How Much House Is Too Much?

Homeownership is a cherished part of American society and a cornerstone of the American Dream. With the homeownership rate at 65% within the U.S. and home prices near record highs, the question is: how much house is too much?

In other words, at what point is your house too big a portion of your overall assets? As a reminder, your total assets are everything that you own. This would include: your car, your house, your stocks, your bonds, your retirement accounts, and much more.

Given this, what percentage of your total assets should be in your primary residence? Is there a point where this percentage gets too high? And what are the risks associated with having too much of your money in a single property?

All of these questions, and more, will be answered in this blog post. We’ll explore the data behind homeownership in the U.S., some rules of thumb when it comes to how much house you can afford, and why this matters.

To start, let’s look at how much house the typical American owns.

How Much House Do Most Americans Own?

Though only 65% of Americans own their own home, among these homeowners, a significant percentage of their assets are in their primary residence. According to the 2022 Survey of Consumer Finances, the typical U.S. homeowner (i.e. median homeowner) has 60% of their total assets in their home.

To put this in perspective, the median total assets among U.S. homeowners is around $530,000. This means that roughly $318,000 of those assets (60%) would be in one asset—their house. The rest of their assets would be everything other than their house. But that’s just the median, what about the rest of the distribution? Here’s what that looks like:

- 10th Percentile = 18% of Total Assets in Primary Residence

- 25th Percentile = 36% of Total Assets in Primary Residence

- 50th Percentile = 60% of Total Assets in Primary Residence

- 75th Percentile = 81% of Total Assets in Primary Residence

- 90th Percentile = 91% of Total Assets in Primary Residence

In other words, 25% of U.S. homeowners have less than 36% of their assets in their primary residence and 1 in 10 U.S. homeowners have more than 91% of their assets in their primary residence! This illustrates the variation in how much house different American households own relative to their assets.

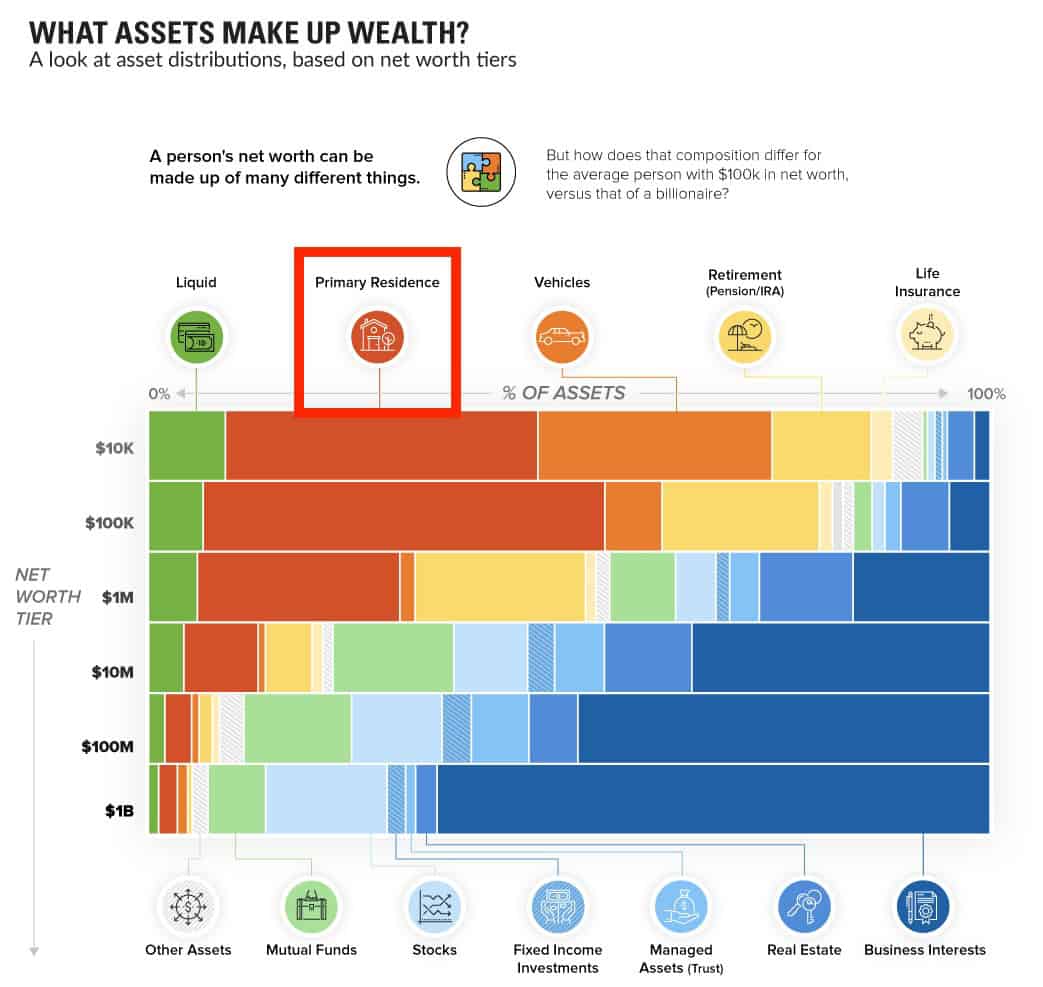

If we look at this breakdown by different net worth tiers, we can see that relatively poorer households have more of their wealth in their primary residence than wealthier households (h/t Visual Capitalist):

This demonstrates the importance of housing for the middle and upper middle class within the United States. Now that we’ve looked at how much house Americans tend to own, is there an ideal amount? Let’s take a look at that now.

What’s the Ideal Amount of House to Own?

When it comes to figuring out the ideal amount of house to own, there are two ways to approach this: based on your assets or based on your income. While neither approach is perfect, these two methodologies should help give you some peace of mind when it comes to buying a home.

- Asset-Based Approaches

- The One-Third Rule: Your primary residence should not be worth more than 33% of your total assets.

- The 40% of Net Worth Rule: Your primary residence should not be worth more than 40% of your total net worth. This rule is based on net worth (i.e. assets minus liabilities) rather than total assets which will be more conservative than the One-Third Rule.

- Age-based: Your allocation to your home should go down over time due to increasing age and decreasing risk tolerance:

- Under 35: Up to 40% of total assets

- 35-55: Up to 30% of total assets

- Over 55: Up to 20% of total assets

- Income-Based Approaches

- The 28/36 Rule: Your monthly mortgage payment shouldn’t exceed 28% of your monthly income and your total debt payments shouldn’t exceed 36% of your monthly income.

- The 35%/45% Rule: Your monthly mortgage payment shouldn’t exceed 35% of your monthly pre-tax income or 45% of your monthly post-tax income.

- The 2.5x Income Rule: Your home’s value should not exceed 2.5x your annual income. Therefore, if your income were $100,000, you shouldn’t buy a house worth more than $250,000.

Based on the asset-based approaches mentioned here, most American homeowners have far too much of their assets in their primary residence. This suggests that these households are either using a more reasonable income-based approach or they are overextending themselves to buy a home.

Whether you decide to use an asset-based or income-based approach when looking for a new home, these guidelines exist for a reason. They are meant to reduce the risk of owning a home so that you don’t get into future financial trouble. For those unfamiliar with such risks, we will cover them now.

The Risks Of Owning Too Much House

When it comes to the risks of having too much of your total assets in your home, a few ideas come to mind:

- Diversification: Concentrating too much of your wealth in a single asset class leaves you exposed to the volatility of that asset class. Anyone who owned a home in 2008 and saw their net worth decline by 20% (or more) knows what this feels like. Having a smaller percentage of your wealth in your primary residence is the best way to offset such a risk.

- Maintenance: Having too much of your assets in your home means that you are likely overextended and have to spend more on maintenance than you may be able to afford. Generally larger home are more expensive to maintain than smaller homes. Keep this in mind when buying a home that is already a little outside your budget.

- Illiquidity: While having a bigger, better home is great, much of that value is inaccessible as home equity. And, as the saying goes, “You can’t eat your home equity.” As a result, before buying a bigger home, think about how much more of your wealth you are locking up in a less liquid asset class.

- Property taxes: Similar to maintenance costs, if your property taxes go up over time, this will cost you even more on a more expensive home (all else equal). Owning a home is a lot more than just a mortgage, so make sure to take these other costs into account before pulling the trigger.

- Opportunity costs: Since your home is illiquid, every dollar you have locked up in it is a dollar that you can’t invest in income-producing assets. Remember what you give up when you decide to buy more house than what you truly need.

The risks of owning a home are about more than what initially meets the eye. While being less diversified is the most obvious risk, it’s not the only one. The phantom costs of owning a more expensive property and the illiquid nature of real estate amplify this problem even further.

The Bottom Line

When trying to figure out how much house is too much, the answer is in the eye of the beholder. Some approaches that work for one person may not work for another. And while there are many guidelines that you should consider on your home-buying journey, there are many other factors that can influence this decision. For example, the financial status of your parents, your financial goals, and where you live will all impact whether you can afford more or less house than the rules listed above.

Ultimately, what matters is finding a balance between getting the home that you want in the present without jeopardizing your financial future. If that means that you end up owning a home that is large share of your assets, but a small share of your income, that’s fine. You don’t have to follow an asset-based or an income-based approach when it comes to buying a house. However, I recommend that you at least consider these approaches during your house-hunting journey.

So, how much house is too much? The amount that could put your financial future in danger. After all, what’s the point of buying a bigger home if you can’t keep it?

Thank you for reading!

If you liked this post, consider signing up for my newsletter.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply