48-Year-Old Earning $2,200 Per Month in Dividends With $378,000 Portfolio Reveals His Portfolio: Top 9 Stocks and ETFs

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

Should you invest in growth stocks for capital gains through stock price appreciation or in dividend stocks for steady, reliable income? There’s no one-size-fits-all answer, but patient investors are crushing it with income strategies, earning substantial returns through regular dividends.

About two months ago, a dividend investor shared his success story and income report on r/Dividends – a community of over 600,000 members on Reddit. The investor, 48, said he was collecting about $2,200 per month in dividend income with a portfolio worth $378,351. This gives the portfolio a strong dividend yield of over 7%.

Don’t Miss Out:

The investor was asked about his expectations of capital growth from his portfolio. Here was his response:

“I expect it to grow between 5-7% annually without reinvesting dividends. Yes, I am reinvesting dividends. With dividends reinvested, I expect it to grow 8-10% annually.”

Based on the screenshots shared by the investor publicly, let’s examine some of the biggest holdings of this high-yield dividend portfolio.

Vanguard 500 Index Fund Admiral Shares

Vanguard 500 Index Fund Admiral Shares (MUTF: VFIAX) was one of the Redditor’s biggest positions, earning $2,200 per month in dividends. His portfolio screenshots showed that VFIAX accounted for about 34.5% of the entire portfolio. This fund tracks the S&P 500 Index, with about 79% of the portfolio comprising large-cap stocks. The fund yields 1.3% and pays quarterly dividends.

Fidelity Total Bond K6 Fund

Fidelity Total Bond K6 Fund (FTKFX) invests in U.S. government securities, investment-grade corporate bonds, mortgage-backed securities and other debt instruments. The fund suits investors looking for safer, fixed-income investments rather than stocks. FTKFX has a dividend yield of about 4.5% and pays monthly. About 32% of the investor’s total portfolio making $2,200 per month was invested in FTKFX.

Trending: Commercial real estate has historically outperformed the stock market, and this platform allows individuals to invest in commercial real estate with as little as $5,000 offering a 12% target yield with a bonus 1% return boost today!.

Billionaires Are Buying This Cryptocurrency That Could Soar 200% Over the Next 12 Months, According to an Investment Firm

After trading down or sideways for much of the past seven months, Bitcoin (CRYPTO: BTC) may finally be ready for a major breakout. The investment firm Bernstein has just released a report detailing all the reasons it thinks Bitcoin could hit a new all-time high of $200,000 by the end of 2025.

Based on Bitcoin’s current price of about $68,000, that would represent nearly a 200% gain. As a result, billionaire investors appear to be rushing to buy the cryptocurrency right now. The most notable of these include hedge fund managers and tech entrepreneurs, and all seem to believe that Bitcoin is poised for a major rally after the 2024 presidential election. So, could they be right?

Michael Saylor, executive chairman of MicroStrategy (NASDAQ: MSTR), is arguably the most prominent of the billionaire bulls. At a Bitcoin conference in Nashville, Tennessee, this past summer, he predicted that the digital coin could hit a price of $13 million by the year 2045. And he continues to buy aggressively for MicroStrategy, to the point where the company now holds more than 1% of all Bitcoin in the world.

Other tech billionaires are also jumping into Bitcoin, including Mark Cuban and Jack Dorsey, head of Block. So are top Silicon Valley venture capitalists, some of whom are now getting involved in the 2024 presidential election. As a sign of their bullish outlook for crypto, Dorsey recently predicted that the crypto could hit a price of $1 million by 2030.

Lastly, there are the billionaire hedge fund managers who are loading up on the new spot Bitcoin exchange-traded funds (ETFs). Based on 13F data from the Securities and Exchange Commission, it’s possible to piece together which funds are buying it, as well as how much they own.

One of the biggest names to watch is Millennium Management, led by the billionaire Israel Englander, who loaded up on $2 billion worth of Bitcoin ETFs at the start of the year. All told, there are now more than 600 investment firms that have significant holdings of the Bitcoin ETFs.

Based on the above, it might be easy to conclude that these billionaires are primarily buying Bitcoin because they expect its price to increase significantly over the short run. In the crypto industry, this is known as “Number Go Up.” You buy Bitcoin because you hope that its price will go up, and you don’t worry about why.

But that is likely painting too simplistic a picture of billionaire buying activity. As part of its $200,000 price prediction for Bitcoin, Bernstein laid out a number of compelling reasons to buy it.

MDJM LTD Received Nasdaq Notification Letter Regarding Bid Price Deficiency

LETHAM, Scotland, Oct. 25, 2024 /PRNewswire/ — MDJM LTD MDJH (the “Company” or “MDJM”), an integrated global culture-driven asset management company, today announced that the Company received a letter (the “Notification Letter”) from the Listing Qualifications Department of the Nasdaq Stock Market LLC (“Nasdaq”) on October 23, 2024, notifying the Company that it is not in compliance with the minimum bid price requirement set forth in the Nasdaq Listing Rules for continued listing on the Nasdaq.

Nasdaq Listing Rule 5550(a)(2) requires listed securities to maintain a minimum bid price of US$1.00 per share, and Nasdaq Listing Rule 5810(c)(3)(A) provides that a failure to meet the minimum bid price requirement exists if the deficiency continues for a period of 30 consecutive business days. Based on the closing bid price of the Company’s ordinary shares for the 30 consecutive business days from September 11, 2024 to October 22, 2024, the Company no longer meets the minimum bid price requirement.

The Notification Letter does not impact the Company’s listing on the Nasdaq Capital Market at this time. In accordance with Nasdaq Listing Rule 5810(c)(3)(A), the Company has been provided 180 calendar days, or until April 21, 2025, to regain compliance with Nasdaq Listing Rule 5550(a)(2). If at any time during such 180-day period the closing bid price of the Company’s ordinary shares is at least $1.00 for a minimum of 10 consecutive business days, Nasdaq will provide the Company written confirmation of compliance.

If the Company does not regain compliance during such 180-day period, the Company may be eligible for an additional 180 calendar days, provided that the Company meets the continued listing requirement for market value of publicly held shares and all other initial listing standards for Nasdaq except for Nasdaq Listing Rule 5550(a)(2), and provides Nasdaq with a written notice of its intention to cure this deficiency during the second compliance period, by effecting a reverse stock split, if necessary.

About MDJM LTD

MDJM LTD is a global culture-driven asset management company focused on transforming historical properties into cultural hubs that blend modern digital technology with rich historical value. The Company is actively expanding its operations in the UK, where it is developing projects such as Fernie Castle in Scotland and the Robin Hill Property in England. These properties are being remodeled into multi-functional cultural venues that will feature fine dining, hospitality services, art exhibitions, and cultural exchange events. As part of its broader strategy, MDJM is positioning itself as a hub for artisan exchanges, art shows, and sales, leveraging its historical properties as platforms for promoting Eastern and Western cultural exchanges. This initiative reflects the Company’s commitment to furthering its global market expansion and enhancing its cultural business footprint. For more information regarding the Company, please visit http://ir.mdjmjh.com.

Forward-Looking Statements

This announcement may contain forward-looking statements. All statements other than statements of historical fact in this announcement are forward-looking statements. These forward-looking statements involve known and unknown risks and uncertainties and are based on current expectations and projections about future events and financial trends that the Company believes may affect its financial condition, results of operations, business strategy, and financial needs. Investors can identify these forward-looking statements by words or phrases such as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “potential,” “continue,” “is/are likely to” or other similar expressions. The Company undertakes no obligation to update forward-looking statements to reflect subsequent occurring events or circumstances, or changes in its expectations, except as may be required by law. Although the Company believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that such expectations will turn out to be correct, and the Company cautions investors that actual results may differ materially from the anticipated results and encourages investors to review other factors that may affect its future results in the Company’s annual report on Form 20-F and its other filings with the U.S. Securities and Exchange Commission.

Investor Contact:

Sherry Zheng

Weitian Group LLC

Email: shunyu.zheng@weitian-ir.com

Phone: +1 718-213-7386

![]() View original content:https://www.prnewswire.com/news-releases/mdjm-ltd-received-nasdaq-notification-letter-regarding-bid-price-deficiency-302287548.html

View original content:https://www.prnewswire.com/news-releases/mdjm-ltd-received-nasdaq-notification-letter-regarding-bid-price-deficiency-302287548.html

SOURCE MDJM LTD

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Canfor Pulp reports results for the third quarter of 2024

VANCOUVER, BC, Oct. 25, 2024 /CNW/ – Canfor Pulp Products Inc. (“The Company” or “CPPI”) CFX today reported its third quarter of 2024 results:

Overview.

- Q3 2024 operating loss of $209 million, includes a $211 million asset write-down and impairment charge in the pulp segment resulting from further deterioration in economic fibre availability following recent British Columbia Interior sawmill closure announcements.

- After taking into consideration one-time items, Q3 2024 operating income of $2 million compared to similarly adjusted operating loss of $6 million in Q2 2024.

- Modest improvement in NBSK pulp unit sales realizations driven by steady North American pulp pricing through most of the third quarter and favourable timing lag in shipments, despite weak demand in China and notable increase in pulp producer inventory levels.

- Orderly wind down of one production line at Northwood NBSK pulp mill completed in August.

Financial results.

The following table summarizes select financial information for CPPI for the comparative periods:

|

(millions of Canadian dollars, except per share amounts) |

Q3 2024 |

Q2 2024 |

YTD 2024 |

Q3 2023 |

YTD 2023 |

||||||||

|

Sales |

$ |

193.2 |

$ |

220.0 |

$ |

635.5 |

$ |

188.8 |

$ |

681.6 |

|||

|

Reported operating income (loss) before amortization, asset write-down and impairment |

$ |

18.8 |

$ |

11.0 |

$ |

31.0 |

$ |

(27.7) |

$ |

(43.6) |

|||

|

Reported operating loss |

$ |

(209.3) |

$ |

(5.6) |

$ |

(230.6) |

$ |

(49.3) |

$ |

(112.4) |

|||

|

Adjusted operating income (loss) before amortization, asset write-down and impairment1 |

$ |

18.8 |

$ |

11.0 |

$ |

31.0 |

$ |

(29.7) |

$ |

(35.1) |

|||

|

Adjusted operating income (loss)1 |

$ |

1.7 |

$ |

(5.6) |

$ |

(19.6) |

$ |

(51.3) |

$ |

(103.9) |

|||

|

Net loss |

$ |

(156.1) |

$ |

(6.3) |

$ |

(164.8) |

$ |

(35.7) |

$ |

(82.9) |

|||

|

Net loss per share, basic and diluted |

$ |

(2.39) |

$ |

(0.10) |

$ |

(2.53) |

$ |

(0.55) |

$ |

(1.27) |

|||

|

Adjusted net loss1 |

$ |

(2.1) |

$ |

(6.3) |

$ |

(10.8) |

$ |

(35.7) |

$ |

(82.9) |

|||

|

Adjusted net loss per share, basic and diluted1 |

$ |

(0.03) |

$ |

(0.10) |

$ |

(0.17) |

$ |

(0.55) |

$ |

(1.27) |

|||

|

1. Adjusted results referenced throughout this news release are defined as non-IFRS financial measures. For further details, refer to the “Non-IFRS financial measures” section of this document. |

For the third quarter of 2024, the Company reported an operating loss of $209.3 million, including an asset write-down and impairment charge totaling $211.0 million within its pulp segment.

In recent years, the Company, like other pulp producers in central and northern British Columbia (“BC”), has experienced a significant reduction in the supply of sawmill residual chips driven by extensive temporary and permanent sawmill curtailments and closures in the region. In response to these fibre constraints, the Company has taken several actions including securing additional fibre supply, prioritizing discretionary capital spending to maximize fibre utilization and recovery, as well as making rationalization decisions with respect to the Company’s operating footprint. Notably, the Company permanently closed the pulp line at its Prince George pulp and paper mill in early 2023, and more recently, completed the wind down of one production line at the Company’s Northwood Northern Bleached Softwood Kraft (“NBSK”) pulp mill (“Northwood”) in August. Collectively, these curtailments reduce the Company’s annual market kraft pulp production by approximately 580,000 tonnes.

During the third quarter of 2024, these fibre challenges were further exacerbated by additional sawmill closure announcements in the BC Interior, which were in response to weak lumber market conditions, upcoming increases in US tariffs on lumber exports and various regulatory complexities. As a result, the reduction in fibre supply as well as the ongoing uncertainty surrounding economic fibre availability continue to impact the Company and consequently, an asset write-down and impairment charge of $211.0 million was recognized in the third quarter of 2024, as a reduction to the carrying value of the Company’s pulp segment assets.

After adjusting for the asset write-down and impairment charge, the Company’s operating income for the third quarter of 2024 was $1.7 million, a $7.3 million improvement compared to the second quarter of 2024. Despite some moderation in US-dollar pulp list prices to China during the current quarter, the Company’s results largely reflected modestly higher NBSK pulp unit sales realizations, offset in part by reduced pulp production and shipment volumes in the period following the successful wind down of one production line at Northwood in August 2024.

Commenting on the Company’s third quarter of 2024 results, CPPI’s President and Chief Executive Officer, Kevin Edgson, said, “The Company continues to face persistent challenges accessing economic fibre, the results of which led to another curtailment of our operations this quarter. These decisions weigh heavily on our results, as well as our employees, their families and the local communities. Despite these challenges, our business realized improved adjusted operating earnings this quarter, and we executed a safe, smooth and efficient wind down of one line at Northwood.”

Third quarter highlights.

Global softwood pulp market fundamentals experienced downward pressure throughout the third quarter of 2024 primarily driven by weak demand from China, as well as the introduction of additional global hardwood capacity. These factors, when combined with the traditional seasonal summer slowdown in global demand, led to a moderation in purchasing activity and prices during the current period. As a result, NBSK US-dollar pulp list prices to China, the world’s largest consumer of pulp, declined in the quarter to a low of US$750 per tonne in August, before stabilizing through the balance of the period, ending September at US$754 per tonne. For the current quarter overall, US-dollar NBSK pulp list prices to China averaged US$771 per tonne, down US$40 per tonne, or 5%, from the prior quarter. Other global regions, including North America, experienced a delayed impact on price moderation, as prices remained steady for most of the third quarter, with slight declines seen towards the end of the period. As a result of these market conditions, particularly in China, global softwood pulp producer inventories experienced a notable increase in the current period to well above the balanced range, ending August at 50 days of supply, an increase of 12 days compared to June 2024.

Pulp production was 125,000 tonnes for the third quarter of 2024, down 5,000 tonnes, or 4%, from the second quarter of 2024, principally reflecting the wind down of one pulp line at the Company’s Northwood pulp mill, which was completed safely and efficiently in August 2024 (approximately 50,000 tonnes).

The Company’s paper segment experienced an operating loss of $0.8 million in the current quarter, compared to operating income of $1.9 million in the previous quarter. This decline was largely driven by reduced paper production and shipments in the current period, primarily as a result of minor mechanical failures at the paper machine.

Outlook.

Looking forward, global softwood pulp market conditions are anticipated to experience a slight improvement through the fourth quarter of 2024, as demand from the Chinese market is forecast to gradually recover and as elevated inventory levels slowly begin to normalize following the end of the seasonally slower summer months.

Results in the fourth quarter of 2024 will reflect the full wind down of one production line at the Company’s Northwood pulp mill, including the impact on pulp production (a reduction of approximately 300,000 tonnes of market kraft pulp annually), shipments and costs. Looking forward, the Company remains focused on optimizing its operating footprint, enhancing operational reliability and closely managing manufacturing and fibre costs.

In addition, the Company will continue to evaluate operating conditions and adjust operating rates at its pulp mills to align with economically viable fibre supply. These factors could also affect the Company’s operating plan, liquidity, cash flows and the valuation of long-lived assets.

Demand for bleached kraft paper is projected to weaken somewhat through the fourth quarter of 2024 with a modest slowdown in kraft paper demand anticipated.

No major maintenance outages are planned for the fourth quarter of 2024.

Additional information and conference call.

A conference call to discuss the third quarter’s financial and operating results will be held on Monday, October 28, 2024, at 8:00 AM Pacific time. To participate in the call, please dial Toll-Free 1-888-510-2154. For instant replay access until November 11, 2024, please dial Toll-Free 1-888-660-6345 and enter participant pass code 89443#.

The conference call will be webcast live and will be available at www.canfor.com. This news release, the attached financial statements and a presentation used during the conference call can be accessed via the Company’s website at www.canfor.com/investor-relations/webcasts.

Non-IFRS financial measures.

Throughout this press release, reference is made to certain non-IFRS financial measures which are used to evaluate the Company’s performance but are not generally accepted under IFRS and may not be directly comparable with similarly titled measures used by other companies. The following table provides a reconciliation of these non-IFRS financial measures to figures reported in the Company’s condensed consolidated interim financial statements:

|

(millions of Canadian dollars) |

Q3 2024 |

Q2 2024 |

YTD 2024 |

Q3 2023 |

YTD 2023 |

|||||||

|

Reported operating loss |

$ |

(209.3) |

$ |

(5.6) |

$ |

(230.6) |

$ |

(49.3) |

$ |

(112.4) |

||

|

Asset write-down and impairment |

$ |

211.0 |

$ |

– |

$ |

211.0 |

$ |

– |

$ |

– |

||

|

Inventory write-down (recovery) |

$ |

– |

$ |

– |

$ |

– |

$ |

(2.0) |

$ |

8.5 |

||

|

Adjusted operating income (loss) |

$ |

1.7 |

$ |

(5.6) |

$ |

(19.6) |

$ |

(51.3) |

$ |

(103.9) |

||

|

Amortization |

$ |

17.1 |

$ |

16.6 |

$ |

50.6 |

$ |

21.6 |

$ |

68.8 |

||

|

Adjusted operating income (loss) before amortization, asset write-down |

$ |

18.8 |

$ |

11.0 |

$ |

31.0 |

$ |

(29.7) |

$ |

(35.1) |

||

|

(millions of Canadian dollars) |

Q3 2024 |

Q2 2024 |

YTD 2024 |

Q3 2023 |

YTD 2023 |

||||||

|

Net loss |

$ |

(156.1) |

$ |

(6.3) |

$ |

(164.8) |

$ |

(35.7) |

$ |

(82.9) |

|

|

Asset write-down and impairment, net of tax |

$ |

154.0 |

$ |

– |

$ |

154.0 |

$ |

– |

$ |

– |

|

|

Adjusted net loss |

$ |

(2.1) |

$ |

(6.3) |

$ |

(10.8) |

$ |

(35.7) |

$ |

(82.9) |

|

Forward-looking statements.

Certain statements in this press release constitute “forward-looking statements” which involve known and unknown risks, uncertainties and other factors that may cause actual results to be materially different from any future results, performance or achievements expressed or implied by such statements. Words such as “expects”, “anticipates”, “projects”, “intends”, “plans”, “will”, “believes”, “seeks”, “estimates”, “should”, “may”, “could”, and variations of such words and similar expressions are intended to identify such forward-looking statements. These statements are based on Management’s current expectations and beliefs and actual events or results may differ materially. There are many factors that could cause such actual events or results expressed or implied by such forward-looking statements to differ materially from any future results expressed or implied by such statements. Forward-looking statements are based on current expectations and Canfor assumes no obligation to update such information to reflect later events or developments, except as required by law.

About Canfor Pulp Products Inc.

Canfor Pulp Products Inc. (“Canfor Pulp” or “CPPI”) is a leading global supplier of pulp and paper products with operations in the northern interior of British Columbia (“BC”). Canfor Pulp operates two mills in Prince George, BC with a total capacity of 780,000 tonnes of Premium Reinforcing Northern Bleached Softwood Kraft (“NBSK”) pulp and 140,000 tonnes of kraft paper. CPPI shares are traded on the Toronto Stock Exchange under the symbol CFX. For more information visit canfor.com.

SOURCE Canfor Pulp Products Inc.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2024/25/c9231.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2024/25/c9231.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

First Solar's Options: A Look at What the Big Money is Thinking

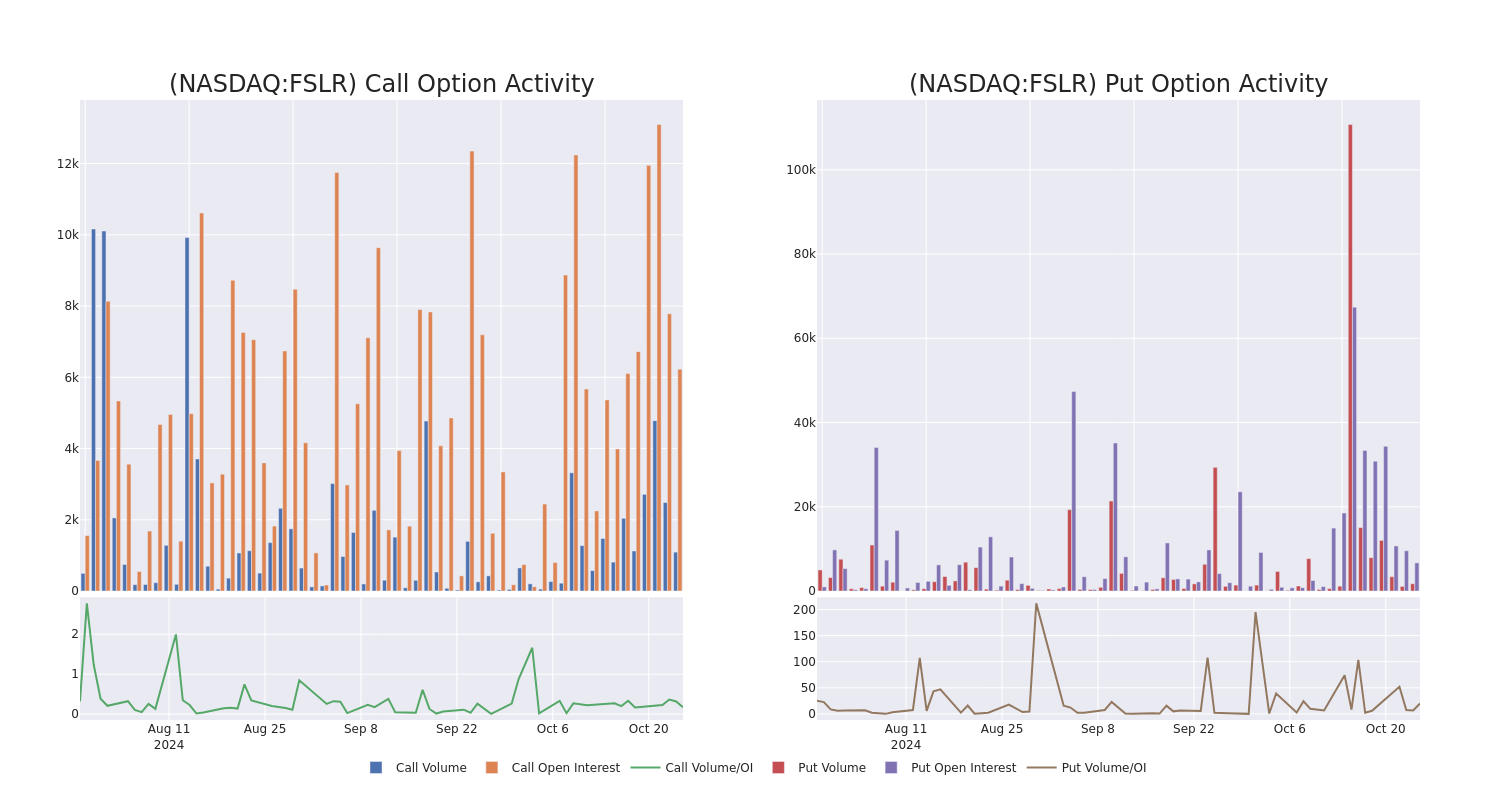

Financial giants have made a conspicuous bearish move on First Solar. Our analysis of options history for First Solar FSLR revealed 21 unusual trades.

Delving into the details, we found 38% of traders were bullish, while 57% showed bearish tendencies. Out of all the trades we spotted, 8 were puts, with a value of $2,392,752, and 13 were calls, valued at $1,524,988.

What’s The Price Target?

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $105.0 and $240.0 for First Solar, spanning the last three months.

Analyzing Volume & Open Interest

In terms of liquidity and interest, the mean open interest for First Solar options trades today is 717.67 with a total volume of 2,830.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for First Solar’s big money trades within a strike price range of $105.0 to $240.0 over the last 30 days.

First Solar Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| FSLR | PUT | SWEEP | BULLISH | 01/17/25 | $12.15 | $11.65 | $11.9 | $175.00 | $1.4M | 2.9K | 800 |

| FSLR | CALL | TRADE | BEARISH | 12/20/24 | $14.3 | $14.0 | $14.0 | $220.00 | $910.0K | 511 | 656 |

| FSLR | PUT | TRADE | BULLISH | 01/17/25 | $12.25 | $11.9 | $11.9 | $175.00 | $476.0K | 2.9K | 400 |

| FSLR | PUT | TRADE | BEARISH | 11/01/24 | $10.8 | $9.95 | $10.8 | $200.00 | $162.0K | 503 | 0 |

| FSLR | PUT | SWEEP | BULLISH | 06/20/25 | $8.45 | $8.3 | $8.3 | $135.00 | $146.0K | 861 | 177 |

About First Solar

First Solar designs and manufactures solar photovoltaic panels, modules, and systems for use in utility-scale development projects. The company’s solar modules use cadmium telluride to convert sunlight into electricity. This is commonly called thin-film technology. First Solar is the world’s largest thin-film solar module manufacturer. It has production lines in Vietnam, Malaysia, the United States, and India.

In light of the recent options history for First Solar, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

First Solar’s Current Market Status

- Currently trading with a volume of 1,866,540, the FSLR’s price is up by 1.25%, now at $198.5.

- RSI readings suggest the stock is currently may be oversold.

- Anticipated earnings release is in 4 days.

Professional Analyst Ratings for First Solar

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $284.2.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Roth MKM has decided to maintain their Buy rating on First Solar, which currently sits at a price target of $280.

* Showing optimism, an analyst from Citigroup upgrades its rating to Buy with a revised price target of $254.

* Consistent in their evaluation, an analyst from Jefferies keeps a Buy rating on First Solar with a target price of $266.

* Reflecting concerns, an analyst from Truist Securities lowers its rating to Buy with a new price target of $300.

* Consistent in their evaluation, an analyst from B of A Securities keeps a Buy rating on First Solar with a target price of $321.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest First Solar options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Should You Buy Nvidia Before Nov. 20? Here's What History Says.

Nvidia (NASDAQ: NVDA) has established itself as a successful investment over time, climbing more than 2,700% over the past five years. And momentum has strengthened as this top chip designer reported quarter after quarter of triple-digit earnings growth. This is thanks to the dominance Nvidia has built in the artificial intelligence (AI) chip market, with the company now holding about 80% share.

And Nvidia isn’t only winning in AI chips but in the entire AI market, which is forecast to grow from $200 billion today to $1 trillion by the end of the decade. This is because Nvidia offers a wide variety of products and services to suit any company developing an AI platform. Speaking on a BG2 podcast earlier this month, CEO Jensen Huang referred to the company as the “on ramp” to the AI world.

Next up for Nvidia is the company’s third-quarter earnings report, scheduled for Nov. 20. Investors will focus on earnings figures, the ability of Nvidia to meet its gross margin goal, and comments about an important upcoming product launch. Should you buy Nvidia stock before this key report? Let’s take a look at what history has to say.

First, let’s consider what investors are expecting from the tech giant. Nvidia has forecast double-digit revenue growth, slower than the recent triple-digit growth. But it’s important to keep in mind that comparison quarters are getting tougher, with Nvidia’s last third quarter already bringing in more revenue than the company made in an entire year just a few years ago — back in fiscal 2021. So double-digit growth should still be considered extremely strong performance at this stage of the Nvidia story.

The company, which last quarter reported gross margin of 75%, aims to maintain the greater than 70% margin level. It’s forecast gross margin in the mid-70% range for the third quarter and the full year. This level of profitability along with double-digit revenue growth should reinforce investors’ confidence in this top tech player.

Finally, investors will be looking for comments about the upcoming launch of Nvidia’s Blackwell architecture and best-performing chip ever. So far, so good — with Nvidia’s Huang saying on the latest earnings call that demand surpassed supply and that should continue into next year.

Now, let’s consider how Nvidia’s stock may react to the Nov. 20 earnings report. And one way to do that is to look at historical trends for Nvidia following these reports. Looking back at the past eight quarters, Nvidia stock rose on six of those occasions in the one-month period following the report. And four of those times, the stock posted double-digit gains.

‘Load Up,’ Says J.P. Morgan About These 3 Nuclear Power Stocks

After five years of closure, the Three Mile Island nuclear power plant is set to reopen. Known for the infamous 1979 partial meltdown that cemented its place in the annals of anti-nuclear activism, the plant is now being revived due to a shift in economic and energy trends.

At the core of the nuclear industry’s resurgence is the rising demand for electricity. The rapid expansion of power-hungry AI-driven data centers, combined with government initiatives promoting a transition from fossil fuels to electric power, has made it essential to boost electricity generation – and nuclear energy is once again becoming a key player in this landscape.

Watching the electric utility stocks for J.P. Morgan, analyst Jeremy Tonet writes of the sector’s growing shift toward nuclear, “We see structural tailwinds, including manufacturing onshoring, broader electrification trends (transportation, heating, and more), as well data center development underpinning a paradigm shift in power demand. We do not see competitive market supply growth matching this demand, enabling IPPs to capture outsized margins for an extended period of time,” Tonet explained. “More specifically, we see burgeoning hyperscaler demand growth focused on firm, carbon-free power, transforming nuclear power into a unique, scarce offering that will command a substantial premium.”

Following from this, Tonet goes on to recommend three nuclear power stocks for investors to buy – now, as the industry is beginning to power up. According to the data from TipRanks, these are all Buy-rated equities that have seen recent strong share appreciation – yet Tonet sees more upside ahead. Here are the details.

We’ll start with Talen Energy, a major independent power and infrastructure company on the North American scene. Talen was founded in 2015, and in its near-decade of business, which has already included bankruptcy in 2022 and restructuring the following year, has expanded to reach a market cap of $9 billion. The company focuses on delivering power generation that is both safe and reliable, providing investors with the most value for every megawatt of energy produced.

Talen’s power generation portfolio includes all of the major assets behind the U.S. electric grid: natural gas, coal, oil, and nuclear. The firm’s operations are built around its Susquehanna nuclear power plant, the nation’s sixth-largest operating nuclear power facility. Talen’s total portfolio has operations in five states—Maryland, Pennsylvania, New Jersey, Massachusetts, and Montana—and has a total of 10.7 gigawatts of power generation. Of that total, 2.2 gigawatts, or more than 20%, comes from the Susquehanna plant.

Canfor reports results for the third quarter of 2024

VANCOUVER, BC, Oct. 25, 2024 /CNW/ – Canfor Corporation (“The Company” or “Canfor”) CFP today reported its third quarter of 2024 results:

Overview.

- Q3 2024 operating loss of $560 million, including a $311 million asset write-down and impairment charge as well as other one-time items1; shareholder net loss of $350 million, or $2.96 per share.

- After taking into consideration adjusting and one-time items1, Q3 2024 operating loss of $139 million, compared to a similarly adjusted operating loss of $135 million in Q2 2024.

- Persistent pressure on North American lumber markets and pricing, especially in US South; positive results from Alberta and Europe.

- Ongoing North American lumber market weakness, high duties and persistent challenges accessing economic fibre led to the announcement of sawmill closures in British Columbia and, as a result, an asset write-down and impairment charge of $100 million in the lumber segment.

- Proceeds of $314 million received in relation to duty deposits loan agreement.

- Modest improvement in NBSK pulp unit sales realizations driven by steady North American pulp pricing through most of the third quarter and favourable timing lag in shipments, despite weak demand in China; fibre-driven asset write-down and impairment charge of $211 million in the pulp segment.

Financial results.

The following table summarizes select financial information for the Company for the comparative periods:

|

(millions of Canadian dollars, except per share amounts) |

Q3 2024 |

Q2 2024 |

YTD 2024 |

Q3 2023 |

YTD 2023 |

|||||||||||

|

Sales |

$ |

1,202.9 |

$ |

1,381.5 |

$ |

3,967.1 |

$ |

1,312.3 |

$ |

4,143.7 |

||||||

|

Reported operating income (loss) before amortization, asset write-downs and impairments |

$ |

(144.4) |

$ |

(98.3) |

$ |

(222.9) |

$ |

42.6 |

$ |

(22.1) |

||||||

|

Reported operating loss |

$ |

(559.7) |

$ |

(250.8) |

$ |

(896.3) |

$ |

(65.1) |

$ |

(340.3) |

||||||

|

Net loss2 |

$ |

(350.1) |

$ |

(191.1) |

$ |

(605.7) |

$ |

(23.1) |

$ |

(209.0) |

||||||

|

Net loss per share, basic and diluted2 |

$ |

(2.96) |

$ |

(1.61) |

$ |

(5.11) |

$ |

(0.19) |

$ |

(1.74) |

||||||

|

1. Adjusted operating loss as well as adjusting and one-time items referenced throughout this news release are defined as non-IFRS financial measures. For further details, refer to the table on page 2 of the news release and the “Non-IFRS financial measures” section of the news release. 2. Attributable to equity shareholders of the Company. |

|||||||||||||||||

For the third quarter of 2024, the Company reported an operating loss of $559.7 million, compared to an operating loss of $250.8 million in the second quarter of 2024.

During the current period, the Company’s British Columbia (“BC”) operations continued to encounter operational challenges, including limited access to economic fibre, weak lumber market conditions, rising operating costs, increased export tariffs to the United States (“US”), as well as various regulatory complexities. After a thorough review of these operational constraints, the Company made the difficult decision to permanently close its Plateau and Fort St. John operations located in northern BC, following an orderly wind down in the fourth quarter of 2024. In connection with these closures, in the third quarter of 2024 the Company recognized an asset write-down and impairment charge of $100.3 million to reduce the carrying value of its lumber segment assets, as well as $38.6 million in restructuring costs.

Recognizing the impact of these recent closures, along with the fibre effects of previously announced reductions and curtailments across the industry in the BC Interior, Canfor Pulp Products Inc. (“CPPI”) recorded an asset write-down and impairment charge of $211.0 million in the same period, as a reduction to the carrying value of its pulp segment assets.

Commenting on the Company’s third quarter results, Canfor’s President and Chief Executive Officer, Don Kayne, said, “This was another extremely challenging quarter for our lumber business. While Alberta and Europe delivered positive results, our North American operations continued to face a persistently weak pricing environment. In BC, this depressed pricing was exacerbated by a complex operating environment, high costs, rising US tariffs and ongoing difficulties in reliably accessing sufficient economic fibre. These conditions have resulted in unsustainable financial losses from our BC operations. As a result, we made the very difficult decision to close both our Plateau and Fort St. John operations in northern BC by the end of 2024. We sincerely regret the impact these decisions have on our employees, their families, contractors, and the businesses that support our operations and the local community.”

“For our pulp business,” added Kayne, “we also continue to face persistent fibre-related constraints, however, during the current quarter, our business had improved adjusted operating results, benefiting from an uplift in pulp unit sales realizations.”

Third quarter adjusting and one-time items.

After taking account of the aforementioned asset write-down and impairment charges as well as other one-time items, combined totaling $420.8 million, as outlined in the table below, the Company’s operating loss for the third quarter of 2024 was $138.9 million, compared to a similarly adjusted operating loss of $135.2 million in the prior quarter. These results primarily reflected lower lumber segment results, partly offset by improved pulp and paper segment earnings.

|

(millions of Canadian dollars) |

Q3 2024 |

Q2 2024 |

YTD 2024 |

Q3 2023 |

YTD 2023 |

|||||||

|

Reported operating loss |

$ |

(559.7) |

$ |

(250.8) |

$ |

(896.3) |

$ |

(65.1) |

$ |

(340.3) |

||

|

Asset write-down and impairment – lumber segment |

$ |

100.3 |

$ |

31.6 |

$ |

131.9 |

$ |

– |

$ |

– |

||

|

Asset write-down and impairment – pulp segment |

$ |

211.0 |

$ |

– |

$ |

211.0 |

$ |

– |

$ |

– |

||

|

Inventory write-down (recovery), net4 |

$ |

(14.8) |

$ |

51.4 |

$ |

6.4 |

$ |

(20.8) |

$ |

(16.1) |

||

|

Adjusted operating loss3 |

$ |

(263.2) |

$ |

(167.8) |

$ |

(547.0) |

$ |

(85.9) |

$ |

(356.4) |

||

|

One-time items – lumber segment3: |

||||||||||||

|

Restructuring and closure costs5 |

$ |

36.5 |

$ |

32.6 |

$ |

69.1 |

$ |

1.1 |

$ |

12.2 |

||

|

Gain on sale of assets, net6 |

$ |

(34.9) |

$ |

– |

$ |

(34.9) |

$ |

– |

$ |

– |

||

|

Duty expense (recovery) related to finalized rates7 |

$ |

67.2 |

$ |

– |

$ |

67.2 |

$ |

(43.3) |

$ |

(43.3) |

||

|

Duty expense related to fair value measurement8 |

$ |

53.4 |

$ |

– |

$ |

53.4 |

$ |

– |

$ |

– |

||

|

One-time items – corporate restructuring costs3,5 |

$ |

2.1 |

$ |

– |

$ |

2.1 |

$ |

– |

$ |

– |

||

|

Adjusted operating loss before one-time items3 |

$ |

(138.9) |

$ |

(135.2) |

$ |

(390.1) |

$ |

(128.1) |

$ |

(387.5) |

||

|

Amortization |

$ |

104.0 |

$ |

120.9 |

$ |

330.5 |

$ |

107.7 |

$ |

318.2 |

||

|

Adjusted operating loss before amortization and one-time items3 |

$ |

(34.9) |

$ |

(14.3) |

$ |

(59.6) |

$ |

(20.4) |

$ |

(69.3) |

||

|

3. Adjusted operating loss as well as adjusting and one-time items referenced throughout this news release are defined as non-IFRS financial measures. For further details, refer to the “Non-IFRS financial measures” section of this news release. |

|

4. For the lumber segment, a $14.8 million net reversal of a previously recognized inventory write-down was recorded in Q3 2024 (Q2 2024 – $51.4 million net inventory write-down expense, Q3 2023 – $18.8 million net reversal of a previously recognized inventory write-down). For the pulp and paper segment, no inventory valuation adjustment was recognized in Q3 2024 and Q2 2024 (Q3 2023 – $2.0 million net reversal of a previously recognized inventory write-down). |

|

5. Restructuring and closure costs of $38.6 million ($36.5 million in the lumber segment and $2.1 million in the unallocated segment), largely comprised of severance, were recognized in Q3 2024 related to the permanent closures of Plateau and Fort St. John (Q2 2024 – restructuring and closure costs of $32.6 million related to Polar and Houston; Q3 2023 – restructuring and closure costs of $1.1 million related to Houston). |

|

6. On September 9, 2024, the Company completed the sale of its remaining Mackenzie sawmill assets and associated forest tenure to the McLeod Lake Indian Band and Tsay Keh Dene Nation for total proceeds of $66.5 million. As a result of this transaction, as well as other asset sales in the current period, a net gain on sale of $34.9 million was recognized in Q3 2024. |

|

7. A duty expense of $67.2 million (US$48.6 million) was recognized in Q3 2024 following the finalization of countervailing (“CVD”) and anti-dumping duty (“ADD”) rates applicable to the fifth period of review (“POR5”) (Q3 2023 – a net duty recovery of $43.3 million related to final rates for the fourth period of review (“POR4”)). |

|

8. In Q3 2024, the Company refined its estimate of the fair value measurement of net duty deposits recoverable. In accordance with IFRS Accounting Standards, this change in accounting estimate was applied on a prospective basis. |

Third quarter lumber segment highlights.

For the lumber segment, the operating loss was $336.2 million for the third quarter of 2024, compared to the previous quarter’s operating loss of $230.5 million. After taking account of adjustments and other one-time items totaling $207.7 million for the lumber segment in the current period, as noted in the table above, the operating loss was $128.5 million, compared to a similarly adjusted operating loss of $114.9 million in the prior quarter.

These results reflected the ongoing weakness in North American lumber markets and pricing in the current quarter, particularly in the US South. These conditions were accompanied by lower lumber production and shipment volumes, driven by continued curtailments in BC, a full quarter impact of the April 2024 closure of Polar, as well as market and capital project related downtime in the US South. Although earnings from Europe were positive in the quarter, overall results reflected the Company’s regular summer downtime.

Despite modestly improving fundamentals, North American lumber markets remained under pressure during the third quarter of 2024. Affordability constraints continued to impact both the repair and remodeling and housing sectors, leading to a decline in US residential construction activity in the current quarter. While some supply pressures in the region resulted in pricing improvements towards the end of the third quarter, weakened demand ultimately contributed to an overall decline in certain North American benchmark prices compared to the previous quarter.

Offshore lumber demand and pricing in Asia remained relatively stable during the third quarter of 2024. In China, the real estate market continued to face challenges despite the government’s ongoing efforts to rejuvenate the economy. However, a slight reduction in inventories in the region contributed to small price increases in the current quarter. In Japan, rising demand in the multi-family rental housing market helped to offset declines in the single-family sector, leading to relatively flat pricing quarter-over-quarter.

In Europe, the ongoing impact of low levels of residential and commercial construction throughout the current quarter was coupled with weakness in the do-it-yourself sector, resulting in continued pricing pressure in the region.

Lumber segment outlook.

Looking ahead, demand in the North American lumber market is anticipated to remain under pressure for the balance of 2024. Residential housing and do-it-yourself activity are likely to continue to be constrained largely due to ongoing affordability concerns despite some initial relief provided by lower interest rates. On the supply side, however, the gradual effects of industry-wide sawmill curtailments and closures, coupled with the decline in European imports into the North American market, have resulted in some modest pricing improvements early in the fourth quarter. This slow improvement is projected to continue through the balance of the year.

Offshore lumber demand and pricing in China is forecast to remain under pressure in the fourth quarter of 2024 predominately due to persistent challenges in the real estate market. In contrast, Japan’s multi-family rental and non-residential markets are anticipated to continue to strengthen and result in some modest upward pricing trends for the rest of the year.

European lumber pricing and demand are projected to remain relatively flat through the fourth quarter of 2024. Increased inventory levels in the United Kingdom are forecast to lead to some pricing declines in the near-term; however, this reduction is anticipated to be offset by overall supply constraints in other European regions.

In BC, despite the Company’s recent announced changes with regards to its operating footprint, it is anticipated that this region will continue to face challenging operating conditions especially with respect to the availability of economically viable fibre and high duties on lumber shipments to the US.

Third quarter pulp and paper segment highlights.

For the pulp and paper segment, the operating loss was $209.3 million, including an asset write-down and impairment charge totaling $211.0 million for the third quarter of 2024. After adjusting for the asset write-down and impairment charge, CPPI’s operating income for the third quarter of 2024 was $1.7 million, a $7.3 million improvement compared to the second quarter of 2024.

Despite some moderation in US-dollar pulp list prices to China during the current quarter, these results largely reflected modestly higher Northern Bleached Softwood Kraft (“NBSK”) pulp unit sales realizations, offset in part by reduced pulp production and shipment volumes in the period following the successful wind down of one production line at Northwood NBSK pulp mill (“Northwood”) in August 2024.

Global softwood pulp market fundamentals experienced downward pressure throughout the third quarter of 2024 primarily driven by weak demand from China, as well as the introduction of additional global hardwood capacity. These factors, when combined with the traditional seasonal summer slowdown in global demand, led to a moderation in purchasing activity and prices during the current period. As a result, NBSK US-dollar pulp list prices to China, the world’s largest consumer of pulp, declined in the quarter to a low of US$750 per tonne in August, before stabilizing through the balance of the period, ending September at US$754 per tonne. For the current quarter overall, US-dollar NBSK pulp list prices to China averaged US$771 per tonne, down US$40 per tonne, or 5%, from the prior quarter. Other global regions, including North America, experienced a delayed impact on price moderation, as prices remained steady for most of the third quarter, with slight declines seen towards the end of the period. As a result of these market conditions, particularly in China, global softwood pulp producer inventories experienced a notable increase in the current period to well above the balanced range, ending August at 50 days of supply, an increase of 12 days compared to June 2024.

Pulp and paper segment outlook.

Looking forward, global softwood pulp market conditions are anticipated to experience a slight improvement through the fourth quarter of 2024, as demand from the Chinese market is forecast to gradually recover and as elevated inventory levels slowly begin to normalize following the end of the seasonally slower summer months.

Results in the fourth quarter of 2024 will reflect the full wind down of one production line at Northwood, including the impact on pulp production (a reduction of approximately 300,000 tonnes of market kraft pulp annually), shipments and costs. Looking forward, CPPI remains focused on optimizing its operating footprint, enhancing operational reliability and closely managing manufacturing and fibre costs.

In addition, CPPI will continue to evaluate operating conditions and adjust operating rates at its pulp mills to align with economically viable fibre supply. These factors could also affect CPPI’s operating plan, liquidity, cash flows and the valuation of long-lived assets.

Additional information and conference call.

A conference call to discuss the third quarter’s financial and operating results will be held on Monday, October 28, 2024, at 8:00 AM Pacific time. To participate in the call, please dial Toll-Free 1-888-510-2154. For instant replay access until November 11, 2024, please dial Toll-Free 1-888-660-6345 and enter participant pass code 89443#.

The conference call will be webcast live and will be available at www.canfor.com. This news release, the attached financial statements and a presentation used during the conference call can be accessed via the Company’s website at www.canfor.com/investor-relations/webcasts.

Non-IFRS financial measures.

Throughout this press release, reference is made to certain non-IFRS financial measures which are used to evaluate the Company’s performance but are not generally accepted under IFRS Accounting Standards and may not be directly comparable with similarly titled measures used by other companies.

Forward-looking statements.

Certain statements in this press release constitute “forward-looking statements” which involve known and unknown risks, uncertainties and other factors that may cause actual results to be materially different from any future results, performance or achievements expressed or implied by such statements. Words such as “expects”, “anticipates”, “projects”, “intends”, “plans”, “will”, “believes”, “seeks”, “estimates”, “should”, “may”, “could”, and variations of such words and similar expressions are intended to identify such forward-looking statements. These statements are based on Management’s current expectations and beliefs and actual events or results may differ materially. There are many factors that could cause such actual events or results expressed or implied by such forward-looking statements to differ materially from any future results expressed or implied by such statements. Forward-looking statements are based on current expectations and Canfor assumes no obligation to update such information to reflect later events or developments, except as required by law.

About Canfor Corporation.

Canfor is a global leader in the manufacturing of high-value low-carbon forest products including dimension and specialty lumber, engineered wood products, pulp and paper, wood pellets and green energy. Proudly headquartered in Vancouver, British Columbia, Canfor produces renewable products from sustainably managed forests, at more than 50 facilities across its diversified operating platform in Canada, the United States and Europe. The Company has a 70% stake in Vida AB, Sweden’s largest privately owned sawmill company and also owns a 54.8% interest in Canfor Pulp Products Inc. Canfor shares are traded on the Toronto Stock Exchange under the symbol CFP. For more information visit canfor.com.

SOURCE Canfor Corporation

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2024/25/c0645.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2024/25/c0645.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Billionaires Have Been Buying These 3 Top Artificial Intelligence (AI) Stocks. Should You Follow Suit?

Investors looking for investment ideas often turn to billionaires’ investment ideas. This can make sense, as one often gets to billionaire status by making wise investing decisions.

One problem with this approach is that a billionaire may have different investing goals than an average investor looking to accumulate wealth over their lifetime. Instead of seeking long-term gains, a billionaire may buy a stock as a short-term trade. We don’t know what billionaires are going to do ahead of time, and we likely won’t know why they make the investing decisions they do. So while it makes sense to see which stocks the super-wealthy like, average investors have to go the extra step and confirm that a stock suits their investment needs.

Let’s dig in on three stocks that billionaires have bought shares of recently.

Admittedly, Amazon (NASDAQ: AMZN) is more of a known quantity to investors of all wealth levels. Its online retail and cloud computing leadership has made it a favorite among consumers and investors alike.

Although its online sales business has not been a growth center, it has benefited from subscription sales, third-party seller services, and advertising. Additionally, amid strong growth in cloud computing and AI, its AWS arm continues to drive most of Amazon’s operating income.

Although net sales rose by only 11% yearly in the first half of 2024, a continued recovery from 2022 weakness took profits higher by 141% over the same period.

Moreover, while its 45 P/E ratio may not sound cheap, it is far below the stock’s average 87 earnings multiple over the last five years.

That may have helped draw several billionaire investors into the stock in the second quarter of 2024. Ken Griffin, Ray Dalio, and Paul Tudor Jones are just some of the billionaires who added positions during that quarter.

With numerous business lines and $89 billion in liquidity, Amazon is among the safest individual stocks to own, likely making it an excellent choice for average investors.

Another noteworthy “stock” choice of billionaires is an exchange-traded fund (ETF) that owns the 100 nonfinancial stocks on the Nasdaq-100 index. The Invesco QQQ Trust (NASDAQ: QQQ) tends to attract investors at all interest levels since individual components tend to have little influence.

Although it contains 100 stocks, its weighting tends to vary. Its top holding, Apple, constitutes just under 9% of the fund as of this writing. Also, the top 10 stocks, all but one of which is a tech stock, make up just over 50% of its assets.

The Ultimate Biotech Stock to Buy With $50 Right Now

If I had to buy one share of any biotech with no price restriction, I’d naturally gravitate toward the most successful companies in the industry. However, the exercise becomes more complicated if you stipulate a limit of $50 per share; most of the prominent biotech stocks are trading well above that amount.

Those around that level are, disproportionately, relatively small and risky companies whose prospects don’t look all that strong. Still, at least one biotech company whose shares are below $50 looks like a great buy: CRISPR Therapeutics (NASDAQ: CRSP).

CRISPR Therapeutics simply hasn’t been a favorite among investors in the past three-and-a-half years. Its stock is down by 77% since mid-January 2021:

At least two factors have led to CRISPR Therapeutics’ poor performance.

First, the company isn’t profitable. That’s pretty normal for a mid-cap biotech, but with rising interest rates, investors wanted to put their money into safer, profitable investments. Plenty of profitable companies have been moving in the wrong direction over the past few years.

Second, CRISPR focuses on gene editing. Although the technology has the potential to unlock treatments for diseases we previously couldn’t cure, it has one major drawback. Ex vivo gene-editing medicines are complex to administer — the process takes a while and can only be done in specialized treatment centers.

Basic finance tells us that the more we lengthen the timing of future cash flow we’ll receive for an asset, the less it’s worth today, all else being equal. The process involved in administering the kinds of therapies developed by CRISPR Therapeutics lengthens the timing of their future cash flow compared to simple oral pills.

Many investors see significant risks in investing in the company because of its gene-editing focus. Case in point: Bluebird Bio is a biotech company with three approved gene-editing treatments, but its stock continues to perform terribly. Revenue isn’t coming fast enough for investors to change their opinion of Bluebird. Is the same fate awaiting CRISPR Therapeutics?

The challenge for CRISPR Therapeutics is threefold. First, it needs to develop successful therapies; that’s hard enough, but especially so in gene editing. Second, the biotech has to fund commercialization efforts until the revenue from its treatments covers — and exceeds — the associated expenses. Third, it has to pour more money into research and development to create newer medicines.