MercadoLibre Options Trading: A Deep Dive into Market Sentiment

Investors with a lot of money to spend have taken a bullish stance on MercadoLibre MELI.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with MELI, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 23 uncommon options trades for MercadoLibre.

This isn’t normal.

The overall sentiment of these big-money traders is split between 52% bullish and 30%, bearish.

Out of all of the special options we uncovered, 9 are puts, for a total amount of $520,721, and 14 are calls, for a total amount of $1,489,483.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $1120.0 to $2600.0 for MercadoLibre during the past quarter.

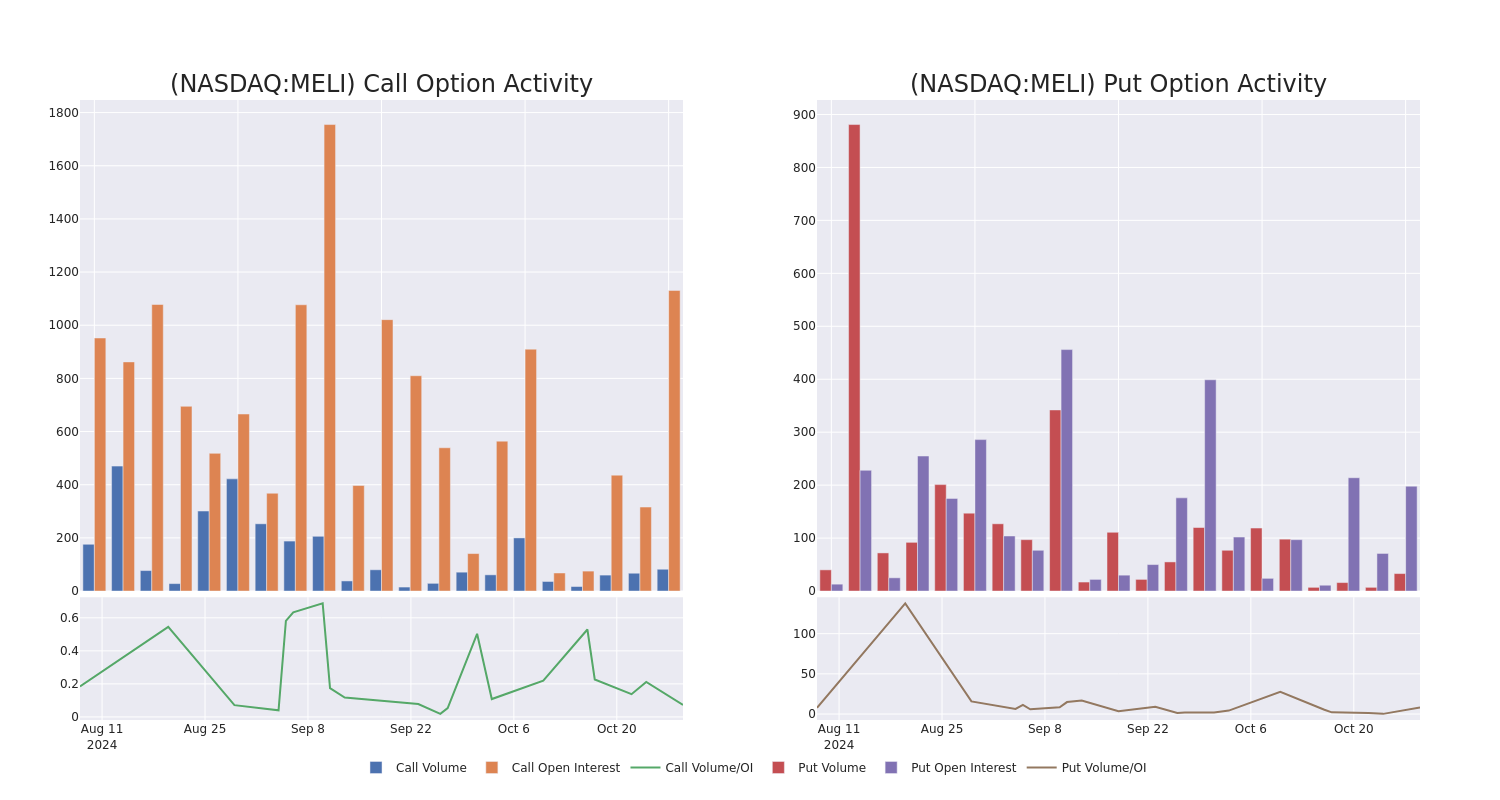

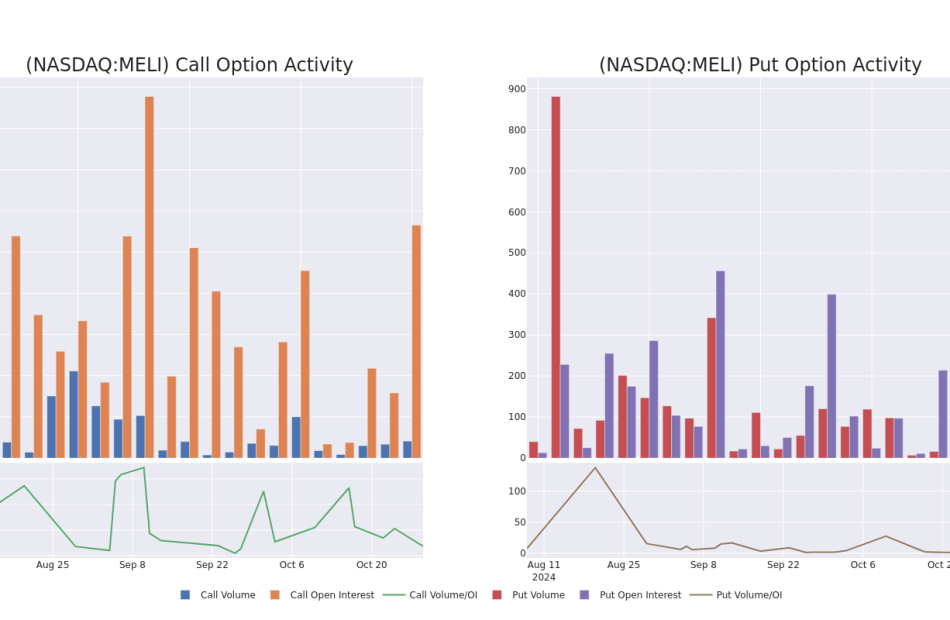

Insights into Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in MercadoLibre’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to MercadoLibre’s substantial trades, within a strike price spectrum from $1120.0 to $2600.0 over the preceding 30 days.

MercadoLibre Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MELI | CALL | TRADE | BEARISH | 01/17/25 | $91.0 | $83.1 | $85.0 | $2120.00 | $850.0K | 106 | 0 |

| MELI | PUT | SWEEP | BEARISH | 11/15/24 | $244.0 | $237.9 | $244.0 | $2200.00 | $122.0K | 32 | 5 |

| MELI | CALL | TRADE | NEUTRAL | 03/21/25 | $138.8 | $120.1 | $130.0 | $2200.00 | $91.0K | 71 | 7 |

| MELI | CALL | TRADE | BULLISH | 11/15/24 | $882.0 | $867.0 | $876.0 | $1120.00 | $87.6K | 1 | 1 |

| MELI | PUT | TRADE | BULLISH | 01/17/25 | $142.8 | $138.1 | $138.1 | $2000.00 | $69.0K | 52 | 5 |

About MercadoLibre

MercadoLibre runs the largest e-commerce marketplace in Latin America, with more than 218 million active users and 1 million active sellers across 18 countries stitching into its commerce network or fintech solutions as of the end of 2023. The company operates a host of complementary businesses to its core online shop, with shipping solutions (Mercado Envios), a payment and financing operation (Mercado Pago and Mercado Credito), advertisements (Mercado Clics), classifieds, and a turnkey e-commerce solution (Mercado Shops) rounding out its arsenal. MercadoLibre generates revenue from final value fees, advertising royalties, payment processing, insertion fees, subscription fees, and interest income from consumer and small-business lending.

Having examined the options trading patterns of MercadoLibre, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

MercadoLibre’s Current Market Status

- With a volume of 363,387, the price of MELI is down -0.29% at $2020.72.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 13 days.

Expert Opinions on MercadoLibre

Over the past month, 4 industry analysts have shared their insights on this stock, proposing an average target price of $2545.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Redburn Atlantic downgraded its action to Buy with a price target of $2800.

* Maintaining their stance, an analyst from Barclays continues to hold a Overweight rating for MercadoLibre, targeting a price of $2500.

* Maintaining their stance, an analyst from Citigroup continues to hold a Buy rating for MercadoLibre, targeting a price of $2480.

* Reflecting concerns, an analyst from JP Morgan lowers its rating to Neutral with a new price target of $2400.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for MercadoLibre with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply