Examining the Future: Alignment Healthcare's Earnings Outlook

Alignment Healthcare ALHC is set to give its latest quarterly earnings report on Tuesday, 2024-10-29. Here’s what investors need to know before the announcement.

Analysts estimate that Alignment Healthcare will report an earnings per share (EPS) of $-0.14.

The market awaits Alignment Healthcare’s announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It’s important for new investors to understand that guidance can be a significant driver of stock prices.

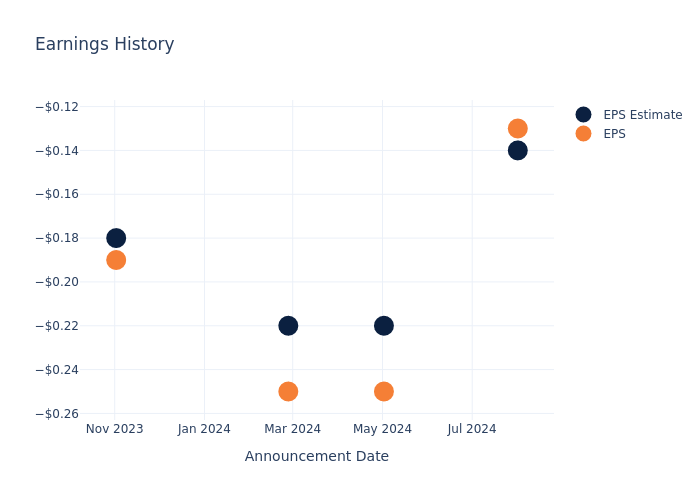

Earnings Track Record

In the previous earnings release, the company beat EPS by $0.01, leading to a 3.71% increase in the share price the following trading session.

Here’s a look at Alignment Healthcare’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | -0.14 | -0.22 | -0.22 | -0.18 |

| EPS Actual | -0.13 | -0.25 | -0.25 | -0.19 |

| Price Change % | 4.0% | 26.0% | -18.0% | -5.0% |

Stock Performance

Shares of Alignment Healthcare were trading at $11.04 as of October 25. Over the last 52-week period, shares are up 65.41%. Given that these returns are generally positive, long-term shareholders should be satisfied going into this earnings release.

Analyst Views on Alignment Healthcare

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Alignment Healthcare.

The consensus rating for Alignment Healthcare is Outperform, based on 4 analyst ratings. With an average one-year price target of $9.5, there’s a potential 13.95% downside.

Analyzing Ratings Among Peers

In this analysis, we delve into the analyst ratings and average 1-year price targets of Clover Health Investments, Progyny and HealthEquity, three key industry players, offering insights into their relative performance expectations and market positioning.

- For Clover Health Investments, analysts project an Neutral trajectory, with an average 1-year price target of $4.0, indicating a potential 63.77% downside.

- The consensus among analysts is an Outperform trajectory for Progyny, with an average 1-year price target of $27.07, indicating a potential 145.2% upside.

- The consensus among analysts is an Outperform trajectory for HealthEquity, with an average 1-year price target of $102.14, indicating a potential 825.18% upside.

Key Findings: Peer Analysis Summary

In the peer analysis summary, key metrics for Clover Health Investments, Progyny and HealthEquity are highlighted, providing an understanding of their respective standings within the industry and offering insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Alignment Healthcare | Outperform | 47.34% | $75.97M | -18.86% |

| Clover Health Investments | Neutral | 11.28% | $107.91M | 2.40% |

| Progyny | Outperform | 8.85% | $68.28M | 3.21% |

| HealthEquity | Outperform | 23.15% | $204.05M | 1.68% |

Key Takeaway:

Alignment Healthcare ranks at the bottom for Revenue Growth among its peers. It also has the lowest Gross Profit margin. However, it has the highest Return on Equity.

Discovering Alignment Healthcare: A Closer Look

Alignment Healthcare Inc is a next-generation, consumer-centric platform that is revolutionizing the healthcare experience for seniors through Medicare Advantage plans. These plans are marketed and sold direct-to-consumer, allowing seniors to select the manner in which customers receive healthcare coverage and services on an annual basis. The company combines a technology platform and clinical model for more effective health outcomes.

Alignment Healthcare: Delving into Financials

Market Capitalization Analysis: Falling below industry benchmarks, the company’s market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Positive Revenue Trend: Examining Alignment Healthcare’s financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 47.34% as of 30 June, 2024, showcasing a substantial increase in top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Health Care sector.

Net Margin: Alignment Healthcare’s net margin is below industry averages, indicating potential challenges in maintaining strong profitability. With a net margin of -3.52%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Alignment Healthcare’s ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of -18.86%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): Alignment Healthcare’s ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of -3.56%, the company may face hurdles in achieving optimal financial performance.

Debt Management: With a high debt-to-equity ratio of 1.78, Alignment Healthcare faces challenges in effectively managing its debt levels, indicating potential financial strain.

To track all earnings releases for Alignment Healthcare visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply