What's Ahead For Intel In Q3? This Analyst Projects In-Line Earnings But Warns Of Data Center Challenges

Intel Corporation INTC will report third-quarter financial results tomorrow, October 31, after the closing bell.

Rosenblatt analyst Hans Mosesmann anticipates that the tech giant will report results that are in line with expectations as the PC market stabilizes. However, he notes that this will be tempered by challenging trends in the data center sector, mainly due to market share losses to Advanced Micro Devices, Inc. AMD.

According to the analyst, Intel is moving towards a more agile structure following a 15% reduction in its workforce and a suspension of its dividend, aiming to prepare for a projected slowdown in 2025. Consequently, the analyst lacks confidence in the out quarter estimates, as Intel struggles to catch up with the current AI cycle while working to improve its CPU roadmap and the Intel Foundry business, among other challenges.

The analyst indicated that for the September quarter, revenue is estimated at $13 billion, aligning with the consensus, which reflects an 8% year-over-year decline and a 1% quarter-over-quarter increase. Management’s guidance for the quarter ranges from $12.5 billion to $13.5 billion, Mosesmann noted.

The analyst projects December quarter revenue will be $14 billion, surpassing the consensus estimate of $13.7 billion. This estimate represents a 9.1% year-over-year decline and a 7.7% quarter-over-quarter increase.

Also Read: What’s Going On With Polestar Automotive Stock Today?

The analyst forecasts FY24 revenue at $53 billion, slightly exceeding the consensus of $52 billion, with Non-GAAP EPS projected at $0.28, in line with consensus.

For FY25, estimated revenue is $55 billion and Non-GAAP EPS is $0.85, which fall short of the consensus expectations of $56.4 billion and $1.10, respectively.

Mosesmann reiterated the Sell rating on the stock with a price forecast of $17.

Price Action: INTC shares are trading lower by 1.83% to $22.48 at last check Wednesday.

Photo: Tada Images/Shutterstock.com

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

FLAGSTAR BANK COMMEMORATES NEW BRANCH OPENING IN BROOKYLN'S BEDFORD-STUYVESANT NEIGHBORHOOD WITH COMMUNITY EVENT AND $50,000 DONATION

– Full-service branch offering banking services and financial education

– Grants $50,000 CRA for Neighborhood Housing Services of Brooklyn Bedford-Stuyvesant CDC

HICKSVILLE, N.Y., Oct. 30, 2024 /PRNewswire/ — Flagstar Bank, N.A., (the “Bank”) a subsidiary of Flagstar Financial, Inc. FLG (the “Company”) hosted a grand opening event to commemorate its new branch in Brooklyn’s Bedford-Stuyvesant neighborhood. In conjunction with the event, the Bank announced a $50,000 Community Reinvestment Act (CRA) grant to Neighborhood Housing Services of Brooklyn Bedford-Stuyvesant CDC, a local building tenant and community partner.

The grant will support first-time homebuyer and financial education programs, covering materials, marketing, and administrative costs, while also including a youth component focused on financial responsibility. Eligible workshop participants may be awarded up to $10,000 from the Flagstar Downpayment Assistance Program and other downpayment assistance programs. Financial literacy courses, covering budgeting, savings, credit, and banking fundamentals, are available both in-person and virtually.

“We believe that a fundamental aspect of being a community-centric bank is our consistent dedication to uplifting those who need support in achieving their goals,” said Beverly Meek, Director of Community Reinvestment Act Giving. “Our gift to Neighborhood Housing Services is more than just a promise fulfilled—it’s a shared vision for developing affordable housing that benefits the entire community.”

The new 2,400 square-foot branch on 1911 Atlantic Avenue in Brooklyn, NY, represents a significant investment in enhancing banking services for low- and moderate-income communities, particularly in majority-minority neighborhoods. This branch reflects the Bank’s ongoing commitment to adding value to its communities through resources, education, and financial support, and in alignment with its multi-year community benefits agreement.

“Change is the only constant in this world,” said Reggie Davis, Senior Executive Vice President and President, Consumer and Small Business Banking. “We see this new branch as a catalyst for the positive transformation we envision in the community. By supporting underbanked neighborhoods, providing financial literacy education, and empowering community members with essential skills, we are helping them take control of their financial futures and creating lasting impact in their lives.”

The branch is located within a newly renovated mixed-use building in a joint venture between Dabar Development Partners and Thorobird Companies and provides 235 units of housing for low- and moderate-income households.

About Flagstar Financial, Inc.

Flagstar Financial, Inc. is the parent company of Flagstar Bank, N.A., one of the largest regional banks in the country. The Company is headquartered in Hicksville, New York. At September 30, 2024, the Company had $114.4 billion of assets, $73.0 billion of loans, deposits of $83.0 billion, and total stockholders’ equity of $8.6 billion.

Flagstar Bank, N.A. operates over 400 branches, including a significant presence in the Northeast and Midwest and locations in high growth markets in the Southeast and West Coast. In addition, the Bank has approximately 90 private banking teams located in over 10 cities in the metropolitan New York City region and on the West Coast, which serve the needs of high-net worth individuals and their businesses.

Cautionary Statements Regarding Forward-Looking Statements

This release may include forward‐looking statements by the Company and our authorized officers pertaining to such matters as our goals, beliefs, intentions, and expectations regarding (a) revenues, earnings, loan production, asset quality, liquidity position, capital levels, risk analysis, divestitures, acquisitions, and other material transactions, among other matters; (b) the future costs and benefits of the actions we may take; (c) our assessments of credit risk and probable losses on loans and associated allowances and reserves; (d) our assessments of interest rate and other market risks; (e) our ability to execute on our strategic plan, including the sufficiency of our internal resources, procedures and systems; (f) our ability to attract, incentivize, and retain key personnel and the roles of key personnel; (g) our ability to achieve our financial and other strategic goals, including those related to our merger with Flagstar Bancorp, Inc., which was completed on December 1, 2022, our acquisition of substantial portions of the former Signature Bank through an FDIC-assisted transaction, and our ability to fully and timely implement the risk management programs institutions greater than $100 billion in assets must maintain; (h) the effect on our capital ratios of the approval of certain proposals approved by our shareholders during our 2024 annual meeting of shareholders; (i) the conversion or exchange of shares of the Company’s preferred stock; (j) the payment of dividends on shares of the Company’s capital stock, including adjustments to the amount of dividends payable on shares of the Company’s preferred stock; (k) the availability of equity and dilution of existing equity holders associated with amendments to the 2020 Omnibus Incentive Plan; (l) the effects of the reverse stock split; and (m) transactions relating to the sale of our mortgage business and mortgage warehouse business.

Forward‐looking statements are typically identified by such words as “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “should,” “confident,” and other similar words and expressions, and are subject to numerous assumptions, risks, and uncertainties, which change over time. Additionally, forward‐looking statements speak only as of the date they are made; the Company does not assume any duty, and does not undertake, to update our forward‐looking statements. Furthermore, because forward‐looking statements are subject to assumptions and uncertainties, actual results or future events could differ, possibly materially, from those anticipated in our statements, and our future performance could differ materially from our historical results.

Our forward‐looking statements are subject to, among others, the following principal risks and uncertainties: general economic conditions and trends, either nationally or locally; conditions in the securities, credit and financial markets; changes in interest rates; changes in deposit flows, and in the demand for deposit, loan, and investment products and other financial services; changes in real estate values; changes in the quality or composition of our loan or investment portfolios, including associated allowances and reserves; changes in future allowance for credit losses, including changes required under relevant accounting and regulatory requirements; the ability to pay future dividends; changes in our capital management and balance sheet strategies and our ability to successfully implement such strategies; recent turnover in our Board of Directors and our executive management team; changes in our strategic plan, including changes in our internal resources, procedures and systems, and our ability to successfully implement such plan; changes in competitive pressures among financial institutions or from non‐financial institutions; changes in legislation, regulations, and policies; the imposition of restrictions on our operations by bank regulators; the outcome of pending or threatened litigation, or of investigations or any other matters before regulatory agencies, whether currently existing or commencing in the future; the success of our blockchain and fintech activities, investments and strategic partnerships; the restructuring of our mortgage business; our ability to recognize anticipated expense reductions and enhanced efficiencies with respect to our recently announced strategic workforce reduction; the impact of failures or disruptions in or breaches of the Company’s operational or security systems, data or infrastructure, or those of third parties, including as a result of cyberattacks or campaigns; the impact of natural disasters, extreme weather events, military conflict (including the Russia/Ukraine conflict, the conflict in Israel and surrounding areas, the possible expansion of such conflicts and potential geopolitical consequences), terrorism or other geopolitical events; and a variety of other matters which, by their nature, are subject to significant uncertainties and/or are beyond our control. Our forward-looking statements are also subject to the following principal risks and uncertainties with respect to our merger with Flagstar Bancorp, which was completed on December 1, 2022, and our acquisition of substantial portions of the former Signature Bank through an FDIC-assisted transaction: the possibility that the anticipated benefits of the transactions will not be realized when expected or at all; the possibility of increased legal and compliance costs, including with respect to any litigation or regulatory actions related to the business practices of acquired companies or the combined business; diversion of management’s attention from ongoing business operations and opportunities; the possibility that the Company may be unable to achieve expected synergies and operating efficiencies in or as a result of the transactions within the expected timeframes or at all; and revenues following the transactions may be lower than expected. Additionally, there can be no assurance that the Community Benefits Agreement entered into with NCRC, which was contingent upon the closing of the Company’s merger with Flagstar Bancorp, Inc., will achieve the results or outcome originally expected or anticipated by us as a result of changes to our business strategy, performance of the U.S. economy, or changes to the laws and regulations affecting us, our customers, communities we serve, and the U.S. economy (including, but not limited to, tax laws and regulations).

More information regarding some of these factors is provided in the Risk Factors section of our Annual Report on Form 10‐K/A for the year ended December 31, 2023, Quarterly Report on Forms 10-Q for the quarters ended March 31, 2024 and June 30, 2024 and in other SEC reports we file. Our forward‐looking statements may also be subject to other risks and uncertainties, including those we may discuss in this news release, on our conference call, during investor presentations, or in our SEC filings, which are accessible on our website and at the SEC’s website, www.sec.gov.

Investor Contact:

Salvatore J. DiMartino

(516) 683-4286

Media Contact:

Nicole Yelland

(248) 219-9234

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/flagstar-bank-commemorates-new-branch-opening-in-brookylns-bedford-stuyvesant-neighborhood-with-community-event-and-50-000-donation-302290733.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/flagstar-bank-commemorates-new-branch-opening-in-brookylns-bedford-stuyvesant-neighborhood-with-community-event-and-50-000-donation-302290733.html

SOURCE Flagstar Financial, Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Koil Energy Solutions Announces Dates for Third Quarter 2024 Earnings Release and Conference Call

HOUSTON, Oct. 30, 2024 (GLOBE NEWSWIRE) — Koil Energy Solutions, Inc. KLNG, a specialist in deepwater energy production and distribution equipment and services, announced today that it will report its third quarter 2024 results on Monday, November 4, 2024 before the market opens.

Koil will host an investor conference call to review its third quarter 2024 results on Monday, November 4, 2024 at 10:00 am Eastern Time (call details below).

| Call Dial-in: | Toll Free: 1-833-630-1956 |

| Toll/International: 1-412-317-1837 | |

| Please ask to join the Koil Energy Solutions call. |

Webcast URL: https://edge.media-server.com/mmc/p/kzxfna26

The earnings release and a replay of the conference call will be available on the Company’s website, www.koilenergy.com, under the “Investors” section.

About Koil

Koil is a leading energy services company offering subsea equipment and support services to the world’s energy and offshore industries. We provide innovative solutions to complex customer challenges presented between the production facility and the energy source. Our core services and technological solutions include distribution system installation support and engineering services, umbilical terminations, loose-tube steel flying leads, and related services. Additionally, Koil’s highly experienced team can support subsea engineering, manufacturing, installation, commissioning, and maintenance projects located anywhere in the world.

Investor Relations Contact:

Trevor Ashurst

ir@koilenergy.com

281-862-2201

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

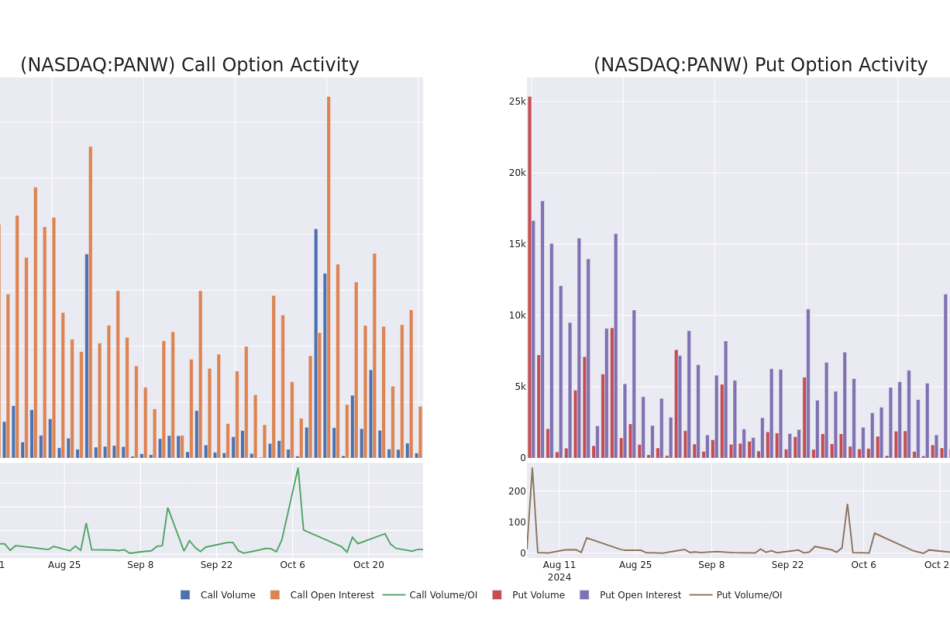

Market Whales and Their Recent Bets on PANW Options

Whales with a lot of money to spend have taken a noticeably bearish stance on Palo Alto Networks.

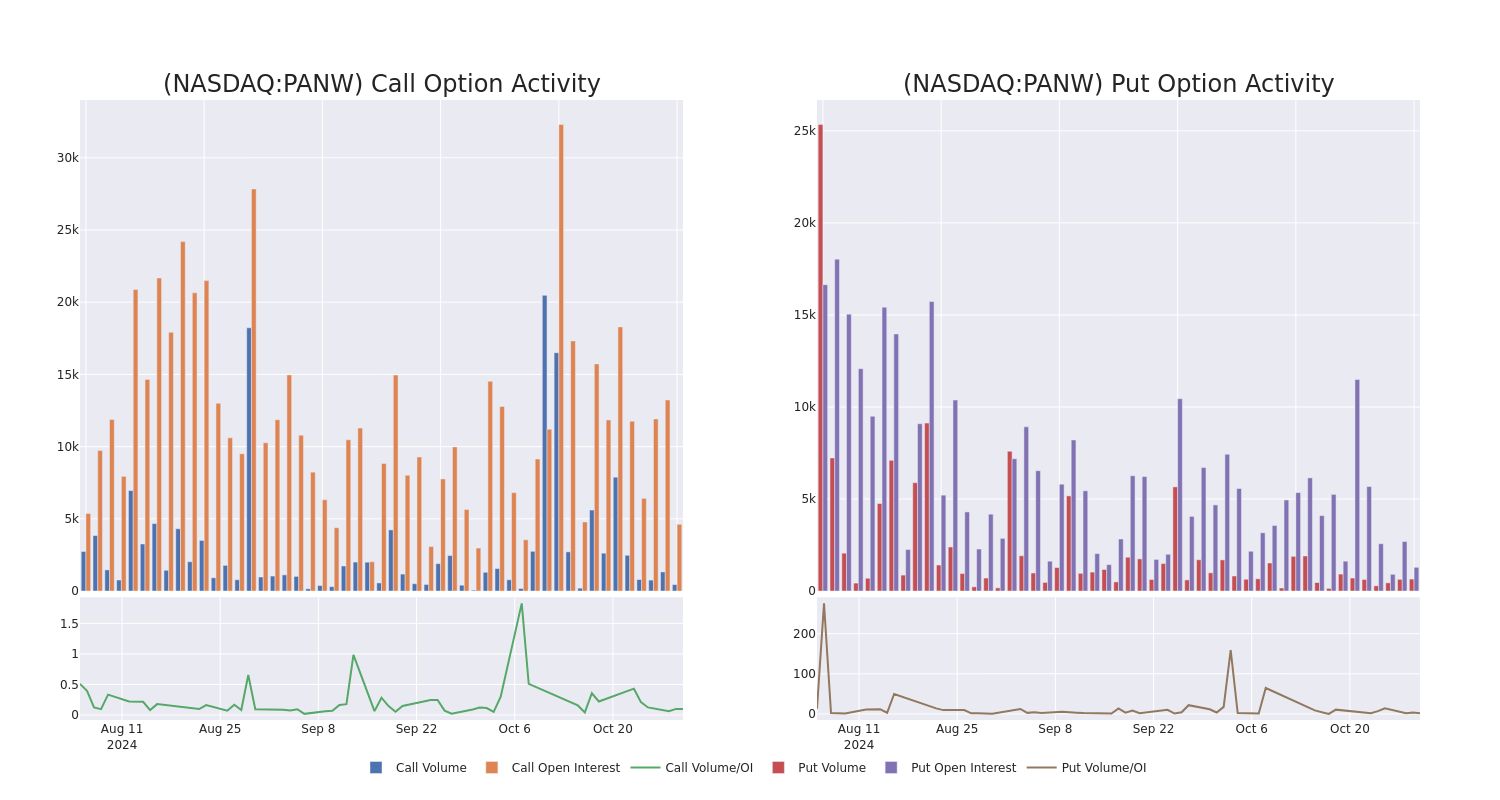

Looking at options history for Palo Alto Networks PANW we detected 12 trades.

If we consider the specifics of each trade, it is accurate to state that 16% of the investors opened trades with bullish expectations and 66% with bearish.

From the overall spotted trades, 5 are puts, for a total amount of $934,051 and 7, calls, for a total amount of $350,415.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $260.0 to $450.0 for Palo Alto Networks over the last 3 months.

Volume & Open Interest Development

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Palo Alto Networks’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Palo Alto Networks’s whale trades within a strike price range from $260.0 to $450.0 in the last 30 days.

Palo Alto Networks Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PANW | PUT | SWEEP | BEARISH | 06/20/25 | $25.65 | $24.45 | $25.51 | $330.00 | $539.8K | 414 | 212 |

| PANW | PUT | SWEEP | NEUTRAL | 06/20/25 | $7.05 | $7.0 | $7.05 | $260.00 | $286.7K | 405 | 404 |

| PANW | CALL | TRADE | BEARISH | 06/20/25 | $34.75 | $33.4 | $33.89 | $400.00 | $111.8K | 1.0K | 44 |

| PANW | CALL | SWEEP | BULLISH | 01/17/25 | $4.7 | $4.6 | $4.7 | $450.00 | $59.6K | 663 | 78 |

| PANW | CALL | SWEEP | NEUTRAL | 01/17/25 | $4.85 | $4.65 | $4.7 | $450.00 | $52.1K | 663 | 289 |

About Palo Alto Networks

Palo Alto Networks is a platform-based cybersecurity vendor with product offerings covering network security, cloud security, and security operations. The California-based firm has more than 80,000 enterprise customers across the world, including more than three fourths of the Global 2000.

Present Market Standing of Palo Alto Networks

- With a volume of 929,091, the price of PANW is down -1.58% at $359.6.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 14 days.

What The Experts Say On Palo Alto Networks

In the last month, 5 experts released ratings on this stock with an average target price of $423.2.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* In a cautious move, an analyst from Exane BNP Paribas downgraded its rating to Outperform, setting a price target of $410.

* An analyst from Oppenheimer persists with their Outperform rating on Palo Alto Networks, maintaining a target price of $450.

* Maintaining their stance, an analyst from Goldman Sachs continues to hold a Buy rating for Palo Alto Networks, targeting a price of $425.

* Maintaining their stance, an analyst from Barclays continues to hold a Overweight rating for Palo Alto Networks, targeting a price of $410.

* An analyst from Morgan Stanley has decided to maintain their Overweight rating on Palo Alto Networks, which currently sits at a price target of $421.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Palo Alto Networks with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Twilio Stock Moves Higher On Strong Q3 Earnings, Company Highlights Ability To Be 'Winner In The Age Of AI'

Twilio Inc TWLO shares are trading higher in Tuesday’s after-hours session after the company reported better-than-expected financial results for the third quarter.

- Q3 Revenue: $1.13 billion, versus estimates of $1.09 billion

- Q3 EPS: $1.02, versus estimates of 85 cents

Third-quarter revenue was up 10% year-over-year. Communications revenue came in at $1.06 billion, up 10% year-over-year. Segment (formerly Data & Applications) revenue totaled $73.4 million, flat on a year-over-year basis.

Twilio had more than 320,000 active customer accounts as of Sept. 30.

The company said it generated $204.3 million in operating cash flow and $189.1 million in free cash flow during the third quarter.

“Twilio continues to operate with financial discipline, operating rigor, and focused innovation, which has enabled us to deliver a strong third quarter of double-digit revenue growth and solid free cash flow generation,” said Khozema Shipchandler, CEO of Twilio.

“Twilio is uniquely positioned to bring the power of communications, plus contextual data, plus AI together to drive better customer experiences. Our continued product innovation and the outsized outcomes that we are delivering for customers illustrates our ability to be a winner in the age of AI.”

Outlook: Twilio expects fourth-quarter revenue to be between $1.15 billion and $1.16 billion versus estimates of $1.15 billion, per Benzinga Pro. The company anticipates fourth-quarter adjusted earnings of 95 cents to $1 per share.

Twilio expects full-year organic revenue growth of 7.5% to 8%. The company anticipates a full-year free cash flow of $650 million to $675 million.

Twilio noted it repurchased $2.7 billion of its stock since the company’s board approved a buyback earlier this year. Twilio plans to complete repurchases under the $3 billion buyback authorization by the end of the year.

TWLO Price Action: Twilio shares were up 9.11% after hours at $77 at the time of publication Wednesday, according to Benzinga Pro.

Read Next:

Photo: Collision Conf from Flickr.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

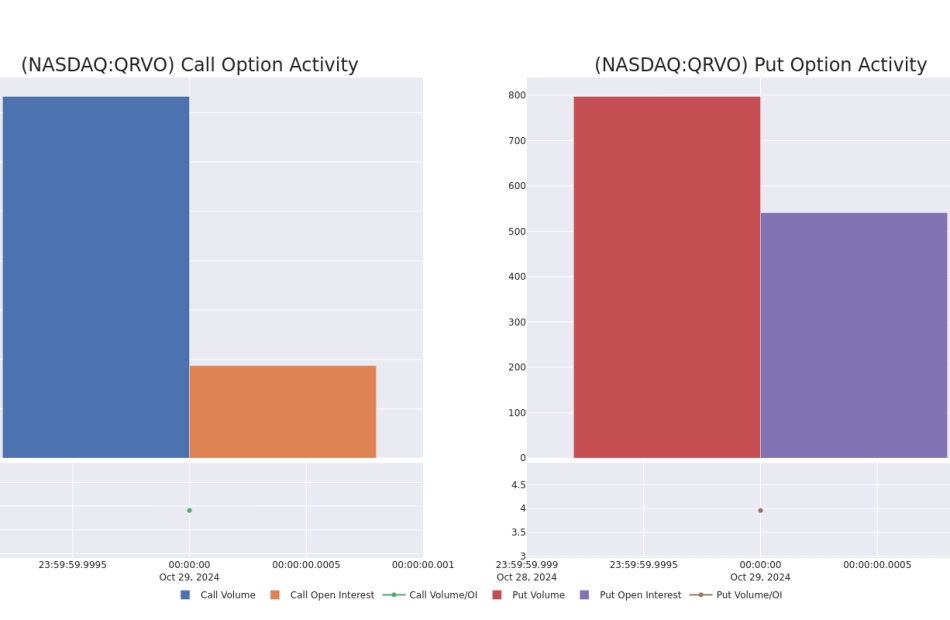

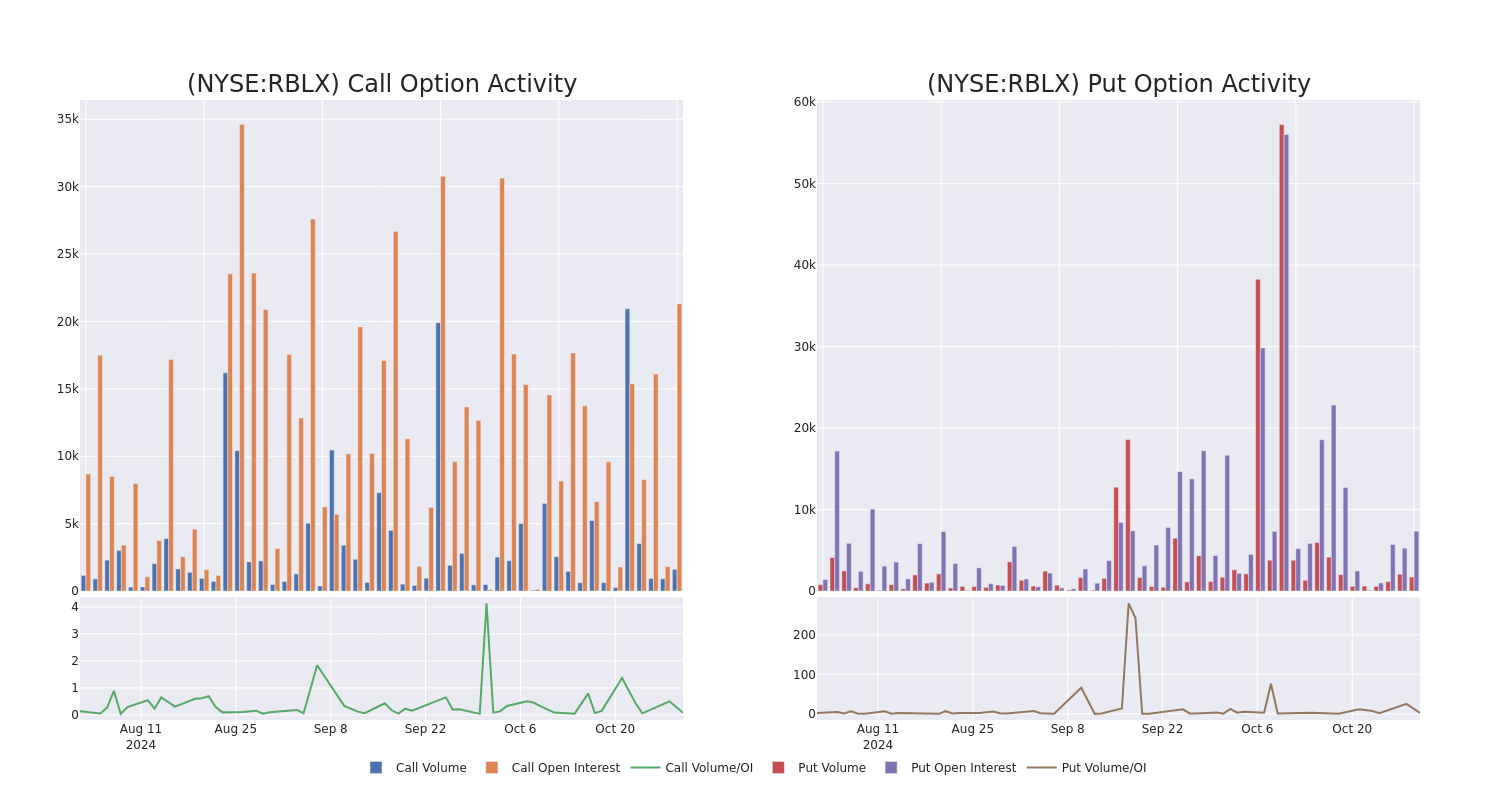

Qorvo's Options Frenzy: What You Need to Know

Investors with a lot of money to spend have taken a bearish stance on Qorvo QRVO.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with QRVO, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

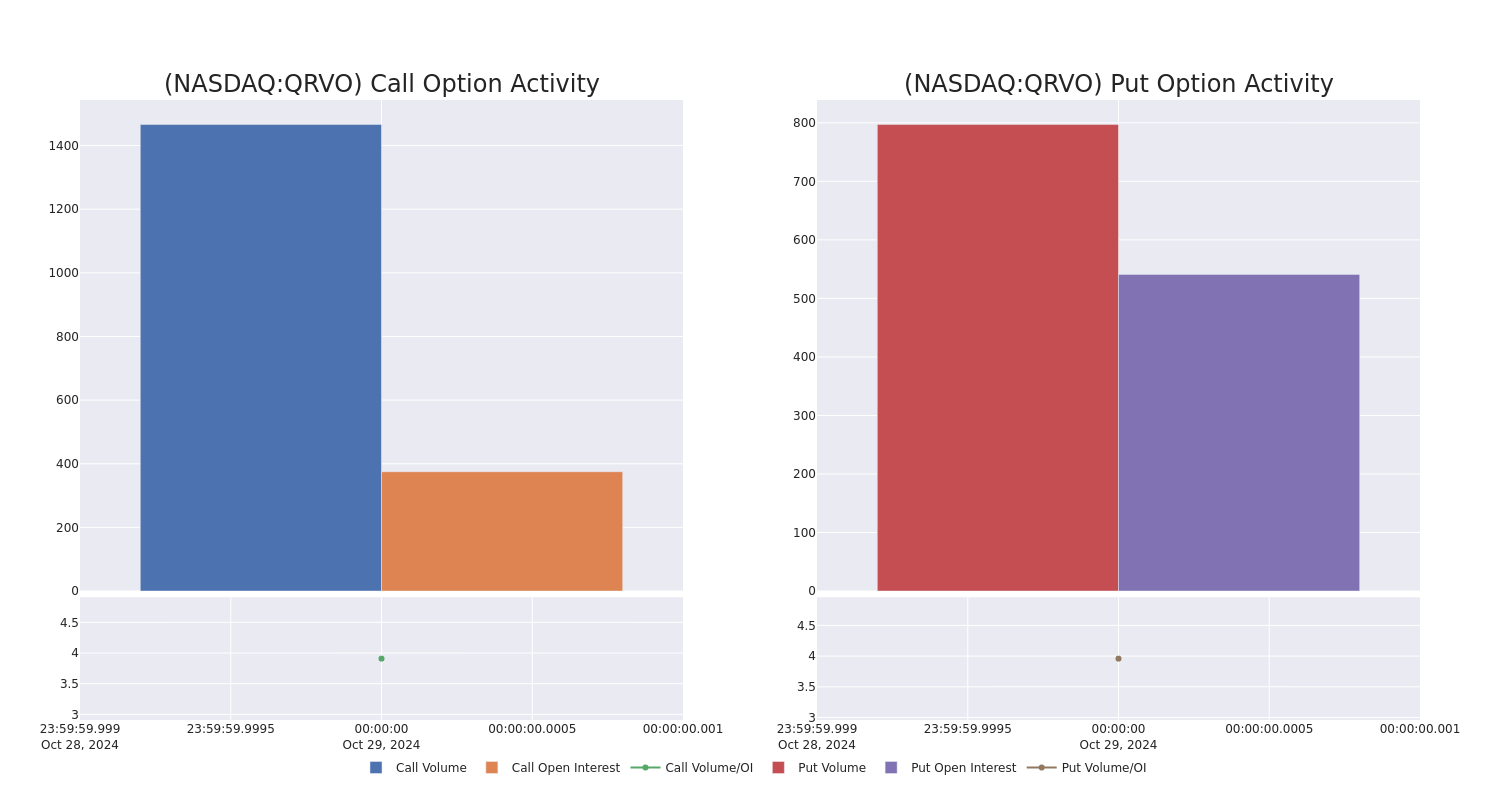

Today, Benzinga‘s options scanner spotted 20 uncommon options trades for Qorvo.

This isn’t normal.

The overall sentiment of these big-money traders is split between 40% bullish and 45%, bearish.

Out of all of the special options we uncovered, 16 are puts, for a total amount of $896,496, and 4 are calls, for a total amount of $219,750.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $60.0 to $125.0 for Qorvo during the past quarter.

Insights into Volume & Open Interest

In today’s trading context, the average open interest for options of Qorvo stands at 177.45, with a total volume reaching 9,485.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Qorvo, situated within the strike price corridor from $60.0 to $125.0, throughout the last 30 days.

Qorvo Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| QRVO | PUT | TRADE | BULLISH | 11/15/24 | $0.5 | $0.35 | $0.35 | $65.00 | $280.0K | 24 | 8.3K |

| QRVO | PUT | TRADE | NEUTRAL | 11/15/24 | $9.2 | $8.8 | $9.0 | $85.00 | $90.0K | 233 | 116 |

| QRVO | CALL | SWEEP | BULLISH | 05/16/25 | $8.7 | $8.1 | $8.7 | $80.00 | $82.6K | 0 | 99 |

| QRVO | CALL | SWEEP | BULLISH | 12/20/24 | $4.8 | $4.5 | $4.8 | $75.00 | $81.6K | 0 | 197 |

| QRVO | PUT | SWEEP | BULLISH | 01/17/25 | $43.2 | $41.0 | $41.01 | $115.00 | $73.8K | 259 | 71 |

About Qorvo

Qorvo represents the combined entity of RF Micro Devices and TriQuint Semiconductor, which merged in January 2015. The company specializes in radio frequency filters, power amplifiers, and front-end modules used in many of the world’s most advanced smartphones. Qorvo also has a suite of products sold into a variety of nonsmartphone end markets, such as wireless base stations, cable TV and networking equipment, and infrastructure and military applications.

Following our analysis of the options activities associated with Qorvo, we pivot to a closer look at the company’s own performance.

Current Position of Qorvo

- With a trading volume of 10,384,279, the price of QRVO is down by -27.31%, reaching $73.04.

- Current RSI values indicate that the stock is may be oversold.

- Next earnings report is scheduled for 91 days from now.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Qorvo options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Badger Infrastructure Solutions Ltd. Delivers Solid Growth in 2024 Third Quarter Revenue, Adjusted EBITDA and Adjusted Net Earnings

CALGARY, Alberta, Oct. 30, 2024 (GLOBE NEWSWIRE) — Badger Infrastructure Solutions Ltd. (“Badger”, the “Company”, “we”, “our” or “us”) BDGI reported third quarter results today. All results are presented in U.S. dollars unless otherwise stated.

2024 THIRD QUARTER OPERATIONAL HIGHLIGHTS

- The Company achieved revenue of $209.4 million, up 7% from 2023.

- U.S. revenue was $185.4 million (89% of total revenue), up 10% from 2023.

- Canada revenue was $24.0 million (11% of total revenue), down 12% from 2023.

- Gross profit margin of 32.5%, up from 32.1% in 2023.

- Adjusted EBITDA(1) improved to $58.3 million, up 11% from 2023.

- Adjusted EBITDA margin(1) rose to 27.8%, up from 26.9% in 2023.

- Revenue per truck per month (“RPT”)(1) for the quarter was $46,851, compared to $49,079 in 2023.

- Adjusted earnings per share(1) was $0.73 per share, up 6% from 2023.

- The Board of Directors has approved the quarterly cash dividend of CAD$0.18 per common share for the third fiscal quarter of 2024, with payment to be made on or after October 15, 2024, to all shareholders of record on September 30, 2024.

- The Toronto Stock Exchange (“TSX”) has accepted Badger’s amended notice of intention to increase the size of its Normal Course Issuer Bid (“NCIB”) effective November 4, 2024. During the third quarter of 2024, we purchased 44,400 shares at a weighted average price of CAD $36.95 per share under the NCIB.

“The solid results achieved in Q3 2024 underscore the continued demand for our non-destructive excavation services in our key end markets within the U.S.. Revenue of $209.4 million grew 7% compared to Q3 2023 while Adjusted EBITDA was 11% higher than last year as we continue to focus on improving our margins and profitability. We are pleased with the team’s strong performance during the busy construction season which positions Badger for the remainder of the year.” said Rob Blackadar, President & Chief Executive Officer.

“We remain focused on executing our pricing, sales and utilization strategies to continue driving revenue growth and profitability, further establishing Badger as the industry leader in non-destructive excavation. We have grown year-to-date revenue in 2024 as compared to the same period in 2023 by 9%, Adjusted EBITDA by 14% and Adjusted earnings per share by 11%.” concluded Mr. Blackadar.

FINANCIAL HIGHLIGHTS

| Three months ended September 30, | Nine months ended September 30, | |||||||

| ($ US thousands except RPT, per share amounts, share information and ratios) | 2024 | 2023 | 2024 | 2023 | ||||

| Revenue: | ||||||||

| Non-destructive excavation service | 198,344 | 186,834 | 527,528 | 487,340 | ||||

| Other | 11,032 | 8,717 | 30,248 | 23,313 | ||||

| Total revenue | 209,376 | 195,551 | 557,776 | 510,653 | ||||

| RPT – Consolidated (mixed currency)(1) | 46,851 | 49,079 | 41,970 | 43,699 | ||||

| RPT – U.S. (USD)(1) | 48,206 | 49,611 | 44,092 | 44,290 | ||||

| RPT – Canada (CAD)(1) | 42,229 | 47,534 | 35,103 | 42,027 | ||||

| Adjusted EBITDA(1) | 58,300 | 52,700 | 132,110 | 115,837 | ||||

| Adjusted EBITDA per share, basic and diluted(1) | $1.69 | $1.53 | $3.83 | $3.36 | ||||

| Adjusted EBITDA margin(1) | 27.8% | 26.9% | 23.7% | 22.7% | ||||

| Net earnings before income tax | 31,595 | 30,831 | 50,488 | 49,464 | ||||

| Net earnings | 23,314 | 23,284 | 37,003 | 37,061 | ||||

| Net earnings per share, basic and diluted(1) | $0.68 | $0.68 | $1.07 | $1.08 | ||||

| Adjusted net earnings(1) | 25,094 | 23,789 | 45,472 | 40,895 | ||||

| Adjusted net earnings per share, basic and diluted(1) | $0.73 | $0.69 | $1.32 | $1.19 | ||||

| Cash flow from operations before working capital and other adjustments | 58,387 | 52,630 | 132,201 | 115,480 | ||||

| Cash flow from operations before working capital and other adjustments per share, basic and diluted(1) |

$1.69 | $1.53 | $3.84 | $3.35 | ||||

| Total debt to Compliance EBITDA(1) | 1.5x | 1.4x | 1.5x | 1.4x | ||||

| Capital expenditures | 24,495 | 27,752 | 83,647 | 83,494 | ||||

| Hydrovac truck count | 1,625 | 1,514 | 1,625 | 1,514 | ||||

| Dividends paid | 4,446 | 4,433 | 13,503 | 13,066 | ||||

| Weighted average common shares outstanding(2) | 34,462,529 | 34,473,438 | 34,467,982 | 34,473,438 | ||||

| (1) | “Adjusted EBITDA”, “Adjusted EBITDA margin”, “Adjusted net earnings”, “Compliance EBITDA”, “Total debt” and “RPT” are not standardized financial measures prescribed by International Financial Reporting Standards (“IFRS”) and may not be comparable to similar measures presented by other companies or entities. See “Non-IFRS Financial Measures” and p.12-13 of the 2023 annual MD&A for additional detail on the definition and calculation of Adjusted EBITDA, Adjusted EBITDA margin, Adjusted net earnings, Compliance EBITDA and Total debt. See “Key Financial Metrics and Other Operational Metrics” and p.10 of the 2023 annual MD&A for additional details on RPT. Per share, basic and diluted measures are calculated by dividing the financial measure with the weighted average common shares outstanding for the period. | |

| (2) | See “Share Capital” for additional details. | |

BUSINESS OUTLOOK

For the remainder of 2024 and into 2025, we continue to see demand in our end markets, including infrastructure, utilities, and non-residential construction, across all our U.S. regions. The rate of growth in select markets has slowed due to the deferral of certain project start-ups and a slowdown in customer activity in those same markets. We anticipate activity to improve in the second half of 2025, supported by expected infrastructure spending and the start-up of deferred projects. In Canada, the slowdown we have experienced is attributed to the delay of several projects and we continue to expect these to begin in 2025.

Our strategy and focus remains the same. We are focused on increasing revenue through our sales and national accounts commercial strategy to drive higher activity levels, and capture pricing opportunities throughout our branch operations network. We also remain focused on both operational, functional and administrative scalability to drive operating leverage and continue growing Adjusted EBITDA margins and Adjusted net earnings at a higher rate than revenue growth.

As a result of slightly lower than expected utilization on our fleet, reflecting primarily weaker results from Canada, we now expect our fleet count to increase at the low end of our 7% – 10% growth range. This will be achieved by building to the low end of our original new build range and tracking to the high end of our retirement range.

| 2024 Outlook | |

| New builds | 190 units to 220 units |

| Retirements | 70 units to 90 units |

| Refurbishments | 35 units to 45 units |

| Total Capital Spend(1) | $90 million to $130 million |

(1) Total capital spend includes the cost to manufacture a new hydrovac, refurbishments, ancillary equipment and other capital projects.

NORMAL COURSE ISSUER BID

The TSX has accepted Badger’s amended notice of intention to increase the size of its NCIB pursuant to which Badger may purchase and cancel up to 2,658,294 common shares, representing 10% of the Company’s public float as at August 12, 2024 (the “Amended NCIB”) and has approved the implementation of an automatic securities purchase plan (the “ASPP”). The Amended NCIB will terminate upon the earlier of: (i) August 25, 2025; (ii) the date on which Badger has purchased an aggregate of 2,658,294 common shares under the Amended NCIB; and (iii) the date on which the Company terminates its bid at its option. The Amended NCIB will be subject to a maximum daily purchase limit on any trading day of 15,502 common shares (being 25% of the average daily trading volume on the TSX of 62,008 common shares for the six month period ending July 31, 2024), except as permitted in accordance with the “block” purchase exception prescribed by the TSX. All common shares purchased pursuant to the Amended NCIB shall be purchased on the Company’s behalf by its broker through the facilities of the TSX and any alternative trading systems in Canada through which trades of common shares may be affected under applicable securities laws, at the market price of the common shares at the time of purchase.

Since the commencement of Badger’s normal course issuer bid on August 26, 2024 which provided for the purchase and cancellation of up to 861,836 common shares (representing approximately 2.5% of the Company’s issued and outstanding common shares as at August 12, 2024), the Company has purchased and cancelled 44,400 common shares at a weighted average price of CAD $36.95 per share. Pursuant to the ASPP, Badger’s broker may facilitate repurchases of common shares during blackout periods within certain parameters prescribed by the TSX, applicable Canadian securities laws, and the terms of the parties’ written agreement. Purchases will be made by Badger’s broker based upon parameters set by Badger when it is not in possession of any material non-public information about itself and its securities, and in accordance with the terms of the ASPP. Outside of the effective period of the ASPP, common shares may continue to be purchased in accordance with Badger’s discretion, subject to applicable law.

ABOUT BADGER INFRASTRUCTURE SOLUTIONS LTD.

Badger Infrastructure Solutions Ltd. BDGI is North America’s largest provider of non-destructive excavating services. Badger works for contractors and facility owners in a broad range of infrastructure industries and in general commercial construction. Badger’s customers typically operate near high concentrations of underground power, communication, water, gas and sewer lines, where safety and economic risks are high and where non-destructive excavation provides a safe alternative for certain customer excavation requirements.

The Company’s key technology is the Badger Hydrovac™, which is used primarily for safe excavation around critical infrastructure and in congested underground conditions. The Badger Hydrovac uses a pressurized water stream to liquify the soil cover, which is then removed with a powerful vacuum system and deposited into a storage tank. Badger is unique in the non-destructive excavation industry because it designs and manufactures all of its hydrovac units at its plant in Red Deer, Alberta, which has an annual production capacity of more than 350 hydrovac units. To complement the Badger Hydrovac, the Company has a select number of specialty units, mainly Airvacs, combo trucks and sewer and flusher units.

2024 THIRD QUARTER CONFERENCE CALL

A conference call and webcast for investors, analysts, brokers and media representatives to discuss the 2024 third quarter results is scheduled for 9:00 a.m. ET on Thursday, October 31, 2024. To join the call and ask a question during the live questions and answers session: https://register.vevent.com/register/BI7d453a6689d14f4ca271c8239a6838cc. To join the call with audio only: https://edge.media-server.com/mmc/p/q3djn6ja/.

2024 THIRD QUARTER DISCLOSURE DOCUMENTS

Badger’s third quarter 2024 Management’s Discussion and Analysis (“MD&A”) and Interim Condensed Consolidated Financial Statements for the three and nine months ended September 30, 2024, along with all previous public filings of Badger Infrastructure Solutions Ltd. may be found on SEDAR+ at www.sedarplus.ca.

NON-IFRS FINANCIAL MEASURES

This press release contains references to certain financial measures, including some that do not have any standardized meaning prescribed by IFRS and that may not be comparable to similar measures presented by other companies or entities. These financial measures are identified and defined below. See “Non-IFRS Financial Measures” in the Company’s 2023 annual MD&A for detailed reconciliations of non-IFRS financial measures.

“Adjusted EBITDA” is earnings before interest, taxes, depreciation and amortization, share-based compensation, gains and losses on derivative instruments, gains and losses on sale of property, plant and equipment and right of use assets, and gains and losses on foreign exchange. Adjusted EBITDA is a measure of the Company’s operating profitability and is therefore useful to management and investors as it provides improved continuity with respect to the comparison of operating results over time. Adjusted EBITDA provides an indication of the results generated by the Company’s principal business activities prior to how these activities are financed, the results are taxed in various jurisdictions and assets are amortized. In addition, Adjusted EBITDA excludes gains and losses on sale of property, plant and equipment and right of use assets as these gains and losses are considered incidental and secondary to the principal business activities, gains and losses on foreign exchange as such gains and losses can vary significantly based on factors beyond the Company’s control; and share-based compensation and gains and losses on derivative instruments as these expenses can vary significantly with changes in the price of the Company’s common shares.

“Adjusted EBITDA margin” is Adjusted EBITDA as defined above, expressed as a percentage of revenues.

“Adjusted net earnings” is net earnings adjusted for share-based compensation, gains and losses on derivative instruments, gains and losses on sale of property, plant and equipment and right of use assets, and gains and losses on foreign exchange, tax impacted using the effective tax rate.

KEY FINANCIAL METRICS AND OTHER OPERATIONAL METRICS

“Revenue per truck per month” (“RPT”) is a measure of non-destructive excavation fleet utilization. It is calculated using non-destructive excavation revenue only. RPT is calculated on both a consolidated basis and for each geographic segment by dividing non-destructive excavation revenue for each segment, in the respective local currency, by the average number of non-destructive excavation units in the segment during the period.

See “Key Financial Metrics and Other Operational Metrics” on page 11 of the Company’s 2024 third quarter MD&A for additional details on RPT.

CAUTIONARY STATEMENTS REGARDING FORWARD-LOOKING INFORMATION AND STATEMENTS

Certain statements and information contained in this press release and other continuous disclosure documents of the Company referenced herein, including statements and information that contain words such as “could”, “should”, “can”, “anticipate”, “expect”, “believe”, “will”, “may”, “continue”, “focus on”, “grow”, “trend”, “plans” and similar expressions relating to matters that are not historical facts, constitute “forward-looking information” within the meaning of applicable Canadian securities legislation. These statements and information involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements and information. The Company believes the expectations reflected in such forward-looking statements and information are reasonable, but no assurance can be given that these expectations will prove to be correct. Such forward-looking statements and information included in this press release should not be unduly relied upon. These forward-looking statements and information speak only as of the date of this press release.

In particular, forward-looking information and statements in this press release include, but are not limited to the following:

- expectations regarding demand for non-destructive excavation services, including with respect to end markets, timing, spending, and project start-ups;

- expectations regarding Badger’s manufacturing and fleet strategy, including with respect to fleet count, new builds, retirements, refurbishments and capital spend; and

- general business strategies and objectives.

The forward-looking information and statements made in this press release rely on certain expected economic conditions and overall demand for Badger’s services and are based on certain assumptions. The assumptions used to generate this forward-looking information and statements are, among other things, that:

- Badger will maintain its financial position and financial resources will continue to be available to Badger;

- There will be long-term sustained customer demand for non-destructive excavation and related services from a broad range of end use markets in North America;

- Badger will maintain relationships with current customers and develop successful relationships with new customers;

- Badger will collect customer payments in a timely manner;

- Badger will be able to compete effectively for the demand for its services;

- There will not be significant changes in profit margins due to pricing changes driven by market conditions, competition, regulatory factors or other unforeseen factors;

- Badger will realize and continue to realize the efficiencies and benefits of the executed business restructuring activities and other business improvement initiatives; and

- Badger will obtain all labour, parts and supplies necessary to complete the planned Badger non-destructive excavation build at the costs and on the timeline expected.

Risks and other uncertainties that could cause actual results to differ materially from those anticipated in such forward-looking statements include, but are not limited to: political and economic conditions; industry competition; price fluctuations for oil and natural gas and related products and services; Badger’s ability to attract and retain key personnel; the availability of future debt and equity financing; changes in laws or regulations, including taxation and environmental regulations which may adversely impact the labour supply and operating costs of Badger; extreme or unsettled weather patterns; and fluctuations in foreign exchange or interest rates.

Readers are cautioned that the foregoing factors are not exhaustive. Additional information on these and other factors that could affect the Company’s operations and financial results is included in reports on file with securities regulatory authorities in Canada and may be accessed through the SEDAR+ website (www.sedarplus.ca) or at the Company’s website. The forward-looking statements and information contained in this press release are expressly qualified by this cautionary statement. The Company does not undertake any obligation to publicly update or revise any forward-looking statements or information, whether as a result of new information, future events or otherwise, except as may be required by applicable securities laws.

Source: Badger Infrastructure Solutions Ltd.

For further information: Robert Blackadar, President & Chief Executive Officer Robert Dawson, Chief Financial Officer Badger Infrastructure Solutions Ltd. ATCO Building II 4th Floor, 919 11th Avenue, SW Calgary, Alberta T2R 1P3 Telephone (403) 264-8500 Fax (403) 228-9773

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

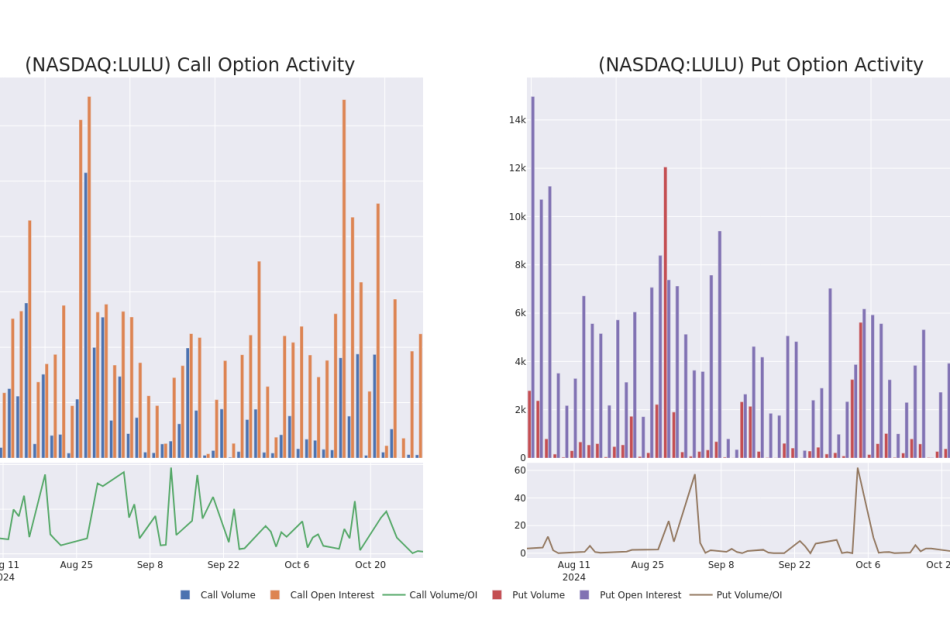

Behind the Scenes of Lululemon Athletica's Latest Options Trends

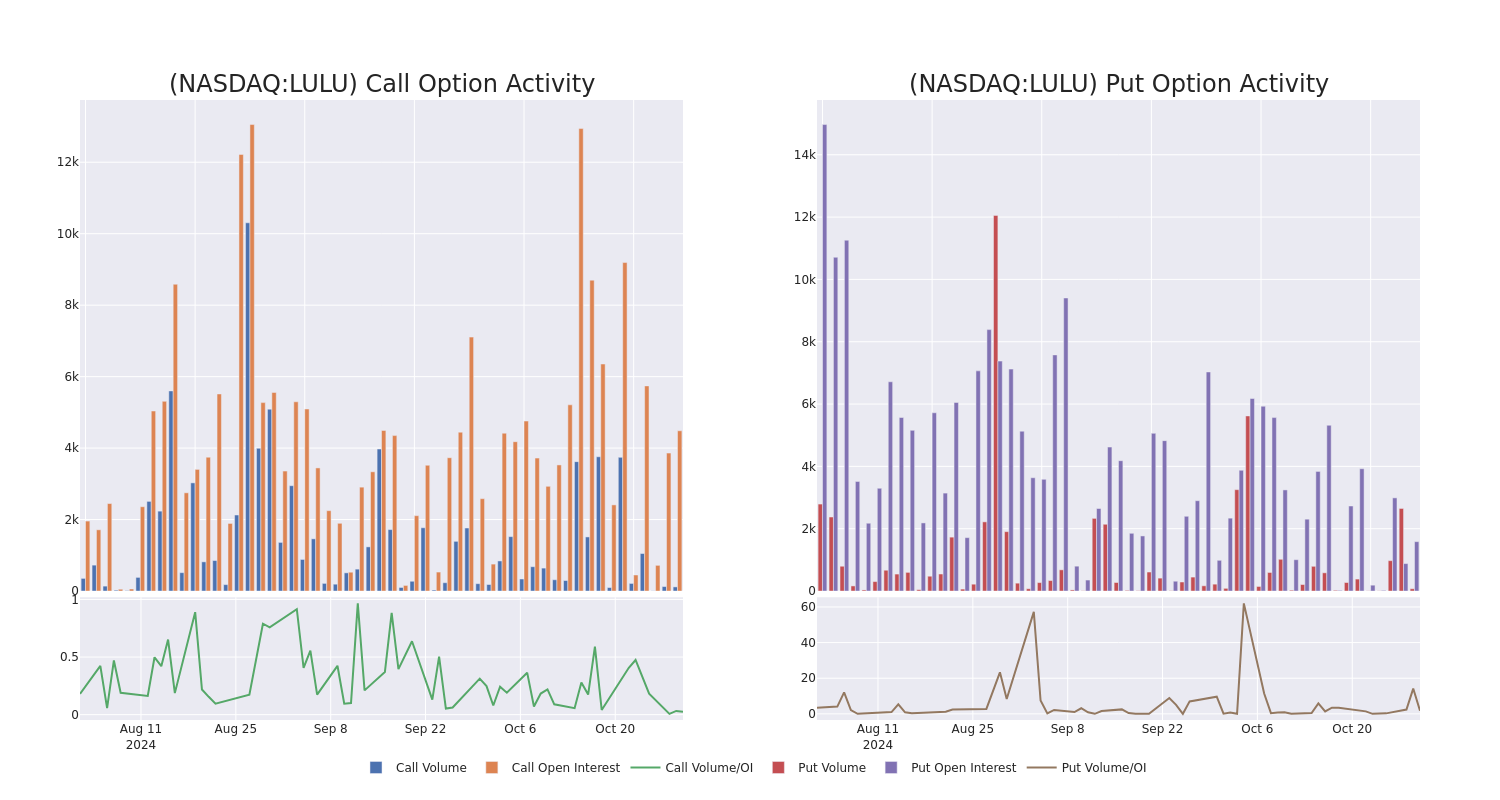

Financial giants have made a conspicuous bullish move on Lululemon Athletica. Our analysis of options history for Lululemon Athletica LULU revealed 8 unusual trades.

Delving into the details, we found 50% of traders were bullish, while 25% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $107,600, and 5 were calls, valued at $230,779.

What’s The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $240.0 to $320.0 for Lululemon Athletica during the past quarter.

Insights into Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Lululemon Athletica’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Lululemon Athletica’s substantial trades, within a strike price spectrum from $240.0 to $320.0 over the preceding 30 days.

Lululemon Athletica Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LULU | CALL | TRADE | NEUTRAL | 12/20/24 | $71.25 | $67.45 | $69.19 | $240.00 | $69.1K | 203 | 10 |

| LULU | CALL | SWEEP | NEUTRAL | 01/16/26 | $87.7 | $86.15 | $86.87 | $260.00 | $60.8K | 98 | 7 |

| LULU | PUT | SWEEP | BEARISH | 01/17/25 | $16.1 | $15.85 | $15.95 | $290.00 | $47.8K | 1.0K | 43 |

| LULU | CALL | TRADE | BULLISH | 11/15/24 | $29.3 | $29.1 | $29.3 | $280.00 | $35.1K | 2.0K | 16 |

| LULU | CALL | TRADE | BULLISH | 03/21/25 | $56.0 | $53.7 | $56.0 | $270.00 | $33.6K | 398 | 6 |

About Lululemon Athletica

Lululemon Athletica designs, distributes, and markets athletic apparel, footwear, and accessories for women, men, and girls. Lululemon offers pants, shorts, tops, and jackets for both leisure and athletic activities such as yoga and running. The company also sells fitness accessories, such as bags, yoga mats, and equipment. Lululemon sells its products through more than 700 company-owned stores in about 20 countries, e-commerce, outlets, and wholesale accounts. The company was founded in 1998 and is based in Vancouver, Canada.

After a thorough review of the options trading surrounding Lululemon Athletica, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is Lululemon Athletica Standing Right Now?

- With a trading volume of 1,509,252, the price of LULU is down by -0.32%, reaching $303.85.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 36 days from now.

What The Experts Say On Lululemon Athletica

In the last month, 1 experts released ratings on this stock with an average target price of $314.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Morgan Stanley persists with their Overweight rating on Lululemon Athletica, maintaining a target price of $314.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Lululemon Athletica with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

CHAMPION IRON REPORTS ITS FY2025 SECOND QUARTER RESULTS, DECLARES DIVIDEND AND ADVANCES THE DRPF PROJECT AS PLANNED

- Quarterly production of 3.2M wmt, sales of 3.3M dmt, revenue of $351M, EBITDA of $75M1 and EPS of $0.04

- Declares a dividend of $0.10 per ordinary share

- DRPF project advancing as planned for scheduled commissioning in H2/2025, including an additional $65M deployed in the quarter and cumulative investments to date of $218M

- Disclosed work programs required for the Company to meet its 2030 Scope 1 and 2 emission reduction commitment and the Company’s initial Scope 3 emissions assessment

MONTRÉAL, Oct. 30, 2024 /CNW/ – (Sydney, October 31, 2024) – Champion Iron Limited CIA CIA CIAFF (“Champion” or the “Company”) reports its operational and financial results for its financial second quarter ended September 30, 2024.

Champion’s CEO, Mr. David Cataford, said, “Although forest fires impacted operations for several days in July, our comprehensive protocols successfully safeguarded our workforce and infrastructure while also achieving quarterly records for material mined and hauled. Notwithstanding the effect of forest fires on quarterly results, Bloom Lake demonstrated its ability to operate at its recently expanded nameplate capacity in the past months. Despite a turbulent macroeconomic environment, our strong balance sheet and continued focus on reliable production performance enabled our Company to pursue its capital return strategy by declaring a seventh consecutive semi-annual dividend. Looking forward, our focus remains on solidifying operations and pursuing the construction of the DRPF project, which will further position our Company as an industry solution to decarbonize steelmaking.”

Conference Call Details

Champion will host a conference call and webcast on October 31, 2024, at 9:00 AM (Montréal time) / November 1, 2024, at 12:00 AM (Sydney time) to discuss the results of the financial second quarter ended September 30, 2024. Call details are set out at the end of this press release.

1. Quarterly Highlights

Operations and Sustainability

- No serious injuries or major environmental incidents reported in the three-month period ended September 30, 2024;

- Gradual return of Bloom Lake’s workforce, three days after being evacuated from the site on July 12, 2024, as a preventive response to nearby forest fires. The Company’s facilities and third parties’ infrastructure were not damaged by the fires. Although these events impacted production for approximately a week, mining activities resumed a few days before the rail service, closely followed by the resumption of operations at the concentration plants;

- As scheduled, the Company successfully executed the major planned semi-annual shutdowns of the two concentration plants in September 2024, impacting production over several days;

- Quarterly production of 3.2 million wmt (3.1 million dmt) of high-grade 66.3% Fe concentrate for the three-month period ended September 30, 2024, down 18% from the previous quarter and down 8% over the same period last year;

- Quarterly iron ore concentrate sales of 3.3 million dmt for the three-month period ended September 30, 2024, down 5% from the previous quarter and up 13% from the prior-year period;

- The Company continues to seek improvements from the rail operator to receive contracted haulage services to ensure that production, as well as iron ore concentrate currently stockpiled at Bloom Lake, is hauled over future periods. Iron ore concentrate stockpiled at Bloom Lake was 2.8 million wmt as at September 30, 2024, down from 3.0 million wmt as at June 30, 2024. The rail operator haulage capacity is expected to increase in the near term as it has recently started receiving additional rolling stock that had previously been ordered; and

- Aligned with its sustainability objectives and vision to reduce emissions across the steelmaking value chain, the Company identified work programs to achieve its 2030 Scope 1 and 2 emission reduction target and completed its initial Scope 3 assessment. Additional details can be found in the Company’s MD&A for the three and six-month periods ended September 30, 2024, available under its profile on SEDAR+ at www.sedarplus.ca, the ASX at www.asx.com.au and the Company’s website at www.championiron.com.

Financial Results

- Gross realized selling price of US$118.9/dmt1, compared to the P65 index average of US$114.2/dmt in the period;

- Net realized selling price of US$79.0/dmt1, representing a 20% decrease quarter-on-quarter, and 21% year-on-year;

- C1 cash cost of $77.5/dmt1 (US$56.8/dmt)2, comparable quarter-on-quarter, and representing an increase of 5% year-on-year;

- EBITDA of $74.5 million1, a decrease of 59% quarter-on-quarter, and 52% year-on-year;

- Net income of $19.8 million, a decrease of 76% quarter-on-quarter, and 70% year-on-year;

- EPS of $0.04, a decrease of 75% quarter-on-quarter, and 69% year-on-year;

- As anticipated, the cash balance decreased by $110.9 million since June 30, 2024, and was $183.8 million as at September 30, 2024, mainly resulting from the dividend payment in July 2024, seasonal sustaining capital expenditures and the advancement of the DRPF project, offset in part by changes in working capital;

- Available liquidity to support growth initiatives, including amounts available from the Company’s credit facilities, totalled $759.3 million1 at quarter-end, compared to $860.8 million1 as at June 30, 2024; and

- Semi-annual dividend of $0.10 per ordinary share declared on October 30, 2024 (Montréal) / October 31, 2024 (Sydney), will be payable on November 28, 2024 (Montréal and Sydney) to the Company’s shareholders on record as at the close of business on November 12, 2024 (Montréal and Sydney), in connection with the semi-annual results for the period ended September 30, 2024.

Growth and Development

- The DRPF project, aimed at upgrading half of Bloom Lake’s capacity to DR quality pellet feed iron ore grading up to 69% Fe, is progressing on schedule and on budget, with commissioning scheduled for the second half of calendar year 2025. Advanced engineering and construction works continued as planned, with quarterly and cumulative investments of $64.7 million and $218.4 million, respectively, as at September 30, 2024, out of the estimated total capital expenditures of $470.7 million detailed in the project study released in January 2023;

- Progressed the Environmental Impact Statement for the Kami Project as required by the Government of Newfoundland and Labrador, officially introduced the project’s brand to support local community awareness, and appointed a General Manager with significant experience in developing and operating sizeable mining projects. Concurrently, the Company continued to work on initiatives to improve the project economics prior to considering a final investment decision, including strategic partnerships;

- The production of 400 additional railcars, ordered in the previous quarter, commenced in September 2024, with delivery to Sept-Îles expected in the coming months. This acquisition should be fully financed through a long-term loan and is expected to improve the Company’s rail shipment flexibility and potentially increase Bloom Lake’s sales in the future; and

- Promotion of François Lavoie as Senior Vice-President, Sales, Technical Marketing and Product Development, joining Champion’s Management Team on July 25, 2024, in recognition of years of valuable contributions to the Company’s success, including the recommissioning of Bloom Lake in 2018 and completion of several project economic studies.

2. Bloom Lake Mine Operating Activities

During the three-month period ended September 30, 2024, Bloom Lake’s operations continued to deliver solid performance. Production and sales during the period were impacted by the planned major semi-annual shutdowns of both concentration plants and rail infrastructures, in addition to approximately one week of production losses following the preventive evacuation of Bloom Lake’s facilities on July 12, 2024, in response to nearby forest fires. Although production and sales were negatively impacted by these events, the Company continued to solidify its operations and achieved record volume of material mined and hauled during the second quarter, benefiting from improved mining equipment availability and productivity. During the three-month period ended September 30, 2024, volumes transported were slightly higher than production as rail haulage services resumed shortly before processing activities returned to their normal operational cadence in July 2024, following the forest fires. The Company also drew stockpiled iron ore at Bloom Lake during its scheduled semi-annual plants maintenance. Accordingly, the iron ore concentrate stockpiled at Bloom Lake decreased to 2.8 million wmt as at September 30, 2024, from 3.0 million wmt as at June 30, 2024.

The Company continues to seek improvements from the rail operator to receive contracted haulage services to ensure that Bloom Lake’s production, as well as iron ore concentrate currently stockpiled at Bloom Lake, is hauled over future periods. The rail operator recently received and is expected to receive in the near-term additional rolling stock, which should increase its shipment capacity. The production of an additional 400 railcars, ordered by the Company in July 2024, began in September and are expected to be gradually delivered to Sept-Îles in the coming months. The 400 railcars, combined with additional rolling stock from the rail operator, are expected to increase Champion’s rail haulage flexibility over time as part of its strategy to potentially increase Bloom Lake’s future sales.

The Company continued to analyze work programs and investments required to structurally increase Bloom Lake’s nameplate capacity beyond 15 Mtpa over time. The recently acquired additional mining equipment, to be delivered and commissioned over the coming months, is expected to support the mine’s production capacity, as the Company evaluates opportunities to address operational bottlenecks and maintain high stripping activities in the future, as per the mine plan.

|

Q2 FY25 |

Q1 FY25 |

Q/Q Change |

Q2 FY24 |

Y/Y Change |

|||

|

Operating Data |

|||||||

|

Waste mined and hauled (wmt) |

9,323,600 |

6,733,700 |

38 % |

6,264,600 |

49 % |

||

|

Ore mined and hauled (wmt) |

9,287,100 |

10,779,300 |

(14) % |

10,593,600 |

(12) % |

||

|

Material mined and hauled (wmt) |

18,610,700 |

17,513,000 |

6 % |

16,858,200 |

10 % |

||

|

Stripping ratio |

1.00 |

0.62 |

61 % |

0.59 |

69 % |

||

|

Ore milled (wmt) |

9,125,000 |

11,084,300 |

(18) % |

10,339,700 |

(12) % |

||

|

Head grade Fe (%) |

29.1 |

29.1 |

0 % |

28.2 |

3 % |

||

|

Fe recovery (%) |

78.7 |

79.3 |

(1) % |

77.8 |

1 % |

||

|

Product Fe (%) |

66.3 |

66.3 |

— % |

66.1 |

— % |

||

|

Iron ore concentrate produced (wmt) |

3,170,100 |

3,876,500 |

(18) % |

3,447,200 |

(8) % |

||

|

Iron ore concentrate sold (dmt) |

3,265,700 |

3,442,800 |

(5) % |

2,883,800 |

13 % |

During the three-month period ended September 30, 2024, a record 18.6 million tonnes of material were mined and hauled, compared to 16.9 million tonnes during the same period in 2023 and 17.5 million tonnes during the previous quarter, representing an increase of 10% and 6%, respectively. The increased mine performance was attributable to a higher utilization and availability of mining equipment, and reduced trucking cycle time associated with the construction of additional ramp accesses in the previous quarters.

The mining equipment’s increased performance allowed the Company to mine and haul a higher volume of waste material, resulting in a stripping ratio of 1.00 for the three-month period ended September 30, 2024, significantly higher than 0.59 for the same prior-year period, and 0.62 in the previous quarter. After the July 2024 forest fires, the Company resumed mining operations earlier than the concentration plants, enabling the reallocation of mining equipment to move additional waste materials during the three-month period ended September 30, 2024. With the addition of mining equipment in the coming months, the Company expects to maintain this high level of mining and hauling activities in the future, in line with the LoM plan.

During the three-month period ended September 30, 2024, the two concentration plants at Bloom Lake processed 9.1 million tonnes of ore, compared to 10.3 million tonnes for the same prior-year period and 11.1 million tonnes in the previous quarter, a decrease of 12% and 18%, respectively. Ore processed during the three-month period ended September 30, 2024, was negatively impacted by the availability of the concentration plants due to the major scheduled semi-annual shutdowns, as well as the production interruption due to the preventive evacuation of Bloom Lake in response to the nearby forest fires. Ore processed was also negatively impacted during the quarter by a mined area of higher ore hardness, reducing milling capacity and affecting the Fe recovery.

The iron ore head grade for the three-month period ended September 30, 2024, was 29.1%, compared to 28.2% for the same period in 2023, and 29.1% during the previous quarter. The variation in head grade was within expected normal variations of the mine plan.

Champion’s average Fe recovery rate was 78.7% for the three-month period ended September 30, 2024, compared to 77.8% for the same period in 2023, and 79.3% during the previous quarter. The Company continued its work programs to optimize its recovery circuits and expects to improve recovery rates over time.

Bloom Lake produced 3.2 million wmt (3.1 million dmt) of high-grade iron ore concentrate during the three-month period ended September 30, 2024, a decrease of 8% compared to 3.4 million wmt (3.4 million dmt) during the same period in 2023, and a decrease of 18% compared to 3.9 million wmt (3.8 million dmt) during the previous quarter.

3. Financial Performance

|

Q2 FY25 |

Q1 FY25 |

Q/Q Change |

Q2 FY24 |

Y/Y Change |

|||

|

Financial Data (in thousands of dollars) |

|||||||

|

Revenues |

350,980 |

467,084 |

(25 %) |

387,568 |

(9 %) |

||

|

Cost of sales |

252,960 |

264,911 |

(5 %) |

212,584 |

19 % |

||

|

Other expenses |

23,153 |

21,159 |

9 % |

20,192 |

15 % |

||

|

Net finance costs |

7,486 |

8,259 |

(9 %) |

11,634 |

(36 %) |

||

|

Net income |

19,807 |

81,357 |

(76 %) |

65,281 |

(70 %) |

||

|

EBITDA1 |

74,536 |

181,160 |

(59 %) |

155,036 |

(52 %) |

||

|

Statistics (in dollars per dmt sold) |

|||||||

|

Gross average realized selling price1 |

161.8 |

171.6 |

(6 %) |

169.4 |

(4 %) |

||

|

Net average realized selling price1 |

107.5 |

135.7 |

(21 %) |

134.4 |

(20 %) |

||

|

C1 cash cost1 |

77.5 |

76.9 |

1 % |

73.7 |

5 % |

||

|

AISC1 |

101.4 |

91.6 |

11 % |

99.1 |

2 % |

||

|

Cash operating margin1 |

6.1 |

44.1 |

(86 %) |

35.3 |

(83 %) |

A. Revenues

Revenues totalled $351.0 million for the three-month period ended September 30, 2024, compared to $387.6 million for the same period in 2023, driven by lower gross average realized selling prices, $22.9 million negative provisional pricing adjustments on sales recorded during the previous quarter and higher freight costs. This was partially offset by sales volume of 3.3 million tonnes of high-grade iron ore concentrate, up from 2.9 million tonnes for the same prior-year period, and by a weaker Canadian dollar. Sales volume increased year-over-year despite a planned shutdown of rail operations in September, a rail closure caused by nearby forest fires in July, rolling equipment maintenance activities, and a minor rock slide on the rail road, together interrupting rail services for several days during the period. Sales volumes last year were negatively impacted by railway interruptions and reduced service capacity due to forest fires in June 2023.

Negative provisional pricing adjustments on prior quarter sales of $22.9 million (US$17.1 million) were recorded during the three-month period ended September 30, 2024, representing a negative impact of US$5.2/dmt over 3.3 million dmt sold during the quarter as a final average price of US$110.0/dmt was established for the 1.8 million tonnes of iron ore that were in transit as at June 30, 2024, and which were provisionally priced at US$119.4/dmt.

The gross average realized selling price of US$118.9/dmt1 for the three-month period ended September 30, 2024, was higher than the P65 index average price of US$114.2/dmt for the period. The gross average realized selling price for the period was impacted by the 2.3 million tonnes in transit as at September 30, 2024, which were evaluated using an average price of US$119.9/dmt and certain sales contracts using backward-looking iron ore index prices, when the index was higher than the P65 index average price for the period. The P65 index premium over the P62 index remained resilient despite market challenges and increased to 14.6% over the P62 index average price of US$99.7/dmt during the quarter, compared to a premium of 9.6% in the prior-year period, and up from a premium of 12.8% in the previous quarter.

Freight and other costs of US$34.7/dmt increased by 31% during the three-month period ended September 30, 2024, compared to US$26.4/dmt in the same prior-year period. This increase was driven by a significantly higher average C3 index of US$26.7/t for the period, compared to US$20.3/t for the same period last year. This can likely be attributed to the conflict in the Red Sea which impacted freight routes during the period.

After taking into account sea freight and other costs of US$34.7/dmt and the negative provisional pricing adjustments of US$5.2/dmt, the Company obtained a net average realized selling price of US$79.0/dmt (C$107.5/dmt1) for its high-grade iron ore shipped during the quarter.

B. Cost of Sales and C1 Cash Cost

For the three-month period ended September 30, 2024, the cost of sales totalled $253.0 million with a C1 cash cost of $77.5/dmt1, compared to $212.6 million with a C1 cash cost of $73.7/dmt1 for the same period in 2023. Cost of sales in the previous quarter was $264.9 million with a C1 cash cost of $76.9/dmt1.

Mining and processing costs for the 3.1 million dmt produced in the three-month period ended September 30, 2024, totalled $57.7/dmt produced1, representing an increase of 22% compared to $47.3/dmt produced1 in the same period last year. This increase was mainly driven by an 8% reduction in the volume of iron ore concentrate produced, leading to a lower absorption of fixed costs, and higher maintenance costs associated with the major scheduled semi-annual shutdowns performed at both concentration plants during the quarter. Last year’s major scheduled semi-annual shutdowns of the two concentration plants were performed over two quarters. Land transportation and port handling costs for the three-month period ended September 30, 2024, were $26.7/dmt sold1, comparable to last year, as the higher volume of iron ore concentrate transiting at the port facilities in Sept-Îles offset higher fixed costs incurred by the port service provider. The increase in C1 cash cost over the same period last year was also due to the impact of the change in concentrate inventory valuation, resulting from higher mining and processing costs incurred in the current quarter as discussed above.

C. Net Income & EBITDA

For the three-month period ended September 30, 2024, the Company generated EBITDA of $74.5 million1, representing an EBITDA margin of 21%1, compared to $155.0 million1, representing an EBITDA margin of 40%1, for the same period in 2023. Lower EBITDA and EBITDA margin were mainly driven by lower net average realized selling prices.

For the three-month period ended September 30, 2024, the Company generated net income of $19.8 million (EPS of $0.04), compared to $65.3 million (EPS of $0.13) for the same prior-year period. This decrease in net income is attributable to lower gross profit partially offset by lower income and mining taxes.

D. All In Sustaining Cost & Cash Operating Margin

During the three-month period ended September 30, 2024, the Company realized an AISC of $101.4/dmt1, compared to $99.1/dmt1 for the same period in 2023, mainly attributable to higher C1 cash cost, as previously discussed in this section.

The Company generated a cash operating margin of $6.1/dmt1 for each tonne of high-grade iron ore concentrate sold during the three-month period ended September 30, 2024, compared to $35.3/dmt1 for the same prior-year period. The variation was due to a lower net average realized selling price, combined with a higher AISC for the period.

4. Exploration Activities

During the three and six-month periods ended September 30, 2024;

- the Company maintained all of its properties in good standing and did not enter into any farm-in/farm-out arrangements;

- $4.8 million and $7.4 million were incurred in exploration and evaluation expenditures, respectively, compared to $4.6 million and $7.3 million, respectively, for the same prior-year periods; and

- evaluation expenditures mainly consisted of work done in Québec and in Newfoundland and Labrador.

Details on exploration projects and maps are available on the Company’s website at www.championiron.com under the Operations & Projects section.

5. Cash Flows — Purchase of Property, Plant and Equipment

|

Three Months Ended |

Six Months Ended |

|||||||

|

September 30, |

September 30, |

|||||||

|

2024 |

2023 |

2024 |

2023 |

|||||

|

(in thousands of dollars) |

||||||||

|

Tailings lifts |

27,997 |

43,041 |

44,101 |

54,987 |

||||

|

Stripping and mining activities |

17,582 |

6,542 |

27,907 |

9,805 |

||||

|

Other sustaining capital expenditures |

20,340 |

10,863 |

31,919 |

15,457 |

||||

|

Sustaining capital expenditures |

65,919 |

60,446 |

103,927 |

80,249 |

||||

|

DRPF project |

64,677 |

16,938 |

123,142 |

28,021 |

||||

|

Other capital development expenditures at Bloom Lake |

48,586 |

13,002 |

67,574 |

37,786 |

||||

|

Purchase of property, plant and equipment as per cash flows |

179,182 |

90,386 |

294,643 |

146,056 |

||||

Sustaining Capital Expenditures

Sustaining capital expenditures were $15.5/dmt sold for the six-month period ended September 30, 2024, compared to $14.7/dmt for the same prior-year period. This slight increase reflected additional mining development and equipment rebuild programs required to support additional production over the LoM, partially offset by the timing in tailings lift work programs.

The tailings-related investments for the three and six-month periods ended September 30, 2024, were in line with the Company’s long-term plan to support the LoM operations. As part of its ongoing and thorough tailings infrastructure monitoring and inspections, Champion continues to invest in its safe tailings strategy and is implementing its long-term tailings investment plan. The Company’s tailings work programs are typically and mostly completed in the first half of the financial year due to more favourable weather conditions.

The increase in stripping and mining activities for the three and six-month periods ended September 30, 2024, was attributable to mine development costs, including topographic and pre-cut drilling work, as part of the Company’s mine plan. During the three and six-month periods ended September 30, 2024, $5.9 million of stripping costs were capitalized (nil and $0.3 million respectively, for the same periods in 2023).

The increase in other sustaining capital expenditures for the three and six-month periods ended September 30, 2024, was mainly attributable to mining equipment rebuild programs driven by Champion’s growing mining fleet, renovations of accommodation complexes, and railcars-related improvements, as part of the Company’s plan to increase its rail capacity. These expenditures are in line with the Company’s investment strategy to support growth projects over the LoM.

DRPF Project

During the three and six-month periods ended September 30, 2024, $64.7 million and $123.1 million, respectively, were spent in capital expenditures related to the DRPF project ($16.9 million and $28.0 million respectively, for the same prior-year periods). Investments mainly consisted of engineering work, foundations-related civil work and erection of the building extension. Cumulative investments of $218.4 million were deployed on the DRPF project as at September 30, 2024, with an estimated total capital expenditure of $470.7 million, as per the project study released in January 2023.

Other Capital Development Expenditures at Bloom Lake

During the three-month period ended September 30, 2024, other capital development expenditures at Bloom Lake totalled $48.6 million, compared to $13.0 million for the same period last year. During the six-month period ended September 30, 2024, other capital development expenditures totalled $67.6 million, compared to $37.8 million for the same period last year.

The following table details other capital development expenditures at Bloom Lake:

|

Three Months Ended |

Six Months Ended |

||||||

|

September 30, |

September 30, |

||||||

|

2024 |

2023 |

2024 |

2023 |

||||

|

(in thousands of dollars) |

|||||||

|

Infrastructure improvements and conformity (i) |

14,907 |

5,625 |

25,065 |

14,016 |

|||

|

Mine maintenance garage expansion (ii) |

3,680 |

6,822 |

7,463 |

15,184 |

|||

|

Deposits or final payment for mining equipment |

16,668 |

5,064 |

19,420 |

11,677 |

|||

|

Railcars (iii) |

9,723 |

— |

9,723 |

— |

|||

|

Other (iv) |

3,608 |

(4,509) |

5,903 |

(3,091) |

|||

|

Other Capital Development Expenditures at Bloom Lake |

48,586 |

13,002 |

67,574 |

37,786 |

|||

|

(i) |

Infrastructure improvements and conformity expenditures included various capital projects aimed at improving the performance or capacity of assets, including pads to expand the Company’s capacity to stockpile concentrate at the site, construction of a core shack, autonomous and remote drilling hardware and bridge conformity work programs. |

|

(ii) |

The mine maintenance garage expansion was required to support the Company’s expanded truck fleet, which made a significant contribution to the Company’s recent mining performance. |

|

(iii) |

Champion ordered 400 additional railcars in July 2024, which are expected to improve rail shipment flexibility in the future. The Company started to pay for the first railcars produced and expects the remaining ones to be paid and delivered in the upcoming months. This acquisition should be fully financed by a long-term loan. |

|

(iv) |

Other expenditures mainly consisted of capitalized borrowing costs on the DRPF project, partially offset by the receipt of government grants in the 2024 financial year, related to the Company’s initiatives to reduce GHG emissions and energy consumption. |

6. Conference Call and Webcast Information

A webcast and conference call to discuss the foregoing results will be held on October 31, 2024, at 9:00 AM (Montréal time) / November 1, 2024, at 12:00 AM (Sydney time). Listeners may access a live webcast of the conference call from the Investors section of the Company’s website at www.championiron.com/investors/events-presentations or by dialing toll free +1-888-510-2154 within North America or +61-2-8017-1385 from Australia.