Spotlight on Duolingo: Analyzing the Surge in Options Activity

Whales with a lot of money to spend have taken a noticeably bullish stance on Duolingo.

Looking at options history for Duolingo DUOL we detected 17 trades.

If we consider the specifics of each trade, it is accurate to state that 58% of the investors opened trades with bullish expectations and 41% with bearish.

From the overall spotted trades, 5 are puts, for a total amount of $265,830 and 12, calls, for a total amount of $670,279.

What’s The Price Target?

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $210.0 and $400.0 for Duolingo, spanning the last three months.

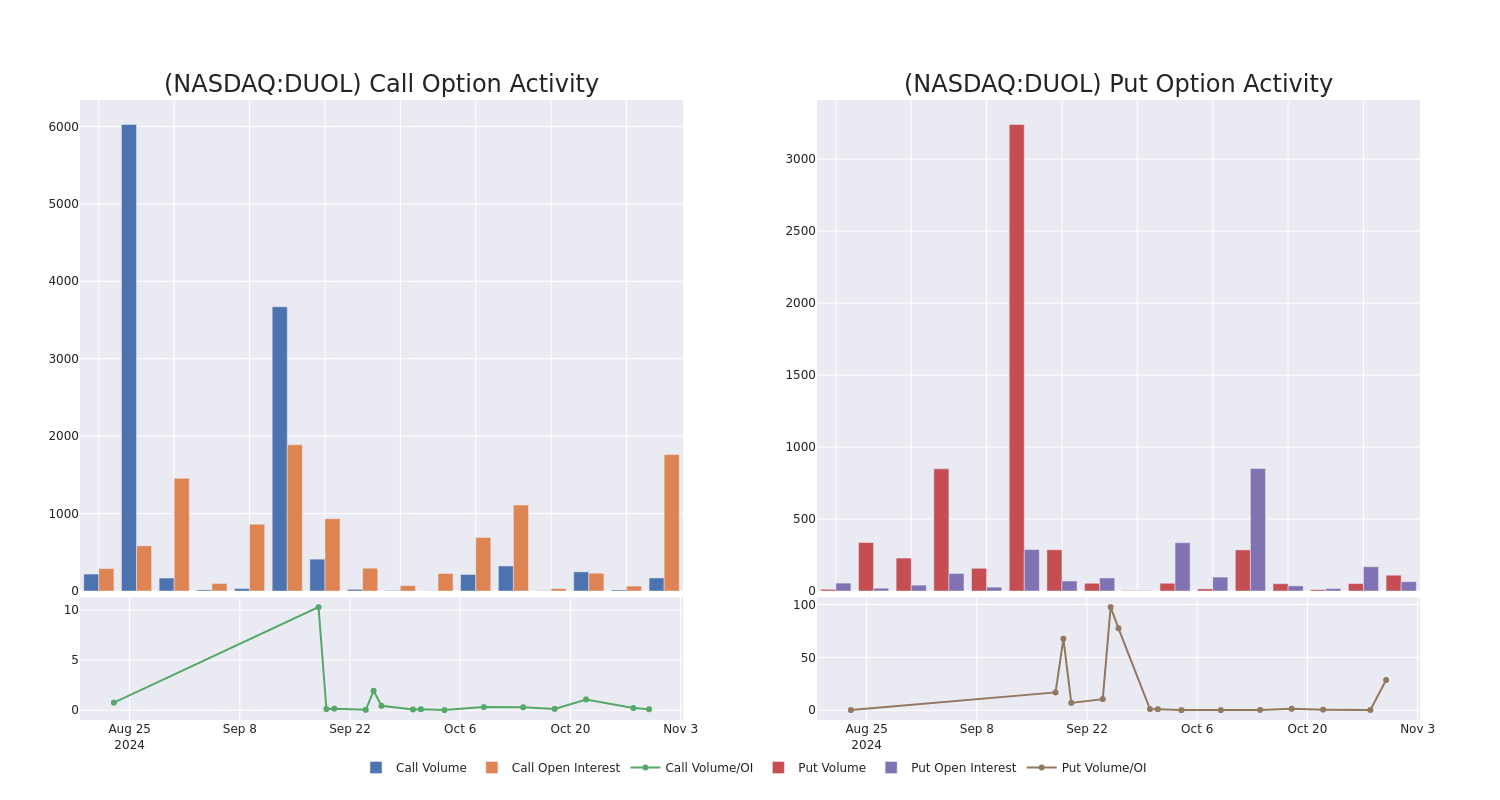

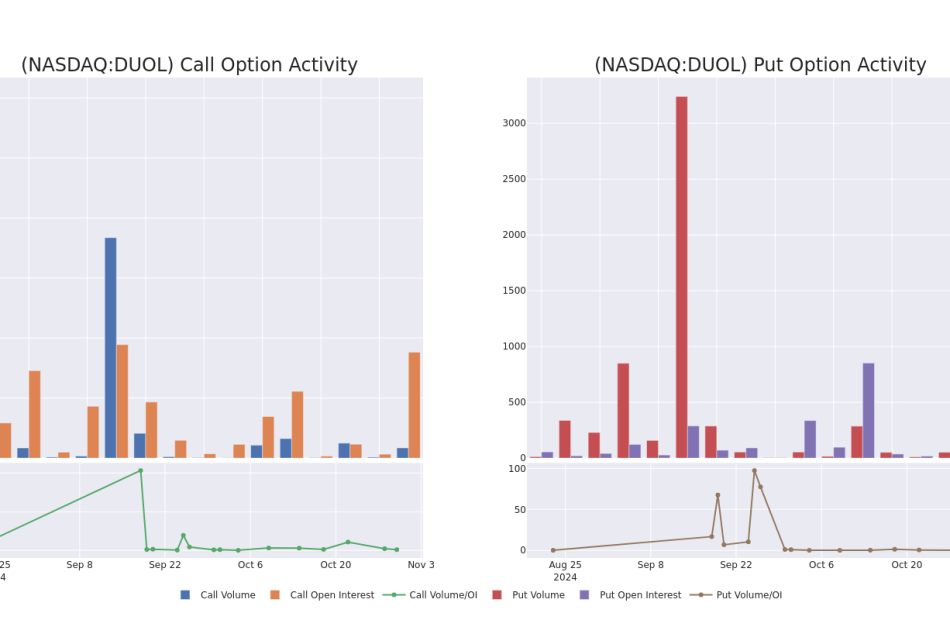

Volume & Open Interest Trends

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Duolingo’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Duolingo’s whale trades within a strike price range from $210.0 to $400.0 in the last 30 days.

Duolingo Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DUOL | CALL | SWEEP | BULLISH | 02/21/25 | $40.5 | $38.5 | $39.98 | $300.00 | $122.6K | 113 | 30 |

| DUOL | CALL | TRADE | BEARISH | 11/15/24 | $56.6 | $54.5 | $54.5 | $250.00 | $103.5K | 179 | 1 |

| DUOL | PUT | TRADE | BEARISH | 11/15/24 | $92.8 | $89.7 | $92.1 | $400.00 | $92.1K | 1 | 10 |

| DUOL | CALL | TRADE | BEARISH | 02/21/25 | $79.5 | $76.9 | $77.7 | $240.00 | $77.7K | 42 | 10 |

| DUOL | PUT | TRADE | BULLISH | 11/15/24 | $35.4 | $34.5 | $34.8 | $330.00 | $69.6K | 4 | 20 |

About Duolingo

Duolingo Inc is a technology company that develops mobile learning platform to learn languages and is the top-grossing app in the Education category on both Google Play and the Apple App Store. Its products are powered by sophisticated data analytics and artificial intelligence and delivered with class art, animation, and design to make it easier for learners to stay motivated master new material, and achieve their learning goals. Its solutions include The Duolingo Language Learning App, Super Duolingo, Duolingo English Test: AI-Driven Language Assessment, Duolingo For Schools, Duolingo ABC, and Duolingo Math. It has three predominant sources of revenue; time-based subscriptions, in-app advertising placement by third parties, and the Duolingo English Test.

Having examined the options trading patterns of Duolingo, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Duolingo

- With a trading volume of 614,483, the price of DUOL is up by 2.77%, reaching $302.98.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 7 days from now.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Duolingo options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply