Insights Ahead: Enovix's Quarterly Earnings

Enovix ENVX is gearing up to announce its quarterly earnings on Tuesday, 2024-10-29. Here’s a quick overview of what investors should know before the release.

Analysts are estimating that Enovix will report an earnings per share (EPS) of $-0.20.

The announcement from Enovix is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It’s worth noting for new investors that guidance can be a key determinant of stock price movements.

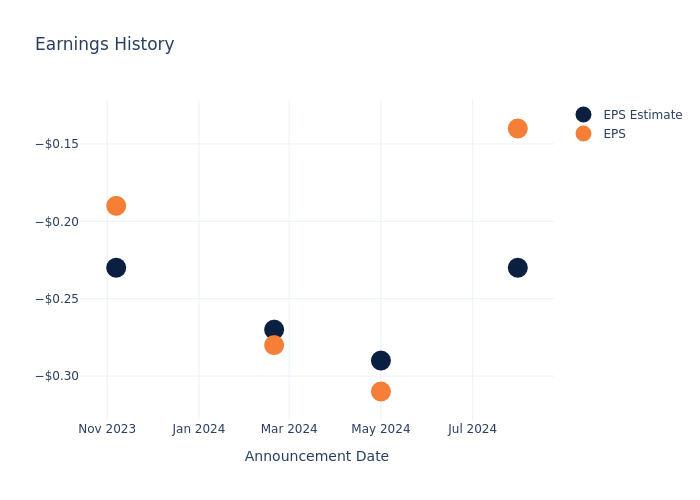

Past Earnings Performance

During the last quarter, the company reported an EPS beat by $0.09, leading to a 19.15% drop in the share price on the subsequent day.

Here’s a look at Enovix’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | -0.23 | -0.29 | -0.27 | -0.23 |

| EPS Actual | -0.14 | -0.31 | -0.28 | -0.19 |

| Price Change % | -19.0% | 45.0% | -9.0% | 15.0% |

Market Performance of Enovix’s Stock

Shares of Enovix were trading at $10.41 as of October 25. Over the last 52-week period, shares are up 28.73%. Given that these returns are generally positive, long-term shareholders should be satisfied going into this earnings release.

Analyst Views on Enovix

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on Enovix.

The consensus rating for Enovix is Outperform, based on 7 analyst ratings. With an average one-year price target of $22.0, there’s a potential 111.34% upside.

Understanding Analyst Ratings Among Peers

In this comparison, we explore the analyst ratings and average 1-year price targets of Plug Power and Vicor, three prominent industry players, offering insights into their relative performance expectations and market positioning.

- The consensus outlook from analysts is an Neutral trajectory for Plug Power, with an average 1-year price target of $2.57, indicating a potential 75.31% downside.

- The prevailing sentiment among analysts is an Neutral trajectory for Vicor, with an average 1-year price target of $43.0, implying a potential 313.06% upside.

Summary of Peers Analysis

Within the peer analysis summary, vital metrics for Plug Power and Vicor are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Enovix | Outperform | 8871.43% | $-655K | -58.00% |

| Plug Power | Neutral | -44.90% | $-131.25M | -8.87% |

| Vicor | Neutral | 8.52% | $42.77M | 2.12% |

Key Takeaway:

Enovix ranks highest in Revenue Growth among its peers. However, it has the lowest Gross Profit margin. In terms of Return on Equity, Enovix is at the bottom compared to its peers.

All You Need to Know About Enovix

Enovix Corp is engaged in the business of advanced silicon-anode lithium-ion battery development and production. It is also developing its 3D cell technology and production process for the electric vehicle and energy storage markets to help enable the widespread utilization of renewable energy.

Enovix: A Financial Overview

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Revenue Growth: Over the 3 months period, Enovix showcased positive performance, achieving a revenue growth rate of 8871.43% as of 30 June, 2024. This reflects a substantial increase in the company’s top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Industrials sector.

Net Margin: Enovix’s net margin lags behind industry averages, suggesting challenges in maintaining strong profitability. With a net margin of -3075.16%, the company may face hurdles in effective cost management.

Return on Equity (ROE): The company’s ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of -58.0%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): Enovix’s ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of -23.22%, the company may face hurdles in achieving optimal financial returns.

Debt Management: Enovix’s debt-to-equity ratio is notably higher than the industry average. With a ratio of 1.14, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

To track all earnings releases for Enovix visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply