Smart Money Is Betting Big In Li Auto Options

Investors with a lot of money to spend have taken a bullish stance on Li Auto LI.

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with LI, it often means somebody knows something is about to happen.

Today, Benzinga’s options scanner spotted 28 options trades for Li Auto.

This isn’t normal.

The overall sentiment of these big-money traders is split between 53% bullish and 35%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $60,800, and 27, calls, for a total amount of $1,670,482.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $28.0 to $31.0 for Li Auto over the last 3 months.

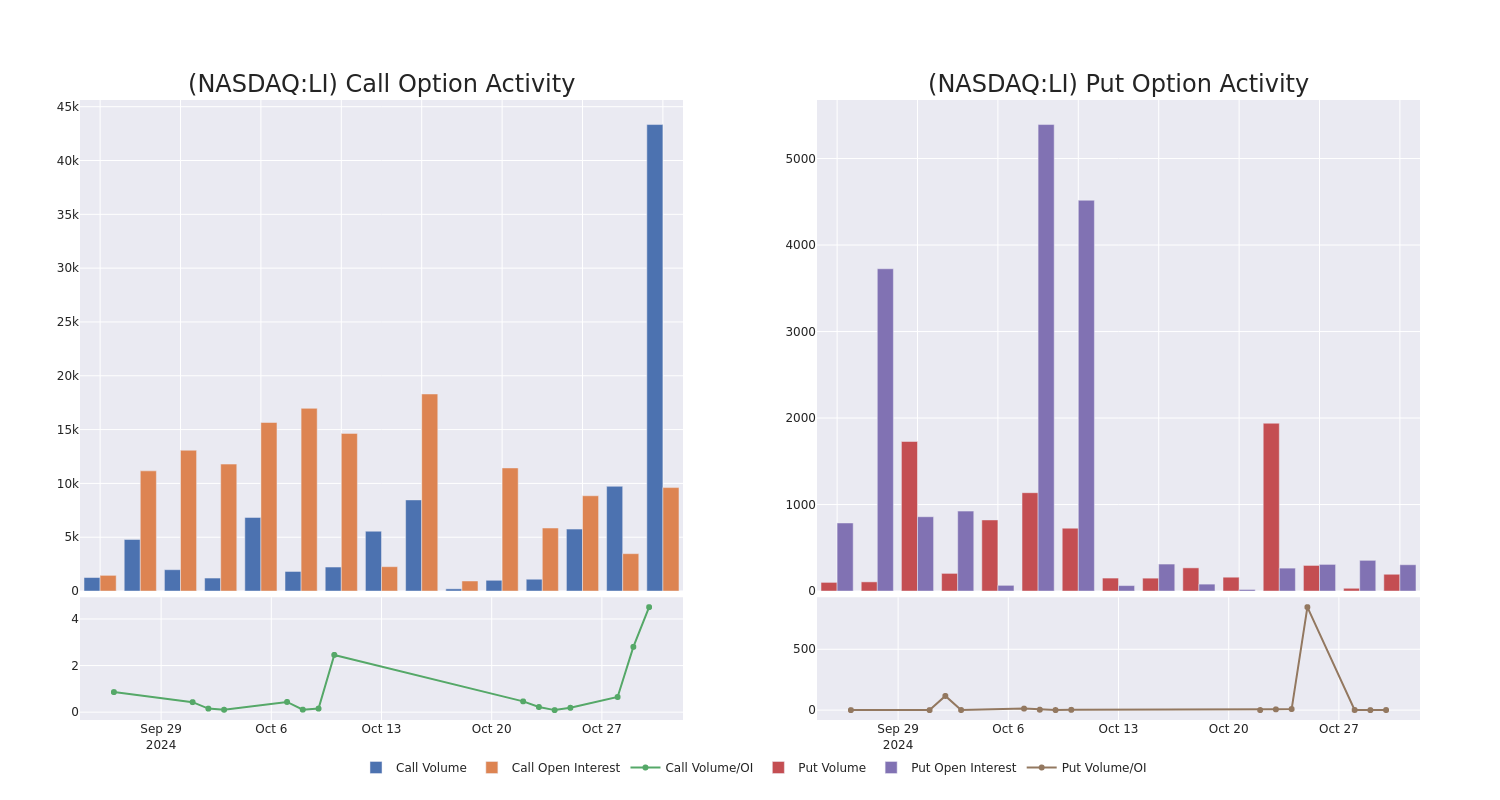

Insights into Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Li Auto’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Li Auto’s substantial trades, within a strike price spectrum from $28.0 to $31.0 over the preceding 30 days.

Li Auto Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LI | CALL | SWEEP | NEUTRAL | 06/20/25 | $5.95 | $5.85 | $5.85 | $28.00 | $118.7K | 749 | 203 |

| LI | CALL | SWEEP | BULLISH | 12/20/24 | $1.87 | $1.86 | $1.86 | $31.00 | $116.5K | 1.5K | 2.1K |

| LI | CALL | SWEEP | BULLISH | 12/20/24 | $2.03 | $1.91 | $2.03 | $31.00 | $103.9K | 1.5K | 4.4K |

| LI | CALL | SWEEP | BULLISH | 12/20/24 | $2.03 | $2.02 | $2.03 | $31.00 | $101.5K | 1.5K | 3.9K |

| LI | CALL | SWEEP | BEARISH | 03/21/25 | $3.9 | $3.85 | $3.85 | $30.00 | $92.4K | 1.6K | 241 |

About Li Auto

Li Auto is a leading Chinese NEV manufacturer that designs, develops, manufactures, and sells premium smart NEVs. The company started volume production of its first model Li One in November 2019. The model is a six-seater, large, premium plug-in electric SUV equipped with a range extension system and advanced smart vehicle solutions. It sold over 376,000 NEVs in 2023, accounting for about 4% of China’s passenger new energy vehicle market. Beyond Li One, the company expands its product line, including both BEVs and PHEVs, to target a broader consumer base.

Having examined the options trading patterns of Li Auto, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Li Auto’s Current Market Status

- Trading volume stands at 8,535,156, with LI’s price up by 2.71%, positioned at $29.19.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 1 days.

What The Experts Say On Li Auto

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $33.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Macquarie downgraded its action to Neutral with a price target of $33.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Li Auto, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply