Unpacking the Latest Options Trading Trends in Mobileye Global

Financial giants have made a conspicuous bearish move on Mobileye Global. Our analysis of options history for Mobileye Global MBLY revealed 9 unusual trades.

Delving into the details, we found 22% of traders were bullish, while 66% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $328,610, and 3 were calls, valued at $474,370.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $12.0 to $13.5 for Mobileye Global over the recent three months.

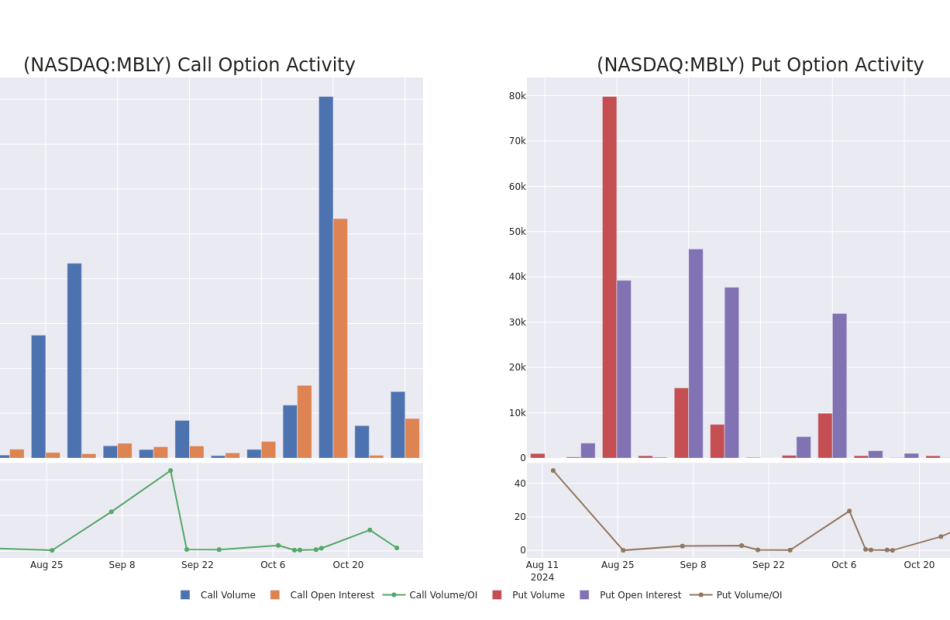

Volume & Open Interest Trends

In today’s trading context, the average open interest for options of Mobileye Global stands at 1030.67, with a total volume reaching 26,344.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Mobileye Global, situated within the strike price corridor from $12.0 to $13.5, throughout the last 30 days.

Mobileye Global Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MBLY | CALL | SWEEP | BULLISH | 01/17/25 | $2.8 | $2.6 | $2.77 | $12.00 | $329.8K | 909 | 2.3K |

| MBLY | CALL | SWEEP | BULLISH | 01/17/25 | $2.75 | $2.7 | $2.7 | $12.00 | $109.3K | 909 | 409 |

| MBLY | PUT | SWEEP | BEARISH | 05/16/25 | $3.0 | $2.95 | $3.0 | $13.00 | $90.3K | 1.3K | 341 |

| MBLY | PUT | SWEEP | BEARISH | 11/01/24 | $0.45 | $0.4 | $0.45 | $12.00 | $67.3K | 595 | 3.5K |

| MBLY | PUT | SWEEP | BEARISH | 11/01/24 | $0.6 | $0.5 | $0.6 | $12.50 | $64.0K | 2.2K | 7.5K |

About Mobileye Global

Mobileye Global Inc engages in the development and deployment of ADAS and autonomous driving technologies and solutions. It is building a portfolio of end-to-end ADAS and autonomous driving solutions to provide the capabilities needed for the future of autonomous driving, leveraging a comprehensive suite of purpose-built software and hardware technologies. Mobileye is the Company’s only reportable operating segment. Its solutions comprise Driver Assist, Cloud-Enhanced Driver Assist, Mobileye SuperVision Lite, Mobileye SuperVision, Mobileye Chauffeur, Mobileye Drive, Self-Driving System & Vehicles. It also provides data services to Expedite Maintenance Operations with AI-Powered Road Survey Technology.

After a thorough review of the options trading surrounding Mobileye Global, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Mobileye Global

- Currently trading with a volume of 3,891,167, the MBLY’s price is up by 1.54%, now at $13.22.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 2 days.

What The Experts Say On Mobileye Global

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $18.8.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from Goldman Sachs continues to hold a Buy rating for Mobileye Global, targeting a price of $20.

* An analyst from Evercore ISI Group persists with their Outperform rating on Mobileye Global, maintaining a target price of $30.

* Reflecting concerns, an analyst from RBC Capital lowers its rating to Sector Perform with a new price target of $11.

* Maintaining their stance, an analyst from Barclays continues to hold a Overweight rating for Mobileye Global, targeting a price of $19.

* An analyst from UBS downgraded its action to Neutral with a price target of $14.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Mobileye Global, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply