NB Bancorp, Inc. Reports Third Quarter 2024 Financial Results

NEEDHAM, Mass., Oct. 30, 2024 /PRNewswire/ — NB Bancorp, Inc. (the “Company”) (Nasdaq Capital Market: NBBK), the holding company of Needham Bank (the “Bank”), today announced its third quarter 2024 financial results.

SELECTED FINANCIAL HIGHLIGHTS FOR THE THIRD QUARTER OF 2024

- Net income of $8.4 million, or $0.21 per diluted share, compared to net income of $9.5 million, or $0.24 per diluted share, for the prior quarter. Operating net income, excluding one-time charges, amounted to $13.1 million, or $0.33 per diluted share for the current quarter. One-time charges include:

- Loss on the sale of available-for sale securities amounting to $1.9 million;

- Tax expense and a modified endowment contract penalty related to the surrender of bank-owned life insurance (“BOLI”) policies of $1.6 million, and;

- Tax expense related to a basis write-down of solar income tax credits of $2.5 million, partially offset by;

- Reversal of previously recognized amortization related to solar income tax credit investments during the first six months of the year, amounting to $913 thousand.

- Gross loans increased $151.8 million, or 3.7%, to $4.25 billion, from the prior quarter.

- Net interest margin increased 5 basis points to 3.51% during the current quarter from 3.46% in the prior quarter.

- A portfolio of available-for-sale securities was sold at a $1.9 million net loss during the current quarter, with the proceeds reinvested into higher-yielding securities, which were restructured to mitigate portfolio risk and increase yield. The securities sold had an average yield of 0.97% with remaining duration of 2.4 years and were reinvested into securities with an average yield of 4.27% and average duration of 4.1 years. The earn-back period on the loss from the sale of the available-for-sale securities is expected to be approximately 2.5 years. The newly purchased securities carry a lower risk weight than the securities sold, mitigating risk in the Bank’s available-for-sale securities portfolio.

- During the current quarter, the Bank surrendered $46.7 million of existing BOLI policies that were earning an annualized yield of 3.08%. Prior to the surrender of the policies, the Bank took out an additional $50.0 million of BOLI policies, which are currently yielding 4.81%. As a result of the surrender of the BOLI policies, the Bank incurred $1.6 million of tax and penalty, which the Bank expects to earn back in less than 2 years. The insurance carriers have six months to pay out the surrendered policies, and as a result, the Bank expects BOLI to be at higher balances and to continue earning income related to the increase in cash surrender value until the proceeds are received, which will further shorten the earn-back period on the tax and penalty amount.

- During the current quarter, the Bank charged off $5.3 million of loans, including $4.0 million related to one non-owner-occupied commercial real estate office loan, which was a purchased participation loan. As a result of the deterioration of this loan, management engaged a third-party loan review firm to review our remaining real estate office loan portfolio, which was completed and did not result in any additional criticized loans or downgrades to our current risk ratings.

- Asset quality remains strong:

- Annualized net charge-offs increased forty-one basis points to 0.50% of average total loans during the current quarter from 0.09% of average total loans during the prior quarter. Non-performing loans decreased to $16.0 million, or 0.38% of total loans during the current quarter from $20.7 million, or 0.51% of total loans during the prior quarter.

- The increase in annualized net charge-offs and the decrease in non-performing loans was primarily due to the charge-off of a $4.0 million office participation loan during the quarter, along with the payoff of a $2.2 million construction loan at par.

- Provision for credit losses for the third quarter amounted to $2.6 million, a decrease from $3.7 million in the prior quarter, contributing to a decrease in the allowance for credit losses (“ACL”) of $252 thousand and decreasing the ACL as a percentage of total loans to 0.89%.

- During the quarter, the Bank adopted Accounting Standards Update (“ASU”) 2023-02, with a modified retrospective adoption reflected as of January 1, 2024, to record solar income tax credit investments under the proportional amortization method (“PAM”), whereby the solar income tax credit investments are amortized in proportion to the amount of overall benefits received from the investment. As a result of the adoption, the amortization of solar income tax credit investments where the credits were received in prior years was reflected as a retained earnings adjustment, which resulted in a $10.1 million reduction to retained earnings, along with a corresponding reduction in non-public investments. Additionally, $913 thousand of amortization expense related to these investments that was recorded during the first six months of 2024 was also reversed during the current quarter to apply retrospective treatment to the beginning of the year. The impact of adopting PAM on current quarter results amounted to $18.0 million in income tax expense, which included $2.5 million of a deferred tax liability related to the write-down of the basis of the investment. This was partially offset by a reduction in income tax expense of $17.3 million from the recognition of income tax credits during the quarter.

- Total deposits increased $124.9 million, or 3.2%, from the prior quarter. Brokered deposits increased by $29.9 million or 10.0% from the prior quarter, while the remaining $95.0 million increase represents core deposit growth of 2.6%, for the quarter.

- FHLB advances increased $55.5 million during the quarter, primarily in short-term advances, which were used to fund loan growth and the BOLI policy purchase.

- Borrowings and brokered deposits totaled 8.9% of total assets, an increase from 7.5% at the prior quarter end.

- Strong capital position of 14.9% shareholders’ equity to total assets and 14.9% tangible shareholders’ equity to tangible assets.

- Book value per share and tangible book value per share were $17.50 and $17.48, respectively, which increased from $17.19 and $17.17, respectively in the prior quarter. The increase in tangible book value per share was due to net income for the current quarter of $8.4 million and a $4.0 million reduction in accumulated other comprehensive loss.

“We continued with another strong quarter, with loan growth of 3.7%, primarily funded by deposits, which grew 3.2% during the quarter. We have shown another quarter of strong, but disciplined loan growth, with the ability to self-fund from our continued growth in deposits. Operating net income was $0.33 per share for the quarter, excluding the one-time charges taken during the quarter, which is expected to help our earnings run rate going forward. While we took a large charge-off during the current quarter, we are confident that the credit quality in the rest of our portfolio remains strong. Our balance sheet remains a strength as we head into the fourth quarter and we are optimistic about our opportunities as we look to close out our first full year as a public company,” said Joseph Campanelli, Chairman, President and Chief Executive Officer. “Tangible book value per share grew $0.31 during the quarter, and the Company continues to be disciplined in our capital management.”

BALANCE SHEET

Total assets amounted to $5.00 billion as of September 30, 2024, representing an increase of $202.8 million, or 4.2%, from June 30, 2024.

- Cash and cash equivalents decreased $11.9 million, or 3.6%, to $317.0 million from $328.9 million, in the prior quarter as a result of loan growth outpacing deposit growth.

- Net loans increased to $4.21 billion, representing an increase of $152.0 million, or 3.7%, from the prior quarter as demand for new originations continued. The current quarter growth was primarily seen in construction and land development loans, which increased $88.5 million, or 15.3%, commercial real estate loans excluding multi-family loans, which increased $55.7 million or 4.6%, consumer loans, which increased $13.1 million, or 5.9%, and residential real estate loans, which increased $9.5 million, or 0.8%; offset partially by a decrease in commercial and industrial loans of $19.4 million, or 3.3%.

- BOLI assets increased to $101.7 million from $51.3 million, a $50.4 million, or 98.2%, increase from the prior quarter as a result of the BOLI transaction noted previously.

- Prepaid expenses and other assets increased $24.8 million, or 50.0%, to $74.6 million from $49.7 million, primarily from an increase in income tax receivable of $18.9 million, as a result of the solar income tax credits earned during the current quarter.

- Non-public investments decreased to $5.7 million from $16.1 million, a $10.4 million, or 64.8%, decrease from the prior quarter as a result of the amortization of solar income tax credit investments under PAM due to the adoption of ASU 2023-02, as described previously.

- Deposits totaled $4.04 billion representing an increase of $124.9 million, or 3.2%, from the prior quarter. The increase in deposits was the result of growth in customer deposits, primarily certificates of deposit, which increased $78.6 million, or 4.9%, from the prior quarter, along with money market accounts, which increased $68.6 million, or 7.1%. Additionally, brokered deposits increased $29.9 million, or 10.0%, from the prior quarter. The above increases were partially offset by decreases in the balances of non-interest-bearing deposits of $28.4 million, or 4.8%, and NOW accounts of $23.0 million, or 6.5%.

- FHLB borrowings increased to $116.3 million from $60.8 million, a $55.5 million, or 91.2%, increase during the current quarter as a result of the need to fund the BOLI transaction described previously.

- Shareholders’ equity was $747.4 million, representing an increase of $13.1 million, or 1.8%, from the prior quarter, primarily as a result of $8.4 million of net income and a $4.0 million decrease in accumulated other comprehensive loss due to interest rate changes during the current quarter.

NET INTEREST INCOME

Net interest income was $41.3 million for the quarter ended September 30, 2024, compared to $38.7 million for the prior quarter, representing an increase of $2.6 million, or 6.7%.

- The increase in interest income during the quarter ended September 30, 2024 was primarily attributable to increases in the average balance of loans, which contributed $3.4 million, and increases in the average rate on loans, which contributed $1.9 million. These increases were partially offset by decreases in the average balance and average rate on short-term investments, which decreased interest income by $204 thousand and $164 thousand, respectively, during the quarter ended September 30, 2024.

- The increase in interest expense for the quarter ended September 30, 2024 was primarily driven by increases in the average balance of certificates of deposit, which increased interest expense by $1.3 million, increases in the average balance of money market accounts, which increased interest expense by $408 thousand and increases in the average rate on money market accounts, which increased interest expense by $151 thousand.

NONINTEREST INCOME

Noninterest income was $1.3 million for the quarter ended September 30, 2024, compared to $3.0 million for the prior quarter, representing a decrease of $1.7 million, or 57.6%.

- Net loss on sale of available-for-sale securities increased $1.9 million, or 100.0%, during the quarter as a result of the loss trades executed to restructure the securities portfolio for higher yields and lower risk.

- Swap contract income was $375 thousand, compared to $265 thousand in the prior quarter, representing an increase of $110 thousand, or 41.5%, due to increased swap contract originations.

- Customer service fee income was $2.0 million, compared to $1.9 million in the prior quarter, representing an increase of $91 thousand, or 4.9%, as a result of a higher volume of fees earned during the current quarter.

NONINTEREST EXPENSE

Noninterest expense for the quarter ended September 30, 2024 was $24.6 million, representing a decrease of $1.6 million, or 6.2%, from the prior quarter.

- General and administrative expenses decreased $1.6 million, or 93.2%, for the quarter ended September 30, 2024, primarily as a result of the adoption of ASU 2023-02 under the PAM method which reclassified the amortization of solar tax credit investments from general and administration expenses to income tax expense.

- Salaries and employee benefits were $17.2 million for the quarter ended September 30, 2024, representing an increase of $456 thousand, or 2.7%, from the prior quarter, primarily due to increased employee compensation of $308 thousand, increased bonus expense of $194 thousand and additional ESOP compensation expense of $134 thousand; partially offset by reductions in 401(k) matching expenses of $100 thousand and employee benefits expenses of $68 thousand.

- Director and professional service fees decreased $275 thousand during the quarter ended September 30, 2024, primarily as a result of decreased appraisal fees of $142 thousand and decreased professional services expenses of $97 thousand.

- Marketing and charitable contributions decreased $253 thousand during the quarter ended September 30, 2024, primarily as a result of decreased public relations costs of $94 thousand, decreased broadcast media costs of $48 thousand and decreased promotional costs of $45 thousand.

INCOME TAXES

Income tax expense for the quarter ended September 30, 2024 was $7.0 million, representing a $4.6 million increase, or 195.4%, from the prior quarter. The increase was primarily driven by the adoption of PAM under ASU 2023-02. The effective tax rate for the current quarter was 45.5%, compared to 20.0% in the prior quarter. The primary driver of the increase in the effective tax was the income tax expense for the basis reduction on the solar income tax credits, which resulted in $2.5 million of income tax expense, along with the BOLI-related tax and penalty, which amounted to $1.6 million of additional tax expense. Excluding these two items, the effective tax rate would have been 18.8%.

COMMERCIAL REAL ESTATE PORTFOLIO

Commercial real estate loans increased $60.8 million, or 4.1%, to $1.55 billion, during the quarter ended September 30, 2024.

- Cannabis facility commercial real estate loans increased $49.1 million, or 18.3%, during the quarter ended September 30, 2024. The Company’s cannabis facility commercial real estate portfolio is secured entirely by the underlying commercial real estate of the borrower operation. The vast majority of the loan portfolio balances have a loan-to-value ratio of 65% or lower, with appraisal reports taking a blended approach (using both cannabis and non-cannabis use real estate sales comparables, which are generally more conservative). The portfolio has geographic dispersion, with lower dollar exposure loans remaining local and larger dollar exposure loans generally tied to multi-state operators with a more national footprint. All cannabis facility loan relationships were pass-rated and current at the end of the current quarter.

- The Company’s $272.6 million multi-family real estate loan portfolio consists of high-quality, performing loans primarily located in the Greater Boston area, primarily all of which are adjustable-rate loans.

- The Company’s $215.4 million office portfolio consists principally of suburban Class A and B office space used as medical and traditional offices. The portfolio does not consist of high-rise towers located in Boston.

ASSET QUALITY

- The ACL amounted to $37.6 million as of September 30, 2024, or 0.89% of total gross loans, compared to $37.9 million, or 0.92% of total loans at June 30, 2024. The Company recorded provisions for credit losses of $2.6 million during the quarter ended September 30, 2024, compared to $3.7 million for the prior quarter, which included a provision of $5.0 million for loans and a release of $2.4 million for unfunded commitments in the current quarter. The provision of $5.0 million for credit losses on loans was mainly the result of the $4.0 million charge-off of one commercial real estate office participation loan coupled with loan growth during the current quarter. The release of $2.4 million for unfunded commitments was mainly the result of reduced qualitative factors and reduced balances of unfunded construction loan commitments.

- Non-performing loans totaled $16.0 million as of September 30, 2024, a decrease of $4.7 million, or 22.8%, from $20.7 million at the end of the prior quarter. The decrease was primarily due to one commercial real estate office participation loan, which had previously been on non-accrual at June 30, 2024, being charged off during the quarter ended September 30, 2024, along with one construction loan amounting to $2.2 million that paid off during the quarter.

- During the quarter ended September 30, 2024, the Company recorded total net charge-offs of $5.2 million, or 0.50% of average total loans on an annualized basis, compared to $878 thousand, or 0.09% of average total loans on an annualized basis, in the prior quarter. The increase in net charge-offs during the quarter ended September 30, 2024 was due to a $4.0 million charge-off of one commercial real estate office participation loan and $1.3 million of purchased consumer loan charge-offs.

- The Company’s loan portfolio consists primarily of commercial real estate and multi-family loans, one-to-four-family residential real estate loans, construction and land development loans, commercial and industrial loans and consumer loans. These loans are primarily made to individuals and businesses located in our primary lending market area, which is the Greater Boston metropolitan area and surrounding communities in Massachusetts, eastern Connecticut, southern New Hampshire and Rhode Island.

ABOUT NB BANCORP, INC.

NB Bancorp, Inc. (Nasdaq Capital Market: NBBK) is the registered bank holding company of Needham Bank. Needham Bank is headquartered in Needham, Massachusetts, which is approximately 17 miles southwest of Boston’s financial district. Known as the “Builder’s Bank,” Needham Bank has been helping individuals, businesses and non-profits build for their futures since 1892.

Needham Bank offers an array of tech-forward products and services that businesses and consumers use to manage their financial needs. We have the financial expertise typically found at much larger institutions and the local knowledge and commitment you can only find at a community bank. For more information, please visit https://NeedhamBank.com. Needham Bank is a member of FDIC and DIF.

Non-GAAP Financial Measures

In addition to results presented in accordance with accounting principles generally accepted in the United States of America (“GAAP”), this press release contains certain non-GAAP financial measures, including operating net income, operating noninterest expense, operating noninterest income, operating earnings per share, basic, operating earnings per share, diluted, operating return on average assets, operating return on average shareholders’ equity, operating efficiency ratio, tangible shareholders’ equity, tangible assets, tangible book value per share, and efficiency ratio. The Company’s management believes that the supplemental non-GAAP information is utilized by regulators and market analysts to evaluate a Company’s financial condition and therefore, such information is useful to investors. These disclosures should not be viewed as a substitute for financial results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. Because non-GAAP financial measures are not standardized, it may not be possible to compare these financial measures with other companies’ non-GAAP financial measures having the same or similar names.

Forward-Looking Statements

Statements in this press release that are not historical facts are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and are intended to be covered by the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. We may also make forward-looking statements in other documents we file with the Securities and Exchange Commission (the “SEC”), in our annual reports to our stockholders, in press releases and other written materials, and in oral statements made by our officers, directors or employees. You can identify forward-looking statements by the use of the words “believe,” “expect,” “anticipate,” “intend,” “estimate,” “assume,” “outlook,” “will,” “should,” and other expressions that predict or indicate future events and trends and which do not relate to historical matters.

Although the Company believes that these forward-looking statements are based on reasonable estimates and assumptions, they are not guarantees of future performance and are subject to known and unknown risks, uncertainties, and other factors. You should not place undue reliance on our forward-looking statements. You should exercise caution in interpreting and relying on forward-looking statements because they are subject to significant risks, uncertainties and other factors which are, in some cases, beyond the Company’s control. The Company’s actual results could differ materially from those projected in the forward-looking statements as a result of, among other factors, changes in general business and economic conditions on a national basis and in the local markets in which the Company operates, including changes which adversely affect borrowers’ ability to service and repay loans; changes in customer behavior due to political, business and economic conditions, including inflation and concerns about liquidity; turbulence in the capital and debt markets; reductions in net interest income resulting from interest rate volatility as well as changes in the balances and mix of loans and deposits; changes in interest rates and real estate values; changes in loan collectability and increases in defaults and charge-off rates; decreases in the value of securities and other assets, adequacy of credit loss reserves, or deposit levels necessitating increased borrowing to fund loans and investments; changing government regulation; competitive pressures from other financial institutions; changes in legislation or regulation and accounting principles, policies and guidelines; cybersecurity incidents, fraud, natural disasters, and future pandemics; the risk that the Company may not be successful in the implementation of its business strategy; the risk that intangibles recorded in the Company’s financial statements will become impaired; changes in assumptions used in making such forward-looking statements;

and the other risks and uncertainties detailed in the Company’s Form 10-K and updated by our Quarterly Report on Form 10-Q and other filings submitted to the SEC. These statements speak only as of the date of this release and the Company does not undertake any obligation to update or revise any of these forward-looking statements to reflect events or circumstances occurring after the date of this communication or to reflect the occurrence of unanticipated events.

|

NB BANCORP, INC. |

||||||||

|

SELECTED FINANCIAL HIGHLIGHTS |

||||||||

|

(Unaudited) |

||||||||

|

(Dollars in thousands, except per share data) |

||||||||

|

As of and for the three months ended |

||||||||

|

September 30, 2024 |

June 30, 2024 |

September 30, 2023 |

||||||

|

Earnings data |

||||||||

|

Net interest income |

$ |

41,324 |

$ |

38,722 |

$ |

33,484 |

||

|

Noninterest income |

1,265 |

2,981 |

3,138 |

|||||

|

Total revenue |

42,589 |

41,703 |

36,622 |

|||||

|

Provision for credit losses |

2,623 |

3,667 |

1,965 |

|||||

|

Noninterest expense |

24,586 |

26,214 |

23,088 |

|||||

|

Pre-tax income |

15,380 |

11,822 |

11,569 |

|||||

|

Net income |

8,383 |

9,453 |

8,467 |

|||||

|

Operating net income (non-GAAP) |

13,116 |

9,858 |

8,467 |

|||||

|

Operating noninterest expense (non-GAAP) |

25,499 |

25,708 |

23,088 |

|||||

|

Per share data |

||||||||

|

Earnings per share, basic |

$ |

0.21 |

$ |

0.24 |

N/A |

|||

|

Earnings per share, diluted |

0.21 |

0.24 |

N/A |

|||||

|

Operating earnings per share, basic (non-GAAP) |

0.33 |

0.25 |

N/A |

|||||

|

Operating earnings per share, diluted (non-GAAP) |

0.33 |

0.25 |

N/A |

|||||

|

Book value per share |

17.50 |

17.19 |

N/A |

|||||

|

Tangible book value per share (non-GAAP) |

17.48 |

17.17 |

N/A |

|||||

|

Profitability |

||||||||

|

Return on average assets |

0.68 % |

0.81 % |

0.81 % |

|||||

|

Operating return on average assets (non-GAAP) |

1.07 % |

0.84 % |

0.81 % |

|||||

|

Return on average shareholders’ equity |

4.42 % |

5.13 % |

9.24 % |

|||||

|

Operating return on average shareholders’ equity (non-GAAP) |

6.91 % |

5.35 % |

9.24 % |

|||||

|

Net interest margin |

3.51 % |

3.46 % |

3.36 % |

|||||

|

Cost of deposits |

3.37 % |

3.33 % |

2.49 % |

|||||

|

Efficiency ratio |

57.73 % |

62.86 % |

63.04 % |

|||||

|

Operating efficiency ratio (non-GAAP) |

57.36 % |

61.65 % |

63.04 % |

|||||

|

Balance sheet, end of period |

||||||||

|

Total assets |

$ |

5,002,557 |

$ |

4,799,777 |

$ |

4,231,792 |

||

|

Total loans |

4,249,074 |

4,097,278 |

3,715,151 |

|||||

|

Total deposits |

4,042,817 |

3,917,905 |

3,436,659 |

|||||

|

Total shareholders’ equity |

747,449 |

734,312 |

365,701 |

|||||

|

Asset quality |

||||||||

|

Allowance for credit losses (ACL) |

$ |

37,605 |

$ |

37,857 |

$ |

31,889 |

||

|

ACL / Total non-performing loans (NPLs) |

234.9 % |

182.6 % |

246.3 % |

|||||

|

Total NPLs / Total loans |

0.38 % |

0.51 % |

0.35 % |

|||||

|

Net charge-offs (annualized) / Average total loans |

(0.50) % |

(0.09) % |

(0.17) % |

|||||

|

Capital ratios |

||||||||

|

Shareholders’ equity / Total assets |

14.94 % |

15.30 % |

8.64 % |

|||||

|

Tangible shareholders’ equity / tangible assets (non-GAAP) |

14.92 % |

15.28 % |

8.61 % |

|||||

|

NB BANCORP, INC. |

||||||||||||||||

|

CONSOLIDATED BALANCE SHEETS |

||||||||||||||||

|

(Unaudited) |

||||||||||||||||

|

(Dollars in thousands, except share and per share data) |

||||||||||||||||

|

As of |

September 30, 2024 change from |

|||||||||||||||

|

September 30, 2024 |

June 30, 2024 |

September 30, 2023 |

June 30, 2024 |

September 30, 2023 |

||||||||||||

|

Assets |

||||||||||||||||

|

Cash and due from banks |

$ |

148,187 |

$ |

170,255 |

$ |

102,452 |

$ |

(22,068) |

(13.0) % |

$ |

45,735 |

44.6 % |

||||

|

Federal funds sold |

168,862 |

158,687 |

31,382 |

10,175 |

6.4 % |

137,480 |

438.1 % |

|||||||||

|

Total cash and cash equivalents |

317,049 |

328,942 |

133,834 |

(11,893) |

(3.6) % |

183,215 |

136.9 % |

|||||||||

|

Available-for-sale securities, at fair value |

202,541 |

205,065 |

196,943 |

(2,524) |

(1.2) % |

5,598 |

2.8 % |

|||||||||

|

Loans receivable, net of deferred fees |

4,249,074 |

4,097,278 |

3,715,151 |

151,796 |

3.7 % |

533,923 |

14.4 % |

|||||||||

|

Allowance for credit losses |

(37,605) |

(37,857) |

(31,889) |

252 |

(0.7) % |

(5,716) |

17.9 % |

|||||||||

|

Net loans |

4,211,469 |

4,059,421 |

3,683,262 |

152,048 |

3.7 % |

528,207 |

14.3 % |

|||||||||

|

Accrued interest receivable |

18,671 |

19,007 |

15,846 |

(336) |

(1.8) % |

2,825 |

17.8 % |

|||||||||

|

Banking premises and equipment, net |

34,802 |

35,290 |

35,964 |

(488) |

(1.4) % |

(1,162) |

(3.2) % |

|||||||||

|

Federal Home Loan Bank (“FHLB”) stock, at cost |

6,848 |

4,767 |

17,622 |

2,081 |

43.7 % |

(10,774) |

(61.1) % |

|||||||||

|

Federal Reserve Bank stock, at cost |

11,769 |

11,333 |

9,797 |

436 |

3.8 % |

1,972 |

20.1 % |

|||||||||

|

Non-public investments |

5,654 |

16,053 |

10,502 |

(10,399) |

(64.8) % |

(4,848) |

(46.2) % |

|||||||||

|

Bank-owned life insurance (“BOLI”) |

101,736 |

51,321 |

50,123 |

50,415 |

98.2 % |

51,613 |

103.0 % |

|||||||||

|

Prepaid expenses and other assets |

74,550 |

49,706 |

65,751 |

24,844 |

50.0 % |

8,799 |

13.4 % |

|||||||||

|

Deferred income tax asset |

17,468 |

18,872 |

12,148 |

(1,404) |

(7.4) % |

5,320 |

43.8 % |

|||||||||

|

Total assets |

$ |

5,002,557 |

$ |

4,799,777 |

$ |

4,231,792 |

$ |

202,780 |

4.2 % |

$ |

770,765 |

18.2 % |

||||

|

Liabilities and shareholders’ equity |

||||||||||||||||

|

Deposits |

$ |

4,042,817 |

$ |

3,917,905 |

$ |

3,436,659 |

$ |

124,912 |

3.2 % |

$ |

606,158 |

17.6 % |

||||

|

Mortgagors’ escrow accounts |

4,401 |

4,022 |

3,953 |

379 |

9.4 % |

448 |

11.3 % |

|||||||||

|

FHLB borrowings |

116,335 |

60,835 |

345,634 |

55,500 |

91.2 % |

(229,299) |

(66.3) % |

|||||||||

|

Accrued expenses and other liabilities |

69,524 |

62,624 |

65,368 |

6,900 |

11.0 % |

4,156 |

6.4 % |

|||||||||

|

Accrued retirement liabilities |

22,031 |

20,079 |

14,477 |

1,952 |

9.7 % |

7,554 |

52.2 % |

|||||||||

|

Total liabilities |

4,255,108 |

4,065,465 |

3,866,091 |

189,643 |

4.7 % |

389,017 |

10.1 % |

|||||||||

|

Shareholders’ equity: |

||||||||||||||||

|

Preferred stock, $0.01 par value, 5,000,000 shares authorized; no shares |

||||||||||||||||

|

issued and outstanding |

– |

– |

– |

– |

0.0 % |

– |

0.0 % |

|||||||||

|

Common stock, $0.01 par value, 120,000,000 shares authorized; 42,705,729 |

||||||||||||||||

|

issued and outstanding at September 30 and June 30, 2024, respectively, no shares issued |

||||||||||||||||

|

and outstanding at September 30, 2023 |

427 |

427 |

– |

– |

0.0 % |

427 |

0.0 % |

|||||||||

|

Additional paid-in capital |

417,013 |

416,845 |

– |

168 |

0.0 % |

417,013 |

0.0 % |

|||||||||

|

Unallocated common shares held by the Employee Stock Ownership Plan (“ESOP”) |

(45,407) |

(46,002) |

– |

595 |

(1.3) % |

(45,407) |

0.0 % |

|||||||||

|

Retained earnings |

382,561 |

374,177 |

379,792 |

8,384 |

2.2 % |

2,769 |

0.7 % |

|||||||||

|

Accumulated other comprehensive loss |

(7,145) |

(11,135) |

(14,091) |

3,990 |

(35.8) % |

6,946 |

(49.3) % |

|||||||||

|

Total shareholders’ equity |

747,449 |

734,312 |

365,701 |

13,137 |

1.8 % |

381,748 |

104.4 % |

|||||||||

|

Total liabilities and shareholders’ equity |

$ |

5,002,557 |

4,799,777 |

$ |

4,231,792 |

$ |

202,780 |

4.2 % |

$ |

770,765 |

18.2 % |

|||||

|

NB BANCORP, INC. |

||||||||||||||||

|

CONSOLIDATED STATEMENTS OF INCOME |

||||||||||||||||

|

(Unaudited) |

||||||||||||||||

|

(Dollars in thousands, except share and per share data) |

||||||||||||||||

|

For the Three Months Ended |

Three Months Ended September 30, 2024 |

|||||||||||||||

|

September 30, 2024 |

June 30, 2024 |

September 30, 2023 |

June 30, 2024 |

September 30, 2023 |

||||||||||||

|

INTEREST AND DIVIDEND INCOME |

||||||||||||||||

|

Interest and fees on loans |

$ |

70,518 |

$ |

65,271 |

$ |

56,702 |

$ |

5,247 |

8.0 % |

$ |

13,816 |

24.4 % |

||||

|

Interest on investment securities |

1,768 |

1,690 |

1,105 |

78 |

4.6 % |

663 |

60.0 % |

|||||||||

|

Interest and dividends on cash equivalents and other |

3,717 |

4,161 |

1,791 |

(444) |

(10.7) % |

1,926 |

107.5 % |

|||||||||

|

Total interest and dividend income |

76,003 |

71,122 |

59,598 |

4,881 |

6.9 % |

16,405 |

27.5 % |

|||||||||

|

INTEREST EXPENSE |

||||||||||||||||

|

Interest on deposits |

33,612 |

31,579 |

20,789 |

2,033 |

6.4 % |

12,823 |

61.7 % |

|||||||||

|

Interest on borrowings |

1,067 |

821 |

5,325 |

246 |

30.0 % |

(4,258) |

(80.0) % |

|||||||||

|

Total interest expense |

34,679 |

32,400 |

26,114 |

2,279 |

7.0 % |

8,565 |

32.8 % |

|||||||||

|

NET INTEREST INCOME |

41,324 |

38,722 |

33,484 |

2,602 |

6.7 % |

7,840 |

23.4 % |

|||||||||

|

PROVISION FOR CREDIT LOSSES |

||||||||||||||||

|

Provision for credit losses – loans |

4,997 |

4,429 |

1,965 |

568 |

12.8 % |

3,032 |

154.3 % |

|||||||||

|

(Release of) provision for credit losses – unfunded commitments |

(2,374) |

(762) |

– |

(1,612) |

211.5 % |

(2,374) |

0.0 % |

|||||||||

|

Total provision for credit losses |

2,623 |

3,667 |

1,965 |

(1,044) |

(28.5) % |

658 |

33.5 % |

|||||||||

|

NET INTEREST INCOME AFTER PROVISION FOR CREDIT LOSSES |

38,701 |

35,055 |

31,519 |

3,646 |

10.4 % |

7,182 |

22.8 % |

|||||||||

|

NONINTEREST INCOME |

||||||||||||||||

|

Customer service fees |

1,963 |

1,872 |

1,689 |

91 |

4.9 % |

274 |

16.2 % |

|||||||||

|

Increase in cash surrender value of BOLI |

414 |

404 |

374 |

10 |

2.5 % |

40 |

10.7 % |

|||||||||

|

Mortgage banking income |

367 |

428 |

101 |

(61) |

(14.3) % |

266 |

263.4 % |

|||||||||

|

Swap contract income |

375 |

265 |

950 |

110 |

41.5 % |

(575) |

(60.5) % |

|||||||||

|

Loss on sale of available-for-sale securities, net |

(1,868) |

– |

– |

(1,868) |

100.0 % |

(1,868) |

0.0 % |

|||||||||

|

Other income |

14 |

12 |

24 |

2 |

16.7 % |

(10) |

(41.7) % |

|||||||||

|

Total noninterest income |

1,265 |

2,981 |

3,138 |

(1,716) |

(57.6) % |

(1,873) |

(59.7) % |

|||||||||

|

NONINTEREST EXPENSE |

||||||||||||||||

|

Salaries and employee benefits |

17,202 |

16,746 |

14,659 |

456 |

2.7 % |

2,543 |

17.3 % |

|||||||||

|

Director and professional service fees |

1,995 |

2,270 |

1,609 |

(275) |

(12.1) % |

386 |

24.0 % |

|||||||||

|

Occupancy and equipment expenses |

1,394 |

1,461 |

1,279 |

(67) |

(4.6) % |

115 |

9.0 % |

|||||||||

|

Data processing expenses |

2,226 |

2,325 |

2,017 |

(99) |

(4.3) % |

209 |

10.4 % |

|||||||||

|

Marketing and charitable contribution expenses |

842 |

1,095 |

918 |

(253) |

(23.1) % |

(76) |

(8.3) % |

|||||||||

|

FDIC and state insurance assessments |

812 |

633 |

1,215 |

179 |

28.3 % |

(403) |

(33.2) % |

|||||||||

|

General and administrative expenses |

115 |

1,684 |

1,391 |

(1,569) |

(93.2) % |

(1,276) |

(91.7) % |

|||||||||

|

Total noninterest expense |

24,586 |

26,214 |

23,088 |

(1,628) |

(6.2) % |

1,498 |

6.5 % |

|||||||||

|

INCOME BEFORE TAXES |

15,380 |

11,822 |

11,569 |

3,558 |

30.1 % |

3,811 |

32.9 % |

|||||||||

|

INCOME TAXES |

6,997 |

2,369 |

3,102 |

4,628 |

195.4 % |

3,895 |

125.6 % |

|||||||||

|

NET INCOME |

$ |

8,383 |

$ |

9,453 |

$ |

8,467 |

$ |

(1,070) |

(11.3) % |

$ |

(84) |

(1.0) % |

||||

|

Weighted average common shares outstanding, basic |

39,289,271 |

39,289,271 |

N/A |

– |

0.0 % |

N/A |

N/A |

|||||||||

|

Weighted average common shares outstanding, diluted |

39,289,271 |

39,289,271 |

N/A |

– |

0.0 % |

N/A |

N/A |

|||||||||

|

Earnings per share, basic |

$ |

0.21 |

$ |

0.24 |

$ |

N/A |

$ |

(0.03) |

(11.3) % |

$ |

N/A |

N/A |

||||

|

Earnings per share, diluted |

$ |

0.21 |

$ |

0.24 |

$ |

N/A |

$ |

(0.03) |

(11.3) % |

$ |

N/A |

N/A |

||||

|

NB BANCORP, INC. AVERAGE BALANCES, INTEREST EARNED/PAID & AVERAGE YIELDS (Unaudited) (Dollars in thousands) |

|||||||||||||||||||||||||

|

For the Three Months Ended |

|||||||||||||||||||||||||

|

September 30, 2024 |

June 30, 2024 |

September 30, 2023 |

|||||||||||||||||||||||

|

Average |

Average |

Average |

|||||||||||||||||||||||

|

Outstanding |

Average |

Outstanding |

Average |

Outstanding |

Average |

||||||||||||||||||||

|

Balance |

Interest |

Yield/Rate (4) |

Balance |

Interest |

Yield/Rate (4) |

Balance |

Interest |

Yield/Rate (4) |

|||||||||||||||||

|

Interest-earning assets: |

|||||||||||||||||||||||||

|

Loans |

$ |

4,188,504 |

$ |

70,518 |

6.70 |

% |

$ |

3,987,452 |

$ |

65,271 |

6.58 |

% |

$ |

3,623,804 |

$ |

56,702 |

6.21 |

% |

|||||||

|

Securities |

204,273 |

1,768 |

3.44 |

% |

204,336 |

1,690 |

3.33 |

% |

204,074 |

1,105 |

2.15 |

% |

|||||||||||||

|

Other investments (5) |

30,707 |

223 |

2.89 |

% |

28,474 |

299 |

4.22 |

% |

39,696 |

780 |

7.80 |

% |

|||||||||||||

|

Short-term investments (5) |

264,394 |

3,494 |

5.26 |

% |

279,559 |

3,862 |

5.56 |

% |

81,380 |

1,011 |

4.93 |

% |

|||||||||||||

|

Total interest-earning assets |

4,687,878 |

76,003 |

6.45 |

% |

4,499,821 |

71,122 |

6.36 |

% |

3,948,954 |

59,598 |

5.99 |

% |

|||||||||||||

|

Non-interest-earning assets |

240,821 |

238,370 |

216,254 |

||||||||||||||||||||||

|

Allowance for credit losses |

(38,495) |

(34,735) |

(32,062) |

||||||||||||||||||||||

|

Total assets |

$ |

4,890,204 |

$ |

4,703,456 |

$ |

4,133,146 |

|||||||||||||||||||

|

Interest-bearing liabilities: |

|||||||||||||||||||||||||

|

Savings accounts |

$ |

112,632 |

15 |

0.05 |

% |

$ |

117,701 |

15 |

0.05 |

% |

$ |

136,241 |

17 |

0.05 |

% |

||||||||||

|

NOW accounts |

327,484 |

180 |

0.22 |

% |

328,192 |

204 |

0.25 |

% |

337,799 |

158 |

0.19 |

% |

|||||||||||||

|

Money market accounts |

876,933 |

8,943 |

4.06 |

% |

836,757 |

8,384 |

4.03 |

% |

806,815 |

5,623 |

2.77 |

% |

|||||||||||||

|

Certificates of deposit and individual |

1,941,143 |

24,474 |

5.02 |

% |

1,834,480 |

22,976 |

5.04 |

% |

1,445,885 |

14,991 |

4.11 |

% |

|||||||||||||

|

Total interest-bearing deposits |

3,258,192 |

33,612 |

4.10 |

% |

3,117,130 |

31,579 |

4.07 |

% |

2,726,740 |

20,789 |

3.02 |

% |

|||||||||||||

|

FHLB advances |

85,156 |

1,067 |

4.98 |

% |

61,968 |

821 |

5.33 |

% |

383,549 |

5,325 |

5.51 |

% |

|||||||||||||

|

Total interest-bearing liabilities |

3,343,348 |

34,679 |

4.13 |

% |

3,179,098 |

32,400 |

4.10 |

% |

3,110,289 |

26,114 |

3.33 |

% |

|||||||||||||

|

Non-interest-bearing deposits |

713,566 |

694,669 |

582,507 |

||||||||||||||||||||||

|

Other non-interest-bearing liabilities |

78,681 |

88,364 |

76,881 |

||||||||||||||||||||||

|

Total liabilities |

4,135,595 |

3,962,131 |

3,769,677 |

||||||||||||||||||||||

|

Shareholders’ equity |

754,609 |

741,325 |

363,469 |

||||||||||||||||||||||

|

Total liabilities and shareholders’ |

$ |

4,890,204 |

$ |

4,703,456 |

$ |

4,133,146 |

|||||||||||||||||||

|

Net interest income |

$ |

41,324 |

$ |

38,722 |

$ |

33,484 |

|||||||||||||||||||

|

Net interest rate spread (1) |

2.32 |

% |

2.26 |

% |

2.66 |

% |

|||||||||||||||||||

|

Net interest-earning assets (2) |

$ |

1,344,530 |

$ |

1,320,723 |

$ |

838,665 |

|||||||||||||||||||

|

Net interest margin (3) |

3.51 |

% |

3.46 |

% |

3.36 |

% |

|||||||||||||||||||

|

Average interest-earning assets to |

140.22 |

% |

141.54 |

% |

126.96 |

% |

|||||||||||||||||||

|

(1) Net interest rate spread represents the difference between the weighted average yield on interest-earning assets and the weighted average rate of interest-bearing liabilities. |

|

(2) Net interest-earning assets represent total interest-earning assets less total interest-bearing liabilities. |

|

(3) Net interest margin represents net interest income divided by average total interest-earning assets. |

|

(4) Annualized |

|

(5) Other investments are comprised of FRB stock, FHLB stock and swap collateral accounts. Short-term investments are comprised of cash and cash equivalents. |

|

NB BANCORP, INC. COMMERCIAL REAL ESTATE BY COLLATERAL TYPE (Unaudited) (Dollars in thousands) |

|||||||||||

|

September 30, 2024 |

|||||||||||

|

Owner-Occupied |

Non-Owner- |

Balance |

Percentage |

||||||||

|

Cannabis Facility |

$ |

301,931 |

$ |

15,334 |

$ |

317,265 |

20 % |

||||

|

Multi-Family |

— |

272,561 |

272,561 |

18 % |

|||||||

|

Office |

30,455 |

184,895 |

215,350 |

14 % |

|||||||

|

Industrial |

109,341 |

53,608 |

162,949 |

10 % |

|||||||

|

Hospitality |

55 |

157,027 |

157,082 |

10 % |

|||||||

|

Special Purpose |

80,575 |

54,010 |

134,585 |

9 % |

|||||||

|

Retail |

30,232 |

93,432 |

123,664 |

8 % |

|||||||

|

Other |

39,990 |

57,268 |

97,258 |

6 % |

|||||||

|

Mixed-Use |

8,509 |

63,292 |

71,801 |

5 % |

|||||||

|

Total commercial real estate |

$ |

601,088 |

$ |

951,427 |

$ |

1,552,515 |

100 % |

||||

|

June 30, 2024 |

Change From Three Months Ended September 30, 2024 |

||||||||||||||||||||||

|

Owner- |

Non- |

Balance |

Percentage |

Owner- |

Non- |

Balance |

Percentage |

||||||||||||||||

|

Cannabis Facility |

$ |

252,741 |

$ |

15,408 |

$ |

268,149 |

18 % |

$ |

49,190 |

$ |

(74) |

$ |

49,116 |

18 % |

|||||||||

|

Multi-Family |

— |

267,544 |

267,544 |

18 % |

— |

5,017 |

5,017 |

2 % |

|||||||||||||||

|

Office |

32,793 |

189,157 |

221,950 |

15 % |

(2,338) |

(4,262) |

(6,600) |

(3) % |

|||||||||||||||

|

Industrial |

106,755 |

52,142 |

158,897 |

11 % |

2,586 |

1,466 |

4,052 |

3 % |

|||||||||||||||

|

Hospitality |

61 |

148,955 |

149,016 |

10 % |

(6) |

8,072 |

8,066 |

5 % |

|||||||||||||||

|

Special Purpose |

80,001 |

54,229 |

134,230 |

9 % |

574 |

(219) |

355 |

0 % |

|||||||||||||||

|

Retail |

29,675 |

102,562 |

132,237 |

9 % |

557 |

(9,130) |

(8,573) |

(6) % |

|||||||||||||||

|

Other |

32,701 |

54,840 |

87,541 |

6 % |

7,289 |

2,428 |

9,717 |

11 % |

|||||||||||||||

|

Mixed-Use |

8,563 |

63,628 |

72,191 |

5 % |

(54) |

(336) |

(390) |

(1) % |

|||||||||||||||

|

Total commercial real estate |

$ |

543,290 |

$ |

948,465 |

$ |

1,491,755 |

100 % |

$ |

57,798 |

$ |

2,962 |

$ |

60,760 |

4 % |

|||||||||

|

September 30, 2023 |

Change From Three Months Ended September 30, 2024 |

||||||||||||||||||||||

|

Owner- |

Non- |

Balance |

Percentage |

Owner- |

Non- |

Balance |

Percentage |

||||||||||||||||

|

Cannabis Facility |

$ |

143,818 |

$ |

16,327 |

$ |

160,145 |

12 % |

$ |

158,113 |

$ |

(993) |

$ |

157,120 |

98 % |

|||||||||

|

Multi-Family |

— |

208,879 |

208,879 |

16 % |

— |

63,682 |

63,682 |

30 % |

|||||||||||||||

|

Office |

28,060 |

173,920 |

201,980 |

16 % |

2,395 |

10,975 |

13,370 |

7 % |

|||||||||||||||

|

Industrial |

103,749 |

54,332 |

158,081 |

12 % |

5,592 |

(724) |

4,868 |

3 % |

|||||||||||||||

|

Hospitality |

37 |

147,521 |

147,558 |

11 % |

18 |

9,506 |

9,524 |

6 % |

|||||||||||||||

|

Special Purpose |

84,951 |

56,734 |

141,685 |

11 % |

(4,376) |

(2,724) |

(7,100) |

(5) % |

|||||||||||||||

|

Retail |

26,595 |

103,751 |

130,346 |

10 % |

3,637 |

(10,319) |

(6,682) |

(5) % |

|||||||||||||||

|

Other |

24,268 |

40,889 |

65,157 |

5 % |

15,722 |

16,379 |

32,101 |

49 % |

|||||||||||||||

|

Mixed-Use |

8,842 |

62,765 |

71,607 |

6 % |

(333) |

527 |

194 |

0 % |

|||||||||||||||

|

Total commercial real estate |

$ |

420,320 |

$ |

865,118 |

$ |

1,285,438 |

100 % |

$ |

20,260 |

$ |

12,645 |

$ |

32,905 |

3 % |

|||||||||

|

NB BANCORP, INC. |

||||||||

|

NON-GAAP RECONCILIATION |

||||||||

|

(Unaudited) |

||||||||

|

(Dollars in thousands) |

||||||||

|

For the Three Months Ended |

||||||||

|

September 30, 2024 |

June 30, 2024 |

September 30, 2023 |

||||||

|

Net income (GAAP) |

$ |

8,383 |

$ |

9,453 |

$ |

8,467 |

||

|

Add (Subtract): |

||||||||

|

Adjustments to net income: |

||||||||

|

Losses on sales of securities available for sale, net |

1,868 |

– |

– |

|||||

|

Income tax expense on solar tax credit investment basis reduction |

2,503 |

– |

– |

|||||

|

BOLI surrender tax and modified endowment contract penalty |

1,552 |

– |

– |

|||||

|

Adjustment for adoption of ASU 2023-02 |

(913) |

506 |

– |

|||||

|

Total adjustments to net income |

$ |

5,010 |

$ |

506 |

$ |

– |

||

|

Less net tax benefit (cost) associated with losses on sales of securities available for sale, net and reversal of previously |

||||||||

|

taken amortization of solar tax credit investments |

277 |

101 |

– |

|||||

|

Non-GAAP adjustments, net of tax |

4,733 |

405 |

– |

|||||

|

Operating net income (non-GAAP) |

$ |

13,116 |

$ |

9,858 |

$ |

8,467 |

||

|

Weighted average common shares outstanding, basic |

39,289,271 |

39,289,271 |

N/A |

|||||

|

Weighted average common shares outstanding, diluted |

39,289,271 |

39,289,271 |

N/A |

|||||

|

Operating earnings per share, basic (non-GAAP) |

0.33 |

0.25 |

N/A |

|||||

|

Operating earnings per share, diluted (non-GAAP) |

0.33 |

0.25 |

N/A |

|||||

|

Noninterest expense (GAAP) |

$ |

24,586 |

$ |

26,214 |

$ |

23,088 |

||

|

Subtract (Add): |

||||||||

|

Noninterest expense components: |

||||||||

|

Adjustment for adoption of ASU 2023-02 |

(913) |

506 |

– |

|||||

|

Total impact of non-GAAP noninterest expense adjustments |

$ |

(913) |

$ |

506 |

$ |

– |

||

|

Noninterest expense on an operating basis (non-GAAP) |

$ |

25,499 |

$ |

25,708 |

$ |

23,088 |

||

|

Noninterest income (GAAP) |

$ |

1,265 |

$ |

2,981 |

$ |

3,138 |

||

|

Subtract (Add): |

||||||||

|

Noninterest expense components: |

||||||||

|

Losses on sales of securities available for sale, net |

(1,868) |

– |

– |

|||||

|

Total impact of non-GAAP noninterest income adjustments |

$ |

(1,868) |

$ |

– |

$ |

– |

||

|

Noninterest income on an operating basis (non-GAAP) |

$ |

3,133 |

$ |

2,981 |

$ |

3,138 |

||

|

Operating net income (non-GAAP) |

$ |

13,116 |

$ |

9,858 |

$ |

8,467 |

||

|

Average assets |

4,890,204 |

4,703,456 |

4,133,146 |

|||||

|

Operating return on average assets (non-GAAP) |

1.07 % |

0.84 % |

0.81 % |

|||||

|

Average shareholders’ equity |

754,609 |

741,325 |

363,469 |

|||||

|

Operating return on average shareholders’ equity (non-GAAP) |

6.91 % |

5.35 % |

9.24 % |

|||||

|

Noninterest expense on an operating basis (non-GAAP) |

$ |

25,499 |

$ |

25,708 |

$ |

23,088 |

||

|

Total revenue (net interest income plus total noninterest income on an operating basis) (non-GAAP) |

44,457 |

41,703 |

36,622 |

|||||

|

Operating efficiency ratio (non-GAAP) |

57.36 % |

61.65 % |

63.04 % |

|||||

|

As of |

||||||||

|

September 30, 2024 |

June 30, 2024 |

September 30, 2023 |

||||||

|

Total shareholders’ equity (GAAP) |

$ |

747,449 |

$ |

734,312 |

$ |

365,701 |

||

|

Subtract: |

||||||||

|

Intangible assets (core deposit intangible) |

1,116 |

1,153 |

1,265 |

|||||

|

Total tangible shareholders’ equity (non-GAAP) |

746,333 |

733,159 |

364,436 |

|||||

|

Total assets (GAAP) |

5,002,557 |

4,799,777 |

4,231,792 |

|||||

|

Subtract: |

||||||||

|

Intangible assets (core deposit intangible) |

1,116 |

1,153 |

1,265 |

|||||

|

Total tangible assets (non-GAAP) |

$ |

5,001,441 |

$ |

4,798,624 |

$ |

4,230,527 |

||

|

Tangible shareholders’ equity / tangible assets (non-GAAP) |

14.92 % |

15.28 % |

8.61 % |

|||||

|

Total common shares outstanding |

42,705,729 |

42,705,729 |

N/A |

|||||

|

Tangible book value per share (non-GAAP) |

$ |

17.48 |

$ |

17.17 |

$ |

N/A |

||

|

NB BANCORP, INC. ASSET QUALITY – NON-PERFORMING ASSETS (1) (Unaudited) (Dollars in thousands) |

|||||||||

|

September 30, 2024 |

June 30, 2024 |

September 30, 2023 |

|||||||

|

Real estate loans: |

|||||||||

|

One to four-family residential |

$ |

5,070 |

$ |

4,251 |

$ |

3,903 |

|||

|

Home equity |

1,060 |

636 |

592 |

||||||

|

Commercial real estate |

3,030 |

7,056 |

430 |

||||||

|

Construction and land development |

10 |

2,237 |

2,414 |

||||||

|

Commercial and industrial |

4,743 |

4,575 |

4,615 |

||||||

|

Consumer |

2,099 |

1,974 |

993 |

||||||

|

Total |

$ |

16,012 |

$ |

20,729 |

$ |

12,947 |

|||

|

Total non-performing loans to total loans |

0.38 % |

0.51 % |

0.35 % |

||||||

|

Total non-performing assets to total assets |

0.32 % |

0.43 % |

0.31 % |

||||||

|

(1) Non-performing loans and assets are comprised of non-accrual loans |

|

NB BANCORP, INC. ASSET QUALITY – PROVISION, ALLOWANCE, AND NET (CHARGE-OFFS) RECOVERIES (Unaudited) (Dollars in thousands) |

||||||||

|

For the Three Months Ended |

||||||||

|

September 30, 2024 |

June 30, 2024 |

September 30, 2023 |

||||||

|

Allowance for credit losses at beginning of the period |

$ |

37,857 |

$ |

34,306 |

$ |

31,473 |

||

|

Provision for credit losses |

4,997 |

4,429 |

1,965 |

|||||

|

Charge-offs: |

||||||||

|

One-to-Four-Family Residential |

— |

— |

379 |

|||||

|

Commercial and industrial |

— |

22 |

679 |

|||||

|

Consumer |

1,305 |

924 |

699 |

|||||

|

Commercial real estate |

4,000 |

— |

— |

|||||

|

Total charge-offs |

5,305 |

946 |

1,757 |

|||||

|

Recoveries of loans previously charged off: |

||||||||

|

Commercial and industrial |

12 |

14 |

12 |

|||||

|

Consumer |

44 |

54 |

196 |

|||||

|

Total recoveries |

56 |

68 |

208 |

|||||

|

Net (charge-offs) recoveries |

(5,249) |

(878) |

(1,549) |

|||||

|

Allowance for credit losses at end of the period |

$ |

37,605 |

$ |

37,857 |

$ |

31,889 |

||

|

Allowance to non-performing loans |

234.9 % |

182.6 % |

246.3 % |

|||||

|

Allowance to total loans outstanding at the end of the period |

0.89 % |

0.92 % |

0.86 % |

|||||

|

Net (charge-offs) recoveries (annualized) to average loans |

(0.50) % |

(0.09) % |

(0.17) % |

|||||

![]() View original content:https://www.prnewswire.com/news-releases/nb-bancorp-inc-reports-third-quarter-2024-financial-results-302292147.html

View original content:https://www.prnewswire.com/news-releases/nb-bancorp-inc-reports-third-quarter-2024-financial-results-302292147.html

SOURCE Needham Bank

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cannabis Stock Gainers And Losers From October 30, 2024

GAINERS:

LOSERS:

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Click on the image for more info.

Cannabis rescheduling seems to be right around the corner

Want to understand what this means for the future of the industry?

Hear directly for top executives, investors and policymakers at the Benzinga Cannabis Capital Conference, coming to Chicago this Oct. 8-9.

Get your tickets now before prices surge by following this link.

MGM Resorts Shares Slide After Worse-Than-Expected Q3 Results: Details

MGM Resorts International MGM reported its third-quarter results after Wednesday’s closing bell. Here’s a look at the details from the quarter.

The Details: MGM Resorts reported quarterly earnings of 54 cents per share, which missed the analyst consensus estimate of 61 cents. Quarterly revenue came in at $4.2 billion, which missed the analyst consensus estimate of $4.21 billion.

- Las Vegas Strip Resorts recorded net revenues of $2.1 billion in the quarter, an increase of 1% compared to the prior year quarter due primarily to an increase in non-gaming revenue, partially offset by a decrease in casino revenue.

- Regional Operations recorded net revenues of $952 million in the current quarter, compared to $925 million in the prior year quarter, an increase of 3%, due primarily to an increase in casino revenue.

- MGM China recorded net revenues of $929 million in the current quarter compared to $813 million in the prior year quarter, an increase of 14%. The current quarter was positively affected by the recovery of operations after the removal of COVID-19-related travel and entry restrictions in the first quarter of 2023.

Read Next: Reddit ‘Remains A Favorite’ For Wall Street After ‘Emphatic Beat And Raise’ In Q3

“We are pleased to report record consolidated net revenues for the third quarter, driven by record results from MGM China. In Las Vegas, we drove sequential improvement throughout the quarter and many key metrics are demonstrating strength including growth in ADR and occupancy,” said Bill Hornbuckle, CEO of MGM Resorts International.

“MGM Resorts is well positioned for long-term growth driven by the positive inflection to come in our digital investments alongside the enviable integrated resorts pipeline of development that we have in Japan as well as opportunities in New York and beyond,” Hornbuckle added.

MGM Price Action: According to Benzinga Pro, MGM Resorts shares are down 5.82% after-hours at $39 at the time of publication Wednesday.

Read Also:

Image: Pixabay

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

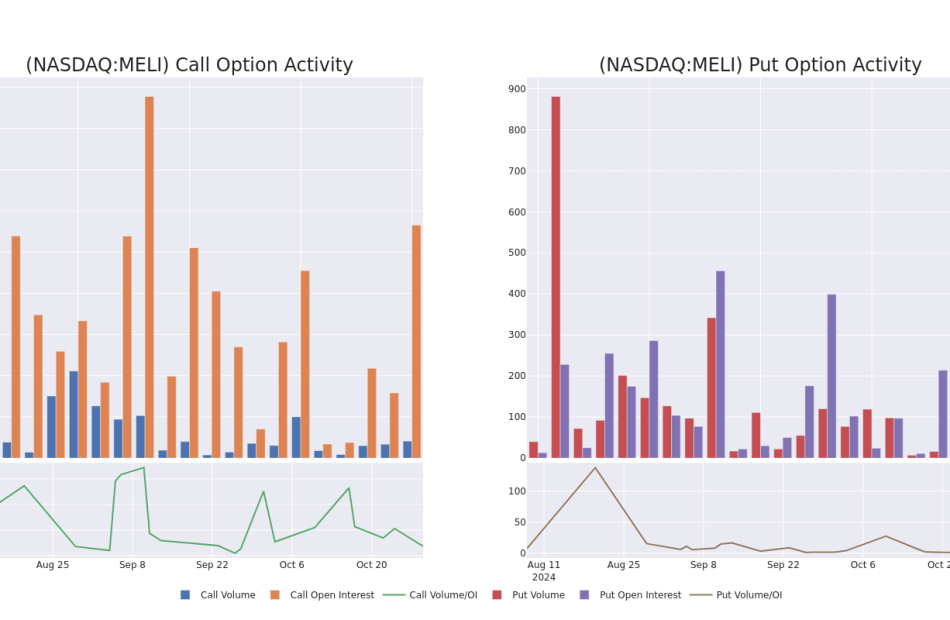

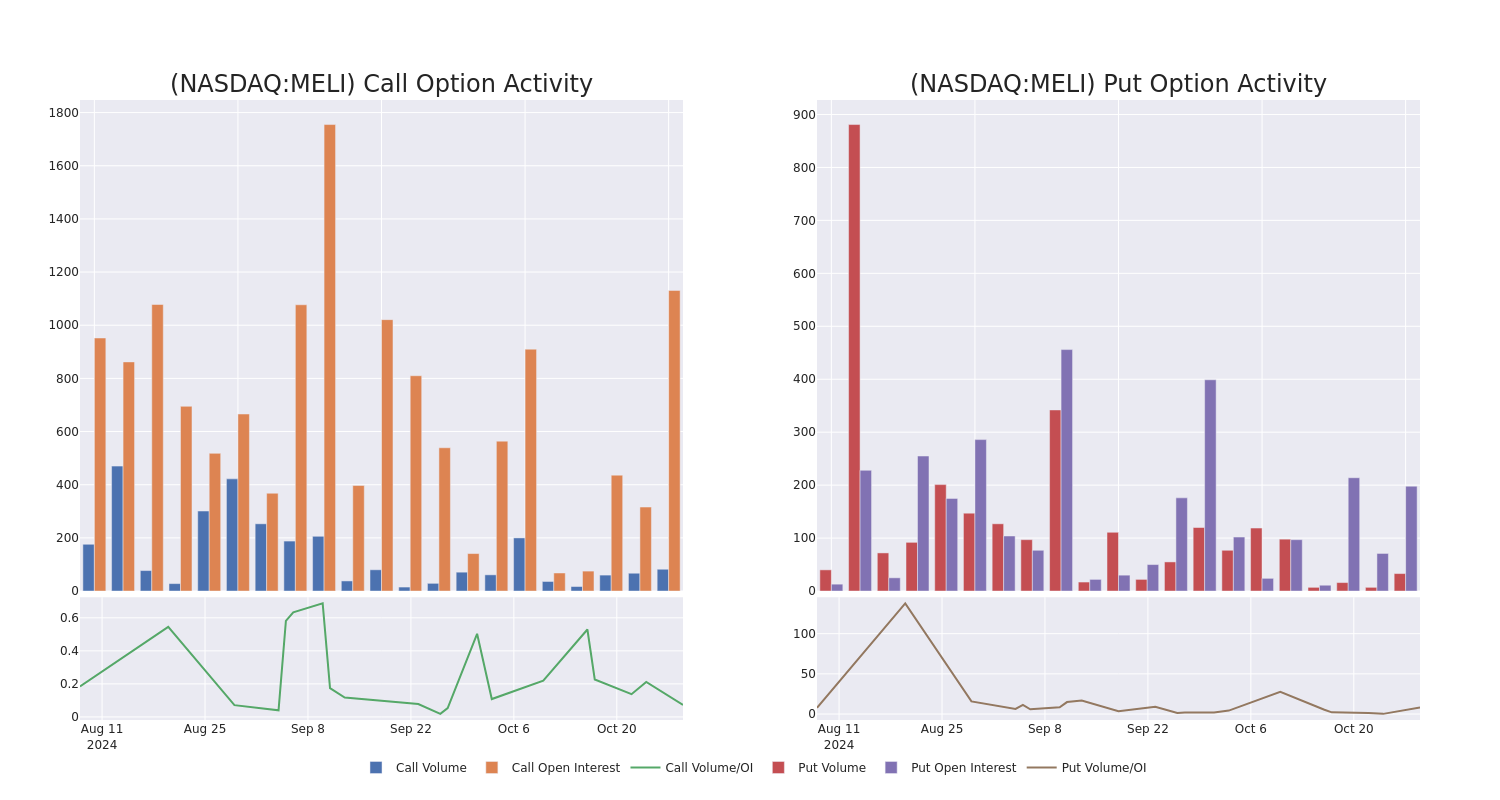

MercadoLibre Options Trading: A Deep Dive into Market Sentiment

Investors with a lot of money to spend have taken a bullish stance on MercadoLibre MELI.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with MELI, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 23 uncommon options trades for MercadoLibre.

This isn’t normal.

The overall sentiment of these big-money traders is split between 52% bullish and 30%, bearish.

Out of all of the special options we uncovered, 9 are puts, for a total amount of $520,721, and 14 are calls, for a total amount of $1,489,483.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $1120.0 to $2600.0 for MercadoLibre during the past quarter.

Insights into Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in MercadoLibre’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to MercadoLibre’s substantial trades, within a strike price spectrum from $1120.0 to $2600.0 over the preceding 30 days.

MercadoLibre Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MELI | CALL | TRADE | BEARISH | 01/17/25 | $91.0 | $83.1 | $85.0 | $2120.00 | $850.0K | 106 | 0 |

| MELI | PUT | SWEEP | BEARISH | 11/15/24 | $244.0 | $237.9 | $244.0 | $2200.00 | $122.0K | 32 | 5 |

| MELI | CALL | TRADE | NEUTRAL | 03/21/25 | $138.8 | $120.1 | $130.0 | $2200.00 | $91.0K | 71 | 7 |

| MELI | CALL | TRADE | BULLISH | 11/15/24 | $882.0 | $867.0 | $876.0 | $1120.00 | $87.6K | 1 | 1 |

| MELI | PUT | TRADE | BULLISH | 01/17/25 | $142.8 | $138.1 | $138.1 | $2000.00 | $69.0K | 52 | 5 |

About MercadoLibre

MercadoLibre runs the largest e-commerce marketplace in Latin America, with more than 218 million active users and 1 million active sellers across 18 countries stitching into its commerce network or fintech solutions as of the end of 2023. The company operates a host of complementary businesses to its core online shop, with shipping solutions (Mercado Envios), a payment and financing operation (Mercado Pago and Mercado Credito), advertisements (Mercado Clics), classifieds, and a turnkey e-commerce solution (Mercado Shops) rounding out its arsenal. MercadoLibre generates revenue from final value fees, advertising royalties, payment processing, insertion fees, subscription fees, and interest income from consumer and small-business lending.

Having examined the options trading patterns of MercadoLibre, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

MercadoLibre’s Current Market Status

- With a volume of 363,387, the price of MELI is down -0.29% at $2020.72.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 13 days.

Expert Opinions on MercadoLibre

Over the past month, 4 industry analysts have shared their insights on this stock, proposing an average target price of $2545.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Redburn Atlantic downgraded its action to Buy with a price target of $2800.

* Maintaining their stance, an analyst from Barclays continues to hold a Overweight rating for MercadoLibre, targeting a price of $2500.

* Maintaining their stance, an analyst from Citigroup continues to hold a Buy rating for MercadoLibre, targeting a price of $2480.

* Reflecting concerns, an analyst from JP Morgan lowers its rating to Neutral with a new price target of $2400.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for MercadoLibre with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Timbercreek Financial Announces 2024 Third Quarter Results

TORONTO, Oct. 30, 2024 (GLOBE NEWSWIRE) — Timbercreek Financial TF (the “Company”) announced today its financial results for the three and nine months ended September 30, 2024 (“Q3 2024”).

Q3 2024 Highlights1

- The net mortgage investment portfolio increased by $14.1 million to $1,017.6 million at the end of Q3 2024 from $1,003.4 million at the end of Q2 2024 (Q3 2023 – $1,068.6 million).

- Net investment income of $25.4 million compared to $30.3 million in Q3 2023.

- Net income and comprehensive income of $14.1 million (Q3 2023 – $16.5 million) or basic earnings per share of $0.17 (Q3 2023 – $0.20).

- Distributable income of $15.0 million (Q3 2023 – $16.8 million) or distributable income per share of $0.18 (Q3 2023 – $0.20 per share).

- Declared a total of $14.3 million in dividends to shareholders, or $0.17 per share, reflecting a distributable income payout ratio of 95.3% (Q2 2023 – 85.6%).

- The quarterly weighted average interest rate on net mortgage investments was 9.3% in Q3 2024, compared to 9.8% in Q2 2024 (Q3 2023 – 9.9%). Interest rate exposure in the net mortgage investment portfolio was well protected at the end of Q3 2024, with floating rate loans with rate floors representing 77.9% (Q3 2023 – 87.5%) of the net mortgage investment portfolio.

- Maintained conservative portfolio risk composition focused on income-producing commercial real estate:

- 63.8% weighted average loan-to-value (“LTV”); and

- 87.1% first mortgages in mortgage investment portfolio.

- The Company’s management team continues to focus on growing the portfolio and redeploying capital into loans at today’s values in our core asset types, generating attractive returns relative to the portfolio today.

“The portfolio increased modestly in the quarter and we delivered solid financial results generating stable cash flows and dividends, even during a period of reduced transaction volume due to volatility in the commercial real estate markets,” said Blair Tamblyn, CEO of Timbercreek Financial. “The commercial real estate environment is stabilizing and showing signs of steady improvement and we remain optimistic that additional rate cuts will strengthen market conditions and drive increased financing opportunities for Timbercreek. We are well positioned to deploy capital in this environment and expand the portfolio back to – or above – historical levels. At the same time, our team is effectively managing the remaining exposure to staged loans. The improved environment will add a tailwind as we work to resolve these situations and redeploy this capital into productive loans in our core asset types, such as multi-residential and industrial, where we see positive long-term market drivers.”

Mr. Tamblyn added: “In a decreasing rate environment, our monthly dividend provides shareholders with an increasing spread versus instruments such as high interest savings accounts and GICs.”

Quarterly Comparison

| $ millions | Q3 2024 | Q3 2023 | Q2 2024 | |||||||||

| Net Mortgage Investments1 | $ | 1,017.6 | $ | 1,068.6 | $ | 1,003.4 | ||||||

| Enhanced Return Portfolio Investments1 | $ | 50.7 | $ | 59.3 | $ | 62.0 | ||||||

| Real Estate Inventory | $ | 34.4 | $ | 30.5 | $ | 30.6 | ||||||

| Real Estate held for sale, net of collateral liability | $ | 62.2 | $ | 62.0 | $ | 62.2 | ||||||

| Net Investment Income | $ | 25.4 | $ | 30.3 | $ | 26.4 | ||||||

| Income from Operations | $ | 22.5 | $ | 26.1 | $ | 23.5 | ||||||

| Net Income and comprehensive Income | $ | 14.1 | $ | 16.5 | $ | 15.4 | ||||||

| –Adjusted Net Income and comprehensive Income | $ | 14.2 | $ | 16.4 | $ | 15.7 | ||||||

| Distributable income1 | $ | 15.0 | $ | 16.8 | $ | 16.3 | ||||||

| Dividends declared to Shareholders2 | $ | 14.3 | $ | 14.4 | $ | 14.3 | ||||||

| $ per share | Q3 2024 | Q3 2023 | Q2 2024 | |||||||||

| Dividends per share | $ | 0.17 | $ | 0.17 | $ | 0.17 | ||||||

| Distributable income per share1 | $ | 0.18 | $ | 0.20 | $ | 0.20 | ||||||

| Earnings per share | $ | 0.17 | $ | 0.20 | $ | 0.19 | ||||||

| –Adjusted Earnings per share | $ | 0.17 | $ | 0.20 | $ | 0.19 | ||||||

| Payout Ratio on Distributable Income1 | 95.3 | % | 85.6 | % | 87.8 | % | ||||||

| Payout Ratio on Earnings per share | 101.9 | % | 87.4 | % | 93.2 | % | ||||||

| –Payout Ratio on Adjusted Earnings per share | 101.1 | % | 87.7 | % | 91.1 | % | ||||||

| Net Mortgage Investments | Q3 2024 | Q3 2023 | Q2 2024 | |||||||||

| Weighted Average Loan-to-Value | 63.8 | % | 67.0 | % | 62.3 | % | ||||||

| Weighted Average Remaining Term to Maturity | 0.9 yr | 0.7 yr | 1.0 yr | |||||||||

| First Mortgages | 87.1 | % | 92.2 | % | 85.6 | % | ||||||

| Cash-Flowing Properties | 83.2 | % | 86.5 | % | 83.4 | % | ||||||

| Multi-family residential | 59.8 | % | 58.2 | % | 51.2 | % | ||||||

| Floating Rate Loans with rate floors (at quarter end) | 77.9 | % | 87.5 | % | 78.3 | % | ||||||

| Weighted Average Interest Rate | ||||||||||||

| For the quarter ended | 9.3 | % | 9.9 | % | 9.8 | % | ||||||

| Weighted Average Lender Fee | ||||||||||||

| New and Renewed | 0.7 | % | 0.7 | % | 0.9 | % | ||||||

| New Net Mortgage Investment Only | 1.1 | % | 1.0 | % | 1.0 | % | ||||||

- Refer to non-IFRS measures section below for net mortgages, enhanced return portfolio investments, adjusted net income and comprehensive income, distributable income and adjusted distributable income.

- Dividends declared exclude 2023 year-end special dividends paid in March 2024.

Quarterly Conference Call

Interested parties are invited to participate in a conference call with management on Thursday, October 31, 2024 at 1:00 p.m. (ET) which will be followed by a question and answer period with analysts.

To join the Zoom Webinar:

If you are a Guest, please click the link below to join:

https://us02web.zoom.us/j/86473939910?pwd=Y0kzK1MwZFAwUGIxd2JQOE1xZEdqZz09

Webinar ID: 864 7393 9910

Passcode: 1234

Or Telephone:

Dial (for higher quality, dial a number based on your current location):

Canada: +1 780 666 0144, +1 204 272 7920, +1 438 809 7799, +1 587 328 1099, +1 647 374 4685, +1 647 558 0588, +1 778 907 2071

International numbers available: https://us02web.zoom.us/u/kbE03DvhIf

Speakers will receive a separate link to the Webinar.

The playback of the conference call will also be available on www.timbercreekfinancial.com following the call.

About the Company

Timbercreek Financial is a leading non-bank, commercial real estate lender providing shorter-duration, structured financing solutions to commercial real estate professionals. Our sophisticated, service-oriented approach allows us to meet the needs of borrowers, including faster execution and more flexible terms that are not typically provided by Canadian financial institutions. By employing thorough underwriting, active management and strong governance, we are able to meet these needs while generating strong risk-adjusted yields for investors. Further information is available on our website, www.timbercreekfinancial.com.

Non-IFRS Measures

The Company prepares and releases financial statements in accordance with IFRS. As a complement to results provided in accordance with IFRS, the Company discloses certain financial measures not recognized under IFRS and that do not have standard meanings prescribed by IFRS (collectively the “non-IFRS measures”). These non-IFRS measures are further described in Management’s Discussion and Analysis (“MD&A”) available on SEDAR+. Certain non-IFRS measures relating to net mortgages, adjusted net income and comprehensive income and adjusted distributable income have been shown below. The Company has presented such non-IFRS measures because the Manager believes they are relevant measures of the Company’s ability to earn and distribute cash dividends to shareholders and to evaluate its performance. The following non-IFRS financial measures should not be construed as alternatives to total net income and comprehensive income or cash flows from operating activities as determined in accordance with IFRS as indicators of the Company’s performance.