Smart Money Is Betting Big In BAC Options

Deep-pocketed investors have adopted a bearish approach towards Bank of America BAC, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in BAC usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 16 extraordinary options activities for Bank of America. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 37% leaning bullish and 50% bearish. Among these notable options, 6 are puts, totaling $251,916, and 10 are calls, amounting to $541,952.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $30.0 to $50.0 for Bank of America over the last 3 months.

Analyzing Volume & Open Interest

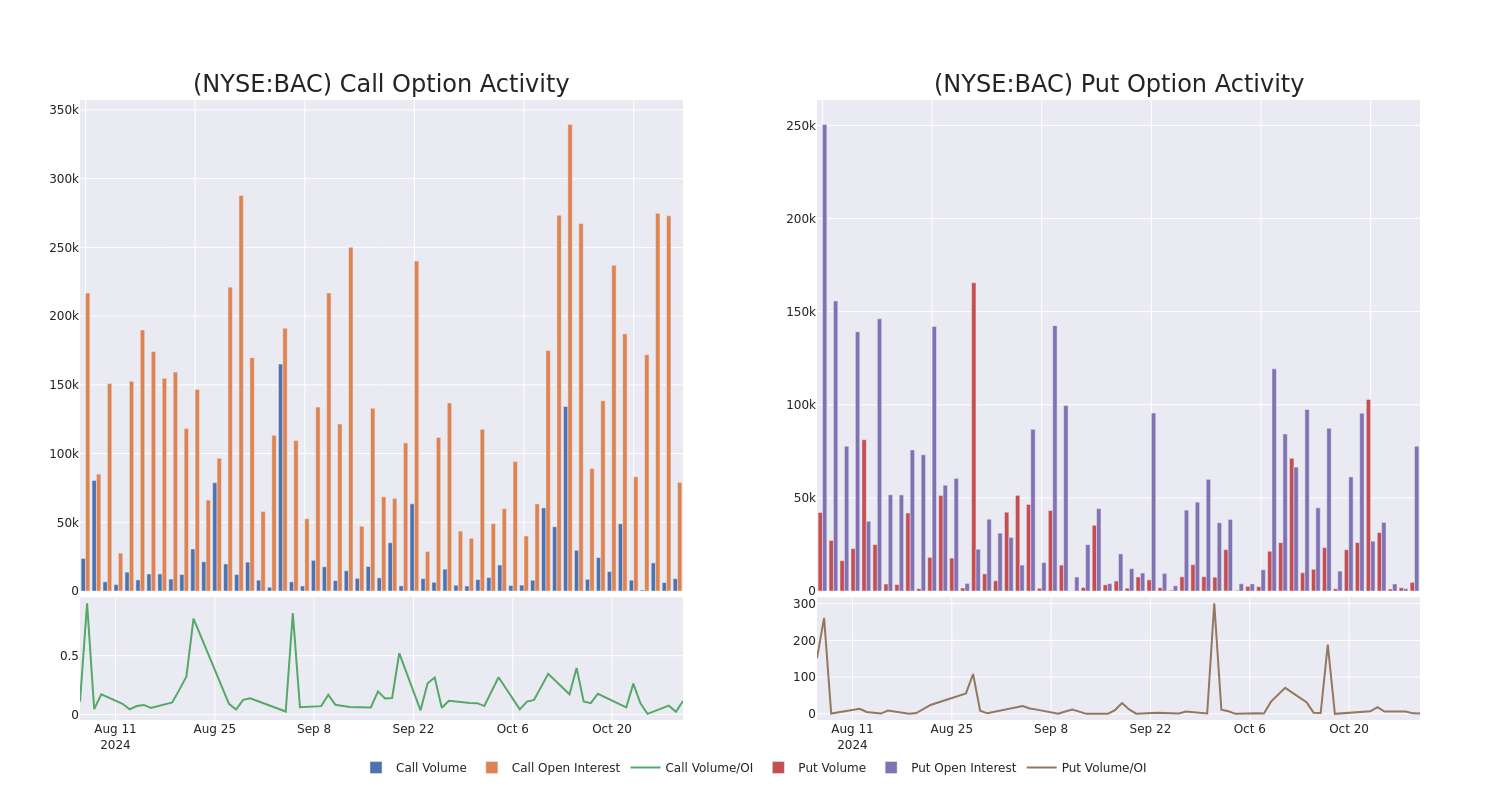

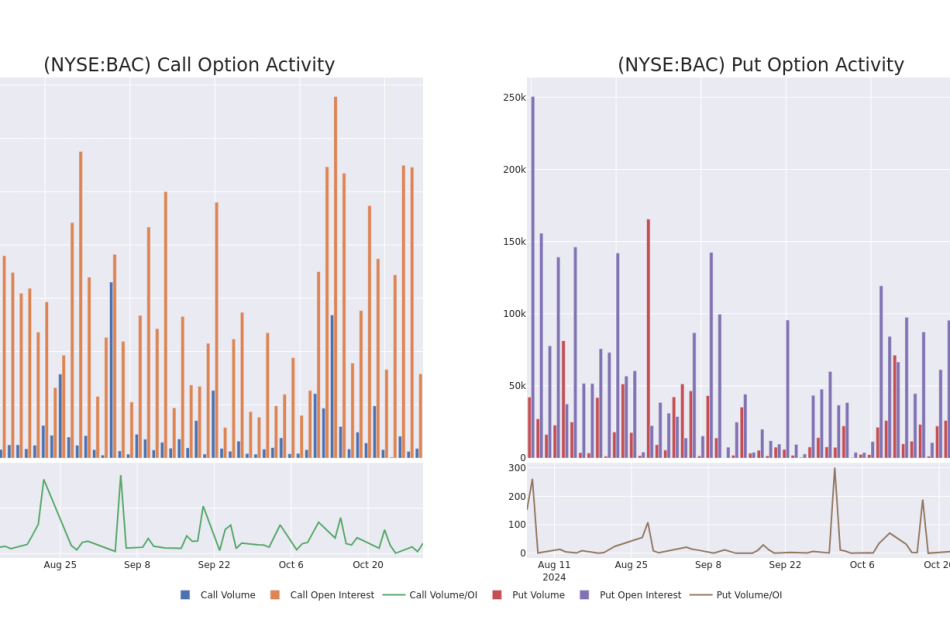

In today’s trading context, the average open interest for options of Bank of America stands at 9801.5, with a total volume reaching 13,625.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Bank of America, situated within the strike price corridor from $30.0 to $50.0, throughout the last 30 days.

Bank of America Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BAC | CALL | SWEEP | BEARISH | 11/15/24 | $1.01 | $1.0 | $1.0 | $43.00 | $100.0K | 20.9K | 1.3K |

| BAC | CALL | SWEEP | BEARISH | 11/15/24 | $7.7 | $7.65 | $7.68 | $35.00 | $96.0K | 4.8K | 125 |

| BAC | PUT | SWEEP | BEARISH | 11/15/24 | $0.74 | $0.72 | $0.73 | $42.00 | $67.7K | 14.7K | 1.2K |

| BAC | CALL | TRADE | BEARISH | 11/01/24 | $0.46 | $0.44 | $0.44 | $42.50 | $61.6K | 9.5K | 5.0K |

| BAC | CALL | SWEEP | BULLISH | 11/15/24 | $9.85 | $9.8 | $9.84 | $33.00 | $59.0K | 233 | 62 |

About Bank of America

Bank of America is one of the largest financial institutions in the United States, with more than $3.0 trillion in assets. It is organized into four major segments: consumer banking, global wealth and investment management, global banking, and global markets. Bank of America’s consumer-facing lines of business include its network of branches and deposit-gathering operations, retail lending products, credit and debit cards, and small-business services. The company’s Merrill Lynch operations provide brokerage and wealth-management services, as does its private bank. Wholesale lines of business include investment banking, corporate and commercial real estate lending, and capital markets operations. Bank of America has operations in several countries but is primarily US-focused.

Where Is Bank of America Standing Right Now?

- Trading volume stands at 28,291,427, with BAC’s price down by -0.51%, positioned at $42.31.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 78 days.

What Analysts Are Saying About Bank of America

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $48.8.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Morgan Stanley persists with their Overweight rating on Bank of America, maintaining a target price of $48.

* An analyst from Phillip Securities has elevated its stance to Accumulate, setting a new price target at $44.

* An analyst from Keefe, Bruyette & Woods persists with their Outperform rating on Bank of America, maintaining a target price of $50.

* An analyst from Oppenheimer has decided to maintain their Outperform rating on Bank of America, which currently sits at a price target of $49.

* Consistent in their evaluation, an analyst from Barclays keeps a Overweight rating on Bank of America with a target price of $53.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Bank of America with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply