A Look Ahead: TOMI Environmental Solns's Earnings Forecast

TOMI Environmental Solns TOMZ is set to give its latest quarterly earnings report on Wednesday, 2024-10-30. Here’s what investors need to know before the announcement.

Analysts estimate that TOMI Environmental Solns will report an earnings per share (EPS) of $0.00.

Investors in TOMI Environmental Solns are eagerly awaiting the company’s announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It’s worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

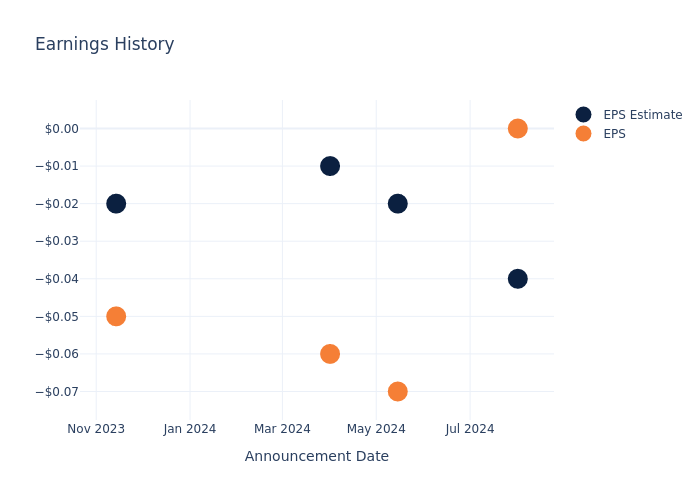

Historical Earnings Performance

In the previous earnings release, the company beat EPS by $0.04, leading to a 8.23% drop in the share price the following trading session.

Here’s a look at TOMI Environmental Solns’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | -0.04 | -0.02 | -0.01 | -0.02 |

| EPS Actual | 0 | -0.07 | -0.06 | -0.05 |

| Price Change % | -8.0% | -6.0% | 2.0% | 7.000000000000001% |

Market Performance of TOMI Environmental Solns’s Stock

Shares of TOMI Environmental Solns were trading at $0.92405 as of October 28. Over the last 52-week period, shares are down 2.02%. Given that these returns are generally negative, long-term shareholders are likely upset going into this earnings release.

Analysts’ Perspectives on TOMI Environmental Solns

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding TOMI Environmental Solns.

The consensus rating for TOMI Environmental Solns is Buy, derived from 1 analyst ratings. An average one-year price target of $3.5 implies a potential 278.77% upside.

Understanding Analyst Ratings Among Peers

The below comparison of the analyst ratings and average 1-year price targets of Aqua Metals and Quest Resource Holding, three prominent players in the industry, gives insights for their relative performance expectations and market positioning.

- Aqua Metals is maintaining an Buy status according to analysts, with an average 1-year price target of $1.5, indicating a potential 62.33% upside.

- Quest Resource Holding is maintaining an Buy status according to analysts, with an average 1-year price target of $12.75, indicating a potential 1279.8% upside.

Overview of Peer Analysis

Within the peer analysis summary, vital metrics for Aqua Metals and Quest Resource Holding are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| TOMI Environmental Solns | Buy | 8.60% | $1.85M | 0.42% |

| Aqua Metals | Buy | 0.00% | $-2.37M | -25.59% |

| Quest Resource Holding | Buy | -1.81% | $13.53M | -2.30% |

Key Takeaway:

TOMI Environmental Solns ranks highest in Revenue Growth among its peers. It has the lowest Gross Profit margin. The company’s Return on Equity is also the lowest among its peers.

Discovering TOMI Environmental Solns: A Closer Look

TOMI Environmental Solutions Inc is a bacteria decontamination and infectious disease control company, providing environmental solutions for indoor surface decontamination through the manufacturing, sales, service and licensing of its SteraMist brand of products, including SteraMist BIT, a low percentage (7.8%) hydrogen peroxide-based fog or mist that uses Binary Ionization Technology (BIT). Its product portfolio includes SteraMist Surface Unit; SteraMist Environment System; The SteraMist Total Disinfection Cart; SteraMist Select Surface Unit; Stainless Steel 90 Degree Applicator; iHP Plasma Decontamination Chamber; SteraMist Custom Engineered System (CES); and iHP Corporate Service Decontamination.

Understanding the Numbers: TOMI Environmental Solns’s Finances

Market Capitalization: Indicating a reduced size compared to industry averages, the company’s market capitalization poses unique challenges.

Revenue Growth: Over the 3 months period, TOMI Environmental Solns showcased positive performance, achieving a revenue growth rate of 8.6% as of 30 June, 2024. This reflects a substantial increase in the company’s top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Industrials sector.

Net Margin: TOMI Environmental Solns’s net margin is impressive, surpassing industry averages. With a net margin of 1.0%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): TOMI Environmental Solns’s ROE stands out, surpassing industry averages. With an impressive ROE of 0.42%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): TOMI Environmental Solns’s ROA excels beyond industry benchmarks, reaching 0.25%. This signifies efficient management of assets and strong financial health.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.42.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply