Questex Travel Group Announces 2025 Topics for Complimentary Virtual Events

NEW YORK, Oct. 29, 2024 (GLOBE NEWSWIRE) — Questex Travel Group announces the topics for its two complimentary virtual event series in 2025 – “Navigating Your Travel Business” and “Selling Luxury,” each hosted by the editors of Travel Agent Central and Luxury Travel Advisor respectively.

Both programs will feature a lineup of leading speakers and suppliers who will present tangible content travel advisors can leverage in their day-to-day businesses, regardless of experience level, yet targeted to either luxury-focused or contemporary travel. Topics chosen are relevant to the needs of today’s busy advisors and based on feedback provided by the advisors themselves. Between the two programs, a free virtual event will be available every month, offering educational opportunities for advisors year-round.

2025 Program:

Navigating Your Travel Business – Presented by Travel Agent Central

- January 21: Setting a Business Plan for the New Year

- March 18: Adventure Travel in Great Destinations

- May 13: Sustainability/Eco-Travel

- July 15: Island Travel

- August 19: Creating Multi-Gen Itineraries

- September 16: Traveling with Pets and Children

- November 18: How to Sell Wellness Vacations

Selling Luxury – Presented by Luxury Travel Advisor

- February 18: Crafting Over the Top Romantic Getaways

- April 15: How to Grow Your Luxury Clientele

- June 17: How to Develop Your Luxury Niche

- October 14: How to Develop Unique FIT Itineraries

- December 16: Amazing New Travel Options

Each program runs for about 90 minutes, from 1:00 pm – 3:00 pm Eastern Time, with room for Q&A at the end, and offered to advisors at no charge. Every virtual event will be recorded and available to view on-demand for six months. In addition, all materials presented by the speakers will be available for download. Plus, all who attend will be entered to win a $100 gift card each time.

Suppliers interested in presenting a product or destination during a virtual event, please click here to be contacted by a sales representative.

About Questex

Questex helps people live better and longer. Questex brings people together in the markets that help people live better: hospitality and wellness; the industries that help people live longer: life science and healthcare; and the technologies that enable and fuel these new experiences. We live in the experience economy – connecting our ecosystem through live events, surrounded by data insights and digital communities. We deliver experience and real results. It happens here.

Media Contact:

Jennifer Rosen

Senior Marketing Director

jrosen@questex.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

FIBRA Prologis Announces Third Quarter 2024 Earnings Results

MEXICO CITY, Oct. 29, 2024 /PRNewswire/ — FIBRA Prologis FIBRAPL, a leading owner and operator of Class-A industrial real estate in Mexico, today reported results for the third quarter 2024.

HIGHLIGHTS FROM THE QUARTER:

- Net effective rents on rollover were 56.2 percent.

- Period-end and average occupancy were 98.1 and 97.8 percent, respectively.

- Customer retention was 52.7 percent.

- Same store cash NOI was 4.4 percent.

- Successful first tender offer for Terrafina, 77 percent ownership acquired.

Net earnings per CBFI was Ps. 6.4887 (US$0.3448) for the quarter compared with Ps. 6.1356 (US$0.3609) for the same period in 2023.

Funds from operations (FFO), as modified by FIBRA Prologis per CBFI, was Ps. 0.6481 (US$0.0461) for the quarter compared with Ps. 0.9185 (US$0.0481) for the same period in 2023.

SOLID OPERATING RESULTS

“The third quarter marks an important milestone for the company. Following its successful tender offer, FIBRA Prologis now owns 77 percent of Terrafina,” said Héctor Ibarzabal, CEO of FIBRA Prologis. “Meanwhile, we delivered strong results and fundamentals remain healthy in our key markets.”

|

Operating Portfolio (only FIBRA |

3Q24 |

3Q23 |

Notes |

|

Period End Occupancy |

98.1 % |

98.4 % |

Four of our markets are above 99%. |

|

Average Occupancy |

97.8 % |

98.5 % |

|

|

Leases Commenced |

1.0 MSF |

1.9 MSF |

Activity primarily concentrated in Mexico City, |

|

Customer Retention |

52.7 % |

81.5 % |

Four customers vacated, strong releasing |

|

Net Effective Rent Change |

56.2 % |

46.5 % |

Led by Tijuana, Juarez, and Monterrey. |

|

Same Store Cash NOI |

4.4 % |

9.5 % |

Led by rent change and annual rent increases. |

|

Same Store Net Effective NOI |

3.0 % |

9.6 % |

Led by rent change and annual rent increases. |

STRONG FINANCIAL POSITION

As of September 30, 2024, FIBRA Prologis’ leverage was 23.3 percent and liquidity was approximately Ps. 14.3 billion (US$728 million), which included Ps. 13.2 billion (US$669 million) of available capacity on its unsecured credit facility and Ps. 1.2 billion (US$59 million) of unrestricted cash.

UPDATED GUIDANCE FOR 2024

|

(US$ in million, except per CBFI amounts) |

Low |

High |

|

FFO per CBFI |

US$0.1900 |

US$0.1950 |

|

Same Store Cash NOI |

8.5 % |

9.5 % |

|

Asset Management and Professional Fees |

US$50 |

US$55 |

|

Building Acquisitions (not including |

US$250 |

US$350 |

WEBCAST & CONFERENCE CALL INFORMATION

FIBRA Prologis will host a live webcast/conference call to discuss quarterly results, current market conditions and future outlook. Here are the event details:

- Wednesday, October 30, 2024, at 9 a.m. Mexico Time.

- Access the live webcast at www.fibraprologis.com, in the Investor Relations section, by clicking Events.

- Dial in: +1 888 596 4144 or +1 646 968 2525 and enter Passcode 4603995.

A telephonic replay will be available October 30 – November 13 at +1 800 770 2030 from the U. S. and Canada or at +1 647 362 9199 from all other countries using conference code 4603995. The replay will be posted in the Investor Relations section of the FIBRA Prologis website.

ABOUT FIBRA PROLOGIS

FIBRA Prologis is a leading owner and operator of Class-A industrial real estate in Mexico. As of September 30, 2024, FIBRA Prologis was comprised of 514 logistics and manufacturing facilities in six industrial markets in Mexico totaling 89.5 million square feet (8.3 million square meters) of gross leasable area along with 165 buildings totaling 24.0 million square feet (2.2 million square meters) of non-strategic assets.

FORWARD-LOOKING STATEMENTS

The statements in this release that are not historical facts are forward-looking statements. These forward-looking statements are based on current expectations, estimates and projections about the industry and markets in which FIBRA Prologis operates, management’s beliefs and assumptions made by management. Such statements involve uncertainties that could significantly impact FIBRA Prologis financial results. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” variations of such words and similar expressions are intended to identify such forward-looking statements, which generally are not historical in nature. All statements that address operating performance, events or developments that we expect or anticipate will occur in the future — including statements relating to rent and occupancy growth, acquisition activity, development activity, disposition activity, general conditions in the geographic areas where we operate, our debt and financial position, are forward-looking statements. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict. Although we believe the expectations reflected in any forward-looking statements are based on reasonable assumptions, we can give no assurance that our expectations will be attained and therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements. Some of the factors that may affect outcomes and results include, but are not limited to: (i) national, international, regional and local economic climates, (ii) changes in financial markets, interest rates and foreign currency exchange rates, (iii) increased or unanticipated competition for our properties, (iv) risks associated with acquisitions, dispositions and development of properties, (v) maintenance of real estate investment trust (“FIBRA”) status and tax structuring, (vi) availability of financing and capital, the levels of debt that we maintain and our credit ratings, (vii) risks related to our investments (viii) environmental uncertainties, including risks of natural disasters, (ix) risks related to the coronavirus pandemic, and (x) those additional factors discussed in reports filed with the “Comisión Nacional Bancaria y de Valores” and the Mexican Stock Exchange by FIBRA Prologis under the heading “Risk Factors.” FIBRA Prologis undertakes no duty to update any forward-looking statements appearing in this release.

Non-Solicitation – Any securities discussed herein or in the accompanying presentations, if any, have not been registered under the Securities Act of 1933 or the securities laws of any state and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements under the Securities Act and any applicable state securities laws. Any such announcement does not constitute an offer to sell or the solicitation of an offer to buy the securities discussed herein or in the presentations, if and as applicable.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/fibra-prologis-announces-third-quarter-2024-earnings-results-302290772.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/fibra-prologis-announces-third-quarter-2024-earnings-results-302290772.html

SOURCE FIBRA Prologis

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

First National Financial Corporation Reports Third Quarter 2024 Results, Increases Common Share Dividend and Announces Special Dividend

TORONTO, Oct. 29, 2024 /CNW/ – First National Financial Corporation FN FN FN (the “Company” or “FNFC”) today announced its financial results for the three and nine months ended September 30, 2024. The Company derives virtually all of its earnings from its wholly owned subsidiary, First National Financial LP (“FNFLP” or “First National”), one of Canada’s largest non-bank mortgage originators and underwriters.

Third Quarter Summary

- Mortgages Under Administration (“MUA”) increased 6% to a record $150.6 billion from $141.9 billion at September 30, 2023

- Revenue decreased 1% to $560.4 from $562.9 million a year ago

- Pre-FMV Income(1) decreased 21% to $75.3 million from $95.5 million a year ago

- Net income was $36.4 million ($0.59 cents per share) compared to $83.6 million ($1.38 per share) a year ago

|

1 |

This non-IFRS measure adjusts income before income taxes by eliminating the impact of changes in fair value by adding back losses on the valuation of financial instruments (except those on mortgage investments) and deducting gains on the valuation of financial instruments (except those on mortgage investments). See Non-GAAP measures. |

Increase in Common Share Dividend

The Board of Directors today announced an increase in the Company’s regular monthly dividend to an annualized rate of $2.50 per common share from $2.45 per share annualized, effective with the payment on December 13, 2024, for shareholders of record November 29, 2024.

Special Dividend

The Board of Directors also announced a special dividend of $0.50 per common share to be paid on December 13, 2024 to shareholders of record on November 29, 2024. This payment reflects the Board’s determination that First National has generated excess capital in the past year and that the capital needed for near-term growth can be generated from current operations.

Management Commentary

“The third quarter unfolded as we expected with First National’s diverse revenue sources helping to offset the effects of a challenging marketplace on mortgage origination activity,” said Jason Ellis, President and CEO. “With recent action by the Bank of Canada to reduce interest rates, we are now seeing a marked increase in residential mortgage commitments which should translate well in coming quarters. The strength of our business model and confidence in the future are reflected in the Board’s decision to increase the common share dividend – for the 18th time in the 18 years since FN listed on the S&P/TSX. Going forward, our focus remains squarely on delivering good service for our customers and partners, which is our foundation for value creation.”

Third Quarter Review

|

Quarter ended |

Nine months ended |

|||

|

September 30, |

September 30, |

September 30, |

September 30, |

|

|

For the Period |

($000s) |

|||

|

Revenue |

560,386 |

562,861 |

1,616,881 |

1,520,844 |

|

Income before income taxes |

49,689 |

113,830 |

191,071 |

284,012 |

|

Pre-FMV Income (1) |

75,254 |

95,456 |

215,497 |

245,058 |

|

At Period End |

||||

|

Total assets |

50,460,286 |

45,176,543 |

50,460,286 |

45,176,543 |

|

Mortgages Under Administration |

150,568,194 |

141,915,465 |

150,568,194 |

141,915,465 |

|

1 |

This non-IFRS measure adjusts income before income taxes by eliminating the impact of changes in fair value by adding back losses on the valuation of financial instruments (except those on mortgage investments) and deducting gains on the valuation of financial instruments (except those on mortgage investments). See Non-GAAP Measures. |

First National’s MUA increased 6% to $150.6 billion at September 30, 2024 from $141.9 billion at September 30, 2023, or 6% on an annualized basis since June 30, 2024. At quarter end, single-family MUA was $95.4 billion, up 1% from $94.6 billion at September 30, 2023, while commercial MUA was $55.2 billion, up 16% from $47.4 billion a year ago.

Single-family mortgage origination (including renewals) was $6.7 billion compared to $8.3 billion in the third quarter of 2023, a decrease of 20%. This performance reflected increased competition in the mortgage broker distribution channel. Despite the year-over-year decrease in origination, First National has maintained its relative position within the channel. First National’s MERLIN technology and operating systems continued to support efficient and effective mortgage underwriting across the country.

Commercial segment originations (including renewals) were $2.7 billion compared to $3.3 billion in the third quarter a year ago, a 17% decrease primarily attributable to fewer renewal opportunities in the quarter. Mortgage volume growth of 17% over the first nine months of 2024 reflected continuing demand for insured mortgages in the multi-unit property market.

Third quarter revenue decreased 1% to $560.4 million from $562.9 million a year ago. During the quarter, the Company generated:

- $60.2 million of net interest revenue earned on securitized mortgages (NII) compared to $57.7 million a year ago, a 4% increase as the Company’s portfolio of mortgages pledged under securitization grew 14% year over year to $44.4 billion. Commercial segment earnings increased $3.3 million on a larger portfolio combined with an increase in NII reflecting the success of the Company’s insured construction loan program, while Residential segment NII was lower by $0.8 million on narrower margins on Prime mortgages partially offset by favourable results from the Excalibur securitization program

- $57.1 million of placement fees, down 25% from $75.8 million a year ago due to a 29% reduction in placement activity. Per-unit placement fees were 7% higher year over year largely due to several residential placement transactions priced at market yields at settlement as opposed to the more common fixed placement fee set at origination

- $66.1 million of mortgage servicing income, compared to $71.1 million a year ago, a 7% decrease reflecting lower revenues from third-party underwriting, partially offset by higher revenues related to MUA including administrative fees

- $40.9 million of mortgage investment income compared to $42.3 million a year ago, a 3% reduction primarily reflecting a smaller mortgage investment portfolio

- $2.9 million of gains on deferred placement fees compared to $7.0 million a year ago, a 59% decrease as fewer multi-unit residential mortgages were originated and sold to institutional investors combined with generally tighter spreads in this business reflecting a more competitive environment. Of the $9.4 billion of originations in the third quarter, $5.4 billion was placed with institutional investors and $3.8 billion was originated for the Company’s own securitization programs.

Third quarter income before income taxes was $49.7 million compared to $113.8 million a year ago, reflecting changing capital market conditions which affected the value of financial instruments used to economically hedge residential mortgage commitments. More specifically, during the 2024 third quarter, the Company recorded $25.6 million of losses on financial instruments (excluding losses related to mortgage and loan investments) compared to gains of $18.4 million a year ago on the same basis. This performance reflected a decline in bond yields in 2024 as less restrictive monetary policy led to interest rate cuts compared to 2023 when bond yields increased. Without these changes, revenue grew by 8%, supported by higher revenue from a growing securitization portfolio and higher coupon rates.

Earnings before income taxes and gains and losses on financial instruments (“Pre-FMV Income1“), which excludes the impact of these changes, decreased 21% to $75.3 million from $95.5 million in the third quarter of 2023. This reflected lower single-family origination which negatively affected both placement fees and mortgage servicing revenue related to third-party underwriting services. Lower volumes reduced the Company’s operating leverage compared to the prior year’s quarter. The Company also invested more heavily in its direct securitization programs which delayed the recognition of revenue to future periods in contrast to the comparative quarter. Higher operating costs, particularly related to technology, further reduced earnings by $4.9 million.

Outstanding Securities

At September 30, 2024 and October 29, 2024, the Corporation had outstanding: 59,967,429 common shares; 2,984,835 Class A preference shares, Series 1; 1,015,165 Class A preference shares, Series 2; 200,000 November 2024 senior unsecured notes; 200,000 November 2025 senior unsecured notes; 200,000 September 2026 unsecured notes; and 200,000 November 2027 senior unsecured notes.

Dividends

Common share dividends paid or declared in the third quarter amounted to $36.7 million (payout ratio 104%) compared to $36.0 million a year ago (payout ratio 44%). If gains and losses on financial instruments in the two quarters are excluded, the regular dividend payout ratio for the third quarter of 2024 would have been 68% compared to 52% in the 2023 quarter. Gains and losses are recorded in the period in which the price of Government of Canada bonds change; however, the offsetting economic impact is generally reflected in narrower or wider spreads in the future once the mortgages have been pledged for securitization. Accordingly, management does not consider such gains and losses to affect its dividend payment policy in the short term.

First National paid $1.0 million of dividends on its preferred shares in the third quarter, unchanged from a year ago.

First National, for the purposes of the Income Tax Act (Canada) and any similar provincial legislation, advises that its dividends declared will be eligible dividends, unless otherwise indicated. This includes the special common share dividend to be paid in December 2024.

Outlook

The third quarter of 2024 unfolded much as the Company expected. In general, management believes housing activity and prices are relatively stable with some regional outperformance observed in Alberta and Quebec. The Company believes lower single-family origination is primarily the result of increased competition particularly in the mortgage broker distribution channel. In the third quarter, the Company continued to build its MUA and its portfolio of mortgages pledged under securitization. It will benefit from both MUA and the securitized portfolio in the future: earning income from mortgage administration, net securitization margin and improving its position to capture increased renewal opportunities.

In the short term, the Company now expects increased year-over-year single-family origination in the next two quarters. With the Bank of Canada cutting overnight rates by 0.75% between June and September and a further reduction of 0.50% on October 23, 2024, not only are mortgage rates lower but the fear of a rising rate environment has been allayed somewhat. Management believes this backdrop may provide confidence to borrowers who have remained on the sidelines. In fact, single-family mortgage commitments issued in the third quarter were approximately 50% higher than those issued during the same quarter last year. Given this growth in mortgage commitments, management expects fourth quarter new origination volumes to exceed those from the same quarter last year. For its commercial segment, the Company anticipates steady new origination volumes as government incentives support the creation of multi-unit housing. These initiatives, including the recent increase of the Canada Mortgage Bond program from $40 to $60 billion, not only enhanced the level of financing available for multi-unit mortgages, but removed uncertainties about such programs in the future. These developments have created a reliable and stable source of funds for the Company to originate CMHC insured multi-unit mortgages. However, given the increased certainty of these programs, other lenders have become more aggressive and mortgage spreads are narrowing from the levels originated in 2023 and those to start 2024 as the Company competes for qualifying mortgages. In both business segments, management is confident that First National will remain a competitive lender in the marketplace.

First National is well prepared to execute its business plan. The Company expects to enjoy the value of its continued goodwill with broker partners earned over the last 35+ years. With diverse relationships over an array of institutional investors and solid securitization markets, the Company has access to consistent and reliable sources of funding.

The Company is confident that its strong relationships with mortgage brokers and diverse funding sources will continue to set First National apart from its competition. The Company will continue to generate income and cash flow from its $44 billion portfolio of mortgages pledged under securitization and $104 billion servicing portfolio and focus on the value inherent in its significant single-family renewal book.

Conference Call and Webcast

|

October 30, 2024 10:00 am ET |

1-888 510-2154 or (437) 900-0527 www.firstnational.ca

|

A taped rebroadcast of the conference call will be available until November 6, 2024 at midnight ET. To access the rebroadcast, please dial (888) 660-6345 or (646) 517-4150 and enter passcode 09696 followed by the number sign. The webcast is archived at www.firstnational.ca for three months.

Complete consolidated financial statements for the Company as well as management’s discussion and analysis are available at www.sedar.com and at www.firstnational.ca.

About First National Financial Corporation

First National Financial Corporation FNFNFN is the parent company of First National Financial LP, a Canadian-based originator, underwriter and servicer of predominantly prime residential (single-family and multi-unit) and commercial mortgages. With more than $150 billion in mortgages under administration, First National is one of Canada’s largest non-bank mortgage originators and underwriters and is among the top three lenders in market share in the mortgage broker distribution channel. For more information, please visit www.firstnational.ca.

1 Non-GAAP Measures

The Company uses IFRS as its accounting framework. IFRS are generally accepted accounting principles (GAAP) for Canadian publicly accountable enterprises for years beginning on or after January 1, 2011. The Company also refers to certain measures to assist in assessing financial performance. These “non-GAAP measures” such as “Pre-FMV EBITDA” and “After tax Pre-FMV Dividend Payout Ratio” should not be construed as alternatives to net income or loss or other comparable measures determined in accordance with GAAP as an indicator of performance or as a measure of liquidity and cash flow. Non-GAAP measures do not have standard meanings prescribed by GAAP and therefore may not be comparable to similar measures presented by other issuers.

Forward-Looking Information

Certain information included in this news release may constitute forward-looking information within the meaning of securities laws. In some cases, forward-looking information can be identified by the use of terms such as “may”, “will, “should”, “expect”, “plan”, “anticipate”, “believe”, “intend”, “estimate”, “predict”, “potential”, “continue” or other similar expressions concerning matters that are not historical facts. Forward-looking information may relate to management’s future outlook and anticipated events or results, and may include statements or information regarding the future financial position, business strategy and strategic goals, product development activities, projected costs and capital expenditures, financial results, risk management strategies, hedging activities, geographic expansion, licensing plans, taxes and other plans and objectives of or involving the Company. Particularly, information regarding growth objectives, any future increase in mortgages under administration, future use of securitization vehicles, industry trends and future revenues is forward-looking information. Forward-looking information is based on certain factors and assumptions regarding, among other things, interest rate changes and responses to such changes, the demand for institutionally placed and securitized mortgages, the status of the applicable regulatory regime and the use of mortgage brokers for single family residential mortgages. This forward-looking information should not be read as providing guarantees of future performance or results, and will not necessarily be an accurate indication of whether or not, or the times by which, those results will be achieved. While management considers these assumptions to be reasonable based on information currently available, they may prove to be incorrect. Forward looking-information is subject to certain factors, including risks and uncertainties listed under ”Risks and Uncertainties Affecting the Business” in the MD&A, that could cause actual results to differ materially from what management currently expects. These factors include reliance on sources of funding, concentration of institutional investors, reliance on relationships with independent mortgage brokers and changes in the interest rate environment. This forward-looking information is as of the date of this release, and is subject to change after such date. However, management and First National disclaim any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required under applicable securities regulations.

SOURCE First National Financial Corporation

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2024/29/c1093.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2024/29/c1093.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

MSTR Vs. RIOT Vs. COIN: Which Crypto Stock Stands Out Ahead Of Q3 Earnings?

As the cryptocurrency sector remains a rollercoaster ride for investors, three heavyweights – MicroStrategy Inc. MSTR, Riot Platforms Inc. RIOT, and Coinbase Global Inc. COIN – are gearing up to release their third-quarter earnings on Wednesday.

With varied year-to-date performances and significant price movements, the question on everyone’s mind is: which of these crypto stocks is primed for a bullish breakout?

MicroStrategy: Riding High On Bitcoin

MicroStrategy has become a darling for crypto investors, boasting an impressive 275.55% year-to-date rise and a staggering 512.40% over the past year, bolstered by Bitcoin‘s BTC/USD trajectory. However, the company is expected to report a loss of 14 cents per share, with revenues projected at $122.66 million.

Chart created using Benzinga Pro

The technical indicators paint a glowing picture: the stock trades well above its five, 20 and 50-day exponential moving averages, signaling strong bullish momentum. Currently priced at $256.34, MSTR is above all key simple moving averages (SMAs), making it a strong bullish case.

With a Moving Average Convergence/Divergence (MACD) of 23.01 and a Relative Strength Index (RSI) suggesting overbought conditions at 77.16, the bullish sentiment seems almost undeniable.

Analysts agree, giving it a consensus price target of $432.45—a potential goldmine if MicroStrategy continues its upward trajectory.

Riot Platforms: A Phoenix Rising From The Ashes?

On the other end of the spectrum, Riot Platforms has struggled with a 28.96% decline year-to-date, despite showing a modest 13.91% rise over the past year. Anticipating a loss of 16 cents per share with revenues of $95.35 million, RIOT’s price is $10.93.

Chart created using Benzinga Pro

However, the technicals suggest a turnaround is possible. Like MSTR, RIOT’s shares are above their five, 20,and 50-day EMAs, indicating bullish pressure. With all relevant SMAs affirming a bullish signal, RIOT could be poised for a comeback.

Its MACD is positive, 0.73, while the RSI is at 73.07, which indicates the stock is in overbought territory. However, analysts still see potential, with a consensus price target of $18.98.

Coinbase: The Heavy Hitter

Finally, we have Coinbase, which has seen a respectable 40.74% gain year-to-date and is up an eye-popping 200% over the past year. Expecting earnings of 43 cents per share and revenues of $1.25 billion, COIN’s current price is $219.75.

Chart created using Benzinga Pro

The stock also demonstrates robust technical indicators, trading above all its short- to long-term SMAs, further supporting a bullish outlook. With a MACD of 10.41 and an RSI of 63.61, COIN appears to be in a solid position as it approaches earnings.

Analysts are optimistic, giving it a consensus price target of $231.27, suggesting there’s room for more growth ahead.

The Verdict

As these three crypto stocks prepare to unveil their third-quarter earnings, MicroStrategy seems to be the frontrunner, bolstered by bullish solid indicators and a high analyst price target. Riot Platforms is eyeing a potential turnaround, while Coinbase stands strong with solid fundamentals and a promising outlook.

Read Next:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Preview: ACRES Commercial Realty's Earnings

ACRES Commercial Realty ACR is gearing up to announce its quarterly earnings on Wednesday, 2024-10-30. Here’s a quick overview of what investors should know before the release.

Analysts are estimating that ACRES Commercial Realty will report an earnings per share (EPS) of $0.47.

ACRES Commercial Realty bulls will hope to hear the company announce they’ve not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

Historical Earnings Performance

Last quarter the company beat EPS by $0.05, which was followed by a 3.56% increase in the share price the next day.

Here’s a look at ACRES Commercial Realty’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.46 | 0.46 | 0.47 | 0.46 |

| EPS Actual | 0.51 | 0.16 | 0.55 | 0.73 |

| Price Change % | 4.0% | -4.0% | 1.0% | 5.0% |

Performance of ACRES Commercial Realty Shares

Shares of ACRES Commercial Realty were trading at $15.12 as of October 28. Over the last 52-week period, shares are up 100.95%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Don't Be Fooled By Flashy Numbers: Read Between The Lines With This Guide To Cannabis Earnings Reports

Whether you’re a newcomer, a seasoned investor, or just curious about the cannabis industry, this guide offers a breakdown of key elements and advanced metrics to help you make informed investment decisions. Understanding these financial statements enables you to read between the lines, assess a company’s performance, and recognize growth or red flags.

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. You can’t afford to miss out if you’re serious about the business.

Guide To Cannabis Earnings Reports

1. Revenue And Growth Metrics

- What It Means: Revenue reflects total sales and is a core indicator of demand for a company’s products.

- Look For: Compare revenue year-over-year (YoY) and quarter-over-quarter (QoQ). Small revenue increases or a flatline across quarters could suggest growth has slowed. For example, if last quarter’s revenue was CA$118 million and this quarter is CA$118.1 million, that minor growth isn’t as impactful as a “record quarter” headline might suggest.

2. Net Income vs. Net Loss

- What It Means: Net income (or net loss if negative) shows if a company is profitable after all expenses.

- Look For: Positive net income or narrower losses over time are positive signals. Watch for companies that emphasize “record revenue” without disclosing their net income, as this can sometimes mask ongoing losses.

3. Gross Profit And Gross Margin

- What It Means: Gross profit is revenue minus production costs, while gross margin is the percentage of revenue left after production costs.

- Look For: Ideally, you want stable or growing gross margins. Shrinking gross margins, often seen in cannabis due to price competition, suggest increased costs or reduced pricing power.

4. Operating Income And Operating Margin

- What It Means: Operating income reflects profit from core business operations, and operating margin shows the percentage of revenue that becomes operating income.

- Look For: Consistently high operating margins, which indicate efficiency. Cannabis companies with strong operating margins are better positioned to weather market fluctuations.

5. EBITDA And Adjusted EBITDA

- What It Means: EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) reflects core profitability, excluding financing and non-operational expenses.

- Look For: Adjusted EBITDA excludes one-time or non-cash expenses and can provide insight into the business’s performance. However, checking what’s included in “adjustments” is crucial since this can sometimes obscure true operating costs.

6. Cash Flow Metrics

- What It Means: Cash flow reflects real cash generated or used within a company. Operating cash flow is critical as it shows if core business activities are profitable.

- Look For: Positive operating cash flow suggests strong operational health. Companies reliant on financing (rather than operations) to generate cash may face sustainability challenges.

Read Also: Your CPA Called: Here’s What The IRS Should Know About Cannabis Businesses

Advanced Metrics And Ratios: Key Performance Indicators (KPIs)

Once you’re familiar with core metrics, these advanced ratios provide a clearer picture of a company’s financial health and efficiency:

Quick Ratio

- Definition: Measures a company’s ability to cover its short-term liabilities with liquid assets (cash and receivables). Calculated as (cash + accounts receivable) / current liabilities.

- Why It Matters: A higher quick ratio indicates strong liquidity. Cannabis companies facing tight cash flows should ideally have a quick ratio above 1.

Current Ratio

- Definition: Reflects a company’s ability to meet short-term obligations with current assets, calculated as current assets / current liabilities.

- Why It Matters: A current ratio above 1 is generally favorable. In cannabis, this ratio provides insight into a company’s short-term financial resilience, especially for companies needing to cover costs without additional debt or equity.

Cash Conversion Cycle (CCC)

- Definition: Measures the time it takes for a company to convert inventory into cash flow. The formula adds Days Inventory Outstanding (DIO) and Days Sales Outstanding (DSO) and subtracts Days Payables Outstanding (DPO).

- Why It Matters: A shorter CCC indicates faster cash flow generation from inventory. Cannabis companies with a high CCC may face delays in revenue realization, which can strain cash flow, especially if they operate in highly regulated environments with compliance costs.

Free Cash Flow (FCF)

- Definition: Cash remaining after capital expenditures, calculated as operating cash flow – capital expenditures (CapEx).

- Why It Matters: Positive free cash flow enables companies to invest in growth or reduce debt. Cannabis companies with positive FCF are better positioned for expansion without relying on external financing.

Cash Burn Rate

- Definition: Measures how quickly a company uses cash, calculated as (beginning cash – ending cash) / period length (in months).

- Why It Matters: A high burn rate may indicate unsustainable expenses, especially for cannabis startups. Tracking burn rate against cash reserves (cash runway) reveals how long a company can operate before needing more capital.

Debt-to-Equity Ratio

- Definition: Compares total liabilities to shareholders’ equity, showing how much of the company’s financing comes from debt versus equity.

- Why It Matters: High debt in cannabis is riskier due to limited financing options. A lower debt-to-equity ratio generally indicates less risk, especially in a market with uncertain regulation.

Dilution Rate

- Definition: Measures how much a company’s share count has increased, calculated as shares outstanding this year divided by shares last year.

- Why It Matters: Frequent share issuance dilutes existing shareholders and can signal a company’s dependence on external funding. In cannabis, a high dilution rate can indicate cash flow issues, as many companies rely on issuing shares for funding.

Interest Expense Coverage

- Definition: Compares a company’s operating income to its interest expenses, highlighting how well it can cover debt costs.

- Why It Matters: Given the cannabis industry’s often limited access to traditional financing, managing debt interest is critical. A high coverage ratio (operating income comfortably covering interest) is a positive sign.

Pro Tip: Beware Of “Highlights Only” Releases

- Why This Matters: Companies often share “highlights” in a press release without disclosing net income, operating expenses, or other critical metrics. Wait for the full earnings report to ensure you have the complete picture.

By understanding these core and advanced metrics, you can gain a well-rounded view of a cannabis company’s financial health. And if you’re looking for accessible financial insights, check out Brian Feroldi on Instagram, where he breaks down complex financial topics for free. Happy reading and investing!

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Click on the image for more info.

Cannabis rescheduling seems to be right around the corner

Want to understand what this means for the future of the industry?

Hear directly for top executives, investors and policymakers at the Benzinga Cannabis Capital Conference, coming to Chicago this Oct. 8-9.

Get your tickets now before prices surge by following this link.

A Look Ahead: TOMI Environmental Solns's Earnings Forecast

TOMI Environmental Solns TOMZ is set to give its latest quarterly earnings report on Wednesday, 2024-10-30. Here’s what investors need to know before the announcement.

Analysts estimate that TOMI Environmental Solns will report an earnings per share (EPS) of $0.00.

Investors in TOMI Environmental Solns are eagerly awaiting the company’s announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It’s worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

Historical Earnings Performance

In the previous earnings release, the company beat EPS by $0.04, leading to a 8.23% drop in the share price the following trading session.

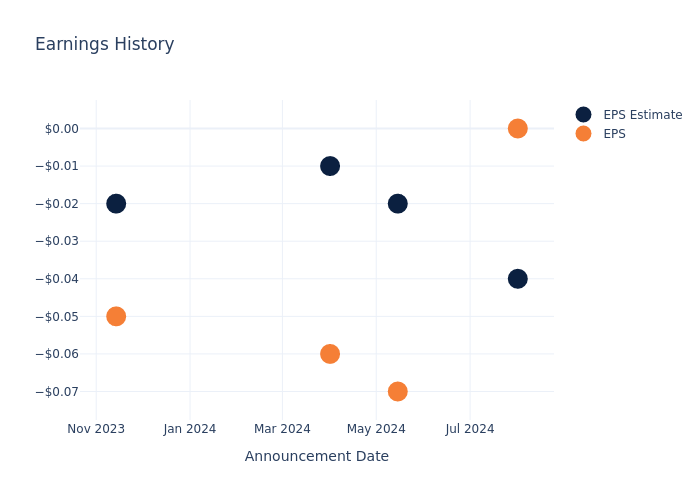

Here’s a look at TOMI Environmental Solns’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | -0.04 | -0.02 | -0.01 | -0.02 |

| EPS Actual | 0 | -0.07 | -0.06 | -0.05 |

| Price Change % | -8.0% | -6.0% | 2.0% | 7.000000000000001% |

Market Performance of TOMI Environmental Solns’s Stock

Shares of TOMI Environmental Solns were trading at $0.92405 as of October 28. Over the last 52-week period, shares are down 2.02%. Given that these returns are generally negative, long-term shareholders are likely upset going into this earnings release.

Analysts’ Perspectives on TOMI Environmental Solns

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding TOMI Environmental Solns.

The consensus rating for TOMI Environmental Solns is Buy, derived from 1 analyst ratings. An average one-year price target of $3.5 implies a potential 278.77% upside.

Understanding Analyst Ratings Among Peers

The below comparison of the analyst ratings and average 1-year price targets of Aqua Metals and Quest Resource Holding, three prominent players in the industry, gives insights for their relative performance expectations and market positioning.

- Aqua Metals is maintaining an Buy status according to analysts, with an average 1-year price target of $1.5, indicating a potential 62.33% upside.

- Quest Resource Holding is maintaining an Buy status according to analysts, with an average 1-year price target of $12.75, indicating a potential 1279.8% upside.

Overview of Peer Analysis

Within the peer analysis summary, vital metrics for Aqua Metals and Quest Resource Holding are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| TOMI Environmental Solns | Buy | 8.60% | $1.85M | 0.42% |

| Aqua Metals | Buy | 0.00% | $-2.37M | -25.59% |

| Quest Resource Holding | Buy | -1.81% | $13.53M | -2.30% |

Key Takeaway:

TOMI Environmental Solns ranks highest in Revenue Growth among its peers. It has the lowest Gross Profit margin. The company’s Return on Equity is also the lowest among its peers.

Discovering TOMI Environmental Solns: A Closer Look

TOMI Environmental Solutions Inc is a bacteria decontamination and infectious disease control company, providing environmental solutions for indoor surface decontamination through the manufacturing, sales, service and licensing of its SteraMist brand of products, including SteraMist BIT, a low percentage (7.8%) hydrogen peroxide-based fog or mist that uses Binary Ionization Technology (BIT). Its product portfolio includes SteraMist Surface Unit; SteraMist Environment System; The SteraMist Total Disinfection Cart; SteraMist Select Surface Unit; Stainless Steel 90 Degree Applicator; iHP Plasma Decontamination Chamber; SteraMist Custom Engineered System (CES); and iHP Corporate Service Decontamination.

Understanding the Numbers: TOMI Environmental Solns’s Finances

Market Capitalization: Indicating a reduced size compared to industry averages, the company’s market capitalization poses unique challenges.

Revenue Growth: Over the 3 months period, TOMI Environmental Solns showcased positive performance, achieving a revenue growth rate of 8.6% as of 30 June, 2024. This reflects a substantial increase in the company’s top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Industrials sector.

Net Margin: TOMI Environmental Solns’s net margin is impressive, surpassing industry averages. With a net margin of 1.0%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): TOMI Environmental Solns’s ROE stands out, surpassing industry averages. With an impressive ROE of 0.42%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): TOMI Environmental Solns’s ROA excels beyond industry benchmarks, reaching 0.25%. This signifies efficient management of assets and strong financial health.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.42.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

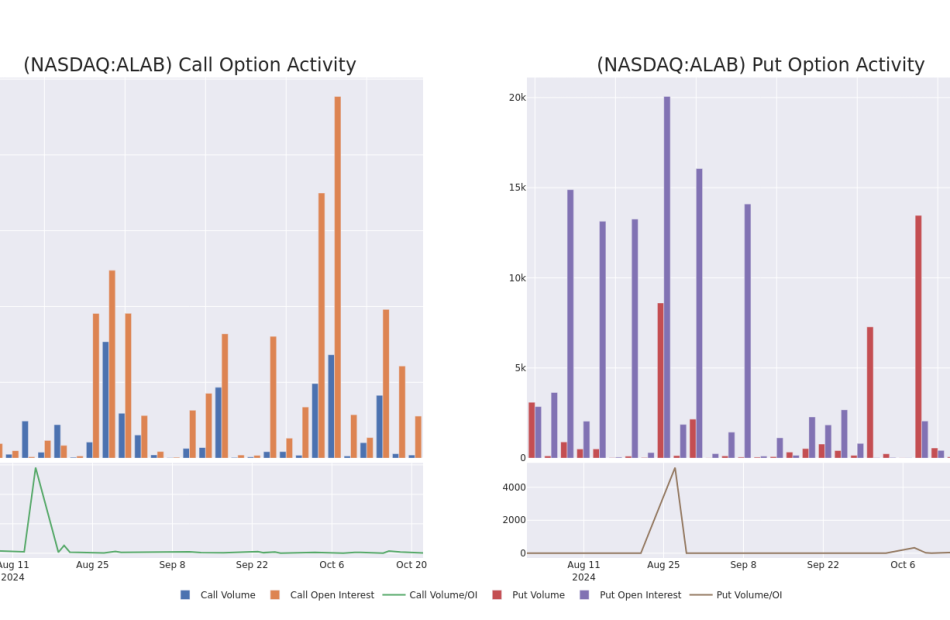

Check Out What Whales Are Doing With ALAB

Investors with a lot of money to spend have taken a bullish stance on Astera Labs ALAB.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with ALAB, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 12 uncommon options trades for Astera Labs.

This isn’t normal.

The overall sentiment of these big-money traders is split between 58% bullish and 16%, bearish.

Out of all of the special options we uncovered, 4 are puts, for a total amount of $171,519, and 8 are calls, for a total amount of $356,432.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $40.0 to $100.0 for Astera Labs over the recent three months.

Insights into Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Astera Labs’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Astera Labs’s substantial trades, within a strike price spectrum from $40.0 to $100.0 over the preceding 30 days.

Astera Labs Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ALAB | CALL | SWEEP | BULLISH | 01/17/25 | $11.0 | $10.7 | $11.0 | $72.50 | $110.0K | 56 | 100 |

| ALAB | PUT | TRADE | NEUTRAL | 11/15/24 | $8.9 | $6.5 | $7.5 | $77.50 | $71.2K | 2 | 95 |

| ALAB | CALL | SWEEP | NEUTRAL | 11/15/24 | $20.0 | $19.3 | $20.0 | $55.00 | $60.0K | 4.9K | 37 |

| ALAB | PUT | SWEEP | BULLISH | 11/15/24 | $6.0 | $5.9 | $5.95 | $75.00 | $38.9K | 59 | 81 |

| ALAB | CALL | SWEEP | NEUTRAL | 11/15/24 | $3.9 | $3.7 | $3.7 | $80.00 | $38.8K | 2.0K | 343 |

About Astera Labs

Astera Labs Inc is a company that offers an Intelligent Connectivity Platform, comprised of Semiconductor-based, high-speed mixed-signal connectivity products that integrate a matrix of microcontrollers and sensors. COSMOS, their software suite which is embedded in its connectivity products and integrated into their customers’ systems. The Company delivers critical connectivity performance, enables flexibility and customization, and supports observability and predictive analytics. This approach addresses the data, network, and memory bottlenecks, scalability, and other infrastructure requirements of hyperscalers and system original equipment manufacturers.

In light of the recent options history for Astera Labs, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Astera Labs’s Current Market Status

- Currently trading with a volume of 1,416,242, the ALAB’s price is up by 1.96%, now at $74.3.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 6 days.

Expert Opinions on Astera Labs

Over the past month, 2 industry analysts have shared their insights on this stock, proposing an average target price of $69.5.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Morgan Stanley has decided to maintain their Overweight rating on Astera Labs, which currently sits at a price target of $74.

* Reflecting concerns, an analyst from Needham lowers its rating to Buy with a new price target of $65.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Astera Labs, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Avista Foundation awards 27 grants to support local initiatives

SPOKANE, Wash., Oct. 29, 2024 (GLOBE NEWSWIRE) — The Avista Foundation is awarding $122,750 in grants to 27 nonprofit organizations in Washington, Idaho, Oregon, and Alaska to support economic and community development.

“With these contributions, the Avista Foundation is creating positive change, driving economic development, and enriching our communities,” said Dennis Vermillion, Avista CEO.

The third-quarter grants support a diverse range of organizations and programs. A few examples include:

- Supporting AHANA‘s efforts to serve multi-ethnic and multicultural business owners in Spokane, Washington.

- Bringing area lighting to improve safety at the Sandpoint Skatepark in Sandpoint, Idaho.

- Enabling program expansion with a new larger building at Southeast Alaska Food Bank in Juneau, Alaska.

- Helping Southern Oregon Child and Family Council Inc’s LISTO Family Literacy Program provide education for Latinx adults in Jackson County, Oregon.

The full list of third-quarter awards includes:

| Name | State | Award | |

| AHANA | Washington | $ | 10,000 |

| Bonner County Skatepark Association | Idaho | $ | 1,500 |

| Cup of Cool Water | Washington | $ | 2,000 |

| Center for Inclusive Entrepreneurship | Washington | $ | 2,500 |

| Clearwater Community Complex, Inc. | Idaho | $ | 5,000 |

| Freedom Farms | Oregon | $ | 1,500 |

| Global Neighborhood | Washington | $ | 3,500 |

| Hispanic Business Professional Association dba Nuestras Raices | Washington | $ | 10,000 |

| Homeshare Kootenai County Inc | Idaho | $ | 2,000 |

| Latinos En Spokane | Washington | $ | 2,500 |

| Moscow Affordable Housing Trust, Inc | Idaho | $ | 2,000 |

| NAMI Far North | Idaho | $ | 1,000 |

| Operation Healthy Family | Washington | $ | 3,000 |

| Spokanimal CARE | Washington | $ | 1,500 |

| Sky Lakes Foundation | Oregon | $ | 5,000 |

| Southeast Alaska Food Bank | Alaska | $ | 10,000 |

| Southern Oregon Child and Family Council, Inc. | Oregon | $ | 3,000 |

| Spokane Alliance United | Washington | $ | 3,500 |

| Spokane Area Jewish Family Services | Washington | $ | 1,000 |

| Spokane Humane Society | Washington | $ | 1,500 |

| Spokane Independent Metro Business Alliance (SIMBA) | Washington | $ | 7,500 |

| Spokane Valley HUB (dba HUB Sports Center) | Washington | $ | 10,000 |

| Spruce Root Inc. | Alaska | $ | 5,000 |

| Valley Community Center | Washington | $ | 1,250 |

| WA-ID Volunteer Center | Idaho | $ | 2,000 |

| St Vincent de Paul CDA | Idaho | $ | 10,000 |

| Providence Foundation | Washington | $ | 15,000 |

The Avista Foundation offers four grant cycles each year. Environmental and arts and culture proposals are due by November 1, 2024. Organizations can see if they are eligible and apply for funding by visiting avistafoundation.com.

About the Avista Foundation

Since its establishment in 2002, the Avista Foundation has made grants totaling over $16 million. The foundation focuses its giving in the areas of vulnerable and limited-income populations, education, and economic and cultural vitality. It is a separate, non-profit organization established by Avista Corp., and does not receive funding from Avista Utilities or AEL&P customers through rates.

The Avista logo is a trademark of Avista Corporation.

To unsubscribe from Avista’s news release distribution, send reply message to dalila.sheehan@avistacorp.com

Contact:

Media: Ariana Barrey (509) 279-3308, Ariana.Barrey@avistacorp.com

Avista 24/7 Media Access: (509) 495-4174

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Fannie Mae Announces Changes to Appraisal Alternatives Requirements

WASHINGTON, Oct. 28, 2024 /PRNewswire/ — Fannie Mae FNMA today announced changes to the eligibility requirements for Value Acceptance (previously known as appraisal waivers) and Value Acceptance + Property Data (also known as inspection-based appraisal waivers), two key components of the company’s valuation modernization options. The changes are part of Fannie Mae’s ongoing efforts to offer a balance of traditional appraisals and appraisal alternatives to confirm a property’s value in order to meet the needs of the market.

Beginning in Q1 2025, for purchase loans for primary residences and second homes, the eligible loan-to-value (LTV) ratios for Value Acceptance will increase from 80% to 90% and Value Acceptance + Property Data will increase from 80% to the program limits. Both options are designed to match the risk of the collateral and the loan transaction.

“Fannie Mae is on a journey of continuous improvement to make the home valuation process more effective, efficient, and impartial for lenders, appraisers, and secondary mortgage market participants while maintaining Fannie Mae’s safety and soundness,” said Jake Williamson, Senior Vice President of Single-Family Collateral & Quality Risk Management, Fannie Mae. “Responsibly increasing the eligibility for valuation options that leverage data- and technology-driven approaches can also help reduce costs for borrowers.”

Since early 2020, Fannie Mae estimates the use of appraisal alternatives such as Value Acceptance and Value Acceptance + Property Data on loans Fannie Mae has acquired saved mortgage borrowers more than $2.5 billion.

Value Acceptance leverages a robust data and modeling framework to confirm the validity of a property’s value and sale price. Alternatively, Value Acceptance + Property Data utilizes trained and vetted third-party property data collectors, such as appraisers, real estate agents, and insurance inspectors, who conduct interior and exterior data collection on the subject property. Lenders are notified of transactions that are eligible for Value Acceptance or Value Acceptance + Property Data via Fannie Mae’s Desktop Underwriter®.

About Fannie Mae

Fannie Mae advances equitable and sustainable access to homeownership and quality, affordable rental housing for millions of people across America. We enable the 30-year fixed-rate mortgage and drive responsible innovation to make homebuying and renting easier, fairer, and more accessible. To learn more, visit:

fanniemae.com | X (formerly Twitter) | Facebook | LinkedIn | Instagram | YouTube | Blog

Fannie Mae Newsroom

https://www.fanniemae.com/news

Photo of Fannie Mae

https://www.fanniemae.com/resources/img/about-fm/fm-building.tif

Fannie Mae Resource Center

1-800-2FANNIE (800-232-6643)

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/fannie-mae-announces-changes-to-appraisal-alternatives-requirements-302288881.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/fannie-mae-announces-changes-to-appraisal-alternatives-requirements-302288881.html

SOURCE Fannie Mae

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.