Aker BP reports third quarter 2024

LYSAKER, Norway, Oct. 30, 2024 /PRNewswire/ — Aker BP delivered strong results in third quarter 2024, driven by high production efficiency, low costs, and low emissions. With production guidance raised, early project completions, and robust cash flow generation, we continue to create value and return it to shareholders through dividends.

Highlights

- Efficient operations: Oil and gas production averaged 415 (444) thousand barrels of oil equivalent per day (mboepd) during the quarter. Full-year guidance raised to 430-440 (previously 420-440) mboepd.

- Low cost: Production cost was USD 6.6 (6.4) per barrel. Full-year guidance lowered to USD ~6.5 (previously ~7) per barrel.

- Low emissions: Greenhouse gas emission intensity averaged 2.4 (2.6) kg CO2e per boe (scope 1 & 2), ranking among the lowest in the global oil and gas sector.

- Projects on track: All field development projects progressing on schedule and within budget.

- Tyrving on stream: The Tyrving field in the Alvheim area commenced production five months ahead of original plan.

- Strong financial performance: Aker BP reported EBITDA of USD 2.6 (3.0) billion, net profit of USD 173 (561) million, and record-high cash flow from operations of USD 2.8 (1.5) billion.

- Improved debt profile: Average debt maturity extended by three years following issuance of new 10- and 30-year bonds (completed in October).

- Returning value: Quarterly dividend of USD 0.60 per share.

Comment from Karl Johnny Hersvik, CEO of Aker BP

– We are pleased to report another quarter of high production efficiency, supported by smooth execution of our maintenance program. This performance has allowed us to increase our production guidance for 2024 and reinforces our position as an industry leader in both low costs and low emissions.

– The execution of our development projects is progressing well. This quarter, we celebrated the early production start from the Tyrving field, which came on stream in September – five months ahead of schedule, thanks to the outstanding efforts of our project team and alliance partners. Delivering with quality, on time, and within budget is a key priority as we continue developing new fields that will support future profitable growth.

– Our strong financial position was further enhanced by the issuance of 10- and 30-year bonds, extending our debt maturity and underscoring the capital markets’ confidence in our strategy. This financial flexibility ensures we are well-positioned not only to deliver on current projects but also to seize future opportunities and navigate potential challenges in an evolving macroeconomic and industry landscape.

– In summary, Aker BP continues to generate value through operational excellence, strategic investments in profitable growth, and disciplined financial management. We remain fully committed to delivering value to our shareholders through consistent dividends and long-term growth.

Webcast presentation

Today at 08:30 CET, the management will present the results on a webcast available on www.akerbp.com. The presentation will be followed by an online Q&A session.

Attachments

Aker BP 2024-Q3 Presentation.pdf

CONTACT:

Investor contacts:

Kjetil Bakken, Head of IR, tel.: +47 918 89 889

Carl Christian Bachke, IR Officer, tel.: +47 909 80 848

Martin Seland Simensen, IR Officer, tel.: +47 416 92 087

Media contact:

Ole-Johan Faret, Press Spokesperson, tel.: +47 402 24 217

This information was brought to you by Cision http://news.cision.com

https://news.cision.com/aker-bp-asa/r/aker-bp-reports-third-quarter-2024,c4058041

The following files are available for download:

![]() View original content:https://www.prnewswire.com/news-releases/aker-bp-reports-third-quarter-2024-302291064.html

View original content:https://www.prnewswire.com/news-releases/aker-bp-reports-third-quarter-2024-302291064.html

SOURCE Aker BP ASA

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

9M 2024: +4% organic growth driven by Electrification – Set for a robust year

9M 2024 financial information

+4% organic growth driven by Electrification

Set for a robust year

_PRESS RELEASE_

- Standard sales of €5,226 million in the first nine months of 2024, up +4.0% organically year on year and up +6.9% excluding Other activities

- Electrification businesses up +7.9% organically in the third quarter of 2024, reflecting early-bird strategic investments in the Generation & Transmission segment

- Strong adjusted backlog for Generation & Transmission, mainly subsea-driven, at €6.2 billion, up +19% compared to September 2023

- Expansion of manufacturing capacities through investments in onshore high-voltage and the production of low-carbon medium-voltage cables in France

- Strategic investment agreement in France to increase copper production and recycling capacity across Europe

- Ambitious Net-Zero 2050 climate targets approved by the Science Based Targets initiative

- Full-year 2024 guidance as updated in July 2024 confirmed

- Adjusted EBITDA of between €750 and 800 million

- Normalized Free Cash Flow of between €275 and 375 million

- Capital Markets Day to be held on November 13, 2024 in London and virtually, and US investors day on November 20, 2024 in New York City

~ ~ ~

Paris, October 30, 2024 – Nexans, a global leader in the design and manufacturing of cable systems to power the world, announces its financial information for the first nine months of 2024. Commenting on the Group’s highlights, Christopher Guérin, Nexans’ Chief Executive Officer, said:

“The first nine months of 2024 have laid strong foundations for a robust financial year. Our Electrification businesses continue to drive growth, up +7.9% organically in the third quarter of 2024, showcasing that early strategic investments in Generation & Transmission are already yielding benefits.

In order to reinforce the positioning of our electrification strategy and keep pace with increasing electricity demand, we have decided to invest €90 million in onshore high-voltage capacity at our French and Belgian plants and €15 million in the production of low-carbon medium-voltage cables in France. In addition, Nexans continues to lead the way in the circular economy with a strategic investment agreement at the Lens plant, enabling the recycling of over 80,000 metric tons per year.

As we look ahead, I am confident that our continued focus on performance and strategic execution will drive long-term value for all stakeholders. At our upcoming Capital Markets Day in November, where we will further outline the initiatives that will shape Nexans’ trajectory in the years to come.”

CONSOLIDATED SALES BY SEGMENT

| (in millions of euros) At standard metal prices Copper reference at €5,000/t |

9M 2023 | 9M 2024 | Organic growth 9M 2024 vs. 9M 2023 |

Organic growth Q3 2024 vs. Q3 2023 |

|

| Electrification | 2,768 | 3,344 | +12.1% | +7.9% | |

| Generation & Transmission | 593 | 899 | +54.3% | +36.2% | |

| Distribution | 889 | 923 | +1.6% | -0.1% | |

| Usage | 1,286 | 1,522 | +0.5% | -0.7% | |

| Non-electrification (Industry & Solutions) | 1,352 | 1,294 | -3.8% | -8.4% | |

| Total Group (excl. Other activities) | 4,120 | 4,639 | +6.9% | +2.5% | |

| Other activities | 800 | 588 | -14.2% | -19.4% | |

| Group Total | 4,921 | 5,226 | +4.0% | -0.5% |

9M AND Q3 2024 HIGHLIGHTS

In the first nine months of 2024, standard sales amounted to €5,226 million, up +4.0% compared to the same period of 2023 and up +6.9% excluding Other activities, which are being scaled down in line with the Group’s strategy. Third-quarter 2024 standard sales amounted to €1,680 million, down -0.5% organically and up +2.5% excluding Other activities compared to the third quarter of 2023.

The Electrification businesses (Generation & Transmission, Distribution and Usage) witnessed a strong organic sales increase of +12.1% in the first nine months thanks to (i) the ramp-up of the Halden plant (Norway) in the Generation & Transmission segment, (ii) ongoing positive demand driven by long-term trends in the Distribution segment, and (iii) a resilient Usage segment.

Non-electrification sales were down -3.8% in the first nine months of the year on account of a slowdown in the Automation business and a high base effect in the Auto-harnesses business. Other activities experienced a significant organic decrease of -14.2% compared to the first nine months of 2023 in line with the Group’s strategy.

SUSTAINABILITY

As a key player in electrification, Nexans is committed to not only driving the future of power, but also to integrating and promoting sustainability and safety across all its operations and activities. Aligned with its fundamental principles and commitments to achieving Net-Zero emissions by 2050, key initiatives were implemented during third-quarter 2024:

- Nexans’ ambitious Net-Zero 2050 climate objectives were approved by the Science Based Targets initiative, underscoring the company’s leadership in climate action.

- The Copper Mark, an esteemed label for responsible copper production, was awarded to Nexans’ foundries in Montreal, Canada, and Lens, France, highlighting the company’s dedication to ethical and sustainable practices.

- In a strategic move to bolster energy efficiency, Nexans partnered with Niehoff to launch an innovative rod breakdown line at the Lens facility in France, which is projected to cut energy usage by 25%. This translates into a substantial reduction of approximately 840 tons of CO2 emissions annually.

- In line with its target of 100% decarbonized electricity consumption by 2030, Nexans inaugurated a 1.7 MW solar farm at its Cortaillod plant in Switzerland, with over 90% of the energy generated being used onsite.

9M 2024 STANDARD SALES PER SEGMENT

| GENERATION & TRANSMISSION (17% OF TOTAL STANDARD SALES)

| (in millions of euros) | 9M 2023 | 9M 2024 | Q3 2023 | Q3 2024 |

| Sales at current metal prices | 611 | 919 | 215 | 284 |

| Sales at standard metal prices | 593 | 899 | 209 | 277 |

| Organic growth (%) | -2.1% | +54.3% | +17.8% | +36.2% |

Generation & Transmission standard sales came in at €899 million in the first nine months of 2024, up +54.3% organically compared to the first nine months of 2023, propelled by the ramp up of new capacity at the Halden plant (Norway). In the third quarter of 2024, sales were up +36.2% organically compared to the third quarter of 2023, reflecting notably robust installation campaigns, Great Sea Interconnector execution and contributions from Inspection, Maintenance and Repair (IMR) works.

Customer activity remained robust, and in line with its risk-reward selectivity approach, the segment’s adjusted backlog reached €6.2 billion at September 30, 2024, up +19% compared to September 30, 2023. In the third quarter, Nexans secured the final contract for the pioneering electrical transmission link from the Orkney Islands in Scotland. Additionally, a definitive agreement was reached between Greece and Cyprus for the ambitious Great Sea Interconnector at the end of September. This key development represents a crucial step forward for the project, and Nexans is now anticipating the final notice to proceed with the contract.

During the third quarter, the Group unveiled a strategic €90 million investment at its facilities in France and Belgium. This investment will increase the production of advanced 525kV onshore cables meeting the requirements of the TenneT frame agreement. Progress continues apace on Nexans Electra, the company’s third cable-laying vessel. This state-of-the-art vessel is set to markedly increase the company’s installation capacity, effectively addressing the business’s expanding backlog.

| DISTRIBUTION (18% OF TOTAL STANDARD SALES)

| (in millions of euros) | 9M 2023 | 9M 2024 | Q3 2023 | Q3 2024 |

| Sales at current metal prices | 1,026 | 1,077 | 331 | 344 |

| Sales at standard metal prices | 889 | 923 | 290 | 288 |

| Organic growth (%) | +2.9% | +1.6% | +0.0% | -0.1% |

Distribution sales amounted to €923 million at standard metal prices in the first nine months of 2024, up +1.6% organically, compared to the first nine months of 2023.

Europe has seen an uptick, thanks to the establishment of new frame agreements and a surge in renewable energy projects. This progress has been achieved notwithstanding the temporary dip in activity due to the consolidation of manufacturing operations in Finland during the third quarter. In France, the Group invested €15 million in late August to increase its capabilities in producing low-carbon medium-voltage cables in order to support growth in electrification requirements in France and in Western Europe. Additionally, the Group pioneered a cutting-edge solar power solution in France, designed to support the photovoltaic sector with a sustainable, low-carbon alternative.

The Asia Pacific region has witnessed a rebound primarily fueled by substantial investments in renewable energy and grid enhancement projects, especially in Australia and New Zealand.

In the Americas, the underlying market conditions have continued to exhibit strength. Despite this, the growth trajectory has moderated slightly, influenced by destocking and the timing of substantial orders.

| USAGE (29% OF TOTAL STANDARD SALES)

| (in millions of euros) | 9M 2023 | 9M 2024 | Q3 2023 | Q3 2024 |

| Sales at current metal prices | 1,704 | 2,006 | 527 | 730 |

| Sales at standard metal prices | 1,286 | 1,522 | 397 | 533 |

| Organic growth (%) | -6.1% | +0.5% | -12.6% | -0.7% |

Usage sales amounted to €1,522 million at standard metal prices in the first nine months of 2024, up +0.5% organically compared with the first nine months of 2023.

In North America (Canada), solid demand in industrial markets during Q3 2024 supported the Group’s growth. While Europe faced headwinds with lower volumes and destocking in certain markets, South America saw strong demand in Brazil and Chile, while destocking in Columbia. In Africa, a robust recovery in Morocco offset the subdued demand in Turkey.

In a strategic move to fortify its commitment to 30% recycled copper in its products by 2030, Nexans launched CableLoop, an exclusive cable recycling and recovery service in France and across Europe. CableLoop is a pioneering, end-to-end solution that facilitates the collection of installation cable off-cuts in distributors’ networks at the Group’s recycling centers. Here, these materials are transformed into high-quality recycled raw materials, exemplifying the Group’s dedication to circular economy principles.

The sales figures reflect the strategic acquisitions of La Triveneta Cavi as of June 1, 2024, and Reka Cables since April 2023. These acquisitions are integral to Nexans’ Electrification strategy, expanding the Group’s capabilities in key regions.

| NON-ELECTRIFICATION (Industry & Solutions) (25% OF TOTAL STANDARD SALES)

| (in millions of euros) | 9M 2023 | 9M 2024 | Q3 2023 | Q3 2024 |

| Sales at current metal prices | 1,459 | 1,406 | 479 | 443 |

| Sales at standard metal prices | 1,352 | 1,294 | 443 | 404 |

| Organic growth (%) | +17.7% | -3.8% | +13.1% | -8.4% |

In the Industry & Solutions segment, standard sales for 9M 2024 amounted to €1,294 million, reflecting an organic year-on-year decline of -3.8%. This was primarily attributed to a slowdown in Automation, which was partially offset by robust growth in the Shipbuilding, Nuclear and Rolling Stock markets. Auto-harnesses market remained resilient despite a high base effect from last year.

| OTHER ACTIVITIES (11% OF TOTAL STANDARD SALES)

| (in millions of euros) | 9M 2023 | 9M 2024 | Q3 2023 | Q3 2024 |

| Sales at current metal prices | 1,104 | 889 | 344 | 273 |

| Sales at standard metal prices | 800 | 588 | 260 | 177 |

| Organic growth (%) | -15.5% | -14.2% | -6.0% | -19.4% |

The Other Activities segment – corresponding for the most part to copper wire sales and corporate costs that cannot be allocated to other segments – reported standard sales of €588 million in 9M 2024. Standard sales were down -14.2% organically year-on-year, mainly linked to the Group’s strategy to reduce copper wire external sales through tolling agreements in order to mitigate their dilutive effect.

2024 OUTLOOK

As the world continues to embrace electrification, Nexans is well-positioned to harness buoyant market demand, supported by global megatrends and the Company’s commitment to delivering value-added solutions. Nexans’ Generation & Transmission segment boasts a strong risk-reward adjusted backlog, ensuring solid visibility. The Group is poised to reap benefits from the expanded capacity of the Halden plant in Norway, positioning Nexans to meet the growing global demand for high-voltage solutions. Looking ahead, the Generation & Transmission business is on a trajectory of gradual improvement. This progress is contingent upon the successful execution of projects and the completion of legacy contracts. The Distribution market is entering a significant hyper cycle of investment, presenting Nexans with opportunities for growth and enhanced profitability. Despite weak demand in certain geographies within the construction sector, Nexans’ Usage segment remains resilient, with strategic initiatives in place to mitigate the impact of these macroeconomic conditions.

The Group expects to achieve the following targets which were upgraded in July, excluding the impact of any non-closed acquisitions and divestments:

- Adjusted EBITDA of between €750 and €800 million (€670 – €730 million previously);

- Normalized Free Cash Flow of between €275 and €375 million (€200 – €300 million previously).

Nexans reaffirms its commitment to the 2021 Capital Markets Day targets and will continue to execute its strategic roadmap and priorities.

SIGNIFICANT EVENTS SINCE THE END OF SEPTEMBER

October 22, 2024 – Nexans signed a strategic investment agreement in France to increase its copper production and recycling capacity across Europe. With an investment of over €90 million, wire rod production capacity will increase by over 50% at the Lens plant, boosting its copper scrap recycling capacity to manage up to 80,000 metric tons per year.

The third-quarter 2024 press release and presentation slides are available in the Investor Relations Results section at Nexans – Financial results.

A conference call is scheduled today at 9:45 a.m. CET. Please find below the access details:

Webcast

https://channel.royalcast.com/landingpage/nexans/20241030_1/

Audio dial-in

- International switchboard: +44 (0) 33 0551 0200

- France: +33 (0) 1 70 37 71 66

- United Kingdom: +44 (0) 33 0551 0200

- United States: +1 786 697 3501

Confirmation code: Nexans

~ ~ ~

Financial calendar

November 13, 2024: Capital Markets Day, London and virtually

November 20, 2024: US investors day, New York City

February 19, 2025: Full-year 2024 earnings

About Nexans

For over a century, Nexans has played a crucial role in the electrification of the planet and is committed to electrifying the future. With approximately 28,500 people in 41 countries, the Group is paving the way to a new world of safe, sustainable and decarbonized electricity that is accessible to everyone. In 2023, Nexans generated €6.5 billion in standard sales. The Group is a leader in the design and manufacturing of cable systems and services across four main business areas: Generation & Transmission, Distribution, Usage and Industry & Solutions. Nexans was the first company in its industry to create a Foundation supporting sustainable initiatives, bringing access to energy to disadvantaged communities worldwide. The Group is recognized on the CDP Climate Change A List as a global leader on climate action and has committed to Net-Zero emissions by 2050 aligned with the Science Based Targets initiative (SBTi).

Nexans. Electrify the Future.

Nexans is listed on Euronext Paris, compartment A.

For more information, please visit www.nexans.com

Contacts

NB: Any discrepancies are due to rounding

This press release contains forward-looking statements which are subject to various expected or unexpected risks and uncertainties that could have a material impact on the Company’s future performance.

Readers are invited to visit the Group’s website where they can view and download the Universal Registration Document, which include a description of the Group’s risk factors.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Sandoz reports third-quarter and nine-month 2024 sales

Ad hoc announcement pursuant to art. 53 SIX Swiss Exchange Listing Rules

MEDIA RELEASE

- Strong third-quarter biosimilars growth of 37% in constant currencies from existing portfolio and recent launches

- Generics growth acceleration driven by Europe

- Third-quarter net sales¹ of USD 2.6 billion, up 12% in constant currencies (up 11% in USD)

- Nine-month net sales of USD 7.6 billion, up 9% in constant currencies (up 8% in USD)

- Net sales growth guidance increased to high-single digit in constant currencies (from mid- to high-single digit) and core EBITDA margin² guidance of around 20% confirmed

Basel, October 30, 2024 – Sandoz SDZNY, the global leader in generic and biosimilar medicines, today announced net sales for the third quarter and nine months ended September 30, 2024. For the third quarter, net sales were USD 2.6 billion, an increase of 12% in constant currencies compared to the same quarter of the prior year. For the first nine months of 2024, net sales were USD 7.6 billion, an increase of 9% in constant currencies compared to the prior year.

Richard Saynor, Chief Executive Officer of Sandoz, said: “We remain focused on execution, meeting key milestones in our biosimilars business and progressing on our journey as a standalone company. In recent months, we received approval for Pyzchiva® and Enzeevu™ in the US, launched Pyzchiva® in Europe and see continued strong uptake of Hyrimoz® in the US.

“Net sales growth was achieved across generics and biosimilars, with generics accelerating in the third quarter and strong double-digit biosimilars growth in both the third quarter and first nine months. Additionally, all three regions contributed to this strong performance. We expect momentum in our business to continue, driving margin expansion through favorable product mix and leveraging our cost base. We have further advanced on our path to simplifying our business, including progression on the transformation program we launched earlier this year.”

THIRD-QUARTER AND NINE-MONTH SALES

Net sales for the third quarter were USD 2.6 billion, up 12% in constant currencies, compared to the third quarter of 2023. Volume contributed 13 percentage points of growth. This was partially offset by price erosion of 1 percentage point. Biosimilars were the key driver of growth in the quarter, while generics experienced solid demand. Growth accelerated in both businesses.

Net sales for the first nine months of 2024 were USD 7.6 billion, up 9% in constant currencies compared to prior year. Volume contributed 11 percentage points of growth. This was partially offset by price erosion of 2 percentage points. The growth was primarily driven by biosimilars, with strong demand for both the base business and new in-market organic and acquired products in the US.

Net sales by business

| Q3 2024 | Q3 2023 | Change % | 9M 2024 | 9M 2023 | Change % | |||||||

| USD millions unless indicated otherwise | USD | cc* | USD | cc* | ||||||||

| Generics | 1 854 | 1 794 | 3 | 4 | 5 558 | 5 512 | 1 | 2 | ||||

| Biosimilars | 741 | 543 | 36 | 37 | 2 084 | 1 592 | 31 | 32 | ||||

| Net sales to third parties |

2 595 | 2 337 | 11 | 12 | 7 642 | 7 104 | 8 | 9 | ||||

*constant currencies

Generics overview

Net sales for the third quarter were USD 1.9 billion, up 4% in constant currencies, compared to the third quarter of 2023. Net sales for the first nine months were USD 5.6 billion, up 2% in constant currencies versus prior year.

Growth in the Europe region accelerated in the third quarter, mainly driven by recent launches. The momentum continued in the International region, aided by demand for the antifungal agent Mycamine® and favorable pricing dynamics, partly offset by the divestment of the Chinese business. North America declined due to timing of new launches in the US.

Biosimilars overview

Net sales for the third quarter were USD 741 million, up 37% in constant currencies, compared to the third quarter of 2023. Net sales for the first nine months were USD 2.1 billion, up 32% in constant currencies versus prior year.

The strong double-digit biosimilars growth reflects the uptake of Hyrimoz® (adalimumab) in the US, the acquisition of Cimerli® (ranibizumab), the continued strong demand for our first-ever biosimilar, Omnitrope® (somatropin), and the launches of Tyruko® (natalizumab) and Pyzchiva® (ustekinumab) in Europe.

Net sales by region

| Q3 2024 | Q3 2023 | Change % | 9M 2024 | 9M 2023 | Change % | |||||||

| USD millions unless indicated otherwise | USD | cc | USD | cc | ||||||||

| Europe | 1 362 | 1 204 | 13 | 12 | 3 996 | 3 751 | 7 | 6 | ||||

| North America | 598 | 510 | 17 | 18 | 1 742 | 1 514 | 15 | 15 | ||||

| International | 635 | 623 | 2 | 8 | 1 904 | 1 839 | 4 | 9 | ||||

| Net sales to third parties |

2 595 | 2 337 | 11 | 12 | 7 642 | 7 104 | 8 | 9 | ||||

Europe overview

Net sales for the third quarter were USD 1.4 billion, up 12% in constant currencies, compared to the third quarter of 2023. Net sales for the first nine months were USD 4.0 billion, up 6% in constant currencies versus prior year.

Strong growth in biosimilars continues, led by demand for Omnitrope® and the contribution from the recent launches of Tyruko® and Pyzchiva®. Generics momentum accelerated in the third quarter, driven by recent launches and the lapping of the strong prior-year comparison in the first half.

North America overview

Net sales for the third quarter were USD 598 million, up 18% in constant currencies, compared to the third quarter of 2023. Net sales for the first nine months were USD 1.7 billion, up 15% in constant currencies versus prior year.

Growth was driven by the ongoing uptake of Hyrimoz® in the US, the acquisition of Cimerli®, share gain of Omnitrope® in the US and the launch of Wyost®/Jubbonti® in Canada. This was partly offset by a decline in generics sales due to the timing of new launches in the US.

International overview

Net sales for the third quarter were USD 635 million, up 8% in constant currencies, compared to the third quarter of 2023. Net sales for the first nine months were USD 1.9 billion, up 9% in constant currencies versus prior year.

This was primarily a result of strong volume growth across both generics and biosimilars, contribution from the acquisition of Mycamine® in the prior year, favorable price dynamics and recent launches, partly offset by the divestment of the Chinese business in the second quarter.

GUIDANCE 2024

On the back of strong momentum in its biosimilars business and solid generics demand, the company is increasing its full-year 2024 net sales guidance to high-single digit growth in constant currencies versus prior year (from mid- to high-single digit) and is confirming its core EBITDA margin guidance of around 20%.

THIRD-QUARTER STRATEGIC MILESTONES

Sandoz continued to execute on its strategy and passed additional milestones in its biosimilars portfolio.

On July 1, the company announced the US FDA approval of biosimilar Pyzchiva® for all indications of the reference medicine. The company intends to launch Pyzchiva® in the US among the first wave of ustekinumab biosimilars in February 2025.

On July 25, Sandoz announced the launch of biosimilar Pyzchiva® across Europe to treat chronic inflammatory diseases. Pyzchiva® was the first biosimilar to launch in Europe with all reference medicine strengths, including an initiation dose for Crohn’s disease.

On August 12, Sandoz received FDA approval for Enzeevu™ to treat neovascular age-related macular degeneration. This approval further enhances the company’s leading US ophthalmology portfolio and increases access for patients. Launch timing will be dependent on several factors, including the progress and outcome of pending or potential litigation or any potential settlements.

KEY LINKS

Webcast – Live at 9am CET

Analyst call presentation

Analyst consensus

DISCLAIMER

This media release contains forward-looking statements, which offer no guarantee with regard to future performance. These statements are made on the basis of management’s views and assumptions regarding future events and business performance at the time the statements are made. They are subject to risks and uncertainties including, but not confined to, future global economic conditions, exchange rates, legal provisions, market conditions, activities by competitors and other factors outside of the control of Sandoz. Should one or more of these risks or uncertainties materialize or should underlying assumptions prove incorrect, actual outcomes may vary materially from those forecasted or expected. Each forward-looking statement speaks only as of the date of the particular statement, and Sandoz undertakes no obligation to publicly update or revise any forward-looking statements, except as required by law.

This media release includes non-IFRS financial measures as defined by Sandoz. An explanation of non-IFRS measures can be found in the Supplementary financial information of the Half-Year Report 2024.

ABOUT SANDOZ

Sandoz (SDZSDZNY is the global leader in generic and biosimilar medicines, with a growth strategy driven by its Purpose: pioneering access for patients. More than 20,000 people of 100 nationalities work together to ensure 800 million patient treatments are provided by Sandoz, generating substantial global healthcare savings and an even larger social impact. Its leading portfolio of approximately 1,500 products addresses diseases from the common cold to cancer. Headquartered in Basel, Switzerland, Sandoz traces its heritage back to 1886. Its history of breakthroughs includes Calcium Sandoz in 1929, the world’s first oral penicillin in 1951, and the world’s first biosimilar in 2006. In 2023, Sandoz recorded net sales of USD 9.6 billion.

CONTACTS

SUPPORTING FINANCIAL INFORMATION

Quarterly net sales

2024

| Q1 2024 | Change % | Q2 2024 | Change % | Q3 2024 | Change % | |||||||

| USD millions unless indicated otherwise | USD | cc | USD | cc | USD | cc | ||||||

| Generics | 1 869 | 0 | 1 | 1 835 | -1 | 1 | 1 854 | 3 | 4 | |||

| Biosimilars | 623 | 21 | 21 | 720 | 35 | 37 | 741 | 36 | 37 | |||

| Net sales to third parties |

2 492 | 5 | 6 | 2 555 | 7 | 9 | 2 595 | 11 | 12 | |||

| Q1 2024 | Change % | Q2 2024 | Change % | Q3 2024 | Change % | |||||||

| USD millions unless indicated otherwise | USD | cc | USD | cc | USD | cc | ||||||

| Europe | 1 326 | 4 | 2 | 1 308 | 2 | 3 | 1 362 | 13 | 12 | |||

| North America | 524 | 6 | 6 | 620 | 22 | 23 | 598 | 17 | 18 | |||

| International | 642 | 4 | 12 | 627 | 5 | 9 | 635 | 2 | 8 | |||

| Net sales to third parties |

2 492 | 5 | 6 | 2 555 | 7 | 9 | 2 595 | 11 | 12 | |||

2023

| Q1 2023 | Change % | Q2 2023 | Change % | Q3 2023 | Change % | Q4 2023 | Change % | |||||||||

| USD millions unless indicated otherwise | USD | cc* | USD | cc* | USD | cc* | USD | cc* | ||||||||

| Generics | 1 868 | 2 | 6 | 1 850 | 4 | 6 | 1 794 | 5 | 4 | 1 920 | 6 | 6 | ||||

| Biosimilars | 516 | 11 | 17 | 533 | 13 | 14 | 543 | 7 | 4 | 623 | 29 | 26 | ||||

| Net sales to third parties |

2 384 | 4 | 9 | 2 383 | 5 | 8 | 2 337 | 6 | 4 | 2 543 | 11 | 10 | ||||

| Q1 2023 | Change % | Q2 2023 | Change % | Q3 2023 | Change % | Q4 2023 | Change % | |||||||||

| USD millions unless indicated otherwise | USD | cc* | USD | cc* | USD | cc* | USD | cc* | ||||||||

| Europe | 1 270 | 10 | 16 | 1 277 | 14 | 12 | 1 204 | 11 | 3 | 1 272 | 10 | 4 | ||||

| North America | 496 | -5 | -3 | 508 | -4 | -2 | 510 | -4 | -3 | 615 | 20 | 20 | ||||

| International | 618 | -1 | 4 | 598 | -3 | 8 | 623 | 3 | 12 | 656 | 4 | 14 | ||||

| Net sales to third parties |

2 384 | 4 | 9 | 2 383 | 5 | 8 | 2 337 | 6 | 4 | 2 543 | 11 | 10 | ||||

¹ Net sales in this document refer systematically to net sales to third parties. In the first nine months of 2023, third-party sales excluded sales to our former parent. Post spin-off, sales to our former parent are reported as third-party sales.

² An explanation of non-IFRS measures can be found in the Supplementary financial information of the Half-Year Report 2024

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Alphabet, Microsoft And 3 Stocks To Watch Heading Into Wednesday

With U.S. stock futures trading mixed this morning on Wednesday, some of the stocks that may grab investor focus today are as follows:

- Wall Street expects Meta Platforms, Inc. META to report quarterly earnings at $5.25 per share on revenue of $40.29 billion after the closing bell, according to data from Benzinga Pro. Meta shares gained 2.3% to $606.90 in after-hours trading.

- Alphabet Inc. GOOG GOOGL posted better-than-expected results for the third quarter on Tuesday. The company reported third-quarter revenue of $88.27 billion, up 15% year-over-year. The total beat a Street consensus estimate of $86.31 billion. Alphabet shares gained 5.8% to $179.50 in the after-hours trading session.

- Analysts expect Microsoft Corp. MSFT to post quarterly earnings at $3.10 per share on revenue of $64.51 billion. The company will release earnings after the markets close. Microsoft shares rose 1.2% to $437.06 in after-hours trading.

Check out our premarket coverage here

- Visa Inc. V reported upbeat fourth-quarter results after Tuesday’s closing bell. Visa reported quarterly earnings of $2.71 per share, which beat the analyst consensus estimate of $2.58 per share. Visa shares rose 1.8% to $286.93 in the after-hours trading session.

- Analysts expect Caterpillar Inc. CAT to report quarterly earnings at $5.36 per share on revenue of $16.28 billion before the opening bell. Caterpillar shares fell 0.1% to $387.21 in after-hours trading.

Check This Out:

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nasdaq Hits Record High Ahead Of Big Tech Earnings: Fear Index Remains In 'Greed' Zone

The CNN Money Fear and Greed index showed a decline in the overall market sentiment, while the index remained in the “Greed” zone on Tuesday.

U.S. stocks settled mixed on Tuesday, with the Nasdaq Composite surging to a new record high during the session.

Pfizer Inc. PFE reported better-than-expected results for its third quarter. McDonald’s Corp. MCD posted better-than-expected third-quarter earnings on Tuesday.

On the economic data front, the S&P CoreLogic Case-Shiller home price index rose 5.2% year-over-year in August versus a 5.9% gain in July. U.S. wholesale inventories declined by 0.1% month-over-month to $905 billion in September compared to a revised 0.2% gain in the earlier month. The U.S. trade deficit increased to $108.2 billion in September from the $94.2 billion gap in the previous month.

Most sectors on the S&P 500 closed on a negative note, with energy, consumer staples, and utilities stocks recording the biggest losses on Tuesday. However, information technology and communication services stocks bucked the overall market trend, closing the session higher.

The Dow Jones closed lower by around 155 points to 42,233.05 on Tuesday. The S&P 500 rose 0.16% to 5,832.92, while the Nasdaq Composite climbed 0.78% to close at 18,712.75 during Tuesday’s session.

Investors are awaiting earnings results from Meta Platforms, Inc. META, Microsoft Corp. MSFT, Caterpillar Inc. CAT, and Starbucks Corp. SBUX today.

What is CNN Business Fear & Greed Index?

At a current reading of 60.2, the index remained in the “Greed” zone on Tuesday, versus a prior reading of 60.9.

The Fear & Greed Index is a measure of the current market sentiment. It is based on the premise that higher fear exerts pressure on stock prices, while higher greed has the opposite effect. The index is calculated based on seven equal-weighted indicators. The index ranges from 0 to 100, where 0 represents maximum fear and 100 signals maximum greediness.

Read Next:

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bitcoin Correction Incoming? Bhutan Moves BTC Worth $60M To Binance

Bhutan transferred millions worth of state-owned Bitcoin BTC/USD to Binance after a four-month hiatus, sparking speculations of profit-taking as the top cryptocurrency surged toward all-time highs.

What Happened: On Tuesday, on-chain analytics firm Arkham Intelligence disclosed that the Bhutanese government moved a sizable portion of its stash, up to 832.249 BTC, worth $60.16 million at the current market price, to the leading cryptocurrency exchange. The last time such a transaction occurred was in July, marking a four-month gap.

After the transfer, the associated wallet was still left with 12,467 BTCs, worth $902 million.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Benzinga simplifies the market for smarter investing

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.

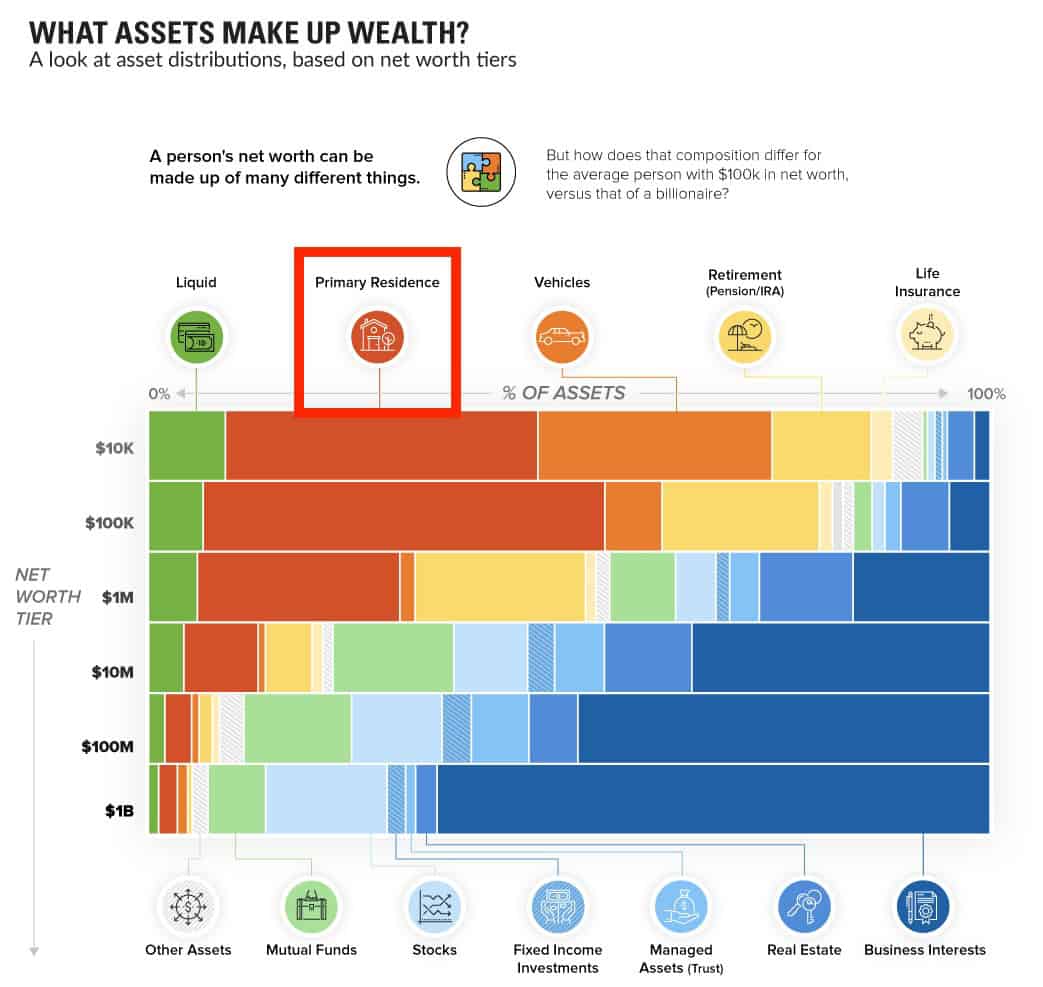

How Much House Is Too Much?

Homeownership is a cherished part of American society and a cornerstone of the American Dream. With the homeownership rate at 65% within the U.S. and home prices near record highs, the question is: how much house is too much?

In other words, at what point is your house too big a portion of your overall assets? As a reminder, your total assets are everything that you own. This would include: your car, your house, your stocks, your bonds, your retirement accounts, and much more.

Given this, what percentage of your total assets should be in your primary residence? Is there a point where this percentage gets too high? And what are the risks associated with having too much of your money in a single property?

All of these questions, and more, will be answered in this blog post. We’ll explore the data behind homeownership in the U.S., some rules of thumb when it comes to how much house you can afford, and why this matters.

To start, let’s look at how much house the typical American owns.

How Much House Do Most Americans Own?

Though only 65% of Americans own their own home, among these homeowners, a significant percentage of their assets are in their primary residence. According to the 2022 Survey of Consumer Finances, the typical U.S. homeowner (i.e. median homeowner) has 60% of their total assets in their home.

To put this in perspective, the median total assets among U.S. homeowners is around $530,000. This means that roughly $318,000 of those assets (60%) would be in one asset—their house. The rest of their assets would be everything other than their house. But that’s just the median, what about the rest of the distribution? Here’s what that looks like:

- 10th Percentile = 18% of Total Assets in Primary Residence

- 25th Percentile = 36% of Total Assets in Primary Residence

- 50th Percentile = 60% of Total Assets in Primary Residence

- 75th Percentile = 81% of Total Assets in Primary Residence

- 90th Percentile = 91% of Total Assets in Primary Residence

In other words, 25% of U.S. homeowners have less than 36% of their assets in their primary residence and 1 in 10 U.S. homeowners have more than 91% of their assets in their primary residence! This illustrates the variation in how much house different American households own relative to their assets.

If we look at this breakdown by different net worth tiers, we can see that relatively poorer households have more of their wealth in their primary residence than wealthier households (h/t Visual Capitalist):

This demonstrates the importance of housing for the middle and upper middle class within the United States. Now that we’ve looked at how much house Americans tend to own, is there an ideal amount? Let’s take a look at that now.

What’s the Ideal Amount of House to Own?

When it comes to figuring out the ideal amount of house to own, there are two ways to approach this: based on your assets or based on your income. While neither approach is perfect, these two methodologies should help give you some peace of mind when it comes to buying a home.

- Asset-Based Approaches

- The One-Third Rule: Your primary residence should not be worth more than 33% of your total assets.

- The 40% of Net Worth Rule: Your primary residence should not be worth more than 40% of your total net worth. This rule is based on net worth (i.e. assets minus liabilities) rather than total assets which will be more conservative than the One-Third Rule.

- Age-based: Your allocation to your home should go down over time due to increasing age and decreasing risk tolerance:

- Under 35: Up to 40% of total assets

- 35-55: Up to 30% of total assets

- Over 55: Up to 20% of total assets

- Income-Based Approaches

- The 28/36 Rule: Your monthly mortgage payment shouldn’t exceed 28% of your monthly income and your total debt payments shouldn’t exceed 36% of your monthly income.

- The 35%/45% Rule: Your monthly mortgage payment shouldn’t exceed 35% of your monthly pre-tax income or 45% of your monthly post-tax income.

- The 2.5x Income Rule: Your home’s value should not exceed 2.5x your annual income. Therefore, if your income were $100,000, you shouldn’t buy a house worth more than $250,000.

Based on the asset-based approaches mentioned here, most American homeowners have far too much of their assets in their primary residence. This suggests that these households are either using a more reasonable income-based approach or they are overextending themselves to buy a home.

Whether you decide to use an asset-based or income-based approach when looking for a new home, these guidelines exist for a reason. They are meant to reduce the risk of owning a home so that you don’t get into future financial trouble. For those unfamiliar with such risks, we will cover them now.

The Risks Of Owning Too Much House

When it comes to the risks of having too much of your total assets in your home, a few ideas come to mind:

- Diversification: Concentrating too much of your wealth in a single asset class leaves you exposed to the volatility of that asset class. Anyone who owned a home in 2008 and saw their net worth decline by 20% (or more) knows what this feels like. Having a smaller percentage of your wealth in your primary residence is the best way to offset such a risk.

- Maintenance: Having too much of your assets in your home means that you are likely overextended and have to spend more on maintenance than you may be able to afford. Generally larger home are more expensive to maintain than smaller homes. Keep this in mind when buying a home that is already a little outside your budget.

- Illiquidity: While having a bigger, better home is great, much of that value is inaccessible as home equity. And, as the saying goes, “You can’t eat your home equity.” As a result, before buying a bigger home, think about how much more of your wealth you are locking up in a less liquid asset class.

- Property taxes: Similar to maintenance costs, if your property taxes go up over time, this will cost you even more on a more expensive home (all else equal). Owning a home is a lot more than just a mortgage, so make sure to take these other costs into account before pulling the trigger.

- Opportunity costs: Since your home is illiquid, every dollar you have locked up in it is a dollar that you can’t invest in income-producing assets. Remember what you give up when you decide to buy more house than what you truly need.

The risks of owning a home are about more than what initially meets the eye. While being less diversified is the most obvious risk, it’s not the only one. The phantom costs of owning a more expensive property and the illiquid nature of real estate amplify this problem even further.

The Bottom Line

When trying to figure out how much house is too much, the answer is in the eye of the beholder. Some approaches that work for one person may not work for another. And while there are many guidelines that you should consider on your home-buying journey, there are many other factors that can influence this decision. For example, the financial status of your parents, your financial goals, and where you live will all impact whether you can afford more or less house than the rules listed above.

Ultimately, what matters is finding a balance between getting the home that you want in the present without jeopardizing your financial future. If that means that you end up owning a home that is large share of your assets, but a small share of your income, that’s fine. You don’t have to follow an asset-based or an income-based approach when it comes to buying a house. However, I recommend that you at least consider these approaches during your house-hunting journey.

So, how much house is too much? The amount that could put your financial future in danger. After all, what’s the point of buying a bigger home if you can’t keep it?

Thank you for reading!

If you liked this post, consider signing up for my newsletter.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

SKF interim report Q3 2024: Solid margin and strong cash flow in weak markets

GOTHENBURG, Sweden, Oct. 30, 2024 /PRNewswire/ —

Q3 2024

Net sales: SEK 23,692 million (25,771)

Organic growth: −4.4% (−0.6%), driven by lower market demand across most regions and industries.

Adjusted operating profit: SEK 2,821 million (2,956). Continued strong price/mix contribution, driven by pricing actions and active portfolio management, as well as good cost control which largely offset the lower volumes and currency headwind.

Adjusted operating margin: 11.9% (11.5%)

Net cash flow from operations: SEK 3,576 million (3,435)

Rickard Gustafson, President and CEO:

“We are pleased to report a continued solid margin development, representing a year-over-year improvement, despite declining volumes in the prevailing weak market environment and significant currency headwinds. We continue our strategic execution creating an even stronger SKF, with the initiated separation of our Automotive business as a key component.”

Solid margin and strong cash flow

The weak market conditions prevailed globally during the third quarter, which also was reflected in multiple leading external macro indicators. Our organic sales declined by -4.4%, driven in particular by a weak demand in China and within Automotive, especially towards the end of the quarter. On the other hand, our sales in India and within Aerospace were solid.

Our adjusted operating margin, on the other hand, improved year-over-year and came in just shy of 12%, another proof point of our ability to better adapt to volatile market conditions. Our cost management and robust price/mix actions have effectively offset lower sales volumes, a significant negative currency impact and ongoing regionalization of our manufacturing footprint. We continue to work hard on cost out activities to mitigate potential short-term impact on our cost efficiency from the current lower volume environment.

Our ability to uphold solid earnings also contributed to a strong cash flow from operations of SEK 3.6 billion.

Unlocking value by separating the Automotive business

The announced initiated separation of our Automotive segment follows our strategy to create a separate Automotive business. There is a strong strategic rationale for the separation since Industrial and Automotive are two business segments with different business logics. By establishing two fit-for-purpose independent companies, we expect to unlock long-term value and to accelerate profitable growth in both businesses.

Since the announcement of the separation in mid-September, we have kick-started the separation planning and formed a dedicated project organization with the aim of listing the Automotive business in the first half of 2026. We intend to host a Capital Markets Day in Q4 2025 to share more information on the ambitions for both our Industrial and Automotive businesses.

Strategic portfolio management to build a stronger SKF

We continue to actively work with our portfolio to create a more focused and resilient SKF. I’m pleased that we have signed a contract to divest our ring and seal operation in Hanover, USA, which is a non-strategic asset for our Aerospace business, representing annual sales of approximately SEK 700 million, for a total value of approximately SEK 2.3 billion. Aerospace will remain one of our largest customer industries, representing total annual sales of approximately SEK 6 billion, corresponding to 9% of industrial net sales after the divestment. We will continue to invest and strengthen our position in core Aerospace segments related to the aeroengine and aerostructure bearing offers to optimize our business potential.

With our strategy and decentralized operating model being well implemented, we are now in a position to also gradually accelerate profitable growth through smaller bolt-on acquisitions. As an example, the announced acquisition of John Sample Group is margin accretive and further strengthens our lubrication offering and position in the expansive India and Southeast Asia region.

I would like to express my sincere gratitude to our employees for their contributions to achieving solid margin and strong cash flow, despite the weak demand environment, and a continued high pace in our strategic execution.

Outlook

We expect to see continued market and geopolitical volatility, and the business is prepared to tackle different scenarios. For the fourth quarter of 2024, we expect a mid-single-digit organic sales decline, year-over-year. For the full year, we expect a mid-single-digit organic sales decline, compared to 2023.”

|

Financial overview, MSEK unless otherwise stated |

Q3 2024 |

Q3 2023 |

Jan-Sep 2024 |

Jan-Sep 2023 |

|

Net sales |

23,692 |

25,771 |

73,997 |

79,443 |

|

Organic growth, % |

−4.4 |

−0.6 |

−6.1 |

5.7 |

|

Adjusted operating profit |

2,821 |

2,956 |

9,448 |

10,049 |

|

Adjusted operating margin, % |

11.9 |

11.5 |

12.8 |

12.6 |

|

Operating profit |

2,526 |

2,567 |

8,008 |

9,159 |

|

Operating margin, % |

10.7 |

10.0 |

10.8 |

11.5 |

|

Adjusted profit before taxes |

2,536 |

2,582 |

8,515 |

8,855 |

|

Profit before taxes |

2,241 |

2,193 |

7,075 |

7,965 |

|

Net cash flow from operating activities |

3,576 |

3,435 |

7,509 |

9,846 |

|

Basic earnings per share |

3.40 |

3.64 |

10.91 |

12.67 |

|

Adjusted earnings per share |

4.05 |

4.49 |

14.07 |

14.62 |

|

Net sales, change y-o-y, %, Q3 |

Organic1) |

Structure |

Currency |

Total |

|

SKF Group |

−4.4 |

0.0 |

−3.6 |

−8.0 |

|

Industrial |

−4.6 |

0.0 |

−3.7 |

−8.3 |

|

Automotive |

−4.0 |

0.0 |

−3.5 |

−7.5 |

|

1) Price, mix and volume |

||||

|

Net sales, change y-o-y, %, Jan-Sep 2024 |

Organic1) |

Structure |

Currency |

Total |

|

SKF Group |

−6.1 |

0.0 |

−0.8 |

−6.9 |

|

Industrial |

−6.5 |

0.1 |

−0.9 |

−7.3 |

|

Automotive |

−5.1 |

0.0 |

−0.8 |

−5.9 |

|

1) Price, mix and volume |

||||

|

Organic sales in local currencies, change y-o-y, %, Q3 |

Europe, Middle East & Africa |

The Americas |

China & Northeast Asia |

India & Southeast Asia |

|

SKF Group |

−5.2 |

−2.9 |

−8.7 |

2.9 |

|

Industrial |

– |

+/- |

— |

+ |

|

Automotive |

— |

– |

+/- |

+ |

|

Organic sales in local currencies, change y-o-y, %, Jan-Sep 2024 |

Europe, Middle East & Africa |

The Americas |

China & Northeast Asia |

India & Southeast Asia |

|

SKF Group |

−5.5 |

−6.1 |

−10.8 |

1.5 |

|

Industrial |

— |

— |

— |

+/- |

|

Automotive |

— |

— |

+/- |

++ |

Outlook and Guidance

Outlook

- Q4 2024: We expect a mid-single-digit organic sales decline, year-over-year.

- FY 2024: We expect a mid-single-digit organic sales decline, year-over-year.

Guidance Q4 2024

- Currency impact on the operating profit is expected to be around SEK 250 million negative compared with the fourth quarter 2023, based on exchange rates per 30 September 2024.

Guidance FY 2024

- Tax level excluding effects related to divested businesses: around 26%.

- Additions to property, plant and equipment: around SEK 5 billion.

A webcast will be held on 30 October 2024 at 08:00 (CET):

Sweden +46 (0)8 5051 0031

UK / International +44 (0)207 107 0613

https://investors.skf.com/en

Aktiebolaget SKF

(publ)

The financial information in this press release contains inside information that AB SKF is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication through the agency of the contact person set out below on 30 October 2024 at 07.00 CET.

For further information, please contact:

PRESS: Carl Bjernstam, Head of Media Relations

tel: 46 31-337 2517; mobile: 46 722-201 893; e-mail: carl.bjernstam@skf.com

INVESTOR RELATIONS: Sophie Arnius, Head of Investor Relations

tel: 46 31-337 8072; mobile: 46 705-908 072; e-mail: sophie.arnius@skf.com

This information was brought to you by Cision http://news.cision.com

The following files are available for download:

![]() View original content:https://www.prnewswire.com/news-releases/skf-interim-report-q3-2024-solid-margin-and-strong-cash-flow-in-weak-markets-302291134.html

View original content:https://www.prnewswire.com/news-releases/skf-interim-report-q3-2024-solid-margin-and-strong-cash-flow-in-weak-markets-302291134.html

SOURCE SKF

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Akastor ASA: Third Quarter Results 2024

FORNEBU, Norway, Oct. 30, 2024 /PRNewswire/ —

Third Quarter Highlights

- Net capital employed increased by NOK 0.1 billion during the quarter to NOK 4.8 billion. Equity stood at NOK 5.6 billion at the end of the quarter, corresponding to NOK 20.4 per share, up from NOK 20.2 per share at the end of the last quarter.

- Akastor remained in a net cash position through the quarter, with no draw on corporate facilities.

- HMH delivered an adjusted EBITDA of USD 46 million for the quarter, up 32 percent year-on-year. The company completed the acquisition of Drillform, a leader in automated drilling tools, in July.

- Post-quarter end, Mr. Daniel “Dan” W. Rabun was appointed as Chairman of the Board of Directors of HMH.

- AKOFS Offshore achieved near-100 percent utilization on AKOFS Seafarer and Aker Wayfarer during the period. AKOFS Santos saw improved performance, recording a utilization of 85 percent, including 10 days of maintenance downtime.

- DDW Offshore operated all three vessels throughout the quarter, with a significant contract backlog secured post-quarter end, providing a solid foundation for 2025.

Akastor CEO Karl Erik Kjelstad comments:

“Akastor maintained its strong financial position through the third quarter, with net cash on account and no draw on corporate facilities, leaving us well positioned for potential future distributions. Our portfolio companies delivered another solid quarter, confirming their attractive positions within their respective niches. Despite slightly lower activity in HMH’s Service segment, the company achieved impressive year-on-year EBITDA growth. We were also pleased to see HMH complete the acquisition of Drillform, further advancing its growth strategy by expanding onshore capabilities. Both AKOFS Offshore and DDW Offshore delivered solid performances, with all vessels in operation throughout the quarter and high utilization. Additionally, DDW Offshore secured a significant contract backlog after the quarter ended, positioning the company well for the future.”

HMH

HMH reported revenues of USD 213 million in the quarter, with an adjusted EBITDA of USD 46 million, corresponding to an EBITDA margin of almost 22 percent.

Revenues from Aftermarket Services were USD 141 million in the quarter, down 4 percent year-on-year and down 6 percent quarter-on-quarter driven by lower service order intake in the quarter. Order intake within this segment was down 10 percent year-on-year and down 8 percent quarter-on-quarter driven by flat rig activity and restrained spending by customers.

Revenues from Projects, Products & Other were USD 73 million in the quarter, up 30 percent year-on-year and up 25 percent quarter-on-quarter driven by increased product shipments.

AKOFS Offshore

AKOFS Offshore reported revenues of USD 38 million and EBITDA of USD 11 million in the quarter.

The three vessels AKOFS Seafarer, AKOFS Santos and Aker Wayfarer all operated under their respective contracts through the full period. Aker Wayfarer delivered a revenue utilization of 99 percent, while AKOFS Seafarer delivered 98 percent. AKOFS Santos reported a revenue utilization of 85 percent in period, affected by a maintenance stop of 10 days.

DDW Offshore

DDW Offshore reported revenues of NOK 97 million and EBITDA of NOK 40 million in the quarter, up from NOK 53 million and NOK 18 million respectively in the same period last year. Revenue and EBITDA in period was affected by higher utilization than previous periods, as all three vessels were in operation through the full period. Skandi Emerald operated for Petrofac, while Skandi Atlantic was on contract with Chevron, both recording 100 percent utilization in the period. Skandi Peregrino operated in the spot market from Aberdeen through the third quarter after being reactivated and classed earlier this year, with a recorded utilization of 40 percent for the period.

Post quarter-end, the vessels Skandi Peregrino and Skandi Atlantic secured one-year contracts with an international oil company in Australia, set to commence in January and March 2025, respectively. These contracts provide solid visibility into 2025 and strengthen DDW Offshore’s presence in the Australian market.

Financial holdings

Net financials were negative NOK 59 million in the quarter, which included a non-cash net foreign exchange loss of NOK 27 million. Other financial investments contributed negatively with NOK 42 million.

Share of net profit from equity-accounted investees contributed positively with NOK 58 million. HMH contributed positively with NOK 100 million, whilst AKOFS Offshore contributed negatively with NOK 42 million.

Consolidated financial figures

Akastor’s consolidated revenue and EBTDA include earnings from subsidiaries which represent a minor part of Akastor’s total Net Capital Employed. The most relevant proxy for value development of Akastor is therefore the financial performance of each of the largest investments such as HMH, NES Fircroft and AKOFS Offshore. With this in mind, consolidated revenue and EBITDA of Akastor in the third quarter was NOK 99 million and NOK 25 million, respectively. Net profit in the third quarter was NOK 6 million.

Financial calendar

Fourth Quarter Results 2024: February 13, 2025

Media Contact

Øyvind Paaske

Chief Financial Officer

Tel: +47 917 59 705

E-mail: oyvind.paaske@akastor.com

Akastor is a Norway-based oil-services investment company with a portfolio of industrial holdings and other investments. The company has a flexible mandate for active ownership and long-term value creation.

This information is subject to the disclosure requirements pursuant to section 5 -12 of the Norwegian Securities Trading Act.

This information was brought to you by Cision http://news.cision.com.

The following files are available for download:

![]() View original content:https://www.prnewswire.com/news-releases/akastor-asa-third-quarter-results-2024-302291137.html

View original content:https://www.prnewswire.com/news-releases/akastor-asa-third-quarter-results-2024-302291137.html

SOURCE Akastor ASA

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Wolters Kluwer 2024 Nine-Month Trading Update

Wolters Kluwer 2024 Nine-Month Trading Update

Alphen aan den Rijn, October 30, 2024 – Wolters Kluwer, a global leader in professional information, software solutions and services, today releases its scheduled 2024 nine-month trading update.

Highlights

- Full-year 2024 guidance reiterated.

- Nine-month revenues up 6% in constant currencies and up 6% organically.

- Recurring revenues (83% of total revenues) up 7% organically; non-recurring revenues up 2%.

- Expert solutions revenues (59% of total revenues) grew 8% organically.

- Cloud software revenues (18% of total revenues) grew 16% organically.

- Nine-month adjusted operating profit up 8% in constant currencies.

- Nine-month adjusted operating profit margin increased.

- Nine-month adjusted free cash flow up 9% in constant currencies.

- Third quarter benefitted from favorable timing of vendor payments.

- Net-debt-to-EBITDA ratio 1.8x as of September 30, 2024.

- Share buyback 2024: on track to reach €1 billion by year-end.

- Share buyback 2025: mandate signed to repurchase up to €100 million in January and February 2025.

Nancy McKinstry, CEO and Chair of the Executive Board, commented: “I am pleased to report 6% organic growth through the first nine months, supported by continued growth in recurring revenues, led by our expert solutions including cloud-based software platforms. Investments in product innovation remained at record levels as we continue to pursue opportunities to support our customers in their drive for improved performance, outcomes, and efficiencies. We are on track to meet our full-year guidance.”

Nine Months to September 30, 2024

Total revenues were up 6% in the first nine months of 2024, despite a slightly weaker U.S. dollar in the third quarter. Excluding the effect of currency, acquisitions, and divestments, organic growth was 6% in the first nine months (9M 2023: 5%).

Recurring revenues (83% of total revenues) sustained 7% organic growth (9M 2023: 7%; HY 2024: 7%). Within recurring revenues, cloud software revenues grew 16% organically (9M 2023: 15%). Non-recurring revenues (17% of total revenues) increased 2% organically (9M 2023: 2% decline), benefitting from the improved trend in Legal Services transactional fees in the Financial & Corporate Compliance division compared to last year. Apart from transactional fees, non-recurring revenues include print books, on-premise software licenses, software implementation services, and other non-subscription products and services.

Revenues from North America (64% of total) grew 6% organically (9M 2023: 4%) while revenues from Europe (28% of total) grew 5% (9M 2023: 7%). Asia Pacific & ROW (8% of total) grew 7% organically (9M 2023: 8%).

Nine-month adjusted operating profit increased 8% in constant currencies. The nine-month adjusted operating profit margin improved, mainly driven by our Financial & Corporate Compliance and Legal & Regulatory divisions. Restructuring expenses, which are included in adjusted operating profit, increased. Product development spend (CAPEX + OPEX) was maintained at 11% of revenues (9M 2023: 11% of revenues).

Health: Nine-month revenues increased 6% in constant currencies and 6% organically (9M 2023: 6%). Clinical Solutions recorded 8% organic growth (9M 2023: 7%), led by clinical decision tool UpToDate and our clinical drug databases (Medi-Span and UpToDate Lexidrug). The UpToDate patient engagement solution delivered good growth. Surveillance, compliance, and terminology software saw improved organic growth, mainly reflecting the Invistics drug diversion business acquired in June 2023. Health Learning, Research & Practice recorded 3% organic growth (9M 2023: 4%), with good organic growth in medical research against a challenging comparable alongside improved growth in education and practice. In September 2024, we completed the previously announced divestment of Learner’s Digest International (LDI).

Tax & Accounting: Nine-month revenues increased 5% in constant currencies, reflecting the transfer of our Chinese legal research solution (BOLD) from Tax & Accounting to Legal & Regulatory at the start of the year. On an organic basis, revenues grew 7% (9M 2023: 8%). The North American business recorded 7% organic growth (9M 2023: 8%), driven by double-digit organic growth in our cloud-based software suite, CCH Axcess. While outsourced professional services continued to see strong growth, print books and other non-recurring revenues recorded slower growth. Tax & Accounting Europe sustained 7% organic growth (9M 2023: 7%) and began integrating the cloud software business acquired in September from the Isabel Group. Tax & Accounting Asia Pacific & ROW organic revenues were stable.

Financial & Corporate Compliance: Nine-month revenues increased 5% in constant currencies. On an organic basis, revenues rose 5% (9M 2023: 1%), with recurring revenues up 6% organically (9M 2023: 5%) and non-recurring transactional revenues up 3% (9M 2023: 7% decline). Legal Services grew 7% organically (9M 2023: 1%), supported by services subscriptions and 6% growth in Legal Services transactions. Subscriptions to our Beneficial Ownership Information (BOI) platform continued to build, in line with expectations. Financial Services recorded 3% organic growth (9M 2023: 0%), reflecting growth in recurring revenues and a stabilization in transactional revenues.

Legal & Regulatory: Nine-month revenues grew 8% in constant currencies, partly reflecting the transfer of BOLD into the division and bolt-on acquisitions. On an organic basis, revenues grew 5% (9M 2023: 4%). Legal & Regulatory Information Solutions grew 5% organically (9M 2023: 4%), supported by 7% growth in digital information solutions. Legal & Regulatory Software revenues grew 7% organically (9M 2023: 5%), led by double-digit organic growth at Legisway and continued growth in ELM transactional revenues.

Corporate Performance & ESG: Nine-month revenues increased 7% in constant currencies. On an organic basis, revenues increased by 7% (9M 2023: 8%), as recurring cloud software revenues sustained growth of 12%, but non-recurring on-premise license fees and software implementation services declined 2% (9M 2023: 0%). Our EHS & ESG1 unit (Enablon) delivered 14% organic growth (9M 2023: 15%), driven by 21% growth in cloud-based software revenues, partly offset by a decline in on-premise software license revenues. Within Corporate Performance Management, the CCH Tagetik CPM platform delivered 9% organic growth (9M 2023: 14%), driven by 17% organic growth in cloud software accompanied by a decline in on-premise software licenses and modest growth in services. Our Audit & Assurance (TeamMate) and Finance, Risk & Reporting (OneSumX) units posted modest organic growth for the nine-month period.

Corporate: Costs decreased in constant currencies as increased personnel costs were more than offset by lower miscellaneous expenses.

Cash Flow and Net Debt

Nine-month adjusted operating cash flow increased 7% in constant currencies, reflecting fewer large vendor payments in the third quarter. Nine-month adjusted free cash flow increased 9% in constant currencies.

Total dividends paid to shareholders amounted to €491 million in the first nine months, including the 2023 final dividend and the 2024 interim dividend (withholding tax to be paid in October). Total acquisition spending, net of cash acquired and including transaction costs, was €332 million in the first nine months, primarily related to the acquisition of Isabel Group assets completed in September 2024. Share repurchases amounted to €762 million in the first nine months.

As of September 30, 2024, net debt was €3,356 million (year-end 2023: €2,612 million), reflecting acquisition spending and cash returns to shareholders. Twelve months’ rolling net-debt-to-EBITDA was 1.8x (compared to 1.5x at year-end 2023).

Sustainability Update

Throughout 2024, we have continued to invest in programs designed to attract, engage, retain, and develop talent globally. Our workforce turnover rate remained stable throughout the first nine months at around 10%. Human resources programs currently emphasize career development and manager enablement while continuing initiatives to support an inclusive and engaging workplace culture. In the third quarter, we rolled out our Annual Compliance Training, which covers cybersecurity, data privacy, and business ethics. As of the end of October, over 99% of employees globally have completed the exercise.

Our global real estate team made better-than-expected progress in further rationalizing our office footprint, having been able to exit certain office leases earlier than planned. Through the first nine months of 2024, we have achieved an 8% organic reduction in office space (m2) compared to year-end 2023, thereby reducing our Scope 1 and 2 greenhouse gas emissions.

We continued work to align our sustainability reporting with the European Sustainability Reporting Standards (ESRS) set by the EU Corporate Sustainability Reporting Directive (CSRD).

Share Cancellation 2024

On September 13, 2024, we cancelled 10.0 million shares that were held in treasury, as approved by shareholders at the AGM in May 2024. Following this cancellation, the number of issued ordinary shares is now 238,516,153. As of September 30, 2024, 235.8 million shares were outstanding, and 2.7 million shares were held in treasury.

Share Buyback Program 2024 and 2025

In February 2024, we announced a 2024 share buyback program of up to €1 billion. In the year to date, through October 28, 2024, we have completed approximately 85% of this buyback, having repurchased €853 million in shares (5.8 million shares at an average price of €147.64). A third-party mandate is in place to complete the final tranche of €147 million in the period starting October 31, 2024, up to and including December 27, 2024.

For the upcoming year 2025, we have this week signed a third-party mandate to execute up to €100 million in share buybacks for the period starting January 2, 2025, up to and including February 24, 2025.

We continue to believe this level of share buybacks leaves us with ample headroom to support our dividend plans, to sustain organic investment, and to make selective acquisitions. The share repurchases may be suspended, discontinued, or modified at any time.

Third party mandates are governed by the limits of relevant laws and regulations (in particular Regulation (EU) 596/2014) and Wolters Kluwer’s Articles of Association. Repurchased shares are added to and held as treasury shares and are either cancelled or held to meet future obligations arising from share-based incentive plans. We remain committed to our anti-dilution policy which aims to offset the dilution caused by our annual incentive share issuance with share repurchases.

Full-Year 2024 Outlook

Our group-level guidance for 2024 is unchanged. See table below. We expect sustained good organic growth in 2024, in line with the prior year, and an increase in the adjusted operating profit margin.

| Full-Year 2024 Outlook | |||

| Performance indicators | 2024 Guidance | 2023 Actual | |

| Adjusted operating profit margin* | 26.4%-26.8% | 26.4% | |

| Adjusted free cash flow** | €1,150-€1,200 million | €1,164 million | |

| ROIC* | 17%-18% | 16.8% | |

| Diluted adjusted EPS growth** | Mid- to high single-digit | 12% | |

| *Guidance for adjusted operating profit margin and ROIC is in reporting currency and assumes an average EUR/USD rate in 2024 of €/$1.10. **Guidance for adjusted free cash flow and diluted adjusted EPS is in constant currencies (€/$ 1.08). Guidance reflects share repurchases of €1 billion in 2024. | |||

In 2023, Wolters Kluwer generated over 60% of its revenues and adjusted operating profit in North America. As a rule of thumb, based on our 2023 currency profile, each 1 U.S. cent move in the average €/$ exchange rate for the year causes an opposite change of approximately 3 euro cents in diluted adjusted EPS2.

We include restructuring costs in adjusted operating profit. We now expect 2024 restructuring expenses to increase to approximately €20-€25 million (FY 2023: €15 million). We expect adjusted net financing costs3 in constant currencies to be approximately €55 million. We expect the benchmark tax rate on adjusted pre-tax profits to be in the range of 23.0%-24.0% (FY 2023: 22.9%).

Capital expenditures are expected to be at the upper end of our guidance range of 5.0%-6.0% of total revenues (FY 2023: 5.8%). We continue to expect the full-year 2024 cash conversion ratio to be around 95% (FY 2023: 100%) due to lower net working capital inflows.

Our guidance assumes no additional significant change to the scope of operations. We may make further acquisitions or disposals which can be dilutive to margins, earnings, and ROIC in the near term.

2024 outlook by division

Our guidance for full-year 2024 organic revenue growth by divisions is summarized below. We expect the increase in full-year adjusted operating profit margin to be driven by our Finance & Corporate Compliance, Legal & Regulatory, and Corporate Performance & ESG divisions.

Health: we expect full-year 2024 organic growth to be in line with prior year (FY 2023: 6%). The division margin is expected to decline slightly due to one-time write-offs to streamline the portfolio.

Tax & Accounting: we expect full-year 2024 organic growth to be slightly below prior year (FY 2023: 8%) due to slower growth in non-recurring revenues and the absence of one-time favorable events in Europe. The division margin is expected to decline slightly due to increased product investment.

Financial & Corporate Compliance: we expect full-year 2024 organic growth to be higher than prior year (FY 2023: 2%) with Legal Services transactions recovering and Financial Services transactions stable.

Legal & Regulatory: we expect full-year 2024 organic growth to be in line with or slightly better than prior year (FY 2023: 4%).

Corporate Performance & ESG: we expect full-year 2024 organic growth to be in line with or slightly higher than in the prior year (FY 2023: 9%) as Finance, Risk & Reporting revenues stabilize.

About Wolters Kluwer

Wolters Kluwer WKL is a global leader in information, software solutions and services for professionals in healthcare; tax and accounting; financial and corporate compliance; legal and regulatory; corporate performance and ESG. We help our customers make critical decisions every day by providing expert solutions that combine deep domain knowledge with technology and services.

Wolters Kluwer reported 2023 annual revenues of €5.6 billion. The group serves customers in over 180 countries, maintains operations in over 40 countries, and employs approximately 21,400 people worldwide. The company is headquartered in Alphen aan den Rijn, the Netherlands.

Wolters Kluwer shares are listed on Euronext Amsterdam (WKL) and are included in the AEX, Euro Stoxx 50, and Euronext 100 indices. Wolters Kluwer has a sponsored Level 1 American Depositary Receipt (ADR) program. The ADRs are traded on the over-the-counter market in the U.S. (WTKWY).

For more information, visit www.wolterskluwer.com, follow us on LinkedIn, Facebook, YouTube, and Instagram.

Financial Calendar

February 26, 2025 Full-Year 2024 Results

March 12, 2025 Publication of 2024 Annual Report

May 6, 2025 First-Quarter 2025 Trading Update

May 15, 2025 Annual General Meeting of Shareholders

May 19, 2025 Ex-dividend date: 2024 final dividend ordinary shares

May 20, 2025 Record date: 2024 final dividend

June 11, 2025 Payment date: 2024 final dividend ordinary shares

June 18, 2025 Payment date: 2024 final dividend ADRs

July 30, 2025 Half-Year 2025 Results

August 26, 2025 Ex-dividend date: 2025 interim dividend ordinary shares

August 27, 2025 Record date: 2025 interim dividend

September 18, 2025 Payment date: 2025 interim dividend

September 25, 2025 Payment date: 2025 interim dividend ADRs

November 5, 2025 Nine-Month 2025 Trading Update

| Media | Investors/Analysts |

| Dave Guarino | Meg Geldens |