Should Nvidia Investors Be Nervous About This Red Flag?

When it comes to manufacturing artificial intelligence (AI) chips, Nvidia (NASDAQ: NVDA) has a heavy lead on the competition. According to most estimates, the company has an 80% to 95% market share for AI graphics processing units (GPUs).

However, with the company’s shares trading at 36 times sales, Nvidia’s stock price will be very sensitive to competitive pressures. And according to one metric, those competitive pressures could arrive sooner than expected.

When it comes to cutting-edge AI stocks like Nvidia, monitoring research and development (R&D) spending is a must. Research and development expenses help investors gauge how much a company is investing in innovation. Often, these expenses won’t see a payoff for years, but ignoring this critical area of investment can prevent a business from maintaining its competitive advantages over the long term.

Right now, there’s no doubt that Nvidia has a huge competitive advantage when it comes to AI GPUs. The company is generating gross margins of around 75%, while competitors, including Intel and AMD, are only managing gross margins between 40% and 50% — a strong sign of Nvidia’s pricing power.

Nvidia isn’t trading higher prices for lower volumes, either. Nearly every market estimate pegs the company with a controlling market share for AI GPUs.

There’s just one problem: Nvidia appears to be underinvesting in research and development just as its lead in AI GPUs grows to dominant proportions. Intel is spending billions more per year in research and development, despite having a 95% smaller market cap. Even AMD has a higher research and development spend as a percentage of its revenue.

I’m worried Nvidia is sacrificing future growth by not spending more on research and development.

Here’s the basic truth of investing in chip stocks like Nvidia: This industry is very cyclical. In 2022, the valuations of nearly every chipmaker — Nvidia included — fell by double digits, even as volumes continued to rise on a long-term basis. Then in 2023, the industry’s valuation soared across the board.

However, in 2024, something interesting happened. Nvidia’s share price continued to skyrocket, while AMD’s valuation remained flat and Intel actually lost around one-third of its value.

The past few years aren’t atypical. Each year in the semiconductor space brings new challenges and opportunities, with valuations and market shares shifting dramatically with new innovations and growth categories. But there’s no doubt what the biggest growth driver over the next decade or more will be: AI.

Where Will Nvidia Be 6 Months After the Blackwell Launch? Here's What History Says.

Nvidia (NASDAQ: NVDA) may be heading for its biggest moment yet. The artificial intelligence (AI) chip giant is getting ready to launch its new architecture, one that could be a game changer for the industry considering the number of innovative features included in the platform. Nvidia aims to ramp production of the Blackwell architecture and chip in the fourth quarter.

This comes at a key moment for the technology company. Nvidia has built an AI empire over the past few years and grown revenue in the triple digits quarter after quarter. Now, though, as the company’s revenue levels reach extremely high points, triple-digit gains may not be sustainable. And rivals have also produced chips they hope can take market share. So, it’s logical to ask this question: Where will Nvidia be six months after the Blackwell launch? Let’s consider what history has to say — and a few other clues — and find out.

First, a quick summary of Nvidia’s path so far and what to expect from the Blackwell launch. Nvidia has built dominance in the AI market by designing the most powerful chips and an entire platform of products and services to accompany them. So, customers can go to Nvidia simply for the chips, known as graphics processing units (GPUs), or they can get in on the entire Nvidia stack to run their data centers.

This has helped the company grow its quarterly revenue to a record $30 billion and gross margin to levels above 70%. Nvidia also has increased net income in the triple digits, reporting profit of more than $16 billion in the recent quarter.

Investors now are eagerly awaiting the Blackwell launch with high hopes thanks to the architecture’s six game-changing innovations — from Nvidia’s best chip yet to a high-performance preventative maintenance system to ensure system uptime and a fifth-generation NVLink to deliver high-speed communication among up to 576 GPUs.

As mentioned, Nvidia plans on ramping production of Blackwell in the coming weeks, and in Nvidia’s most recent earnings report, chief executive officer Jensen Huang offered us clues about customer interest in this new product. Huang said demand has surpassed supply, and he expects this to continue into next year. More recently, in an interview with CNBC, Huang reconfirmed this, calling demand for Blackwell “insane.”

All of this prompted Nvidia to forecast billions of dollars in Blackwell revenue in the fourth quarter. So Blackwell won’t take long to start adding significantly to Nvidia’s top line. On top of this, Nvidia predicts gross margin in the mid-70% range for the full year, showing us the company is capable of launching this major product while still maintaining an extremely high level of profitability.

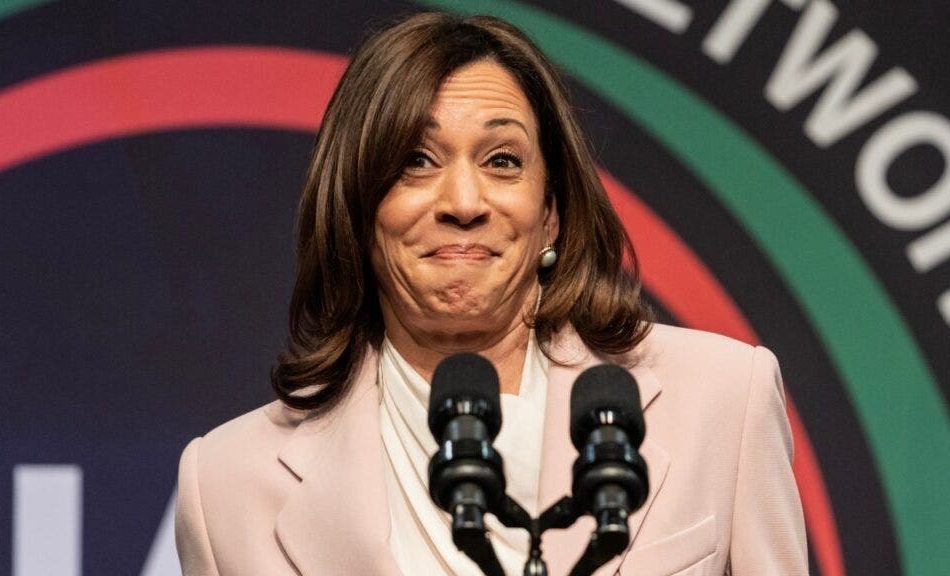

Kamala Harris To Win The Popular Vote? A $4 Million Payday For One Trader Who Thinks Trump's Chances Are Only 15%

A pseudonymous Polymarket trader by the name of ‘Redegen’ has taken a sizeable position on Vice President Kamala Harris winning the popular vote in the November election.

What Happened: Redegen stated on X that if his bet proves accurate, he could bank a profit of almost $4 million. “I think it’s a hugely EV+ bet,” he said, citing the stability of Harris’s lead and estimating Donald Trump has less than a 15% chance of overcoming it.

Don’t Miss:

Redegen also holds a bet against Donald Trump winning the election and the the popular vote. His current total position is valued at $6.4 million but currently underwater by over $250,000.

This bold stance contrasts with other interpretations of the race. Nate Silver, former editor-in-chief of FiveThirtyEight, suggested both Harris and former President Donald Trump might exceed their current poll numbers

Trending: Groundbreaking trading app with a ‘Buy-Now-Pay-Later’ feature for stocks tackles the $644 billion margin lending market – here’s how to get equity in it with just $100

Why It Matters: Rising tensions around the upcoming election and varied forecasts on candidate performance make Redegen’s high-stakes bet notable. Nate Silver’s model suggests a Trump sweep of swing states is the most probable, happening 24% of the time, with a Harris sweep next at 15%.

Recently, Harris received endorsements from 23 Nobel laureates, including economist Daron Acemoglu, who support her economic policies for fostering strong and equitable growth.

This wager reflects both the broader economic sentiment and strategic political forecasts heading into the election.

What’s Next: The aftermath of the election and its consequences for the digital asset industry will be thoroughly explored at Benzinga’s upcoming Future of Digital Assets event on Nov. 19.

Read Next:

Image: Shutterstock

UNLOCKED: 5 NEW TRADES EVERY WEEK. Click now to get top trade ideas daily, plus unlimited access to cutting-edge tools and strategies to gain an edge in the markets.

Presidential Race Predictions, Investment Warnings, And Billion-Dollar Proposals: This Week In Crypto

The past week was buzzing with a flurry of news from the world of finance and cryptocurrency. From bold predictions about the presidential race and the future of digital assets to investment warnings and intriguing proposals, the stories were as diverse as they were impactful. Here’s a quick recap of the top stories that made headlines.

Nate Silver’s Presidential Race Predictions

Former FiveThirtyEight editor-in-chief Nate Silver stirred the pot with his contrasting interpretations of the presidential race. In an opinion piece, he suggested that both Vice President Kamala Harris and former President Donald Trump could outperform their current poll numbers. Silver’s “gut” leans towards a Trump victory, but he also believes that Harris could surprise many by sweeping key battleground states.

Anthony Scaramucci’s Crypto Predictions

With a potentially crypto-friendly Congress on the horizon, Anthony Scaramucci anticipates significant policy changes that could shape the digital asset industry. In an exclusive interview with Benzinga, he discussed potential regulatory shifts, including the possibility of established protocols being classified as “decentralized commodities”. This could reduce legal risks and bring more clarity to the market, he said.

See Also: MicroStrategy Pushes Higher As BlackRock Buys In, But Peter Schiff Sees A Crash Ahead

Peter Schiff’s Investment Warning

Economist Peter Schiff warned investors against holding cash as a long-term strategy, citing the risk of significant purchasing power erosion due to inflation. He advised against investing in cash, stating that while you may not lose any money, your money could lose most of its purchasing power.

Michael Saylor’s Proposal to Microsoft

MicroStrategy’s Michael Saylor reached out to Microsoft Corp. CEO Satya Nadella with a proposal to help with the company’s Bitcoin strategy. Saylor suggested that if Nadella is interested in creating the next trillion-dollar opportunity, he should get in touch.

Jamie Dimon’s Bitcoin Skepticism

JPMorgan Chase & Co. CEO Jamie Dimon continued to express his skepticism towards Bitcoin, questioning its hard cap of 21 million. At the Institute of International Finance event, Dimon challenged the audience, asking how they can be sure of the cap.

Read Next:

Photo courtesy: Shutterstock

This story was generated using Benzinga Neuro and edited by Anan Ashraf.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Apple wins $250 in Masimo smartwatch patent case

The legal battle between Apple and medical technology company Masimo rages on, with the bigger company — sorta, kinda — winning their latest face off. A federal jury has agreed with Apple that previous versions of Masimo’s W1 and Freedom (pictured above) watches infringed on its design patents, according to Reuters. It only awarded Apple $250 in damages, which is the smallest amount that could be awarded for patent infringement, but the company’s lawyers reportedly told the court that it wasn’t after money anyway.

What Apple, which is worth $3.5 trillion, wanted was an injunction on the sales of Masimo’s current smartwatch models. However, the jury determined that those newer models don’t violate Apple’s intellectual property. That is why Masimo is also treating the jury’s decision as a win, telling the news organization that it’s thankful for the verdict that’s “in favor of Masimo and against Apple on nearly all issues.” Apparently, the ruling only affects a “discontinued module and charger.” As for Apple, it told Reuters that it was “glad the jury’s decision today will protect the innovations [it advances] on behalf of [its] customers.”

Masimo sued Apple in 2021, accusing it of infringing on several of its light-based blood-oxygen monitoring patents, while the tech giant countersued a year later. A court sided with Masimo in 2023, forcing Apple to pause sales on its latest smartwatch models, as the US International Trade Commission blocked all Watch Series 9 and Ultra 2 imports into the country. The company appealed and was ultimately able to sell its watches in the country earlier this year by removing the technology from the units offered in the US.

Money market account rates today, October 27, 2024 (best account provides 5.05% APY)

Between March 2022 and July 2023, the Federal Reserve raised its benchmark rate 11 times. As a result, money market account (MMA) interest rates rose sharply.

However, the Fed slashed the federal funds rate by 50 basis points in September. So deposit rates — including money market account rates — have started falling. It’s more important than ever to compare MMA rates and ensure you earn as much as possible on your balance.

The national average money market account rate stands at 0.64%, according to the FDIC. This might not seem like much, but consider that just two years ago, it was just 0.23%, reflecting a sharp rise in a short period of time.

This is largely due to monetary policy decisions by the Fed, which began raising its benchmark rate in March 2022 to combat skyrocketing inflation. In fact, the Fed increased rates 11 times. But it finally cut its benchmark rate in September, causing deposit account rates to start dropping

Even so, some of the top accounts are currently offering upwards of 5% APY. Since these rates may not be around much longer, consider opening a money market account now to take advantage of today’s high rates.

Here’s a look at some of the top MMA rates available today:

See our picks for the 10 best money market accounts available today>>

Additionally, the table below features some of the best savings and money market account rates available today from our verified partners.

The amount of interest you can earn from a money market account depends on the annual percentage rate (APY). This is a measure of your total earnings after one year when considering the base interest rate and how often interest compounds (money market account interest typically compounds daily).

Say you put $1,000 in an MMA at the average interest rate of 0.64% with daily compounding. At the end of one year, your balance would grow to $1,006.42 — your initial $1,000 deposit, plus just $6.42 in interest.

Now let’s say you choose a high-yield money market account that offers 5% APY instead. In this case, your balance would grow to $1,051.27 over the same period, which includes $51.27 in interest.

The more you deposit in a money market account, the more you stand to earn. If we took our same example of a money market account at 5% APY, but deposit $10,000, your total balance after one year would be $10,512.67, meaning you’d earn $512.67 in interest.

‘Who do people like me turn to?’ I am 70 with absolutely no emergency or retirement savings. So now what?

MarketWatch Picks highlights items we think you’ll find useful; we are independent of the MarketWatch newsroom. We might earn a commission from links in this content. Learn more

Question: “I am 70 with no emergency or retirement savings. Who do people like me turn to for advice at this stage? What can I do?”

Answer: Most certified financial planners and other financial pros work with people who have financial means — sometimes pretty hefty ones — so you’ll likely need to take a different path to get advice. The good news here is that we have a variety of ways for people to get quality, free (yes, you read that right) or very low-cost financial advice.

Know, too, that there are things you can do yourself to try to remedy your situation. “You should try to stay away from credit card debt and have an emergency fund even if it’s the equivalent of one month of your essential expenses. For as long as you can, find a job, even if it’s part-time, to supplement your Social Security income. Ask the adviser who serves you to explain if your additional income can cause your Social Security check to be taxed in any proportion so that you can get your numbers right,” says certified financial planner Alonso Rodriguez Segarra at Advise Financial.

If you’re open to part-time work, sites like FlexJobs, Indeed, ZipRecruiter and the AARP’s Job Board all list gigs with hiring opportunities. You can choose to focus on a specific area of interest or within your ZIP code, and some of the jobs are entirely remote, meaning you can work from anywhere.

At your age with no savings or retirement funds, it’s essential to explore all available options. “Connecting with an adviser can help you review potential income sources, such as maximizing your Social Security benefits and exploring options if you own equity in your primary residence,” says certified financial planner Ryan Haiss at Flynn Zito Capital Management.

Billionaire Stanley Druckenmiller Bet Big on This High-Yield Dividend Stock, and It's Up 41% This Year. Is It Too Late to Buy?

Stanley Druckenmiller is one of the greatest investors of all time. As the manager of Duquesne Capital Management for nearly three decades, from 1981 to 2010, he generated an average annual return of 30% and never had a losing year.

Druckenmiller also worked closely with George Soros, helping to “break the Bank of England” through a massive short bet on the pound in 1992.

These days, Druckenmiller is retired as a hedge fund manager, but he still manages his own money through the Duquesne Family Office, and the billionaire’s moves are worth following. Druckenmiller was early to recognize the growth potential of Nvidia in artificial intelligence (AI), moving aggressively into the stock in Q4 2022 after ChatGPT was released, but he acknowledged recently that he sold it too early, dumping all of it earlier this year.

However, Druckenmiller made another smart buy earlier this year, buying 889,355 shares of Philip Morris International (NYSE: PM) and call options giving him the rights to buy another 963,000 shares of the tobacco stock.

Druckenmiller opened up a position in the stock in the second quarter, and though we don’t know exactly when he bought the stock, we do know that he’s up big on the dividend stock since then. Philip Morris has gained 30% since the end of the second quarter, an impressive feat for a high-yield dividend stock, and shares just surged on its third-quarter earnings report.

Let’s take a look at those numbers and where the business is today before discussing whether it makes sense to follow Druckenmiller into the stock.

Though smoking is in decline in much of the world, Philip Morris has adapted to that reality better than its two closest peers on the stock market, Altria and British American Tobacco.

Roughly 40% of its revenue now comes from next-gen products like its Iqos devices, which heat real tobacco without burning it, and Zyn, the popular oral nicotine pouches it gained in its acquisition of Swedish Match for $16 billion in 2022. It’s invested in growth in both those categories, adding new plants to expand production of Zyn, and rolling out Iqos in the U.S.

That strength was on display in the company’s third-quarter earnings report as Philip Morris blew past analyst estimates and the stock jumped 10.5% on Wednesday.

The tobacco company reported revenue of $9.91 billion, up 11.6% on an organic basis (meaning excluding the impact of currency exchange, divestitures, and acquisitions), and ahead of estimates of $9.69 billion. Organic revenue from its smoke-free business jumped 16.8% to $3.8 billion, and its combustibles business delivered 8.6% organic revenue growth thanks to rising prices and a 1.3% increase in cigarette volumes to 163.2 billion.

These 7 Blunt Words Just Opened a Can of Worms For Pfizer's Stock

Pfizer‘s (NYSE: PFE) burgeoning tiff with activist investor group Starboard Value looks like it’s escalating. Since the activist took a $1 billion stake in the drug developer, it’s been an open question as to what it wants changed and how it proposes to do so.

Now, after a presentation at the 13D Monitor Active-Passive Investor Summit by Starboard’s CEO Jeffrey Smith on Oct. 22, there’s a lot less ambiguity. In particular, Smith had seven simple and brutal words that shed light on his group’s perspective on Pfizer and its management.

If you’re a shareholder or thinking about investing in this stock, you need to know what he said and why it opened a can of worms.

“The track record here is not great,” quipped Smith, referring to Pfizer’s recent lack of new launches of blockbuster drugs capable of earning more than $1 billion per year in revenue.

Starboard’s criticism is targeted squarely at Pfizer CEO Albert Bourla, who has led the pharma juggernaut since early 2019. Though the activists applaud Bourla’s leadership during the coronavirus vaccine and therapeutics races, they allege that the business lost between roughly $20 billion and $60 billion in value under his tenure, depending on how the figure is calculated.

Starboard identifies four key issues with Pfizer:

-

Its recent internal research and development (R&D) efficiency

-

Its expected future returns on R&D investments

-

Its capital allocation strategy

-

Its forecasting and budgeting processes

On the first two issues, the group’s account is hard to dispute. Despite repeated glowing public reports from the CEO about the strength of the pipeline, and 10 potential blockbuster drugs teed up for launch between 2019 and 2022, a series of late-stage clinical trial failures and worse-than-anticipated sales performance of the approved medicines left shareholders with dashed hopes.

Furthermore, despite management’s optimism about the business’ ongoing attempt to develop a drug for treating obesity and type 2 diabetes — potentially opening the door to accessing a market that could be worth as much as $100 billion by 2030 — Starboard correctly points out that, so far, Pfizer’s efforts have not been successful.

Another issue is that for the programs currently in Pfizer’s pipeline, the anticipated return on R&D investment is just 15%, putting it far beneath practically all of its big pharma peers, which expect a median return of 38%. Part of the problem is that its top line is only estimated to grow by around 41% between now and 2030, excluding both its coronavirus products and the revenue it’ll lose when certain patents expire. The activists point to this problem as being the root cause of the pharma’s ongoing struggle.

Billionaire Jeff Yass Just Increased His Position In This Dirt Cheap Artificial Intelligence (AI) Stock By 148%. Here Are 3 Things Smart Investors Should Know.

Every quarter, investment firms that manage more than $100 million file a form 13F with the Securities and Exchange Commission (SEC). I find the 13F to be a valuable tool because it breaks down in detail which stocks institutional investors are buying and selling, and it can be interesting to try and identify patterns among Wall Street’s biggest money managers.

One investor that I enjoy following is Jeff Yass, the co-founder of Susquehanna International Group (SIG). During the second quarter, SIG purchased roughly 5 million shares of artificial intelligence (AI) stock Super Micro Computer (NASDAQ: SMCI) — increasing its position in the company (also known as Supermicro) by 148%.

Below, I’m going to break down the mechanics of Supermicro’s place in the AI realm and address some important topics that should be considered when investing in the company.

Supermicro often comes up when semiconductor companies such as Nvidia or Advanced Micro Devices are mentioned. For this reason, many investors perceive Supermicro as another chip stock — but in reality, this isn’t exactly right.

Supermicro is an IT infrastructure business that specializes in designing storage architecture for Nvidia’s and AMD’s graphics processing units (GPU). So, while demand in the chip industry has direct influences on Supermicro’s operation, the company itself is not a true semiconductor stock.

Although Supermicro has undoubtedly benefited from AI tailwinds, the financial profile below paints a pretty sobering reality.

Namely, Supermicro’s gross profit margin is trending in the wrong direction. Despite consistent acceleration across the top line, Supermicro’s unit economics are pretty backward.

While management has said that these headwinds will be short-lived, the reality is that IT infrastructure is not a high-margin industry. This dynamic leads me to my next important topic: competition and the risk of commoditization.

While Supermicro has done a respectable job of fostering relationships with some of the world’s leading GPU producers, these relationships are by no means exclusive.

Supermicro competes with plenty of other businesses that offer IT architecture solutions, including Dell Technologies, Hewlett Packard Enterprise, Lenovo, and Cisco. These companies are much larger and more diverse than Supermicro, making them formidable rivals.

Broadly speaking, when the same solution is offered by many players within the same industry, companies become forced to compete on price. So, even though Supermicro’s management has been forecasting increasing operating profit, I question how profitable the company will ever become as competition heats up.