Advisory: Fortis Inc. to Hold Teleconference on November 5 to Discuss Third Quarter 2024 Results

ST. JOHN’S, Newfoundland and Labrador, Oct. 28, 2024 (GLOBE NEWSWIRE) — Fortis Inc. (“Fortis” or the “Corporation”) FTS will release its third quarter 2024 financial results on Tuesday, November 5, 2024. A teleconference and webcast will be held the same day at 8:30 a.m. (Eastern). David Hutchens, President and Chief Executive Officer and Jocelyn Perry, Executive Vice President and Chief Financial Officer will discuss the Corporation’s third quarter financial results.

Shareholders, analysts, members of the media and other interested parties are invited to listen to the teleconference via the live webcast on the Corporation’s website, www.fortisinc.com/investors/events-and-presentations.

Those members of the financial community in North America wishing to ask questions during the call are invited to participate toll free by calling 1.800.717.1738 while those outside of North America can participate by calling 1.289.514.5100. Please dial in 10 minutes prior to the start of the call. No passcode is required.

A live and archived audio webcast of the teleconference will be available on the Corporation’s website, www.fortisinc.com. A replay of the teleconference will be available two hours after the conclusion of the call until December 5, 2024. Please call 1.888.660.6264 or 1.289.819.1325 and enter passcode 33826#.

About Fortis

Fortis is a well-diversified leader in the North American regulated electric and gas utility industry with 2023 revenue of $12 billion and total assets of $69 billion as at June 30, 2024. The Corporation’s 9,600 employees serve utility customers in five Canadian provinces, ten U.S. states and three Caribbean countries.

Fortis shares are listed on the TSX and NYSE and trade under the symbol FTS. Additional information can be accessed at www.fortisinc.com, www.sedarplus.ca, or www.sec.gov.

A .pdf version of this press release is available at: http://ml.globenewswire.com/Resource/Download/edeaf80a-e47c-4db9-a80e-bdf7fe1b91c2

For further information contact

| Investor Enquiries: Ms. Stephanie Amaimo Vice President, Investor Relations Fortis Inc. 248.946.3572 investorrelations@fortisinc.com |

Media Enquiries: Ms. Karen McCarthy Vice President, Communications & Government Relations Fortis Inc. 709.737.5323 media@fortisinc.com |

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

This Is What Whales Are Betting On Walt Disney

Investors with a lot of money to spend have taken a bullish stance on Walt Disney DIS.

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with DIS, it often means somebody knows something is about to happen.

Today, Benzinga’s options scanner spotted 31 options trades for Walt Disney.

This isn’t normal.

The overall sentiment of these big-money traders is split between 58% bullish and 35%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $25,569, and 30, calls, for a total amount of $1,238,034.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $70.0 and $120.0 for Walt Disney, spanning the last three months.

Insights into Volume & Open Interest

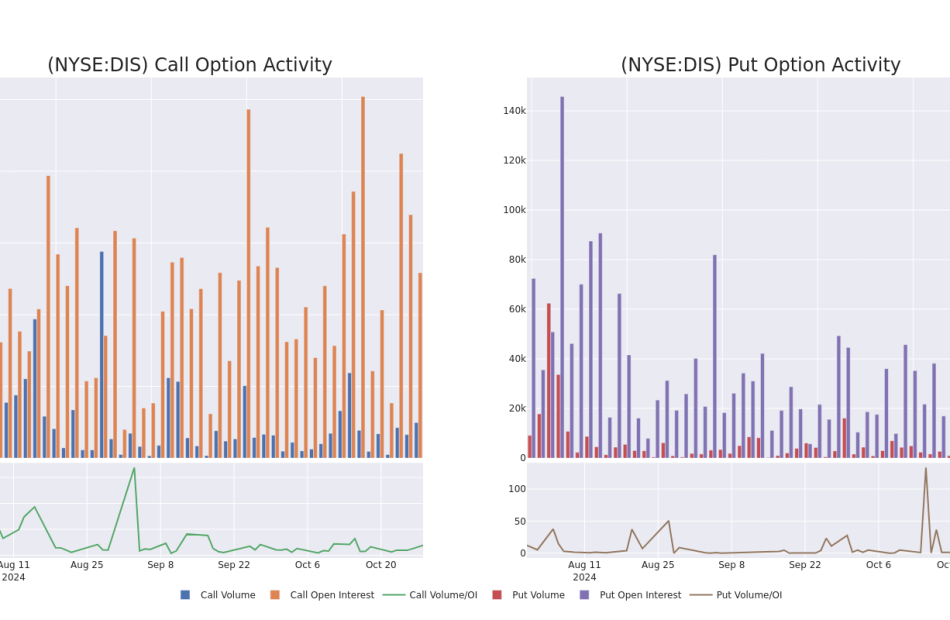

In today’s trading context, the average open interest for options of Walt Disney stands at 4049.5, with a total volume reaching 9,998.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Walt Disney, situated within the strike price corridor from $70.0 to $120.0, throughout the last 30 days.

Walt Disney Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DIS | CALL | SWEEP | BULLISH | 09/19/25 | $7.85 | $7.75 | $7.85 | $105.00 | $91.8K | 1.4K | 1 |

| DIS | CALL | TRADE | BEARISH | 03/21/25 | $18.75 | $18.65 | $18.65 | $80.00 | $65.2K | 523 | 36 |

| DIS | CALL | SWEEP | BULLISH | 12/19/25 | $13.95 | $13.85 | $13.85 | $95.00 | $62.5K | 981 | 46 |

| DIS | CALL | SWEEP | BULLISH | 01/17/25 | $3.95 | $3.9 | $3.95 | $100.00 | $53.7K | 15.6K | 246 |

| DIS | CALL | TRADE | BEARISH | 12/20/24 | $17.1 | $16.9 | $16.97 | $80.00 | $50.9K | 1.2K | 60 |

About Walt Disney

Disney operates in three global business segments: entertainment, sports, and experiences. Entertainment and experiences both benefit from franchises and characters the firm has created over the course of a century. Entertainment includes the ABC broadcast network, several cable television networks, and the Disney+ and Hulu streaming services. Within the segment, Disney also engages in movie and television production and distribution, with content licensed to movie theaters, other content providers, or, increasingly, kept in-house for use on Disney’s own streaming platform and television networks. The sports segment houses ESPN and the ESPN+ streaming service. Experiences contains Disney’s theme parks and vacation destinations, and also benefits from merchandise licensing.

Following our analysis of the options activities associated with Walt Disney, we pivot to a closer look at the company’s own performance.

Where Is Walt Disney Standing Right Now?

- With a volume of 5,646,884, the price of DIS is up 1.39% at $96.36.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 17 days.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Walt Disney options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

VF Corp Q2 Earnings: Revenue Beat, EPS Beat, Cost Reductions On Track, Guidance And More

V.F. Corp VFC reported second-quarter financial results after the market close on Monday. Here’s a rundown of the report.

Q2 Earnings: VF Corp, the parent company of Vans and The North Face, reported second-quarter revenue of $2.8 billion, beating the consensus estimate of $2.7 billion, according to Benzinga Pro. The company reported second-quarter earnings of 60 cents per share, beating analyst estimates of 37 cents per share.

Total revenues were down 6% year-over-year. The North Face revenues were down 3% in the second quarter and Vans’ revenues fell 11%. Americas revenues were down 10% in the quarter and international revenues fell 2%.

Inventories were down 13% compared to the prior year’s quarter. The company noted that it lowered its debt by $446 million in the quarter, bringing net debt down to $5.7 billion at quarter’s end.

“Our results in the quarter met our expectations and reflect a sequential and broad-based improvement in year-on-year trends. At the same time, we made further progress on our four Reinvent priorities and we are on track to reach our previously announced $300 million savings target by the end of FY25,” said Bracken Darrell, president and CEO of VF Corp.

Looking Ahead: VF Corp expects third-quarter revenue to be in the range of $2.7 billion to $2.75 billion versus estimates of $2.96 billion, according to Benzinga Pro. The company anticipates third-quarter adjusted operating income of $170 million to $200 million.

VF Corp anticipates full-year free cash flow from continuing operations of approximately $425 million. The company noted that core fundamentals remain in line with previous guidance.

The company’s board declared a dividend of 9 cents per share, payable on Dec. 18 to shareholders of record as of Dec. 10. VF Corp’s management team is currently discussing the quarter on a conference call that started at 4:30 p.m. ET.

VFC Price Action: VF Corp shares were up 16.85% in after-hours, trading at $19.90 at the time of publication Monday, per Benzinga Pro.

Photo: Shutterstock.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Price Over Earnings Overview: Halliburton

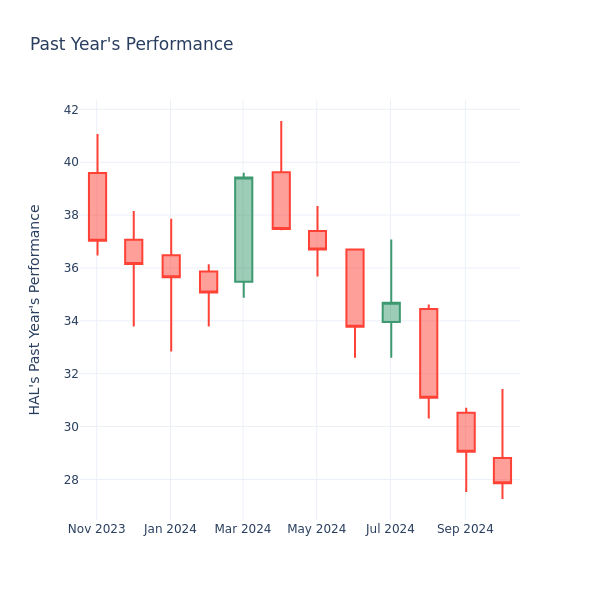

In the current session, Halliburton Inc. HAL is trading at $27.86, after a 1.38% decrease. Over the past month, the stock fell by 6.92%, and in the past year, by 29.18%. With performance like this, long-term shareholders are more likely to start looking into the company’s price-to-earnings ratio.

Comparing Halliburton P/E Against Its Peers

The P/E ratio is used by long-term shareholders to assess the company’s market performance against aggregate market data, historical earnings, and the industry at large. A lower P/E could indicate that shareholders do not expect the stock to perform better in the future or it could mean that the company is undervalued.

Compared to the aggregate P/E ratio of the 28.86 in the Energy Equipment & Services industry, Halliburton Inc. has a lower P/E ratio of 9.39. Shareholders might be inclined to think that the stock might perform worse than it’s industry peers. It’s also possible that the stock is undervalued.

In summary, while the price-to-earnings ratio is a valuable tool for investors to evaluate a company’s market performance, it should be used with caution. A low P/E ratio can be an indication of undervaluation, but it can also suggest weak growth prospects or financial instability. Moreover, the P/E ratio is just one of many metrics that investors should consider when making investment decisions, and it should be evaluated alongside other financial ratios, industry trends, and qualitative factors. By taking a comprehensive approach to analyzing a company’s financial health, investors can make well-informed decisions that are more likely to lead to successful outcomes.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bitcoin Spikes Above $68,000: These Macro Indicators Are Key To New All-Time Highs

Bitcoin BTC/USD has surged to $68,770 in Monday morning trading, up 1.7% over the past 24 hours as Donald Trump’s chances of winning the 2024 election continue to rise.

What Happened: The apex crypto is up 4.8% over the past 30 days as traders are looking for the “Trump trade” to play out in light of the GOP’s increasing chances. It is only better by two other cryptocurrencies in the top 10: Solana SOL/USD, up 11.6% over the past 30 days and Dogecoin DOGE/USD, up 18.8% over the same timeframe.

Benjamin Cowen, CEO and founder of IntoCryptoVerse, highlighted on X how labor market data might shape the crypto king’s near-term price action.

Cowen detailed two main scenarios for Bitcoin’s price movement: either a cyclical rally toward $70,000 or a dip with a recovery slated for early 2025. Should Bitcoin breach the $70,000 level, he favors the cyclical forecast but a fallback to $64,000 would align more closely with monetary policy-driven delays in momentum until 2025.

He also emphasized that this week’s labour market data release and next week’s Federal Open Market Committee meeting and election results could impact BTC’s short-term trend. This comes in the wake of Bitcoin’s dominance approaching the critical 60% threshold—an indicator that could lead to considerable shifts across the market.

Why It Matters: Labor data for the week ending Oct. 19 showed a drop in initial jobless claims to 227,000, down 15,000 from the previous week but below the forecasted 242,000, marking the biggest weekly decline since August.

Minutes released from September’s Fed meeting have adjusted the odds of a November rate cut from 87% to 75%, with a 25% of no rate cut occurring in November.

What’s Next: The influence of Bitcoin as an institutional asset class is expected to be thoroughly explored at Benzinga’s upcoming Future of Digital Assets event on Nov. 19.

Read Next:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Seelaus Asset Management, LLC expands its Impact Investment Offering in Agency MBS with the launch of the Seelaus Housing Equality Fund, LP

CHATHAM, N.J., Oct. 28, 2024 /PRNewswire/ — Seelaus Asset Management, LLC (SAM) announced the launch of the Seelaus Housing Equality Fund, LP – an impact investment strategy designed to address access to affordable housing in underserved communities while offering investors a competitive rate of return. With this launch, SAM took another step forward in its commitment to driving impact through investments in partnership with its clients. The fund structure is able to fulfill a wide range of impact and investment objectives from a nationwide to regional focus benchmarked against relevant fixed income indices.

The Seelaus Housing Equality Fund will invest in Agency MBS Pools and CMOs, and will target low income, high minority, high poverty, and low home ownership communities in New Jersey.

The seed investors in the fund are the Geraldine R. Dodge Foundation and The Community Foundation of NJ, who collaborated with the SAM investment team to create a fund supporting access to home ownership in underserved communities in the State of New Jersey. The Seelaus Housing Equality Fund will invest in Agency MBS Pools and CMOs, and will target low income, high minority, high poverty, and low home ownership communities in New Jersey.

“We are grateful to these two foundations for recognizing they could align their investment portfolio with their organization’s mission and values without any concession on their investment objectives,” said CEO Annie Seelaus. “This is a unique, liquid approach to addressing a need in our communities, and in partnering with a women-owned asset manager our investors are generating what we call double impact.”

While the initial sleeve of the fund launch is designed to support access to affordable home ownership in New Jersey based communities, Seelaus Asset Management offers its investors the opportunity to address other geographies or demographics with their investment as well. “I believe the market backdrop is supportive of this asset class and our approach is a true differentiator,” said Senior Portfolio Manager Dave Mangone. “The fund is able to support additional cities, states, and individual communities. Should client needs call for more specific impact support, the strategy is available as a separately managed account with almost limitless impact customization.”

The ability to target specific geographies also makes this investment an ideal solution for buyers of Community Reinvestment Act (CRA) credit.

If you would like to learn more about this fund or Seelaus Asset Management, please reach out to ir@seelausam.com or call 1-800-922-0584.

The information contained herein is provided for informational and discussion purposes only and is not intended and may not be relied on in any manner as, legal, tax or investment advice or as an offer to sell or be viewed as a solicitation of an offer to buy an interest in the Fund or other investment vehicles sponsored or managed by Seelaus Asset Management, LLC (the “Investment Manager”). As with any investment, there is a risk of loss of value based on a variety of risks associated with this investment which include, but are not limited to, market risk, liquidity risk, concentration risk, and credit risk. Before deciding to invest in the Seelaus Housing Equality Fund, LP, investors should read and be familiar with the Offering Memorandum and understand the risk factors contained therein including those previously mentioned.

Seelaus Asset Management, LLC (“SAM”) is a subsidiary of R. Seelaus & Co., Inc. and is a SEC-registered investment advisor. It specializes in fixed income portfolio management and tactical asset allocation investment strategies for private clients, family offices, financial advisors, insurance companies, pension plans and other institutional investors. SAM strategies include those focused on impact investing, municipal bonds, corporate bonds, MBS, and domestic equities. The firm has offices in Chatham NJ and Redbank NJ. SAM is qualified to do business in various state jurisdictions where required.

Information about Seelaus Asset Management and the Seelaus Group of companies is available at www.rseelaus.com.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/seelaus-asset-management-llc-expands-its-impact-investment-offering-in-agency-mbs-with-the-launch-of-the-seelaus-housing-equality-fund-lp-302289131.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/seelaus-asset-management-llc-expands-its-impact-investment-offering-in-agency-mbs-with-the-launch-of-the-seelaus-housing-equality-fund-lp-302289131.html

SOURCE Seelaus Asset Management

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

BANKFIRST CAPITAL CORPORATION Reports Third Quarter 2024 Earnings of $6.4 Million

COLUMBUS, Miss., Oct. 28, 2024 /PRNewswire/ — BankFirst Capital Corporation BFCC (“BankFirst” or the “Company”), parent company of BankFirst Financial Services, Macon, Mississippi (the “Bank”), reported net income of $6.4 million, or $0.97 per share, for the third quarter of 2024, compared to net income of $6.5 million, or $1.09 per share, for the second quarter of 2024, and compared to net income of $8.4 million, or $1.55 per share, for the third quarter of 2023.

Third Quarter 2024 Highlights:

- Net interest income totaled $21.2 million in the third quarter of 2024 compared to $21.6 million in the third quarter of 2023.

- Total assets increased 2% to $2.8 billion at September 30, 2024 from $2.7 billion at September 30, 2023.

- Total gross loans increased 3% to $1.84 billion at September 30, 2024 from $1.78 billion at September 30, 2023.

- Total deposits increased 3% to $2.4 billion at September 30, 2024 from $2.3 billion at September 30, 2023.

- Available liquidity sources totaled approximately $985.2 million as of September 30, 2024 through (i) available advances from the Federal Home Loan Bank of Dallas (“FHLB”), (ii) the Federal Reserve Bank of St. Louis (“FRB”) Discount Window, and (iii) access to funding through several relationships with correspondent banks.

- Total off-balance sheet liquidity through the IntraFi Insured Cash Sweep program totaled approximately $155.2 million as of September 30, 2024.

- Credit quality remains strong with non-performing assets (excluding restructured) to total assets of 0.47% as of September 30, 2024 compared to 0.47% September 30, 2023.

- The Company’s wholly-owned banking subsidiary, BankFirst Financial Services (the “Bank”), was named a recipient of a grant award under the Community Development Financial Institution (“CDFI”) Bank Enterprise Award Program (“BEA Program”) in the amount of $280 thousand. The Bank recognized this award during the third quarter of 2024.

Recent Developments

- As previously reported, on May 15, 2024, the Board authorized a stock repurchase program pursuant to which the Company may repurchase up to $10.0 million of the outstanding shares of the Company’s common stock from time to time in open market purchases or privately negotiated transactions (the “Stock Repurchase Program”). The Stock Repurchase Program will expire on Wednesday, May 21, 2025, subject to the earlier termination or extension by the Board, in its sole discretion and without prior notice, or until such time that the funds designated for the Stock Repurchase Program are depleted. During the third quarter of 2024, the Company repurchased 4,256 shares under the Stock Repurchase Program for an aggregate purchase price of approximately $145 thousand.

- Finally, as previously disclosed, the Company closed on the issuance of $175.0 million of senior perpetual noncumulative preferred stock (the “Senior Preferred”) to the U.S. Department of the Treasury (“Treasury”) pursuant to the Emergency Capital Investment Program (“ECIP”) in April 2022 and assumed an additional $43.6 million of outstanding Senior Preferred through the Company’s acquisition of Mechanics Banc Holding Company, which was effective on January 1, 2023. The Senior Preferred issued to Treasury will pay non-cumulative dividends, payable quarterly in arrears on March 15, June 15, September 15 and December 15 of each year beginning on the second dividend payment date after the two-year anniversary of the date of issuance. The dividend rate to be paid on the Senior Preferred will adjust annually based on certain measurements of the Company’s extensions of credit to minority, rural, and urban low-income and underserved communities and low- and moderate-income borrowers. On September 15, 2024, the Company paid its second quarterly dividend to Treasury in an amount equal to $1.092 million.

CEO Commentary

Moak Griffin, President and Chief Executive Officer of the Company and the Bank, stated, “We are pleased with our third quarter results as we saw continued modest growth of loans and deposits. Our credit quality remains stable as our non-performing assets continue to remain low. Overall, we remain optimistic about the remainder of 2024 and ahead into 2025.”

Financial Condition and Results of Operations

Total assets were $2.8 billion at September 30, 2024, compared to $2.8 billion at June 30, 2024 and $2.7 billion at September 30, 2023. Total loans outstanding, net of the allowance for credit losses, as of September 30, 2024 totaled $1.8 billion, compared to $1.8 billion as of June 30, 2024 and $1.8 billion as of September 30, 2023.

Total deposits as of September 30, 2024 were $2.4 billion, compared to $2.3 billion at June 30, 2024 and $2.3 billion at September 30, 2023. Non-interest-bearing deposits were $529.5 million as of September 30, 2024, compared to $537.5 million as of June 30, 2024, a decrease of 1%, and $586.6 million as of September 30, 2023, a decrease of 10%. Non-interest-bearing deposits represented 23% of total deposits as of September 30, 2024.

The Company’s consolidated cost of funds was 2.04% for the third quarter of 2024, compared to 2.05% for the second quarter of 2024 and 1.40% for the third quarter 2023. The decrease in the Company’s consolidated cost of funds during the third quarter of 2024 compared to the prior periods was primarily due to the continued flattening of market interest rates for deposits across the Bank’s market areas and due to the retirement of $7.5 million of the Company’s subordinated debt, as previously disclosed in the second quarter of 2024. Bank-only cost of funds for the third quarter of 2024 was 2.02% compared to 1.98% for the second quarter of 2024 and 1.31% for the third quarter of 2023.

The ratio of loans to deposits was 78.0% as of September 30, 2024, compared to 79.3% as of June 30, 2024 and 76.8% as of September 30, 2023.

Net interest income was $21.2 million for the third quarter of 2024, compared to $20.9 million for the second quarter of 2024 and $21.6 million for the third quarter of 2023. Net interest margin was 3.44% in the third quarter of 2024, a decrease from 3.46% in the second quarter of 2024 and a decrease from 3.55% in the third quarter of 2023. Yield on interest-earning assets was 5.41% during the third quarter of 2024, compared to 5.44% during the second quarter of 2024 and 4.90% during the third quarter of 2023.

Noninterest income was $7.4 million for the third quarter of 2024, compared to $7.9 million for the second quarter of 2024, an decrease of 7% and compared to $10.1 million for the third quarter of 2023, an decrease of 26%. The decrease in noninterest income in the second quarter is related to the pre-tax gain of gain of approximately $953.6 thousand on the redemption of $7.5 million in subordinated debentures recognized in the second quarter of 2024. The decrease in noninterest income in the second quarter related to the third quarter in 2023 was due to the recognition of the Equitable Recovery Program grant in the amount of $6.2 million. Mortgage banking revenue during the third quarter of 2024 was $818 thousand, a decrease of $40 thousand, or 5%, from $858 thousand in the second quarter of 2024, and an increase of $14 thousand, or 2%, from $804 thousand in the third quarter of 2023. During the third quarter of 2024, the Bank retained $3.6 million of the $37.3 million in secondary market mortgages originated to hold in-house, compared to $28.6 million secondary market loans originated during the third quarter of 2023, of which $3.1 million were retained to hold in-house.

Noninterest expense was $20.0 million for the third quarter of 2024, compared to $19.7 million for the second quarter of 2024 and $20.0 million for the third quarter of 2023.

As of September 30, 2024, tangible common book value per share (non-GAAP) was $23.97. According to OTCQX, there were 451 trades of the Company’s shares of common stock during the third quarter of 2024 for a total of 146,732 shares and for a total price of $5,251,604. The closing price of the Company’s common stock quoted on OTCQX on September 30, 2024 was $38.50 per share. Based on this closing share price, the Company’s market capitalization was $209.1 million as of September 30, 2024.

Credit Quality

The Company recorded a provision for credit losses of $525 thousand during the third quarter of 2024, compared to a provision of $525 thousand for the second quarter of 2024 and a provision of $875 thousand for the third quarter of 2023. The Company continues to closely monitor the continued economic uncertainty, especially in the commercial real estate market, as discussed below.

The Company recorded $944 thousand of net loan charge-offs in the third quarter of 2024, compared to $1.1 million in the second quarter of 2024 and $413 thousand in the third quarter of 2023. Non-performing assets, excluding restructured loans, to total assets were 0.47% for the third quarter of 2024, compared to 0.41% for the second quarter of 2024 and 0.47% for the third quarter of 2023. Annualized net charge-offs to average loans for the third quarter of 2024 were 0.05% compared to annualized net charge-offs of 0.06% for the second quarter of 2024 and 0.02% for the third quarter of 2023.

As of September 30, 2024, the allowance for credit losses equaled $23.3 million, compared to $23.7 million as of June 30, 2024 and $23.7 million as of September 30, 2023. Allowance for credit losses as a percentage of total loans was 1.27% at September 30, 2024, compared to 1.29% at June 30, 2024 and 1.33% at September 30, 2023. Allowance for credit losses as a percentage of nonperforming loans was 176% at September 30, 2024, compared to 208% at June 30, 2024 and 185% at September 30, 2023.

The Company continues to closely monitor credit quality in light of the continued economic uncertainty due to the prolonged elevated interest rate environment and persistent inflationary pressures in the United States and our market areas. Accordingly, additional provisions for credit losses may be necessary in future periods.

Liquidity and Capital Position

Liquidity – We have a limited reliance on wholesale funding and currently have no brokered deposits. We currently have the capacity to borrow up to approximately $910.5 million from the FHLB, $14.7 million from the FRB Discount Window and an estimated additional $60.0 million in funding through several relationships with correspondent banks.

Capital Requirements and the Community Bank Leverage Ratio Framework – Pursuant to federal regulations, bank holding companies and banks, like the Company and the Bank, must maintain capital levels commensurate with the level of risk to which they are exposed, including the volume and severity of problem loans. Federal banking regulations implementing the international regulatory capital framework, referred to as the “Basel III Rules,” apply to both depository institutions and (subject to certain exceptions not applicable to the Company) their holding companies. The Basel III Rules also establish a “capital conservation buffer” of 2.5% above the regulatory minimum risk-based capital requirements. The Basel III minimum capital ratios with the full capital conservation buffer are summarized in the table below.

|

Basel III |

Basel III |

Basel III Ratio |

||||

|

Total Risk-Based Capital (total capital to risk weighted assets) |

8.00 % |

2.50 % |

10.50 % |

|||

|

Tier 1 Risk-Based Capital (tier 1 to risk weighted assets) |

6.00 % |

2.50 % |

8.50 % |

|||

|

Tier 1 Leverage Ratio (tier 1 to average assets)(1) |

4.00 % |

N/A |

4.00 % |

|||

|

Common Equity Tier 1 Risk-Based Capital (CET1 to risk weighted assets) |

4.50 % |

2.50 % |

7.00 % |

|||

|

(1) The capital conservation buffer is not applicable to Tier 1 Leverage Ratio. |

||||||

On September 17, 2019, the federal banking agencies jointly finalized a rule intended to simplify the Basel III regulatory capital requirements described above for qualifying community banking organizations that opt into the Community Bank Leverage Ratio (“CBLR”) framework, as required by Section 201 of the Economic Growth, Regulatory Relief, and Consumer Protection Act. The final rule became effective on January 1, 2020, and the CBLR framework became available for banks to use beginning with their March 31, 2020 Call Reports. Under the final rule, if a qualifying community banking organization opts into the CBLR framework and meets all requirements under the framework, it will be considered to have met the “well-capitalized” regulatory capital ratio requirements under the “prompt corrective action” regulations promulgated by the federal banking agencies and will not be required to report or calculate risk-based capital under the Basel III Rules. In order to qualify for the CBLR framework, a community banking organization must have a tier 1 leverage ratio of greater than 9.0%, less than $10 billion in total consolidated assets, and limited amounts of off-balance-sheet exposures and trading assets and liabilities.

The Company and the Bank are qualifying community banking organizations and, on June 15, 2022, the Company and the Bank elected to opt into the CBLR framework. However, the Company currently operates under the Small Bank Holding Company Policy Statement of the Board of Governors of the Federal Reserve System (the “Federal Reserve”) and, therefore, is not currently subject to the Federal Reserve’s consolidated capital reporting requirements. Accordingly, the Company’s election to opt into the CBLR framework will commence for the first reporting period for which the Company no longer operates under the Federal Reserve’s Small Bank Holding Company Policy Statement, at which time the Company will become subject to the Federal Reserve’s consolidated capital requirements.

By electing to opt into the CBLR framework, the Company and the Bank are not required to report or calculate risk-based capital under the Basel III Rules described above. As of September 30, 2024, the Bank’s bank-only CBLR amounted to 11.23%. While the Company is currently not subject to the Federal Reserve’s consolidated capital requirements, as discussed above, the Company’s consolidated CBLR would have amounted to 12.50% as of September 30, 2024. These levels exceeded the 9.0% minimum CBLR necessary to be deemed “well-capitalized.”

Included in shareholders’ equity at September 30, 2024 was an unrealized loss in accumulated other comprehensive income of $7.4 million related to the unrealized loss in the Company’s investment securities portfolio primarily due to continued elevated market interest rates during the period. At September 30, 2024, the composition of the Bank’s investment securities portfolio includes $234 million, or 43%, classified as available-for-sale, and $312 million, or 57%, classified as held to maturity. All investments in our investment securities portfolio are expected to mature at par value.

Our investment securities portfolio made up 19.5% of our total assets at September 30, 2024, compared to 20.0% and 20.9% at June 30, 2024 and September 30, 2023, respectively.

ABOUT BANKFIRST CAPITAL CORPORATION

BankFirst Capital Corporation BFCC is a registered bank holding company headquartered in Columbus, Mississippi with approximately $2.8 billion in total assets as of September 30, 2024. BankFirst Financial Services, the Company’s wholly-owned banking subsidiary, was founded in 1888 and is locally owned, controlled, and operated. The Bank is headquartered in Macon, Mississippi, and operates additional branch offices in Coldwater, Columbus, Flowood, Hattiesburg, Hernando, Independence, Jackson, Louin, Madison, Newton, Oxford, Senatobia, Southaven, Starkville, Tupelo, Water Valley, and West Point, Mississippi; and Addison, Aliceville, Arley, Bear Creek, Carrollton, Curry, Double Springs, Fayette, Gordo, Haleyville, Northport, and Tuscaloosa, Alabama. The Bank also operates four loan production offices in Biloxi and Brookhaven, Mississippi, and in Birmingham and Huntsville, Alabama. BankFirst offers a wide variety of services for businesses and consumers. The Bank also offers internet banking, no-fee ATM access, checking, CD, and money market accounts, merchant services, mortgage loans, remote deposit capture, and more. For more information, visit www.BankFirstfs.com.

NON-GAAP FINANCIAL MEASURES

Some of the financial measures included in this press release are not measures of financial performance recognized in accordance with generally accepted accounting principles in the United States (“GAAP”). These non-GAAP financial measures include tangible book value per share. The Company believes these non-GAAP financial measures provide both management and investors a more complete understanding of the Company’s financial position and performance. These non-GAAP financial measures are supplemental and are not a substitute for any analysis based on GAAP financial measures.

We classify a financial measure as being a non-GAAP financial measure if that financial measure excludes or includes amounts, or is subject to adjustments that have the effect of excluding or including amounts, that are included or excluded, as the case may be, in the most directly comparable measure calculated and presented in accordance with GAAP as in effect from time to time in the United States in our statements of income, balance sheets or statements of cash flows. Not all companies use the same calculation of these measures; therefore, this presentation may not be comparable to other similarly titled measures as presented by other companies.

A reconciliation of non-GAAP financial measures to GAAP financial measures is provided at the end of this press release.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This press release contains, among other things, certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including, without limitation, statements regarding certain of the Company’s goals and expectations with respect to future events that are subject to various risks and uncertainties, and statements preceded by, followed by, or that include the words “may,” “will,” “could,” “should,” “expect,” “plan,” “project,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “pursuant,” “target,” “continue,” and similar expressions. These statements are based upon the current belief and expectations of the Company’s management team and are subject to significant risks and uncertainties that are subject to change based on various factors (many of which are beyond the Company’s control). Factors that could cause actual results to differ materially from management’s projections, forecasts, estimates and expectations include, but are not limited to: the impact on us or our customers of a decline in general economic conditions and any regulatory responses thereto; potential recession in the United States and our market areas; the impacts related to or resulting from bank failures and any continuation of uncertainty in the banking industry, including the associated impact to the Company and other financial institutions of any regulatory changes or other mitigation efforts taken by government agencies in response thereto; increased competition for deposits and related changes in deposit customer behavior; the impact of changes in market interest rates, whether due to the current elevated interest rate environment or future reductions in interest rates and a resulting decline in net interest income; the resurgence of elevated levels of inflation or inflationary pressures in the United States and our market areas; the uncertain impacts of ongoing quantitative tightening and current and future monetary policies of the Federal Reserve; increases in unemployment rates in the United States and our market areas; declines in commercial real estate values and prices; uncertainty regarding United States fiscal debt, deficit and budget matters; cyber incidents or other failures, disruptions or breaches of our operational or security systems or infrastructure, or those of our third-party vendors or other service providers, including as a result of cyber attacks; severe weather, natural disasters, acts of war or terrorism, geopolitical instability or other external events; the impact of changes in U.S. presidential administrations or Congress; the maintenance and development of well-established and valued client relationships and referral source relationships; acquisition or loss of key production personnel; changes in tax laws; the risks related to the development, implementation, use and management of emerging technologies, including artificial intelligence and machine learnings; potential increased regulatory requirements and costs related to the transition and physical impacts of climate change; and current or future litigation, regulatory examinations or other legal and/or regulatory actions. These forward-looking statements are based on current information and/or management’s good faith belief as to future events. Although the Company believes that the assumptions underlying the forward-looking statements are reasonable, any of the assumptions could prove to be inaccurate. Therefore, the Company can give no assurance that the results contemplated in the forward-looking statements will be realized. Due to these and other possible uncertainties and risks, readers are cautioned not to place undue reliance on the forward-looking statements contained in this press release. The inclusion of this forward-looking information should not be construed as a representation by the Company or any person that the future events, plans or expectations contemplated by the Company will be achieved. All subsequent written and oral forward-looking statements attributable to the Company or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above. The forward-looking statements are made as of the date of this press release. The Company does not undertake any obligation to update any forward-looking statement to reflect circumstances or events that occur after the date the forward-looking statements are made, except as required by law. All forward-looking statements, express or implied, included in the press release are qualified in their entirety by this cautionary statement.

AVAILABLE INFORMATION

The Company maintains an Internet web site at www.BankFirstfs.com/about/investor-relations. The Company makes available, free of charge, on its web site the Company’s annual reports, quarterly earnings reports, and other press releases. In addition, the OTC Markets Group maintains an Internet site that contains reports, proxy and information statements, and other information regarding the Company (at www.otcmarkets.com/stock/BFCC/overview).

The Company routinely posts important information for investors on its web site (under www.BankFirstfs.com and, more specifically, under the Investor Relations tab at www.BankFirstfs.com/about/investor-relations). The Company intends to use its web site as a means of disclosing material non-public information and for complying with its disclosure obligations under the OTC Markets Group OTCQX Rules for U.S. Banks. Accordingly, investors should monitor the Company’s web site, in addition to following the Company’s press releases, OTC filings, public conference calls, presentations and webcasts.

The information contained on, or that may be accessed through, the Company’s web site is not incorporated by reference into, and is not a part of, this press release.

Member FDIC

|

BankFirst Capital Corporation |

|||||||||

|

September 30 |

June 30 |

March 31 |

December 31 |

September 30 |

|||||

|

2024 |

2024 |

2024 |

2023 |

2023 |

|||||

|

Assets |

|||||||||

|

Cash and due from banks |

$ 105,825 |

$ 101,285 |

$ 112,028 |

$ 51,829 |

$ 60,454 |

||||

|

Interest bearing bank balances |

93,784 |

43,293 |

64,967 |

61,264 |

73,114 |

||||

|

Federal funds sold |

50 |

1,350 |

200 |

14,500 |

18,075 |

||||

|

Securities available for sale at fair value |

234,474 |

232,819 |

234,243 |

235,970 |

234,392 |

||||

|

Securities held to maturity |

311,756 |

317,293 |

323,523 |

328,013 |

332,799 |

||||

|

Loans |

1,835,311 |

1,839,640 |

1,806,925 |

1,813,168 |

1,783,089 |

||||

|

Allowance for credit losses |

(23,301) |

(23,720) |

(24,332) |

(24,084) |

(23,684) |

||||

|

Loans, net of allowance for credit losses |

1,812,010 |

1,815,920 |

1,782,593 |

1,789,084 |

1,759,405 |

||||

|

Premises and equipment |

68,035 |

67,224 |

66,586 |

66,217 |

64,196 |

||||

|

Interest receivable |

11,811 |

11,891 |

11,831 |

11,286 |

10,079 |

||||

|

Goodwill |

66,966 |

66,966 |

66,966 |

66,966 |

66,966 |

||||

|

Other intangible assets |

10,074 |

10,480 |

10,885 |

11,290 |

11,695 |

||||

|

Other |

87,312 |

89,247 |

87,911 |

89,375 |

84,099 |

||||

|

Total assets |

$ 2,802,097 |

$ 2,757,768 |

$ 2,761,733 |

$ 2,727,769 |

$ 2,715,274 |

||||

|

Liabilities and Stockholders’ Equity |

|||||||||

|

Liabilities |

|||||||||

|

Noninterest bearing deposits |

$ 529,533 |

$ 537,515 |

$ 518,369 |

$ 545,024 |

$ 586,301 |

||||

|

Interest bearing deposits |

1,823,231 |

1,782,710 |

1,805,512 |

1,744,111 |

1,697,616 |

||||

|

Total deposits |

2,352,764 |

2,320,225 |

2,323,881 |

2,289,135 |

2,283,917 |

||||

|

Notes payable |

5,793 |

6,330 |

6,868 |

7,405 |

7,943 |

||||

|

Subordinated debt |

22,142 |

22,146 |

29,651 |

29,635 |

29,619 |

||||

|

Interest payable |

7,955 |

8,137 |

7,039 |

6,086 |

4,418 |

||||

|

Other |

21,043 |

18,818 |

17,887 |

20,599 |

25,350 |

||||

|

Total liabilities |

2,409,697 |

2,375,656 |

2,385,326 |

2,355,332 |

2,351,247 |

||||

|

Stockholders’ Equity |

|||||||||

|

Preferred stock |

188,680 |

188,680 |

188,680 |

188,680 |

188,680 |

||||

|

Common stock |

1,629 |

1,631 |

1,633 |

1,620 |

1,620 |

||||

|

Additional paid-in capital |

62,731 |

62,741 |

62,396 |

62,065 |

61,779 |

||||

|

Retained earnings |

146,759 |

141,251 |

135,561 |

130,557 |

128,925 |

||||

|

Accumulated other comprehensive income |

(7,399) |

(12,191) |

(11,863) |

(10,485) |

(16,977) |

||||

|

Total stockholders’ equity |

392,400 |

382,112 |

376,407 |

372,437 |

364,027 |

||||

|

Total liabilities and stockholders’ equity |

$ 2,802,097 |

$ 2,757,768 |

$ 2,761,733 |

$ 2,727,769 |

$ 2,715,274 |

||||

|

Common shares outstanding |

5,431,551 |

5,436,106 |

5,444,930 |

5,399,972 |

5,399,367 |

||||

|

Book value per common share |

$ 37.51 |

$ 35.58 |

$ 34.48 |

$ 34.03 |

$ 32.48 |

||||

|

Tangible book value per common share |

$ 23.97 |

$ 21.34 |

$ 20.18 |

$ 19.54 |

$ 17.91 |

||||

|

Securitites held to maturity (fair value) |

$ 271,129 |

$ 264,807 |

$ 271,724 |

$ 279,117 |

$ 264,859 |

||||

|

BankFirst Capital Corporation |

|||||||

|

For Three Months Ended |

For the Nine Months Ended |

||||||

|

September |

June |

September |

September |

||||

|

2024 |

2024 |

2024 |

2023 |

||||

|

Interest Income |

|||||||

|

Interest and fees on loans |

$ 28,810 |

$ 28,118 |

$ 83,274 |

$ 70,967 |

|||

|

Taxable securities |

3,336 |

3,441 |

10,135 |

11,051 |

|||

|

Tax-exempt securities |

514 |

517 |

1,551 |

2,219 |

|||

|

Federal funds sold |

4 |

10 |

26 |

1,157 |

|||

|

Interest bearing bank balances |

749 |

802 |

2,344 |

393 |

|||

|

Total interest income |

33,413 |

32,888 |

97,330 |

85,787 |

|||

|

Interest Expense |

|||||||

|

Deposits |

11,748 |

11,438 |

33,637 |

15,804 |

|||

|

Short-term borrowings |

6 |

7 |

14 |

141 |

|||

|

Federal Home Loan Bank advances |

– |

– |

– |

358 |

|||

|

Other borrowings |

445 |

542 |

1,558 |

1,682 |

|||

|

Total interest expense |

12,199 |

11,987 |

35,209 |

17,985 |

|||

|

Net Interest Income |

21,214 |

20,901 |

62,121 |

67,802 |

|||

|

Provision for Credit Losses |

525 |

525 |

1,575 |

1,625 |

|||

|

Net Interest Income After Provision for Loan Losses |

20,689 |

20,376 |

60,546 |

66,177 |

|||

|

Noninterest Income |

|||||||

|

Service charges on deposit accounts |

2,579 |

2,445 |

7,503 |

7,523 |

|||

|

Mortgage income |

818 |

858 |

2,350 |

1,974 |

|||

|

Interchange income |

1,370 |

1,665 |

4,466 |

4,124 |

|||

|

Net realized gains (losses) on available-for-sale securities |

– |

(194) |

(194) |

(1,403) |

|||

|

Gains (losses) on retirement of subordinated debt |

– |

956 |

956 |

||||

|

Grant Income |

280 |

280 |

6,197 |

||||

|

Other |

2,412 |

2,128 |

6,602 |

3,311 |

|||

|

Total noninterest income |

7,459 |

7,858 |

21,963 |

21,726 |

|||

|

Noninterest Expense |

|||||||

|

Salaries and employee benefits |

10,938 |

11,252 |

33,250 |

31,888 |

|||

|

Net occupancy expenses |

1,285 |

1,236 |

3,864 |

3,920 |

|||

|

Equipment and data processing expenses |

1,774 |

1,790 |

5,537 |

5,656 |

|||

|

Other |

6,021 |

5,437 |

17,056 |

18,534 |

|||

|

Total noninterest expense |

20,018 |

19,715 |

59,707 |

59,998 |

|||

|

Income Before Income Taxes |

8,130 |

8,519 |

22,802 |

27,905 |

|||

|

Provision for Income Taxes |

1,767 |

1,997 |

4,913 |

6,196 |

|||

|

Net Income |

$ 6,363 |

$ 6,522 |

$ 17,889 |

$ 21,709 |

|||

|

Basic/Diluted Earnings Per Common Share |

$ 0.97 |

$ 1.09 |

$ 2.99 |

$ 4.03 |

|||

|

BankFirst Capital Corporation |

|||||||||

|

Quarter Ended |

|||||||||

|

September 30 |

June 30 |

March 31 |

December 31 |

September 30 |

|||||

|

2024 |

2024 |

2024 |

2023 |

2023 |

|||||

|

Interest Income |

|||||||||

|

Interest and fees on loans |

$ 28,810 |

$ 27,983 |

$ 26,481 |

$ 26,161 |

$ 25,027 |

||||

|

Taxable securities |

3,336 |

3,441 |

3,358 |

3,483 |

3,583 |

||||

|

Tax-exempt securities |

514 |

517 |

520 |

530 |

533 |

||||

|

Federal funds sold |

4 |

10 |

12 |

202 |

333 |

||||

|

Interest bearing bank balances |

749 |

802 |

793 |

841 |

354 |

||||

|

Total interest income |

33,413 |

32,753 |

31,164 |

31,217 |

29,830 |

||||

|

Interest Expense |

|||||||||

|

Deposits |

11,748 |

11,438 |

10,451 |

9,036 |

7,250 |

||||

|

Short-term borrowings |

6 |

7 |

1 |

– |

42 |

||||

|

Federal Home Loan Bank advances |

– |

– |

– |

– |

336 |

||||

|

Other borrowings |

445 |

542 |

571 |

582 |

590 |

||||

|

Total interest expense |

12,199 |

11,987 |

11,023 |

9,618 |

8,218 |

||||

|

Net Interest Income |

21,214 |

20,766 |

20,141 |

21,599 |

21,612 |

||||

|

Provision for Loan Losses |

525 |

525 |

525 |

360 |

875 |

||||

|

Net Interest Income After Provision for Credit Losses |

20,689 |

20,241 |

19,616 |

21,239 |

20,737 |

||||

|

Noninterest Income |

|||||||||

|

Service charges on deposit accounts |

2,579 |

2,445 |

2,479 |

2,477 |

2,298 |

||||

|

Mortgage income |

818 |

858 |

674 |

542 |

683 |

||||

|

Interchange income |

1,370 |

1,665 |

1,431 |

1,355 |

1,263 |

||||

|

Net realized gains (losses) on available-for-sale securities |

– |

(194) |

– |

112 |

(1,471) |

||||

|

Gains (losses) on retirement of subordinated debt |

– |

956 |

– |

– |

– |

||||

|

Grant Income |

280 |

– |

– |

– |

6,197 |

||||

|

Other |

2,412 |

2,263 |

1,927 |

1,636 |

1,132 |

||||

|

Total noninterest income |

7,459 |

7,993 |

6,511 |

6,122 |

10,102 |

||||

|

Noninterest Expense |

|||||||||

|

Salaries and employee benefits |

10,938 |

11,252 |

11,060 |

10,065 |

10,267 |

||||

|

Net occupancy expenses |

1,285 |

1,236 |

1,343 |

1,275 |

1,351 |

||||

|

Equipment and data processing expenses |

1,774 |

1,790 |

1,973 |

3,824 |

1,836 |

||||

|

Other |

6,021 |

5,437 |

5,598 |

4,043 |

6,584 |

||||

|

Total noninterest expense |

20,018 |

19,715 |

19,974 |

19,207 |

20,038 |

||||

|

Income Before Income Taxes |

8,130 |

8,519 |

6,153 |

8,154 |

10,801 |

||||

|

Provision for Income Taxes |

1,767 |

1,997 |

1,149 |

1,662 |

2,440 |

||||

|

Net Income |

$ 6,363 |

$ 6,522 |

$ 5,004 |

$ 6,492 |

$ 8,361 |

||||

|

Basic/Diluted Earnings Per Common Share |

$ 0.97 |

$ 1.09 |

$ 0.93 |

$ 1.20 |

$ 1.55 |

||||

|

BankFirst Capital Corporation |

||||||||||

|

September 30 |

June 30 |

March 31 |

December 31 |

September 30 |

||||||

|

Asset Quality |

2024 |

2024 |

2024 |

2023 |

2023 |

|||||

|

Nonaccrual Loans |

13,182 |

11,292 |

11,420 |

9,615 |

12,716 |

|||||

|

Restructured Loans |

4,599 |

5,102 |

5,178 |

5,303 |

8,209 |

|||||

|

OREO |

– |

– |

64 |

1 |

1 |

|||||

|

90+ still accruing |

31 |

138 |

75 |

520 |

107 |

|||||

|

Non-performing Assets (excluding restructured)1 |

13,213 |

11,430 |

11,559 |

10,136 |

12,824 |

|||||

|

Allowance for credit loss to total loans |

1.27 % |

1.29 % |

1.35 % |

1.33 % |

1.33 % |

|||||

|

Allowance for credit loss to non-performing assets1 |

176 % |

208 % |

211 % |

237 % |

185 % |

|||||

|

Non-performing assets1 to total assets |

0.47 % |

0.41 % |

0.42 % |

0.37 % |

0.47 % |

|||||

|

Non-performing assets1 to total loans and OREO |

0.72 % |

0.62 % |

0.64 % |

0.56 % |

0.72 % |

|||||

|

Annualized net charge-offs to average loans |

0.05 % |

0.06 % |

0.02 % |

0.00 % |

0.02 % |

|||||

|

Net charge-offs (recoveries) |

944 |

1,137 |

277 |

– |

413 |

|||||

|

Capital Ratios 2 |

||||||||||

|

CET1 Ratio |

7.36 % |

6.88 % |

6.58 % |

6.49 % |

6.16 % |

|||||

|

CET1 Capital |

137,619 |

131,735 |

125,316 |

119,580 |

113,663 |

|||||

|

Tier 1 Ratio |

18.25 % |

17.51 % |

17.25 % |

17.52 % |

17.19 % |

|||||

|

Tier 1 Capital |

340,941 |

335,066 |

328,652 |

322,916 |

317,004 |

|||||

|

Total Capital Ratio |

19.90 % |

19.15 % |

19.29 % |

19.58 % |

19.25 % |

|||||

|

Total Capital |

371,820 |

366,506 |

367,498 |

360,996 |

355,088 |

|||||

|

Risk Weighted Assets |

1,868,584 |

1,913,609 |

1,905,373 |

1,843,587 |

1,844,314 |

|||||

|

Tier 1 Leverage Ratio |

12.50 % |

12.49 % |

12.39 % |

12.17 % |

12.15 % |

|||||

|

Total Average Assets for Leverage Ratio |

2,728,597 |

2,683,525 |

2,653,494 |

2,653,106 |

2,609,072 |

|||||

|

1. The restructured loan balance above includes performing and non-performing loans. The non-performing assets includes Nonaccrual loans, 2. Since the Company has total consolidated assets of less than $3 billion, the Company is not subject to regulatory capital requirements. |

||||||||||

|

BankFirst Capital Corporation |

|||||||||

|

September 30 |

June 30 |

March 31 |

December 31 |

September 30 |

|||||

|

2024 |

2024 |

2024 |

2023 |

2023 |

|||||

|

Book value per common share – GAAP |

$ 37.51 |

$ 35.58 |

$ 34.48 |

$ 34.03 |

$ 32.48 |

||||

|

Total common stockholders’ equity – GAAP |

203,720 |

193,432 |

187,727 |

183,757 |

175,347 |

||||

|

Adjustment for Intangibles |

73,500 |

73,888 |

77,851 |

78,256 |

78,661 |

||||

|

Tangible common stockholders’ equity – non-GAAP |

130,220 |

119,544 |

109,876 |

109,095 |

96,686 |

||||

|

Tangible book value per common share – non-GAAP |

$ 23.97 |

$ 21.34 |

$ 20.18 |

$ 19.54 |

$ 17.91 |

||||

![]() View original content:https://www.prnewswire.com/news-releases/bankfirst-capital-corporation-reports-third-quarter-2024-earnings-of-6-4-million-302289079.html

View original content:https://www.prnewswire.com/news-releases/bankfirst-capital-corporation-reports-third-quarter-2024-earnings-of-6-4-million-302289079.html

SOURCE BankFirst Capital Corporation

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

AllianceBernstein Global High Income Fund, Inc. RELEASES MONTHLY PORTFOLIO UPDATE

AllianceBernstein Global High Income Fund, Inc.

Top 10 Fixed-Income Holdings

Portfolio %

1) U.S. Treasury Notes 2.25%, 02/15/27

1.06 %

2) CCO Holdings 4.50%, 08/15/30 – 06/01/33

0.78 %

3) CCO Holdings 4.75%, 02/01/32

0.63 %

4) Dominican Republic Intl Bond 8.625%, 04/20/27

0.60 %

5) Royal Caribbean Cruises 5.50%, 08/31/26 – 04/01/28

0.53 %

6) AMMC CLO 25 Ltd. 12.051%, 04/15/35

0.51 %

7) DaVita, Inc. 4.625%, 06/01/30

0.46 %

8) Allied Universal Holdco/Allied Universal Finance Corp. 4.625%, 06/01/28

0.42 %

9) Palmer Square CLO Ltd. 11.713%, 01/15/35

0.42 %

10) Bausch Health Cos., Inc. 4.875%, 06/01/28

0.40 %

Investment Type

Portfolio %

Corporates – Non-Investment Grade

Industrial

Energy

7.93 %

Consumer Non-Cyclical

7.51 %

Communications – Media

6.61 %

Capital Goods

4.72 %

Basic

4.30 %

Consumer Cyclical – Other

3.83 %

Consumer Cyclical – Retailers

3.52 %

Communications – Telecommunications

3.35 %

Services

2.70 %

Consumer Cyclical – Automotive

2.57 %

Technology

1.86 %

Consumer Cyclical – Entertainment

1.71 %

Transportation – Services

1.24 %

Transportation – Airlines

1.14 %

Consumer Cyclical – Restaurants

0.52 %

Other Industrial

0.45 %

SUBTOTAL

53.96 %

Credit Default Swaps

14.50 %

Financial Institutions

Finance

2.23 %

Brokerage

1.14 %

REITs

1.09 %

Insurance

1.00 %

Other Finance

0.71 %

Banking

0.67 %

SUBTOTAL

6.84 %

Utility

Electric

1.07 %

Natural Gas

0.06 %

SUBTOTAL

1.13 %

SUBTOTAL

76.43 %

Corporates – Investment Grade

Financial Institutions

Banking

4.15 %

Insurance

1.02 %

Finance

0.64 %

REITs

0.38 %

Brokerage

0.17 %

SUBTOTAL

6.36 %

Industrial

Communications – Media

1.28 %

Energy

1.24 %

Consumer Cyclical – Other

0.82 %

Consumer Cyclical – Automotive

0.79 %

Basic

0.68 %

Consumer Non-Cyclical

0.44 %

Consumer Cyclical – Retailers

0.24 %

Transportation – Services

0.22 %

Consumer Cyclical – Entertainment

0.17 %

Transportation – Airlines

0.13 %

Capital Goods

0.12 %

Other Industrial

0.05 %

Technology

0.04 %

Services

0.03 %

Transportation – Railroads

0.03 %

SUBTOTAL

6.28 %

Utility

Electric

1.48 %

Other Utility

0.05 %

SUBTOTAL

1.53 %

SUBTOTAL

14.17 %

Emerging Markets – Corporate Bonds

Industrial

Basic

1.87 %

Energy

1.13 %

Consumer Cyclical – Other

1.00 %

Consumer Non-Cyclical

0.73 %

Communications – Media

0.21 %

Communications – Telecommunications

0.20 %

Capital Goods

0.18 %

Consumer Cyclical – Retailers

0.14 %

Services

0.04 %

Consumer Cyclical – Automotive

0.02 %

Transportation – Services

0.02 %

SUBTOTAL

5.54 %

Utility

Electric

0.37 %

Other Utility

0.07 %

SUBTOTAL

0.44 %

Financial Institutions

Banking

0.12 %

SUBTOTAL

0.12 %

SUBTOTAL

6.10 %

Interest Rate Futures

3.60 %

Collateralized Loan Obligations

CLO – Floating Rate

3.30 %

SUBTOTAL

3.30 %

Bank Loans

Industrial

Consumer Non-Cyclical

0.71 %

Communications – Media

0.43 %

Technology

0.42 %

Communications – Telecommunications

0.36 %

Energy

0.34 %

Capital Goods

0.21 %

Other Industrial

0.15 %

Consumer Cyclical – Retailers

0.05 %

Consumer Cyclical – Restaurants

0.02 %

Transportation – Airlines

0.02 %

SUBTOTAL

2.71 %

Financial Institutions

Insurance

0.32 %

Finance

0.02 %

SUBTOTAL

0.34 %

SUBTOTAL

3.05 %

Collateralized Mortgage Obligations

Risk Share Floating Rate

2.01 %

Non-Agency Fixed Rate

0.32 %

Non-Agency Floating Rate

0.29 %

Agency Fixed Rate

0.21 %

SUBTOTAL

2.83 %

Emerging Markets – Sovereigns

2.38 %

U.S. Govt & Agency Securities

1.65 %

Quasi-Sovereigns

Quasi-Sovereign Bonds

1.31 %

SUBTOTAL

1.31 %

EM Government Agencies

0.65 %

Local Governments – US Municipal Bonds

0.40 %

Commercial Mortgage-Backed Securities

Non-Agency Fixed Rate CMBS

0.35 %

SUBTOTAL

0.35 %

Asset-Backed Securities

Other ABS – Floating Rate

0.25 %

Autos – Fixed Rate

0.08 %

SUBTOTAL

0.33 %

Inflation-Linked Securities

0.24 %

Common Stocks

0.14 %

Preferred Stocks

Industrials

0.09 %

SUBTOTAL

0.09 %

Governments – Sovereign Agencies

0.05 %

Forward Currency Exchange Contracts

Currency Instruments

-0.09 %

SUBTOTAL

-0.09 %

Reverse Repurchase Agreements

-0.78 %

Cash & Cash Equivalents

Cash

1.50 %

Funds and Investment Trusts

0.28 %

SUBTOTAL

1.78 %

Derivative Offsets

Futures Offsets

-3.58 %

Swap Offsets

-14.40 %

SUBTOTAL

-17.98 %

TOTAL

100.00 %

Country Breakdown

Portfolio %

United States

68.84 %

United Kingdom

3.35 %

Canada

2.31 %

France

2.29 %

Germany

1.77 %

Mexico

1.51 %

Brazil

1.48 %

Colombia

1.39 %

Spain

1.28 %

Luxembourg

1.14 %

Italy

1.11 %

India

0.97 %

Chile

0.86 %

Dominican Republic

0.85 %

Israel

0.84 %

South Africa

0.67 %

Australia

0.65 %

Macau

0.63 %

Peru

0.58 %

China

0.57 %

Netherlands

0.56 %

Nigeria

0.53 %

Hong Kong

0.52 %

Kazakhstan

0.37 %

Puerto Rico

0.37 %

Angola

0.32 %

Finland

0.32 %

Switzerland

0.31 %

Turkey

0.31 %

Ireland

0.30 %

Indonesia

0.27 %

El Salvador

0.25 %

Zambia

0.25 %

Egypt

0.24 %

Slovenia

0.21 %

Romania

0.20 %

Norway

0.19 %

Jersey (Channel Islands)

0.17 %

Ukraine

0.15 %

Panama

0.14 %

Guatemala

0.12 %

Azerbaijan

0.11 %

Malaysia

0.08 %

Japan

0.07 %

Argentina

0.05 %

Jamaica

0.05 %

United Republic of Tanzania

0.05 %

Czech Republic

0.04 %

Kuwait

0.04 %

Morocco

0.04 %

Cash & Cash Equivalents

0.28 %

Total Investments

100.00 %

Net Currency Exposure Breakdown

Portfolio %

US Dollar

100.00 %

Canadian Dollar

0.19 %

Pound Sterling

0.11 %

Dominican Peso

0.07 %

Norwegian Krone

0.02 %

Brazilian Real

0.01 %

Indonesian Rupiah

0.01 %

Indian Rupee

0.01 %

Chilean Peso

-0.01 %

South Korean Won

-0.01 %

New Zealand Dollar

-0.01 %

Polish Zloty

-0.01 %

Colombian Peso

-0.10 %

Euro

-0.28 %

Total Net Assets

100.00 %

Credit Rating

Portfolio %

AAA

1.47 %

AA

0.26 %

A

1.26 %

BBB

15.42 %

BB

47.40 %

B

22.00 %

CCC

7.92 %

CC

0.18 %

Not Rated

2.57 %

Short Term Investments

0.28 %

Reverse Repurchase Agreements

-0.78 %

N/A

2.02 %

Total

100.00 %

Bonds by Maturity

Portfolio %

Less than 1 Year

7.59 %

1 To 5 Years

64.31 %

5 To 10 Years

23.68 %

10 To 20 Years

2.33 %

20 To 30 Years

1.54 %

More than 30 Years

0.41 %

Other

0.14 %

Total Net Assets

100.00 %

Portfolio Statistics:

Average Coupon:

7.54 %

Average Bond Price:

97.11

Percentage of Leverage(based on gross assets):

Bank Borrowing:

0.00 %

Investment Operations:*

14.91 %

Preferred Stock:

0.00 %

Tender Option Bonds:

0.00 %

VMTP Shares:

0.00 %

VRDP Shares:

0.00 %

Total Fund Leverage:

14.91 %

Average Maturity:

4.71 Years

Effective Duration:

3.10 Years

Total Net Assets:

$989.33 Million

Net Asset Value:

$11.47

Total Number of Holdings:

1,256

Portfolio Turnover:

45.00 %

* Investment Operations may include the use of certain portfolio management techniques such as credit

default swaps, dollar rolls, negative cash, reverse repurchase agreements and when-issued securities.

The foregoing portfolio characteristics are as of the date indicated and can be expected to change. The

Fund is a closed-end U.S.-registered management investment company advised by AllianceBernstein L. P.

Hitek Global Inc. Announces First Half of Fiscal Year 2024 Financial Results

XIAMEN, China, Oct. 28, 2024 /PRNewswire/ — Hitek Global Inc. HKIT (the “Company”), a China-based information technology consulting and solutions service provider, today announced its unaudited financial results for the six months ended June 30, 2024.

Ms. Xiaoyang Huang, Chief Executive Officer and Director of Hitek Global Inc., commented, “We are pleased to report a solid performance for the first half of fiscal year 2024, as we continue to adapt to an evolving market environment. Despite facing challenges, particularly due to the implementation of Golden Tax Phase IV, which introduced new complexities for enterprises in managing their taxes, we have remained resilient. One of the key highlights of our financial performance is the increase in our gross profit margin, which rose to 52.0% for the six months ended June 30, 2024, compared to 50.9% in the same period last year. This improvement reflects our successful shift toward higher-margin revenue streams, especially in software sales, which continue to grow as we cater to larger clients. As we move forward, we are also actively expanding into new business modules to strengthen our market position. We are exploring strategic acquisitions and partnerships, particularly in the technical services, which we believe will offer immense growth potential. These moves are aligned with our long-term vision. By leveraging our expertise and seizing these emerging opportunities, we are confident in our ability to drive sustainable growth and deliver greater value to our shareholders.”

First Half 2024 Financial Highlights

- Revenue was $1.83 million for the six months ended June 30, 2024 compared to $2.95 million for the same period of last year.

- Gross profit was $0.95 million for the six months ended June 30, 2024 compared to $1.5 million for the same period of last year.

- Gross profit margin as a percentage of revenue increased to 52.0% for the six months ended June 30, 2024 from 50.9% for the same period of last year.

- Basic and diluted earnings per share was $0.01 for the six months ended June 30, 2024 compared to $0.05 for the same period of last year.

First Half 2024 Financial Results

Revenue

Total revenues were $1.83 million for the six months ended June 30, 2024, compared to $2.95 million for the same period of last year.

- Revenue generated from hardware sales was $0.75 million for the six months ended June 30, 2024, compared to $1.31 million for the same period of last year. The hardware sales decrease was mainly due to the decrease in our customers’ demands affected by the sluggish economic environment.

- Revenue generated from CIS software sales was $0.82 million for the six months ended June 30, 2024, increased by 6.1% from $0.78 million for the same period of last year. CIS software sales increased mainly due to the increase in software sales to large customers.

- Revenue generated from tax devices and services was $0.26 million for the six months ended June 30, 2024, compared to $0.86 million for the same period of last year. Tax devices and service sales decreased due to new policies that Xiamen tax authorities implemented the use of electronic invoices system to replace the prior tax control system.

Gross Profit and Gross Margin

Gross profit was $0.95 million for the six months ended June 30, 2024 compared to $1.5 million for the same period of last year.

Gross profit margin as a percentage of revenue increased to 52.0% for the six months ended June 30, 2024 from 50.9% for the same period of last year. This was mainly due to the increase of software sales, which has a relatively high gross profit margin compared with other revenue streams.

Operating Expenses

Operating expenses were $0.99 million for the six months ended June 30, 2024, decreased by 8.0% from $1.08 million for the same period of last year.

- Selling expenses were $9,844 for the six months ended June 30, 2024, increased by 2,928.9% from $325 for the same period of last year. Selling expenses were 0.5% of total revenues for the six months ended June 30, 2024 and 0.01% of total revenues in the comparable period of 2023. The increase results from marketing activities to attract new purchases from new and existing customers.

- General and administrative expenses were $1.32 million for the six months ended June 30, 2024, increased by 32.7% from $0.99 million for the same period of last year. The increase was mainly due to the increase in consulting fees for financing.

Operating loss was $0.37 million for the six months ended June 30, 2024 compared to operating income of $0.51 million for the comparable period of 2023. The decrease in operating income in 2024 was primarily due to the decrease in revenue and increase of general and administrative expenses.

Other Income

Other income was $0.66 million and $0.44 million for the six months ended June 30, 2024 and 2023, respectively. The increase was primarily due to the increase in interest income from loan receivables and increase of net investment income.

Net Income

As a result of the factors described above, net income was $0.12 million for the six months ended June 30, 2024, compared to $0.62 million for the comparable period of 2023.

Basic and Diluted Earnings per Share

Basic and diluted earnings per share was $0.01 for the six months ended June 30, 2024, compared to $0.05 for the same period of last year.

Balance Sheet

As of June 30, 2024, the Company had cash of $7.22 million, compared to $9.31 million as of December 31, 2023.

Cash Flow

Net cash provided by operating activities was $0.75 million for the six months ended June 30, 2024, compared to $0.20 million for the same period of last year.

Net cash used in investing activities was $11.03 million for the six months ended June 30, 2024, compared to $11.00 million for the same period of last year.

Net cash provided by financing activities was $8.20 million for the six months ended June 30, 2024, compared to $15.14 million for the same period of last year.

About Hitek Global Inc.

Hitek Global Inc., headquartered in Xiamen, China, is an information technology (“IT”) consulting and solutions service provider in China. The Company has two lines of business: 1) services to small and medium businesses, which consists of Anti-Counterfeiting Tax Control System (“ACTCS”) tax devices, ACTCS services, and IT services, and 2) services to large businesses, which consists of hardware sales and software sales. The Company’s vision is to become a one-stop consulting destination for holistic IT and other business consulting services in China. For more information, visit the Company’s website at http://ir.xmhitek.com/.

Forward-Looking Statements

This announcement contains forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact in this announcement are forward-looking statements. These forward-looking statements involve known and unknown risks and uncertainties and are based on current expectations and projections about future events and financial trends that the Company believes may affect its financial condition, results of operations, business strategy and financial needs. Investors can identify these forward-looking statements by words or phrases such as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “potential,” “continue,” “is/are likely to” or other similar expressions. The Company undertakes no obligation to update forward-looking statements to reflect subsequent occurring events or circumstances, or changes in its expectations, except as may be required by law. Although the Company believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that such expectations will turn out to be correct, and the Company cautions investors that actual results may differ materially from the anticipated results and encourages investors to review other factors that may affect its future results in the Company’s registration statement and in its other filings with the SEC.

For investor and media inquiries please contact:

Hitek Global Inc.

Investor Relations Department

Email: ir@xmhitek.com

![]() View original content:https://www.prnewswire.com/news-releases/hitek-global-inc-announces-first-half-of-fiscal-year-2024-financial-results-302288405.html

View original content:https://www.prnewswire.com/news-releases/hitek-global-inc-announces-first-half-of-fiscal-year-2024-financial-results-302288405.html

SOURCE HITEK GLOBAL INC

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

ALLIANCEBERNSTEIN CLOSED-END FUNDS ANNOUNCE DISTRIBUTION RATES

NEW YORK, Oct. 28, 2024 /PRNewswire/ — The AllianceBernstein Closed-End Funds declared the following distributions today:

|

FUND NAME AND DISTRIBUTIONS |