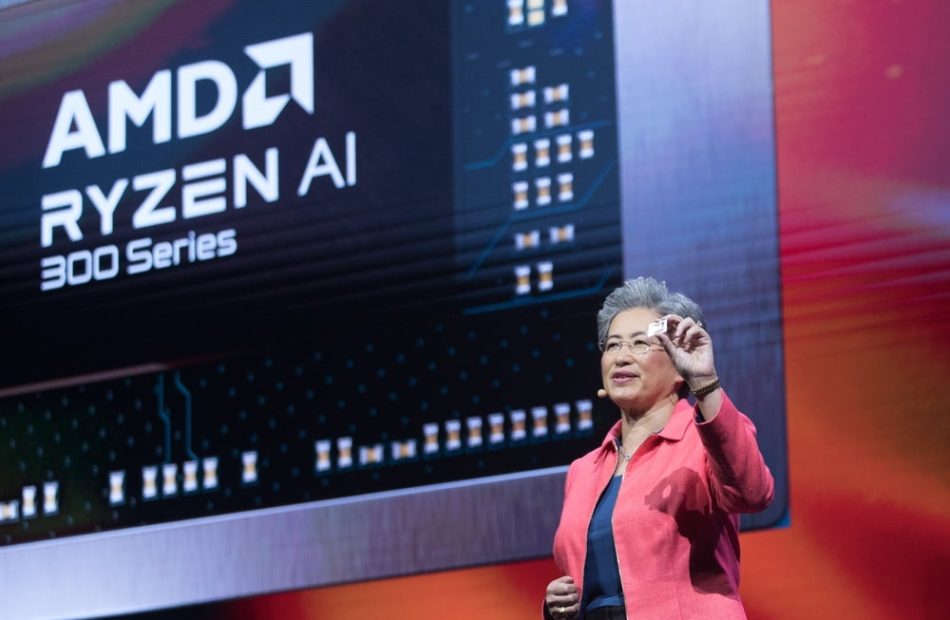

AMD CEO Lisa Su: No 'One Size Fits All' In $500B AI Computing Future

Lisa Su, CEO of Advanced Micro Devices Inc. AMD, provided an optimistic outlook for the company’s position in the burgeoning artificial intelligence market.

What Happened: Su emphasized the potential for AI compute technology to evolve, in a recent interview with CNBC’s Squawk on the Street, stating, “We really do believe that AI compute will enable the models to get even better, smarter…there is no one size fits all for compute.”

When asked about the changing landscape of AI, particularly regarding inference and the computing power required for various applications, Su acknowledged the complexities of the evolving technology.

“As you are really going through multiple steps, I mean these models are amazing. We made excellent progress when you think about where we are today with some of the OpenAI models or some of the Llama models; they’re great, but they can get better,” she noted.

Furthermore, Su shared an ambitious forecast regarding the total addressable market for data center AI, projecting it to reach $500 billion by 2028. This figure will encompass a variety of computing needs, including both training and inference processes.

Why It Matters: As AMD positions itself against major competitors like NVIDIA Corp (NASDAQ: NVDA), analysts are optimistic about the company’s potential to capture market share in several sectors. This sentiment is supported by AMD’s recent third-quarter results, which indicate a strong trajectory for its AI business.

Meta Platforms Inc. META CEO Mark Zuckerberg recently revealed that Meta is developing its next-generation AI model, Llama 4, using an unprecedented computing infrastructure of over 100,000 Nvidia H100 GPUs.

AMD’s progress in the AI space has been acknowledged by industry experts, including CNBC’s Jim Cramer, who believes that AMD will continue to see significant growth in the AI space, challenging Nvidia’s dominance.

Price Action: AMD’s stock closed at $148.60 on Wednesday, down 10.62%, for the day. In after-hours trading, the stock fell further 0.98%. Despite the recent declines, AMD’s stock has seen a year-to-date increase of 7.23%, according to data from Benzinga Pro.

Read Next:

Image Via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply