Is Elon Musk "Superhuman"? Here's Why Nvidia's Jensen Huang Thinks So After the Tesla Chief's $2.5 Billion Feat

Few people elicit as strong a reaction as Elon Musk. The outspoken Tesla founder is fond of making bold claims and huge promises — promises that he doesn’t always keep, much to the chagrin of Tesla investors. Add to that his social media activity, and he is often a divisive figure.

One thing that can’t be denied is that Musk has vision. That — and a massive net worth — make him capable of marshaling huge resources to accomplish incredible tasks. Look no further than the recent successful rocket booster “capture” executed by his company, SpaceX. And while that truly is an incredible feat, Musk recently pulled off something else that left Nvidia (NASDAQ: NVDA) CEO, Jensen Huang, thoroughly impressed.

While X, Tesla, and SpaceX dominate the headlines, Musk’s artificial intelligence (AI) startup, xAI, recently built what could be the most powerful AI-training supercomputer around. Dubbed “Colossus,” the supercomputer will be used to train Grok, a large language model (LLM) and the company’s answer to ChatGPT. The LLM will be available to paying X customers initially, but many believe Grok will eventually power Tesla’s humanoid robots. Sounds like science fiction, no? It’s not.

Here’s the thing, xAI built the facility in a matter of months, but it installed 100,000 Nvidia H100s in just 19 days. The Nvidia chief was recently interviewed about the installation, and it was clear this was something he’d never seen, calling it “superhuman” and “unbelievable.” Why? According to Huang, it’s a process that would normally take years.

Musk isn’t done, however. He plans to install another 50,000 H200s in the next few months, roughly doubling its current power. Although nothing official has been announced, I wouldn’t be surprised if he is first in line for Nvidia’s yet-to-be-released B200s. xAI has spent a few billion on the project thus far and at $25,000 a pop, an estimated $2.5 billion of that was spent just on the H100 chips themselves.

While Musk and xAI’s feat is undeniably impressive, I would take Huang’s statements with a grain of salt. CEOs of companies that do billions of dollars of business together tend to be quite complimentary of each other, and like Musk, Huang doesn’t shy away from bold claims.

The whole project shows the incredible lengths to which companies will go to win the AI arms race — companies with billions to burn. During the last round of quarterly earnings, CEOs from the largest companies in tech reiterated that losing was not an option, and they will keep spending whatever it takes to win. Alphabet CEO Sundar Pichai put it bluntly, “The risk of underinvesting is dramatically greater than the risk of overinvesting for us.” That’s why the company expects to spend roughly $50 billion this year in capital expenditures, up from $31 billion the year before, with much of it going toward AI infrastructure and Nvidia chips.

TOP RANKED ROSEN LAW FIRM Encourages Coinbase Global, Inc. Investors to Secure Counsel Before Important Deadline in Securities Class Action First Filed by the Firm – COIN

NEW YORK, Oct. 26, 2024 (GLOBE NEWSWIRE) —

WHY: Rosen Law Firm, a global investor rights law firm, reminds purchasers of securities of Coinbase Global, Inc. COIN between April 14, 2021 and July 25, 2024, both dates inclusive (the “Class Period”), of the important November 12, 2024 lead plaintiff deadline in the securities class action first filed by the Firm.

SO WHAT: If you purchased Coinbase securities during the Class Period you may be entitled to compensation without payment of any out of pocket fees or costs through a contingency fee arrangement.

WHAT TO DO NEXT: To join the Coinbase class action, go to https://rosenlegal.com/submit-form/?case_id=28116 or call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com for information on the class action. A class action lawsuit has already been filed. If you wish to serve as lead plaintiff, you must move the Court no later than November 12, 2024. A lead plaintiff is a representative party acting on behalf of other class members in directing the litigation.

WHY ROSEN LAW: We encourage investors to select qualified counsel with a track record of success in leadership roles. Often, firms issuing notices do not have comparable experience, resources, or any meaningful peer recognition. Many of these firms do not actually litigate securities class actions, but are merely middlemen that refer clients or partner with law firms that actually litigate the cases. Be wise in selecting counsel. The Rosen Law Firm represents investors throughout the globe, concentrating its practice in securities class actions and shareholder derivative litigation. Rosen Law Firm has achieved the largest ever securities class action settlement against a Chinese Company. Rosen Law Firm was Ranked No. 1 by ISS Securities Class Action Services for number of securities class action settlements in 2017. The firm has been ranked in the top 4 each year since 2013 and has recovered hundreds of millions of dollars for investors. In 2019 alone the firm secured over $438 million for investors. In 2020, founding partner Laurence Rosen was named by law360 as a Titan of Plaintiffs’ Bar. Many of the firm’s attorneys have been recognized by Lawdragon and Super Lawyers.

DETAILS OF THE CASE: According to the lawsuit, defendants throughout the Class Period made materially false and/or misleading statements and/or failed to disclose that: (1) in 2020, the United Kingdom’s Financial Conduct Authority (“FCA”) had deemed efforts by Coinbase’s British unit, CB Payments Limited (“CBPL”), to prevent criminals from using its platform, to be inadequate; (2) as a result, the FCA reached an agreement with CBPL, which put requirements in place that were designed to prevent high risk customers from using CBPL’s platform; (3) CBPL then breached that agreement, which resulted in 13,416 high risk individuals receiving services; (4) the foregoing resulted in an undisclosed heightened regulatory risk; and (5) as a result, defendants statements about its business, operations and prospects were materially false and misleading and/or lacked a reasonable basis at all relevant times. When the true details entered the market, the lawsuit claims that investors suffered damages.

To join the Coinbase class action, go to https://rosenlegal.com/submit-form/?case_id=28116 call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com for information on the class action.

No Class Has Been Certified. Until a class is certified, you are not represented by counsel unless you retain one. You may select counsel of your choice. You may also remain an absent class member and do nothing at this point. An investor’s ability to share in any potential future recovery is not dependent upon serving as lead plaintiff.

Follow us for updates on LinkedIn: https://www.linkedin.com/company/the-rosen-law-firm or on Twitter: https://twitter.com/rosen_firm or on Facebook: https://www.facebook.com/rosenlawfirm.

Attorney Advertising. Prior results do not guarantee a similar outcome.

——————————-

Contact Information:

Laurence Rosen, Esq.

Phillip Kim, Esq.

The Rosen Law Firm, P.A.

275 Madison Avenue, 40th Floor

New York, NY 10016

Tel: (212) 686-1060

Toll Free: (866) 767-3653

Fax: (212) 202-3827

case@rosenlegal.com

www.rosenlegal.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Agnico Eagle Mines Options Trading: A Deep Dive into Market Sentiment

Investors with a lot of money to spend have taken a bearish stance on Agnico Eagle Mines AEM.

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with AEM, it often means somebody knows something is about to happen.

Today, Benzinga’s options scanner spotted 8 options trades for Agnico Eagle Mines.

This isn’t normal.

The overall sentiment of these big-money traders is split between 37% bullish and 50%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $43,400, and 7, calls, for a total amount of $661,568.

What’s The Price Target?

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $70.0 and $90.0 for Agnico Eagle Mines, spanning the last three months.

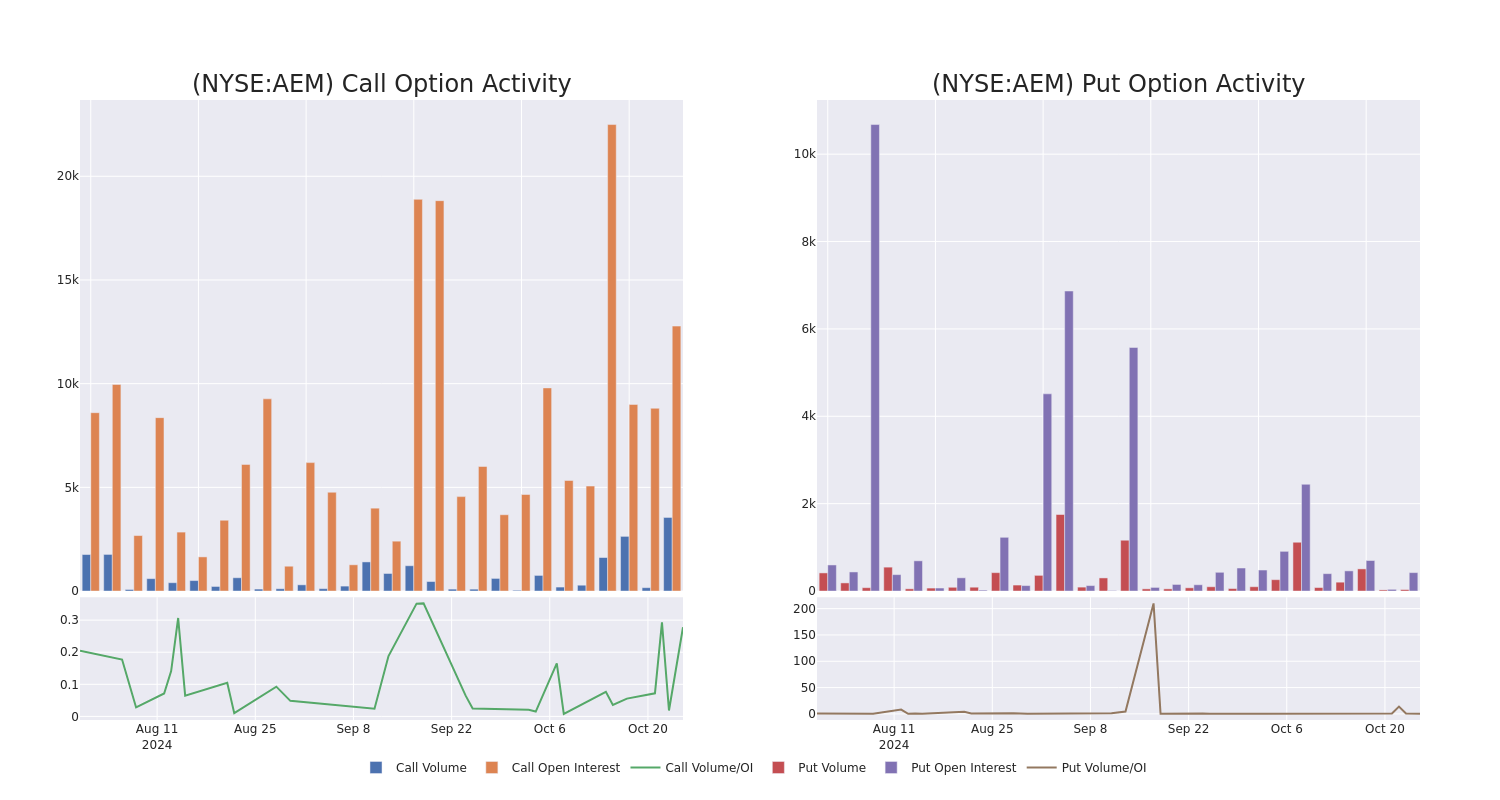

Volume & Open Interest Development

In today’s trading context, the average open interest for options of Agnico Eagle Mines stands at 2639.8, with a total volume reaching 3,583.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Agnico Eagle Mines, situated within the strike price corridor from $70.0 to $90.0, throughout the last 30 days.

Agnico Eagle Mines Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AEM | CALL | TRADE | BEARISH | 01/17/25 | $4.6 | $4.5 | $4.5 | $90.00 | $405.0K | 8.6K | 1.6K |

| AEM | CALL | SWEEP | BULLISH | 10/17/25 | $13.2 | $13.0 | $13.2 | $85.00 | $69.9K | 100 | 55 |

| AEM | CALL | TRADE | BEARISH | 11/15/24 | $2.35 | $2.25 | $2.28 | $90.00 | $45.5K | 3.9K | 225 |

| AEM | CALL | TRADE | NEUTRAL | 01/17/25 | $4.6 | $4.4 | $4.5 | $90.00 | $45.0K | 8.6K | 610 |

| AEM | PUT | SWEEP | BULLISH | 12/20/24 | $3.7 | $3.5 | $3.5 | $85.00 | $43.4K | 422 | 34 |

About Agnico Eagle Mines

Agnico Eagle is a gold miner with mines in Canada, Mexico, Finland, and Australia. Agnico operated just one mine, LaRonde, as recently as 2008 before bringing its other mines online in rapid succession in the following years. It merged with Kirkland Lake Gold in 2022, acquiring the Detour Lake and Macassa mines in Canada along with the high-grade, low-cost Fosterville mine in Australia. It produced more than 3.4 million gold ounces in 2023 and had about 15 years of gold reserves at end 2023. Agnico Eagle is focused on increasing gold production in lower-risk jurisdictions and bought the remaining 50% of its Canadian Malartic mine along with the Wasamac project and other assets from Yamana Gold in 2023.

Having examined the options trading patterns of Agnico Eagle Mines, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Agnico Eagle Mines

- Currently trading with a volume of 2,327,317, the AEM’s price is down by -1.23%, now at $86.85.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 5 days.

Expert Opinions on Agnico Eagle Mines

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $85.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Jefferies has decided to maintain their Hold rating on Agnico Eagle Mines, which currently sits at a price target of $85.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Agnico Eagle Mines options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Money market account rates today, October 26, 2024 (best account provides 5.05% APY)

Between March 2022 and July 2023, the Federal Reserve raised its benchmark rate 11 times. As a result, money market account (MMA) interest rates rose sharply.

However, the Fed slashed the federal funds rate by 50 basis points in September. So deposit rates — including money market account rates — have started falling. It’s more important than ever to compare MMA rates and ensure you earn as much as possible on your balance.

The national average money market account rate stands at 0.64%, according to the FDIC. This might not seem like much, but consider that just two years ago, it was just 0.23%, reflecting a sharp rise in a short period of time.

This is largely due to monetary policy decisions by the Fed, which began raising its benchmark rate in March 2022 to combat skyrocketing inflation. In fact, the Fed increased rates 11 times. But it finally cut its benchmark rate in September, causing deposit account rates to start dropping

Even so, some of the top accounts are currently offering upwards of 5% APY. Since these rates may not be around much longer, consider opening a money market account now to take advantage of today’s high rates.

Here’s a look at some of the top MMA rates available today:

See our picks for the 10 best money market accounts available today>>

Additionally, the table below features some of the best savings and money market account rates available today from our verified partners.

The amount of interest you can earn from a money market account depends on the annual percentage rate (APY). This is a measure of your total earnings after one year when considering the base interest rate and how often interest compounds (money market account interest typically compounds daily).

Say you put $1,000 in an MMA at the average interest rate of 0.64% with daily compounding. At the end of one year, your balance would grow to $1,006.42 — your initial $1,000 deposit, plus just $6.42 in interest.

Now let’s say you choose a high-yield money market account that offers 5% APY instead. In this case, your balance would grow to $1,051.27 over the same period, which includes $51.27 in interest.

The more you deposit in a money market account, the more you stand to earn. If we took our same example of a money market account at 5% APY, but deposit $10,000, your total balance after one year would be $10,512.67, meaning you’d earn $512.67 in interest.

Lawsuit Against The Feds Could Set Precedent On State Rights: New Mexico Marijuana Firms Move To Stop Seizures

Eight licensed marijuana companies in New Mexico have filed a federal lawsuit against the U.S. Department of Homeland Security and U.S. Customs and Border Protection, alleging constitutional rights violations through property seizures at interior checkpoints.

According to court documents, Border Patrol agents seized more than $1 million worth of state-licensed cannabis products, cash and other assets from these companies.

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. You can’t afford to miss out if you’re serious about the business.

Alleged Due Process Violations

The companies claim that federal authorities are infringing on their due process rights and demand the return of seized property or equivalent compensation. The suit further requests a jury trial to resolve the issue, asserting that federal agents acted unlawfully by confiscating state-regulated marijuana products and vehicles belonging to cannabis companies and their employees.

Federal Inspections Targeting Cannabis Shipments

The suit alleges that Homeland Security is operating inspection checkpoints along New Mexico’s interstate highways, where agents reportedly search vehicles for contraband.

Although cannabis is regulated within New Mexico, federal agents have seized these shipments, claiming the products are illegal under federal law.

Read Also: Federal Court Schedules Oral Arguments In Landmark Cannabis Prohibition Case

Impact On New Mexico’s Cannabis Industry

These incidents have drawn attention from state leaders, including Governor Michelle Grisham Lujan, who previously criticized Homeland Security’s actions. The lawsuit argues that continued federal seizures are disrupting New Mexico’s cannabis regulatory framework, risking the viability of the state’s licensed cannabis businesses.

According to MJBizDaily, which first reported on these incidents earlier this year, federal agents have allegedly placed detained cannabis employees on an “International Drug Traffickers List” without issuing charges or documentation, further escalating tensions between state and federal authorities.

Read Next: $8B Market On The Brink: Texas Senator Calls It ‘Uncontrollable,’ Proposes Erasing Hemp

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Unisys Corporation Announcement: If You Have Suffered Losses in Unisys Corporation (NYSE: UIS), You Are Encouraged to Contact The Rosen Law Firm About Your Rights

NEW YORK, Oct. 26, 2024 (GLOBE NEWSWIRE) —

Why: Rosen Law Firm, a global investor rights law firm, announces an investigation of potential securities claims on behalf of shareholders of Unisys Corporation UIS resulting from allegations that Unisys may have issued materially misleading business information to the investing public.

So What: If you purchased Unisys securities you may be entitled to compensation without payment of any out of pocket fees or costs through a contingency fee arrangement. The Rosen Law Firm is preparing a class action seeking recovery of investor losses.

To join the prospective class action, go to https://rosenlegal.com/submit-form/?case_id=9648 or call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com for information on the class action.

What is this about: On October 22, 2024, the Securities and Exchange Commission announced that it had charged four companies, including Unisys, with “making materially misleading disclosures regarding cybersecurity risks and intrusions.” Further, the SEC also charged Unisys with disclosure controls and procedures violations.

On this news, Unisys stock fell 8.6% on October 22, 2024.

Why Rosen Law: We encourage investors to select qualified counsel with a track record of success in leadership roles. Often, firms issuing notices do not have comparable experience, resources, or any meaningful peer recognition. Many of these firms do not actually litigate securities class actions. Be wise in selecting counsel. The Rosen Law Firm represents investors throughout the globe, concentrating its practice in securities class actions and shareholder derivative litigation. Rosen Law Firm has achieved the largest ever securities class action settlement against a Chinese Company. Rosen Law Firm was Ranked No. 1 by ISS Securities Class Action Services for number of securities class action settlements in 2017. The firm has been ranked in the top 4 each year since 2013 and has recovered hundreds of millions of dollars for investors. In 2019 alone the firm secured over $438 million for investors. In 2020, founding partner Laurence Rosen was named by law360 as a Titan of Plaintiffs’ Bar. Many of the firm’s attorneys have been recognized by Lawdragon and Super Lawyers.

Follow us for updates on LinkedIn: https://www.linkedin.com/company/the-rosen-law-firm, on Twitter: https://twitter.com/rosen_firm or on Facebook: https://www.facebook.com/rosenlawfirm/.

Attorney Advertising. Prior results do not guarantee a similar outcome.

——————————-

Contact Information:

Laurence Rosen, Esq.

Phillip Kim, Esq.

The Rosen Law Firm, P.A.

275 Madison Avenue, 40th Floor

New York, NY 10016

Tel: (212) 686-1060

Toll Free: (866) 767-3653

Fax: (212) 202-3827

case@rosenlegal.com

www.rosenlegal.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

ROSEN, NATIONAL INVESTOR COUNSEL, Encourages Allarity Therapeutics, Inc. Investors to Secure Counsel Before Important Deadline in Securities Class Action – ALLR

NEW YORK, Oct. 26, 2024 (GLOBE NEWSWIRE) — WHY: Rosen Law Firm, a global investor rights law firm, reminds purchasers of securities of Allarity Therapeutics, Inc. ALLR between May 17, 2022 and July 19, 2024, both dates inclusive (the “Class Period”), of the important November 12, 2024 lead plaintiff deadline.

SO WHAT: If you purchased Allarity securities during the Class Period you may be entitled to compensation without payment of any out of pocket fees or costs through a contingency fee arrangement.

WHAT TO DO NEXT: To join the Allarity class action, go to https://rosenlegal.com/submit-form/?case_id=27420 or call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com for information on the class action. A class action lawsuit has already been filed. If you wish to serve as lead plaintiff, you must move the Court no later than November 12, 2024. A lead plaintiff is a representative party acting on behalf of other class members in directing the litigation.

WHY ROSEN LAW: We encourage investors to select qualified counsel with a track record of success in leadership roles. Often, firms issuing notices do not have comparable experience, resources or any meaningful peer recognition. Many of these firms do not actually litigate securities class actions, but are merely middlemen that refer clients or partner with law firms that actually litigate cases. Be wise in selecting counsel. The Rosen Law Firm represents investors throughout the globe, concentrating its practice in securities class actions and shareholder derivative litigation. Rosen Law Firm has achieved the largest ever securities class action settlement against a Chinese Company. Rosen Law Firm was Ranked No. 1 by ISS Securities Class Action Services for number of securities class action settlements in 2017. The firm has been ranked in the top 4 each year since 2013 and has recovered hundreds of millions of dollars for investors. In 2019 alone the firm secured over $438 million for investors. In 2020, founding partner Laurence Rosen was named by law360 as a Titan of Plaintiffs’ Bar. Many of the firm’s attorneys have been recognized by Lawdragon and Super Lawyers.

DETAILS OF THE CASE: According to the lawsuit, throughout the Class Period, defendants made false and/or misleading statements and/or failed to disclose that: (1) defendants had overstated the Dovitinib, Allarity’s drug candidate which treats renal cell carcinoma, new drug application’s (“NDA”) continued regulatory prospects; (2) Allarity and three of its former officers had engaged in illegal, illicit, and/or otherwise improper conduct in connection with the Dovitinib NDA and/or the Dovitinib-DRP premarket approval application (“PMA”); (3) the foregoing misconduct subjected Allarity to an increased risk of regulatory and/or governmental scrutiny and enforcement action, as well as significant legal, monetary, and reputational harm; (4) following Allarity’s announcement that it was, in fact, being investigated for wrongdoing in connection with the Dovitinib NDA and/or the Dovitinib-DRP PMA, Allarity downplayed the substantial likelihood that an enforcement action would result from such investigation; and (5) as a result, Allarity’s public statements were materially false and misleading at all relevant times. When the true details entered the market, the lawsuit claims that investors suffered damages.

To join the Allarity class action, go to https://rosenlegal.com/submit-form/?case_id=27420 or call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com for information on the class action.

No Class Has Been Certified. Until a class is certified, you are not represented by counsel unless you retain one. You may select counsel of your choice. You may also remain an absent class member and do nothing at this point. An investor’s ability to share in any potential future recovery is not dependent upon serving as lead plaintiff.

Follow us for updates on LinkedIn: https://www.linkedin.com/company/the-rosen-law-firm, on Twitter: https://twitter.com/rosen_firm or on Facebook: https://www.facebook.com/rosenlawfirm/.

Attorney Advertising. Prior results do not guarantee a similar outcome.

——————————-

Contact Information:

Laurence Rosen, Esq.

Phillip Kim, Esq.

The Rosen Law Firm, P.A.

275 Madison Avenue, 40th Floor

New York, NY 10016

Tel: (212) 686-1060

Toll Free: (866) 767-3653

Fax: (212) 202-3827

case@rosenlegal.com

www.rosenlegal.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

22-Year-Old Angel Reese Pays $8,000 In Rent – Admits She's 'Living Beyond Her Means' And WNBA Salary Isn't Enough To Cover The Bills

Angel Reese may be dominating on the basketball court, but she’s facing a financial battle off the court. The 22-year-old WNBA star recently opened up to her followers about the reality of her $8,000 monthly rent – and how her salary from the Chicago Sky doesn’t come close to covering her living expenses. In a refreshingly candid moment during an Instagram Live session reported by ESPN, she confessed, “I just hope y’all know the WNBA doesn’t pay my bills at all. I don’t even think it pays one of my bills, literally.”

Don’t Miss:

For someone earning around $73,439 a year from her WNBA salary, shelling out $8,000 a month for rent seems like quite the stretch – and Reese didn’t hesitate to call it out. Doing the math, her annual rent adds up to $96,000, well above her league earnings. No wonder she admitted, “I’m living beyond my means.”

But if the WNBA paycheck isn’t cutting it, how exactly is she affording such a luxury lifestyle? Reese didn’t shy away from that detail either. She explained that the real source of her financial comfort comes from endorsement deals and her booming social media presence. “I don’t even know my salary – 74 [thousand]?” she mused during the live session, clarifying that her basketball earnings are only a small part of her financial picture. According to Sky Star, Reese is also reported to be joining a new 3-on-3 women’s league called “Unrivaled” in January where the salary there is expected to be $250,000 for an eight-week season.

See Also: This Jeff Bezos-backed startup will allow you to become a landlord in just 10 minutes, and you only need $100.

Reese isn’t just a basketball star – she’s also a social media sensation with a massive following. As a student-athlete at LSU, she was one of the top college athletes in NIL (Name, Image and Likeness) earnings. At one point, her potential NIL value jumped to $876,000, placing her among the top earners in college sports, rivaling even Caitlin Clark, another WNBA star.

Thanks to these endorsement deals, Reese has partnered with major brands like Wingstop, McDonald’s, PlayStation, Amazon and Coach. With these sponsorships bringing in a cool $1.7 million in 2022 and 2023 alone, it’s no wonder she can afford to live in one of Chicago’s priciest high-rises. Her building has everything from stunning views of the Chicago skyline to top-tier amenities like a private basketball court, Pilates studio and even a spa.

Trending: Warren Buffett once said, “If you don’t find a way to make money while you sleep, you will work until you die.” These high-yield real estate notes that pay 7.5% – 9% make earning passive income easier than ever.

But even with her high-rise lifestyle and brand deals, Reese’s story sheds light on a bigger issue in women’s sports: the pay gap. While her social media fame and endorsements keep her afloat, not every player has the same opportunities. As Reese’s situation highlights, WNBA salaries simply don’t stack up against the NBA’s – and that’s something many in the sport hope to change as women’s basketball continues to grow in popularity.

In the meantime, Angel Reese is living proof that hustle doesn’t stop on the court. She’s managing her lavish lifestyle through savvy business moves and a strong social media presence – because, as she reminded everyone, the WNBA paycheck alone isn’t enough.

This story is updated to additional true projected revenue from new information received

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Major Purchase Alert: John McGinnis Invests $498K In ManpowerGroup Stock

John McGinnis, EVP at ManpowerGroup MAN, disclosed an insider purchase on October 24, based on a new SEC filing.

What Happened: McGinnis’s recent purchase of 8,000 shares of ManpowerGroup, disclosed in a Form 4 filing with the U.S. Securities and Exchange Commission on Thursday, reflects confidence in the company’s potential. The total transaction value is $498,240.

ManpowerGroup‘s shares are actively trading at $63.56, experiencing a down of 0.09% during Friday’s morning session.

About ManpowerGroup

ManpowerGroup Inc. is engaged in providing workforce solutions and services. The company provides services that includes Recruitment and Assessment, Upskilling, Reskilling, Training and Development, Career Management, Outsourcing, and Workforce Consulting. The reportable segments of the company are Staffing and Interim, Outcome-Based Solutions and Consulting, Permanent Recruitment, and Others. The Staffing and Interim segment derives maximum of the company’s revenue. The company derives maximum geographical revenue from Southern European region.

ManpowerGroup: A Financial Overview

Revenue Growth: Over the 3 months period, ManpowerGroup showcased positive performance, achieving a revenue growth rate of 0.21% as of 30 September, 2024. This reflects a substantial increase in the company’s top-line earnings. When compared to others in the Industrials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Evaluating Earnings Performance:

-

Gross Margin: The company issues a cost efficiency warning with a low gross margin of 17.26%, indicating potential difficulties in maintaining profitability compared to its peers.

-

Earnings per Share (EPS): ManpowerGroup’s EPS is below the industry average. The company faced challenges with a current EPS of 0.48. This suggests a potential decline in earnings.

Debt Management: With a below-average debt-to-equity ratio of 0.61, ManpowerGroup adopts a prudent financial strategy, indicating a balanced approach to debt management.

Understanding Financial Valuation:

-

Price to Earnings (P/E) Ratio: ManpowerGroup’s current Price to Earnings (P/E) ratio of 73.13 is higher than the industry average, indicating that the stock may be overvalued according to market sentiment.

-

Price to Sales (P/S) Ratio: The Price to Sales ratio is 0.17, which is lower than the industry average. This suggests a possible undervaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): The company’s EV/EBITDA ratio 11.91 is below the industry average, indicating that it may be relatively undervalued compared to peers.

Market Capitalization Analysis: Positioned below industry benchmarks, the company’s market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Impact of Insider Transactions on Investments

Insider transactions are not the sole determinant of investment choices, but they are a factor worth considering.

From a legal standpoint, the term “insider” pertains to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as outlined in Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and significant hedge funds. These insiders are mandated to inform the public of their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

A company insider’s new purchase is a indicator of their positive anticipation for a rise in the stock.

While insider sells may not necessarily reflect a bearish view and can be motivated by various factors.

A Closer Look at Important Transaction Codes

For investors, a primary focus lies on transactions occurring in the open market, as indicated in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of ManpowerGroup’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Palantir vs. Adobe: Wall Street Says to Buy One AI Stock and Sell the Other

The most popular stock in the artificial intelligence (AI) software space is undoubtedly Palantir (NYSE: PLTR). The stock is up an incredible 160% this year and dwarfs the performance of the software company that most want to be when they grow up: Adobe (NASDAQ: ADBE).

Adobe’s stock is down 15% this year, but it also belongs in the AI conversation because it is heavily pursuing the AI image-generation market as well as AI video. However, despite Palantir’s fantastic year and Adobe’s poor one, Wall Street thinks investors would be wise to sell Palantir and buy Adobe.

Why? Well, the answer centers around valuation.

Palantir’s AI platform is designed to give anyone with decision-making power the most up-to-date information possible. It involves processing multiple data streams simultaneously and then harnessing the power of AI to make recommendations. Originally, this software was designed for government use, but it has also made its way into the commercial sector.

More recently, Palantir’s new product, Artificial Intelligence Platform (AIP), has gained steam. AIP allows companies to build generative AI into their business systems, which turns AI from a tool someone might use on the side to one integrated into workflows. This is a critical step, as it controls what information a large language model sees and prevents sensitive information from entering another company’s database.

Adobe isn’t quite as technologically advanced as Palantir. Its product suite is the industry standard for graphics design, but Adobe isn’t asleep at the wheel. It has added Firefly to its product lineup, allowing creators to adjust images or create new ones with text input. However, many generative AI models already have this capability, so Firefly isn’t setting it apart.

Few models can generate AI video, yet Adobe is nearing the full-scale launch of Firefly Video. With Adobe at the forefront of this fundamental change in how people work, it isn’t at risk of being replaced anytime soon. However, the stock doesn’t get as much respect as it used to.

Both Palantir and Adobe have legitimate investment theses and are strong AI companies. However, Wall Street is much more bullish on Adobe than Palantir, and I agree.

Wall Street currently has an average price target of $27.67 on Palantir’s stock, indicating about 35% downside. Adobe’s one-year average target is $621.15, indicating about 25% upside (both consensus targets are from TipRanks).