Quad/Graphics's Earnings Outlook

Quad/Graphics QUAD will release its quarterly earnings report on Monday, 2024-10-28. Here’s a brief overview for investors ahead of the announcement.

Analysts anticipate Quad/Graphics to report an earnings per share (EPS) of $0.23.

Anticipation surrounds Quad/Graphics’s announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

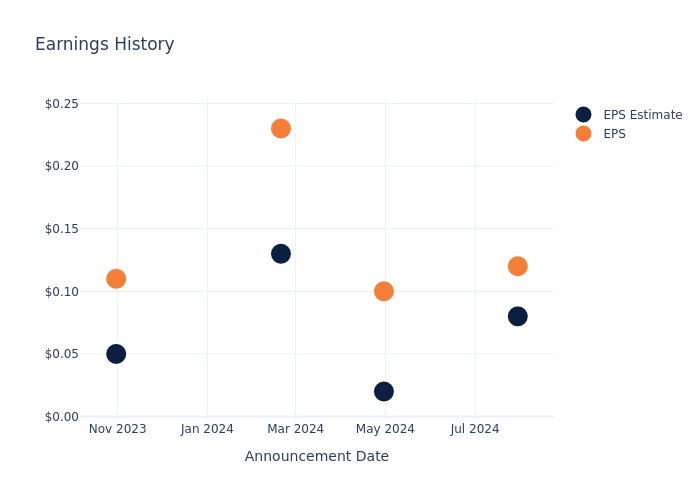

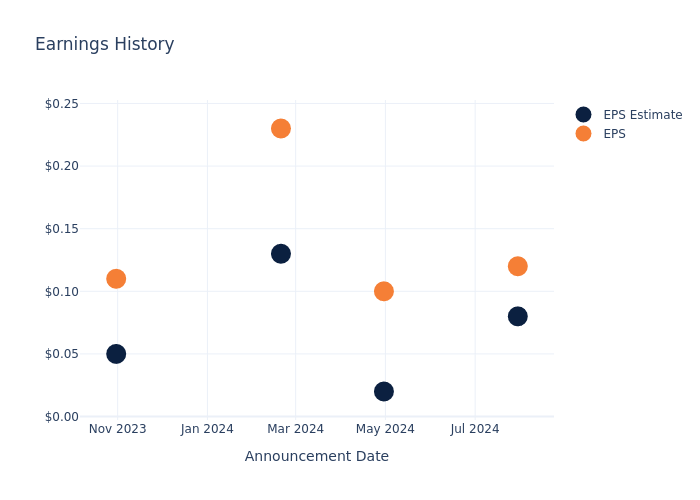

Historical Earnings Performance

Last quarter the company beat EPS by $0.04, which was followed by a 18.39% drop in the share price the next day.

Here’s a look at Quad/Graphics’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.08 | 0.02 | 0.13 | 0.05 |

| EPS Actual | 0.12 | 0.10 | 0.23 | 0.11 |

| Price Change % | -18.0% | 1.0% | -9.0% | -13.0% |

Tracking Quad/Graphics’s Stock Performance

Shares of Quad/Graphics were trading at $5.46 as of October 24. Over the last 52-week period, shares are up 2.82%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analysts’ Perspectives on Quad/Graphics

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Quad/Graphics.

Analysts have given Quad/Graphics a total of 5 ratings, with the consensus rating being Buy. The average one-year price target is $7.96, indicating a potential 45.79% upside.

Understanding Analyst Ratings Among Peers

In this comparison, we explore the analyst ratings and average 1-year price targets of and Quad/Graphics, three prominent industry players, offering insights into their relative performance expectations and market positioning.

Peer Metrics Summary

Within the peer analysis summary, vital metrics for and Quad/Graphics are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Quad/Graphics | Buy | -9.80% | $140.30M | -3.33% |

Key Takeaway:

Quad/Graphics is positioned at the bottom for Revenue Growth among its peers. It also ranks at the bottom for Gross Profit. In terms of Return on Equity, Quad/Graphics is also at the bottom compared to its peers. The consensus rating for Quad/Graphics is ‘Buy’.

All You Need to Know About Quad/Graphics

Quad/Graphics Inc provides print and marketing services to help customers market their products, services, and contents. The company operates in the commercial segment of the printing industry. It operates through three divisions. The United States print and related services segment consists of the company’s American operations. Besides the complete set of print and marketing solutions, this segment also manufactures ink. The international segment includes the company’s printing business in Europe and Latin America. The corporate segment is engaged in the general and administrative activities as well as associated costs. The company almost generates all its revenue from the American domestic market.

A Deep Dive into Quad/Graphics’s Financials

Market Capitalization Analysis: The company’s market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Revenue Challenges: Quad/Graphics’s revenue growth over 3 months faced difficulties. As of 30 June, 2024, the company experienced a decline of approximately -9.8%. This indicates a decrease in top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Industrials sector.

Net Margin: The company’s net margin is a standout performer, exceeding industry averages. With an impressive net margin of -0.44%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Quad/Graphics’s ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of -3.33%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): Quad/Graphics’s ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of -0.2%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: With a high debt-to-equity ratio of 8.1, Quad/Graphics faces challenges in effectively managing its debt levels, indicating potential financial strain.

To track all earnings releases for Quad/Graphics visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply