GE Aero Unusual Options Activity

Financial giants have made a conspicuous bullish move on GE Aero. Our analysis of options history for GE Aero GE revealed 28 unusual trades.

Delving into the details, we found 46% of traders were bullish, while 46% showed bearish tendencies. Out of all the trades we spotted, 22 were puts, with a value of $1,064,694, and 6 were calls, valued at $934,110.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $115.0 to $210.0 for GE Aero during the past quarter.

Insights into Volume & Open Interest

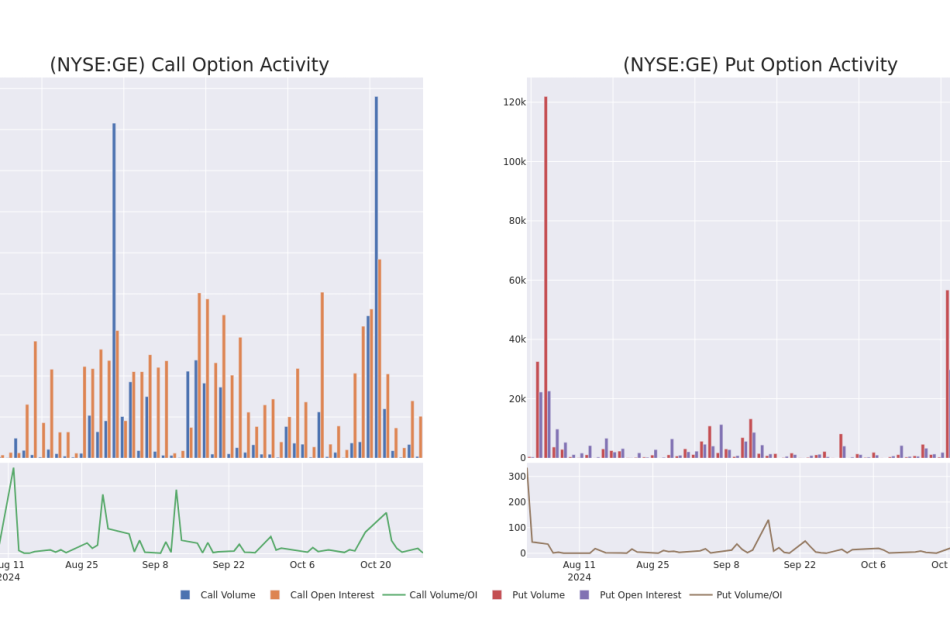

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for GE Aero’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of GE Aero’s whale activity within a strike price range from $115.0 to $210.0 in the last 30 days.

GE Aero Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GE | CALL | TRADE | BULLISH | 12/20/24 | $3.75 | $3.55 | $3.74 | $185.00 | $729.3K | 5.2K | 150 |

| GE | PUT | SWEEP | BEARISH | 01/17/25 | $8.9 | $8.85 | $8.85 | $175.00 | $92.9K | 2.2K | 123 |

| GE | CALL | TRADE | BULLISH | 01/17/25 | $60.0 | $59.65 | $60.0 | $115.00 | $60.0K | 42 | 10 |

| GE | PUT | TRADE | BEARISH | 12/20/24 | $18.0 | $15.7 | $18.0 | $190.00 | $54.0K | 669 | 30 |

| GE | PUT | SWEEP | BEARISH | 12/20/24 | $13.85 | $13.55 | $13.74 | $185.00 | $50.8K | 893 | 324 |

About GE Aero

GE Aerospace is the global leader in designing, manufacturing, and servicing large aircraft engines, along with partner Safran in their CFM joint venture. With its massive global installed base of nearly 70,000 commercial and military engines, GE Aerospace earns most of its profits on recurring service revenue of that equipment, which operates for decades. GE Aerospace is the remaining core business of the company formed in 1892 with historical ties to American inventor Thomas Edison; that company became a storied conglomerate with peak revenue of $130 billion in 2000. GE spun off its appliance, finance, healthcare, and wind and power businesses between 2016 and 2024.

Present Market Standing of GE Aero

- Trading volume stands at 3,150,620, with GE’s price down by -0.63%, positioned at $174.25.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 84 days.

What The Experts Say On GE Aero

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $213.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from UBS continues to hold a Buy rating for GE Aero, targeting a price of $230.

* An analyst from B of A Securities persists with their Buy rating on GE Aero, maintaining a target price of $200.

* Consistent in their evaluation, an analyst from Bernstein keeps a Outperform rating on GE Aero with a target price of $225.

* Consistent in their evaluation, an analyst from RBC Capital keeps a Outperform rating on GE Aero with a target price of $200.

* Maintaining their stance, an analyst from Wells Fargo continues to hold a Overweight rating for GE Aero, targeting a price of $210.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest GE Aero options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply