If You Invested $100 In This Stock 10 Years Ago, You Would Have $300 Today

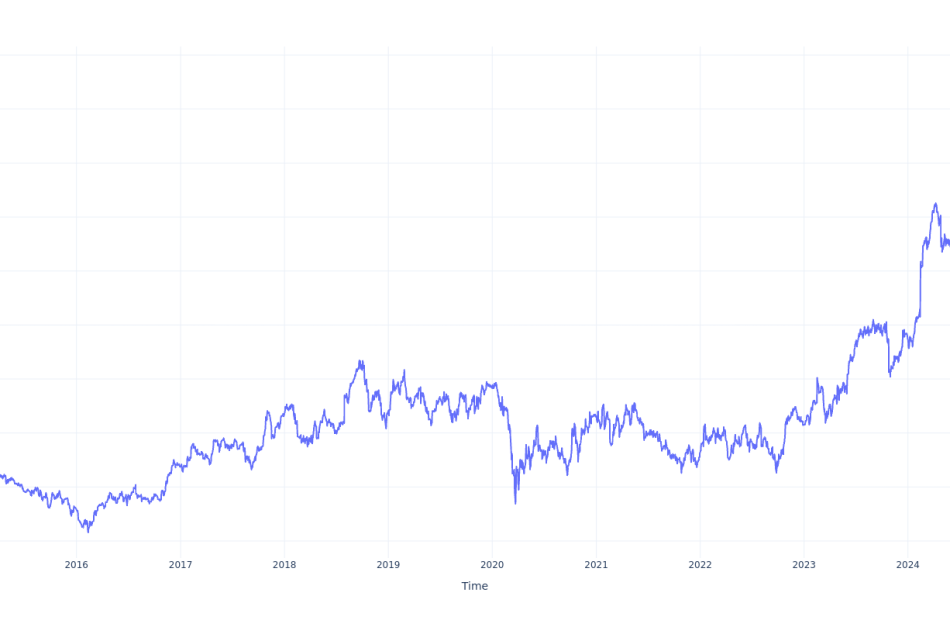

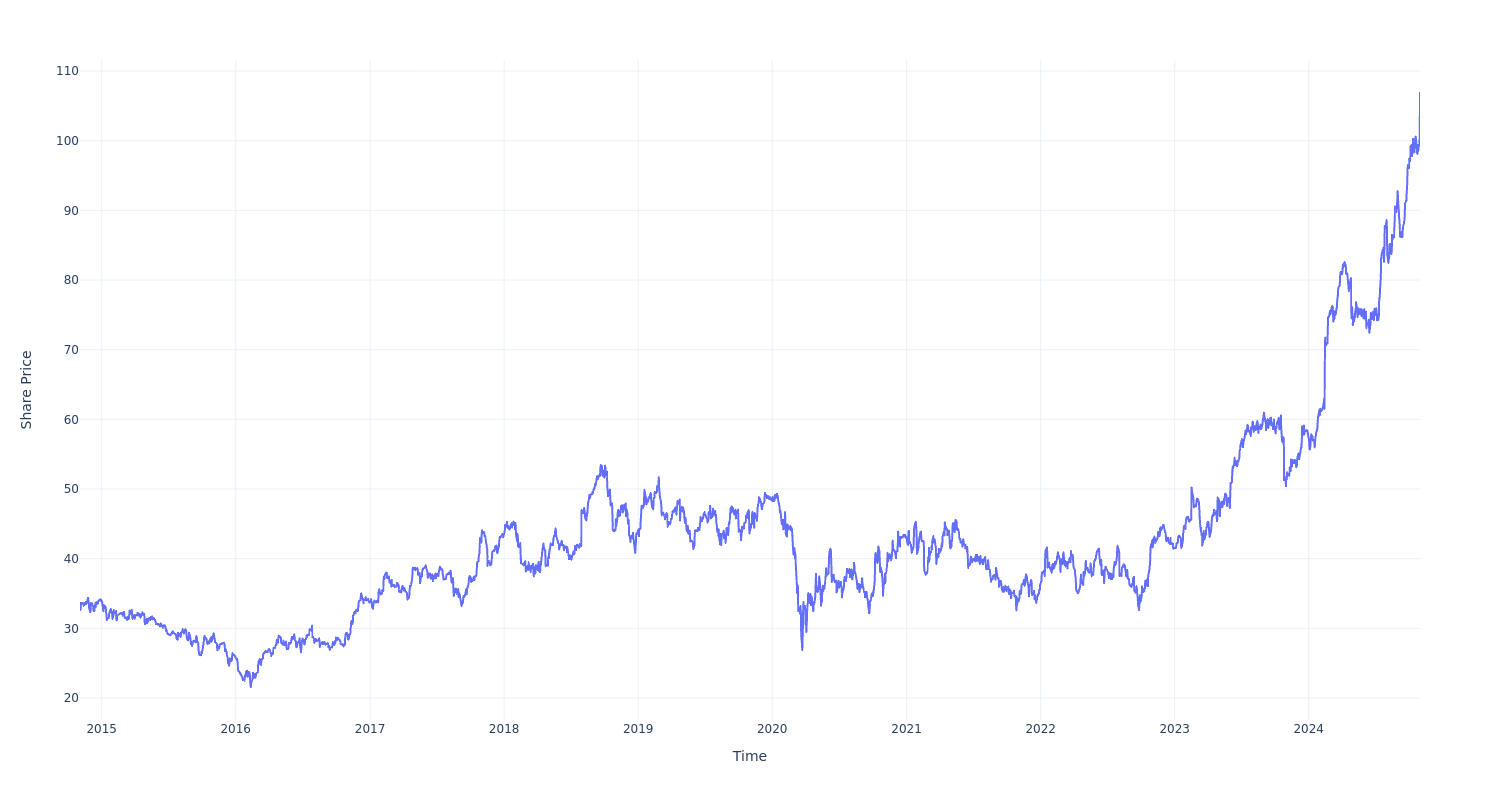

Allison Transmission ALSN has outperformed the market over the past 10 years by 1.4% on an annualized basis producing an average annual return of 12.59%. Currently, Allison Transmission has a market capitalization of $9.06 billion.

Buying $100 In ALSN: If an investor had bought $100 of ALSN stock 10 years ago, it would be worth $325.96 today based on a price of $104.00 for ALSN at the time of writing.

Allison Transmission’s Performance Over Last 10 Years

Finally — what’s the point of all this? The key insight to take from this article is to note how much of a difference compounded returns can make in your cash growth over a period of time.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Noble Acquires Marriott and Hyatt Hotel Portfolio Courtyard by Marriott, Hyatt House & Hyatt Place Indianapolis | Fishers

ATLANTA, Oct. 30, 2024 /PRNewswire/ — Noble Investment Group (“Noble”) today announced the acquisition of the Courtyard by Marriott Indianapolis | Fishers and the dual-brand Hyatt House & Hyatt Place Indianapolis | Fishers. The newly built hotels are located within the Fishers District, a 150-acre live, work, play, and stay development featuring vibrant dining, retail, and entertainment venues.

Fishers, Indiana, is a dynamic and rapidly expanding market proximate to Indianapolis. It is recognized for its strong economic growth and business-friendly environment. The area has recently experienced over $2.0 billion in new development, with meaningful additional investments being delivered over the coming years.

“Noble is excited to add these new, high-yielding hotels with in-place cash flows to our growing portfolio and capitalize on the region’s continued economic expansion,” said Ben Brunt, Noble’s Managing Principal and Chief Investment Officer.

About Noble Investment Group

Noble is an award-winning real estate investment manager specializing in the travel and hospitality sector. With a track record spanning three decades, Noble has invested over $6.0 billion in communities throughout the country, adding value across cycles and supporting the significant creation of jobs. PERE has named Noble one of the Top 200 Global Investment Managers, and the firm has been recognized as one of the Best Places to Work by Pensions & Investments and the Atlanta Business Chronicle.

As a fiduciary to institutional investors, including foremost pensions plans, endowments, foundations, wealth management firms, and insurance companies, Noble’s endeavors help to preserve and grow our limited partners’ capital, which assists in providing retirement benefits for our country’s teachers, law enforcement, firefighters, other pensioners, and financial resources for students to attend college. For more information, please visit www.nobleinvestment.com.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/noble-acquires-marriott-and-hyatt-hotel-portfolio-courtyard-by-marriott-hyatt-house–hyatt-place-indianapolis–fishers-302291359.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/noble-acquires-marriott-and-hyatt-hotel-portfolio-courtyard-by-marriott-hyatt-house–hyatt-place-indianapolis–fishers-302291359.html

SOURCE Noble Investment Group

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Superior Energy Services Announces Third Quarter 2024 Results and Conference Call

HOUSTON, Oct. 30, 2024 (GLOBE NEWSWIRE) — Superior Energy Services, Inc. (the “Company”) filed its Form 10-Q for the period ended September 30, 2024. In accordance with the Company’s Shareholders Agreement, it will host a conference call with shareholders on November 1, 2024.

For the third quarter of 2024, the Company reported net income from continuing operations of $21.9 million, or $1.09 per diluted share, with revenue of $197.3 million. This compares to net income from continuing operations of $29.5 million or $1.46 per diluted share, with revenue of $201.1 million, for the second quarter of 2024.

The Company’s Adjusted EBITDA (a non-GAAP measure defined on page 4) was $57.8 million compared to $60.0 million for the second quarter of 2024. Refer to pages 11 and 12 for a reconciliation of Adjusted EBITDA to GAAP results.

Third Quarter 2024 Geographic Breakdown

U.S. land revenue was $36.0 million for the third quarter of 2024, a decrease of 8% compared to revenue of $39.0 million for the second quarter of 2024. The decline in U.S. land revenue was primarily driven by decreased activity from our premium drill pipe and bottom hole accessories product lines within our Rentals segment, consistent with a reduced U.S. land rig count.

U.S. offshore revenue was $49.7 million in the third quarter of 2024, a decrease of 8% compared to revenue of $53.8 million in the second quarter of 2024. U.S. offshore revenue decreased primarily in our Well Services segments, with the most significant decline coming from our project-based completion services product line. U.S. Offshore revenue in the Rentals segment for the third quarter of 2024 was up $1.6 million versus the second quarter of 2024, despite approximately $1.0 million of revenue slipping to the fourth quarter of 2024 due to hurricane activity in September.

International revenue was $111.6 million in the third quarter of 2024, an increase of 3% compared to revenue of $108.4 million in the second quarter of 2024. International revenue was up across both our Rentals and Well Services segments, with the increase being driven by our hydraulic snubbing and well control services product lines.

Third Quarter 2024 Segment Reporting

The Rentals segment revenue in the third quarter of 2024 was $97.9 million, a 2% decrease compared to revenue of $99.9 million in the second quarter of 2024, primarily driven by reduced activity in U.S. land and hurricane disruptions in the U.S. offshore market. In the third quarter of 2024, Rentals segment income from operations was $43.9 million as compared to $44.1 million in the second quarter of 2024. Adjusted EBITDA was $55.9 million, a decrease from $56.0 million in the second quarter of 2024. Adjusted EBITDA Margin (a non-GAAP measure defined on page 4) was 57%, a 1% increase from the second quarter of 2024.

The Well Services segment revenue in the third quarter of 2024 was $99.5 million, a 2% decrease compared to revenue of $101.2 million in the second quarter of 2024 and income from operations for the third quarter of 2024 was $3.8 million as compared to $10.7 million in the second quarter of 2024. Adjusted EBITDA for the third quarter of 2024 was $15.4 million with an Adjusted EBITDA Margin of 16%, as compared to Adjusted EBITDA of $19.1 million with an Adjusted EBITDA Margin of 19% in the second quarter of 2024. The Well Services segment sequential decline was primarily driven by lower activity in our project-based completion services product line.

Liquidity

As of September 30, 2024, the Company had cash, cash equivalents, and restricted cash of approximately $380.6 million. As of September 30, 2024, our borrowing base, as defined in our credit agreement, was approximately $89.9 million, and we had $39.5 million in letters of credit outstanding which reduced the borrowing availability to $50.4 million. At September 30, 2024, we had no outstanding borrowings under our credit facility.

During the third quarter of 2024, we utilized an indirect foreign exchange mechanism known as a Blue Chip Swap. The transactions were completed at implied exchange rates that were approximately 63.0% higher than the official exchange rate, resulting in a loss of approximately $5.1 million during the third quarter of 2024.

During the third quarter of 2024, net cash from operating activities was $62.5 million. Free Cash Flow (a non-GAAP measure defined on page 4) for the third quarter of 2024 totaled $50.5 million as compared to $39.0 million for the second quarter of 2024. Refer to page 8 for a reconciliation of Free Cash Flow to Net Cash from Operating Activities.

Third quarter 2024 capital expenditures were $12.0 million. The Company expects total capital expenditures for 2024 to be approximately $100 to $110 million. Approximately 91% of total 2024 capital expenditures are targeted for the replacement of existing assets. Of the total estimated 2024 capital expenditures, approximately 68% is expected to be invested in the Rentals segment.

2024 Guidance

Our full year 2024 guidance remains consistent from the second quarter 2024 guidance. We expect 2024 revenue to come in at a range of $780 million to $840 million with 2024 Adjusted EBITDA expected to be in a range of $235 million to $265 million.

Conference Call Information

The Company’s management team will host a conference call on Friday, November 1, 2024, at 10:00 a.m. Eastern Time. The call will be available via live webcast in the “Events” section at ir.superiorenergy.com. To access via phone, participants can register for the call here, where they will be provided a phone number and access code. The call will be available for replay until November 1, 2025 on Superior’s website at ir.superiorenergy.com. If you are a shareholder and would like to submit a question, please email your question beforehand to Jamie Spexarth at ir@superiorenergy.com.

About Superior Energy Services

Superior Energy Services serves the drilling, completion and production-related needs of oil and gas companies worldwide through a diversified portfolio of specialized oilfield services and equipment that are used throughout the economic life cycle of oil and gas wells. For more information, visit: www.superiorenergy.com.

Non-GAAP Financial Measures

To supplement Superior’s consolidated financial statements, which are prepared and presented in accordance with generally accepted accounting principles in the United States (“GAAP”), the Company also uses Adjusted EBITDA and Adjusted EBITDA Margin. Management uses Adjusted EBITDA and Adjusted EBITDA Margin internally for financial and operational decision-making and as a means to evaluate period-to-period comparisons. The Company also believes these non-GAAP measures provide investors useful information about operating results, enhance the overall understanding of past financial performance and future prospects, and allow for greater transparency with respect to key metrics used by management in its financial and operational decision making. Non-GAAP financial measures are not recognized measures for financial statement presentation under U.S. GAAP and do not have standardized meanings and may not be comparable to similar measures presented by other public companies. Adjusted EBITDA and Adjusted EBITDA Margin should be considered as supplements to, and not as substitutes for, or superior to, the corresponding measures calculated in accordance with GAAP. We define Adjusted EBITDA as net income (loss) from continuing activities before net interest expense, income tax expense (benefit) and depreciation, amortization, accretion and depletion, restructuring and transaction expenses, adjusted for other gains and losses and other expenses, net, which management does not consider representative of our ongoing operations. We define Adjusted EBITDA Margin as Adjusted EBITDA by segment as a percentage of segment revenues. For a reconciliation of Adjusted EBITDA to net income, the most directly comparable GAAP financial measure, please see the tables under “―Superior Energy Services, Inc. and Subsidiaries Reconciliation of Adjusted EBITDA” and “—Superior Energy Services, Inc. and Subsidiaries Reconciliation of Adjusted EBITDA by Segment” included on pages 11 and 12 of this press release.

Free Cash Flow is defined as net cash from operating activities less payments for capital expenditures. Free Cash Flow is considered a non-GAAP financial measure under the SEC’s rules. Management believes, however, that Free Cash Flow is an important financial measure for use in evaluating the Company’s financial performance, as it measures our ability to generate additional cash from our business operations. Free Cash Flow should be considered in addition to, rather than as a substitute for, net income as a measure of our performance or net cash provided by operating activities as a measure of our liquidity. Additionally, our definition of Free Cash Flow is limited and does not represent residual cash flows available for discretionary expenditures due to the fact that the measure does not deduct the payments required for debt service and other obligations or payments made for business acquisitions. Therefore, we believe it is important to view Free Cash Flow as supplemental to our entire Statement of Cash Flows. Please see table under “—Condensed Consolidated Statements of Cash Flows” included on page 8 of this press release.

The Company is unable to provide a reconciliation of the forward-looking non-GAAP financial measure, Adjusted EBITDA, contained in this press release to its most directly comparable GAAP financial measure, net income, as the information necessary for a quantitative reconciliation of the forward-looking non-GAAP financial measure to its respective most directly comparable GAAP financial measure is not (and was not, when prepared) available to the Company without unreasonable efforts due to the inherent difficulty and impracticability of predicting certain amounts required by GAAP with a reasonable degree of accuracy. Net income includes the impact of depreciation, income taxes and certain other items that impact comparability between periods, which may be significant and are difficult to project with a reasonable degree of accuracy. In addition, we believe such reconciliation could imply a degree of precision that might be confusing or misleading to investors. The probable significance of providing this forward-looking non-GAAP financial measure without the directly comparable GAAP financial measure is that such GAAP financial measure may be materially different from the corresponding non-GAAP financial measure.

Forward-Looking Statements

This press release contains, and future oral or written statements or press releases by the Company and its management may contain, certain forward-looking statements within the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Generally, the words “expects,” “anticipates,” “targets,” “goals,” “projects,” “intends,” “plans,” “believes,” “seeks”, “will,” “could,” “may” and “estimates,” variations of such words and similar expressions identify forward-looking statements, although not all forward-looking statements contain these identifying words. All statements other than statements of historical fact regarding the Company’s financial position and results, financial performance, liquidity, market outlook, future capital needs, capital allocation plans, business strategies and other plans and objectives of our management for future operations and activities are forward-looking statements. These statements are based on certain assumptions and analyses made by the Company’s management in light of its experience and prevailing circumstances on the date such statements are made. Such forward-looking statements, and the assumptions on which they are based, are inherently speculative and are subject to a number of risks and uncertainties, including but not limited to conditions in the oil and gas industry, U.S. and global market and economic conditions generally and macroeconomic conditions worldwide (including inflation, interest rates, supply chain disruptions and capital and credit markets conditions) and other uncertainties (such as the war in Ukraine and conflict in Israel and broader geopolitical tensions in the Middle East and eastern Europe) that could cause the Company’s actual results to differ materially from such statements. These forward-looking statements rely on a number of assumptions concerning future events and are subject to a number of uncertainties and factors, many of which are outside the control of the Company, which could cause actual results to differ materially from such statements.

While the Company believes that the assumptions concerning future events are reasonable, it cautions that there are inherent difficulties in predicting certain important factors that could impact the future performance or results of its business.

These forward-looking statements are also affected by the risk factors, forward-looking statements and challenges and uncertainties described in the Company’s Form 10-K for the year ended December 31, 2023 and subsequent reports on Form 10-Qs and those set forth from time to time in the Company’s other periodic filings with the Securities and Exchange Commission, which are available at www.superiorenergy.com. Except as required by law, the Company expressly disclaims any intention or obligation to revise or update any forward-looking statements, whether as a result of new information, future events or otherwise.

| SUPERIOR ENERGY SERVICES, INC. AND SUBSIDIARIES |

|||||||||||||||||||

| CONSOLIDATED STATEMENTS OF OPERATIONS |

|||||||||||||||||||

| (in thousands, unaudited) | |||||||||||||||||||

| Three Months Ended | Nine Months Ended | ||||||||||||||||||

| September 30, | June 30, | September 30, | September 30, | ||||||||||||||||

| 2024 | 2024 | 2023 | 2024 | 2023 | |||||||||||||||

| Rentals | $ | 97,857 | $ | 99,851 | $ | 113,201 | $ | 305,799 | $ | 334,433 | |||||||||

| Well Services | 99,450 | 101,230 | 97,184 | 301,223 | 340,562 | ||||||||||||||

| Total revenues | 197,307 | 201,081 | 210,385 | 607,022 | 674,995 | ||||||||||||||

| Rentals | 35,227 | 36,596 | 37,769 | 109,589 | 109,258 | ||||||||||||||

| Well Services | 74,172 | 71,672 | 72,076 | 214,717 | 239,062 | ||||||||||||||

| Total cost of revenues | 109,399 | 108,268 | 109,845 | 324,306 | 348,320 | ||||||||||||||

| Depreciation, depletion, amortization and accretion | 21,077 | 20,868 | 20,490 | 62,392 | 61,250 | ||||||||||||||

| General and administrative expenses | 33,458 | 33,404 | 30,089 | 101,837 | 92,256 | ||||||||||||||

| Restructuring and transaction expenses | 5,891 | – | – | 5,891 | 1,983 | ||||||||||||||

| Other gains, net | (133 | ) | (614 | ) | (4,073 | ) | (1,829 | ) | (5,424 | ) | |||||||||

| Income from operations | 27,615 | 39,155 | 54,034 | 114,425 | 176,610 | ||||||||||||||

| Other income (expense): | |||||||||||||||||||

| Interest income, net | 5,032 | 5,760 | 6,629 | 17,632 | 18,581 | ||||||||||||||

| Loss on Blue Chip Swaps | (5,113 | ) | – | (12,120 | ) | (5,113 | ) | (12,120 | ) | ||||||||||

| Other income (expense) | 979 | (2,082 | ) | (4,520 | ) | (2,916 | ) | (8,508 | ) | ||||||||||

| Income from continuing operations before income taxes | 28,513 | 42,833 | 44,023 | 124,028 | 174,563 | ||||||||||||||

| Income tax expense | (6,597 | ) | (13,370 | ) | (11,403 | ) | (34,754 | ) | (44,615 | ) | |||||||||

| Net income from continuing operations | 21,916 | 29,463 | 32,620 | 89,274 | 129,948 | ||||||||||||||

| Income from discontinued operations, net of income tax | – | 1,896 | 128 | 1,896 | 408 | ||||||||||||||

| Net income | $ | 21,916 | $ | 31,359 | $ | 32,748 | $ | 91,170 | $ | 130,356 | |||||||||

| Income per share – basic: | |||||||||||||||||||

| Net income from continuing operations | $ | 1.09 | $ | 1.46 | $ | 1.62 | $ | 4.43 | $ | 6.46 | |||||||||

| Income from discontinued operations, net of income tax | – | 0.09 | 0.01 | 0.09 | 0.02 | ||||||||||||||

| Net income | $ | 1.09 | $ | 1.55 | $ | 1.63 | $ | 4.52 | $ | 6.48 | |||||||||

| Income per share – diluted | |||||||||||||||||||

| Net income from continuing operations | $ | 1.09 | $ | 1.46 | $ | 1.62 | $ | 4.42 | $ | 6.45 | |||||||||

| Income from discontinued operations, net of income tax | – | 0.09 | – | 0.10 | 0.02 | ||||||||||||||

| Net income | $ | 1.09 | $ | 1.55 | $ | 1.62 | $ | 4.52 | $ | 6.47 | |||||||||

| Weighted-average shares outstanding | |||||||||||||||||||

| Basic | 20,177 | 20,172 | 20,136 | 20,170 | 20,123 | ||||||||||||||

| Diluted | 20,186 | 20,183 | 20,159 | 20,182 | 20,144 | ||||||||||||||

| SUPERIOR ENERGY SERVICES, INC. AND SUBSIDIARIES |

|||||||

| CONSOLIDATED BALANCE SHEETS |

|||||||

| (in thousands, unaudited) | |||||||

| September 30, | December 31, | ||||||

| 2024 | 2023 | ||||||

| ASSETS | |||||||

| Current assets: | |||||||

| Cash and cash equivalents | $ | 325,881 | $ | 391,684 | |||

| Accounts receivable, net | 200,106 | 276,868 | |||||

| Inventory | 70,293 | 74,995 | |||||

| Income taxes receivable | 13,383 | 10,542 | |||||

| Prepaid expenses | 23,363 | 18,614 | |||||

| Other current assets | 7,765 | 7,922 | |||||

| Total current assets | 640,791 | 780,625 | |||||

| Property, plant and equipment, net | 306,285 | 294,960 | |||||

| Note receivable | 72,694 | 69,005 | |||||

| Restricted cash | 54,707 | 85,444 | |||||

| Deferred tax assets | 59,555 | 67,241 | |||||

| Other assets, net | 42,319 | 43,718 | |||||

| Total assets | $ | 1,176,351 | $ | 1,340,993 | |||

| LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT) | |||||||

| Current liabilities: | |||||||

| Accounts payable | $ | 38,897 | $ | 38,214 | |||

| Accrued expenses | 106,203 | 103,782 | |||||

| Income taxes payable | 20,100 | 20,220 | |||||

| Decommissioning liability | 30,747 | 21,631 | |||||

| Total current liabilities | 195,947 | 183,847 | |||||

| Decommissioning liability | 140,030 | 148,652 | |||||

| Other liabilities | 38,599 | 47,583 | |||||

| Total liabilities | 374,576 | 380,082 | |||||

| Total equity | 801,775 | 960,911 | |||||

| Total liabilities and equity | $ | 1,176,351 | $ | 1,340,993 | |||

| SUPERIOR ENERGY SERVICES, INC. AND SUBSIDIARIES | |||||||||||||||||||

| CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS | |||||||||||||||||||

| (in thousands, unaudited) | |||||||||||||||||||

| Three Months Ended | Nine Months Ended | ||||||||||||||||||

| September 30, | June 30, | September 30, | September 30, | ||||||||||||||||

| 2024 | 2024 | 2023 | 2024 | 2023 | |||||||||||||||

| Cash flows from operating activities | |||||||||||||||||||

| Net income | $ | 21,916 | $ | 31,359 | $ | 32,748 | $ | 91,170 | $ | 130,356 | |||||||||

| Adjustments to reconcile net loss to net cash from operating activities: | |||||||||||||||||||

| Depreciation, depletion, amortization and accretion | 21,077 | 20,868 | 20,490 | 62,392 | 61,250 | ||||||||||||||

| Loss on Blue Chip Swaps | 5,113 | – | 12,120 | 5,113 | 12,120 | ||||||||||||||

| Washington State Tax Settlement | – | – | – | – | (27,068 | ) | |||||||||||||

| Decommissioning costs | (5,111 | ) | (143 | ) | (3,401 | ) | (5,684 | ) | (6,279 | ) | |||||||||

| Other non-cash items | (2,642 | ) | 4,205 | 566 | 4,798 | 23,357 | |||||||||||||

| Changes in operating assets and liabilities: | 22,162 | 17,487 | (10,112 | ) | 67,396 | (38,390 | ) | ||||||||||||

| Net cash from operating activities | 62,515 | 73,776 | 52,411 | 225,185 | 155,346 | ||||||||||||||

| Cash flows from investing activities | |||||||||||||||||||

| Payments for capital expenditures | (12,005 | ) | (34,744 | ) | (21,592 | ) | (67,447 | ) | (67,218 | ) | |||||||||

| Proceeds from sales of assets | 292 | 669 | 9,563 | 3,577 | 24,710 | ||||||||||||||

| Proceeds from sales of Blue Chip Swap securities | 8,121 | – | 9,656 | 8,121 | 9,656 | ||||||||||||||

| Purchases of Blue Chip Swap securities | (13,234 | ) | – | (21,776 | ) | (13,234 | ) | (21,776 | ) | ||||||||||

| Net cash from investing activities | (16,826 | ) | (34,075 | ) | (24,149 | ) | (68,983 | ) | (54,628 | ) | |||||||||

| Cash flows from financing activities | |||||||||||||||||||

| Distributions to shareholders | – | – | – | (250,417 | ) | – | |||||||||||||

| Repurchase of shares | – | – | – | (962 | ) | – | |||||||||||||

| Other | (358 | ) | – | – | (1,363 | ) | (1,116 | ) | |||||||||||

| Net cash from financing activities | (358 | ) | – | – | (252,742 | ) | (1,116 | ) | |||||||||||

| Net change in cash, cash equivalents, and restricted cash | 45,331 | 39,701 | 28,262 | (96,540 | ) | 99,602 | |||||||||||||

| Cash, cash equivalents and restricted cash at beginning of period | 335,257 | 295,556 | 410,447 | 477,128 | 339,107 | ||||||||||||||

| Cash, cash equivalents, and restricted cash at end of period | $ | 380,588 | $ | 335,257 | $ | 438,709 | $ | 380,588 | $ | 438,709 | |||||||||

| Reconciliation of Free Cash Flow | |||||||||||||||||||

| Net cash from operating activities | $ | 62,515 | $ | 73,776 | $ | 52,411 | $ | 225,185 | $ | 155,346 | |||||||||

| Payments for capital expenditures | (12,005 | ) | (34,744 | ) | (21,592 | ) | (67,447 | ) | (67,218 | ) | |||||||||

| Free Cash Flow | $ | 50,510 | $ | 39,032 | $ | 30,819 | $ | 157,738 | $ | 88,128 | |||||||||

| Free Cash Flow is a Non-GAAP measure. See Non-GAAP Financial Measures for our definition of Free Cash Flow. | |||||||||||||||||||

| SUPERIOR ENERGY SERVICES, INC. AND SUBSIDIARIES |

|||||||||||||||||||

| REVENUE BY GEOGRAPHIC REGION BY SEGMENT |

|||||||||||||||||||

| (in thousands, unaudited) | |||||||||||||||||||

| Three Months Ended | Nine Months Ended | ||||||||||||||||||

| September 30, | June 30, | September 30, | September 30, | ||||||||||||||||

| 2024 | 2024 | 2023 | 2024 | 2023 | |||||||||||||||

| U.S. land | |||||||||||||||||||

| Rentals | $ | 28,934 | $ | 32,713 | $ | 37,478 | $ | 100,653 | $ | 127,341 | |||||||||

| Well Services | 7,027 | 6,242 | 8,223 | 20,735 | 20,384 | ||||||||||||||

| Total U.S. land | 35,961 | 38,955 | 45,701 | 121,388 | 147,725 | ||||||||||||||

| U.S. offshore | |||||||||||||||||||

| Rentals | 32,228 | 30,644 | 44,681 | 100,123 | 117,867 | ||||||||||||||

| Well Services | 17,489 | 23,125 | 14,459 | 69,486 | 54,185 | ||||||||||||||

| Total U.S. offshore | 49,717 | 53,769 | 59,140 | 169,609 | 172,052 | ||||||||||||||

| International | |||||||||||||||||||

| Rentals | 36,695 | 36,494 | 31,042 | 105,023 | 89,225 | ||||||||||||||

| Well Services | 74,934 | 71,863 | 74,502 | 211,002 | 265,993 | ||||||||||||||

| Total International | 111,629 | 108,357 | 105,544 | 316,025 | 355,218 | ||||||||||||||

| Total Revenues | $ | 197,307 | $ | 201,081 | $ | 210,385 | $ | 607,022 | $ | 674,995 | |||||||||

| SUPERIOR ENERGY SERVICES, INC. AND SUBSIDIARIES | |||||||||||||||||||

| SEGMENT HIGHLIGHTS | |||||||||||||||||||

| (in thousands, unaudited) | |||||||||||||||||||

| Three Months Ended | Nine Months Ended | ||||||||||||||||||

| September 30, | June 30, | September 30, | September 30, | ||||||||||||||||

| 2024 | 2024 | 2023 | 2024 | 2023 | |||||||||||||||

| Revenues | |||||||||||||||||||

| Rentals | $ | 97,857 | $ | 99,851 | $ | 113,201 | $ | 305,799 | $ | 334,433 | |||||||||

| Well Services | 99,450 | 101,230 | 97,184 | 301,223 | 340,562 | ||||||||||||||

| Total Revenues | $ | 197,307 | $ | 201,081 | $ | 210,385 | $ | 607,022 | $ | 674,995 | |||||||||

| Income (loss) from Operations | |||||||||||||||||||

| Rentals | $ | 43,856 | $ | 44,061 | $ | 56,253 | $ | 139,128 | $ | 167,373 | |||||||||

| Well Services | 3,789 | 10,686 | 10,581 | 27,867 | 50,860 | ||||||||||||||

| Corporate and other | (20,030 | ) | (15,592 | ) | (12,800 | ) | (52,570 | ) | (41,623 | ) | |||||||||

| Income from operations | $ | 27,615 | $ | 39,155 | $ | 54,034 | $ | 114,425 | $ | 176,610 | |||||||||

| Adjusted EBITDA | |||||||||||||||||||

| Rentals | $ | 55,915 | $ | 56,023 | $ | 68,791 | $ | 174,959 | $ | 204,632 | |||||||||

| Well Services | 15,427 | 19,078 | 15,137 | 56,028 | 69,697 | ||||||||||||||

| Corporate and other | (13,576 | ) | (15,078 | ) | (12,125 | ) | (45,096 | ) | (37,207 | ) | |||||||||

| Total Adjusted EBITDA | $ | 57,766 | $ | 60,023 | $ | 71,803 | $ | 185,891 | $ | 237,122 | |||||||||

| Adjusted EBITDA Margin | |||||||||||||||||||

| Rentals | 57 | % | 56 | % | 61 | % | 57 | % | 61 | % | |||||||||

| Well Services | 16 | % | 19 | % | 16 | % | 19 | % | 20 | % | |||||||||

| Corporate and other | n/a | n/a | n/a | n/a | n/a | ||||||||||||||

| Total Adjusted EBITDA Margin | 29 | % | 30 | % | 34 | % | 31 | % | 35 | % | |||||||||

| Adjusted EBITDA is a Non-GAAP measure. See Non-GAAP Financial Measures for our definition of Adjusted EBITDA and pages 11 and 12 for a reconciliation to income (loss) from operations. | |||||||||||||||||||

| SUPERIOR ENERGY SERVICES, INC. AND SUBSIDIARIES |

|||||||||||||||||||

| RECONCILIATION OF ADJUSTED EBITDA |

|||||||||||||||||||

| (in thousands, unaudited) | |||||||||||||||||||

| Three Months Ended | Nine Months Ended | ||||||||||||||||||

| September 30, | June 30, | September 30, | September 30, | ||||||||||||||||

| 2024 | 2024 | 2023 | 2024 | 2023 | |||||||||||||||

| Net income from continuing operations | $ | 21,916 | $ | 29,463 | $ | 32,620 | $ | 89,274 | $ | 129,948 | |||||||||

| Depreciation, depletion, amortization and accretion | 21,077 | 20,868 | 20,490 | 62,392 | 61,250 | ||||||||||||||

| Interest income, net | (5,032 | ) | (5,760 | ) | (6,629 | ) | (17,632 | ) | (18,581 | ) | |||||||||

| Income tax expense | 6,597 | 13,370 | 11,403 | 34,754 | 44,615 | ||||||||||||||

| Restructuring expenses and other adjustments (1) | 9,074 | – | (2,721 | ) | 9,074 | (738 | ) | ||||||||||||

| Loss on Blue Chip Swap Securities | 5,113 | – | 12,120 | 5,113 | 12,120 | ||||||||||||||

| Other (income) expense, net | (979 | ) | 2,082 | 4,520 | 2,916 | 8,508 | |||||||||||||

| Adjusted EBITDA | $ | 57,766 | $ | 60,023 | $ | 71,803 | $ | 185,891 | $ | 237,122 | |||||||||

| Adjusted EBITDA is a Non-GAAP measure. See Non-GAAP Financial Measures for our definition of Adjusted EBITDA. | |||||||||||||||||||

| (1) Restructuring expenses and other adjustments for the three and nine months ended September 30, 2024 relate to costs associated with changes in our executive management and other restructuring costs. Adjustments for the three and nine months ended September 30, 2023 relate to exit and disposal activities related to non-core businesses and other restructuring costs. | |||||||||||||||||||

| SUPERIOR ENERGY SERVICES, INC. AND SUBSIDIARIES | |||||||||||||||||||

| RECONCILIATION OF ADJUSTED EBITDA BY SEGMENT | |||||||||||||||||||

| (in thousands, unaudited) | |||||||||||||||||||

| Three Months Ended | Nine Months Ended | ||||||||||||||||||

| September 30, | June 30, | September 30, | September 30, | ||||||||||||||||

| 2024 | 2024 | 2023 | 2024 | 2023 | |||||||||||||||

| Rentals | |||||||||||||||||||

| Income from operations | $ | 43,856 | $ | 44,061 | $ | 56,253 | $ | 139,128 | $ | 167,373 | |||||||||

| Depreciation, depletion, amortization and accretion | 12,059 | 11,962 | 12,538 | 35,831 | 37,259 | ||||||||||||||

| Adjusted EBITDA | $ | 55,915 | $ | 56,023 | $ | 68,791 | $ | 174,959 | $ | 204,632 | |||||||||

| Well Services | |||||||||||||||||||

| Income from operations | $ | 3,789 | $ | 10,686 | $ | 10,581 | $ | 27,867 | $ | 50,860 | |||||||||

| Depreciation, depletion, amortization and accretion | 8,455 | 8,392 | 7,277 | 24,978 | 21,558 | ||||||||||||||

| Restructuring expenses and other adjustments(1) | 3,183 | – | (2,721 | ) | 3,183 | (2,721 | ) | ||||||||||||

| Adjusted EBITDA | $ | 15,427 | $ | 19,078 | $ | 15,137 | $ | 56,028 | $ | 69,697 | |||||||||

| Corporate | |||||||||||||||||||

| Loss from operations | $ | (20,030 | ) | $ | (15,592 | ) | $ | (12,800 | ) | $ | (52,570 | ) | $ | (41,623 | ) | ||||

| Depreciation, depletion, amortization and accretion | 563 | 514 | 675 | 1,583 | 2,433 | ||||||||||||||

| Restructuring expenses and other adjustments (1) | 5,891 | – | – | 5,891 | 1,983 | ||||||||||||||

| Adjusted EBITDA | $ | (13,576 | ) | $ | (15,078 | ) | $ | (12,125 | ) | $ | (45,096 | ) | $ | (37,207 | ) | ||||

| Total | |||||||||||||||||||

| Income from operations | $ | 27,615 | $ | 39,155 | $ | 54,034 | $ | 114,425 | $ | 176,610 | |||||||||

| Depreciation, depletion, amortization and accretion | 21,077 | 20,868 | 20,490 | 62,392 | 61,250 | ||||||||||||||

| Restructuring expenses and other adjustments (1) | 9,074 | – | (2,721 | ) | 9,074 | (738 | ) | ||||||||||||

| Adjusted EBITDA | $ | 57,766 | $ | 60,023 | $ | 71,803 | $ | 185,891 | $ | 237,122 | |||||||||

| Adjusted EBITDA is a Non-GAAP measure. See Non-GAAP Financial Measures for our definition of Adjusted EBITDA. | |||||||||||||||||||

| (1) Restructuring expenses and other adjustments for the three and nine months ended September 30, 2024 relate to costs associated with changes in our executive management and other restructuring costs. Adjustments for the three and nine months ended September 30, 2023 relate to exit and disposal activities related to non-core businesses and other restructuring costs. | |||||||||||||||||||

FOR FURTHER INFORMATION CONTACT:

Jamie Spexarth, Chief Financial Officer

1001 Louisiana St., Suite 2900

Houston, TX 77002

Investor Relations, ir@superiorenergy.com, (713) 654-2200

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

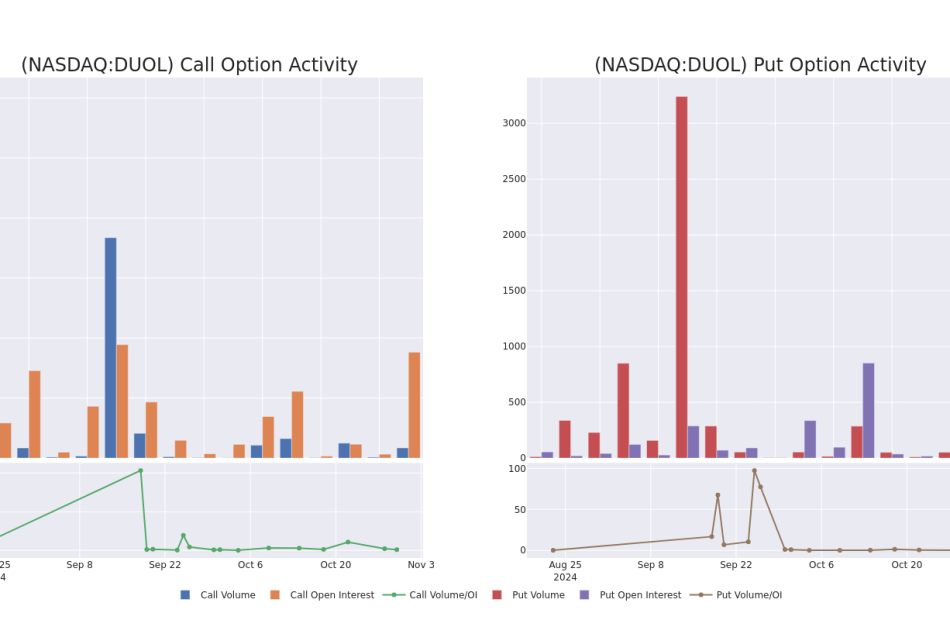

Spotlight on Duolingo: Analyzing the Surge in Options Activity

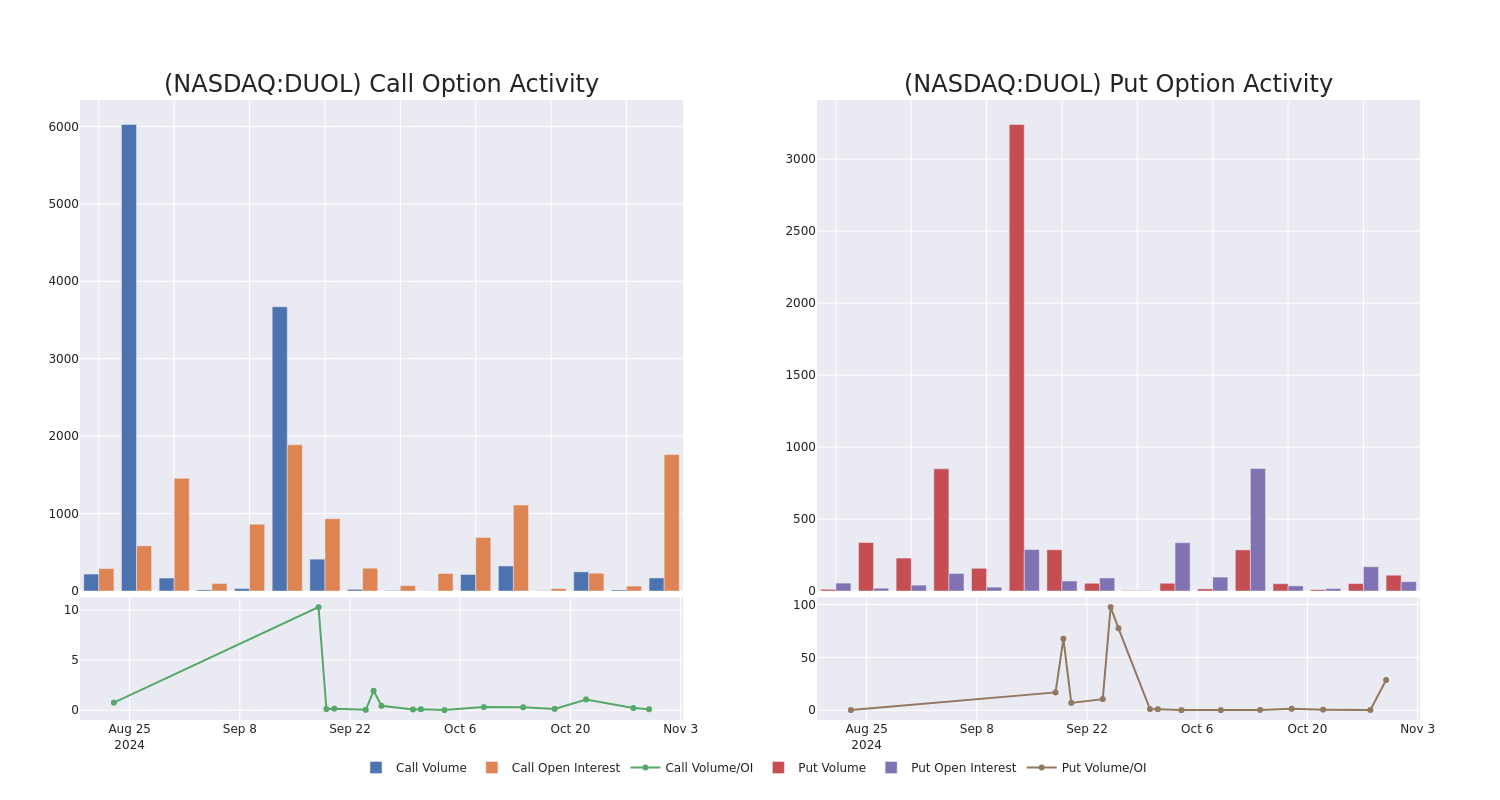

Whales with a lot of money to spend have taken a noticeably bullish stance on Duolingo.

Looking at options history for Duolingo DUOL we detected 17 trades.

If we consider the specifics of each trade, it is accurate to state that 58% of the investors opened trades with bullish expectations and 41% with bearish.

From the overall spotted trades, 5 are puts, for a total amount of $265,830 and 12, calls, for a total amount of $670,279.

What’s The Price Target?

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $210.0 and $400.0 for Duolingo, spanning the last three months.

Volume & Open Interest Trends

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Duolingo’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Duolingo’s whale trades within a strike price range from $210.0 to $400.0 in the last 30 days.

Duolingo Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DUOL | CALL | SWEEP | BULLISH | 02/21/25 | $40.5 | $38.5 | $39.98 | $300.00 | $122.6K | 113 | 30 |

| DUOL | CALL | TRADE | BEARISH | 11/15/24 | $56.6 | $54.5 | $54.5 | $250.00 | $103.5K | 179 | 1 |

| DUOL | PUT | TRADE | BEARISH | 11/15/24 | $92.8 | $89.7 | $92.1 | $400.00 | $92.1K | 1 | 10 |

| DUOL | CALL | TRADE | BEARISH | 02/21/25 | $79.5 | $76.9 | $77.7 | $240.00 | $77.7K | 42 | 10 |

| DUOL | PUT | TRADE | BULLISH | 11/15/24 | $35.4 | $34.5 | $34.8 | $330.00 | $69.6K | 4 | 20 |

About Duolingo

Duolingo Inc is a technology company that develops mobile learning platform to learn languages and is the top-grossing app in the Education category on both Google Play and the Apple App Store. Its products are powered by sophisticated data analytics and artificial intelligence and delivered with class art, animation, and design to make it easier for learners to stay motivated master new material, and achieve their learning goals. Its solutions include The Duolingo Language Learning App, Super Duolingo, Duolingo English Test: AI-Driven Language Assessment, Duolingo For Schools, Duolingo ABC, and Duolingo Math. It has three predominant sources of revenue; time-based subscriptions, in-app advertising placement by third parties, and the Duolingo English Test.

Having examined the options trading patterns of Duolingo, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Duolingo

- With a trading volume of 614,483, the price of DUOL is up by 2.77%, reaching $302.98.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 7 days from now.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Duolingo options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Allied Announces Third-Quarter Results

TORONTO, Oct. 30, 2024 (GLOBE NEWSWIRE) — Allied Properties Real Estate Investment Trust (“Allied”) (TSX: “AP.UN”) today announced results for the three months ended September 30, 2024. “Our occupied and leased area remained steady for the second consecutive quarter, and our urban workspace portfolio continued to outperform the market,” said Cecilia Williams, President & CEO. “With demand rising in Canada’s major cities, we expect our leasing activity to accelerate over the remainder of the year and into 2025.”

Operations

Allied’s portfolio is comprised of three urban workspace formats. Allied Heritage is a format created through the adaptive re-use of light industrial structures for office use above grade and retail use at grade. The buildings are inherently distinctive, clustered in the urban core and generally low-rise. Allied Modern is a format created specifically for office use. The buildings are generally mid- to high-rise, clustered in the urban core and distinctive by virtue of design, integration with heritage structure and/or integration with the different elements of mixed-use, amenity-rich urban neighbourhoods. Allied Flex is a limited format for buildings that Allied intends to redevelop comprehensively within a five-to 10-year period. Because of the near-term transformation of these buildings, Allied can make workspace in them available on more flexible than normal terms.

Utilization of, and demand for, Allied’s workspace continued to strengthen in the third quarter. In the Montréal rental portfolio, demand for storefront retail space and Allied Heritage was most pronounced. In the Toronto rental portfolio, demand across all three formats was strong, giving rise to a 1.5% increase in leased area. In the Calgary and Vancouver rental portfolios, demand for Allied Heritage was most pronounced.

Allied conducted 266 lease tours in its rental portfolio in the third quarter. Its occupied and leased area at the end of the quarter was 85.6% and 87.2%, respectively. Allied renewed 60% of the leases maturing in the quarter, closer to its normal level of 70% to 75%.

Allied leased a total of 640,331 square feet of GLA in the third quarter, 617,743 square feet in its rental portfolio and 22,588 square feet in its development portfolio. Of the 617,743 square feet Allied leased in its rental portfolio, 174,065 square feet were vacant, 100,342 square feet were maturing in the quarter and 343,336 square feet were maturing after the quarter. 94,262 square feet of the vacant space leased in the quarter involved expansion by existing users, a long-standing trend in Allied’s rental portfolio that appears now to be regaining momentum.

Average in-place net rent per occupied square foot continued its steady improvement, ending the third quarter at $25.30. Excluding a short-term renewal at an Allied Flex property in Toronto, Allied maintained rent levels on renewal in the third quarter (up 0.5% ending-to-starting base rent and up 10.3% average-to-average base rent).

Results

Operating income from continuing operations was $83 million, up 4.2% from the comparable quarter last year. Allied’s net loss and comprehensive loss was $94 million, in large part due to fair value adjustments on investment properties, Exchangeable LP Units and derivative instruments.

With temporary downward pressure from Allied’s recent portfolio optimization transactions at 400 West Georgia in Vancouver and 19 Duncan in Toronto, FFO(1) was $75 million (53.5 cents per unit), down 10.5% from $84 million (59.8 cents per unit) in the comparable quarter last year. AFFO(1) was $65 million (46.6 cents per unit), down 14.5% from $76 million (54.5 cents per unit) in the comparable quarter last year. This resulted in FFO and AFFO pay-out ratios(1) in the third quarter of 84.1% and 96.6%, respectively, and year-to-date of 82.4% and 91.2%, respectively. Same Asset NOI(1) from Allied’s rental portfolio was down 3.1% while Same Asset NOI from its total portfolio was up 1.1%, reflecting the productivity of its upgrade and development portfolio.

_____________________________________________________________________________

(1) This is a non-GAAP measure and includes the results of the continuing operations and the discontinued operations (except for Same Asset NOI, which only includes continuing operations) and excludes condominium related items, financing prepayment costs, and the mark-to-market adjustment on unit-based compensation. Refer to the Non-GAAP Measures section below.

Non-Core Property Sales and Portfolio Optimization

Allied has made steady progress this year in selling non-core properties at or above IFRS value. This includes the completed sale of three properties in Montréal for $51 million, the net proceeds of which were used to repay short-term, variable-rate debt. It also includes the pending sale over the remainder of the year of five properties (including the TELUS Sky reorganization) for approximately $142 million, the net proceeds of which will be used for the same purpose.

In the first half of 2025, Allied intends to sell additional non-core properties at or above IFRS value for approximately $200 million. Management expects to use the bulk of the net proceeds to repay the $200 million series C senior unsecured debenture due on April 21, 2025.

Debt Financing and Balance-Sheet Optimization

Just prior to the end of the third quarter, Allied completed the offering of $250 million aggregate principal amount of series J senior unsecured debentures for a term of four years bearing interest at 5.534% per annum. The proceeds were used to repay short-term, variable-rate debt.

Allied has obtained a commitment for a $63 million first mortgage on 375-381 Queen Street West in Toronto for a term of five years bearing interest at approximately 4.7% per annum and a $100 million first mortgage on 425 Viger Street West in Montréal for a term of five years bearing interest at approximately 4.9% per annum, the net proceeds of which will be used to repay short-term, variable-rate debt over the remainder of the year. Allied and Westbank have obtained a $180 million first-mortgage financing commitment on 400 West Georgia in Vancouver for a term of five years bearing interest at approximately 4.75% per annum, the net proceeds of which will be used to repay the current short-term, variable-rate facility. These three financings will materially reduce Allied’s annual interest expense and extend the term-to-maturity of its debt.

Allied and Westbank have obtained a commitment for $100 million of first-mortgage financing on the residential component of TELUS Sky with the intention to obtain a higher amount of CMHC-insured financing in due course. Allied and Westbank are working toward finalizing a commitment for approximately $340 million of CMHC-insured, first-mortgage financing on 19 Duncan in Toronto for a term of 10 years bearing interest at approximately 3.5% per annum. With funding scheduled for the first quarter of 2025, the net proceeds will be used to repay the current construction financing and will materially reduce Allied’s annual interest expense and extend the term-to-maturity of its debt.

“We’re committed to maintaining and ultimately improving our access to the debt capital markets and will continue to manage our balance sheet accordingly,” said Michael Emory, Founder & Executive Chair. “We’re also committed to growing our FFO and AFFO per unit going forward. These commitments are mutually reinforcing, well within our operating capability and responsive to the rightful expectations of equity and debt investors.”

Outlook

Thus far in 2024, Allied experienced steady demand for urban workspace, urban rental-residential space and urban amenity space, as well as strong and quantifiable engagement among users of space in the Allied portfolio generally. Management expects this to underpin a slow but steady return to earnings and value growth in 2025 and beyond.

Financial Measures

The following tables summarize GAAP financial measures for the three and nine months ended September 30, 2024, and 2023:

| For the three months ended September 30 | ||||||||||||

| (in thousands except for % amounts) | 2024 | 2023 | Change | % Change | ||||||||

| Continuing operations | ||||||||||||

| Rental revenue | $ | 146,593 | $ | 138,455 | $ | 8,138 | 5.9 | % | ||||

| Property operating costs | $ | (63,364 | ) | $ | (58,558 | ) | $ | (4,806 | ) | (8.2 | )% | |

| Operating income | $ | 83,229 | $ | 79,897 | $ | 3,332 | 4.2 | % | ||||

| Interest income | $ | 10,302 | $ | 14,887 | $ | (4,585 | ) | (30.8 | )% | |||

| Interest expense | $ | (31,361 | ) | $ | (27,447 | ) | $ | (3,914 | ) | (14.3 | )% | |

| General and administrative expenses (1) | $ | (2,141 | ) | $ | (5,964 | ) | $ | 3,823 | 64.1 | % | ||

| Condominium marketing expenses | $ | (17 | ) | $ | (137 | ) | $ | 120 | 87.6 | % | ||

| Amortization of other assets | $ | (390 | ) | $ | (388 | ) | $ | (2 | ) | (0.5 | )% | |

| Transaction costs | $ | (136 | ) | $ | — | $ | (136 | ) | 100.0 | % | ||

| Net income (loss) from joint venture | $ | 450 | $ | (908 | ) | $ | 1,358 | 149.6 | % | |||

| Fair value loss on investment properties and investment properties held for sale | $ | (47,359 | ) | $ | (126,253 | ) | $ | 78,894 | 62.5 | % | ||

| Fair value (loss) gain on Exchangeable LP Units | $ | (57,983 | ) | $ | 44,757 | $ | (102,740 | ) | (229.6 | )% | ||

| Fair value (loss) gain on derivative instruments | $ | (16,689 | ) | $ | 11,186 | $ | (27,875 | ) | (249.2 | )% | ||

| Impairment of residential inventory | $ | (32,082 | ) | $ | (15,376 | ) | $ | (16,706 | ) | (108.6 | )% | |

| Net loss and comprehensive loss from continuing operations | $ | (94,177 | ) | $ | (25,746 | ) | $ | (68,431 | ) | (265.8 | )% | |

| Net loss and comprehensive loss from discontinued operations | $ | — | $ | (8,212 | ) | $ | 8,212 | 100.0 | % | |||

| Net loss and comprehensive loss | $ | (94,177 | ) | $ | (33,958 | ) | $ | (60,219 | ) | (177.3 | )% | |

(1) For the three months ended September 30, 2024, general and administrative expenses decreased by $3,823 or 64.1% from the comparable period. This was primarily due to the fair value adjustment on the total return swap of $3,676 on unit-based compensation plans. The fair value adjustment on the total return swap is added back in the calculation of FFO defined in REALPAC’s “Funds From Operations (FFO) & Adjusted Funds From Operations (AFFO) for IFRS” issued in January 2022.

| For the nine months ended September 30 | ||||||||||||

| (in thousands except for % amounts) | 2024 | 2023 | Change | % Change | ||||||||

| Continuing operations | ||||||||||||

| Rental revenue | $ | 436,920 | $ | 413,082 | $ | 23,838 | 5.8 | % | ||||

| Property operating costs | $ | (192,829 | ) | $ | (177,920 | ) | $ | (14,909 | ) | (8.4 | )% | |

| Operating income | $ | 244,091 | $ | 235,162 | $ | 8,929 | 3.8 | % | ||||

| Interest income | $ | 34,676 | $ | 34,856 | $ | (180 | ) | (0.5 | )% | |||

| Interest expense | $ | (84,724 | ) | $ | (76,808 | ) | $ | (7,916 | ) | (10.3 | )% | |

| General and administrative expenses (1) | $ | (15,959 | ) | $ | (16,848 | ) | $ | 889 | 5.3 | % | ||

| Condominium marketing expenses | $ | (117 | ) | $ | (449 | ) | $ | 332 | 73.9 | % | ||

| Amortization of other assets | $ | (1,150 | ) | $ | (1,118 | ) | $ | (32 | ) | (2.9 | )% | |

| Transaction costs | $ | (136 | ) | $ | — | $ | (136 | ) | 100.0 | % | ||

| Net income (loss) from joint venture | $ | 1,737 | $ | (1,491 | ) | $ | 3,228 | 216.5 | % | |||

| Fair value loss on investment properties and investment properties held for sale | $ | (211,534 | ) | $ | (278,081 | ) | $ | 66,547 | 23.9 | % | ||

| Fair value (loss) gain on Exchangeable LP Units | $ | (472 | ) | $ | 55,267 | $ | (55,739 | ) | (100.9 | )% | ||

| Fair value (loss) gain on derivative instruments | $ | (13,031 | ) | $ | 18,519 | $ | (31,550 | ) | (170.4 | )% | ||

| Impairment of residential inventory | $ | (38,259 | ) | $ | (15,376 | ) | $ | (22,883 | ) | (148.8 | )% | |

| Net loss and comprehensive loss from continuing operations | $ | (84,878 | ) | $ | (46,367 | ) | $ | (38,511 | ) | (83.1 | )% | |

| Net income and comprehensive income from discontinued operations | $ | — | $ | 124,991 | $ | (124,991 | ) | (100.0 | )% | |||

| Net (loss) income and comprehensive (loss) income | $ | (84,878 | ) | $ | 78,624 | $ | (163,502 | ) | (208.0 | )% | ||

(1) For the nine months ended September 30, 2024, general and administrative expenses decreased by $889 or 5.3% from the comparable period primarily due to fair value adjustments on the total return swap on unit-based compensation plans of $1,993. This was partially offset by lower capitalization to qualifying investment properties of $779 primarily due to the directly attributable employee costs related to the disposition of the UDC portfolio in 2023. The fair value adjustment on the total return swap is added back in the calculation of FFO defined in REALPAC’s “Funds From Operations (FFO) & Adjusted Funds From Operations (AFFO) for IFRS” issued in January 2022.

The following table summarizes other financial measures as at September 30, 2024, and 2023:

| As at September 30 | ||||||||||||

| (in thousands except for per unit and % amounts) | 2024 | 2023 | Change | % Change | ||||||||

| Investment properties (1) | $ | 9,667,178 | $ | 9,717,184 | $ | (50,006 | ) | (0.5 | )% | |||

| Unencumbered investment properties (2) | $ | 8,386,958 | $ | 8,342,560 | $ | 44,398 | 0.5 | % | ||||

| Total Assets (1) | $ | 10,930,951 | $ | 11,274,187 | $ | (343,236 | ) | (3.0 | )% | |||

| Cost of PUD as a % of GBV (2) | 10.7 | % | 11.6 | % | — | (0.9 | )% | |||||

| NAV per unit (3) | $ | 43.76 | $ | 49.83 | $ | (6.07 | ) | (12.2 | )% | |||

| Debt (1) | $ | 4,321,654 | $ | 3,834,573 | $ | 487,081 | 12.7 | % | ||||

| Total indebtedness ratio (2) | 39.7 | % | 34.2 | % | — | 5.5 | % | |||||

| Annualized Adjusted EBITDA (2) | $ | 394,432 | $ | 416,068 | $ | (21,636 | ) | (5.2 | )% | |||

| Net debt as a multiple of Annualized Adjusted EBITDA (2) | 10.7x | 7.9x | 2.8x | — | ||||||||

| Interest coverage ratio including interest capitalized and excluding financing prepayment costs – three months trailing (2) | 2.3x | 2.5x | (0.2x | ) | — | |||||||

| Interest coverage ratio including interest capitalized and excluding financing prepayment costs – twelve months trailing (2) | 2.5x | 2.5x | — | — | ||||||||

(1) This measure is presented on an IFRS basis.

(2) This is a non-GAAP measure and includes the results of the continuing operations and the discontinued operations. Refer to the Non-GAAP Measures section below.

(3) Prior to Allied’s conversion to an open-end trust, net asset value per unit (“NAV per unit”) was calculated as total equity as at the corresponding period ended, divided by the actual number of Units and class B limited partnership units of Allied Properties Exchangeable Limited Partnership (“Exchangeable LP Units”) outstanding at period end. With Allied’s conversion to an open-end trust on June 12, 2023, NAV per unit is calculated as total equity plus the value of Exchangeable LP Units as at the corresponding period ended, divided by the actual number of Units and Exchangeable LP Units. The rationale for including the value of Exchangeable LP Units is because they are economically equivalent to Units, receive distributions equal to the distributions paid on the Units and are exchangeable, at the holder’s option, for Units.

Non-GAAP Measures

Management uses financial measures based on International Financial Reporting Standards (“IFRS” or “GAAP”) and non-GAAP measures to assess Allied’s performance. Non-GAAP measures do not have any standardized meaning prescribed under IFRS, and therefore, should not be construed as alternatives to net income or cash flow from operating activities calculated in accordance with IFRS. Refer to the Non-GAAP Measures section on page 16 of the MD&A as at September 30, 2024, available on www.sedarplus.ca, for an explanation of the composition of the non-GAAP measures used in this press release and their usefulness for readers in assessing Allied’s performance. Such explanation is incorporated by reference herein.

The following tables summarize non-GAAP financial measures for the three and nine months ended September 30, 2024, and 2023:

| For the three months ended September 30 | |||||||||||

| (in thousands except for per unit and % amounts)(1) | 2024 | 2023 | Change | % Change | |||||||

| Adjusted EBITDA | $ | 98,608 | $ | 104,017 | $ | (5,409 | ) | (5.2 | )% | ||

| Same Asset NOI – rental portfolio | $ | 73,892 | $ | 76,221 | $ | (2,329 | ) | (3.1 | )% | ||

| Same Asset NOI – total portfolio | $ | 84,495 | $ | 83,574 | $ | 921 | 1.1 | % | |||

| FFO | $ | 77,645 | $ | 83,719 | $ | (6,074 | ) | (7.3 | )% | ||

| FFO per unit (diluted) | $ | 0.556 | $ | 0.599 | $ | (0.043 | ) | (7.2 | )% | ||

| FFO pay-out ratio | 81.0 | % | 75.1 | % | — | 5.9 | % | ||||

| AFFO | $ | 68,005 | $ | 76,337 | $ | (8,332 | ) | (10.9 | )% | ||

| AFFO per unit (diluted) | $ | 0.487 | $ | 0.546 | $ | (0.059 | ) | (10.8 | )% | ||

| AFFO pay-out ratio | 92.5 | % | 82.4 | % | — | 10.1 | % | ||||

| All amounts below are excluding condominium related items, financing prepayment costs, and the mark-to-market adjustment on unit-based compensation: | |||||||||||

| FFO | $ | 74,782 | $ | 83,556 | $ | (8,774 | ) | (10.5 | )% | ||

| FFO per unit (diluted) | $ | 0.535 | $ | 0.598 | $ | (0.063 | ) | (10.5 | )% | ||

| FFO pay-out ratio | 84.1 | % | 75.3 | % | — | 8.8 | % | ||||

| AFFO | $ | 65,142 | $ | 76,174 | $ | (11,032 | ) | (14.5 | )% | ||

| AFFO per unit (diluted) | $ | 0.466 | $ | 0.545 | $ | (0.079 | ) | (14.5 | )% | ||

| AFFO pay-out ratio | 96.6 | % | 82.6 | % | — | 14.0 | % | ||||

(1) These non-GAAP measures include the results of the continuing operations and the discontinued operations (except for Same Asset NOI – rental portfolio, which only includes continuing operations).

| For the nine months ended September 30 | |||||||||||

| (in thousands except for per unit and % amounts)(1) | 2024 | 2023 | Change | % Change | |||||||

| Adjusted EBITDA | $ | 290,888 | $ | 313,397 | $ | (22,509 | ) | (7.2 | )% | ||

| Same Asset NOI – rental portfolio | $ | 218,792 | $ | 224,402 | $ | (5,610 | ) | (2.5 | )% | ||

| Same Asset NOI – total portfolio | $ | 252,110 | $ | 247,618 | $ | 4,492 | 1.8 | % | |||

| FFO | $ | 230,883 | $ | 247,118 | $ | (16,235 | ) | (6.6 | )% | ||

| FFO per unit (diluted) | $ | 1.652 | $ | 1.768 | $ | (0.116 | ) | (6.6 | )% | ||

| FFO pay-out ratio | 81.7 | % | 76.4 | % | — | 5.3 | % | ||||

| AFFO | $ | 208,632 | $ | 225,875 | $ | (17,243 | ) | (7.6 | )% | ||

| AFFO per unit (diluted) | $ | 1.493 | $ | 1.616 | $ | (0.123 | ) | (7.6 | )% | ||

| AFFO pay-out ratio | 90.4 | % | 83.5 | % | — | 6.9 | % | ||||

| All amounts below are excluding condominium related items, financing prepayment costs, and the mark-to-market adjustment on unit-based compensation: | |||||||||||

| FFO | $ | 229,059 | $ | 246,857 | $ | (17,798 | ) | (7.2 | )% | ||

| FFO per unit (diluted) | $ | 1.639 | $ | 1.766 | $ | (0.127 | ) | (7.2 | )% | ||

| FFO pay-out ratio | 82.4 | % | 76.4 | % | — | 6.0 | % | ||||

| AFFO | $ | 206,808 | $ | 225,614 | $ | (18,806 | ) | (8.3 | )% | ||

| AFFO per unit (diluted) | $ | 1.480 | $ | 1.614 | $ | (0.134 | ) | (8.3 | )% | ||

| AFFO pay-out ratio | 91.2 | % | 83.6 | % | — | 7.6 | % | ||||

(1) These non-GAAP measures include the results of the continuing operations and the discontinued operations (except for Same Asset NOI – rental portfolio, which only includes continuing operations).

The following tables reconcile the non-GAAP measures to the most comparable IFRS measures for the three and nine months ended September 30, 2024, and the comparable period in 2023. These terms do not have any standardized meaning prescribed under IFRS and may not be comparable to similarly titled measures presented by other publicly traded entities.

The following table reconciles Allied’s net income (loss) and comprehensive income (loss) to Adjusted EBITDA, a non-GAAP measure, for the three and nine months ended September 30, 2024, and 2023.

| Three months ended | Nine months ended | ||||||||||||

| September 30, 2024 |

September 30, 2023 | September 30, 2024 |

September 30, 2023 | ||||||||||

| Net (loss) income and comprehensive (loss) income for the period | $ | (94,177 | ) | $ | (33,958 | ) | $ | (84,878 | ) | $ | 78,624 | ||

| Interest expense | 31,361 | 28,328 | 84,724 | 81,241 | |||||||||

| Amortization of other assets | 441 | 388 | 1,311 | 1,118 | |||||||||

| Amortization of improvement allowances | 9,645 | 7,896 | 28,453 | 24,418 | |||||||||

| Impairment of residential inventory | 32,082 | 15,376 | 38,259 | 15,376 | |||||||||

| Transaction costs | 136 | 13,246 | 136 | 13,246 | |||||||||

| Fair value loss on investment properties and investment properties held for sale (1) | 47,328 | 128,984 | 211,321 | 173,870 | |||||||||

| Fair value loss (gain) on Exchangeable LP Units | 57,983 | (44,757 | ) | 472 | (55,267 | ) | |||||||

| Fair value loss (gain) on derivative instruments | 16,689 | (11,186 | ) | 13,031 | (18,519 | ) | |||||||

| Mark-to-market adjustment on unit-based compensation | (2,880 | ) | (300 | ) | (1,941 | ) | (710 | ) | |||||

| Adjusted EBITDA (2) | $ | 98,608 | $ | 104,017 | $ | 290,888 | $ | 313,397 | |||||

(1) Includes Allied’s proportionate share of the equity accounted investment’s fair value gain on investment properties of $31 and $213 for the three and nine months ended September 30, 2024, respectively (September 30, 2023 – fair value loss on investment properties of $1,895 and $4,638, respectively).

(2) The Adjusted EBITDA for the three and nine months ended September 30, 2023 includes the Urban Data Centre segment which was classified as a discontinued operation from Q4 2022 until its disposition in August 2023.

The following table reconciles operating income to net operating income, a non-GAAP measure, for the three and nine months ended September 30, 2024, and 2023.

| Three months ended | Nine months ended | |||||||||||

| September 30, 2024 |

September 30, 2023 | September 30, 2024 |

September 30, 2023 | |||||||||

| Operating income, IFRS basis | $ | 83,229 | $ | 79,897 | $ | 244,091 | $ | 235,162 | ||||

| Add: investment in joint venture | 466 | 980 | 1,659 | 3,129 | ||||||||

| Operating income, proportionate basis | $ | 83,695 | $ | 80,877 | $ | 245,750 | $ | 238,291 | ||||

| Amortization of improvement allowances (1)(2) | 9,645 | 7,831 | 28,453 | 24,092 | ||||||||

| Amortization of straight-line rent (1)(2) | (2,188 | ) | (2,308 | ) | (5,898 | ) | (5,713 | ) | ||||

| NOI from continuing operations | $ | 91,152 | $ | 86,400 | $ | 268,305 | $ | 256,670 | ||||

| NOI from discontinued operations | $ | — | $ | 6,586 | $ | — | $ | 33,452 | ||||

| Total NOI | $ | 91,152 | $ | 92,986 | $ | 268,305 | $ | 290,122 | ||||

(1) Includes Allied’s proportionate share of the equity accounted investment of the following amounts for the three and nine months ended September 30, 2024: amortization improvement allowances of $213 and $589, respectively (September 30, 2023 – $164 and $491, respectively) and amortization of straight-line rent of $(57) and $(152), respectively (September 30, 2023 – $(49) and $(147), respectively).

(2) Excludes the Urban Data Centre segment which was classified as a discontinued operation starting in Q4 2022, and was sold in Q3 2023. For the three and nine months ended September 30, 2023, the Urban Data Centre segment’s amortization of improvement allowances was $65 and $326, respectively, and the amortization of straight-line rent was $(230) and $(695), respectively.

Same Asset NOI, a non-GAAP measure, is measured as the net operating income for the properties that Allied owned and operated for the entire duration of both the current and comparative period.

| Three months ended | Change | ||||||||||

| September 30, 2024 | September 30, 2023 | $ | % | ||||||||

| Rental Portfolio – Same Asset NOI | $ | 73,892 | $ | 76,221 | $ | (2,329 | ) | (3.1 | )% | ||

| Assets Held for Sale – Same Asset NOI | 2,739 | 3,757 | (1,018 | ) | (27.1 | ) | |||||

| Rental Portfolio and Assets Held for Sale – Same Asset NOI | $ | 76,631 | $ | 79,978 | $ | (3,347 | ) | (4.2 | %) | ||

| Development Portfolio – Same Asset NOI | 7,864 | 3,596 | 4,268 | 118.7 | |||||||

| Total Portfolio – Same Asset NOI | $ | 84,495 | $ | 83,574 | $ | 921 | 1.1 | % | |||

| Acquisitions | 3,999 | — | 3,999 | ||||||||

| Dispositions | 756 | 7,539 | (6,783 | ) | |||||||

| Development fees and corporate items | 1,902 | 1,873 | 29 | ||||||||

| Total NOI | $ | 91,152 | $ | 92,986 | $ | (1,834 | ) | (2.0 | %) | ||

| Nine months ended | Change | |||||||||||

| September 30, 2024 |

September 30, 2023 | $ |

% |

|||||||||

| Rental Portfolio – Same Asset NOI | $ | 218,792 | $ | 224,402 | $ | (5,610 | ) | (2.5 | )% | |||

| Assets Held for Sale – Same Asset NOI | 9,035 | 11,530 | (2,495 | ) | (21.6 | ) | ||||||

| Rental Portfolio and Assets Held for Sale – Same Asset NOI | $ | 227,827 | $ | 235,932 | $ | (8,105 | ) | (3.4 | %) | |||

| Development Portfolio – Same Asset NOI | 24,283 | 11,686 | 12,597 | 107.8 | ||||||||

| Total Portfolio – Same Asset NOI | $ | 252,110 | $ | 247,618 | $ | 4,492 | 1.8 | % | ||||

| Acquisitions | 7,664 | — | 7,664 | |||||||||

| Dispositions | 2,430 | 36,750 | (34,320 | ) | ||||||||

| Lease terminations | 28 | 193 | (165 | ) | ||||||||

| Development fees and corporate items | 6,073 | 5,561 | 512 | |||||||||

| Total NOI | $ | 268,305 | $ | 290,122 | $ | (21,817 | ) | (7.5 | %) | |||

The following tables reconcile Allied’s net loss and comprehensive loss from continuing operations to FFO, FFO excluding condominium related items, financing prepayment costs, and the mark-to-market adjustment on unit-based compensation, AFFO, and AFFO excluding condominium related items, financing prepayment costs, and the mark-to-market adjustment on unit-based compensation, which are non-GAAP measures, for the three and nine months ended September 30, 2024, and 2023.

| Three months ended | |||||||||

| September 30, 2024 |

September 30, 2023 | Change | |||||||

| Net loss and comprehensive loss from continuing operations | $ | (94,177 | ) | $ | (25,746 | ) | $ | (68,431 | ) |

| Net loss and comprehensive loss from discontinued operations | — | (8,212 | ) | 8,212 | |||||

| Adjustment to fair value of investment properties and investment properties held for sale | 47,359 | 127,089 | (79,730 | ) | |||||

| Adjustment to fair value of Exchangeable LP Units | 57,983 | (44,757 | ) | 102,740 | |||||

| Adjustment to fair value of derivative instruments | 16,689 | (11,186 | ) | 27,875 | |||||

| Impairment of residential inventory | 32,082 | 15,376 | 16,706 | ||||||

| Transaction costs | 136 | 13,246 | (13,110 | ) | |||||

| Incremental leasing costs | 2,544 | 2,347 | 197 | ||||||

| Amortization of improvement allowances | 9,432 | 7,732 | 1,700 | ||||||

| Amortization of property, plant and equipment (1) | 101 | 101 | — | ||||||

| Distributions on Exchangeable LP Units | 5,314 | 5,314 | — | ||||||

| Adjustments relating to joint venture: | |||||||||

| Adjustment to fair value on investment properties | (31 | ) | 1,895 | (1,926 | ) | ||||

| Amortization of improvement allowances | 213 | 164 | 49 | ||||||

| Interest expense(2) | — | 356 | (356 | ) | |||||

| FFO | $ | 77,645 | $ | 83,719 | $ | (6,074 | ) | ||

| Condominium marketing costs | 17 | 137 | (120 | ) | |||||

| Financing prepayment costs | — | — | — | ||||||

| Mark-to-market adjustment on unit-based compensation | (2,880 | ) | (300 | ) | (2,580 | ) | |||

| FFO excluding condominium related items, financing prepayment costs, and the mark-to-market adjustment on unit-based compensation | $ | 74,782 | $ | 83,556 | $ | (8,774 | ) | ||

| FFO | $ | 77,645 | $ | 83,719 | $ | (6,074 | ) | ||

| Amortization of straight-line rent | (2,131 | ) | (2,489 | ) | 358 | ||||

| Regular leasing expenditures | (3,650 | ) | (1,523 | ) | (2,127 | ) | |||

| Regular and recoverable maintenance capital expenditures | (2,022 | ) | (1,678 | ) | (344 | ) | |||

| Incremental leasing costs (related to regular leasing expenditures) | (1,781 | ) | (1,643 | ) | (138 | ) | |||

| Adjustment relating to joint venture: | |||||||||

| Amortization of straight-line rent | (57 | ) | (49 | ) | (8 | ) | |||

| Regular leasing expenditures | 1 | — | 1 | ||||||

| AFFO | $ | 68,005 | $ | 76,337 | $ | (8,332 | ) | ||

| Condominium marketing costs | 17 | 137 | (120 | ) | |||||

| Financing prepayment costs | — | — | — | ||||||

| Mark-to-market adjustment on unit-based compensation | (2,880 | ) | (300 | ) | (2,580 | ) | |||

| AFFO excluding condominium related items, financing prepayment costs, and the mark-to-market adjustment on unit-based compensation | $ | 65,142 | $ | 76,174 | $ | (11,032 | ) | ||

| Weighted average number of units (3) | |||||||||

| Basic | 139,765,128 | 139,765,128 | — | ||||||

| Diluted | 139,765,128 | 139,765,128 | — | ||||||

| Per unit – basic and diluted | |||||||||

| FFO | $ | 0.556 | $ | 0.599 | $ | (0.043 | ) | ||

| FFO excluding condominium related items, financing prepayment costs, and the mark-to-market adjustment on unit-based compensation | $ | 0.535 | $ | 0.598 | $ | (0.063 | ) | ||

| AFFO | $ | 0.487 | $ | 0.546 | $ | (0.059 | ) | ||

| AFFO excluding condominium related items, financing prepayment costs, and the mark-to-market adjustment on unit-based compensation | $ | 0.466 | $ | 0.545 | $ | (0.079 | ) | ||

| Pay-out Ratio | |||||||||

| FFO | 81.0 | % | 75.1 | % | 5.9 | % | |||

| FFO excluding condominium related items, financing prepayment costs, and the mark-to-market adjustment on unit-based compensation | 84.1 | % | 75.3 | % | 8.8 | % | |||

| AFFO | 92.5 | % | 82.4 | % | 10.1 | % | |||

| AFFO excluding condominium related items, financing prepayment costs, and the mark-to-market adjustment on unit-based compensation | 96.6 | % | 82.6 | % | 14.0 | % | |||

(1) Property, plant and equipment relates to owner-occupied property.

(2) This amount represents interest expense on Allied’s joint venture investment in TELUS Sky and is not capitalized under IFRS, but is allowed as an adjustment under REALPAC’s definition of FFO in “Funds From Operations (FFO) & Adjusted Funds From Operations (AFFO) for IFRS” issued in January 2022.

(3) The weighted average number of units includes Units and Exchangeable LP Units. The Exchangeable LP Units were reclassified from non-controlling interests in equity to liabilities in the unaudited condensed consolidated financial statements on Allied’s conversion to an open-end trust on June 12, 2023.

| Nine months ended | |||||||||

| September 30, 2024 |

September 30, 2023 | Change | |||||||

| Net loss and comprehensive loss from continuing operations | $ | (84,878 | ) | $ | (46,367 | ) | $ | (38,511 | ) |

| Net income and comprehensive income from discontinued operations | — | 124,991 | (124,991 | ) | |||||

| Adjustment to fair value of investment properties and investment properties held for sale | 211,534 | 169,232 | 42,302 | ||||||

| Adjustment to fair value of Exchangeable LP Units | 472 | (55,267 | ) | 55,739 | |||||

| Adjustment to fair value of derivative instruments | 13,031 | (18,519 | ) | 31,550 | |||||

| Impairment of residential inventory | 38,259 | 15,376 | 22,883 | ||||||

| Transaction costs | 136 | 13,246 | (13,110 | ) | |||||

| Incremental leasing costs | 7,847 | 6,882 | 965 | ||||||

| Amortization of improvement allowances | 27,864 | 23,927 | 3,937 | ||||||

| Amortization of property, plant and equipment (1) | 300 | 302 | (2 | ) | |||||

| Distributions on Exchangeable LP Units | 15,942 | 7,085 | 8,857 | ||||||

| Adjustments relating to joint venture: | |||||||||

| Adjustment to fair value on investment properties | (213 | ) | 4,638 | (4,851 | ) | ||||

| Amortization of improvement allowances | 589 | 491 | 98 | ||||||

| Interest expense (2) | — | 1,101 | (1,101 | ) | |||||

| FFO | $ | 230,883 | $ | 247,118 | $ | (16,235 | ) | ||

| Condominium marketing costs | 117 | 449 | (332 | ) | |||||

| Financing prepayment costs | — | — | — | ||||||

| Mark-to-market adjustment on unit-based compensation | (1,941 | ) | (710 | ) | (1,231 | ) | |||

| FFO excluding condominium related items, financing prepayment costs, and the mark-to-market adjustment on unit-based compensation | $ | 229,059 | $ | 246,857 | $ | (17,798 | ) | ||

| FFO | $ | 230,883 | $ | 247,118 | $ | (16,235 | ) | ||

| Amortization of straight-line rent | (5,746 | ) | (6,261 | ) | 515 | ||||

| Regular leasing expenditures | (7,403 | ) | (5,622 | ) | (1,781 | ) | |||

| Regular and recoverable maintenance capital expenditures | (3,450 | ) | (4,395 | ) | 945 | ||||

| Incremental leasing costs (related to regular leasing expenditures) | (5,493 | ) | (4,818 | ) | (675 | ) | |||

| Adjustment relating to joint venture: | |||||||||

| Amortization of straight-line rent | (152 | ) | (147 | ) | (5 | ) | |||

| Regular leasing expenditures | (7 | ) | — | (7 | ) | ||||

| AFFO | $ | 208,632 | $ | 225,875 | $ | (17,243 | ) | ||

| Condominium marketing costs | 117 | 449 | (332 | ) | |||||

| Financing prepayment costs | — | — | — | ||||||

| Mark-to-market adjustment on unit-based compensation | (1,941 | ) | (710 | ) | (1,231 | ) | |||

| AFFO excluding condominium related items, financing prepayment costs, and the mark-to-market adjustment on unit-based compensation | $ | 206,808 | $ | 225,614 | $ | (18,806 | ) | ||

| Weighted average number of units (3) | |||||||||

| Basic | 139,765,128 | 139,765,128 | — | ||||||

| Diluted | 139,765,128 | 139,765,128 | — | ||||||

| Per unit – basic and diluted | |||||||||

| FFO | $ | 1.652 | $ | 1.768 | $ | (0.116 | ) | ||

| FFO excluding condominium related items, financing prepayment costs, and the mark-to-market adjustment on unit-based compensation | $ | 1.639 | $ | 1.766 | $ | (0.127 | ) | ||

| AFFO | $ | 1.493 | $ | 1.616 | $ | (0.123 | ) | ||

| AFFO excluding condominium related items, financing prepayment costs, and the mark-to-market adjustment on unit-based compensation | $ | 1.480 | $ | 1.614 | $ | (0.134 | ) | ||

| Pay-out Ratio | |||||||||

| FFO | 81.7 | % | 76.4 | % | 5.3 | % | |||

| FFO excluding condominium related items, financing prepayment costs, and the mark-to-market adjustment on unit-based compensation | 82.4 | % | 76.4 | % | 6.0 | % | |||

| AFFO | 90.4 | % | 83.5 | % | 6.9 | % | |||

| AFFO excluding condominium related items, financing prepayment costs, and the mark-to-market adjustment on unit-based compensation | 91.2 | % | 83.6 | % | 7.6 | % | |||

(1) Property, plant and equipment relates to owner-occupied property.

(2) This amount represents interest expense on Allied’s joint venture investment in TELUS Sky and is not capitalized under IFRS, but is allowed as an adjustment under REALPAC’s definition of FFO in “Funds From Operations (FFO) & Adjusted Funds From Operations (AFFO) for IFRS” issued in January 2022.

(3) The weighted average number of units includes Units and Exchangeable LP Units. The Exchangeable LP Units were reclassified from non-controlling interests in equity to liabilities in the unaudited condensed consolidated financial statements on Allied’s conversion to an open-end trust on June 12, 2023.

Cautionary Statements

This press release may contain forward-looking statements with respect to Allied, its operations, strategy, financial performance and condition, and the assumptions underlying any of the foregoing. These statements generally can be identified by the use of forward-looking words such as “forecast”, “outlook”, “may”, “will”, “expect”, “estimate”, “anticipate”, “intends”, “believe”, “assume”, “plans” or “continue” or the negative thereof or similar variations. The forward-looking statements in this press release are not guarantees of future results, operations or performance and are based on estimates and assumptions that are subject to risks and uncertainties, including those described under “Risks and Uncertainties” in Allied’s Annual MD&A, which is available at www.sedarplus.ca. Those risks and uncertainties include risks associated with financing and interest rates, access to capital, general economic conditions and lease roll-over. Allied’s actual results and performance discussed herein could differ materially from those expressed or implied by such statements. These cautionary statements qualify all forward-looking statements attributable to Allied and persons acting on its behalf. All forward-looking statements speak only as of the date of this press release and, except as required by applicable law, Allied has no obligation to update such statements.

About Allied

Allied is a leading owner-operator of distinctive urban workspace in Canada’s major cities. Allied’s mission is to provide knowledge-based organizations with workspace that is sustainable and conducive to human wellness, creativity, connectivity and diversity. Allied’s vision is to make a continuous contribution to cities and culture that elevates and inspires the humanity in all people.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Cecilia C. Williams

President & Chief Executive Officer

(416) 977-9002

cwilliams@alliedreit.com

Nanthini Mahalingam

Senior Vice President & Chief Financial Officer

(416) 977-9002

nmahalingam@alliedreit.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Dynamic Funds announces sub-advisor change

TORONTO, Oct. 30, 2024 /CNW/ – 1832 Asset Management L.P., the manager of Dynamic Asia Pacific Equity Fund (the “Fund”), announced today that the sub-advisor of this Fund will become Jarislowsky, Fraser Limited, effective today.

There will be no change to the investment objectives of the Fund resulting from this change.

For further information on this and other Dynamic Funds, please visit Dynamic.ca.

Commissions, trailing commissions, management fees and expenses may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed or insured by the Canada Deposit Insurance Corporation or any other government deposit insurer, their values change frequently, and past performance may not be repeated.

About Dynamic Funds

Dynamic Funds is a division of 1832 Asset Management L.P., which offers a range of wealth management solutions, including mutual funds, actively managed ETFs, liquid alternative mutual funds and investment solutions for private clients, institutional clients and managed asset programs. 1832 Asset Management L.P. is a limited partnership, the general partner of which is wholly owned by Scotiabank. Dynamic Funds® is a registered trademark of The Bank of Nova Scotia, used under license by, and is a division of, 1832 Asset Management L.P.

© Copyright 2024 The Bank of Nova Scotia. All rights reserved.

Website: www.dynamic.ca |X : @DynamicFunds | LinkedIn: https://www.linkedin.com/company/dynamic-funds/

© Copyright 2024 The Bank of Nova Scotia. All rights reserved.

SOURCE Dynamic Funds

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2024/30/c3314.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2024/30/c3314.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.