VP At Valmont Industries Exercises Options Worth $825K

R. Andrew Massey, VP at Valmont Industries VMI, reported a large exercise of company stock options on October 29, according to a new SEC filing.

What Happened: Massey, VP at Valmont Industries, made a strategic move by exercising stock options for 3,977 shares of VMI as detailed in a Form 4 filing on Tuesday with the U.S. Securities and Exchange Commission. The transaction value amounted to $825,863.

The Wednesday morning market activity shows Valmont Industries shares down by 0.0%, trading at $319.74. This implies a total value of $825,863 for Massey’s 3,977 shares.

Get to Know Valmont Industries Better

Valmont Industries Inc is an investment holding company. It operates through two segments namely Infrastructure and Agriculture. The company generates maximum revenue from the Infrastructure segment. The infrastructure segment consists of the manufacture and distribution of products and solutions to serve the infrastructure markets of utility, renewable energy, lighting, transportation, and telecommunications, and coatings services to preserve metal products. Geographically, it derives a majority of its revenue from North America.

Key Indicators: Valmont Industries’s Financial Health

Revenue Challenges: Valmont Industries’s revenue growth over 3 months faced difficulties. As of 30 September, 2024, the company experienced a decline of approximately -1.88%. This indicates a decrease in top-line earnings. When compared to others in the Industrials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Interpreting Earnings Metrics:

-

Gross Margin: The company excels with a remarkable gross margin of 29.57%, indicating superior cost efficiency and profitability compared to its industry peers.

-

Earnings per Share (EPS): The company excels with an EPS that surpasses the industry average. With a current EPS of 4.13, Valmont Industries showcases strong earnings per share.

Debt Management: Valmont Industries’s debt-to-equity ratio is below the industry average at 0.68, reflecting a lower dependency on debt financing and a more conservative financial approach.

Understanding Financial Valuation:

-

Price to Earnings (P/E) Ratio: The Price to Earnings ratio of 21.72 is lower than the industry average, indicating potential undervaluation for the stock.

-

Price to Sales (P/S) Ratio: A higher-than-average P/S ratio of 1.61 suggests overvaluation in the eyes of investors, considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): At 12.9, Valmont Industries’s EV/EBITDA ratio reflects a below-par valuation compared to industry averages signalling undervaluation

Market Capitalization Analysis: The company’s market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Insider Transactions Are Key in Investment Decisions

Insider transactions shouldn’t be used primarily to make an investing decision, however an insider transaction can be an important factor in the investing decision.

From a legal standpoint, the term “insider” pertains to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as outlined in Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and significant hedge funds. These insiders are mandated to inform the public of their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

A company insider’s new purchase is a indicator of their positive anticipation for a rise in the stock.

While insider sells may not necessarily reflect a bearish view and can be motivated by various factors.

Unlocking the Meaning of Transaction Codes

Delving into transactions, investors typically prioritize those unfolding in the open market, as precisely outlined in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Valmont Industries’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

ReposiTrak Insider Trades Send A Signal

A substantial insider sell was reported on October 30, by Randall K Fields, Chief Executive Officer at ReposiTrak TRAK, based on the recent SEC filing.

What Happened: Fields’s decision to sell 7,500 shares of ReposiTrak was revealed in a Form 4 filing with the U.S. Securities and Exchange Commission on Wednesday. The total value of the sale is $143,870.

ReposiTrak‘s shares are actively trading at $19.18, experiencing a down of 0.0% during Wednesday’s morning session.

Delving into ReposiTrak’s Background

ReposiTrak Inc is a software as a service provider with extensive capabilities that gives their customers an easy, cost-efficient way to expand their services to their benefit. The company and its subsidiaries develop, market, and support proprietary software products. These products assist the management of business operations, which helps clients to make more informed decisions. The company also provides a cloud-based solution to remain in compliance with business records and regulatory requirements. The firm’s services comprise implementation, business optimization, outsourcing, technical services, education, and application hosting.

ReposiTrak: Financial Performance Dissected

Revenue Growth: ReposiTrak’s revenue growth over a period of 3 months has been noteworthy. As of 30 June, 2024, the company achieved a revenue growth rate of approximately 7.88%. This indicates a substantial increase in the company’s top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Information Technology sector.

Navigating Financial Profits:

-

Gross Margin: Achieving a high gross margin of 83.7%, the company performs well in terms of cost management and profitability within its sector.

-

Earnings per Share (EPS): ReposiTrak’s EPS is below the industry average, signaling challenges in bottom-line performance with a current EPS of 0.08.

Debt Management: ReposiTrak’s debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.01.

Navigating Market Valuation:

-

Price to Earnings (P/E) Ratio: With a higher-than-average P/E ratio of 66.14, ReposiTrak’s stock is perceived as being overvalued in the market.

-

Price to Sales (P/S) Ratio: With a higher-than-average P/S ratio of 17.75, ReposiTrak’s stock is perceived as being overvalued in the market, particularly in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With an impressive EV/EBITDA ratio of 42.74, ReposiTrak demonstrates exemplary market valuation, surpassing industry averages.

Market Capitalization Analysis: Falling below industry benchmarks, the company’s market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Insider Transactions Are Important

Insider transactions shouldn’t be used primarily to make an investing decision, however, they can be an important factor for an investor to consider.

In the realm of legality, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities under Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are required to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

Notably, when a company insider makes a new purchase, it is considered an indicator of their positive expectations for the stock.

Conversely, insider sells may not necessarily signal a bearish stance on the stock and can be motivated by various factors.

Breaking Down the Significance of Transaction Codes

When it comes to transactions, investors tend to focus on those in the open market, detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S indicates a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of ReposiTrak’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

What's Going On With Cosmetics Company Estée Lauder Stock Today?

Estée Lauder Companies EL shares are trading lower on Wednesday, ahead of the company’s fiscal 2025 first-quarter results scheduled for release on October 31, 2024.

According to Benzinga Pro, EL stock has lost over 31% in the past year.

In a significant leadership change, Estée Lauder announced the appointment of Stéphane de La Faverie as its new President and Chief Executive Officer, effective January 1, 2025. He will also join the Board of Directors, succeeding Fabrizio Freda, who has decided to retire after more than sixteen years with the company.

Also Read: Netflix Restructures Leadership, Bids Farewell to Two Key Executives

Freda has played a crucial role in steering the company through substantial growth and transformation during his tenure.

De La Faverie currently serves as Executive Group President, where he oversees a diverse portfolio of brands, including industry giants like Estée Lauder, as well as developing brands such as Jo Malone London, The Ordinary, and Le Labo. Before joining Estée Lauder in 2011, he was General Manager of Giorgio Armani Beauty USA, a division of L’Oréal Paris.

To ensure a smooth transition, Freda will work closely with de La Faverie over the coming months, fostering continuity and maintaining the company’s strategic direction as it embarks on this new chapter in leadership.

Meanwhile, William P. Lauder will resign as Executive Chairman but will continue to serve as Chair of the Board.

Investors can gain exposure to the stock via VanEck ETF Trust VanEck Morningstar Wide Moat Growth ETF MGRO and KraneShares Trust KraneShares Global Luxury Index ETF KLXY.

Price Action: EL shares are trading lower by 0.98% to $87.88 at last check Wednesday.

Photo via Wikimedia Commons

Also Read:

This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

AgentCoach.AI Launches to Revolutionize Real Estate Coaching and Productivity with AI-Powered Coaching Bots and Tools

Real Estate Professionals Gain Access to On-Demand Expertise and Tools for a Fraction of Traditional Coaching Costs

AUSTIN, Texas, Oct. 30, 2024 /PRNewswire/ — AgentCoach.AI is thrilled to announce the launch of its cutting-edge, AI-powered coaching platform, exclusively for real estate agents. Designed to streamline daily tasks, enhance client communications, and boost sales, AgentCoach.AI provides access to advanced coaching bots and productivity tools – without the high price tag of traditional coaching programs.

The platform offers a range of specialized AI bots, including Real Estate, Sales, Marketing, Negotiation, and Motivation specialists, redefining support for agents. This suite of tools allows agents to be more productive, informed, and prepared. “Imagine being in a tough negotiation, struggling to keep a deal together – calling a coach is unlikely unless you’re paying hundreds monthly. But with AgentCoach.AI, agents can paste their negotiation details into the platform and receive the perfect response – whether it’s a script, email, or letter.”

AI-Powered Bots at Your Service

AgentCoach.AI’s coaching bots are designed to tackle the real estate industry’s most common challenges:

- Real Estate Specialist: Offers expert guidance on property insights, buyer engagement, and client management, including Competitive Market Analyses and First-Time Home Buyer’s Guides.

- Sales Specialist: Provides lead conversion strategies, client follow-up, and closing techniques. Working with an engineer? We can adapt language to resonate perfectly.

- Marketing Specialist: Instantly creates engaging ad copy, social media posts, and email campaigns to boost visibility and attract clients. From blog posts to podcast scripts, AgentCoach.AI can even provide the perfect headline.

- Negotiation Specialist: Delivers customized responses and negotiation tactics to keep deals on track, essentially putting top negotiation coaches in your pocket.

- Motivation Specialist: Helps agents maintain peak performance with daily goal-setting, motivational messages, and calming exercises to manage stress and keep balanced.

Beyond coaching, PropertyPitch generates property descriptions that captivate buyers with vivid narratives. Need images for a social media post? With GraphicGenius, simply describe your idea – “a pink elephant sipping lemonade by a mid-century modern pool” – and it’s created instantly.

Game-Changing Tools for Every Real Estate Professional

AgentCoach.AI transforms repetitive, time-consuming tasks, allowing agents to focus on building relationships and closing deals. With on-demand coaching and tools at their fingertips, agents can gain a competitive edge in today’s fast-paced market.

Try AgentCoach.AI for Free

To celebrate its launch, AgentCoach.AI offers a 7-day free trial, letting agents experience the full range of tools and the convenience of expert guidance whenever needed. Real estate agents ready to elevate their business can sign up at AgentCoach.ai.

Contact:

AgentCoach.AI PR Team

Phone: 303-3785526

Email: 385589@email4pr.com

Website: https://www.agentcoach.ai

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/agentcoachai-launches-to-revolutionize-real-estate-coaching-and-productivity-with-ai-powered-coaching-bots-and-tools-302290502.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/agentcoachai-launches-to-revolutionize-real-estate-coaching-and-productivity-with-ai-powered-coaching-bots-and-tools-302290502.html

SOURCE AgentCoach.AI

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

BV HoldCo Top Bitfury Implements A Sell Strategy: Offloads $6.22M In Cipher Mining Stock

Revealing a significant insider sell on October 29, BV HoldCo Top Bitfury, 10% Owner at Cipher Mining CIFR, as per the latest SEC filing.

What Happened: A Form 4 filing from the U.S. Securities and Exchange Commission on Tuesday showed that Bitfury sold 1,000,000 shares of Cipher Mining. The total transaction amounted to $6,220,000.

At Wednesday morning, Cipher Mining shares are down by 0.74%, trading at $5.35.

About Cipher Mining

Cipher Mining Inc ia an emerging technology company that operates in the Bitcoin mining ecosystem in the United States. The company is developing a cryptocurrency mining business, specializing in Bitcoin. The company is expanding and strengthening the Bitcoin network’s critical infrastructure in the United States.

Cipher Mining’s Financial Performance

Revenue Growth: Cipher Mining’s revenue growth over a period of 3 months has been noteworthy. As of 30 June, 2024, the company achieved a revenue growth rate of approximately 17.88%. This indicates a substantial increase in the company’s top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Information Technology sector.

Exploring Profitability:

-

Gross Margin: The company shows a low gross margin of 16.96%, suggesting potential challenges in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): Cipher Mining’s EPS lags behind the industry average, indicating concerns and potential challenges with a current EPS of -0.05.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.03.

Insights into Valuation Metrics:

-

Price to Earnings (P/E) Ratio: The P/E ratio of 109.92 is lower than the industry average, implying a discounted valuation for Cipher Mining’s stock.

-

Price to Sales (P/S) Ratio: With a relatively high Price to Sales ratio of 9.73 as compared to the industry average, the stock might be considered overvalued based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With a below-average EV/EBITDA ratio of 17.27, Cipher Mining presents an opportunity for value investors. This lower valuation may attract investors seeking undervalued opportunities.

Market Capitalization Analysis: Below industry benchmarks, the company’s market capitalization reflects a smaller scale relative to peers. This could be attributed to factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Exploring the Significance of Insider Trading

Insider transactions should be considered alongside other factors when making investment decisions, as they can offer important insights.

When discussing legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated in Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are required to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

A new purchase by a company insider is a indication that they anticipate the stock will rise.

On the other hand, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

A Closer Look at Important Transaction Codes

Digging into the details of stock transactions, investors frequently turn their attention to those taking place in the open market, as outlined in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Cipher Mining’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Insider Transaction: James Peters Sells $626K Worth Of Whirlpool Shares

Disclosed on October 29, James Peters, EVP at Whirlpool WHR, executed a substantial insider sell as per the latest SEC filing.

What Happened: Peters’s decision to sell 6,000 shares of Whirlpool was revealed in a Form 4 filing with the U.S. Securities and Exchange Commission on Tuesday. The total value of the sale is $626,864.

Monitoring the market, Whirlpool‘s shares up by 0.5% at $103.2 during Wednesday’s morning.

About Whirlpool

Whirlpool Corp is a manufacturer and marketer of home appliances and related products. Its reportable segments consist of five operating segments, which consist of Domestic Appliances (MDA) North America; MDA Europe, MDA Latin America; MDA Asia; and Small Domestic Appliances (SDA). Product categories include refrigeration, laundry, cooking, and dishwashing. The company has also a portfolio of small domestic appliances, including the KitchenAid stand mixer. The company’s international brands include Whirlpool, KitchenAid, Maytag, Consul, and Brastemp among others.

Whirlpool’s Economic Impact: An Analysis

Decline in Revenue: Over the 3 months period, Whirlpool faced challenges, resulting in a decline of approximately -18.94% in revenue growth as of 30 September, 2024. This signifies a reduction in the company’s top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Consumer Discretionary sector.

Evaluating Earnings Performance:

-

Gross Margin: With a low gross margin of 16.1%, the company exhibits below-average profitability, signaling potential struggles in cost efficiency compared to its industry peers.

-

Earnings per Share (EPS): Whirlpool’s EPS is significantly higher than the industry average. The company demonstrates a robust bottom-line performance with a current EPS of 2.01.

Debt Management: With a high debt-to-equity ratio of 2.66, Whirlpool faces challenges in effectively managing its debt levels, indicating potential financial strain.

Valuation Overview:

-

Price to Earnings (P/E) Ratio: The P/E ratio of 10.11 is lower than the industry average, implying a discounted valuation for Whirlpool’s stock.

-

Price to Sales (P/S) Ratio: The P/S ratio of 0.32 is lower than the industry average, implying a discounted valuation for Whirlpool’s stock in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With a lower-than-industry-average EV/EBITDA ratio of 11.87, Whirlpool presents a potential value opportunity, as investors are paying less for each unit of EBITDA.

Market Capitalization: Exceeding industry standards, the company’s market capitalization places it above industry average in size relative to peers. This emphasizes its significant scale and robust market position.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Delving Into the Significance of Insider Transactions

While insider transactions should not be the sole basis for making investment decisions, they can play a significant role in an investor’s decision-making process.

Exploring the legal landscape, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated by Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and major hedge funds. These insiders are required to report their transactions through a Form 4 filing, which must be submitted within two business days of the transaction.

Highlighted by a company insider’s new purchase, there’s a positive anticipation for the stock to rise.

But, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

A Deep Dive into Insider Transaction Codes

Delving into transactions, investors typically prioritize those unfolding in the open market, as precisely outlined in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Whirlpool’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

[Latest] Global Commercial Aircraft Seating Market Size/Share Worth USD 14,119.6 Million by 2033 at a 6.8% CAGR: Custom Market Insights (Analysis, Outlook, Leaders, Report, Trends, Forecast, Segmentation, Growth, Growth Rate, Value)

Austin, TX, USA, Oct. 30, 2024 (GLOBE NEWSWIRE) — Custom Market Insights has published a new research report titled “Commercial Aircraft Seating Market Size, Trends and Insights By Aircraft Type (Narrow-body Aircraft, Wide-body Aircraft, Regional Aircraft, Business Jets), By Class (First Class, Business Class, Premium Economy, Economy Class), By Seat Type (Standard Seats, Lie-flat Seats, Suite Seats, Recliner Seats), By Material (Foam, Fabric, Leather, Other Materials), By Components (Seat Frames, Seat Actuators, Seat Covers, Cushions, Seat Belts, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ in its research database.

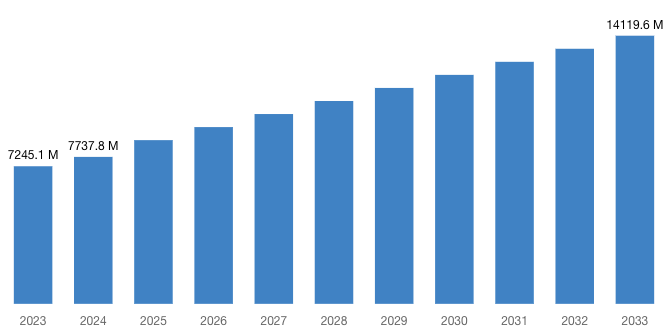

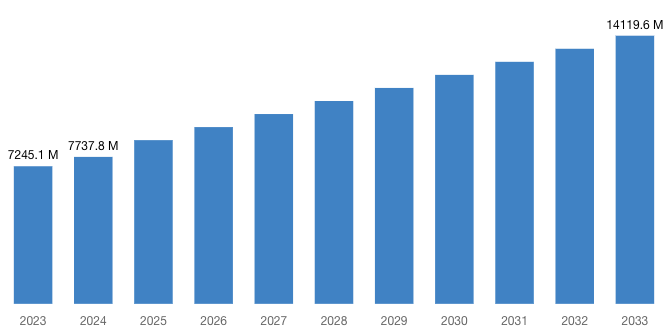

“According to the latest research study, the demand of global Commercial Aircraft Seating Market size & share was valued at approximately USD 7,245.1 Million in 2023 and is expected to reach USD 7,737.8 Million in 2024 and is expected to reach a value of around USD 14,119.6 Million by 2033, at a compound annual growth rate (CAGR) of about 6.8% during the forecast period 2024 to 2033.”

Click Here to Access a Free Sample Report of the Global Commercial Aircraft Seating Market @ https://www.custommarketinsights.com/request-for-free-sample/?reportid=53376

Commercial Aircraft Seating Market: Growth Factors and Dynamics

- Increasing Air Passenger Traffic: The rising number of air travelers globally is a primary driver of demand for new aircraft and, consequently, aircraft seating. This growth is especially pronounced in emerging markets such as Asia-Pacific and the Middle East, where economic growth and expanding middle classes are boosting air travel.

- Technological Advancements: Innovations in seat design and materials are enhancing passenger comfort and reducing weight, contributing to fuel efficiency. Advancements include the use of lightweight composites, ergonomic designs, and integrated in-flight entertainment (IFE) systems, which are becoming standard in modern aircraft seating.

- Airline Fleet Expansion and Replacement: Airlines are expanding their fleets and replacing older aircraft with more fuel-efficient models. This leads to a continuous demand for new seats, as well as retrofitting and refurbishment of existing aircraft to meet current standards of passenger comfort and safety.

- Increasing Focus on Passenger Experience: Airlines are placing greater emphasis on enhancing the passenger experience to gain a competitive advantage. This includes investing in premium seating options, such as lie-flat seats in business class and enhanced economy class seating, to attract high-paying customers and improve customer satisfaction.

- Regulatory and Safety Standards: Compliance with stringent aviation safety regulations and standards necessitates regular updates and upgrades to aircraft seating. This includes requirements for fire retardancy, crashworthiness, and other safety features, driving ongoing investment in seat technology and design.

- Economic and Market Dynamics: Economic factors such as oil prices, airline profitability, and geopolitical events can significantly impact the aircraft seating market. For instance, fluctuations in fuel prices can influence airlines’ investment in new aircraft and seating. Additionally, mergers and acquisitions within the airline industry can lead to fleet consolidation and uniformity in seating products, affecting market dynamics.

- Customization and Branding: Airlines are increasingly seeking customized seating solutions that align with their brand identity and enhance the overall cabin ambiance. This trend includes bespoke designs, unique color schemes, and specialized features that differentiate the airline’s offering, fostering a market for tailored seating solutions.

- Sustainability Initiatives: Growing environmental awareness is driving airlines to adopt more sustainable practices, including the use of eco-friendly materials and designs in aircraft seating. This shift towards sustainability is encouraging innovation in materials and manufacturing processes, such as the use of recyclable components and reducing the carbon footprint of seat production.

Request a Customized Copy of the Commercial Aircraft Seating Market Report @ https://www.custommarketinsights.com/inquire-for-discount/?reportid=53376

Commercial Aircraft Seating Market: Partnership and Acquisitions

- In 2023, Safran clinched a contract with Japan Airlines to provide fully customized Premium Economy, Business Class, and First-Class seats for 13 Airbus A350s. Tailored to meet Japan Airlines’ specific needs, this agreement reaffirms Safran Seats’ dedication to delivering top-tier seating solutions.

- In 2022, STELIA Aerospace and AERQ have partnered to integrate Cabin Digital Signage into OPERA seats for the A320neo family. This collaboration aims to enhance the passenger experience through innovative technology and design solutions for Airbus’s popular aircraft models.

Report Scope

| Feature of the Report | Details |

| Market Size in 2024 | USD 7,737.8 Million |

| Projected Market Size in 2033 | USD 14,119.6 Million |

| Market Size in 2023 | USD 7,245.1 Million |

| CAGR Growth Rate | 6.8% CAGR |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Key Segment | By Aircraft Type, Class, Seat Type, Material, Components and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America |

| Buying Options | Request tailored purchasing options to fulfil your requirements for research. |

(A free sample of the Commercial Aircraft Seating report is available upon request; please contact us for more information.)

Our Free Sample Report Consists of the following:

- Introduction, Overview, and in-depth industry analysis are all included in the 2024 updated report.

- The COVID-19 Pandemic Outbreak Impact Analysis is included in the package.

- About 220+ Pages Research Report (Including Recent Research)

- Provide detailed chapter-by-chapter guidance on the Request.

- Updated Regional Analysis with a Graphical Representation of Size, Share, and Trends for the Year 2024

- Includes Tables and figures have been updated.

- The most recent version of the report includes the Top Market Players, their Business Strategies, Sales Volume, and Revenue Analysis

- Custom Market Insights (CMI) research methodology

(Please note that the sample of the Commercial Aircraft Seating report has been modified to include the COVID-19 impact study prior to delivery.)

Request a Customized Copy of the Commercial Aircraft Seating Market Report @ https://www.custommarketinsights.com/report/commercial-aircraft-seating-market/

Commercial Aircraft Seating Market: COVID-19 Analysis

The COVID-19 pandemic has significantly impacted the Commercial Aircraft Seating Market, with the industry experiencing both positive and negative effects. Here are some of the key impacts:

- Decrease in Demand: The COVID-19 pandemic led to a sharp decline in air travel, resulting in reduced demand for new aircraft and, consequently, aircraft seating. Airlines postponed or cancelled orders, focusing instead on managing operational costs and surviving the downturn.

- Production and Supply Chain Disruptions: The pandemic caused significant disruptions in the production and supply chain of aircraft seating manufacturers. Factory shutdowns, workforce reductions, and logistical challenges affected the timely delivery of components and finished seats, delaying aircraft production and retrofitting projects.

- Resurgence in Air Travel: As global vaccination rates increased and travel restrictions eased, air passenger traffic began to recover. The gradual return to pre-pandemic travel levels has renewed demand for aircraft seating, especially in regions experiencing robust economic recovery.

- Airline Fleet Modernization: Airlines are taking the opportunity to modernize their fleets with more fuel-efficient and technologically advanced aircraft. This includes replacing older, less efficient models with new ones, and driving demand for contemporary seating solutions that offer enhanced comfort and reduced weight.

- Increased Focus on Hygiene and Safety: The pandemic has heightened awareness of hygiene and safety in air travel. Airlines are investing in seats with antimicrobial materials, easy-to-clean surfaces, and other features designed to minimize the spread of infections, appealing to health-conscious travelers.

- Government Support and Stimulus Packages: Many governments have provided financial support and stimulus packages to the aviation industry, helping airlines and manufacturers weather the financial impact of the pandemic. This support has facilitated the resumption of aircraft production and the procurement of new seating.

- Innovation and Technological Advancements: The post-pandemic period has seen a surge in innovation, with manufacturers developing advanced seating solutions that prioritize passenger comfort, space utilization, and health features. Innovations include touchless controls, improved seat ergonomics, and enhanced in-flight entertainment systems, driving market recovery.

- Strategic Partnerships and Collaborations: Aircraft seating manufacturers are forming strategic partnerships and collaborations with airlines, OEMs, and technology providers to accelerate recovery. These alliances enable the sharing of resources, expertise, and technology, fostering resilience and growth in the market.

In conclusion, the COVID-19 pandemic has had a mixed impact on the Commercial Aircraft Seating Market, with some challenges and opportunities arising from the pandemic.

Request a Customized Copy of the Commercial Aircraft Seating Market Report @ https://www.custommarketinsights.com/report/commercial-aircraft-seating-market/

Key questions answered in this report:

- What is the size of the Commercial Aircraft Seating market and what is its expected growth rate?

- What are the primary driving factors that push the Commercial Aircraft Seating market forward?

- What are the Commercial Aircraft Seating Industry’s top companies?

- What are the different categories that the Commercial Aircraft Seating Market caters to?

- What will be the fastest-growing segment or region?

- In the value chain, what role do essential players play?

- What is the procedure for getting a free copy of the Commercial Aircraft Seating market sample report and company profiles?

Key Offerings:

- Market Share, Size & Forecast by Revenue | 2024−2033

- Market Dynamics – Growth Drivers, Restraints, Investment Opportunities, and Leading Trends

- Market Segmentation – A detailed analysis by Types of Services, by End-User Services, and by regions

- Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Buy this Premium Commercial Aircraft Seating Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/commercial-aircraft-seating-market/

Commercial Aircraft Seating Market – Regional Analysis

The Commercial Aircraft Seating Market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

- North America: In North America, a trend in the commercial aircraft seating market involves a focus on premium seating options, such as luxurious lie-flat seats and enhanced entertainment systems, to cater to the region’s high demand for business and leisure travel. Additionally, there’s a growing emphasis on sustainability, with airlines and manufacturers adopting eco-friendly materials and manufacturing processes to align with the region’s environmental regulations and consumer preferences.

- Europe: Europe’s commercial aircraft seating market is witnessing a trend towards modular and customizable seating solutions to accommodate the diverse preferences of both legacy carriers and low-cost airlines. Another notable trend is the integration of connectivity and digital amenities, reflecting the region’s tech-savvy travelers’ demand for seamless in-flight entertainment and Wi-Fi access. Furthermore, there’s a focus on ergonomic designs and space optimization to enhance passenger comfort within the constraints of European airspace regulations.

- Asia-Pacific: In the Asia-Pacific region, a significant trend in the commercial aircraft seating market is the rapid expansion of low-cost carriers (LCCs) and the subsequent demand for cost-effective seating solutions. This includes lightweight and durable materials to reduce fuel costs, as well as innovative seat configurations to maximize cabin capacity. Moreover, there’s increasing adoption of premium seating options by full-service carriers to cater to the region’s growing affluent traveler segment.

- LAMEA (Latin America, Middle East, and Africa): LAMEA’s commercial aircraft seating market is characterized by a focus on luxury and comfort, particularly in the Middle East, where airlines compete to offer lavish first-class and business-class experiences. Another trend in the region is the integration of cultural and regional preferences into seating designs, catering to diverse passenger demographics. Additionally, there’s a growing interest in sustainable seating solutions, driven by environmental concerns and regulatory pressures in certain countries within the region.

Request a Customized Copy of the Commercial Aircraft Seating Market Report @ https://www.custommarketinsights.com/report/commercial-aircraft-seating-market/

(We customized your report to meet your specific research requirements. Inquire with our sales team about customizing your report.)

Still, Looking for More Information? Do OR Want Data for Inclusion in magazines, case studies, research papers, or Media?

Email Directly Here with Detail Information: support@custommarketinsights.com

Browse the full “Commercial Aircraft Seating Market Size, Trends and Insights By Aircraft Type (Narrow-body Aircraft, Wide-body Aircraft, Regional Aircraft, Business Jets), By Class (First Class, Business Class, Premium Economy, Economy Class), By Seat Type (Standard Seats, Lie-flat Seats, Suite Seats, Recliner Seats), By Material (Foam, Fabric, Leather, Other Materials), By Components (Seat Frames, Seat Actuators, Seat Covers, Cushions, Seat Belts, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ Report at https://www.custommarketinsights.com/report/commercial-aircraft-seating-market/

List of the prominent players in the Commercial Aircraft Seating Market:

- Zodiac Aerospace

- Recaro Aircraft Seating GmbH & Co. KG

- B/E Aerospace Inc.

- Aviointeriors S.p.A.

- Geven S.p.A.

- Thompson Aero Seating Ltd.

- STELIA Aerospace (a subsidiary of Airbus)

- Acro Aircraft Seating Ltd.

- HAECO Cabin Solutions (a division of HAECO Group)

- Mirus Aircraft Seating Ltd.

- Expliseat SAS

- ZIM Flugsitz GmbH

- Optimares S.p.A.

- Jamco Corporation

- Airgo Design Pte Ltd.

- Others

Click Here to Access a Free Sample Report of the Global Commercial Aircraft Seating Market @ https://www.custommarketinsights.com/report/commercial-aircraft-seating-market/

Spectacular Deals

- Comprehensive coverage

- Maximum number of market tables and figures

- The subscription-based option is offered.

- Best price guarantee

- Free 35% or 60 hours of customization.

- Free post-sale service assistance.

- 25% discount on your next purchase.

- Service guarantees are available.

- Personalized market brief by author.

Browse More Related Reports:

Used Aircraft Market: Used Aircraft Market Size, Trends and Insights By Aircraft Type (Commercial Aircraft, Business Aircraft, Military Aircraft, General Aviation), By Age of Aircraft (0-10 Years, 11-20 Years, 21+ Years), By End-User (Airlines, Charter Services, Private Owners, Government & Military, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

US Drone Market: US Drone Market Size, Trends and Insights By Type (Fixed-Wing Drone, Rotary Blade Drone, Hybrid Drone), By Payload (<25 Kg, 25 – 500 Kg, >500 Kg), By Propulsion Type (Gasoline, Electric, Hybrid), By Operating Mode (Remotely Piloted, Partially Piloted, Fully Autonomous), By End User (Agriculture, Delivery & Logistics, Energy, Media & Entertainment, Real Estate & Construction, Security & Law Enforcement, Others), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

US Aviation Cloud Market: US Aviation Cloud Market Size, Trends and Insights By Cloud Service Models (Infrastructure as a Service (IaaS), Platform as a Service (PaaS), Software as a Service (SaaS)), By Deployment Models (Public Cloud, Private Cloud, Hybrid Cloud), By Applications (Airline Operations, Airport Management, Air Traffic Management, Maintenance, Repair, and Overhaul (MRO), Passenger Services, Aviation Analytics), By End Users (Airlines, Airports, Air Navigation Service Providers (ANSPs), Aircraft Manufacturers, Maintenance Organizations, Others), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Commercial Aircraft In-seat Power System Market: Commercial Aircraft In-seat Power System Market Size, Trends and Insights By Aircraft Type (Narrow-body Aircraft, Wide-body Aircraft, Regional Aircraft), By Power Type (AC Power, DC Power), By Technology (Traditional Power Outlets, USB Charging Ports, Wireless Charging), By Class (Economy Class, Business/First Class), By End-user (Airlines, Aircraft OEMs), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Commercial Aircraft Seat Actuation Market: Commercial Aircraft Seat Actuation Market Size, Trends and Insights By Aircraft Type (Narrow-body Aircraft, Wide-body Aircraft, Regional Aircraft), By Actuation Type (Electric Actuators, Hydraulic Actuators, Pneumatic Actuators), By Seat Configuration (Single-aisle, Twin-aisle), By Component Type (Linear Actuators, Rotary Actuators), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

India Commercial Drone Market: India Commercial Drone Market Size, Trends and Insights By Application (Filming and Photography, Inspection and Maintenance, Mapping and Surveying, Precision Agriculture, Surveillance and Monitoring, Others), By Mode of Operation (Remotely Operated, Semi-Autonomous, Autonomous), By Product Type (Fixed Wing, Rotary Blade, Hybrid), By Weight (<2 Kg, 2 Kg-25 Kg, 25 Kg-150 Kg), By End User (Agriculture, Delivery and Logistics, Energy, Media and Entertainment, Real Estate and Construction, Security and Law Enforcement, Others), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Military Simulation and Virtual Training Market: Military Simulation and Virtual Training Market Size, Trends and Insights By Platform Type (Flight Simulation, Vehicle Simulation, Battlefield Simulation, Virtual Boot Camp, Others), By Application (Ground, Air, Naval), By Training Type (Live Training, Virtual Training, Constructive Training), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Aircraft Seat Upholstery Market: Aircraft Seat Upholstery Market Size, Trends and Insights By Seat Type (Economy Class, Premium Economy Class, Business Class, First Class), By Material (Leather, Vinyl, Fabric), By Aircraft Type (Helicopters, Narrow-Body Aircraft, Wide-Body Aircraft, Very Large Aircraft, Business Jet, Others), By Seat Cover Type (Headrests, Armrests, Backrests, Seat Rear Pockets, Bottom Covers), By End User (OEM, Aftermarket), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

The Commercial Aircraft Seating Market is segmented as follows:

By Aircraft Type

- Narrow-body Aircraft

- Wide-body Aircraft

- Regional Aircraft

- Business Jets

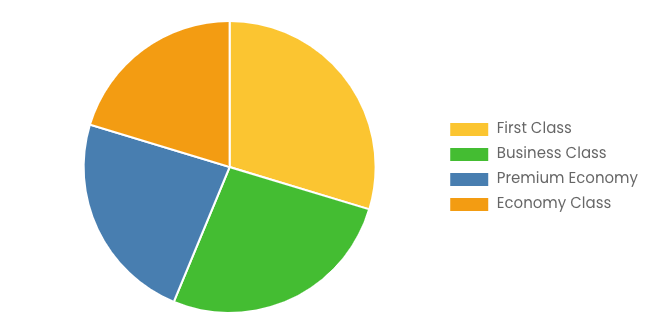

By Class

- First Class

- Business Class

- Premium Economy

- Economy Class

By Seat Type

- Standard Seats

- Lie-flat Seats

- Suite Seats

- Recliner Seats

By Material

- Foam

- Fabric

- Leather

- Other Materials

By Components

- Seat Frames

- Seat Actuators

- Seat Covers

- Cushions

- Seat Belts

- Others

Click Here to Get a Free Sample Report of the Global Commercial Aircraft Seating Market @ https://www.custommarketinsights.com/report/commercial-aircraft-seating-market/

Regional Coverage:

North America

- U.S.

- Canada

- Mexico

- Rest of North America

Europe

- Germany

- France

- U.K.

- Russia

- Italy

- Spain

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Taiwan

- Rest of Asia Pacific

The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

This Commercial Aircraft Seating Market Research/Analysis Report Contains Answers to the following Questions.

- Which Trends Are Causing These Developments?

- Who Are the Global Key Players in This Commercial Aircraft Seating Market? What are Their Company Profile, Product Information, and Contact Information?

- What Was the Global Market Status of the Commercial Aircraft Seating Market? What Was the Capacity, Production Value, Cost and PROFIT of the Commercial Aircraft Seating Market?

- What Is the Current Market Status of the Commercial Aircraft Seating Industry? What’s Market Competition in This Industry, Both Company and Country Wise? What’s Market Analysis of Commercial Aircraft Seating Market by Considering Applications and Types?

- What Are Projections of the Global Commercial Aircraft Seating Industry Considering Capacity, Production and Production Value? What Will Be the Estimation of Cost and Profit? What Will Be Market Share, Supply and Consumption? What about imports and exports?

- What Is Commercial Aircraft Seating Market Chain Analysis by Upstream Raw Materials and Downstream Industry?

- What Is the Economic Impact On Commercial Aircraft Seating Industry? What are Global Macroeconomic Environment Analysis Results? What Are Global Macroeconomic Environment Development Trends?

- What Are Market Dynamics of Commercial Aircraft Seating Market? What Are Challenges and Opportunities?

- What Should Be Entry Strategies, Countermeasures to Economic Impact, and Marketing Channels for Commercial Aircraft Seating Industry?

Click Here to Access a Free Sample Report of the Global Commercial Aircraft Seating Market @ https://www.custommarketinsights.com/report/commercial-aircraft-seating-market/

Reasons to Purchase Commercial Aircraft Seating Market Report

- Commercial Aircraft Seating Market Report provides qualitative and quantitative analysis of the market based on segmentation involving economic and non-economic factors.

- Commercial Aircraft Seating Market report outlines market value (USD) data for each segment and sub-segment.

- This report indicates the region and segment expected to witness the fastest growth and dominate the market.

- Commercial Aircraft Seating Market Analysis by geography highlights the consumption of the product/service in the region and indicates the factors affecting the market within each region.

- The competitive landscape incorporates the market ranking of the major players, along with new service/product launches, partnerships, business expansions, and acquisitions in the past five years of companies profiled.

- Extensive company profiles comprising company overview, company insights, product benchmarking, and SWOT analysis for the major market players.

- The Industry’s current and future market outlook concerning recent developments (which involve growth opportunities and drivers as well as challenges and restraints of both emerging and developed regions.

- Commercial Aircraft Seating Market Includes in-depth market analysis from various perspectives through Porter’s five forces analysis and provides insight into the market through Value Chain.

Reasons for the Research Report

- The study provides a thorough overview of the global Commercial Aircraft Seating market. Compare your performance to that of the market as a whole.

- Aim to maintain competitiveness while innovations from established key players fuel market growth.

Buy this Premium Commercial Aircraft Seating Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/commercial-aircraft-seating-market/

What does the report include?

- Drivers, restrictions, and opportunities are among the qualitative elements covered in the worldwide Commercial Aircraft Seating market analysis.

- The competitive environment of current and potential participants in the Commercial Aircraft Seating market is covered in the report, as well as those companies’ strategic product development ambitions.

- According to the component, application, and industry vertical, this study analyzes the market qualitatively and quantitatively. Additionally, the report offers comparable data for the important regions.

- For each segment mentioned above, actual market sizes and forecasts have been given.

Who should buy this report?

- Participants and stakeholders worldwide Commercial Aircraft Seating market should find this report useful. The research will be useful to all market participants in the Commercial Aircraft Seating industry.

- Managers in the Commercial Aircraft Seating sector are interested in publishing up-to-date and projected data about the worldwide Commercial Aircraft Seating market.

- Governmental agencies, regulatory bodies, decision-makers, and organizations want to invest in Commercial Aircraft Seating products’ market trends.

- Market insights are sought for by analysts, researchers, educators, strategy managers, and government organizations to develop plans.

Request a Customized Copy of the Commercial Aircraft Seating Market Report @ https://www.custommarketinsights.com/report/commercial-aircraft-seating-market/

About Custom Market Insights:

Custom Market Insights is a market research and advisory company delivering business insights and market research reports to large, small, and medium-scale enterprises. We assist clients with strategies and business policies and regularly work towards achieving sustainable growth in their respective domains.

CMI provides a one-stop solution for data collection to investment advice. The expert analysis of our company digs out essential factors that help to understand the significance and impact of market dynamics. The professional experts apply clients inside on the aspects such as strategies for future estimation fall, forecasting or opportunity to grow, and consumer survey.

Follow Us: LinkedIn | Twitter | Facebook | YouTube

Contact Us:

Joel John

CMI Consulting LLC

1333, 701 Tillery Street Unit 12,

Austin, TX, Travis, US, 78702

USA: +1 801-639-9061

India: +91 20 46022736

Email: support@custommarketinsights.com

Web: https://www.custommarketinsights.com/

Blog: https://www.techyounme.com/

Blog: https://atozresearch.com/

Blog: https://www.technowalla.com/

Blog: https://marketresearchtrade.com/

Buy this Premium Commercial Aircraft Seating Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/commercial-aircraft-seating-market/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

BlackRock's Larry Fink Warns Against Overly Optimistic Fed Rate Cuts, Cites High 'Embedded Inflation' And Predicts Only 1 Reduction This Year

Larry Fink, the CEO of BlackRock Inc., has projected that the U.S. Federal Reserve will not reduce interest rates as significantly as the market anticipates, citing high “embedded inflation.”

What Happened: Speaking at a CEO-packed panel in Riyadh, Saudi Arabia, Fink, who manages a colossal fund of over $10 trillion, forecasted only one rate reduction by the end of 2024, contrary to the two reductions predicted by other market players, reported CNBC.

“I think it’s fair to say we’re going to have at least a 25 (basis-point cut), but, that being said, I do believe we have greater embedded inflation in the world than we’ve ever seen,” Fink stated.

He attributed this inflation to government and policy decisions, such as the U.S.’s recent efforts to reduce reliance on foreign supply chains and invest in domestic jobs.

These changes, facilitated by the President Joe Biden administration’s legislation, can lead to higher prices for goods, as American workers are paid more than those in many offshore manufacturing destinations like China.

“Today, I think we have governmental policies that are embedded inflationary, and, with that being said, we’re not gonna see interest rates as low as people are forecasting,” Fink added.

The Fed reduced its benchmark rate by 50 basis points in September, signaling a shift in its management of the U.S. economy and its inflation outlook. Despite this, Fink believes that the Fed will not cut rates as extensively as expected.

See Also: Is S&P 500 Headed For A Lost Decade? Analysts Say ‘We May Have Forgotten About Dividends’

Why It Matters: The Fed’s interest rate decisions have been a hot topic of debate in recent months. Former President Donald Trump‘s economic adviser Kevin Hassett defended the central bank’s rate cut, citing a weakening jobs market.

On the other hand, former Federal Deposit Insurance Corporation Chief Sheila Bair warned against further rate cuts, despite the economy showing positive signs such as increasing wages, a strong stock market, and robust job creation.

Meanwhile, Federal Reserve Governor Adriana Kugler expressed her support for additional interest rate cuts, contingent on continued decreases in inflation. This announcement was made during her speech at the European Central Bank.

On a global scale, the European Central Bank cut interest rates for the third time in a year to stimulate a sluggish economy, shifting its focus from battling inflation to encouraging economic growth.

Read Next:

Image Via Shutterstock

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Automotive Metal Timing Chain Market Size Predicted to Jump from USD 12.79 Billion in 2021 to USD 19.28 Billion by 2031 as Fuel Prices and Emission Standards Drive Growth| Transparency Market Research Inc.

Wilmington, Delaware, United States, Transparency Market Research, Inc., Oct. 30, 2024 (GLOBE NEWSWIRE) — The automotive metal timing chain market (Markt für Kfz-Steuerketten aus Metall ) was worth US$ 12.79 billion in 2021. A CAGR of 4.1% is predicted for the period 2022 to 2031. Global automotive metal timing chain sales are predicted to reach US$ 19.28 billion by 2031.

Manufacturers of automotive metal timing chains can support market growth by providing vehicle owners and repair shops with high-quality replacement chains and components. The growing aftermarket automotive parts market, driven by increasing vehicle age and the need for replacement parts, makes this possible.

The importance of vehicle safety and reliability drives the demand for durable and robust automotive metal timing chains that can withstand high temperatures, extreme conditions, and heavy loads, ensuring optimal engine performance and minimizing the risk of engine failure or malfunction.

The growing aftermarket automotive parts market, driven by increasing vehicle age and the need for replacement parts, creates opportunities for automotive metal timing chain manufacturers to supply high-quality replacement chains and components to vehicle owners and repair shops, supporting market growth.

Request PDF Sample Report: Automotive Metal Timing Chain Market Strategic Insights: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=84815

The need for strong and resilient automotive metal timing chains that can tolerate high temperatures, harsh environments, and large loads is driven by the significance of vehicle safety and dependability. These chains provide optimal engine performance and reduce the possibility of engine failure or malfunction.

Global Automotive Metal Timing Chain Market: Competitive Landscape

A few large vendors control most of the automotive metal timing chain market share. Firms invest heavily in research and development to create durable, lightweight, and versatile products.

It has become a common practice for major players to acquire other companies and expand their product portfolios. Some key market players profiled by Transparency Market Research include the following:

- BG Automotive (British Gaskets Group)

- BorgWarner Inc.

- Cloys

- Continental AG

- Dayco IP Holdings, LLC

- FAI Automotive plc

- Ferdinand Bilstein GmbH + Co. KG

- Iwis

- MAPCO Autotechnik GmbH

- Melling

- NTN-SNR

- Schaeffler Automotive Aftermarket GmbH & Co. KG

- SKF

- Tsubakimoto Europe B.V

- Other Key Players (Renold plc, LG Balakrishnan and Brothers Ltd.)

Key Findings of the Market Report

- A notable CAGR of 4.1% is predicted for the gasoline engine segment over the forecast period.

- The overhead cam engine segment is forecast to expand at a CAGR of over 4% during the forecast period.

- By 2021, Asia Pacific held a 46.18% market share for the automotive metal timing chain market.

- A significant market for automotive metal timing chains, North America held a 21.27% share of the global market in 2021.

- In 2021, Europe was a major market for automotive metal timing chains, holding a value share of 24.66%.

Global Automotive Metal Timing Chain Market: Growth Drivers

- Automotive metal timing chains are in high demand for their role in providing accurate and reliable engine timing in internal combustion engines. Automotive manufacturing is experiencing continual growth, which in turn is being driven by increasing consumer demand globally.

- Automotive metal timing chains are in high demand due to strict regulations to reduce vehicle emissions and increase fuel efficiency. As compared to belts and other timing systems, chains offer better durability, reliability, and performance, contributing to more environmentally friendly and efficient vehicles.

- Developing high-performance engines with variable valve timing and turbocharging systems, among other ongoing advances in engine design and technology, raises the complexity and demand for sophisticated automotive metal timing chains that can provide accurate and reliable engine timing under various operating conditions.

Global Automotive Metal Timing Chain Market: Regional Landscape

- Asia Pacific is the world’s car production leader, increasing the market’s need for metal timing chains. Technological advancements in engine design also boost the adoption of metal timing chains.

- Timing chains are in high demand due to the expanding aftermarket parts market. A strict legal requirement ensures that timing chain items are of the highest quality. As vehicle safety becomes more important, metal timing chains are in greater demand.

- The growing middle class in Asia Pacific is the main driver of car ownership and aftermarket demand. Government programs that support electric and hybrid vehicles impact the dynamics of the timing chain supplier industry.

Unlock Growth Potential in Your Industry! Download PDF Brochure: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=84815

Key Developments

- BG Automotive (British Gaskets Group)- British Gaskets Group supplies components for the automotive aftermarket. Gaskets, engine components, and timing chains are among the products included in this category. As replacement parts providers for vehicles, they play an essential role.

- BorgWarner Inc.: BorgWarner is one of the world’s leading manufacturers of combustion engines, hybrid cars, and electric vehicles. Their expertise includes timing drive components and propulsion systems. The innovative technologies offered by BorgWarner enhance vehicle efficiency, reduce emissions, and enhance vehicle performance.

- Cloys: A leading manufacturer of precision timing chains, Cloys specializes in timing drive systems. In the automotive OEM (Original Equipment Manufacturers) and aftermarket, they are known for their quality and precision.

Global Automotive Metal Timing Chain Market: Segmentation

Vehicle Type

- Two Wheelers

- Three Wheelers

- Passenger Vehicle

- Light Commercial Vehicle

- Trucks

- Buses & Coach

Engine Type

- Overhead Cam Engine

- Push Rod Engine

- Others

Type

- Roller Chain

- Bush Chain

- Toothed/Silent Chain

Sales Channel

Propulsion Type

- Gasoline Engine

- Diesel Engine

- Others

Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Enhance Your Business Now! Acquire Vital Market Insights – Access the Report Now: https://www.transparencymarketresearch.com/checkout.php?rep_id=84815<ype=S

Explore wide-ranging Coverage of TMR’s Automotive Market Insights Landscape

- Electric Vehicle Power Electronics Market – The global electric vehicle power electronics market (Markt für Leistungselektronik für Elektrofahrzeuge) is projected to flourish at a CAGR of 24.1% from 2023 to 2031.

- Electric Vehicle Transmission Market – The global market for electric vehicle transmission (Markt für Elektrofahrzeuggetriebe) is anticipated to grow with a booming 23.7% CAGR from 2022 to 2031.

- Online Vehicle Retail Market – The global online vehicle retail market (Online-Fahrzeughandelsmarkt ) is estimated to grow at a CAGR of 6.6% from 2024 to 2034.

- Train Battery Market – The global train battery market (Markt für Zugbatterien) is estimated to grow at a CAGR of 4.6% from 2024 to 2034.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Opacifying Ingredient Market is Projected to Reach US$ 35.2 Billion by 2034, Expanding at a 6.2% CAGR | Fact.MR Report

Rockville, MD , Oct. 30, 2024 (GLOBE NEWSWIRE) — According to Fact.MR, a market research and competitive intelligence provider, the global opacifying ingredient market is estimated to reach a valuation of US$ 19.3 billion in 2024 and is projected to expand at a CAGR of 6.2% from 2024 to 2034.

Opacifying ingredients are essential for improving the performance of finished goods due to the fact they have an impact on UV resistance, coverage, and durability in paints, cosmetics, and plastics. The market for opacifying ingredients is made up of a variety of compounds that are strategically used in different sectors to improve the performance and opacity of final goods.

Ingredients that soothe are positioned as revolutionary components that not only satisfy industry standards but also adjust to new demands, guaranteeing their continuing market expansion and relevance. The market analysis reveals a significant and rising need for opacifying ingredients in several industries, including food, plastics, paints & coatings, and cosmetics. Players in the market are enabling technologies to lure tech-savvy consumers such as wearable sensors to track sun damage and pH levels.

For More Insights into the Market, Request a Sample of this Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=8117

Key Takeaways from Market Study:

- The global opacifying ingredient market is projected to expand at 6.2% CAGR and reach US$ 35.2 billion by the end of 2034.

- The market advaNCED at a CAGR of 4.6% from 2019 to 2023.

- The paints and coatings segment occupies a leading share of the market in 2024.

- TiO2 accounts for high revenue generation because of its exceptional ability to increase opacity.

- The North American market is projected to expand at a CAGR of 5.5% and reach US$ 6.1 billion by the end of 2034.

“The market is expanding rapidly due to advancements in opacifying ingredient production giving rise to sustainable formulations that meet the needs of various industries. Applications include cosmetics, paints and coatings, as well as food and beverages,” says a Fact.MR analyst.

Leading Players Driving Innovation in the Opacifying Ingredient Market:

Chemours Company | Arkema | Cristal | Dow | Kronos Worldwide Inc | Tronox Limited | Tayca Corporation | En-tech Polymer Co. Ltd. | Venator | Cristal | Kumyang | Tata Pigments | Anten Chemical | Parshwanath Dye Stuff Industries | Panzhihua Haifengxin Chemical Industry Co., Ltd. | Central Drug House | Arihant Solvents and Chemicals | Tinox Chemie GmbH | Otto Chemie Pvt. Ltd. | Suvidhinath Laboratories

Winning Strategy:

The market is monopolistic, and in this fiercely competitive environment, it is quite challenging for new competitors to enter the market. Investors, including end consumers in the paint manufacturing sector and key players in various cosmetics end-use sectors, are expanding their production capacity. To capitalize on groundbreaking discoveries in opacifying ingredients and ensure future revenue prospects, Tier-2 manufacturers should strategically invest in establishing production facilities near distributors while collaborating with owners and end users.

ongoing focus on research and development in opacifying ingredients aims to enhance efficacy, sustainability, and flexibility. Innovations in this field target diverse industry needs in plastics, paints, coatings, and cosmetics, promoting advancements that deliver improved performance, environmentally friendly formulations, and expanded applications for opacifying ingredients.

Opacifying Ingredient Market News:

Dow and Univar Solution signed a deal in Brazil in 2023 to distribute newly created goods and environmentally friendly opacifying ingredient solutions, boosting the company’s capacity in the paints and coatings industry and fortifying links with foreign suppliers. This strengthens an existing partnership with Dow across Europe and North America.

Get Customization on this Report for Specific Research Solutions: https://www.factmr.com/connectus/sample?flag=S&rep_id=8117

More Valuable Insights on Offer:

Fact.MR, in its new offering, presents an unbiased analysis of the opacifying ingredient market, presenting historical market data for 2019 to 2023 and forecast statistics for 2024 to 2034.

The study reveals essential insights based on type (titanium dioxide, zinc oxide, calcium carbonate & barium sulfate, opaque polymers, antimony oxide, others) and application (paints & coatings, ceramics, cosmetics & personal care, plastics, paper, food & beverages, pharmaceuticals, others [textiles, etc.]), across six major regions of the world (North America, Latin America, Europe, East Asia, South Asia, Oceania, and MEA).

Check out More Related Studies Published by Fact.MR:

Mono Methyl Ether of Hydroquinone (MEHQ) Market: The global mono methyl ether of hydroquinone (MEHQ) market is estimated to generate a revenue of US$ 469.16 million in 2024 and is projected to touch US$ 774.15 million by the end of 2034. Demand has been forecasted to increase at a 5.1% CAGR from 2024 to 2034.

Calcium Market: Revenue from the global calcium market is estimated to reach US$ 34.1 billion in 2024. The market is analyzed to expand at a compound annual growth rate (CAGR) of 5.7% to reach US$ 59.26 billion by the end of 2034.

Electroplating Chemicals Market: The global electroplating chemicals market is currently valued at around US$ 49.23 billion in 2024 and is forecasted to expand at a CAGR of 6.8% to reach US$ 94.69 billion by 2034.

Cryolite Market: The global cryolite market is estimated to generate revenue worth US$ 258.8 million in 2024 and is further forecasted to reach US$ 461.4 million by the end of 2034. Demand is evaluated to increase at 6% CAGR between 2024 to 2034.

Cryogenic Ethylene Market: The global cryogenic ethylene market was valued at US$ 5,226.1 million in 2023 and has been forecast to expand at a noteworthy CAGR of 9.2% to end up at US$ 13,760.3 million by 2034.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning.

With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay competitive.

Contact:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team: sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.