Brown & Brown, Inc. announces third quarter 2024 results, including total revenues of $1.2 billion, an increase of 11.0%; Organic Revenue growth of 9.5%; diluted net income per share of $0.81; and Diluted Net Income Per Share – Adjusted of $0.91

DAYTONA BEACH, Fla., Oct. 28, 2024 (GLOBE NEWSWIRE) — Brown & Brown, Inc. BRO (the “Company”) announced its unaudited financial results for the third quarter of 2024.

Revenues for the third quarter of 2024 under U.S. generally accepted accounting principles (“GAAP”) were $1.2 billion, increasing $118 million, or 11.0%, compared to the third quarter of the prior year, with commissions and fees increasing by 10.1% and Organic Revenue increasing by 9.5%. Income before income taxes was $317 million, increasing 31.0% from the third quarter of the prior year with Income Before Income Taxes Margin increasing to 26.7% from 22.7%. EBITDAC – Adjusted was $414 million, increasing 11.9% from the third quarter of the prior year with EBITDAC Margin – Adjusted increasing to 34.9% from 34.6%. Net income attributable to the Company was $234 million, increasing $58 million, or 33.0%, and diluted net income per share increased to $0.81, or 30.6%, with Diluted Net Income Per Share – Adjusted increasing to $0.91, or 12.3%, each as compared to the third quarter of the prior year.

Revenues for the nine months ended September 30, 2024 under GAAP were $3.6 billion, increasing $391 million, or 12.1%, as compared to the same period in 2023, with commissions and fees increasing by 11.0%, and Organic Revenue increasing by 9.4%. Income before income taxes was $1.0 billion, increasing 30.0% with Income Before Income Taxes Margin increasing to 28.4% from 24.5% as compared to the same period in 2023. EBITDAC – Adjusted was $1.3 billion, which was an increase of 15.4% and EBITDAC Margin – Adjusted increased to 35.9% from 34.9% as compared to the same period in 2023. Net income attributable to the Company was $783 million, increasing $181 million, or 30.1%, with diluted net income per share increasing to $2.73, or 29.4%, and Diluted Net Income Per Share – Adjusted increasing to $2.98, or 16.4%, each as compared to the same period in 2023.

J. Powell Brown, President and Chief Executive Officer of the Company, noted, “Our teammates delivered another outstanding quarter, and we have great momentum as we leverage our collective capabilities.”

| Reconciliation of Commissions and Fees to Organic Revenue (in millions, unaudited) |

||||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| Commissions and fees | $ | 1,155 | $ | 1,049 | $ | 3,545 | $ | 3,193 | ||||||||

| Profit-sharing contingent commissions | (27 | ) | (27 | ) | (110 | ) | (88 | ) | ||||||||

| Core commissions and fees | $ | 1,128 | $ | 1,022 | $ | 3,435 | $ | 3,105 | ||||||||

| Acquisitions | (35 | ) | (120 | ) | ||||||||||||

| Dispositions | (26 | ) | (81 | ) | ||||||||||||

| Foreign Currency Translation | 2 | 7 | ||||||||||||||

| Organic Revenue | $ | 1,093 | $ | 998 | $ | 3,315 | $ | 3,031 | ||||||||

| Organic Revenue growth | $ | 95 | $ | 284 | ||||||||||||

| Organic Revenue growth % | 9.5 | % | 9.4 | % | ||||||||||||

See information regarding non-GAAP measures presented later in this press release.

| Reconciliation of Diluted Net Income Per Share to Diluted Net Income Per Share – Adjusted (unaudited) |

||||||||||||||||||||||||||||||||

| Three Months Ended September 30, | Change | Nine Months Ended September 30, | Change | |||||||||||||||||||||||||||||

| 2024 | 2023 | $ | % | 2024 | 2023 | $ | % | |||||||||||||||||||||||||

| Diluted net income per share | $ | 0.81 | $ | 0.62 | $ | 0.19 | 30.6 | % | $ | 2.73 | $ | 2.11 | $ | 0.62 | 29.4 | % | ||||||||||||||||

| Change in estimated acquisition earn-out payables | (0.02 | ) | 0.09 | (0.11 | ) | (0.02 | ) | 0.09 | (0.11 | ) | ||||||||||||||||||||||

| (Gain)/loss on disposal | — | (0.01 | ) | 0.01 | (0.08 | ) | (0.02 | ) | (0.06 | ) | ||||||||||||||||||||||

| Acquisition/Integration Costs | — | — | — | — | 0.02 | (0.02 | ) | |||||||||||||||||||||||||

| Amortization | 0.12 | 0.11 | 0.01 | 0.35 | 0.33 | 0.02 | ||||||||||||||||||||||||||

| 1Q23 Nonrecurring Cost | — | — | — | — | 0.03 | (0.03 | ) | |||||||||||||||||||||||||

| Diluted Net Income Per Share – Adjusted | $ | 0.91 | $ | 0.81 | $ | 0.10 | 12.3 | % | $ | 2.98 | $ | 2.56 | $ | 0.42 | 16.4 | % | ||||||||||||||||

See information regarding non-GAAP measures presented later in this press release.

| Reconciliation of Income Before Income Taxes to EBITDAC and EBITDAC – Adjusted and Income Before Income Taxes Margin(1) to EBITDAC Margin and EBITDAC Margin – Adjusted (in millions, unaudited) |

||||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| Total revenues | $ | 1,186 | $ | 1,068 | $ | 3,622 | $ | 3,231 | ||||||||

| Income before income taxes | $ | 317 | $ | 242 | $ | 1,028 | $ | 791 | ||||||||

| Income Before Income Taxes Margin(1) | 26.7 | % | 22.7 | % | 28.4 | % | 24.5 | % | ||||||||

| Amortization | 45 | 41 | 131 | 123 | ||||||||||||

| Depreciation | 11 | 10 | 33 | 30 | ||||||||||||

| Interest | 50 | 48 | 147 | 143 | ||||||||||||

| Change in estimated acquisition earn-out payables | (8 | ) | 30 | (9 | ) | 30 | ||||||||||

| EBITDAC | $ | 415 | $ | 371 | $ | 1,330 | $ | 1,117 | ||||||||

| EBITDAC Margin | 35.0 | % | 34.7 | % | 36.7 | % | 34.6 | % | ||||||||

| (Gain)/loss on disposal | (1 | ) | (3 | ) | (30 | ) | (9 | ) | ||||||||

| Acquisition/Integration Costs | — | 2 | — | 8 | ||||||||||||

| 1Q23 Nonrecurring Cost | — | 11 | ||||||||||||||

| EBITDAC – Adjusted | $ | 414 | $ | 370 | $ | 1,300 | $ | 1,127 | ||||||||

| EBITDAC Margin – Adjusted | 34.9 | % | 34.6 | % | 35.9 | % | 34.9 | % | ||||||||

(1) “Income Before Income Taxes Margin” is defined as income before income taxes divided by total revenues.

See information regarding non-GAAP measures presented later in this press release.

| Brown & Brown, Inc. Consolidated Statements of Income (in millions, except per share data; unaudited) |

||||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| REVENUES | ||||||||||||||||

| Commissions and fees | $ | 1,155 | $ | 1,049 | $ | 3,545 | $ | 3,193 | ||||||||

| Investment income | 31 | 17 | 71 | 34 | ||||||||||||

| Other | — | 2 | 6 | 4 | ||||||||||||

| Total revenues | 1,186 | 1,068 | 3,622 | 3,231 | ||||||||||||

| EXPENSES | ||||||||||||||||

| Employee compensation and benefits | 607 | 532 | 1,823 | 1,633 | ||||||||||||

| Other operating expenses | 165 | 168 | 499 | 490 | ||||||||||||

| Gain on disposal | (1 | ) | (3 | ) | (30 | ) | (9 | ) | ||||||||

| Amortization | 45 | 41 | 131 | 123 | ||||||||||||

| Depreciation | 11 | 10 | 33 | 30 | ||||||||||||

| Interest | 50 | 48 | 147 | 143 | ||||||||||||

| Change in estimated acquisition earn-out payables | (8 | ) | 30 | (9 | ) | 30 | ||||||||||

| Total expenses | 869 | 826 | 2,594 | 2,440 | ||||||||||||

| Income before income taxes | 317 | 242 | 1,028 | 791 | ||||||||||||

| Income taxes | 78 | 66 | 237 | 189 | ||||||||||||

| Net income before non-controlling interests | 239 | 176 | 791 | 602 | ||||||||||||

| Less: Net income attributable to non-controlling interests | 5 | — | 8 | — | ||||||||||||

| Net income attributable to the Company | $ | 234 | $ | 176 | $ | 783 | $ | 602 | ||||||||

| Net income per share: | ||||||||||||||||

| Basic | $ | 0.82 | $ | 0.62 | $ | 2.75 | $ | 2.12 | ||||||||

| Diluted | $ | 0.81 | $ | 0.62 | $ | 2.73 | $ | 2.11 | ||||||||

| Weighted average number of shares outstanding: | ||||||||||||||||

| Basic | 282 | 280 | 282 | 279 | ||||||||||||

| Diluted | 284 | 281 | 283 | 280 | ||||||||||||

| Brown & Brown, Inc. Consolidated Balance Sheets (in millions, except per share data, unaudited) |

||||||||

| September 30, 2024 |

December 31, 2023 |

|||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 957 | $ | 700 | ||||

| Fiduciary cash | 1,744 | 1,603 | ||||||

| Short-term investments | 11 | 11 | ||||||

| Commission, fees, and other receivables | 917 | 790 | ||||||

| Fiduciary receivables | 961 | 1,125 | ||||||

| Reinsurance recoverable | 2,036 | 125 | ||||||

| Prepaid reinsurance premiums | 539 | 462 | ||||||

| Other current assets | 314 | 314 | ||||||

| Total current assets | 7,479 | 5,130 | ||||||

| Fixed assets, net | 309 | 270 | ||||||

| Operating lease assets | 192 | 199 | ||||||

| Goodwill | 7,577 | 7,341 | ||||||

| Amortizable intangible assets, net | 1,582 | 1,621 | ||||||

| Investments | 21 | 21 | ||||||

| Other assets | 365 | 301 | ||||||

| Total assets | $ | 17,525 | $ | 14,883 | ||||

| LIABILITIES AND EQUITY | ||||||||

| Current liabilities: | ||||||||

| Fiduciary liabilities | $ | 2,705 | $ | 2,727 | ||||

| Losses and loss adjustment reserve | 2,044 | 131 | ||||||

| Unearned premiums | 625 | 462 | ||||||

| Accounts payable | 329 | 459 | ||||||

| Accrued expenses and other liabilities | 597 | 608 | ||||||

| Current portion of long-term debt | 225 | 569 | ||||||

| Total current liabilities | 6,525 | 4,956 | ||||||

| Long-term debt less unamortized discount and debt issuance costs | 3,367 | 3,227 | ||||||

| Operating lease liabilities | 181 | 179 | ||||||

| Deferred income taxes, net | 638 | 616 | ||||||

| Other liabilities | 334 | 326 | ||||||

| Equity: | ||||||||

| Common stock, par value $0.10 per share; authorized 560 shares; issued 306 shares and outstanding 286 shares at 2024, issued 304 shares and outstanding 285 shares at 2023, respectively | 31 | 30 | ||||||

| Additional paid-in capital | 1,095 | 1,027 | ||||||

| Treasury stock, at cost 20 shares at 2024 and 2023 | (748 | ) | (748 | ) | ||||

| Accumulated other comprehensive loss | 125 | (19 | ) | |||||

| Non-controlling interests | 16 | – | ||||||

| Retained earnings | 5,961 | 5,289 | ||||||

| Total equity | 6,480 | 5,579 | ||||||

| Total liabilities and equity | $ | 17,525 | $ | 14,883 | ||||

| Brown & Brown, Inc. Consolidated Statements of Cash Flows (in millions, unaudited) |

||||||||

| Nine Months Ended September 30, | ||||||||

| 2024 | 2023 | |||||||

| Cash flows from operating activities: | ||||||||

| Net income before non-controlling interests | $ | 791 | $ | 602 | ||||

| Adjustments to reconcile net income before non-controlling interests to net cash provided by operating activities: | ||||||||

| Amortization | 131 | 123 | ||||||

| Depreciation | 33 | 30 | ||||||

| Non-cash stock-based compensation | 77 | 67 | ||||||

| Change in estimated acquisition earn-out payables | (9 | ) | 30 | |||||

| Deferred income taxes | (11 | ) | (1 | ) | ||||

| Amortization of debt discount and disposal of deferred financing costs | 3 | 3 | ||||||

| Net gain on sales/disposals of investments, businesses, fixed assets and customer accounts | (29 | ) | (11 | ) | ||||

| Payments on acquisition earn-outs in excess of original estimated payables | (35 | ) | (18 | ) | ||||

| Changes in operating assets and liabilities, net of effect from acquisitions and divestitures: | ||||||||

| Commissions, fees and other receivables (increase)/decrease | (119 | ) | (83 | ) | ||||

| Reinsurance recoverables (increase)/decrease | (1,911 | ) | 612 | |||||

| Prepaid reinsurance premiums (increase)/decrease | (77 | ) | (110 | ) | ||||

| Other assets (increase)/decrease | (81 | ) | (87 | ) | ||||

| Losses and loss adjustment reserve increase/(decrease) | 1,913 | (609 | ) | |||||

| Unearned premiums increase/(decrease) | 163 | 118 | ||||||

| Accounts payable increase/(decrease) | (9 | ) | 163 | |||||

| Accrued expenses and other liabilities increase/(decrease) | (17 | ) | (41 | ) | ||||

| Other liabilities increase/(decrease) | — | (84 | ) | |||||

| Net cash provided by operating activities | 813 | 704 | ||||||

| Cash flows from investing activities: | ||||||||

| Additions to fixed assets | (62 | ) | (38 | ) | ||||

| Payments for businesses acquired, net of cash acquired | (118 | ) | (163 | ) | ||||

| Proceeds from sales of businesses, fixed assets and customer accounts | 60 | 8 | ||||||

| Purchases of investments | (5 | ) | (6 | ) | ||||

| Proceeds from sales of investments | 6 | 6 | ||||||

| Net cash used in investing activities | (119 | ) | (193 | ) | ||||

| Cash flows from financing activities: | ||||||||

| Fiduciary receivables and liabilities, net | 83 | 117 | ||||||

| Payments on acquisition earn-outs | (100 | ) | (57 | ) | ||||

| Proceeds from long-term debt | 599 | — | ||||||

| Payments on long-term debt | (700 | ) | (238 | ) | ||||

| Deferred debt issuance costs | (5 | ) | — | |||||

| Borrowings on revolving credit facilities | 150 | 170 | ||||||

| Payments on revolving credit facilities | (250 | ) | (170 | ) | ||||

| Issuances of common stock for employee stock benefit plans | 44 | 41 | ||||||

| Repurchase shares to fund tax withholdings for non-cash stock-based compensation | (54 | ) | (40 | ) | ||||

| Cash dividends paid | (111 | ) | (98 | ) | ||||

| Other financing activities | 3 | — | ||||||

| Net cash used in financing activities | (341 | ) | (275 | ) | ||||

| Effect of foreign exchange rate changes in cash and cash equivalents inclusive of fiduciary cash | 45 | 2 | ||||||

| Net increase in cash and cash equivalents inclusive of fiduciary cash | 398 | 238 | ||||||

| Cash and cash equivalents inclusive of fiduciary cash at beginning of period | 2,303 | 2,033 | ||||||

| Cash and cash equivalents inclusive of fiduciary cash at end of period | $ | 2,701 | $ | 2,271 | ||||

Conference call, webcast and slide presentation

A conference call to discuss the results of the third quarter of 2024 will be held on Tuesday, October 29, 2024, at 8:00 AM (EDT). The Company may refer to a slide presentation during its conference call. You can access the webcast and the slides from the “Investor Relations” section of the Company’s website at bbinsurance.com.

About Brown & Brown

Brown & Brown, Inc. BRO is a leading insurance brokerage firm, delivering risk management solutions to individuals and businesses since 1939. With over 16,000 teammates and 500+ locations worldwide, we are committed to providing innovative strategies to help protect what our customers value most. For more information or to find an office near you, please visit bbinsurance.com.

Forward-looking statements

This press release may contain certain statements relating to future results which are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, which are intended to be covered by the safe harbors created by those laws. You can identify these statements by forward-looking words such as “may,” “will,” “should,” “expect,” “anticipate,” “believe,” “intend,” “estimate,” “plan” and “continue” or similar words. We have based these statements on our current expectations about potential future events. Although we believe the expectations expressed in the forward-looking statements included in this press release are based upon reasonable assumptions within the bounds of our knowledge of our business, a number of factors could cause actual results to differ materially from those expressed in any forward-looking statements, whether oral or written, made by us or on our behalf. Many of these factors have previously been identified in filings or statements made by us or on our behalf. Important factors which could cause our actual results to differ, possibly materially from the forward-looking statements in this press release include but are not limited to the following items: the Company’s determination as it finalizes its financial results for the third quarter of 2024 that its financial results differ from the current preliminary unaudited numbers set forth herein; the inability to hire, retain and develop qualified employees, as well as the loss of any of our executive officers or other key employees; a cybersecurity attack or any other interruption in information technology and/or data security that may impact our operations or the operations of third parties that support us; acquisition-related risks that could negatively affect the success of our growth strategy, including the possibility that we may not be able to successfully identify suitable acquisition candidates, complete acquisitions, successfully integrate acquired businesses into our operations and expand into new markets; risks related to our international operations, which may result in additional risks or require more management time and expense than our domestic operations to achieve or maintain profitability; the requirement for additional resources and time to adequately respond to dynamics resulting from rapid technological change; the loss of or significant change to any of our insurance company relationships, which could result in loss of capacity to write business, additional expense, loss of market share or material decrease in our commissions; the effect of natural disasters on our profit-sharing contingent commissions, insurer capacity or claims expenses within our capitalized captive insurance facilities; adverse economic conditions, political conditions, outbreaks of war, disasters, or regulatory changes in states or countries where we have a concentration of our business; the inability to maintain our culture or a significant change in management, management philosophy or our business strategy; fluctuations in our commission revenue as a result of factors outside of our control; the effects of sustained inflation or higher interest rates; claims expense resulting from the limited underwriting risk associated with our participation in capitalized captive insurance facilities; risks associated with our automobile and recreational vehicle dealer services (“F&I”) businesses; changes in, or the termination of, certain programs administered by the U.S. federal government from which we derive revenues; the limitations of our system of disclosure and internal controls and procedures in preventing errors or fraud, or in informing management of all material information in a timely manner; the significant control certain shareholders have over the Company; changes in data privacy and protection laws and regulations or any failure to comply with such laws and regulations; improper disclosure of confidential information; our ability to comply with non-U.S. laws, regulations and policies; the potential adverse effect of certain actual or potential claims, regulatory actions or proceedings on our businesses, results of operations, financial condition or liquidity; uncertainty in our business practices and compensation arrangements with insurance carriers due to potential changes in regulations; regulatory changes that could reduce our profitability or growth by increasing compliance costs, technology compliance, restricting the products or services we may sell, the markets we may enter, the methods by which we may sell our products and services, or the prices we may charge for our services and the form of compensation we may accept from our customers, carriers and third-parties; increasing scrutiny and changing laws and expectations from regulators, investors and customers with respect to our environmental, social and governance practices and disclosure; a decrease in demand for liability insurance as a result of tort reform legislation; our failure to comply with any covenants contained in our debt agreements; the possibility that covenants in our debt agreements could prevent us from engaging in certain potentially beneficial activities; changes in the U.S.-based credit markets that might adversely affect our business, results of operations and financial condition; changes in current U.S. or global economic conditions, including an extended slowdown in the markets in which we operate; disintermediation within the insurance industry, including increased competition from insurance companies, technology companies and the financial services industry, as well as the shift away from traditional insurance markets; conditions that result in reduced insurer capacity; quarterly and annual variations in our commissions that result from the timing of policy renewals and the net effect of new and lost business production; intangible asset risk, including the possibility that our goodwill may become impaired in the future; future pandemics, epidemics or outbreaks of infectious diseases, and the resulting governmental and societal responses; other risks and uncertainties as may be detailed from time to time in our public announcements and Securities and Exchange Commission (“SEC”) filings; and other factors that the Company may not have currently identified or quantified. Assumptions as to any of the foregoing, and all statements, are not based upon historical fact, but rather reflect our current expectations concerning future results and events. Forward-looking statements that we make or that are made by others on our behalf are based upon a knowledge of our business and the environment in which we operate, but because of the factors listed above, among others, actual results may differ from those in the forward-looking statements. Consequently, these cautionary statements qualify all of the forward-looking statements we make herein. We cannot assure you that the results or developments anticipated by us will be realized, or even if substantially realized, that those results or developments will result in the expected consequences for us or affect us, our business or our operations in the way we expect. We caution readers not to place undue reliance on these forward-looking statements. All forward-looking statements made herein are made only as of the date of this press release, and the Company does not undertake any obligation to publicly update or correct any forward-looking statements to reflect events or circumstances that subsequently occur or of which the Company hereafter becomes aware.

Non-GAAP supplemental financial information

This press release contains references to “non-GAAP financial measures” as defined in SEC Regulation G, consisting of Organic Revenue, EBITDAC, EBITDAC Margin, EBITDAC – Adjusted, EBITDAC Margin – Adjusted and Diluted Net Income Per Share – Adjusted. We present these measures because we believe such information is of interest to the investment community and because we believe it provides additional meaningful methods to evaluate the Company’s operating performance from period to period on a basis that may not be otherwise apparent on a GAAP basis due to the impact of certain items that have a high degree of variability, that we believe are not indicative of ongoing performance and that are not easily comparable from period to period. This non-GAAP financial information should be considered in addition to, not in lieu of, the Company’s consolidated income statements and balance sheets as of the relevant date. Consistent with Regulation G, a description of such information is provided below and a reconciliation of such items to GAAP information can be found within this press release as well as in our periodic filings with the SEC.

We view Organic Revenue and Organic Revenue growth as important indicators when assessing and evaluating our performance on a consolidated basis and for each of our three segments, because it allows us to determine a comparable, but non-GAAP, measurement of revenue growth that is associated with the revenue sources that were a part of our business in both the current and prior year and that are expected to continue in the future. In addition, we believe Diluted Net Income Per Share – Adjusted provides a meaningful representation of our operating performance and improves the comparability of our results between periods by excluding the impact of the change in estimated acquisition earn-out payables, the impact of amortization of intangible assets and certain other non-recurring or infrequently occurring items. We also view EBITDAC, EBITDAC – Adjusted, EBITDAC Margin and EBITDAC Margin – Adjusted as important indicators when assessing and evaluating our performance, as they present more comparable measurements of our operating margins in a meaningful and consistent manner. As disclosed in our most recent proxy statement, we use Organic Revenue growth, Diluted Net Income Per Share – Adjusted and EBITDAC Margin – Adjusted as key performance metrics for our short-term and long-term incentive compensation plans for executive officers and other key employees.

Beginning January 1, 2024, we no longer exclude Foreign Currency Translation from the calculation of EBITDAC – Adjusted, EBITDAC Margin – Adjusted and Diluted Net Income Per Share – Adjusted. Prior periods are presented accordingly on the same basis so that the calculations of EBITDAC – Adjusted, EBITDAC Margin – Adjusted and Diluted Net Income Per Share – Adjusted are comparable for both periods. We no longer exclude Foreign Currency Translation from the calculation of these earnings measures because fluctuations in Foreign Currency Translation affect both our revenues and expenses, largely offsetting each other. Therefore, excluding Foreign Currency Translation from these earnings measures provides no meaningful incremental value in evaluating our financial performance.

Beginning January 1, 2024, amortization of intangible assets is excluded from the calculation of Diluted Net Income Per Share – Adjusted. Prior periods are presented accordingly on the same basis so that the calculation of Diluted Net Income Per Share – Adjusted is comparable for both periods. We exclude the impact of amortization of intangible assets from the calculation of Diluted Net Income Per Share – Adjusted because amortization of intangible assets is a non-cash expense that is not indicative of the performance of our business and provides no meaningful incremental value in evaluating our financial performance.

Non-GAAP Revenue Measures

• Organic Revenue is our core commissions and fees less: (i) the core commissions and fees earned for the first 12 months by newly acquired operations; (ii) divested business (core commissions and fees generated from offices, books of business or niches sold or terminated during the comparable period); and (iii) Foreign Currency Translation (as defined below). The term “core commissions and fees” excludes profit-sharing contingent commissions and therefore represents the revenues earned directly from specific insurance policies sold and specific fee-based services rendered. Organic Revenue can be expressed as a dollar amount or a percentage rate when describing Organic Revenue growth.

Non-GAAP Earnings Measures

- EBITDAC is defined as income before interest, income taxes, depreciation, amortization and the change in estimated acquisition earn-out payables.

- EBITDAC Margin is defined as EBITDAC divided by total revenues.

- EBITDAC – Adjusted is defined as EBITDAC, excluding (i) (gain)/loss on disposal, (ii) for 2022 and 2023, Acquisition/Integration Costs (as defined below) and (iii) for 2023, the 1Q23 Nonrecurring Cost (as defined below).

- EBITDAC Margin – Adjusted is defined as EBITDAC – Adjusted divided by total revenues.

- Diluted Net Income Per Share – Adjusted is defined as diluted net income per share, excluding the after-tax impact of (i) the change in estimated acquisition earn-out payables, (ii) (gain)/loss on disposal, (iii) for 2022 and 2023, Acquisition/Integration Costs (as defined below), (iv) for 2023, the 1Q23 Nonrecurring Cost (as defined below) and (v) amortization.

Definitions Related to Certain Components of Non-GAAP Measures

- “Acquisition/Integration Costs” means the acquisition and integration costs (e.g., costs associated with regulatory filings, legal/accounting services, due diligence and the costs of integrating our information technology systems) arising out of our acquisitions of GRP (Jersey) Holdco Limited and its business, Orchid Underwriters Agency and CrossCover Insurance Services, and BdB Limited companies, which are not considered to be normal, recurring or part of the ongoing operations.

- “Foreign Currency Translation” means the period-over-period impact of foreign currency translation, which is calculated by applying current-year foreign exchange rates to the various functional currencies in our business to our reporting currency of US dollars for the same period in the prior year.

- “1Q23 Nonrecurring Cost” means approximately $11.0 million expensed and substantially paid in the first quarter of 2023 to resolve a business matter, which is not considered to be normal, recurring or part of the ongoing operations.

- “(Gain)/loss on disposal,” a caption on our consolidated statements of income which reflects net proceeds received as compared to net book value related to sales of books of business and other divestiture transactions, such as the disposal of a business through sale or closure.

Our industry peers may provide similar supplemental non-GAAP information with respect to one or more of these measures, although they may not use the same or comparable terminology and may not make identical adjustments and, therefore comparability may be limited. This supplemental non-GAAP financial information should be considered in addition to, and not in lieu of, the Company’s condensed consolidated financial statements.

For more information:

R. Andrew Watts

Chief Financial Officer

(386) 239-5770

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Elon Musk Channels Warren Buffett As Tesla's Stock Booms After Strong Q3: 'Having A Publicly Traded Company Is Like…'

Tesla Inc. TSLA CEO Elon Musk on Saturday reflected on the company’s stock jump over the past week, terming it a “rollercoaster.”

What Happened: “The stock market is wild, sort of rollercoaster. I think Warren Buffett has a lot of good sayings. One is, ‘Having a publicly traded company is like having someone stand outside your house and yell house prices all day,’ and it’s still the same house,” Musk said at a town hall in Lancaster, Pennsylvania, where he was campaigning for former President and Republican Presidential candidate Donald Trump.

Don’t Miss:

Tesla’s stock was on a more-or-less downward trajectory since the start of the year until the company reported its third-quarter earnings last week on Oct. 23 and gave upbeat forecasts.

The company reported third-quarter earnings per share of 72 cents, beating a Street consensus estimate of 58 cents per share.

Musk also said that he expects vehicle sales to grow 20% to 30% next year, addressing investor concerns of falling EV demand. For 2024 too, the company is looking to exceed its delivery numbers from last tear

For the full-year 2023, Tesla delivered 1,808,581 vehicles. To mark a growth over last year, the company has to deliver at least 514,926 vehicles in the three months through the end of December.

See Also: ‘Scrolling to UBI’: Deloitte’s #1 fastest-growing software company allows users to earn money on their phones – invest today with $1,000 for just $0.25/share

Musk’s Appreciation For Buffett: Meanwhile, this is not the first time that Musk has referred to Berkshire Hathaway CEO Warren Buffett.

In October 2021, Musk even opined on social media platform X, then Twitter, that Buffett should invest in Tesla. Prior to that, in 2018, Musk applauded Buffett’s investment and capital allocation strategy, terming it better than the government’s.

Price Action: Tesla shares closed up 3.3% at $269.19 on Friday. The stock is up 8.4% year-to-date and up by about 23% over the last five days, according to data from Benzinga Pro.

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Read Next:

Photo courtesy: Flickr

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Centrus Reports Third Quarter 2024 Results

- Selected by the U.S. Department of Energy (“DOE”) as an awardee for High Assay Low-Enriched Uranium (“HALEU”) production and HALEU deconversion contracts

- Signed $1.1 billion in new contingent commitments to support deployment of Low-Enriched Uranium (“LEU”) production, for a total of $2.0 billion year-to-date

- Net loss of $5.0 million on $57.7 million in revenue, compared to net income of $8.2 million on $51.3 million in revenue in Q3 2023

- Consolidated cash balance of $194.3 million as of September 30, 2024

BETHESDA, Md., Oct. 28, 2024 /PRNewswire/ — Centrus Energy Corp. LEU (“Centrus” or the “Company”) today reported third quarter 2024 results. The Company reported a net loss of $5.0 million for the three months ended September 30, 2024, which is $0.30 (basic and diluted) per common share.

“Centrus has made enormous progress in recent months in securing two critical awards from the Department of Energy as well as $2.0 billion in contingent commitments from our customers to support a potential expansion of our Ohio enrichment facility,” said Centrus President and CEO Amir Vexler. “The recent announcements by Amazon, Google, and Microsoft to power their data centers with carbon-free nuclear energy has lifted our entire industry, and underscores the urgency of our work to restore a robust domestic nuclear fuel supply chain. We look forward to delivering new enrichment capacity that can fuel the reactors of today as well as the new generation of advanced reactors.”

Financial Results

Centrus generated total revenue of $57.7 million and $51.3 million for the three months ended September 30, 2024 and 2023, respectively, an increase of $6.4 million.

Revenue from the LEU segment was $34.8 million and $40.5 million for the three months ended September 30, 2024 and 2023, respectively, a decrease of $5.7 million. SWU revenue decreased by $5.7 million as a result of a decrease in the volume of SWU sold, partially offset by an increase in the average price of SWU sold.

Revenue from the Technical Solutions segment was $22.9 million and $10.8 million for the three months ended September 30, 2024 and 2023, respectively, an increase of $12.1 million. Revenue generated under the HALEU Operation Contract between the Company and the DOE signed in 2022 increased $12.7 million due to the transition from Phase 1 to Phase 2 in late 2023, as further described below. The remaining change was attributable to other contracts.

Cost of sales for the LEU segment was $29.6 million and $30.4 million for the three months ended September 30, 2024 and 2023, respectively, a decrease of $0.8 million. SWU costs decreased as a result of a decrease in the volume of SWU sold, partially offset by an increase in the average unit cost of SWU sold. Cost of sales for the three months ended September 30, 2024 and 2023, included $1.9 million and $0.6 million, respectively, for the revaluation of inventory loans.

Cost of sales for the Technical Solutions segment was $19.2 million and $9.6 million for the three months ended September 30, 2024 and 2023, respectively, an increase of $9.6 million. Costs incurred for the HALEU Operation Contract increased by $8.8 million due to the transition from Phase 1 to Phase 2 in late 2023. The remaining increase was attributable to other contracts.

Gross profit for the Company was $8.9 million and $11.3 million for the three months ended September 30, 2024 and 2023, respectively. The decrease for the three months ended September 30, 2024 was primarily attributed to the decrease in gross profit in the LEU segment, partially offset by the increase in gross profit in the Technical Solutions segment, driven by the transition from Phase 1 to Phase 2 of the HALEU Operation Contract in late 2023. LEU customers generally have multi-year contracts that carry annual purchase commitments, not quarterly commitments. The gross profit in our LEU business varies based upon the timing of those contracts. The pricing of those deliveries varies depending upon the market conditions at the time the contract was signed with a portion of our outstanding contracts entered into at historically higher prices. The Company’s gross profit in the LEU segment was lower primarily due to the decrease in sales volume, partially offset by the composition of contracts in the current quarter, which included higher-priced legacy contracts.

Domestic Enrichment Update

Centrus is continuing to produce HALEU at its American Centrifuge Plant in Piketon, Ohio, under the HALEU Operation Contract with the DOE. The DOE is contractually required to provide storage cylinders necessary to collect the HALEU uranium hexafluoride (“UF6“) product from Centrus’ centrifuge cascade. Using the storage cylinders currently made available by the DOE, Centrus has now achieved cumulative deliveries to the DOE of approximately 332 kilograms of HALEU UF6.

Additionally, on October 16, 2024, DOE selected Centrus subsidiary American Centrifuge Operating, LLC (“ACO”), as one of the awardees under a competitive solicitation aimed at expanding domestic commercial production of HALEU. The contract has a minimum value of $2.0 million and a total contract ceiling of $2.7 billion for all awardees. On October 4, 2024, DOE selected ACO and other companies under a separate solicitation aimed at HALEU deconversion, a subsequent step in the HALEU production process. The ultimate dollar amount associated with these contracts and the potential scale of the expansion supported will depend upon task orders subsequently issued by the DOE to ACO under the contracts.

The two HALEU related awards, as well as a separate Request for Proposals for LEU production which has not yet been awarded, are backed by more than $3.4 billion in appropriations that have been provided by Congress to date.

The Prohibiting Russian Imports Act

The Prohibiting Russian Imports Act enacted in May 2024 imposed a ban on imports of uranium products from Russia. The ban which went into effect on August 11, 2024, empowers the DOE to issue waivers for certain imports through 2027. On July 18, 2024, the DOE issued the Company a waiver allowing it to import LEU from Russia for deliveries already committed by the Company to its U.S. customers in 2024 and 2025. For the years 2026 and 2027, the DOE deferred its decision to an unspecified date closer in time to the deliveries. The Company is also seeking a waiver to allow for importation of LEU from Russia for processing and reexport to the Company’s foreign customers, and also plans to request a waiver covering imports in 2026 and 2027 that Centrus is obligated to purchase but has not yet committed to particular customers. It is uncertain whether any further waivers will be granted to the Company and, if granted, whether any waiver would be granted in a timely manner or will be sufficient in scope to support the Company’s intended operations.

Backlog

The Company’s backlog is $3.8 billion as of September 30, 2024 and extends to 2040. Our LEU segment backlog as of September 30, 2024 is approximately $2.8 billion and includes future SWU and uranium deliveries primarily under medium and long-term contracts with fixed commitments and approximately $2.0 billion in contingent LEU sales commitments, subject to entering into definitive agreements, in support of potential construction of LEU production capacity at the Piketon, Ohio facility. The contingent LEU sales commitments also depend on our ability to secure substantial public and private investment. Our Technical Solutions segment backlog is approximately $0.9 billion as of September 30, 2024 and includes both funded amounts (services for which funding has been both authorized and appropriated by the customer), unfunded amounts (services for which funding has not been appropriated), and unexercised options.

About Centrus Energy Corp.

Centrus Energy is a trusted supplier of nuclear fuel components and services for the nuclear power industry. Centrus provides value to its utility customers through the reliability and diversity of its supply sources – helping them meet the growing need for clean, affordable, carbon-free electricity. Since 1998, the Company has provided its utility customers with more than 1,850 reactor years of fuel, which is equivalent to more than 7 billion tons of coal. With world-class technical and engineering capabilities, Centrus is pioneering production of High-Assay, Low-Enriched Uranium and is leading the effort to restore America’s uranium enrichment capabilities at scale to meet America’s clean energy, energy security, and national security needs. Find out more at centrusenergy.com.

Forward-Looking Statements:

This news release contains “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. In this context, forward-looking statements mean statements related to future events, which may impact our expected future business and financial performance, and often contain words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “will”, “should”, “could”, “would” or “may” and other words of similar meaning. These forward-looking statements are based on information available to us as of the date of this news release and represent management’s current views and assumptions with respect to future events and operational, economic and financial performance. Forward-looking statements are not guarantees of future performance, events or results and involve known and unknown risks, uncertainties and other factors, which may be beyond our control.

For Centrus Energy Corp., particular risks and uncertainties (hereinafter “risks”) that could cause our actual future results to differ materially from those expressed in our forward-looking statements and which are, and may be, exacerbated by any worsening of the global business and economic environment include but are not limited to the following: risks related to the U.S. Department of Energy (“DOE”) not issuing any task orders to any awardee under any of the HALEU or Deconversion contracts or any task orders to the Company under either of those contracts; risks related to the Company not winning a task order under the HALEU contract to expand its HALEU plant; risks related to DOE not providing adequate share of the appropriated funding; risks related to our ability to secure financing to expand our plant; risks related to our ability to increase capacity in a timely manner to meet market demand or our contractual obligations; risks related to DOE not awarding any contracts to the Company in response to the Company’s remaining proposals; risks related to the war and geopolitical conflicts and the imposition of sanctions or other measures, including bans or tariffs, by (i) the U.S. or foreign governments and institutions such as the European Union, (ii) organizations (including the United Nations or other international organizations), or (iii) entities (including private entities or persons), that could directly or indirectly impact our ability to obtain, deliver, transport or sell low enriched uranium (“LEU”) or the SWU and natural uranium hexafluoride components of LEU delivered to us under the existing supply contract with the Russian government-owned entity, TENEX, Joint-Stock Company (“TENEX”) (“TENEX Supply Contract”) or make related payments or deliveries of natural uranium hexafluoride to TENEX; risks related to laws that ban (i) imports of Russian LEU into the United States, including the Import Ban Act, or (ii) transactions with Rosatom or its subsidiaries, which includes TENEX; risks related to our potential inability to secure additional waivers or other exceptions from the ban or sanction in a timely manner or at all in order to allow us to continue importing Russian LEU under the TENEX Supply Contract or otherwise doing business with TENEX or implementing the TENEX Supply Contract; risks related to TENEX’s refusal or inability to deliver LEU to us for any reason including (i) U.S. or foreign government sanctions or bans are imposed on LEU from Russia or on TENEX, (ii) TENEX is unable or unwilling to deliver LEU, receive payments, receive the return of natural uranium hexafluoride, or conduct other activities related to the TENEX Supply Contract, or (iii) TENEX elects, or is directed (including by its owner or the Russian government), to limit or stop transactions with us or with the United States or other countries; risks related to disputes with third parties, including contractual counterparties, that could result if we cannot receive, or otherwise are unable to receive timely deliveries of LEU under the TENEX Supply Contract; risks related to our dependence on others, such as TENEX, under the TENEX Supply Contract, a subsidiary of Orano Cycle (“Orano”), under our long-term commercial supply agreement with Orano, and other suppliers (including, but not limited to, transporters) who provide, or deliver, us the goods and services we need to conduct our business and any resulting negative impact on our liquidity; risks related to our ability to sell or deliver the LEU we procure pursuant to our purchase obligations under our supply agreements and the impacts of sanctions or limitations on imports of such LEU, including those imposed under the 1992 Russian Suspension Agreement as amended, international trade legislation and other international trade restrictions or the Import Ban Act; risks related to the increasing quantities of LEU being imported into the U.S. from China and the impact on our ability to make future LEU or SWU sales or ability to finance any build out of our enrichment capacities; risks related to whether or when government funding or demand for high-assay low-enriched uranium (“HALEU”) for government or commercial uses will materialize and at what level; risks regarding funding for continuation and deployment of the American Centrifuge technology; risks related to (i) our ability to perform under our agreement with the DOE to deploy and operate a cascade of centrifuges to demonstrate production of HALEU for advanced reactors (the “HALEU Operation Contract”), (ii) our ability to obtain new contracts and funding to be able to continue operations and (iii) our ability to obtain and/or perform under other agreements; risks that (i) we may not obtain the full benefit of the HALEU Operation Contract and may not be able or allowed to operate the HALEU enrichment facility to produce HALEU after the completion of the HALEU Operation Contract or (ii) the output from the HALEU enrichment facility may not be available to us as a future source of supply; risks related to existing or new trade barriers and to contract terms that limit our ability to procure LEU for, or deliver LEU to, customers; risks related to pricing trends and demand in the uranium and enrichment markets and their impact on our profitability; risks related to the movement and timing of customer orders; risks related to the fact that we face significant competition from major LEU producers who may be less cost sensitive or are wholly or partially government owned; risks that our ability to compete in foreign markets may be limited for various reasons, including policies that favor indigenous suppliers over foreign suppliers of goods and services; risks related to the fact that our revenue is largely dependent on our largest customers; risks related to our backlog, including uncertainty concerning customer actions under current contracts and in future contracting due to market conditions, global events or other factors, including our lack of current production capability; risks related to natural and other disasters, including the continued impact of the March 2011 earthquake and tsunami in Japan on the nuclear industry and on our business, results of operations and prospects; risks related to financial difficulties experienced by customers or suppliers, including possible bankruptcies, insolvencies, or any other situation, event or occurrence that affect the ability of others to pay for our products or services in a timely manner or at all; risks related to pandemics, endemics, and other health crises; risks related to the impact and potential extended duration of a supply/demand imbalance in the market for LEU; risks related to reliance on the only firm that has the necessary permits and capability to transport LEU from Russia to the United States and that firm’s ability to maintain those permits and capabilities or secure additional permits; risks related to a government shutdown or lack of funding that could result in program cancellations, disruptions and/or stop work orders and could limit the U.S. government’s ability to make timely payments, and our ability to perform our U.S. government contracts and successfully compete for work; risks related to changes to the U.S. government’s appropriated funding levels for HALEU Operation Contract due to the upcoming November elections or other reasons; risks related to uncertainty regarding our ability to commercially deploy competitive enrichment technology; risks related to the potential for demobilization or termination of the HALEU Operation Contract; risks that we will not be able to timely complete the work that we are obligated to perform; risks related to the government’s inability to satisfy its obligations, including supplying government furnished equipment necessary for us to produce and deliver HALEU under the HALEU Operation Contract and processing security clearance applications due to a government shutdown or other reasons; risks related to our ability to obtain the government’s approval to extend the term of, or the scope of permitted activities under, our lease with the DOE in Piketon, Ohio; risks related to cybersecurity incidents that may impact our business operations; risks related to our ability to perform fixed-price and cost-share contracts such as the HALEU Operation Contract, including the risk that costs that we must bear could be higher than expected and the risk related to complying with stringent government contractual requirements; risks related to attracting qualified employees necessary for the potential expansion of our operations; risks related to our long-term liabilities, including material unfunded defined benefit pension plan obligations and postretirement health and life benefit obligations; risks related to our 8.25% Notes maturing in February 2027; risks of revenue and operating results fluctuating significantly from quarter to quarter, and in some cases, year to year; risks related to the impact of financial market conditions on our business, liquidity, prospects, pension assets and insurance facilities; risks related to the Company’s capital concentration; risks related to the value of our intangible assets related to LEU’s backlog and customer relationships; risks related to the limited trading markets in our securities; risks related to decisions made by our Class B Common Stock stockholders regarding their investment in the Company, including decisions based upon factors that are unrelated to the Company’s performance; risks that a small number of holders of our Class A Common Stock (whose interests may not be aligned with other holders of our Class A Common Stock) may exert significant influence over the direction of the Company and may be motivated by interests that are not aligned with the Company’s other Class A stockholders; risks related to (i) the use of our net operating losses (“NOLs”) carryforwards and net unrealized built-in losses (“NUBILs”) to offset future taxable income and the use of the Rights Agreement, dated as of April 6, 2016 to prevent an “ownership change” as defined in Section 382 of the Internal Revenue Code of 1986, as amended (the “Code”) and (ii) our ability to generate taxable income to utilize all or a portion of the NOLs prior to the expiration thereof and NUBILs; risks related to failures or security breaches of our information technology systems; risks related to our ability to attract and retain key personnel; risks that we will be unable to obtain new business opportunities or achieve market acceptance of our products and services or that products or services provided by others will render our products or services obsolete or noncompetitive; risks related to actions, including reviews or audits, that may be taken by the U.S. government, the Russian government, or other governments that could affect our ability to perform under our contractual obligations or the ability of our sources of supply to perform under their contractual obligations to us; risks related to our ability to perform and receive timely payment under our agreements with the DOE or other government agencies, including risks related to the ongoing funding by the government and potential audits; risks related to changes or termination of our agreements with the U.S. government or other counterparties, or the exercise of contract remedies by such counterparties; risks related to the competitive environment for our products and services; risks related to changes in the nuclear energy industry; risks related to the competitive bidding process associated with obtaining contracts, including government contracts; risks related to potential strategic transactions that could be difficult to implement, that could disrupt our business or that could change our business profile significantly; risks related to the outcome of legal proceedings and other contingencies (including lawsuits and government investigations or audits); risks related to the impact of government regulation and policies or interpretation of laws or regulations, including by the DOE, the U.S. Department of Commerce and the U.S. Nuclear Regulatory Commission; risks of accidents during the transportation, handling, or processing of toxic hazardous or radioactive material that may pose a health risk to humans or animals, cause property or environmental damage, or result in precautionary evacuations, and lead to claims against the Company; risks associated with claims and litigation arising from past activities at sites we currently operate or past activities at sites we no longer operate, including the Paducah, Kentucky, and Portsmouth, Ohio, gaseous diffusion plants; and other risks discussed in this news release and in our filings with the SEC.

Readers are cautioned not to place undue reliance on these forward-looking statements, which apply only as of the date of this news release. These factors may not constitute all factors that could cause actual results to differ from those discussed in any forward-looking statement. Accordingly, forward-looking statements should not be relied upon as a predictor of actual results. Readers are urged to carefully review and consider the various disclosures made in this news release and in our filings with the SEC, including our Annual Report on Form 10-K for the year ended December 31, 2023, under Part II, Item 1A – “Risk Factors” in our Quarterly Report on Form 10-Q for the quarter ended September 30, 2024, and in our filings with the SEC that attempt to advise interested parties of the risks and factors that may affect our business. We do not undertake to update our forward-looking statements to reflect events or circumstances that may arise after the date of this news release, except as required by law.

Contacts:

Investors: Dan Leistikow at LeistikowD@centrusenergy.com

Media: Lindsey Geisler at GeislerLR@centrusenergy.com

|

CENTRUS ENERGY CORP CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (Unaudited; in millions, except share and per share data) |

|||||||

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||

|

2024 |

2023 |

2024 |

2023 |

||||

|

Revenue: |

|||||||

|

Separative work units |

$ 34.8 |

$ 40.5 |

$ 198.1 |

$ 147.4 |

|||

|

Uranium |

— |

— |

29.9 |

39.5 |

|||

|

Technical solutions |

22.9 |

10.8 |

62.4 |

29.7 |

|||

|

Total revenue |

57.7 |

51.3 |

290.4 |

216.6 |

|||

|

Cost of Sales: |

|||||||

|

Separative work units and uranium |

29.6 |

30.4 |

189.3 |

126.1 |

|||

|

Technical solutions |

19.2 |

9.6 |

51.4 |

28.2 |

|||

|

Total cost of sales |

48.8 |

40.0 |

240.7 |

154.3 |

|||

|

Gross profit |

8.9 |

11.3 |

49.7 |

62.3 |

|||

|

Advanced technology costs |

4.1 |

3.3 |

13.9 |

10.8 |

|||

|

Selling, general and administrative |

10.0 |

9.5 |

25.7 |

27.5 |

|||

|

Amortization of intangible assets |

2.4 |

1.4 |

7.2 |

4.2 |

|||

|

Operating income (loss) |

(7.6) |

(2.9) |

2.9 |

19.8 |

|||

|

Nonoperating components of net periodic benefit loss (income) |

0.8 |

(0.6) |

(15.4) |

0.1 |

|||

|

Interest expense |

0.1 |

0.4 |

0.8 |

0.9 |

|||

|

Investment income |

(2.6) |

(2.3) |

(7.8) |

(6.4) |

|||

|

Other expense (income), net |

— |

(1.0) |

0.1 |

(1.0) |

|||

|

Income (loss) before income taxes |

(5.9) |

0.6 |

25.2 |

26.2 |

|||

|

Income tax expense (benefit) |

(0.9) |

(7.6) |

5.7 |

(1.9) |

|||

|

Net income (loss) and comprehensive income (loss) |

$ (5.0) |

$ 8.2 |

$ 19.5 |

$ 28.1 |

|||

|

Net income (loss) per share: |

|||||||

|

Basic |

$ (0.30) |

$ 0.53 |

$ 1.21 |

$ 1.86 |

|||

|

Diluted |

$ (0.30) |

$ 0.52 |

$ 1.20 |

$ 1.82 |

|||

|

Average number of common shares outstanding (in thousands): |

|||||||

|

Basic |

16,422 |

15,374 |

16,172 |

15,127 |

|||

|

Diluted |

16,422 |

15,626 |

16,236 |

15,415 |

|||

|

CENTRUS ENERGY CORP CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited; in millions)

|

|||

|

Nine Months Ended September 30, |

|||

|

2024 |

2023 |

||

|

OPERATING |

|||

|

Net income |

$ 19.5 |

$ 28.1 |

|

|

Adjustments to reconcile net income to cash used in operating activities: |

|||

|

Depreciation and amortization |

7.9 |

4.8 |

|

|

Accrued loss on long-term contract |

— |

(16.7) |

|

|

Deferred tax assets |

5.5 |

(2.3) |

|

|

Gain on remeasurement of retirement benefit plans |

(16.8) |

(0.9) |

|

|

Equity related compensation |

1.1 |

2.0 |

|

|

Revaluation of inventory borrowings |

3.7 |

3.5 |

|

|

Other reconciling adjustments, net |

— |

(1.0) |

|

|

Changes in operating assets and liabilities: |

|||

|

Accounts receivable |

30.3 |

28.7 |

|

|

Inventories |

85.4 |

23.0 |

|

|

Inventories owed to customers and suppliers |

(83.5) |

(60.4) |

|

|

Other current assets |

3.0 |

13.4 |

|

|

Accounts payable and other liabilities |

(8.8) |

(2.5) |

|

|

Payables under inventory purchase agreements |

(41.9) |

(29.8) |

|

|

Deferred revenue and advances from customers, net of deferred costs |

(19.9) |

3.7 |

|

|

Pension and postretirement benefit liabilities |

(6.2) |

(1.7) |

|

|

Other changes, net |

(0.2) |

(0.7) |

|

|

Cash used in operating activities |

(20.9) |

(8.8) |

|

|

INVESTING |

|||

|

Capital expenditures |

(3.4) |

(1.1) |

|

|

Cash used in investing activities |

(3.4) |

(1.1) |

|

|

FINANCING |

|||

|

Proceeds from the issuance of common stock, net |

23.4 |

23.2 |

|

|

Exercise of stock options |

0.4 |

— |

|

|

Common stock withheld for tax obligations under stock-based compensation plan |

(0.3) |

(3.0) |

|

|

Payment of interest classified as debt |

(6.1) |

(6.1) |

|

|

Other |

— |

(0.2) |

|

|

Cash provided by financing activities |

17.4 |

13.9 |

|

|

Effect of exchange rate changes on cash, cash equivalents and restricted cash |

— |

(0.6) |

|

|

Increase (decrease) in cash, cash equivalents and restricted cash |

(6.9) |

3.4 |

|

|

Cash, cash equivalents and restricted cash, beginning of period |

233.8 |

212.4 |

|

|

Cash, cash equivalents and restricted cash, end of period |

$ 226.9 |

$ 215.8 |

|

|

Supplemental cash flow disclosures: |

|||

|

Cash paid for income taxes |

$ 0.6 |

$ — |

|

|

Non-cash activities: |

|||

|

Adjustment of right to use lease assets from lease modification |

$ — |

$ 4.2 |

|

|

Property, plant and equipment included in accounts payable and accrued liabilities |

$ 0.1 |

$ 0.3 |

|

|

Common stock withheld for tax obligations under stock-based compensation plan |

$ 0.1 |

$ — |

|

|

CENTRUS ENERGY CORP CONSOLIDATED BALANCE SHEETS (Unaudited; in millions, except share and per share data) |

|||

|

September 30, |

December 31, |

||

|

ASSETS |

|||

|

Current assets: |

|||

|

Cash and cash equivalents |

$ 194.3 |

$ 201.2 |

|

|

Accounts receivable |

19.1 |

49.4 |

|

|

Inventories |

190.7 |

306.4 |

|

|

Deferred costs associated with deferred revenue |

74.9 |

117.6 |

|

|

Other current assets |

37.9 |

10.8 |

|

|

Total current assets |

516.9 |

685.4 |

|

|

Property, plant and equipment, net of accumulated depreciation of $4.9 million and $4.3 million as of |

8.9 |

7.0 |

|

|

Deposits for financial assurance |

2.6 |

32.4 |

|

|

Intangible assets, net |

32.2 |

39.4 |

|

|

Deferred tax assets |

23.0 |

28.5 |

|

|

Other long-term assets |

7.4 |

3.5 |

|

|

Total assets |

$ 591.0 |

$ 796.2 |

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|||

|

Current liabilities: |

|||

|

Accounts payable and accrued liabilities |

$ 32.8 |

$ 41.9 |

|

|

Payables under inventory purchase agreements |

— |

41.9 |

|

|

Inventories owed to customers and suppliers |

0.8 |

84.3 |

|

|

Deferred revenue and advances from customers |

222.6 |

282.6 |

|

|

Short-term inventory loans |

54.6 |

14.3 |

|

|

Current debt |

6.1 |

6.1 |

|

|

Total current liabilities |

316.9 |

471.1 |

|

|

Long-term debt |

83.5 |

89.6 |

|

|

Postretirement health and life benefit obligations |

75.7 |

81.2 |

|

|

Pension benefit liabilities |

4.6 |

17.3 |

|

|

Advances from customers |

— |

32.8 |

|

|

Long-term inventory loans |

26.5 |

63.1 |

|

|

Other long-term liabilities |

7.4 |

8.8 |

|

|

Total liabilities |

514.6 |

763.9 |

|

|

Stockholders’ equity: |

|||

|

Preferred stock, par value $1.00 per share, 20,000,000 shares authorized |

|||

|

Series A Participating Cumulative Preferred Stock, none issued |

— |

— |

|

|

Series B Senior Preferred Stock, none issued |

— |

— |

|

|

Class A Common Stock, par value $0.10 per share, 70,000,000 shares authorized, 15,677,224 and |

1.6 |

1.5 |

|

|

Class B Common Stock, par value $0.10 per share, 30,000,000 shares authorized, 719,200 shares |

0.1 |

0.1 |

|

|

Excess of capital over par value |

205.2 |

180.5 |

|

|

Accumulated deficit |

(130.0) |

(149.5) |

|

|

Accumulated other comprehensive loss |

(0.5) |

(0.3) |

|

|

Total stockholders’ equity |

76.4 |

32.3 |

|

|

Total liabilities and stockholders’ equity |

$ 591.0 |

$ 796.2 |

|

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/centrus-reports-third-quarter-2024-results-302289128.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/centrus-reports-third-quarter-2024-results-302289128.html

SOURCE Centrus Energy Corp.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

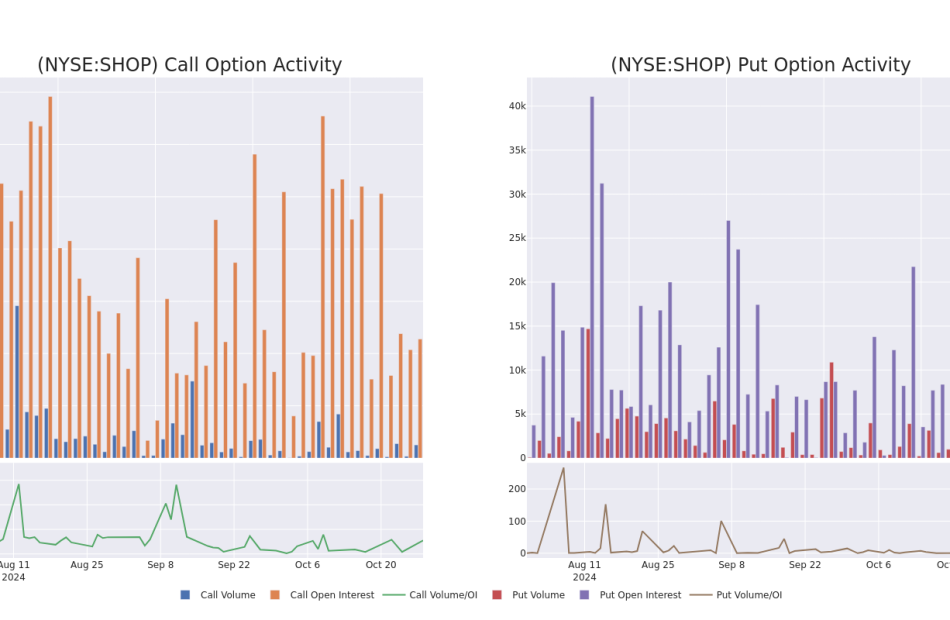

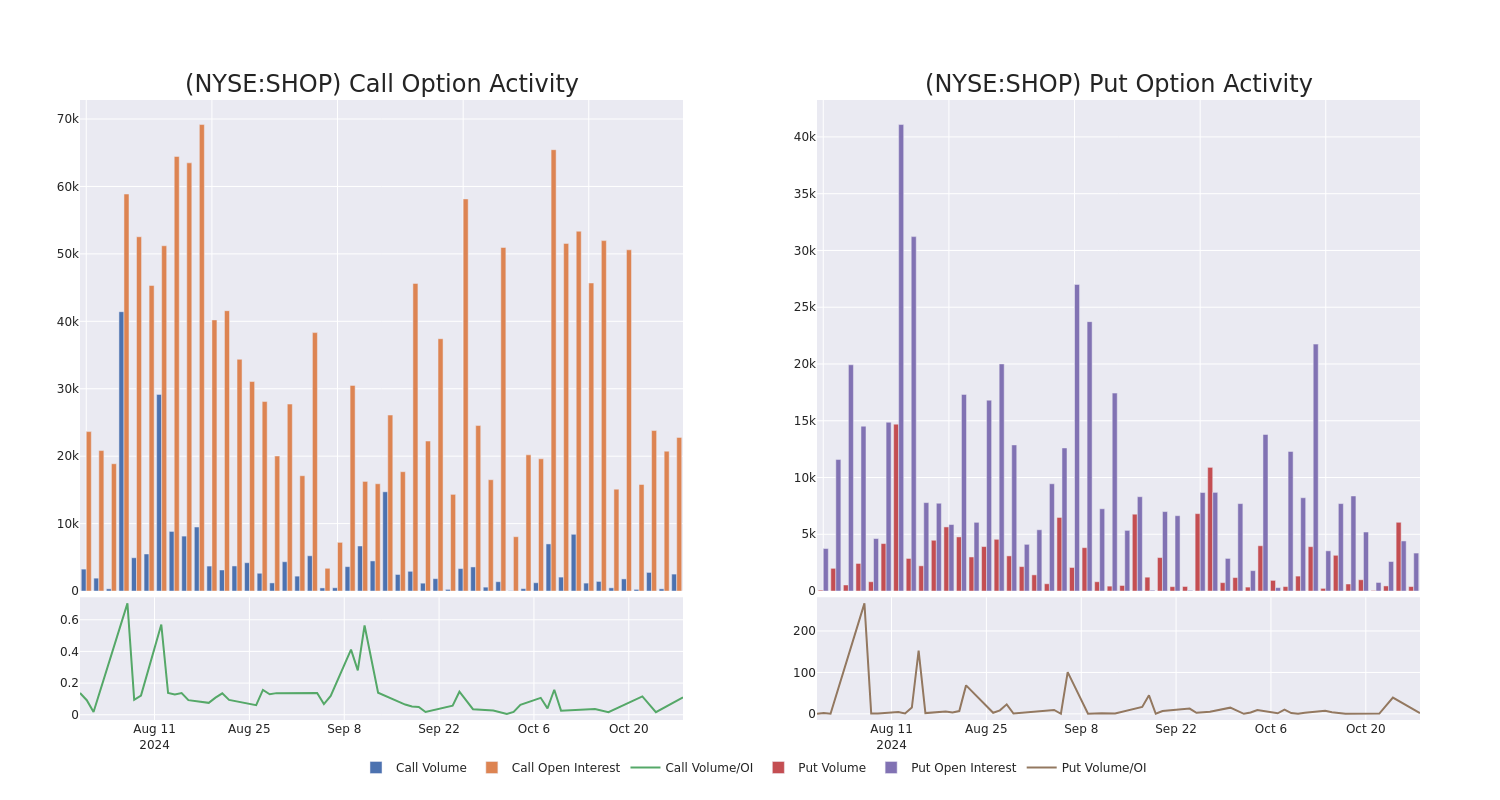

Decoding Shopify's Options Activity: What's the Big Picture?

Deep-pocketed investors have adopted a bullish approach towards Shopify SHOP, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in SHOP usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 18 extraordinary options activities for Shopify. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 44% leaning bullish and 38% bearish. Among these notable options, 5 are puts, totaling $187,170, and 13 are calls, amounting to $692,345.

What’s The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $60.0 to $100.0 for Shopify over the last 3 months.

Volume & Open Interest Trends

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Shopify’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Shopify’s significant trades, within a strike price range of $60.0 to $100.0, over the past month.

Shopify Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SHOP | CALL | SWEEP | BULLISH | 11/15/24 | $4.6 | $4.55 | $4.6 | $82.00 | $127.4K | 220 | 311 |

| SHOP | CALL | SWEEP | BULLISH | 09/19/25 | $15.35 | $15.25 | $15.35 | $80.00 | $85.9K | 576 | 57 |

| SHOP | CALL | SWEEP | BULLISH | 04/17/25 | $5.5 | $5.45 | $5.5 | $95.00 | $55.5K | 1.0K | 301 |

| SHOP | CALL | TRADE | BEARISH | 04/17/25 | $5.55 | $5.5 | $5.5 | $95.00 | $55.0K | 1.0K | 501 |

| SHOP | CALL | TRADE | BEARISH | 04/17/25 | $5.55 | $5.5 | $5.5 | $95.00 | $55.0K | 1.0K | 401 |

About Shopify

Shopify offers an e-commerce platform primarily to small and medium-size businesses. The firm has two segments. The subscription solutions segment allows Shopify merchants to conduct e-commerce on a variety of platforms, including the company’s website, physical stores, pop-up stores, kiosks, social networks (Facebook), and Amazon. The merchant solutions segment offers add-on products for the platform that facilitate e-commerce and include Shopify Payments, Shopify Shipping, and Shopify Capital.

After a thorough review of the options trading surrounding Shopify, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of Shopify

- With a volume of 3,238,291, the price of SHOP is up 1.04% at $79.87.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 15 days.

What Analysts Are Saying About Shopify

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $88.6.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Baird has decided to maintain their Outperform rating on Shopify, which currently sits at a price target of $90.

* An analyst from Citigroup persists with their Buy rating on Shopify, maintaining a target price of $103.

* Maintaining their stance, an analyst from Scotiabank continues to hold a Sector Perform rating for Shopify, targeting a price of $80.

* An analyst from RBC Capital has decided to maintain their Outperform rating on Shopify, which currently sits at a price target of $100.

* An analyst from Barclays has decided to maintain their Equal-Weight rating on Shopify, which currently sits at a price target of $70.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Shopify with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Earnings Preview: Syra Health

Syra Health SYRA is set to give its latest quarterly earnings report on Tuesday, 2024-10-29. Here’s what investors need to know before the announcement.

Analysts estimate that Syra Health will report an earnings per share (EPS) of $-0.21.

The market awaits Syra Health’s announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It’s important for new investors to understand that guidance can be a significant driver of stock prices.

Overview of Past Earnings

During the last quarter, the company reported an EPS missed by $0.02, leading to a 0.61% increase in the share price on the subsequent day.

Here’s a look at Syra Health’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | -0.19 | -0.19 | -0.09 | |

| EPS Actual | -0.21 | -0.22 | -0.16 | -0.08 |

| Price Change % | 1.0% | -5.0% | -15.0% | 14.000000000000002% |

Stock Performance

Shares of Syra Health were trading at $0.404 as of October 25. Over the last 52-week period, shares are down 67.62%. Given that these returns are generally negative, long-term shareholders are likely unhappy going into this earnings release.

To track all earnings releases for Syra Health visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

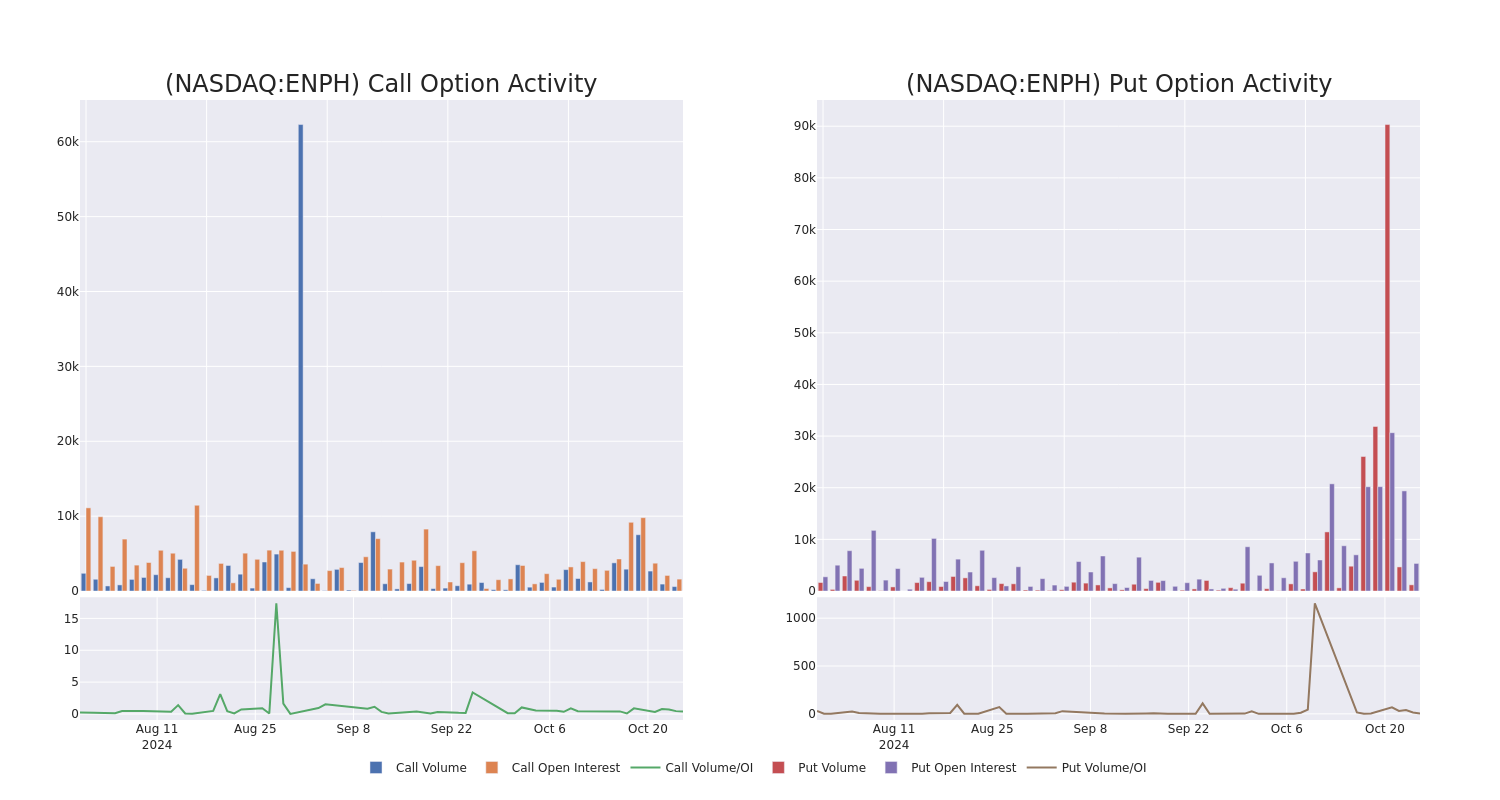

Enphase Energy Unusual Options Activity For October 28

Financial giants have made a conspicuous bearish move on Enphase Energy. Our analysis of options history for Enphase Energy ENPH revealed 22 unusual trades.

Delving into the details, we found 31% of traders were bullish, while 59% showed bearish tendencies. Out of all the trades we spotted, 8 were puts, with a value of $292,401, and 14 were calls, valued at $634,099.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $70.0 to $170.0 for Enphase Energy over the last 3 months.

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Enphase Energy’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Enphase Energy’s substantial trades, within a strike price spectrum from $70.0 to $170.0 over the preceding 30 days.

Enphase Energy Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ENPH | CALL | SWEEP | BEARISH | 02/21/25 | $17.7 | $17.55 | $17.55 | $75.00 | $114.0K | 150 | 66 |

| ENPH | CALL | SWEEP | BEARISH | 05/16/25 | $24.3 | $24.0 | $24.0 | $70.00 | $76.8K | 33 | 37 |

| ENPH | PUT | TRADE | BEARISH | 11/15/24 | $16.3 | $16.15 | $16.3 | $100.00 | $74.9K | 1.6K | 54 |

| ENPH | CALL | TRADE | BEARISH | 12/20/24 | $7.95 | $7.9 | $7.9 | $85.00 | $69.5K | 1.0K | 482 |

| ENPH | CALL | SWEEP | BULLISH | 11/15/24 | $2.87 | $2.87 | $2.87 | $92.00 | $57.4K | 122 | 223 |

About Enphase Energy

Enphase Energy is a global energy technology company. The company delivers smart, easy-to-use solutions that manage solar generation, storage, and communication on one platform. The company’s microinverter technology primarily serves the rooftop solar market and produces a fully integrated solar-plus-storage solution. Geographically, it derives a majority of revenue from the United States.

In light of the recent options history for Enphase Energy, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of Enphase Energy

- Trading volume stands at 4,287,092, with ENPH’s price up by 1.01%, positioned at $84.68.

- RSI indicators show the stock to be may be oversold.

- Earnings announcement expected in 99 days.

What Analysts Are Saying About Enphase Energy

5 market experts have recently issued ratings for this stock, with a consensus target price of $98.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Consistent in their evaluation, an analyst from Piper Sandler keeps a Neutral rating on Enphase Energy with a target price of $105.

* An analyst from Barclays persists with their Overweight rating on Enphase Energy, maintaining a target price of $114.

* In a cautious move, an analyst from RBC Capital downgraded its rating to Sector Perform, setting a price target of $100.

* Reflecting concerns, an analyst from Janney Montgomery Scott lowers its rating to Neutral with a new price target of $83.

* An analyst from Citigroup has decided to maintain their Neutral rating on Enphase Energy, which currently sits at a price target of $88.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Enphase Energy, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

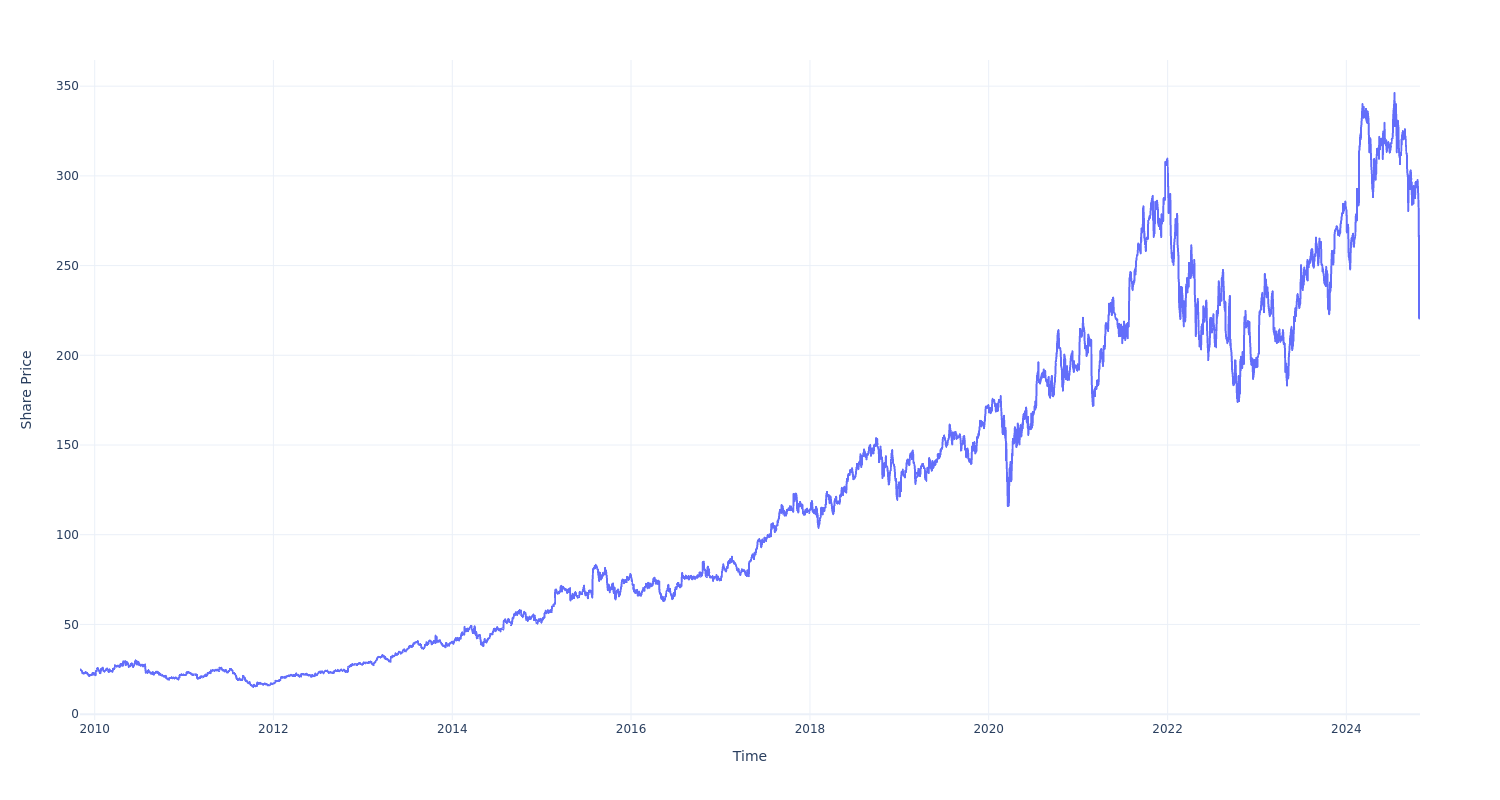

$1000 Invested In This Stock 15 Years Ago Would Be Worth $9,100 Today

Icon ICLR has outperformed the market over the past 15 years by 3.83% on an annualized basis producing an average annual return of 15.94%. Currently, Icon has a market capitalization of $18.20 billion.

Buying $1000 In ICLR: If an investor had bought $1000 of ICLR stock 15 years ago, it would be worth $9,139.97 today based on a price of $220.47 for ICLR at the time of writing.

Icon’s Performance Over Last 15 Years

Finally — what’s the point of all this? The key insight to take from this article is to note how much of a difference compounded returns can make in your cash growth over a period of time.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

COREWEAVE SIGNS 280,000 SF LEASE AT ONYX AND MACHINE'S NORTHEAST SCIENCE & TECHNOLOGY CENTER IN KENILWORTH

Conversion to Datacenter will be a Collaborative Effort Between Developer, CoreWeave and PSE&G