This Is What Whales Are Betting On Lemonade

Whales with a lot of money to spend have taken a noticeably bullish stance on Lemonade.

Looking at options history for Lemonade LMND we detected 8 trades.

If we consider the specifics of each trade, it is accurate to state that 62% of the investors opened trades with bullish expectations and 37% with bearish.

From the overall spotted trades, 5 are puts, for a total amount of $215,432 and 3, calls, for a total amount of $105,105.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $18.0 to $25.0 for Lemonade during the past quarter.

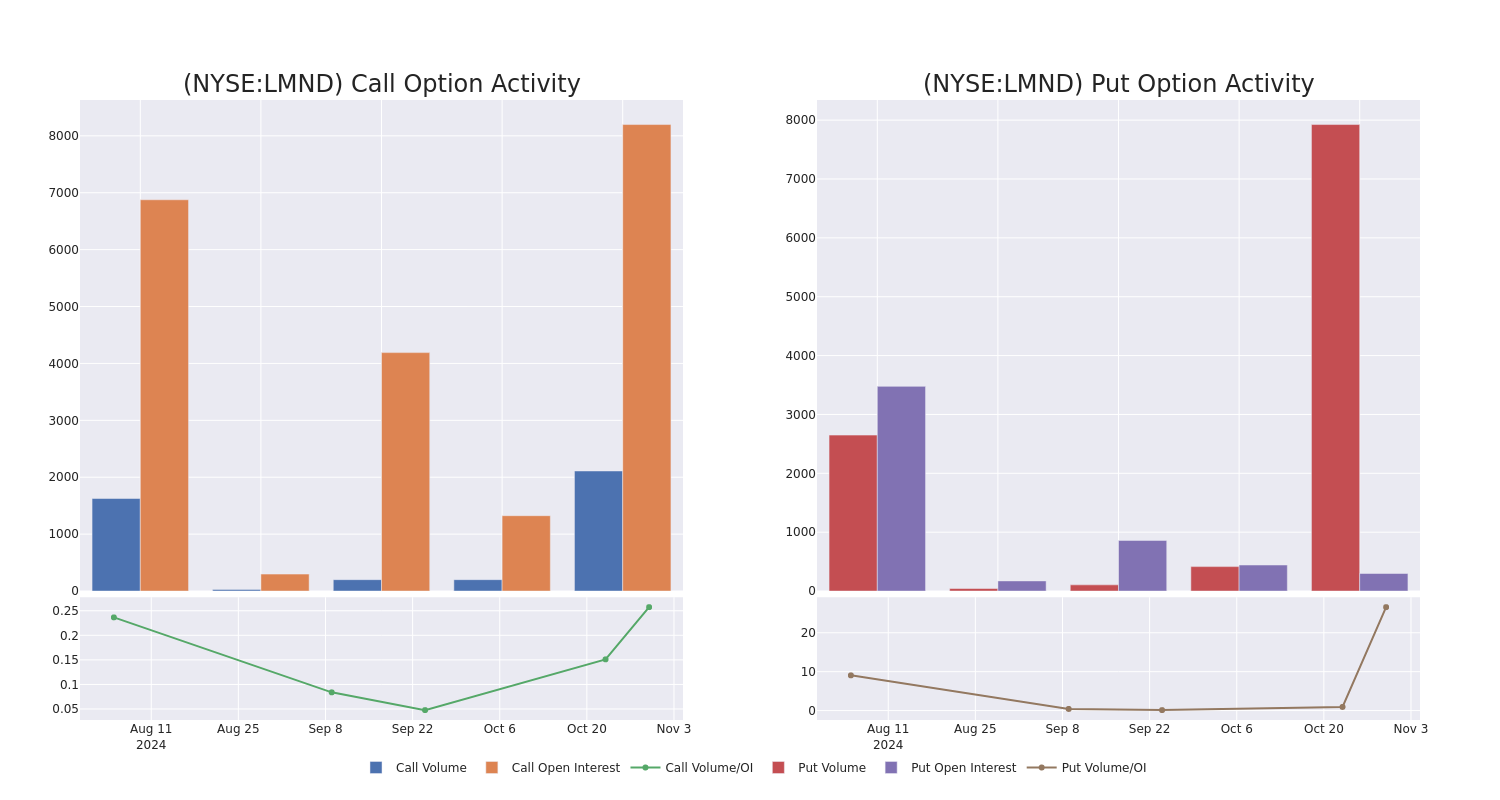

Insights into Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Lemonade options trades today is 2832.0 with a total volume of 10,035.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Lemonade’s big money trades within a strike price range of $18.0 to $25.0 over the last 30 days.

Lemonade 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LMND | PUT | SWEEP | BULLISH | 11/01/24 | $0.9 | $0.9 | $0.9 | $18.00 | $85.1K | 298 | 93 |

| LMND | CALL | SWEEP | BULLISH | 01/17/25 | $0.75 | $0.7 | $0.75 | $25.00 | $43.7K | 2.3K | 704 |

| LMND | PUT | SWEEP | BULLISH | 11/01/24 | $0.8 | $0.75 | $0.8 | $18.00 | $40.6K | 298 | 2.1K |

| LMND | PUT | SWEEP | BULLISH | 11/01/24 | $0.85 | $0.75 | $0.75 | $18.00 | $35.5K | 298 | 2.6K |

| LMND | CALL | TRADE | BULLISH | 01/17/25 | $0.8 | $0.65 | $0.75 | $25.00 | $31.2K | 2.3K | 1.1K |

About Lemonade

Lemonade Inc operates in the insurance industry. The company offers digital and artificial intelligence based platform for various insurances and for settling claims and paying premiums. The platform ensures transparency in issuing policies and settling disputes. The company is using technology, data, artificial intelligence, contemporary design, and social impact to deliver delightful and affordable insurances. Geographically, it operates in California, Texas, New York, New Jersey, Illinois, Georgia, Washington, Colorado, Pennsylvania, Oregon and others.

In light of the recent options history for Lemonade, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Lemonade

- Trading volume stands at 2,060,774, with LMND’s price up by 5.37%, positioned at $19.04.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 0 days.

What Analysts Are Saying About Lemonade

2 market experts have recently issued ratings for this stock, with a consensus target price of $27.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Reflecting concerns, an analyst from JMP Securities lowers its rating to Market Outperform with a new price target of $40.

* Consistent in their evaluation, an analyst from Jefferies keeps a Underperform rating on Lemonade with a target price of $14.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Lemonade with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply