This Is What Whales Are Betting On General Motors

Financial giants have made a conspicuous bullish move on General Motors. Our analysis of options history for General Motors GM revealed 8 unusual trades.

Delving into the details, we found 50% of traders were bullish, while 50% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $103,759, and 6 were calls, valued at $442,030.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $40.0 to $52.5 for General Motors over the last 3 months.

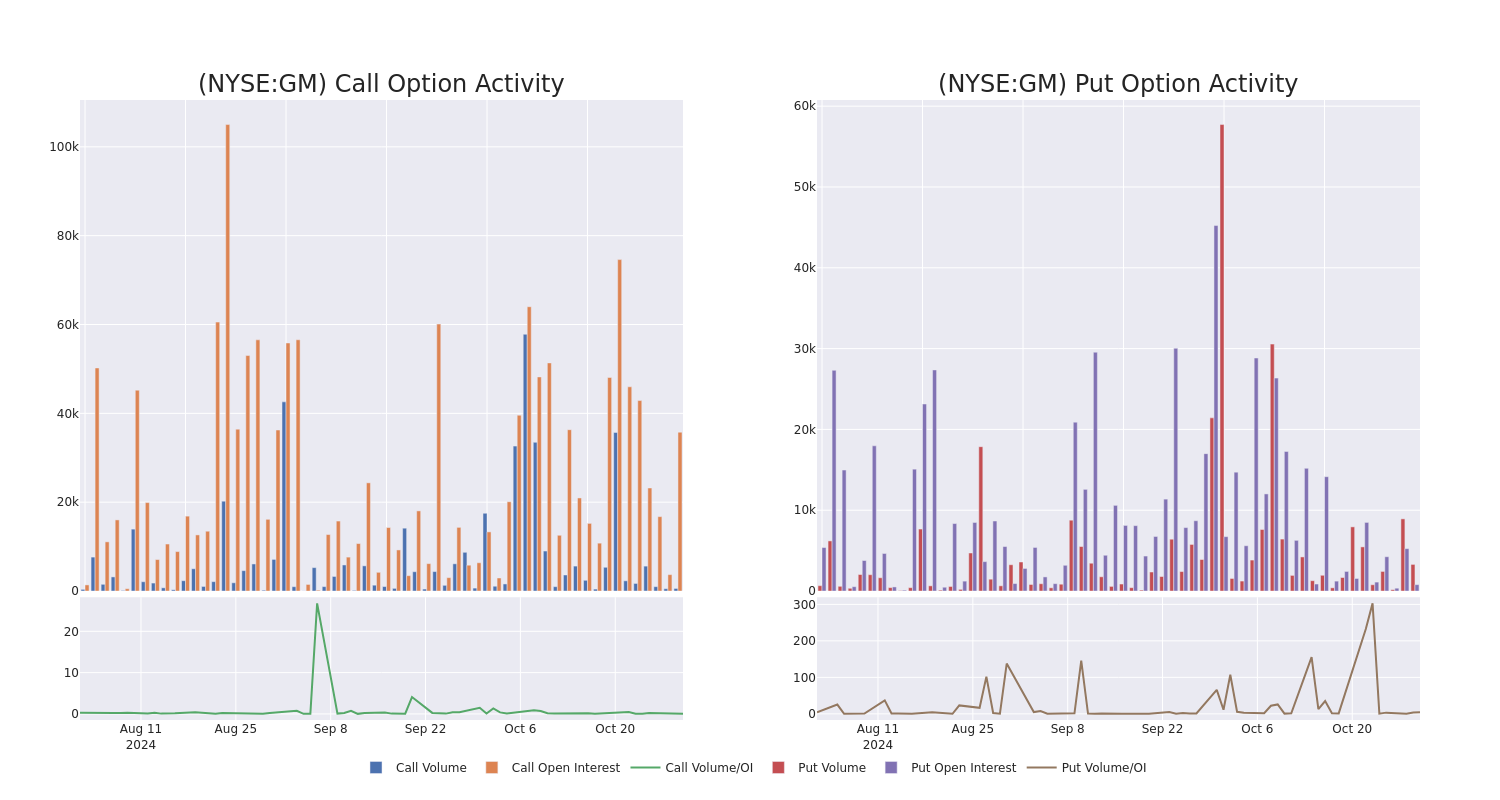

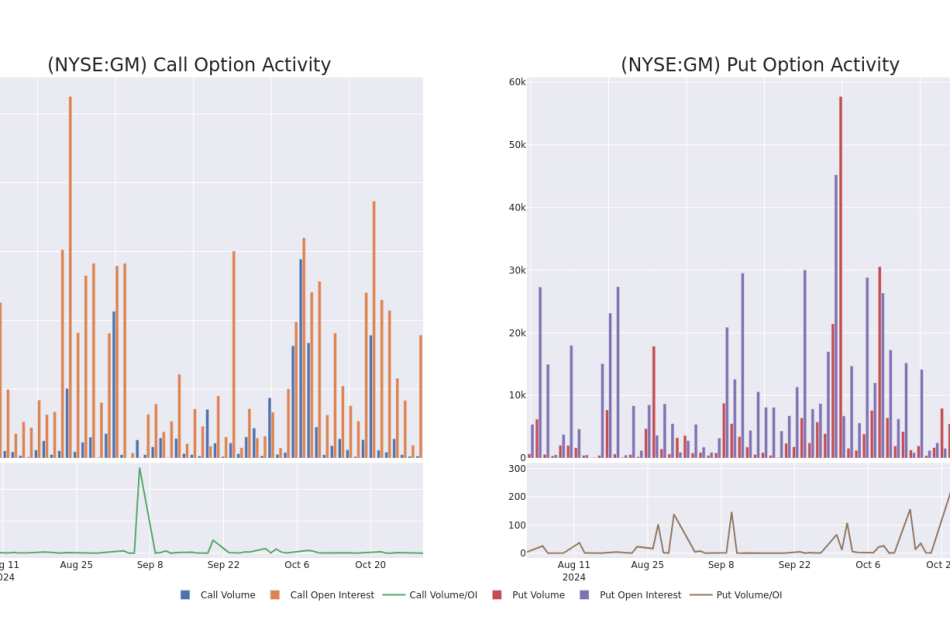

Volume & Open Interest Trends

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for General Motors’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of General Motors’s whale activity within a strike price range from $40.0 to $52.5 in the last 30 days.

General Motors Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GM | CALL | TRADE | BULLISH | 01/17/25 | $12.3 | $12.05 | $12.3 | $40.00 | $123.0K | 10.4K | 100 |

| GM | CALL | SWEEP | BEARISH | 06/20/25 | $10.65 | $10.55 | $10.55 | $45.00 | $99.1K | 8.1K | 98 |

| GM | CALL | SWEEP | BEARISH | 06/20/25 | $10.65 | $10.55 | $10.55 | $45.00 | $69.6K | 8.1K | 164 |

| GM | PUT | SWEEP | BEARISH | 11/08/24 | $0.56 | $0.56 | $0.56 | $51.00 | $66.4K | 792 | 1.3K |

| GM | CALL | SWEEP | BULLISH | 06/20/25 | $5.7 | $5.6 | $5.7 | $52.50 | $63.2K | 2.9K | 112 |

About General Motors

General Motors Co. emerged from the bankruptcy of General Motors Corp. (old GM) in July 2009. GM has eight brands and operates under four segments: GM North America, GM International, Cruise, and GM Financial. The United States now has four brands instead of eight under old GM. The company regained its us market share leader crown in 2022, after losing it to Toyota due to the chip shortage in 2021. 2023’s share was 16.5%. GM’s Cruise autonomous vehicle arm has previously done driverless geofenced AV robotaxi services in San Francisco and other cities but stopped in late 2023 after an accident. It restarted service in 2024 but not in California. GM owns over 80% of Cruise. GM Financial became the company’s captive finance arm in October 2010 via the purchase of AmeriCredit.

General Motors’s Current Market Status

- With a volume of 8,151,027, the price of GM is up 0.83% at $51.97.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 90 days.

Professional Analyst Ratings for General Motors

In the last month, 5 experts released ratings on this stock with an average target price of $58.2.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from RBC Capital downgraded its action to Outperform with a price target of $54.

* Maintaining their stance, an analyst from Bernstein continues to hold a Market Perform rating for General Motors, targeting a price of $55.

* An analyst from UBS has decided to maintain their Buy rating on General Motors, which currently sits at a price target of $62.

* Maintaining their stance, an analyst from RBC Capital continues to hold a Outperform rating for General Motors, targeting a price of $65.

* Reflecting concerns, an analyst from Wedbush lowers its rating to Outperform with a new price target of $55.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for General Motors, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply