle and reduced consumer demand for the PC & tablet category,” Ng said.

The analyst also believes that Apple TV+’s apparent decision to shorten theatrical release windows in favor of a quicker rollout to streaming is driving subscriptions.

Read Next:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Dogecoin Falls More Than 3% In 24 hours

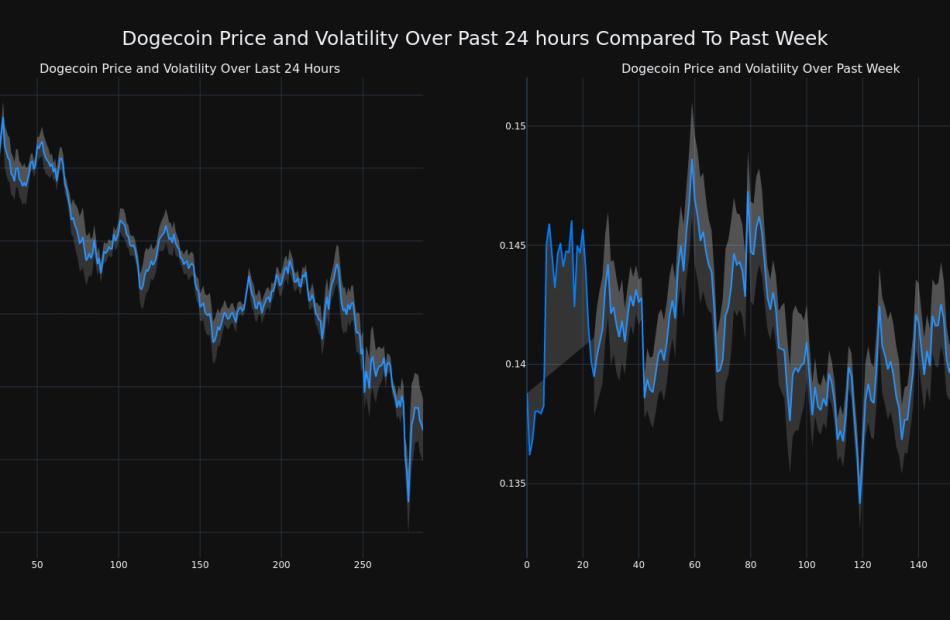

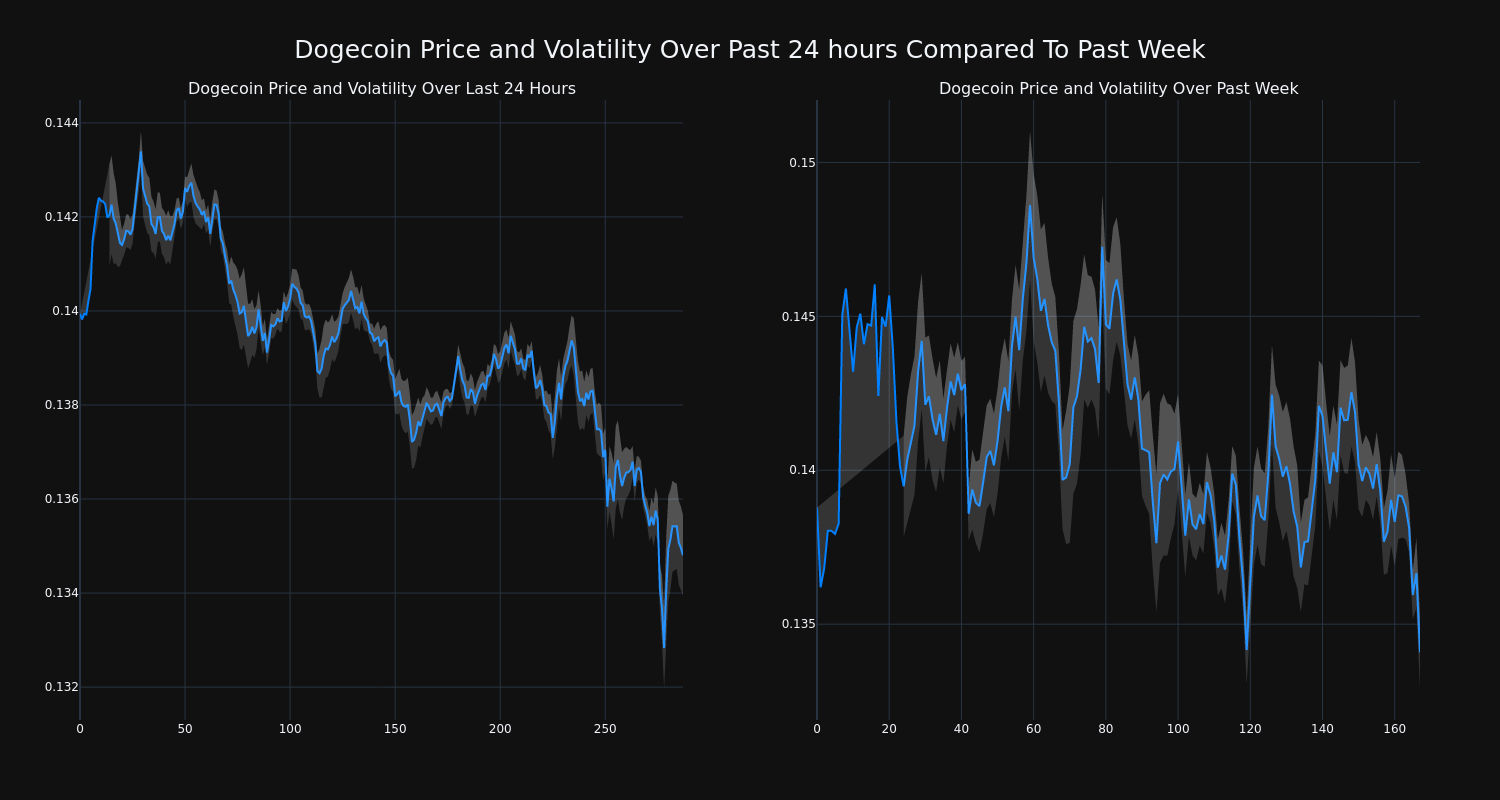

Over the past 24 hours, Dogecoin’s DOGE/USD price has fallen 3.94% to $0.13. This continues its negative trend over the past week where it has experienced a 3.0% loss, moving from $0.14 to its current price.

The chart below compares the price movement and volatility for Dogecoin over the past 24 hours (left) to its price movement over the past week (right). The gray bands are Bollinger Bands, measuring the volatility for both the daily and weekly price movements. The wider the bands are, or the larger the gray area is at any given moment, the larger the volatility.

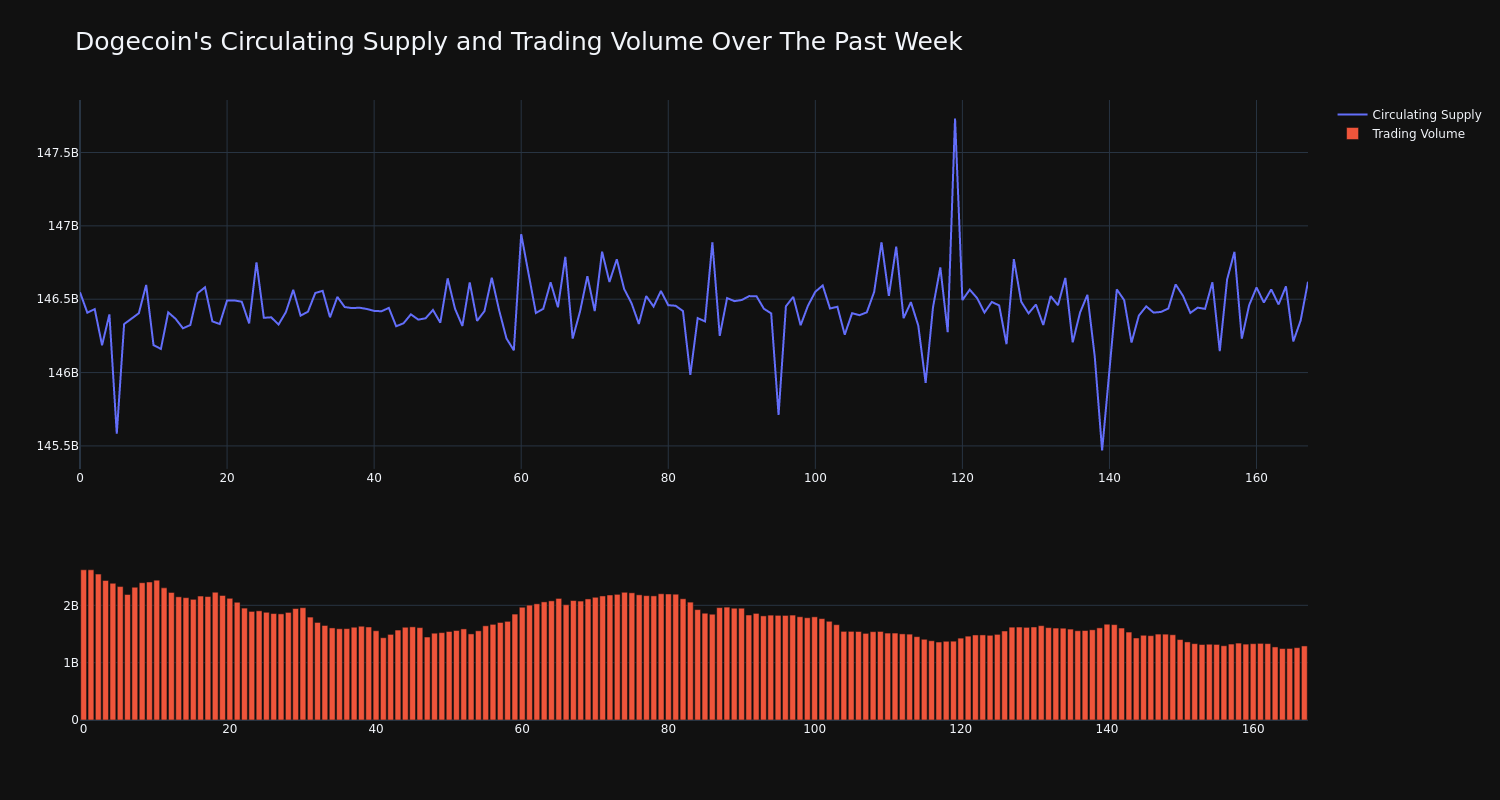

The trading volume for the coin has tumbled 51.0% over the past week while the circulating supply of the coin has risen 0.05%. This brings the circulating supply to 146.46 billion. According to our data, the current market cap ranking for DOGE is #9 at $19.71 billion.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Mercedes car earnings plunge as China shuns luxury

By Andrey Sychev

(Reuters) -Mercedes-Benz will step up cost cuts after earnings halved in the third quarter hit by tepid demand and fierce competition in China, it said on Friday.

The luxury carmaker cut its full-year profit margin target twice during the third quarter, joining a growing number of European rivals blaming a weakening Chinese car market for falling profits and margins.

Union Investment, which according to LSEG is among the 30 top investors in Mercedes, called on the management to amend its strategy as it sees no market for 2 million luxury cars any longer.

“We are clearly in favour of adjusting the strategy and adapting it to the new market conditions and the new competition from China,” said portfolio manager Moritz Kronenberger.

Mercedes refuses to participate in the price war in China and prefers to stick to its “value over volume” strategy, hoping that a massive new model rollout will help to revive sales next year.

The “value over volume” approach can be successful if demand and capacity are roughly equal, Kronenberger said, adding that currently this is not the case for the automaker.

“Chinese demand is currently focused on affordable electric cars. And Mercedes has nothing to offer here,” he said.

Mercedes shares were down 1.6% at 1246 GMT, dragging down peers BMW and Volkswagen.

The stock has lost around 8% year to date, underperforming Germany’s benchmark DAX index but still faring better than Volkswagen, BMW, and Porsche AG.

The pan-European autos index is down 10% year-to-date, the worst-performing sector in Europe this year.

PROFITABILITY DROPS

Mercedes’ car division’s adjusted return on sales fell to 4.7% in the third quarter from 12.4% last year, its worst profitability since the pandemic, while earnings in the unit more than halved, worse than expected by analysts.

“The Q3 results do not meet our ambitions,” CFO Harald Wilhelm said in a statement, adding that the group will step up cost cuts.

Wilhelm declined to provide more details about the cost cuts, but warned that “it will be tighter and tougher for sure”.

Europe’s biggest automaker, Volkswagen is considering plant closures in Germany for the first time.

Stifel analyst Daniel Schwarz noted substantial progress already made by Mercedes in reducing fixed costs since 2019 but there were “fewer low-hanging fruits”, especially when compared to Volkswagen.

In 2020, Mercedes launched a plan to reduce costs by 20% between 2019 and 2025, 15-16% of which was already achieved, according to the finance chief.