ACRES COMMERCIAL REALTY CORP. REPORTS RESULTS FOR THIRD QUARTER 2024

UNIONDALE, N.Y., Oct. 30, 2024 /PRNewswire/ — ACRES Commercial Realty Corp. ACR (“ACR” or the “Company”), a real estate investment trust that is primarily focused on originating, holding and managing commercial real estate mortgage loans and equity investments in commercial real estate property through direct ownership and joint ventures, today reported results for the quarter ended September 30, 2024. ACR’s GAAP net income allocable to common shares was $2.8 million, or $0.36 per share-diluted, for the quarter ended September 30, 2024.

“We are proud of the diligent efforts of the ACRES team in maintaining a robust and high-quality investment portfolio,” said ACRES Commercial Realty Corp. President & CEO Mark Fogel. “Our unwavering focus remains on identifying high-quality opportunities while steadfastly protecting and enhancing shareholder value.”

ACR issued a full, detailed presentation of its results for the quarter ended September 30, 2024 that can be viewed at www.acresreit.com.

Earnings Call Details

ACR will host a live conference call on October 31, 2024 at 10:00 a.m. Eastern Time to discuss its third quarter 2024 operating results. The conference call can be accessed by dialing 1-800-274-8461 (U.S. domestic) or 1-203-518-9814 (International), Conference ID ACRES or from the investor relations section of the Company’s website at www.acresreit.com.

For those unable to listen to the live conference call, a replay will be available on the Company’s website and telephonically through November 14, 2024 by dialing 1-844-512-2921 (U.S. domestic) or 1-412-317-6671 (International), with the passcode 11156888.

About ACRES Commercial Realty Corp.

ACRES Commercial Realty Corp. is a real estate investment trust that is primarily focused on originating, holding and managing commercial real estate mortgage loans and equity investments in commercial real estate properties through direct ownership and joint ventures. The Company is externally managed by ACRES Capital, LLC, a subsidiary of ACRES Capital Corp., a private commercial real estate lender exclusively dedicated to nationwide middle market commercial real estate lending with a focus on multifamily, student housing, hospitality, industrial and office property in top U.S. markets. For more information, please visit the Company’s website at www.acresreit.com or contact investor relations at IR@acresreit.com.

Forward-Looking Statements

This press release contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements can generally be identified by our use of forward-looking terminology such as “may,” “will,” “continue,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “look forward” or other similar words or terms. Because such statements include risks, uncertainties and contingencies, actual results may differ materially from the expectations, intentions, beliefs, plans or predictions of the future expressed or implied by such forward-looking statements. Factors that can affect future results are discussed in the documents filed by the Company from time to time with the Securities and Exchange Commission, including, without limitation, factors impacting whether we will be able to maintain our sources of liquidity and whether we will be able to identify sufficient suitable investments to increase our originations. The Company undertakes no obligation to update or revise any forward-looking statement to reflect new or changing information or events after the date hereof or to reflect the occurrence of unanticipated events, except as may be required by law.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/acres-commercial-realty-corp-reports-results-for-third-quarter-2024-302291718.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/acres-commercial-realty-corp-reports-results-for-third-quarter-2024-302291718.html

SOURCE ACRES Commercial Realty Corp.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

US GDP Rises 2.8% In Q3, But Can The Momentum Last? What 6 Top Economists Are Saying

The U.S. economy grew at a robust 2.8% in the third quarter, but beneath the strong headline number, economists see diverging forces at play.

While the gross domestic product (GDP) growth rate marked a slight slowdown from the 3% pace recorded in the second quarter and came in also below the expected 3%, it still highlights the resilience of the U.S. economy amid a backdrop of elevated cost of borrowing and global geopolitical uncertainties.

From surging consumer spending to an unusual spike in defense spending, six top analysts weighed in on what’s fueling economic growth and whether it can last further.

See Also: Economist Daron Acemoglu And 22 Other Nobel Laureates Endorse Kamala Harris For Presidency

‘Economic Exceptionalism’

According to Mohamed El-Erian, Allianz advisor and president at Queen’s College, the third-quarter GDP numbers highlight what he calls “U.S. economic exceptionalism.”

Even with growth slightly below expectations, El-Erian indicates that America’s economy is outperforming other advanced nations, thanks largely to strong consumer spending and federal budgetary expenditures.

“Personal consumption grew by 3.7%, the highest rate since the first quarter of 2023; and defense spending increased by 14.9%, leading the expansionary fiscal impulse,” El-Erian stated.

Jeffrey Roach, chief economist at LPL Financial, also highlighted the unusual spike in defense spending as a significant factor in the third quarter growth data, but he’s cautious about its sustainability.

“Defense spending spiked almost 15% annualized, the highest since 2003 and will likely revert next quarter,” Roach stated, suggesting that this was a temporary boost.

Roach remains optimistic about the durability of consumer spending, which he views as the real anchor of growth. “Private consumption patterns appear sustainable,” he said. On investments, he flagged that the technological sector is boosting CAPEX driven by the “A.I.. craze”.

Inflation data for third quarter provided mixed signals. Core PCE, the Federal Reserve’s preferred measure of inflation, increased slightly more than expected. Goldman Sachs chief economist Jan Hatzius indicated that the composition of growth was solid, but core inflation nudged upward, leading the firm to raise its September core PCE estimate to 0.26%. On an annual basis, this would place core PCE at 2.65% and headline PCE at 2.09%.

Tailwinds For The Fed

Bill Adams, chief economist at Comerica Bank, highlighted that the outcome marks the sixth consecutive quarter of annualized growth above 2.5%, the longest stretch since 2006.

Adams predicted that the Fed will cut rates by a quarter point after Election Day.

Jamie Cox, managing partner for Harris Financial Group, called the third quarter report an ideal scenario for the Federal Reserve, with solid growth accompanied by moderating inflation.

“Growth up, inflation down is precisely what you want to see,” Cox stated, noting that a steady growth rate paired with easing inflation gives the Fed more flexibility in easing interest rates.

James Thorne, chief market strategist at WellingtonAltus, argued that “the Federal Reserve ought to consider front-loading interest rate cuts” to preemptively counter economic deceleration.

He expects interest rates to fall to 2.75%, given that the Fed’s current rate stance is too high given the economy’s cooling trajectory. Thorne called for a 50-basis-point cut to help counterbalance the “downward momentum in the economy.”

Read Next:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Wall Street Mixed, Semiconductors Tumble As AMD Disappoints, Alphabet Rallies, SMCI Plummets: What's Driving Markets Wednesday?

Wall Street experienced a mixed trading session on Wednesday as investors weigh a batch of corporate earnings and fresh economic data.

The U.S. economy grew at an annualized rate of 2.8% in the third quarter, according to advance estimates. This marks a slight deceleration from the previous quarter’s 3% pace and falls short of analyst expectations of 3%.

On the employment front, the ADP National Employment report showed private payrolls surged by 233,000 in October —well above the 115,000 forecast and a significant increase from the revised 159,000 in September. This stronger-than-expected job growth underscores the resilience of the labor market ahead of Friday’s official jobs report.

In corporate news, Advanced Micro Devices Inc. AMD dropped 10% after posting quarterly results that met expectations but failed to excite investors. The decline in AMD shares dragged down the broader semiconductor sector, with the iShares Semiconductor ETF SOXX sliding over 3%.

In contrast, Alphabet Inc. jumped more than 5% following a robust earnings report that beat Wall Street expectations, boosting optimism around mega-cap tech stocks.

At midday, major U.S. indexes were trading mixed. The S&P 500 and the tech-heavy Nasdaq 100 remained flat, while the small-cap Russell 2000 outperformed with a 0.5% gain.

Gold prices extended all-time highs, up 0.5% to $2,787 per ounce. Oil prices surged 2%, fueled by supply concerns.

Bitcoin BTC/USD eased 0.8% to $72,100, pulling back from recent highs.

Wednesday’s Performance In Major US Indices, ETFs

| Major Indices | Price | 1-day % |

| Russell 2000 | 2,246.40 | 0.4% |

| Dow Jones | 42,309.80 | 0.2% |

| S&P 500 | 5,838.86 | 0.1 % |

| Nasdaq 100 | 20,505.98 | -0.1% |

According to Benzinga Pro data:

- The SPDR S&P 500 ETF Trust SPY inched 0.1% higher to $582.16.

- The SPDR Dow Jones Industrial Average DIA rose 0.2% to $423.25.

- The tech-heavy Invesco QQQ Trust Series QQQ eased 0.2% to $499.18.

- The iShares Russell 2000 ETF IWM rose 0.5% to $222.76.

- The Communication Services Select Sector SPDR Fund XLC outperformed, up by 1.3%. The Technology Select Sector SPDR Fund XLK lagged, down 0.9%.

Wednesday’s Stock Movers

- Super Micro Computer Inc. SMCI tumbled 33% after auditors Ernst & Young announced their resignation amid reporting issues, five days ahead of the company’s earnings report.

Large-cap stocks reacting to earnings were:

- Eli Lilly and Company LLY, down 8%,

- Visa Inc. V, up 3.6%,

- AbbVie Inc. ABBV up over 5%,

- Caterpillar Inc. CAT, down 1.4%,

- Chubb Ltd. CB, down 1%,

- Mondelez International Inc. MDLZ, up 1%,

- Chipotle Mexican Grill Inc. CMG, down over 7%,

- Snap Inc. SNAP, up 15%,

- Reddit Inc. RDDT, up 38%,

- Automatic Data Processing Inc. ADP, up 1%,

- Garmin Ltd. GRMN, up 24%.

Major companies reporting earnings after the close Wednesday include Microsoft Corp. MSFT, Meta Platforms Inc. META, Amgen Inc. AMGN, and Booking Holdings Inc. BKNG.

Read Next:

Photo via Shutterstock.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

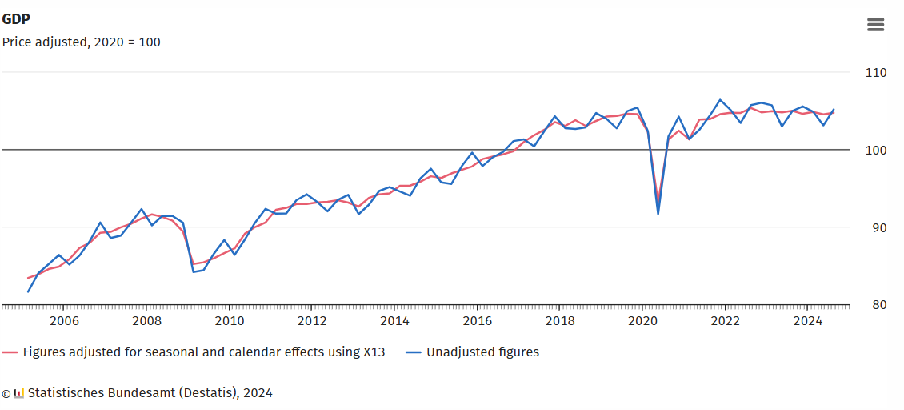

German Economy Faces Strong Headwinds Despite Return To Growth

The German economy faces strong headwinds despite data showing that Europe’s largest exporter of goods returned to economic growth in the third quarter, beating analysts’ estimates.

The economy grew by 0.2% quarter-on-quarter in Q3, from an initial -0.1% in Q2, the Federal Statistical Office (Destatis) reported today. But it shrank by 0.2% on the year in Q3 after price and calendar adjustments, Destatis said. Analysts had a Q3 forecast of -0.1%.

German inflation accelerated to 2% in October from 1.6% in September, or well above the expected 1.8%, Destatis data showed today. Food prices, which accelerated 2.3% in October from 1.6% in September, and higher energy prices drove inflation higher.

The German DAX40 declined 1.1% today, closing at 19,266.

German Economy Remains Stuck In Stagflation

Though positive, the German economy, Europe’s largest, faces considerable challenges due to both cyclical and structural headwinds.

“The German economy avoided a technical recession in the third quarter, showing unexpected growth,” ING Think said. “However, this does not change the fact that the economy remains stuck in stagnation.”

Germany revised its second quarter’s contraction to -0.3% quarter-on-quarter from the initial -0.1%. This “somewhat dampened” the “positive surprise,” ING Think said.

The rise in GDP growth coincided with an improvement in consumer sentiment in November, though the level still remains low, a survey showed on Tuesday. The Gfk German Consumer Climate Index is forecast to rise by 2.7 points to -18.3 points in November compared to the previous month.

German Economy Hurt By Crises, Wars

Although this was the highest level in Gfk German Consumer Climate Index since April 2022, Germans are “pessimistic about overall economic development,” the survey said.

“The uncertainty caused by crises, wars and rising prices is still very much present,” Rolf Bürkl, consumer expert at the Nuremberg Institute for Market Decisions, said.

“Reports of a rising number of company insolvencies and plans to cut jobs or relocate production abroad are also preventing a more significant recovery in consumer sentiment,” Bürkl added.

Volkswagen (OTC:VWAGY), for example, announced on Monday the closure of three German factories and potential mass layoffs. High operating costs, a weak electric vehicle lineup, and diminishing demand in key markets drove the decision.

The group is closing factories to cut costs while a looming trade war with China weighs on sentiment after the European Union (EU) imposed tariffs on electric vehicles.

Volkswagen’s Costs Rise, As Layoffs Loom

Facing pressure from intense competition and rising energy and labor expenses, Volkswagen has taken unprecedented steps to close plants on German soil. This is the first time it had done so in the company’s 87-year history.

Volkswagen brand CEO Thomas Schäfer pointed out the problems in domestic production, as plants operate 25-50% above the firm’s target expenses. “We are not productive enough at our German locations,” Schäfer stated, stressing the urgent need for cost cuts.

Meanwhile, Volkswagen’s works council head Daniela Cavallo called the plan “a starvation, a weakening in installments” that threatens “tens of thousands of jobs in Germany.”

“Management is absolutely serious about all this,” she said. “This is not saber-rattling in the collective bargaining round.”

Volkswagen car sales in Europe, Source: ACEA

German Economy Will Feel Strain Of Plant Closures

The closures are poised to further strain the German economy, sparking concerns about the long-term future of its industrial economy. GDP is already forecasted to contract for a second consecutive year.

Volkswagen’s main restructuring plan sees salary freezes for 2025 and 2026 and a reduction in existing salary levels by at least 10%. It will abolish one-off payments for workers who have stayed at the company for 25 and 35 years. This could impact up to 140,000 workers.

In response, workers protest the proposed changes in Wolfsburg, home to the company’s headquarters. The powerful IG Metall union has threatened strikes by December if no agreement is reached.

VW VLKAF shares fell to €88.92, reaching the second-lowest point in 2024, far below the intra-year peak of €123.30.

EU Tariffs On China’s EVs Will Hurt German Economy

As Volkswagen shutters plants, the EU has introduced new tariffs on electric vehicles (EVs) imported from China. This will escalate trade tensions over Chinese subsidies, which may have a significant impact on German car manufacturers.

As of October 30, the EU introduced tariffs ranging between 7.8% and 35.3% on Chinese EV makers. This is in addition to the existing 10% import duty, with the highest surcharge applied to vehicles from Chinese state-owned automaker SAIC.

The Chinese Ministry of Commerce dismissed the tariffs as “trade protectionism” and has vowed to safeguard Chinese businesses’ interests. It lodged a complaint with the World Trade Organization.

Volkswagen’s financial chief, Arno Antlitz, cautioned that “under a tariffs regime, an industry only loses time.” He warned that Chinese automakers might still access the market through European-based production.

This tactic is underway, with Chinese automakers BYD and Leapmotor setting up production facilities in Europe and Turkey to sidestep tariffs.

“In a world in which, at least in manufacturing, China has become the new Germany,’ Germany’s old macro business model of cheap energy and easily accessible large export markets is no longer working,” ING Think said. “Looking ahead, there is very little reason to expect any imminent relief.”

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Fed's Favorite Inflation Gauge Expected To Fall In September: How Will Markets React?

The Federal Reserve’s preferred inflation measure, the Personal Consumption Expenditure (PCE) price index, is set to be released on Thursday at 8:30 a.m. ET.

Investors and policymakers alike are hoping the data will reaffirm the current disinflationary trend, which could solidify expectations for continued Fed rate cuts in 2024 and into 2025.

Market expectations currently show a nearly certain probability of a rate cut at the Fed’s upcoming meeting next week, according to the CME FedWatch tool.

However, the December rate decision remains more uncertain, with market-implied odds at roughly 70% for an additional quarter-point cut.

September PCE Inflation Report: What Do Wall Street Economists Expect?

- The consensus expects the headline PCE inflation rate to decline to 2.1% year-over-year in September, down from 2.2% in August.

- On a monthly basis, headline PCE inflation is forecasted to increase slightly to 0.2%, up from 0.1% the prior month.

- The core PCE price index, which excludes volatile food and energy prices and is closely watched by the Fed, is projected to fall to 2.6% year-over-year from 2.7% in August.

- Core PCE is expected to see a more significant monthly uptick, rising 0.3% in September from 0.1% in August.

What Economists Are Saying

LPL Financial’s Chief Economist Jeffrey Roach highlighted the overall disinflation trend observed throughout the third quarter, suggesting that this increases the likelihood of Fed cuts at both the November and December meetings.

“Inflation eased considerably throughout Q3,” Roach stated, “which increases the odds the Fed will cut at both of the upcoming meetings this year.”

Bank of America’s U.S. economist Shruti Mishra, however, offered a more cautious view. Mishra highlighted that core PCE inflation in Q3 was actually slightly stronger than expected, which could reflect an upward revision to prior months (July and August) or a firmer-than-expected September.

Bank of America anticipates a core PCE monthly increase of 0.2%, which would keep the three-month annualized rate low at around 2.1% or 2.2%.

On Thursday, Goldman Sachs raised its estimate for September core PCE inflation to 0.26% on a monthly basis, This would translate to an annualized rate of 2.65% for core PCE and 2.09% for headline PCE, suggesting mild upward pressure on inflation but not enough to shift the Fed’s broader policy outlook.

Market Impact: What to Watch for on Thursday

If the PCE data comes in as expected or lower, it could further reassure markets that inflation is on a controlled downward path, supporting the case for continued rate cuts.

Stocks would likely respond positively, while bond yields—especially for shorter-dated maturities—would likely decline.

Conversely, any upside surprises—especially in core PCE—could lead market participants to rethink the pace of rate cuts, especially for the December meeting. This might trigger some volatility, pushing bond yields higher and dampening risk sentiment.

On Wednesday, the SPDR S&P 500 ETF Trust SPY closed 0.3% lower, while the tech-heavy Invesco QQQ Trust QQQ slumped 0.7%.

Read Next:

Image created using artificial intelligence via Midjourney.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

$100 Invested In Royal Caribbean Gr 15 Years Ago Would Be Worth This Much Today

Royal Caribbean Gr RCL has outperformed the market over the past 15 years by 4.46% on an annualized basis producing an average annual return of 16.41%. Currently, Royal Caribbean Gr has a market capitalization of $53.59 billion.

Buying $100 In RCL: If an investor had bought $100 of RCL stock 15 years ago, it would be worth $1,031.29 today based on a price of $208.20 for RCL at the time of writing.

Royal Caribbean Gr’s Performance Over Last 15 Years

Finally — what’s the point of all this? The key insight to take from this article is to note how much of a difference compounded returns can make in your cash growth over a period of time.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

ELS Declares Fourth Quarter 2024 Dividend

CHICAGO, Oct. 30, 2024 /PRNewswire/ — On October 29, 2024, the Board of Directors (the “Board”) of Equity LifeStyle Properties, Inc. ELS (referred to herein as “we,” “us,” and “our”) declared a fourth quarter 2024 dividend of $0.4775 per common share, representing, on an annualized basis, a dividend of $1.91 per common share. The dividend will be paid on January 10, 2025 to stockholders of record at the close of business on December 27, 2024.

This press release includes certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. When used, words such as “anticipate,” “expect,” “believe,” “project,” “estimate,” “guidance,” “intend,” “may be” and “will be” and similar words or phrases, or the negative thereof, unless the context requires otherwise, are intended to identify forward-looking statements and may include, without limitation, information regarding our expectations, goals or intentions regarding the future, and the expected effect of our acquisitions. Forward-looking statements, by their nature, involve estimates, projections, goals, forecasts and assumptions and are subject to risks and uncertainties that could cause actual results or outcomes to differ materially from those expressed in a forward-looking statement due to a number of factors, which include, but are not limited to the following: (i) the mix of site usage within the portfolio; (ii) yield management on our short-term resort and marina sites; (iii) scheduled or implemented rate increases on community, resort and marina sites; (iv) scheduled or implemented rate increases in annual payments under membership subscriptions; (v) occupancy changes; (vi) our ability to attract and retain membership customers; (vii) change in customer demand regarding travel and outdoor vacation destinations; (viii) our ability to manage expenses in an inflationary environment; (ix) changes in debt service and interest rates; (x) our ability to integrate and operate recent acquisitions in accordance with our estimates; (xi) our ability to execute expansion/development opportunities in the face of changes impacting the supply chain or labor markets; (xii) completion of pending transactions in their entirety and on assumed schedule; (xiii) our ability to attract and retain property employees, particularly seasonal employees; (xiv) ongoing legal matters and related fees; (xv) costs to clean up and restore property operations and potential revenue losses following storms or other unplanned events; and (xvi) the potential impact of, and our ability to remediate material weaknesses in our internal control over financial reporting.

For further information on these and other factors that could impact us and the statements contained herein, refer to our filings with the Securities and Exchange Commission, including the “Risk Factors” and “Forward-Looking Statements” sections in our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q.

These forward-looking statements are based on management’s present expectations and beliefs about future events. As with any projection or forecast, these statements are inherently susceptible to uncertainty and changes in circumstances. We are under no obligation to, and expressly disclaim any obligation to, update or alter our forward-looking statements whether as a result of such changes, new information, subsequent events or otherwise.

We are a fully integrated owner of lifestyle-oriented properties and own or have an interest in 452 properties located predominantly in the United States consisting of 172,870 sites as of October 21, 2024. We are a self-administered, self-managed, real estate investment trust with headquarters in Chicago.

![]() View original content:https://www.prnewswire.com/news-releases/els-declares-fourth-quarter-2024-dividend-302292089.html

View original content:https://www.prnewswire.com/news-releases/els-declares-fourth-quarter-2024-dividend-302292089.html

SOURCE Equity Lifestyle Properties, Inc.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.