Smart Money Is Betting Big In DECK Options

Investors with a lot of money to spend have taken a bearish stance on Deckers Outdoor DECK.

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with DECK, it often means somebody knows something is about to happen.

Today, Benzinga’s options scanner spotted 11 options trades for Deckers Outdoor.

This isn’t normal.

The overall sentiment of these big-money traders is split between 9% bullish and 45%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $28,267, and 10, calls, for a total amount of $811,197.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $152.5 to $175.0 for Deckers Outdoor over the last 3 months.

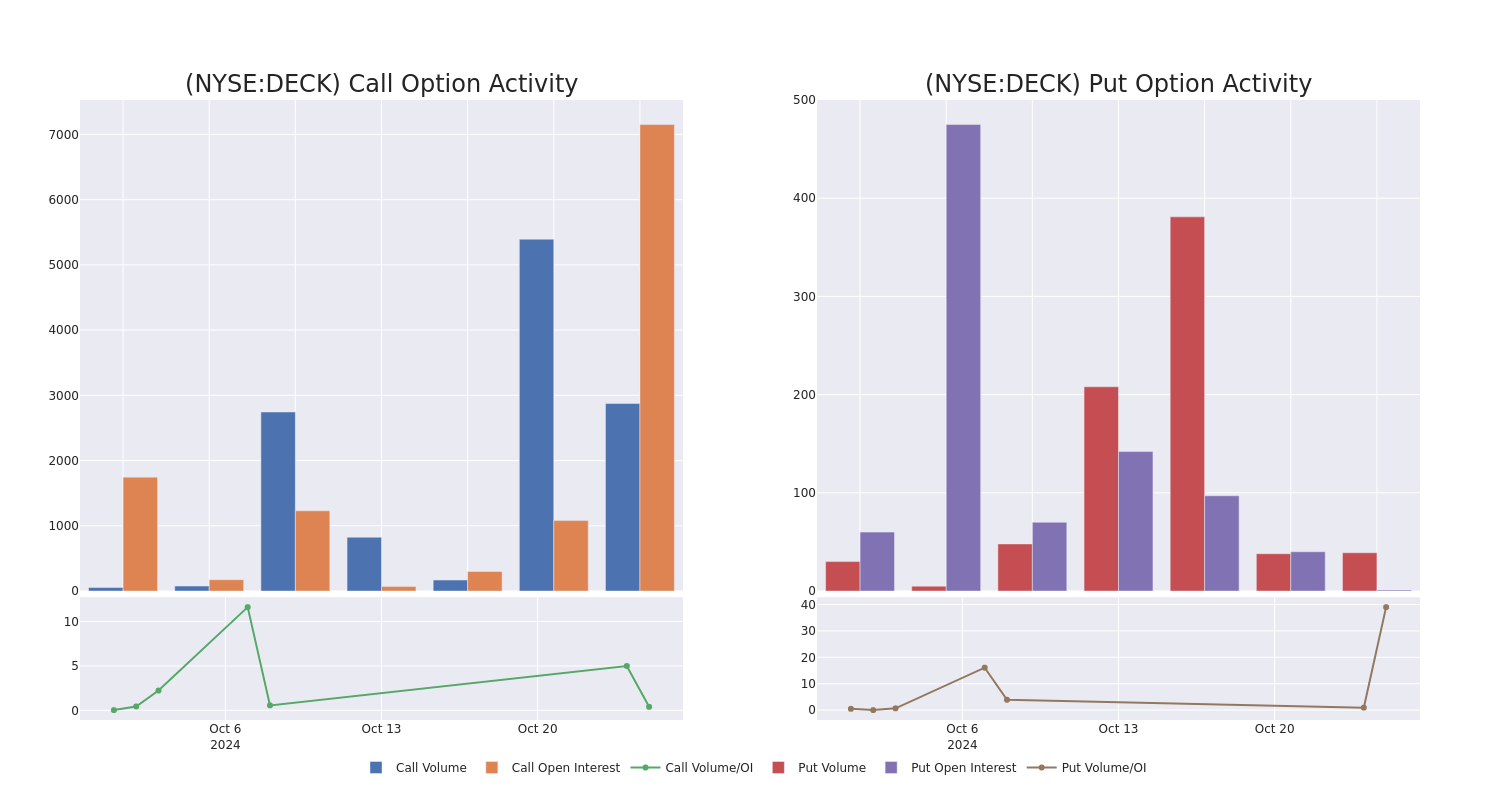

Analyzing Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Deckers Outdoor options trades today is 715.2 with a total volume of 2,913.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Deckers Outdoor’s big money trades within a strike price range of $152.5 to $175.0 over the last 30 days.

Deckers Outdoor Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DECK | CALL | TRADE | BEARISH | 12/20/24 | $10.2 | $10.0 | $10.0 | $171.67 | $200.0K | 524 | 206 |

| DECK | CALL | SWEEP | BEARISH | 10/25/24 | $17.6 | $15.6 | $15.82 | $152.50 | $157.1K | 608 | 265 |

| DECK | CALL | TRADE | BULLISH | 11/01/24 | $1.5 | $1.3 | $1.55 | $175.00 | $155.0K | 2.3K | 1.5K |

| DECK | CALL | TRADE | NEUTRAL | 11/29/24 | $7.9 | $6.7 | $7.3 | $170.00 | $73.0K | 2 | 71 |

| DECK | CALL | SWEEP | BEARISH | 03/21/25 | $28.2 | $23.2 | $23.1 | $155.00 | $69.3K | 54 | 4 |

About Deckers Outdoor

Deckers Outdoor Corp designs and sells casual and performance footwear, apparel, and accessories. Primary brands include UGG, Teva, and Sanuk. The company distributes Majority of its products through its wholesale business, but it also has a substantial direct-to-consumer business with its company-owned retail stores and websites. Majority of its sales are in the United States, although the company also has retail stores and distributors throughout Europe, Asia, Canada, and Latin America. It has structured their reporting around six segments which inlcudes the wholesale operations of specific brands like UGG, HOKA, Teva, Sanuk, and Other brands, alongside a segment focused on direct-to-consumer (DTC) operations.

Present Market Standing of Deckers Outdoor

- With a trading volume of 6,759,703, the price of DECK is up by 10.46%, reaching $167.94.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 97 days from now.

What The Experts Say On Deckers Outdoor

In the last month, 5 experts released ratings on this stock with an average target price of $185.4.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Stifel has decided to maintain their Hold rating on Deckers Outdoor, which currently sits at a price target of $181.

* Consistent in their evaluation, an analyst from Evercore ISI Group keeps a Outperform rating on Deckers Outdoor with a target price of $195.

* An analyst from Keybanc has decided to maintain their Overweight rating on Deckers Outdoor, which currently sits at a price target of $190.

* Consistent in their evaluation, an analyst from TD Cowen keeps a Buy rating on Deckers Outdoor with a target price of $178.

* Maintaining their stance, an analyst from Telsey Advisory Group continues to hold a Outperform rating for Deckers Outdoor, targeting a price of $183.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Deckers Outdoor options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply