Surgery Tables Market Size Anticipated at USD 1.1 Billion by 2031, Expanding at 3.9% CAGR | Analysis by Transparency Market Research, Inc.

Wilmington, Delaware, United States, Transparency Market Research, Inc. , Oct. 25, 2024 (GLOBE NEWSWIRE) — The previous market valuation of the global surgery tables market (سوق طاولات الجراحة) was US$ 801.4 million, measured in 2022. This market is forecasted to reach US$ 1.1 billion by 2031. The market under consideration advances with a sluggish CAGR of 3.9%. However, this growth is attributed to various market drivers.

An ordinary surgery table’s lifespan is limited, typically between 10 and 15 years. Various surgery tables worldwide have attained this period. Therefore, these tables are expected to be replaced with modern ones so that patients can be given optimum comfort. This creates a surge in the demand for surgery tables. Consequently, the subject market is driven heavily by the factors mentioned above.

Governments have been investing heavily in the medical sector, which has caused the medical industry to grow substantially. Due to this, expanding within the medical sector is lucrative for the subject market. Apart from the government, various key industry players have started investing more in the market. This creates another opportunity for manufacturers to produce the required goods. Therefore, this is another market driver helping the subject market to advance.

Download Sample PDF Report: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=50400

Due to various pandemics and epidemic waves, the proportion of people with chronic diseases has been increasing. Serious diseases like respiratory organ failure, brain damage, heart-related issues, etc., are growing exponentially. This demands that the medical sector expand in terms of the total number of surgery tables so that more patients can be treated.

Key Players

- STERIS plc

- Hill-Rom Services Inc.

- Getinge AB

- Stryker

- Mizuho OSI

- Merivaara Corp.

- Surgical Tables Inc.

- AMTAI Medical Equipment Inc.

- BARRFAB

Key Findings from the Market Report

- The global surgery table market is segmented based on many categories. Based on the type of table used, it is segmented as powered surgery tables. The power-driver tables are essential requirements for the dentist clinic. Also, it is more utilized in neurological surgeries, where patients are supposed to be readjusted to be operated on.

- Based on the application of the surgery tables, the orthopedic surgery tables’ market segment is one of the key segments that help surgeons maneuver and readjust patients for better operability.

- The imaging tables market segment is fundamental. These tables scan patients’ internal body parts and can inspect fractures and internal injuries.

- From the end-user industry market segment perspective, hospitals are the largest users of surgery tables. Clinics and other ambulatory surgery centers also use surgery tables extensively.

Regional Profile

- The number of surgeries performed in the United States is higher. Apart from this, the medical sector is constantly evolving due to increased investment by various parties. This helps the country contribute significantly to the global surgery tables market. Thus, North America dominates the subject market by leading the sector.

- Europe has also significantly developed the medical sector. As a result, the healthcare infrastructure in countries like Germany, the United Kingdom, and Denmark is fairly advanced, contributing significantly to the market.

- Developing countries have also contributed significantly to the subject market; therefore, Asia Pacific has recently gained more importance.

Unlock Growth Potential in Your Industry! Download PDF Brochure: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=50400

Key Developments Observed in the Surgery Tables Market

- In December 2021, Baxter acquired Hill-Rom Services, Inc. This acquisition will help the organization transform the healthcare sector using cutting-edge technology.

- In February 2022, ALVO Medical introduced ALVO Rapsodia, which shall prove useful in neurological, colorectal, cardiovascular, gynecology, and spinal surgeries.

- In August 2023, STERIS plc acquired Becton, Dickinson and Company. With the help of this, the organization can acquire sterilization container assets, surgical instrumentation, and laparoscopic instrumentation.

Competitive Landscape

The global surgery tables market competition includes key players developing and innovating products to acquire a competitive edge.

- STERIS plc. is one such organization that produces sterilizers, washing equipment, instruments for dental practitioners, and many more.

- Getinge AB is known to produce anesthesia equipment, ventilators, patient lifting devices, lights, and heart-lung machines. This helps the business diversify its product portfolio.

- Stryker manufactures airway management, cleaners, bed frames, ambulation and related equipment, and disinfectants.

Market Segmentation

Type

Application

- General Surgery Tables

- Orthopedic Tables

- Imaging Tables

- Others

End user

- Hospitals

- Ambulatory Surgery Centers

- Others

Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East & Africa

Purchase the Report for Market-Driven Insights: https://www.transparencymarketresearch.com/checkout.php?rep_id=50400<ype=S

Have a Look at More Valuable Insights of Healthcare

- Electric Tooth Polisher Market: The global electric tooth polisher market (سوق تلميع الأسنان الكهربائية) is estimated to flourish at a CAGR of 5.5% from 2022 to 2031. Transparency Market Research projects that the overall sales revenue for electric tooth polisher is estimated to reach US$ 130.3 million by the end of 2031.

- Stethoscope Market: The global stethoscope market (سوق السماعة الطبية) is likely to expand at a CAGR of 5.5% from 2022 to 2032. People today are more willing to opt for physical examinations and undertake diagnoses with the inclination toward health and fitness.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Wells Fargo Unusual Options Activity For October 25

Investors with a lot of money to spend have taken a bullish stance on Wells Fargo WFC.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with WFC, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 18 uncommon options trades for Wells Fargo.

This isn’t normal.

The overall sentiment of these big-money traders is split between 66% bullish and 22%, bearish.

Out of all of the special options we uncovered, 8 are puts, for a total amount of $833,453, and 10 are calls, for a total amount of $475,873.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $55.0 to $70.0 for Wells Fargo over the recent three months.

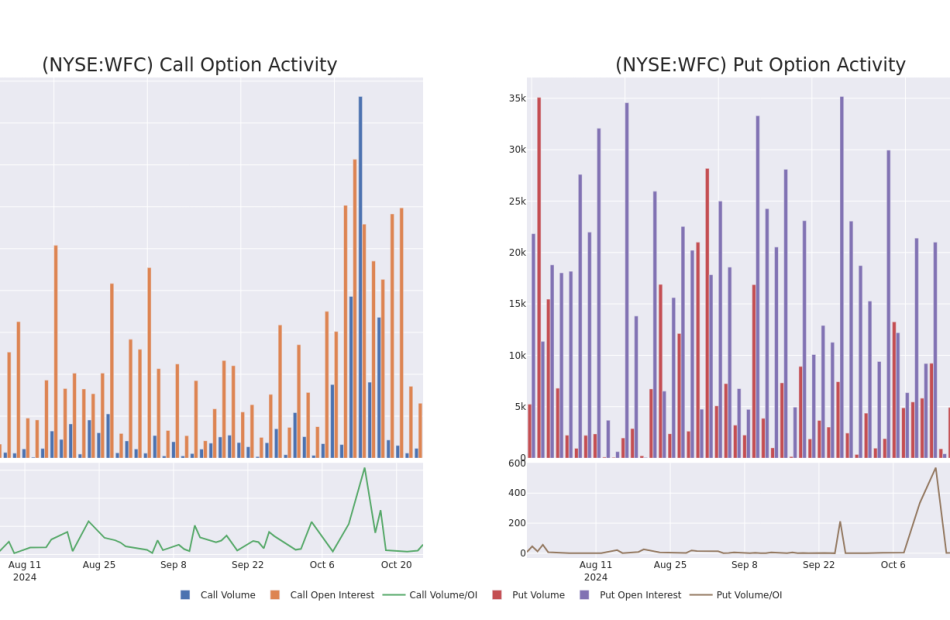

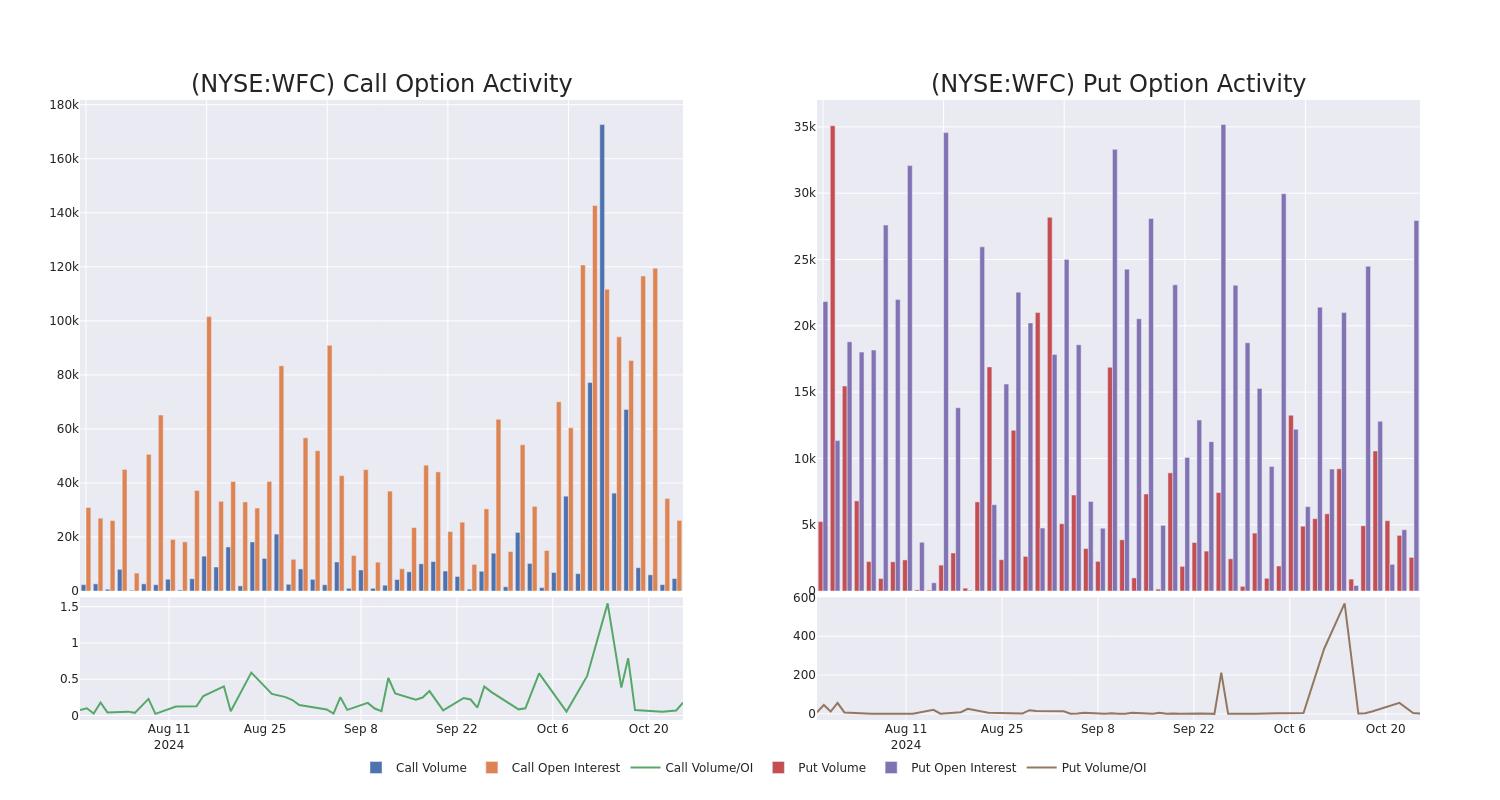

Insights into Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Wells Fargo’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Wells Fargo’s substantial trades, within a strike price spectrum from $55.0 to $70.0 over the preceding 30 days.

Wells Fargo Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WFC | PUT | TRADE | BULLISH | 03/21/25 | $2.47 | $2.43 | $2.44 | $60.00 | $244.0K | 2.9K | 1.0K |

| WFC | PUT | TRADE | BULLISH | 01/17/25 | $1.64 | $1.61 | $1.62 | $60.00 | $226.8K | 15.7K | 11 |

| WFC | PUT | TRADE | BULLISH | 12/20/24 | $1.78 | $1.75 | $1.75 | $62.50 | $140.0K | 4.0K | 871 |

| WFC | CALL | SWEEP | BULLISH | 11/08/24 | $1.12 | $1.09 | $1.11 | $67.00 | $117.0K | 871 | 2.7K |

| WFC | CALL | SWEEP | BEARISH | 11/08/24 | $1.11 | $1.1 | $1.1 | $67.00 | $78.1K | 871 | 1.2K |

About Wells Fargo

Wells Fargo is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company has four primary segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management. It is almost entirely focused on the U.S.

Wells Fargo’s Current Market Status

- With a trading volume of 10,499,068, the price of WFC is down by -1.25%, reaching $64.61.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 82 days from now.

Expert Opinions on Wells Fargo

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $65.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Consistent in their evaluation, an analyst from Compass Point keeps a Neutral rating on Wells Fargo with a target price of $60.

* An analyst from Phillip Securities upgraded its action to Accumulate with a price target of $65.

* An analyst from Evercore ISI Group has decided to maintain their Outperform rating on Wells Fargo, which currently sits at a price target of $68.

* An analyst from RBC Capital downgraded its action to Sector Perform with a price target of $61.

* Consistent in their evaluation, an analyst from Evercore ISI Group keeps a Outperform rating on Wells Fargo with a target price of $71.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Wells Fargo, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Tech Stocks Rally As Investors Await Magnificent 7 Earnings; Dollar Eyes Fourth Straight Positive Week: What's Driving Markets Friday?

Stocks are ending the week on a high note, with tech leading the charge as investors position ahead of next week’s pivotal earnings releases from five of the “Magnificent Seven” stocks.

Microsoft Corp. MSFT, Apple Inc. AAPL, Meta Platforms Inc. META, Amazon.com Inc. AMZN, and Alphabet Inc. GOOGLGOOG will all report quarterly earnings between Oct. 29 and Oct. 31.

Combined, nearly 45% of the S&P 500 by market cap is set to report results next week, with other heavyweights including McDonald’s Corp. MCD, Visa Inc. V, Eli Lilly and Co. LLY, Mastercard Inc. MA, Chevron Corp. CVX and Exxon Mobil Corp. XOM.

Tesla Inc. TSLA continued its upward trajectory on Friday, rising 2.7% following a massive 21% jump on Thursday — its biggest one-day gain since May 2013.

The S&P 500 was up 0.5% at midday trading in New York, while the Nasdaq 100 surged by 1.5%, fueled by semiconductor stocks.

The Dow Jones Industrial Average fell 0.3%, on track to end a six-week winning streak. The U.S. dollar strengthened further, with the DXY Index rising past the 104 mark, setting up for a fourth straight week of gains. Meanwhile, Treasury yields were steady.

WTI crude rose 1.8%, driven by concerns over geopolitical tensions in the Middle East. Bitcoin BTC/USD is up slightly at $67,695.

| Major Indices | Price | 1-day % change |

| Nasdaq 100 | 20,500.56 | 1.3% |

| S&P 500 | 5,839.28 | 0.5% |

| Russell 2000 | 2,219.60 | 0.3% |

| Dow Jones | 42,271.11 | -0.3% |

According to Benzinga Pro data:

- The SPDR S&P 500 ETF Trust SPY rose 0.5% to $582.19.

- The SPDR Dow Jones Industrial Average DIA eased 0.2% to $423.18.

- The tech-heavy Invesco QQQ Trust Series QQQ rallied 1.3% to $498.83.

- The iShares Russell 2000 ETF IWM inched 0.2% up to $220.09.

- The Technology Select Sector SPDR Fund XLK outperformed, up by 1.4%. The Utilities Select Sector SPDR Fund XLU lagged, down 0.9%.

- Capital One Financial Corp. COF rallied 7% to levels last seen in October 2021 on better-than-expected quarterly results.

- Digital Realty Trust DLR rallied over 10% after reporting record new lease bookings.

Other stocks reacting to earnings included:

- Ameriprise Financial Inc. AMP, down 0.13%

- DexCom Inc. DXCM, down 1%

- ResMed Inc. RMD up 7.6%,

- Skechers U.S.A. Inc. SKX down 0.2%,

- Western Digital Corp. WDC up 7.6%,

- Deckers Outdoor Corp. DECK, up 11%

- Edward Lifesciences Corp. EW, down by 0.6%

- HCA Healthcare Inc. HCA, down 10%,

- Aon plc AON, up 6%,

- Colgate-Palmolive Company CL, down 3.4%,

- Centene Corp. CNC, up 6.7%,

- Saia Inc. SAIA, up 9.2%.

Read Now:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Boeing Plans To Sell Off Major Assets As The Company Scrambles To Remain Profitable And Stay Competitive In A Tough Market

Boeing has been making bold moves lately, trying to stay above water in a market that’s becoming more unforgiving. The aerospace giant, which has faced several blows recently, is reportedly considering selling off key assets to shore up its finances.

According to the Wall Street Journal, Boeing is considering divesting from noncore or underperforming units. The latest deal involves a small defense unit that produces surveillance gear for the U.S. military. Insiders say this is just one of many cuts in the works.

Don’t Miss:

This is not a walk in the park. Selling off parts of the company might be risky, but for Boeing, it’s a roll of the dice they seem to have no choice but to make. The company has been hit with a string of crises this year, starting when a 737 MAX had a door panel blow off midflight back in January.

That incident set the tone for a year full of turbulence, from increased regulatory scrutiny to significant slowdowns in production. Things got so bad that the company’s CEO stepped down. Kelly Ortberg, who has since taken the reins, now faces the daunting task of guiding Boeing through the storm.

This isn’t all Boeing’s dealing with. Labor unrest has thrown yet another wrench in the works. In September, around 33,000 unionized workers went on strike, halting production and throwing Boeing’s already shaky finances into even deeper trouble.

See Also: This Adobe-backed AI marketing startup went from a $5 to $85 million valuation working with brands like L’Oréal, Hasbro, and Sweetgreen in just three years – here’s how there’s an opportunity to invest at $1,000 for only $0.50/share today.

The strike completely froze output for key models like the 737 MAX, 767 and 777 widebody jets and now Boeing is facing one more headache it didn’t need. A new contract with Machinists is up for a vote, promising a hefty 35% pay bump over four years. But even if it passes, Boeing’s bottom-line damage might already be too severe to ignore.

Meanwhile, Boeing’s board has been scrambling to find a way out of this mess. They recently met to determine which divisions are worth keeping, reviewing financial reports and grilling division heads.

The Wall Street Journal notes these internal talks are critical as Boeing looks to downsize and pivot. Will it be enough? That’s the million-dollar question, especially with regulatory investigations into the company’s safety practices still in full swing.

Unpacking the Latest Options Trading Trends in Joby Aviation

Financial giants have made a conspicuous bullish move on Joby Aviation. Our analysis of options history for Joby Aviation JOBY revealed 15 unusual trades.

Delving into the details, we found 80% of traders were bullish, while 13% showed bearish tendencies. Out of all the trades we spotted, 8 were puts, with a value of $263,540, and 7 were calls, valued at $360,161.

What’s The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $4.0 to $12.0 for Joby Aviation over the recent three months.

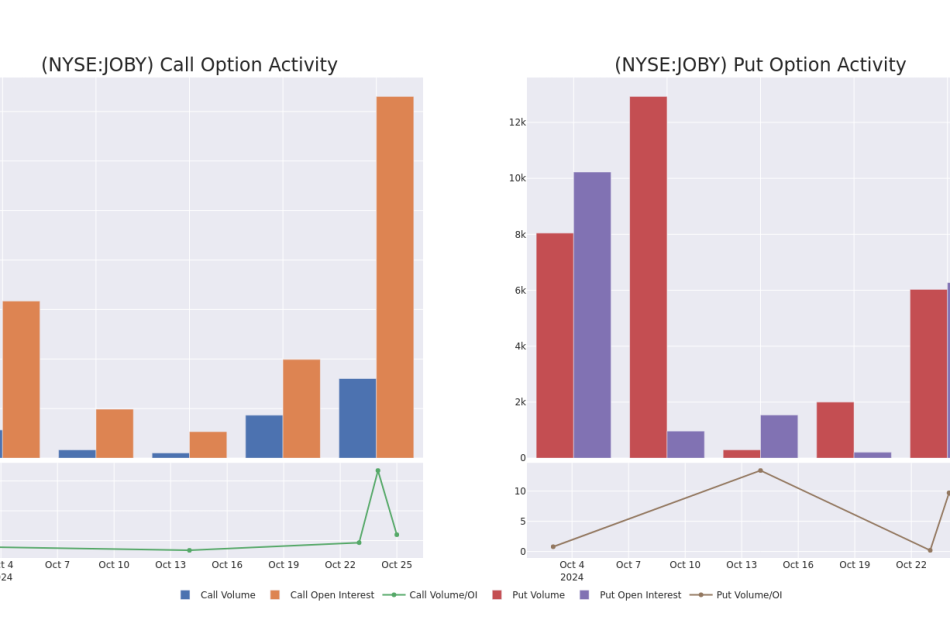

Volume & Open Interest Development

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Joby Aviation’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Joby Aviation’s significant trades, within a strike price range of $4.0 to $12.0, over the past month.

Joby Aviation Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| JOBY | CALL | SWEEP | BULLISH | 01/17/25 | $1.5 | $1.45 | $1.5 | $4.00 | $75.0K | 1.5K | 1.0K |

| JOBY | CALL | SWEEP | BULLISH | 01/17/25 | $1.5 | $1.45 | $1.5 | $4.00 | $75.0K | 1.5K | 518 |

| JOBY | CALL | SWEEP | BULLISH | 01/17/25 | $0.65 | $0.6 | $0.65 | $5.50 | $65.1K | 12.0K | 2.1K |

| JOBY | PUT | SWEEP | BULLISH | 11/15/24 | $1.05 | $0.95 | $0.96 | $6.00 | $48.0K | 1.7K | 514 |

| JOBY | CALL | SWEEP | BULLISH | 01/17/25 | $0.65 | $0.6 | $0.65 | $5.50 | $45.5K | 12.0K | 1.1K |

About Joby Aviation

Joby Aviation Inc is a transportation company developing electric air taxis for commercial passenger service.

After a thorough review of the options trading surrounding Joby Aviation, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Joby Aviation’s Current Market Status

- With a volume of 73,682,452, the price of JOBY is down -15.4% at $5.11.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 12 days.

What The Experts Say On Joby Aviation

3 market experts have recently issued ratings for this stock, with a consensus target price of $9.833333333333334.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Reflecting concerns, an analyst from Cantor Fitzgerald lowers its rating to Overweight with a new price target of $10.

* Consistent in their evaluation, an analyst from Canaccord Genuity keeps a Buy rating on Joby Aviation with a target price of $10.

* An analyst from HC Wainwright & Co. downgraded its action to Buy with a price target of $9.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Joby Aviation, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.