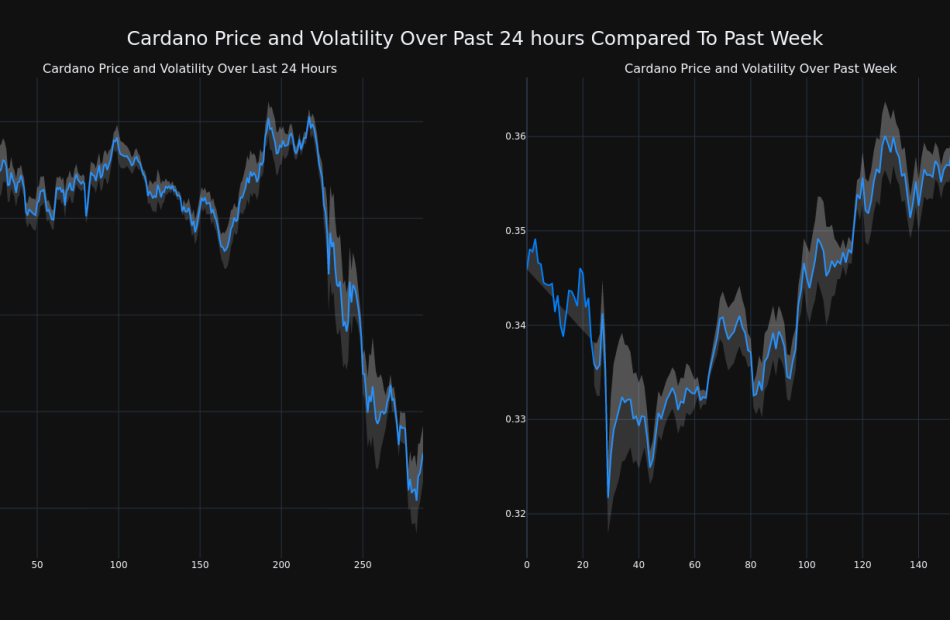

Cardano Decreases More Than 3% Within 24 hours

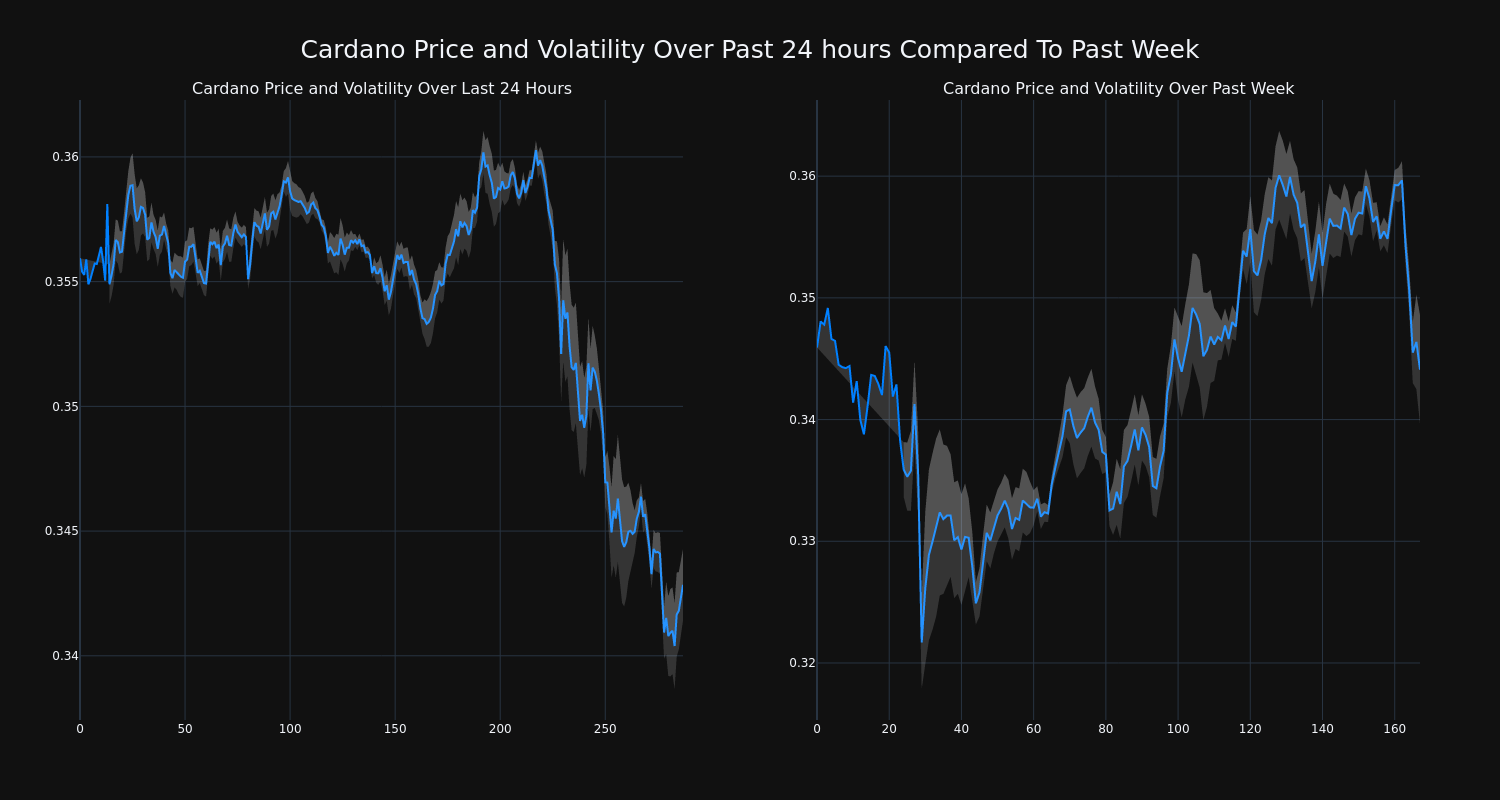

Over the past 24 hours, Cardano’s ADA/USD price has fallen 3.63% to $0.34. This continues its negative trend over the past week where it has experienced a 1.0% loss, moving from $0.35 to its current price.

The chart below compares the price movement and volatility for Cardano over the past 24 hours (left) to its price movement over the past week (right). The gray bands are Bollinger Bands, measuring the volatility for both the daily and weekly price movements. The wider the bands are, or the larger the gray area is at any given moment, the larger the volatility.

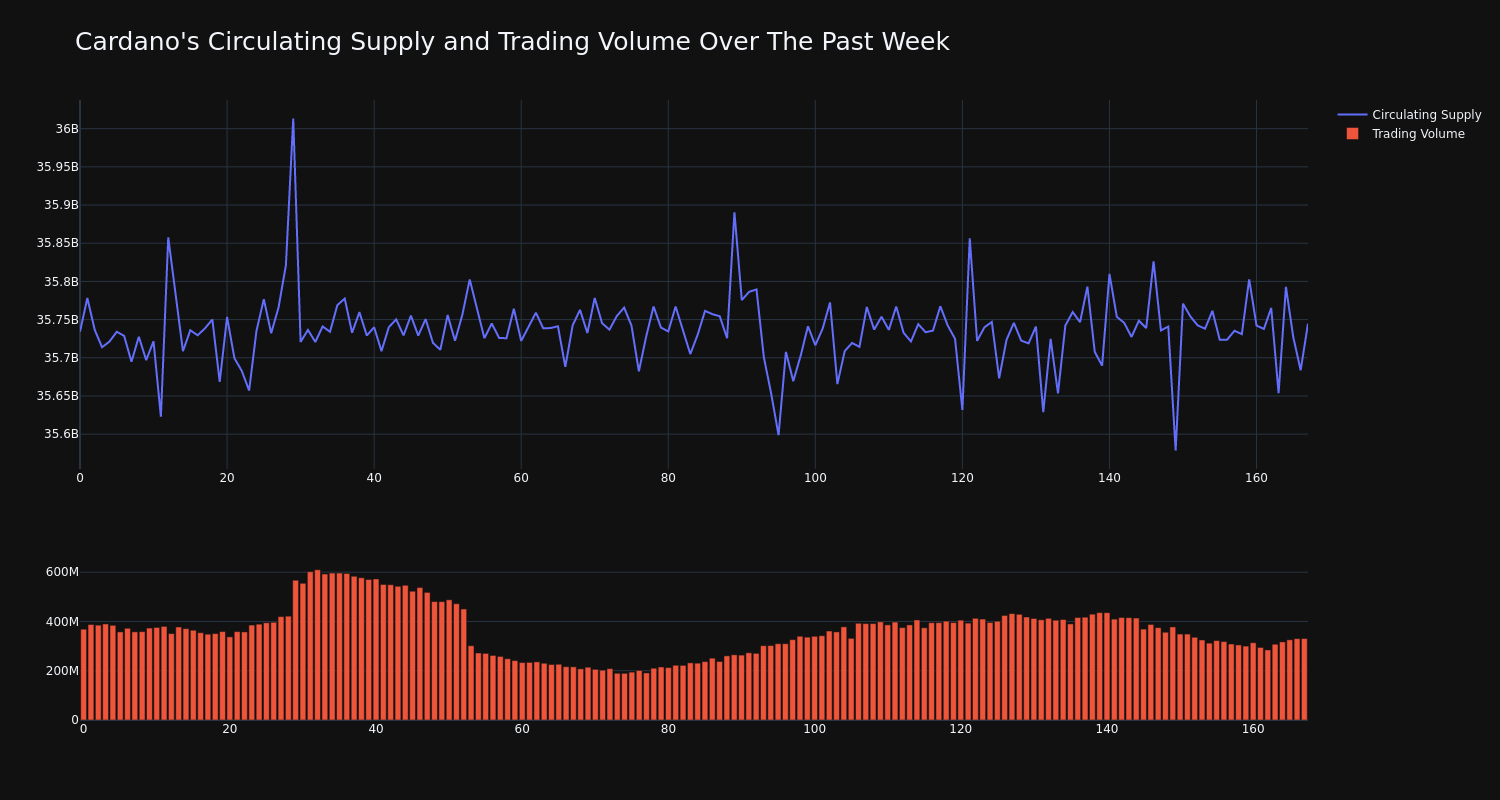

The trading volume for the coin has fallen 10.0% over the past week which is opposite, directionally, with the overall circulating supply of the coin, which has increased 0.03%. This brings the circulating supply to 35.75 billion, which makes up an estimated 79.44% of its max supply of 45.00 billion. According to our data, the current market cap ranking for ADA is #11 at $12.25 billion.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

At Valmont Industries, Ellen S Dasher Chooses To Exercise Options, Resulting In $234K

On October 30, it was revealed in an SEC filing that Ellen S Dasher, VP at Valmont Industries VMI executed a significant exercise of company stock options.

What Happened: A Form 4 filing from the U.S. Securities and Exchange Commission on Wednesday showed that Dasher, VP at Valmont Industries, a company in the Industrials sector, just exercised stock options worth 1,370 shares of VMI stock with an exercise price of $147.31.

Valmont Industries shares are currently trading up by 0.94%, with a current price of $318.6 as of Thursday morning. This brings the total value of Dasher’s 1,370 shares to $234,667.

Delving into Valmont Industries’s Background

Valmont Industries Inc is an investment holding company. It operates through two segments namely Infrastructure and Agriculture. The company generates maximum revenue from the Infrastructure segment. The infrastructure segment consists of the manufacture and distribution of products and solutions to serve the infrastructure markets of utility, renewable energy, lighting, transportation, and telecommunications, and coatings services to preserve metal products. Geographically, it derives a majority of its revenue from North America.

Valmont Industries’s Economic Impact: An Analysis

Revenue Growth: Valmont Industries’s revenue growth over a period of 3 months has faced challenges. As of 30 September, 2024, the company experienced a revenue decline of approximately -1.88%. This indicates a decrease in the company’s top-line earnings. When compared to others in the Industrials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Insights into Profitability:

-

Gross Margin: The company maintains a high gross margin of 29.57%, indicating strong cost management and profitability compared to its peers.

-

Earnings per Share (EPS): Valmont Industries’s EPS outshines the industry average, indicating a strong bottom-line trend with a current EPS of 4.13.

Debt Management: Valmont Industries’s debt-to-equity ratio is below the industry average. With a ratio of 0.68, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Valuation Analysis:

-

Price to Earnings (P/E) Ratio: The P/E ratio of 21.44 is lower than the industry average, implying a discounted valuation for Valmont Industries’s stock.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 1.59 is above industry norms, reflecting an elevated valuation for Valmont Industries’s stock and potential overvaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With a lower-than-industry-average EV/EBITDA ratio of 12.68, Valmont Industries presents a potential value opportunity, as investors are paying less for each unit of EBITDA.

Market Capitalization Analysis: Below industry benchmarks, the company’s market capitalization reflects a smaller scale relative to peers. This could be attributed to factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Importance of Insider Transactions

While insider transactions should not be the sole basis for making investment decisions, they can play a significant role in an investor’s decision-making process.

When discussing legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated in Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are required to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

A new purchase by a company insider is a indication that they anticipate the stock will rise.

On the other hand, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

Transaction Codes Worth Your Attention

Investors prefer focusing on transactions that take place in the open market, indicated in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S indicates a sale. Transaction code C indicates the conversion of an option, and transaction code A indicates grant, award or other acquisition of securities from the company.

Check Out The Full List Of Valmont Industries’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Ardelyx Beats Q3 Sales Estimates, Shares Climb

Ardelyx, Inc. ARDX reported its third-quarter results after Thursday’s closing bell. Here’s a look at the details from the report.

The Details: Ardelyx reported quarterly sales of $98.24 million, which beat the analyst consensus estimate of $86.64 million.

The company reported IBSRELA generated $40.6 million in net product sales revenue and the company expects full-year 2024 IBSRELA net sales revenue to be between $145 million and $150 million.

XPHOZAH generates $51.5 million in net product sales revenue and Ardelyx ended the quarter with approximately $190 million in cash, cash equivalents and investments.

Read Next: Reddit ‘Remains A Favorite’ For Wall Street After ‘Emphatic Beat And Raise’ In Q3

“The continued strong performance of Ardelyx reported during the third quarter demonstrates our ability to execute and deliver on our goals, to focus on serving the patient and to build towards the future,” said Mike Raab, president and CEO of Ardelyx.

ARDX Price Action: According to Benzinga Pro, Ardelyx shares are up 3.07% after-hours at $6.05 at the time of publication Thursday.

Read Also:

Photo: HeungSoon from Pixabay

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

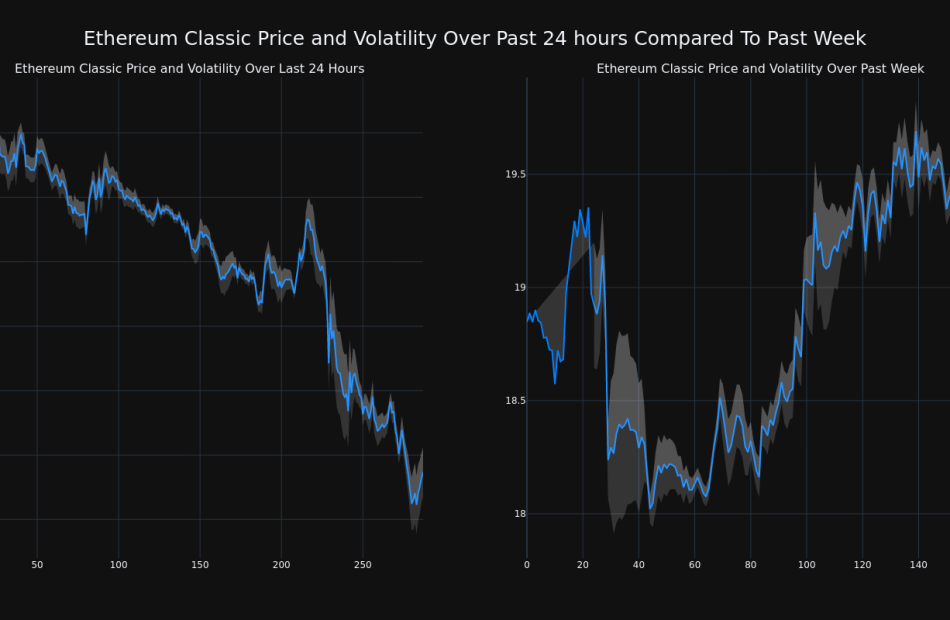

Cryptocurrency Ethereum Classic Down More Than 5% Within 24 hours

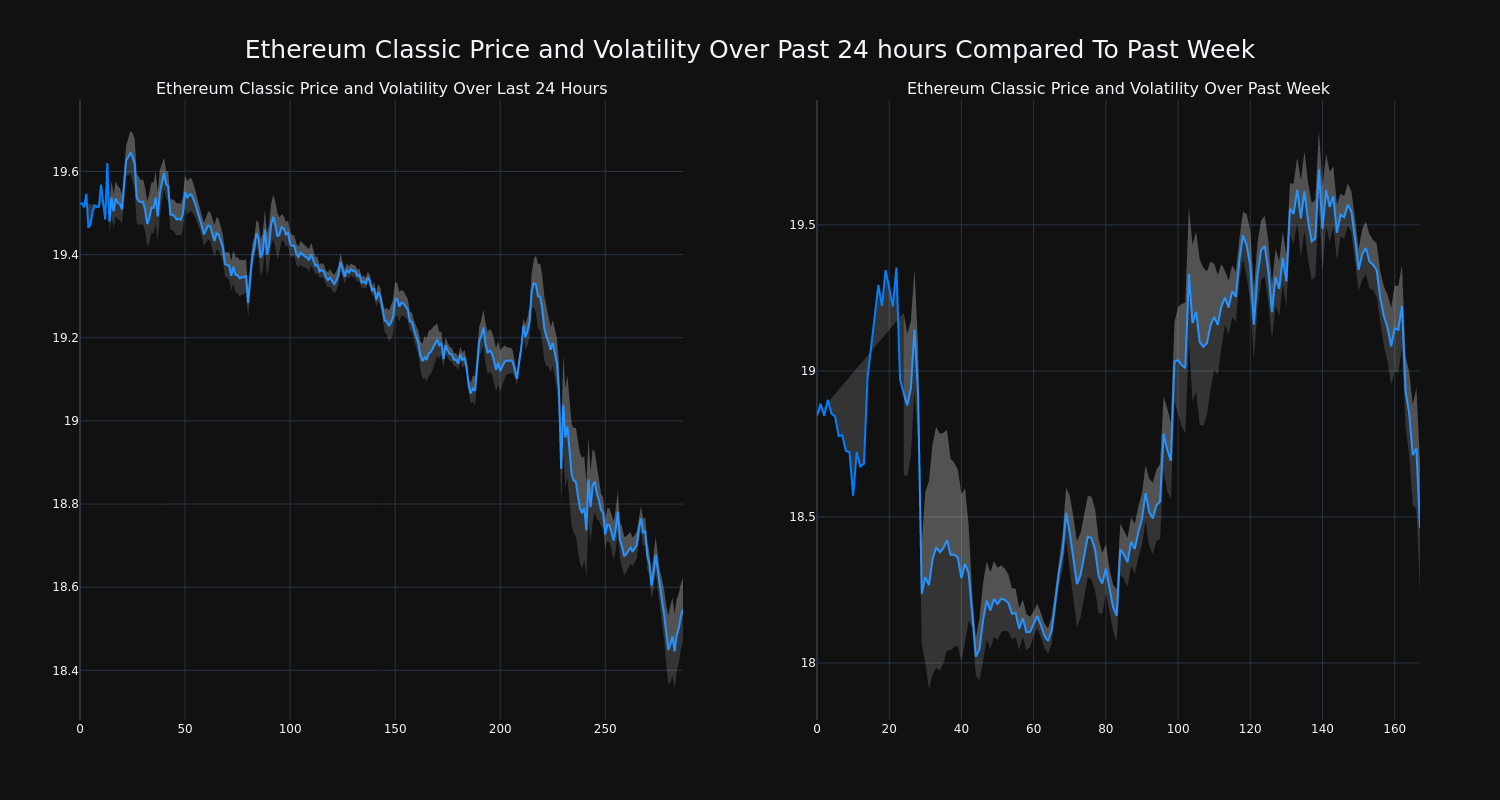

Over the past 24 hours, Ethereum Classic’s ETC/USD price has fallen 5.02% to $18.54. This continues its negative trend over the past week where it has experienced a 2.0% loss, moving from $18.85 to its current price.

The chart below compares the price movement and volatility for Ethereum Classic over the past 24 hours (left) to its price movement over the past week (right). The gray bands are Bollinger Bands, measuring the volatility for both the daily and weekly price movements. The wider the bands are, or the larger the gray area is at any given moment, the larger the volatility.

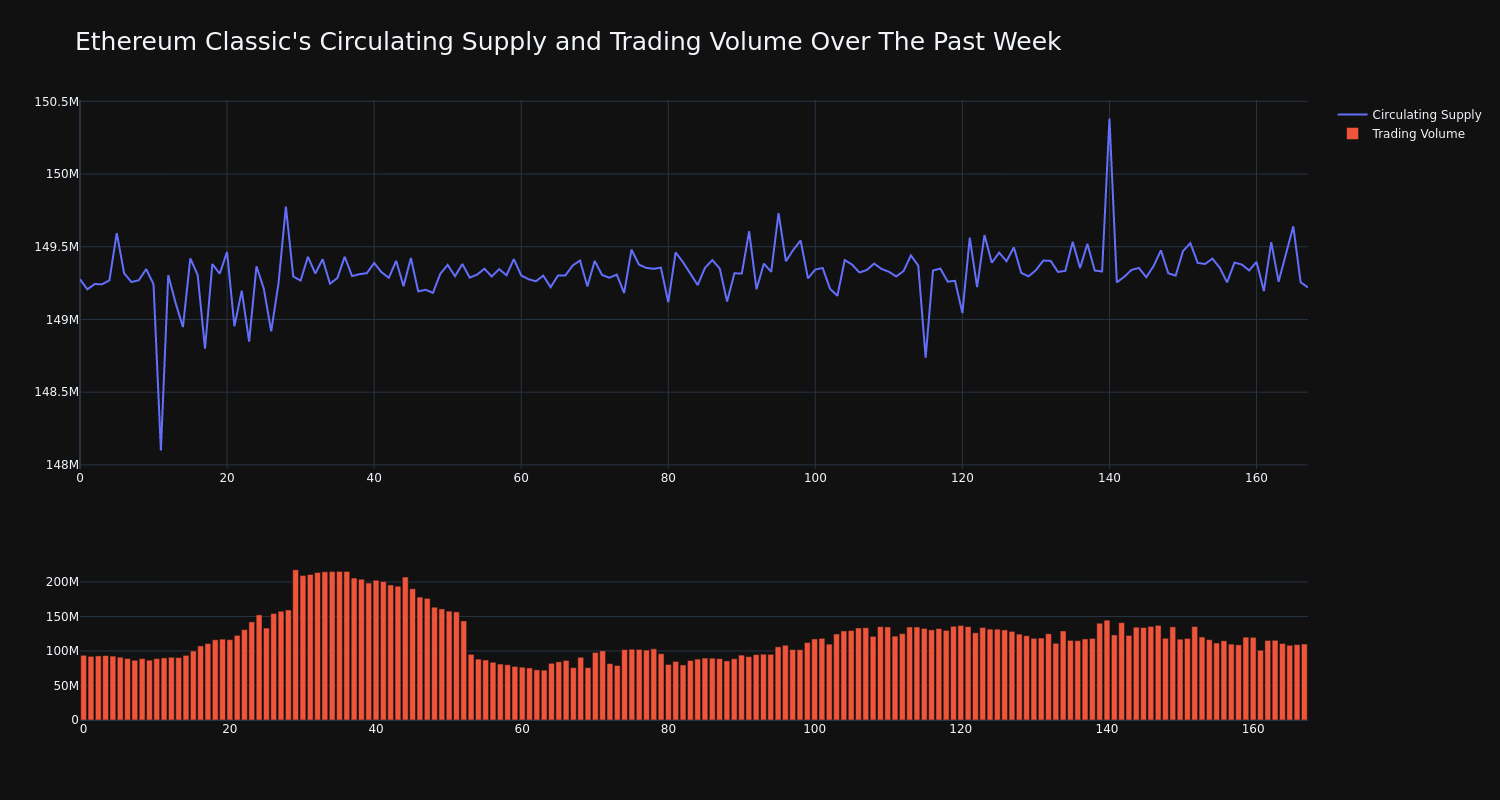

The trading volume for the coin has increased 17.0% over the past week. while the overall circulating supply of the coin has decreased 0.04% This puts its current circulating supply at an estimated 70.89% of its max supply, which is 210.70 million. The current market cap ranking for ETC is #36 at $2.77 billion.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Centerra Gold Reports Third Quarter 2024 Results; Consistent Operating Performance Drives Continued Strong Cash Flow From Operations

All figures are in United States dollars. All production figures reflect payable metal quantities and are on a 100% basis, unless otherwise stated. For references denoted with NG, refer to the “Non-GAAP and Other Financial Measures” disclosure at the end of this news release for a description of these measures.

TORONTO, Oct. 31, 2024 (GLOBE NEWSWIRE) — Centerra Gold Inc. (“Centerra” or the “Company”) CGCGAU today reported its third quarter 2024 operating and financial results.

President and CEO, Paul Tomory, commented, “Centerra continues to deliver consistent operating performance and is on track to meet our consolidated production and cost guidance for the year. We have benefited from margin expansion driven by stable cost performance in an elevated metal price environment. As planned, we have returned to strong free cash flow generation in the third quarter. Even after spending approximately $32 million on the restart of operations at the Thompson Creek mine, we grew our cash and cash equivalents to $604 million at the end of the third quarter. We increased our share buybacks in the third quarter to $12 million, and declared a quarterly dividend, delivering on our disciplined approach of returning capital to shareholders.

“We continue to systematically execute on our strategic plan by working through the assets in our portfolio to unlock value. In February, we announced an additional agreement with Royal Gold, which allowed us to extend the mine life at Mount Milligan by two additional years and created the potential for future mine life extensions. In September, we announced the restart of operations at Thompson Creek and a progressive ramp-up of production at Langeloth, to realize value in our Molybdenum Business Unit. Looking ahead, we are progressing work at Mount Milligan on a preliminary economic assessment that is expected to illustrate the future potential at the mine and is on track to be completed towards the end of the first half of 2025. We also expect to publish an initial resource estimate at Goldfield in conjunction with our year-end reserve and resource update, expected in early 2025. By continuing to execute on our strategic plan, we expect to create value and growth for our shareholders and stakeholders,” concluded Mr. Tomory.

Third Quarter 2024 Highlights

Operations

- Production: Consolidated gold production of 93,712 ounces in the quarter, including 42,993 ounces from the Mount Milligan Mine (“Mount Milligan”) and 50,719 ounces from the Öksüt Mine (“Öksüt”). Copper production in the quarter was 13.7 million pounds. Year-to-date, consolidated gold and copper production was 294,880 ounces of gold and 41.6 million pounds of copper. Consolidated full year 2024 production guidance is unchanged at 370,000 to 410,000 ounces of gold and 55 to 65 million pounds of copper.

- Sales: Third quarter 2024 gold sales were 96,736 ounces at an average realized gold priceNG of $2,206 per ounce and copper sales were 14.2 million pounds at an average realized copper priceNG of $3.37 per pound. The average realized gold and copper prices include the impact of the Mount Milligan streaming agreement with Royal Gold. Gold and copper sales were 16% and 21% higher, respectively, compared to last quarter, mainly driven by the timing of shipments at Mount Milligan.

- Costs: Consolidated gold production costs were $973 per ounce and all-in sustaining costs (“AISC”) on a by-product basisNG were $1,302 per ounce for the quarter. Year-to-date, gold production costs were $860 per ounce and AISC on a by-product basisNG were $1,103 per ounce. Consolidated full year 2024 cost guidance is unchanged. Consolidated gold production costs are expected to be $800 to $900 per ounce and AISC on a by-product basisNG is expected to be $1,075 to $1,175 per ounce.

- Capital expendituresNG: Additions to property, plant, and equipment (“PP&E”) and sustaining capital expendituresNG in the quarter were $79.7 million and $35.3 million, respectively. Sustaining capital expendituresNG in the third quarter 2024 included construction at the tailings storage facility and equipment rebuilds at Mount Milligan, as well as capitalized stripping and expansions at the heap leach pad and waste rock dump at Öksüt. Non-sustaining capital expendituresNG in the third quarter were $25.2 million related mainly to the restart of operations at the Thompson Creek mine (“Thompson Creek”).

Financial

- Net earnings: Third quarter 2024 net earnings were $28.8 million, or $0.14 per share, and adjusted net earningsNG were $38.6 million or $0.19 per share. Adjustments to net earnings included $6.6 million of reclamation provision revaluation recovery and $1.5 million of unrealized loss on the financial asset related to the additional agreement with Royal Gold (the “Additional Royal Gold Agreement”). For additional adjustments refer to the “Non-GAAP and Other Financial Measures” disclosure at the end of this news release.

- Cash provided by operating activities and free cash flowNG: In the third quarter 2024, cash provided by operating activities was $103.6 million and free cash flowNG was $37.4 million. This includes $97.3 million of cash provided by mine operations and $86.8 million of free cash flowNG at Öksüt; and $40.2 million of cash provided by mine operations and $15.6 million of free cash flowNG at Mount Milligan. This is offset by cash used in operating activities and a free cash flow deficitNG from Thompson Creek expenditures.

- Cash and cash equivalents: Total liquidity of $1,004.3 million as at September 30, 2024, comprising a cash balance of $604.3 million and $400.0 million available under a corporate credit facility.

- Dividend: Quarterly dividend declared of C$0.07 per common share.

Other

- Share buybacks: Under Centerra’s normal course issuer bid (“NCIB”) program, the Company repurchased 1,741,800 common shares in the third quarter 2024, for the total consideration of $12.0 million. In the first nine months of 2024, Centerra has returned $65 million to shareholders, including $32 million in share buybacks and $33 million in dividends.

- Thompson Creek feasibility study results and strategic plan for US Molybdenum Operations: In September 2024, Centerra announced a strategic, integrated business plan for its Molybdenum Business Unit (“MBU”) consisting of a restart of Thompson Creek and a commercially optimized ramp up plan for the Langeloth Metallurgical Facility (“Langeloth”), collectively the US Molybdenum Operations (“US Moly”). The US Moly business is expected to produce an after-tax net present value (8%) (“NPV8%“) of $472 million. A key contributor to this value is Langeloth, which at full capacity, integrated with Thompson Creek, has the potential to generate robust annual earnings before interest, taxes, depreciation and amortization (“EBITDA”).

- Intention to renew normal course issuer bid (“NCIB”): Centerra believes its share price continues to be trading in a price range that does not adequately reflect the value of its assets and future prospects. As a result, subject to the approval of the Toronto Stock Exchange (“TSX”), Centerra intends to renew its NCIB to purchase for cancellation a number of common shares in the capital of the Company (“Common Shares”), representing the greater of 5% of the issued and outstanding Common Shares or 10% of the public float. As of October 31, 2024, Centerra had 211,337,985 issued and outstanding Common Shares.

Table 1 – Overview of Consolidated Financial and Operating Highlights

| ($millions, except as noted) | Three months ended September 30, |

Nine months ended September 30, |

|||||||

| 2024 | 2023 | % Change | 2024 | 2023 | % Change | ||||

| Financial Highlights | |||||||||

| Revenue | 323.9 | 343.9 | (6)% | 912.1 | 754.9 | 21 | % | ||

| Production costs | 183.4 | 186.8 | (2)% | 519.8 | 544.6 | (5)% | |||

| Depreciation, depletion, and amortization (“DDA”) | 33.2 | 42.5 | (22)% | 93.9 | 84.4 | 11 | % | ||

| Earnings from mine operations | 107.3 | 114.6 | (6)% | 298.4 | 125.9 | 137 | % | ||

| Net earnings (loss) | 28.8 | 60.6 | (52)% | 132.9 | (52.5 | ) | 353 | % | |

| Adjusted net earnings (loss)(1) | 38.6 | 44.4 | (13)% | 116.3 | (50.7 | ) | 329 | % | |

| Cash provided by (used in) operating activities | 103.6 | 166.6 | (38)% | 205.6 | 100.2 | 105 | % | ||

| Free cash flow(1) | 37.4 | 144.5 | (74)% | 91.6 | 49.2 | 86 | % | ||

| Additions to property, plant and equipment (“PP&E”) | 79.7 | 25.0 | 219 | % | 132.9 | 53.8 | 147 | % | |

| Capital expenditures – total(1) | 60.5 | 24.6 | 146 | % | 113.6 | 51.9 | 119 | % | |

| Sustaining capital expenditures(1) | 35.3 | 23.5 | 50 | % | 82.1 | 49.0 | 68 | % | |

| Non-sustaining capital expenditures(1) | 25.2 | 1.1 | 2191 | % | 31.5 | 2.9 | 986 | % | |

| Net earnings (loss) per common share – $/share basic(2) | 0.14 | 0.28 | (50)% | 0.62 | (0.24 | ) | 357 | % | |

| Adjusted net earnings (loss) per common share – $/share basic(1)(2) | 0.19 | 0.21 | (10)% | 0.54 | (0.23 | ) | 335 | % | |

| Operating highlights | |||||||||

| Gold produced (oz) | 93,712 | 126,221 | (26)% | 294,880 | 221,058 | 33 | % | ||

| Gold sold (oz) | 96,736 | 130,973 | (26)% | 284,307 | 218,118 | 30 | % | ||

| Average market gold price ($/oz) | 2,474 | 1,929 | 28 | % | 2,296 | 1,931 | 19 | % | |

| Average realized gold price ($/oz )(3) | 2,206 | 1,741 | 27 | % | 2,040 | 1,642 | 24 | % | |

| Copper produced (000s lbs) | 13,693 | 15,026 | (9)% | 41,573 | 42,168 | (1)% | |||

| Copper sold (000s lbs) | 14,209 | 15,385 | (8)% | 41,536 | 43,548 | (5)% | |||

| Average market copper price ($/lb) | 4.18 | 3.79 | 10 | % | 4.14 | 3.89 | 6 | % | |

| Average realized copper price ($/lb)(3) | 3.37 | 2.99 | 13 | % | 3.39 | 3.01 | 13 | % | |

| Molybdenum sold (000s lbs) | 2,431 | 2,700 | (10)% | 8,054 | 9,077 | (11)% | |||

| Average market molybdenum price ($/lb) | 21.78 | 23.77 | (8)% | 21.17 | 26.05 | (19)% | |||

| Average realized molybdenum price ($/lb)(3) | 23.27 | 24.08 | (3)% | 21.90 | 25.71 | (15)% | |||

| Unit costs | |||||||||

| Gold production costs ($/oz)(4) | 973 | 643 | 51 | % | 860 | 820 | 5 | % | |

| All-in sustaining costs on a by-product basis ($/oz)(1)(4) | 1,302 | 827 | 57 | % | 1,103 | 1,122 | (2)% | ||

| All-in costs on a by-product basis ($/oz)(1)(4) | 1,509 | 983 | 54 | % | 1,299 | 1,471 | (12)% | ||

| Gold – All-in sustaining costs on a co-product basis ($/oz)(1)(4) | 1,401 | 858 | 63 | % | 1,218 | 1,168 | 4 | % | |

| Copper production costs ($/lb)(4) | 1.99 | 2.30 | (13)% | 2.09 | 2.43 | (14)% | |||

| Copper – All-in sustaining costs on a co-product basis ($/lb)(1)(4) | 2.69 | 2.73 | (1)% | 2.61 | 2.78 | (6)% | |||

| (1) | Non-GAAP financial measure. See discussion under “Non-GAAP and Other Financial Measures”. |

| (2) | As at September 30, 2024, the Company had 211,752,347 common shares issued and outstanding. |

| (3) | This supplementary financial measure within the meaning of National Instrument 52-112 – Non-GAAP and Other Financial Measures Disclosure (“NI 51-112”) is calculated as a ratio of revenue from the consolidated financial statements and units of metal sold and includes the impact from the Mount Milligan Streaming Agreement, copper hedges and mark-to-market adjustments on metal sold not yet finally settled. |

| (4) | All per unit costs metrics are expressed on a metal sold basis. |

2024 Outlook

The Company’s full year 2024 outlook, and comparative actual results for the nine months ended September 30, 2024 are set out in the following table:

| Units | 2024 Guidance |

Nine Months Ended September 30, 2024 | |

| Production | |||

| Total gold production(1) | (Koz) | 370 – 410 | 295 |

| Mount Milligan Mine(2)(3)(4) | (Koz) | 180 – 200 | 130 |

| Öksüt Mine | (Koz) | 190 – 210 | 165 |

| Total copper production(2)(3)(4) | (Mlb) | 55 – 65 | 42 |

| Unit Costs(5) | |||

| Gold production costs(1) | ($/oz) | 800 – 900 | 860 |

| Mount Milligan Mine(2) | ($/oz) | 950 – 1,050 | 1,062 |

| Öksüt Mine | ($/oz) | 650 – 750 | 710 |

| All-in sustaining costs on a by-product basisNG(1)(3)(4) | ($/oz) | 1,075 – 1,175 | 1,103 |

| Mount Milligan Mine(4) | ($/oz) | 1,075 – 1,175 | 1,064 |

| Öksüt Mine | ($/oz) | 900 – 1,000 | 946 |

| Capital Expenditures | |||

| Additions to PP&E(1) | ($M) | 157 – 195 | 132.9 |

| Mount Milligan Mine | ($M) | 55 – 65 | 46.8 |

| Öksüt Mine | ($M) | 40 – 50 | 39.5 |

| Total Capital ExpendituresNG(1) | ($M) | 157 – 195 | 113.6 |

| Mount Milligan Mine | ($M) | 55 – 65 | 46.2 |

| Öksüt Mine | ($M) | 40 – 50 | 30.6 |

| Sustaining Capital ExpendituresNG(1) | ($M) | 101 – 127 | 82.1 |

| Mount Milligan Mine | ($M) | 55 – 65 | 46.2 |

| Öksüt Mine | ($M) | 40 – 50 | 30.6 |

| Non-sustaining Capital ExpendituresNG(1) | ($M) | 56 – 68 | 31.5 |

| Depreciation, depletion and amortization(1) | ($M) | 110 – 135 | 93.9 |

| Mount Milligan Mine | ($M) | 60 – 70 | 51.4 |

| Öksüt Mine | ($M) | 45 – 55 | 39.8 |

| Income tax and BC mineral tax expense(1) | ($M) | 75 – 85 | 70.4 |

| Mount Milligan Mine | ($M) | 1 – 5 | 2.8 |

| Öksüt Mine | ($M) | 74 – 80 | 67.6 |

- Consolidated Centerra figures.

- The Mount Milligan Mine is subject to an arrangement with RGLD Gold AG and Royal Gold Inc. (together, “Royal Gold”) which entitles Royal Gold to purchase 35% and 18.75% of gold and copper produced, respectively, and requires Royal Gold to pay $435 per ounce of gold and 15% of the spot price per metric tonne of copper delivered (“Mount Milligan Mine Streaming Agreement”). Using an assumed market gold price of $2,500 per ounce and a blended copper price of $4.25 per pound for the fourth quarter of 2024, Mount Milligan Mine’s average realized gold and copper price for the remaining three months of 2024 would be $1,777 per ounce and $3.57 per pound, respectively, compared to average realized prices of $2,040 per ounce and $3.39 per pound in the nine-month period ended September 30, 2024, when factoring in the Mount Milligan Streaming Agreement and concentrate refining and treatment costs. The blended copper price of $4.25 per pound factors in copper hedges in place as of September 30, 2024.

- Gold and copper production for the fourth quarter of the year at the Mount Milligan Mine assumes estimated recoveries of 63% to 65% for gold and 75% to 77% for copper compared to actual recoveries for gold of 63.8% and for copper of 75.6% achieved in the first nine months of 2024. The Company estimates full year recoveries of 65% for gold and 77% for copper.

- Unit costs include a credit for forecasted copper sales treated as by-product for all-in sustaining costsNG and all-in costsNG. Production for copper and gold reflects estimated metallurgical losses resulting from handling of the concentrate and metal deductions levied by smelters.

- Units noted as ($/oz) relate to gold ounces and ($/lb) relate to copper pounds.

Molybdenum Business Unit

| (Expressed in millions of United States dollars) | 2024 Guidance | Nine Months Ended September 30, 2024 |

||

| Langeloth Facility | ||||

| Loss from operationsNG(1) | (5) – (15) | (6.1) | ||

| DD&A Expense | 5 – 10 | 2.8 | ||

| Other non-cash adjustments | — | (1.8) | ||

| Cash (used in) provided by operations before changes in working capital | (5) – 0 | (5.1) | ||

| Changes in Working Capital | (20) – 20 | (0.6) | ||

| Cash (Used in) Provided by Operations | (25) – 20 | (5.7) | ||

| Sustaining Capital ExpendituresNG | (5) – (10) | (4.9) | ||

| Free Cash Flow (Deficit) from OperationsNG(2) | (30) – 10 | (10.6) | ||

| Thompson Creek Mine(2) | ||||

| Project Evaluation Expenses(3) | (21.1) | (21.1) | ||

| Care and Maintenance Expenses – Cash | (2.0) | (2.0) | ||

| Other non-cash adjustments | 0.1 | 0.1 | ||

| Cash (used in) provided by operations before changes in working capital | (23.0) | (23.0) | ||

| Changes in Working Capital | 3.4 | 3.4 | ||

| Cash Used in Operations | (19.6) | (19.6) | ||

| Non-sustaining Capital ExpendituresNG | (55) – (65) | (28.9) | ||

| Free Cash Flow (Deficit) from OperationsNG | (75) – (85) | (48.5) | ||

| Endako Mine | ||||

| Care and Maintenance Expenses | (5) – (7) | (3.7) | ||

| Reclamation Costs | (15) – (18) | (4.0) | ||

| Cash Used in Operations | (20) – (25) | (7.7) | ||

- Additions to PP&E calculations for calculating Free Cash Flow (Deficit) from OperationsNG include only cash expenditures for PP&E additions.

- Reflects updated outlook range for the Thompson Creek Mine for the full year of 2024.

- Project evaluation expenses are recognized as expense in the consolidated statements of earnings (loss).

Project Evaluation, Exploration, and Other Costs

| (Expressed in millions of United States dollars) | 2024 Guidance | Nine Months Ended September 30, 2024 |

| Project Exploration and Evaluation Costs | ||

| Goldfield Project | 9 – 13 | 5.7 |

| Thompson Creek Mine(1) | 21 – 27 | 21.1 |

| Kemess Project | 3 – 5 | 0.5 |

| Total Project Evaluation Costs | 33 – 45 | 27.3 |

| Brownfield Exploration(2) | 17 – 22 | 18.6 |

| Greenfield and Generative Exploration | 18 – 23 | 11.2 |

| Total Exploration Costs(2) | 35 – 45 | 29.8 |

| Total Exploration and Project Evaluation Costs | 68 – 90 | 57.1 |

| Other Costs | ||

| Kemess Project Care & Maintenance | 12 – 14 | 9.8 |

| Corporate Administration Costs | 37 – 42 | 30.7 |

| Stock-based Compensation | 8 – 10 | 6.0 |

| Other Corporate Administration Costs | 29 – 32 | 24.7 |

- Thompson Creek Mine’s project evaluation costs updated revised outlook for the full year of 2024.

- Total exploration costs include capitalized exploration costs at the Mount Milligan Mine of $1.5 million for the nine months ended September 30, 2024..

Mount Milligan

Mount Milligan produced 42,993 ounces of gold and 13.7 million pounds of copper in the third quarter of 2024. In the first nine months of 2024, Mount Milligan produced 129,919 ounces of gold and 41.6 million pounds of copper. Mining activities were carried out in phases 5, 6, 7, and 9 with a total of 11.8 million tonnes mined in the third quarter of 2024. Process plant throughput for the third quarter of 2024 was 5.6 million tonnes, averaging 58,520 tonnes per day. Gold sales were 45,968 ounces and copper sales were 14.2 million pounds in the third quarter, up 46% and 21% respectively, compared to last quarter. The higher sales volumes were anticipated due to the timing of shipments. Metal production in the fourth quarter is expected to be slightly higher compared to the previous nine months of 2024 due to higher projected mill throughput and higher expected gold grades. The 2024 production guidance metrics at Mount Milligan remain unchanged at 180,000 to 200,000 ounces of gold and 55 to 65 million pounds of copper, with gold production trending towards the lower end of the range.

Gold production costs in the third quarter 2024 were $1,138 per ounce. AISC on a by-product basisNG was $1,318 per ounce, higher than last quarter due to increased sustaining capital expenditures. In the first nine months of 2024, gold production costs were $1,062 per ounce and AISC on a by-product basisNG was $1,064 per ounce. The Company expects AISC on a by-product basisNG to be lower in the fourth quarter, compared to the second and third quarters, driven by higher expected sales and lower expected sustaining capital expenditures. 2024 cost guidance metrics at Mount Milligan remain unchanged. Gold production costs are expected to be $950 to $1,050 per ounce, and AISC on a by-product basisNG is expected to be $1,075 to $1,175 per ounce. The Company expects AISC on a by-product basisNG at Mount Milligan to be at the lower end of the costs guidance range.

In the third quarter 2024, sustaining capital expendituresNG at Mount Milligan were $24.7 million, focused on the tailings storage facility dam construction and equipment rebuilds. Full year 2024 guidance for sustaining capital expendituresNG is unchanged at $55 to $65 million.

In the third quarter of 2024, Mount Milligan generated solid cash flow from operations of $40.2 million and $15.6 million of free cash flowNG.

The site-wide optimization program at Mount Milligan, initially launched in the fourth quarter 2023, continues to progress. This program covers all aspects of the operation to maximize the potential of the orebody, setting up Mount Milligan for long-term success to 2035 and beyond. Notable achievements in the first nine months of 2024 include an improved safety record, increased availability and utilization of the haul fleet and consistent ore supply which has led to increased mill throughput per operating day. As part of the optimization program, Mount Milligan is actively pursuing opportunities to reduce operating costs. The Company continues to see productivity improvements in the load-haul cycle at the mine, as well as in the unit processing costs. In the first nine months of 2024, milling costs were $5.56 per tonne processed, 12% lower than the first nine months of last year.

In February 2024, Centerra announced that the Company has entered into the Additional Royal Gold Agreement relating to Mount Milligan, which has resulted in a life of mine extension to 2035 and established favourable parameters for potential future mine life extensions. Work is progressing on a preliminary economic assessment (“PEA”) to evaluate the substantial mineral resources at the Mount Milligan mine with a goal to unlock additional value beyond its current 2035 mine life. The PEA is expected to be completed towards the end of the first half of 2025.

Öksüt

Öksüt produced 50,719 ounces of gold in the third quarter of 2024, consistent with last quarter, and produced 164,961 ounces of gold in the first nine months of 2024. Mining activities were focused on phase 5 and phase 4 of the Keltepe pit and in phase 2 of the Güneytepe pit. A total of 4.9 million tonnes were mined and 1.5 million tonnes were stacked at an average grade of 1.05 g/t. In the first nine months of 2024, Öksüt finished processing the excess gold inventory that it had accumulated in the previous year, leading to elevated gold production levels. In the fourth quarter, substantially all gold production is expected from lower grade areas of the mine. As a result, gold production in the fourth quarter is expected to contribute approximately 15% to 20% of the annual gold production. The 2024 production guidance at Öksüt is unchanged and is expected to be 190,000 to 210,000 ounces of gold.

Gold production costs and AISC on a by-product basisNG for the third quarter 2024 at Öksüt were $829 per ounce and $1,092 per ounce, respectively. These costs were impacted by higher royalty expense in the quarter due to elevated gold prices. In the first nine months of 2024, gold production costs were $710 per ounce and AISC on a by-product basisNG was $946 per ounce. The Company expects AISC on a by-product basisNG to be the highest in the fourth quarter, compared to the first nine months of 2024, driven by lower production due to lower expected grades. Öksüt’s gold production costs guidance and AISC on a by-product basisNG guidance for 2024 is unchanged and is expected to be $650 to $750 per ounce, and $900 to $1,000 per ounce, respectively. However, AISC on a by-product basisNG could slightly exceed the guidance range due to higher royalty costs driven by elevated gold prices. Centerra is seeing early indications of high inflation in Türkiye which is not being fully offset by devaluation of the lira, unlike in the past few years. The Company is currently evaluating the potential impact this could have on Öksüt’s cost structure moving forward.

In the third quarter 2024, sustaining capital expenditures at Öksüt were $10.5 million, focused on capitalized stripping, heap leach pad expansion and waste rock dump expansion.

As expected, in the third quarter of 2024, Öksüt returned to generating strong cash flow from operations and free cash flowNG, after making tax and annual royalty payments in the second quarter of 2024. In the third quarter, Öksüt generated $97.3 million of cash from mine operations and $86.8 million of free cash flowNG.

Molybdenum Business Unit

In the third quarter 2024, the MBU sold 2.4 million pounds of molybdenum, generating revenue of $60.4 million with an average realized price of $23.27 per pound.

On September 12, 2024, Centerra announced the results from its Thompson Creek feasibility study, including a strategic, integrated business plan for its MBU consisting of a restart of Thompson Creek and a commercially optimized plan for Langeloth, collectively US Moly. The Company believes the decision will unlock significant value through the restart of operations at Thompson Creek and a progressive ramp-up of production at Langeloth. When Thompson Creek begins production, currently targeted for the second half of 2027, it will provide additional high-grade, high-quality feed to Langeloth, enabling a ramp-up of production to more fully utilize Langeloth’s full annual capacity of 40 million pounds, while improving operational flexibility to meet market demand. For additional details, please refer to the announcement entitled “Centerra Gold Announces Thompson Creek Feasibility Study Results and Strategic Plan for US Molybdenum Operations, Including a Restart of the Thompson Creek Mine and Ramp-up of Langeloth“, issued on September 12, 2024.

The initial capital investment to restart Thompson Creek is approximately $397 million. The capital required is significantly de-risked due to an existing pit, significantly advanced rebuilds and purchases, and an existing process plant that requires minimal upgrades and refurbishments. A majority of the anticipated capital expenditures are focused on capitalized stripping, plant refurbishments and mine mobile fleet upgrades. At current metal prices, the capital investment to restart Thompson Creek is expected to be funded largely from Centerra’s cash flow from operations.

In the third quarter and first nine months of 2024, non-sustaining capital expendituresNG at Thompson Creek were $25.2 million and $25.8 million, respectively. Full year 2024 non-sustaining capitalNG guidance at Thompson Creek is expected to be approximately $55 million to $65 million. Spending in the fourth quarter of 2024 is expected to include capitalized stripping, continued refurbishment of the existing mobile equipment fleet, acquisition of new mine mobile equipment, and initial engineering work on the mill refurbishment.

Intention to Renew NCIB

Subject to the approval of the approval of the TSX, Centerra intends to proceed with a renewal of a NCIB to purchase for cancellation a number of Common Shares representing the greater of 5% of the issued and outstanding Common Shares or 10% of the public float. As of October 31, 2024, Centerra had 211,337,985 issued and outstanding Common Shares.

Centerra believes that the Common Shares continue to be trading in a price range which does not adequately reflect the value of such shares in relation to Centerra’s assets and its future prospects. As a result, Centerra believes that the NCIB will provide the Company with a flexible tool to deploy a portion of its cash balance pursuant to its capital allocation framework to, depending upon future Common Share price movements and other factors, purchase Common Shares for cancellation while preserving its strong balance sheet position.

Centerra will file a notice of intention to renew a NCIB with the TSX and, subject to the approval of the TSX, Centerra may purchase Common Shares under the NCIB over a twelve-month period. Once the NCIB is commenced, the exact timing and amount of any purchases will depend on market conditions and other factors. Centerra will not be obligated to acquire any Common Shares and may suspend or discontinue purchases under the NCIB at any time. Any purchases made under the NCIB will be made at market price at the time of purchase through the facilities of the TSX and/or alternative Canadian trading systems in accordance with applicable securities laws and stock exchange rules. The Company’s previous NCIB authorized the purchase of up to 18,293,896 Common Shares and expires on November 6, 2024. During the period when that program operated through October 30, 2024, a total of 5,783,100 Common Shares of the Company were repurchased through the facilities of the TSX and alternative Canadian trading systems at a volume weighted average price of C$8.74 per Common Share. Centerra intends to establish an automatic share purchase plan in connection with its renewed NCIB to facilitate the purchase of Common Shares during times when Centerra would ordinarily not be permitted to purchase Common Shares due to regulatory restrictions or self-imposed blackout periods. Before entering a black-out period, Centerra may, but is not required to, instruct its designated broker to make purchases under the NCIB based on parameters set by Centerra in accordance with the automatic share purchase plan, applicable securities laws and stock exchange rules.

Third Quarter 2024 Operating and Financial Results Webcast and Conference Call

Centerra invites you to join its 2024 third quarter conference call on Friday, November 1, 2024, at 9:00 a.m. Eastern Time. Details for the webcast and conference call are included below.

Webcast

- Participants can access the webcast at the following webcast link.

- An archive of the webcast will be available until the end of day on February 1, 2025.

Conference Call

- Participants can register for the conference call at the following registration link. Upon registering, you will receive the dial-in details and a unique PIN to access the call. This process will bypass the live operator and avoid the queue. Registration will remain open until the end of the live conference call.

- Participants who prefer to dial in and speak with a live operator can access the call by dialing 1-844-763-8274 or 647-484-8814. It is recommended that you call 10 minutes before the scheduled start time.

- After the call, an audio recording will be made available via telephone for one month, until the end of day December 1, 2024. The recording can be accessed by dialing 1-855-669-9658 or 412-317-0088 and using the access code 4219380. In addition, the webcast will be archived on Centerra’s website at: www.centerragold.com/investors/webcasts.

- Presentation slides will be available on Centerra’s website at www.centerragold.com.

For detailed information on the results contained within this release, please refer to the Company’s Management’s Discussion and Analysis (“MD&A”) and financial statements for the quarter ended September 30, 2024, that are available on the Company’s website www.centerragold.com or SEDAR+ at www.sedarplus.ca.

About Centerra

Centerra Gold Inc. is a Canadian-based mining company focused on operating, developing, exploring and acquiring gold and copper properties in North America, Türkiye, and other markets worldwide. Centerra operates two mines: the Mount Milligan Mine in British Columbia, Canada, and the Öksüt Mine in Türkiye. The Company also owns the Goldfield Project in Nevada, United States, the Kemess Project in British Columbia, Canada, and owns and operates the Molybdenum Business Unit in the United States and Canada. Centerra’s shares trade on the Toronto Stock Exchange (“TSX”) under the symbol CG and on the New York Stock Exchange (“NYSE”) under the symbol CGAU. The Company is based in Toronto, Ontario, Canada.

For more information:

Lisa Wilkinson

Vice President, Investor Relations & Corporate Communications

(416) 204-3780

lisa.wilkinson@centerragold.com

Additional information on Centerra is available on the Company’s website at www.centerragold.com, on SEDAR+ at www.sedarplus.ca and EDGAR at www.sec.gov/edgar.

Qualified Person

All scientific and technical information presented in this document has been prepared in accordance with the standards of the Canadian Institute of Mining, Metallurgy and Petroleum and National Instrument 43-101 and has been reviewed, verified, and compiled by Centerra’s geological and mining staff under the supervision of W. Paul Chawrun, Professional Engineer, member of the Professional Engineers of Ontario (PEO) and Centerra’s Executive Vice President and Chief Operating Officer, the qualified person for the purpose of National Instrument 43-101.

Caution Regarding Forward-Looking Information

This document contains or incorporates by reference “forward-looking statements” and “forward-looking information” as defined under applicable Canadian and U.S. securities legislation. All statements, other than statements of historical fact, which address events, results, outcomes or developments that the Company expects to occur are, or may be deemed to be, forward-looking statements. Such forward-looking information involves risks, uncertainties and other factors that could cause actual results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward-looking statements are generally, but not always, identified by the use of forward-looking terminology such as “believe”, “continue”, “expect”, “evaluate”, “finalizing”, “forecast”, “goal”, “intend”, “ongoing”, “on track”, “plan”, “potential”, “preliminary”, “project”, “pursuing”, “realize”, “restart”, “target” or “update”, or variations of such words and phrases and similar expressions or statements that certain actions, events or results “may”, “could”, “would” or “will” be taken, occur or be achieved or the negative connotation of such terms.

Such statements include, but may not be limited to: statements regarding 2024 guidance, outlook and expectations, including production, cash flow, costs including care and maintenance and reclamation costs, capital expenditures, inflation, depreciation, depletion and amortization, taxes and cash flows; exploration potential, budgets, focuses, programs, targets and projected exploration results; gold and copper prices; the declaration, payment and sustainability of the Company’s dividends; the continuation of the Company’s NCIB and automatic share purchase plan including the intention to renew the NCIB and the timing, methods and quantity of any purchases of Common Shares under the NCIB; statements relating to the TSX’s approval of the NCIB; compliance with applicable laws and regulations pertaining to the NCIB; the availability of cash for repurchases of Common Shares under the NCIB; the timing and amount of future benefits and obligations in connection with the Additional Royal Gold Agreement; a Preliminary Economic Assessment at Mount Milligan Mine and any related evaluation of resources or a life of mine beyond 2035; the integrated business plan of the Molybdenum Business Unit including the restart of the Thompson Creek Mine and commercial optimization of the Langeloth Metallurgical Facility; an initial resource estimate at the Goldfield Project including the success of exploration programs or metallurgical testwork; the Company’s strategic plan; the optimization program at Mount Milligan including any further improvements to occupational health and safety, availability and utilization of the haul fleet, mill throughput and any potential costs savings resulting from the same; the expected gold production at Öksüt Mine in 2024; royalty rates and taxes, including withholding taxes related to repatriation of earnings from Türkiye; project development costs at the Goldfield Project; financial hedges; and other statements that express management’s expectations or estimates of future plans and performance, operational, geological or financial results, estimates or amounts not yet determinable and assumptions of management.

The Company cautions that forward-looking statements are necessarily based upon a number of factors and assumptions that, while considered reasonable by the Company at the time of making such statements, are inherently subject to significant business, economic, technical, legal, political and competitive uncertainties and contingencies. Known and unknown factors could cause actual results to differ materially from those projected in the forward-looking statements and undue reliance should not be placed on such statements and information.

Risk factors that may affect the Company’s ability to achieve the expectations set forth in the forward-looking statements in this document include, but are not limited to: (A) strategic, legal, planning and other risks, including: political risks associated with the Company’s operations in Türkiye, the USA and Canada; resource nationalism including the management of external stakeholder expectations; the impact of changes in, or to the more aggressive enforcement of, laws, regulations and government practices, including unjustified civil or criminal action against the Company, its affiliates, or its current or former employees; risks that community activism may result in increased contributory demands or business interruptions; the risks related to outstanding litigation affecting the Company; the impact of any sanctions imposed by Canada, the United States or other jurisdictions; potential defects of title in the Company’s properties that are not known as of the date hereof; the inability of the Company and its subsidiaries to enforce their legal rights in certain circumstances; risks related to anti-corruption legislation; Centerra not being able to replace mineral reserves; Indigenous claims and consultative issues relating to the Company’s properties which are in proximity to Indigenous communities; and potential risks related to kidnapping or acts of terrorism; (B) risks relating to financial matters, including: sensitivity of the Company’s business to the volatility of gold, copper, molybdenum and other mineral prices; the use of provisionally-priced sales contracts for production at the Mount Milligan Mine; reliance on a few key customers for the gold-copper concentrate at the Mount Milligan Mine; use of commodity derivatives; the imprecision of the Company’s mineral reserves and resources estimates and the assumptions they rely on; the accuracy of the Company’s production and cost estimates; persistent inflationary pressures on key input prices; the impact of restrictive covenants in the Company’s credit facilities and in the Royal Gold Streaming Agreement which may, among other things, restrict the Company from pursuing certain business activities. including paying dividends or repurchasing shares under its normal course issuer bid, or making distributions from its subsidiaries; changes to tax regimes; the Company’s ability to obtain future financing; sensitivity to fuel price volatility; the impact of global financial conditions; the impact of currency fluctuations; the effect of market conditions on the Company’s short-term investments; the Company’s ability to make payments, including any payments of principal and interest on the Company’s debt facilities, which depends on the cash flow of its subsidiaries; the ability to obtain adequate insurance coverage; changes to taxation laws in the jurisdictions where the Company operates and (C) risks related to operational matters and geotechnical issues and the Company’s continued ability to successfully manage such matters, including: unanticipated ground and water conditions; the stability of the pit walls at the Company’s operations leading to structural cave-ins, wall failures or rock-slides; the integrity of tailings storage facilities and the management thereof, including as to stability, compliance with laws, regulations, licenses and permits, controlling seepages and storage of water, where applicable; periodic interruptions due to inclement or hazardous weather conditions or operating conditions and other force majeure events; the risk of having sufficient water to continue operations at the Mount Milligan Mine and achieve expected mill throughput; changes to, or delays in the Company’s supply chain and transportation routes, including cessation or disruption in rail and shipping networks, whether caused by decisions of third-party providers or force majeure events (including, but not limited to: labour action, flooding, landslides, seismic activity, wildfires, earthquakes, pandemics, or other global events such as wars); lower than expected ore grades or recovery rates; the success of the Company’s future exploration and development activities, including the financial and political risks inherent in carrying out exploration activities; inherent risks associated with the use of sodium cyanide in the mining operations; the adequacy of the Company’s insurance to mitigate operational and corporate risks; mechanical breakdowns; the occurrence of any labour unrest or disturbance and the ability of the Company to successfully renegotiate collective agreements when required; the risk that Centerra’s workforce and operations may be exposed to widespread epidemic or pandemic; seismic activity, including earthquakes; wildfires; long lead-times required for equipment and supplies given the remote location of some of the Company’s operating properties and disruptions caused by global events; reliance on a limited number of suppliers for certain consumables, equipment and components; the ability of the Company to address physical and transition risks from climate change and sufficiently manage stakeholder expectations on climate-related issues; regulations regarding greenhouse gas emissions and climate change; significant volatility of molybdenum prices resulting in material working capital changes and unfavourable pressure on viability of the molybdenum business; the Company’s ability to accurately predict decommissioning and reclamation costs and the assumptions they rely upon; the Company’s ability to attract and retain qualified personnel; competition for mineral acquisition opportunities; risks associated with the conduct of joint ventures/partnerships; risk of cyber incidents such as cybercrime, malware or ransomware, data breaches, fines and penalties; and, the Company’s ability to manage its projects effectively and to mitigate the potential lack of availability of contractors, budget and timing overruns, and project resources.

Additional risk factors and details with respect to risk factors that may affect the Company’s ability to achieve the expectations set forth in the forward-looking statements contained in this document are set out in the Company’s latest 40-F/Annual Information Form and Management’s Discussion and Analysis, each under the heading “Risk Factors”, which are available on SEDAR+ (www.sedarplus.ca) or on EDGAR (www.sec.gov/edgar). The foregoing should be reviewed in conjunction with the information, risk factors and assumptions found in this document.

The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether written or oral, or whether as a result of new information, future events or otherwise, except as required by applicable law.

Non-GAAP and Other Financial Measures

This document contains “specified financial measures” within the meaning of NI 52-112, specifically the non-GAAP financial measures, non-GAAP ratios and supplementary financial measures described below. Management believes that the use of these measures assists analysts, investors and other stakeholders of the Company in understanding the costs associated with producing gold and copper, understanding the economics of gold and copper mining, assessing operating performance, the Company’s ability to generate free cash flow from current operations and on an overall Company basis, and for planning and forecasting of future periods. However, the measures have limitations as analytical tools as they may be influenced by the point in the life cycle of a specific mine and the level of additional exploration or other expenditures a company has to make to fully develop its properties. The specified financial measures used in this document do not have any standardized meaning prescribed by IFRS and may not be comparable to similar measures presented by other issuers, even as compared to other issuers who may be applying the World Gold Council (“WGC”) guidelines. Accordingly, these specified financial measures should not be considered in isolation, or as a substitute for, analysis of the Company’s recognized measures presented in accordance with IFRS.

Definitions

The following is a description of the non-GAAP financial measures, non-GAAP ratios and supplementary financial measures used in this document:

- All-in sustaining costs on a by-product basis per ounce is a non-GAAP ratio calculated as all-in sustaining costs on a by-product basis divided by ounces of gold sold. All-in sustaining costs on a by-product basis is a non-GAAP financial measure calculated as the aggregate of production costs as recorded in the condensed consolidated statements of (loss) earnings, refining and transport costs, the cash component of capitalized stripping and sustaining capital expenditures, lease payments related to sustaining assets, corporate general and administrative expenses, accretion expenses, asset retirement depletion expenses, copper and silver revenue and the associated impact of hedges of by-product sales revenue. When calculating all-in sustaining costs on a by-product basis, all revenue received from the sale of copper from the Mount Milligan Mine, as reduced by the effect of the copper stream, is treated as a reduction of costs incurred. A reconciliation of all-in sustaining costs on a by-product basis to the nearest IFRS measure is set out below. Management uses these measures to monitor the cost management effectiveness of each of its operating mines.

- All-in sustaining costs on a co-product basis per ounce of gold or per pound of copper, is a non-GAAP ratio calculated as all-in sustaining costs on a co-product basis divided by ounces of gold or pounds of copper sold, as applicable. All-in sustaining costs on a co-product basis is a non-GAAP financial measure based on an allocation of production costs between copper and gold based on the conversion of copper production to equivalent ounces of gold. The Company uses a conversion ratio for calculating gold equivalent ounces for its copper sales calculated by multiplying the copper pounds sold by estimated average realized copper price and dividing the resulting figure by estimated average realized gold price. For the third quarter ended September 30, 2024, 423 pounds of copper were equivalent to one ounce of gold. A reconciliation of all-in sustaining costs on a co-product basis to the nearest IFRS measure is set out below. Management uses these measures to monitor the cost management effectiveness of each of its operating mines.

- Sustaining capital expenditures and Non-sustaining capital expenditures are non-GAAP financial measures. Sustaining capital expenditures are defined as those expenditures required to sustain current operations and exclude all expenditures incurred at new operations or major projects at existing operations where these projects will materially benefit the operation. Non-sustaining capital expenditures are primarily costs incurred at ‘new operations’ and costs related to ‘major projects at existing operations’ where these projects will materially benefit the operation. A material benefit to an existing operation is considered to be at least a 10% increase in annual or life of mine production, net present value, or reserves compared to the remaining life of mine of the operation. A reconciliation of sustaining capital expenditures and non-sustaining capital expenditures to the nearest IFRS measures is set out below. Management uses the distinction of the sustaining and non-sustaining capital expenditures as an input into the calculation of all-in sustaining costs per ounce and all-in costs per ounce.

- All-in costs on a by-product basis per ounce is a non-GAAP ratio calculated as all-in costs on a by-product basis divided by ounces sold. All-in costs on a by-product basis is a non-GAAP financial measure which includes all-in sustaining costs on a by-product basis, exploration and study costs, non-sustaining capital expenditures, care and maintenance and other costs. A reconciliation of all-in costs on a by-product basis to the nearest IFRS measures is set out below. Management uses these measures to monitor the cost management effectiveness of each of its operating mines.

- Adjusted net earnings (loss) is a non-GAAP financial measure calculated by adjusting net (loss) earnings as recorded in the condensed consolidated statements of (loss) earnings for items not associated with ongoing operations. The Company believes that this generally accepted industry measure allows the evaluation of the results of income-generating capabilities and is useful in making comparisons between periods. This measure adjusts for the impact of items not associated with ongoing operations. A reconciliation of adjusted net (loss) earnings to the nearest IFRS measures is set out below. Management uses this measure to monitor and plan for the operating performance of the Company in conjunction with other data prepared in accordance with IFRS.

- Free cash flow (deficit) is a non-GAAP financial measure calculated as cash provided by operating activities from continuing operations less property, plant and equipment additions. A reconciliation of free cash flow to the nearest IFRS measures is set out below. Management uses this measure to monitor the amount of cash available to reinvest in the Company and allocate for shareholder returns.

- Free cash flow (deficit) from mine operations is a non-GAAP financial measure calculated as cash provided by mine operations less property, plant and equipment additions. A reconciliation of free cash flow from mine operations to the nearest IFRS measures is set out below. Management uses this measure to monitor the degree of self-funding of each of its operating mines and facilities.

- EBITDA is a non-GAAP financial measure that represents earnings before interest, taxes, depreciation, and amortization. It is calculated by adjusting earnings from operations as recorded in the consolidated statements of earnings by depreciation and amortization. Management uses this measure to monitor and plan for the operating performance of the Company in conjunction with other data prepared in accordance with IFRS.

Certain unit costs, including all-in sustaining costs on a by-product basis (including and excluding revenue-based taxes) per ounce, are non-GAAP ratios which include as a component certain non-GAAP financial measures including all-in sustaining costs on a by-product basis which can be reconciled as follows:

| Three months ended September 30, | |||||||||||

| Consolidated | Mount Milligan | Öksüt | |||||||||

| (Unaudited – $millions, unless otherwise specified) | 2024 | 2023 | 2024 | 2023 | 2024 | 2023 | |||||

| Production costs attributable to gold | 94.2 | 84.2 | 52.3 | 45.0 | 41.9 | 39.2 | |||||

| Production costs attributable to copper | 28.3 | 35.4 | 28.3 | 35.4 | — | — | |||||

| Total production costs excluding Molybdenum BU segment, as reported | 122.5 | 119.6 | 80.6 | 80.4 | 41.9 | 39.2 | |||||

| Adjust for: | |||||||||||

| Third party smelting, refining and transport costs | 3.2 | 2.8 | 3.0 | 2.4 | 0.2 | 0.4 | |||||

| By-product and co-product credits | (50.1 | ) | (48.2 | ) | (50.1 | ) | (47.9 | ) | — | (0.3 | ) |

| Adjusted production costs | 75.6 | 74.2 | 33.5 | 34.9 | 42.1 | 39.3 | |||||

| Corporate general administrative and other costs | 10.8 | 7.7 | 0.5 | — | 0.2 | — | |||||

| Reclamation and remediation – accretion (operating sites) | 2.7 | 2.3 | 0.5 | 0.6 | 2.2 | 1.7 | |||||

| Sustaining capital expenditures | 35.2 | 22.6 | 24.7 | 12.5 | 10.5 | 10.1 | |||||

| Sustaining lease payments | 1.8 | 1.5 | 1.3 | 1.3 | 0.5 | 0.2 | |||||

| All-in sustaining costs on a by-product basis | 126.1 | 108.3 | 60.5 | 49.2 | 55.5 | 51.3 | |||||

| Exploration and study costs | 13.5 | 16.5 | 2.3 | 2.9 | 0.3 | 0.5 | |||||

| Non-sustaining capital expenditures | 0.2 | 1.1 | — | — | — | — | |||||

| Care and maintenance and other costs | 6.2 | 2.8 | 1.5 | — | — | — | |||||

| All-in costs on a by-product basis | 146.0 | 128.7 | 64.3 | 52.1 | 55.8 | 51.8 | |||||

| Ounces sold (000s) | 96.7 | 131.0 | 46.0 | 42.9 | 50.7 | 88.1 | |||||

| Pounds sold (millions) | 14.2 | 15.4 | 14.2 | 15.4 | — | — | |||||

| Gold production costs ($/oz) | 973 | 643 | 1,138 | 1,050 | 829 | 445 | |||||

| All-in sustaining costs on a by-product basis ($/oz) | 1,302 | 827 | 1,318 | 1,150 | 1,092 | 582 | |||||

| All-in costs on a by-product basis ($/oz) | 1,509 | 983 | 1,401 | 1,218 | 1,098 | 586 | |||||

| Gold – All-in sustaining costs on a co-product basis ($/oz) | 1,401 | 858 | 1,526 | 1,245 | 1,092 | 582 | |||||

| Copper production costs ($/pound) | 1.99 | 2.30 | 1.99 | 2.30 | n/a | n/a | |||||

| Copper – All-in sustaining costs on a co-product basis ($/pound) | 2.69 | 2.73 | 2.69 | 2.73 | n/a | n/a | |||||

Certain unit costs, including all-in sustaining costs on a by-product basis (including and excluding revenue-based taxes) per ounce, are non-GAAP ratios which include as a component certain non-GAAP financial measures including all-in sustaining costs on a by-product basis which can be reconciled as follows:

| Nine months ended September 30, | ||||||||||||

| Consolidated | Mount Milligan | Öksüt | ||||||||||

| (Unaudited – $millions, unless otherwise specified) | 2024 | 2023 | 2024 | 2023 | 2024 | 2023 | ||||||

| Production costs attributable to gold | 244.5 | 178.8 | 130.1 | 135.3 | 114.4 | 43.5 | ||||||

| Production costs attributable to copper | 86.9 | 106.0 | 86.9 | 106.0 | — | — | ||||||

| Total production costs excluding Molybdenum BU segment, as reported | 331.4 | 284.8 | 217.0 | 241.3 | 114.4 | 43.5 | ||||||

| Adjust for: | ||||||||||||

| Third party smelting, refining and transport costs | 8.3 | 7.8 | 7.6 | 7.4 | 0.7 | 0.4 | ||||||

| By-product and co-product credits | (147.1 | ) | (137.5 | ) | (146.9 | ) | (137.2 | ) | (0.2 | ) | (0.3 | ) |

| Adjusted production costs | 192.6 | 155.1 | 77.7 | 111.5 | 114.9 | 43.6 | ||||||

| Corporate general administrative and other costs | 31.3 | 32.8 | 0.7 | 0.1 | 0.6 | — | ||||||

| Reclamation and remediation – accretion (operating sites) | 7.6 | 4.3 | 1.7 | 1.8 | 5.9 | 2.5 | ||||||

| Sustaining capital expenditures | 77.2 | 48.1 | 46.2 | 27.6 | 30.6 | 20.5 | ||||||

| Sustaining lease payments | 5.0 | 4.3 | 4.0 | 3.8 | 1.0 | 0.5 | ||||||

| All-in sustaining costs on a by-product basis | 313.7 | 244.6 | 130.3 | 144.8 | 153.0 | 67.1 | ||||||

| Exploration and study costs | 34.5 | 50.4 | 5.3 | 4.2 | 0.7 | 1.3 | ||||||

| Non-sustaining capital expenditures | 0.8 | 2.9 | — | — | — | — | ||||||

| Care and maintenance and other costs | 20.3 | 23.0 | 4.2 | — | — | 14.2 | ||||||

| All-in costs on a by-product basis | 369.3 | 320.9 | 139.8 | 149.0 | 153.7 | 82.6 | ||||||

| Ounces sold (000s) | 284.3 | 218.1 | 122.5 | 119.3 | 161.8 | 98.8 | ||||||

| Pounds sold (millions) | 41.5 | 43.5 | 41.5 | 43.5 | — | — | ||||||

| Gold production costs ($/oz) | 860 | 820 | 1,062 | 1,134 | 710 | 440 | ||||||

| All-in sustaining costs on a by-product basis ($/oz) | 1,103 | 1,122 | 1,064 | 1,214 | 946 | 679 | ||||||

| All-in costs on a by-product basis ($/oz) | 1,299 | 1,471 | 1,141 | 1,249 | 950 | 836 | ||||||

| Gold – All-in sustaining costs on a co-product basis ($/oz) | 1,218 | 1,168 | 1,329 | 1,300 | 946 | 679 | ||||||

| Copper production costs ($/pound) | 2.09 | 2.43 | 2.09 | 2.43 | n/a | n/a | ||||||

| Copper – All-in sustaining costs on a co-product basis ($/pound) | 2.61 | 2.78 | 2.61 | 2.78 | n/a | n/a | ||||||

Adjusted net earnings (loss) is a non-GAAP financial measure and can be reconciled as follows:

| Three months ended September 30, | Nine months ended September 30, | ||||||||||

| ($millions, except as noted) | 2024 | 2023 | 2024 | 2023 | |||||||

| Net earnings (loss) | $ | 28.8 | $ | 60.6 | $ | 132.9 | $ | (52.5 | ) | ||

| Adjust for items not associated with ongoing operations: | |||||||||||

| Unrealized loss on financial assets relating to the Additional Royal Gold Agreement | 1.5 | — | 10.4 | — | |||||||

| Unrealized foreign exchange loss (gain)(1) | 1.3 | (2.3 | ) | (2.1 | ) | (2.3 | ) | ||||

| Income and mining tax adjustments(2) | 0.4 | 9.2 | (4.5 | ) | 19.9 | ||||||

| Transaction costs related to the Additional Royal Gold Agreement | — | — | 2.5 | — | |||||||

| Unrealized loss on marketable securities | — | — | 0.6 | — | |||||||

| Reclamation expense (recovery) at the Molybdenum BU sites and the Kemess Project | 6.6 | (23.1 | ) | (23.5 | ) | (15.8 | ) | ||||

| Adjusted net earnings (loss) | $ | 38.6 | $ | 44.4 | $ | 116.3 | $ | (50.7 | ) | ||

| Net earnings (loss) per share – basic | $ | 0.14 | $ | 0.28 | $ | 0.62 | $ | (0.24 | ) | ||

| Net earnings (loss) per share – diluted | $ | 0.13 | $ | 0.27 | $ | 0.61 | $ | (0.25 | ) | ||

| Adjusted net earnings (loss) per share – basic | $ | 0.19 | $ | 0.21 | $ | 0.54 | $ | (0.23 | ) | ||

| Adjusted net earnings (loss) per share – diluted | $ | 0.18 | $ | 0.20 | $ | 0.54 | $ | (0.23 | ) | ||

| (1) | Effect of the foreign exchange movement on the reclamation provision at the Endako Mine and Kemess Project and on the income tax payable and royalty payable related to the Öksüt Mine. |

| (2) | Income tax adjustments reflect the impact of foreign currency translation on deferred income taxes at the Öksüt Mine and the Mount Milligan Mine and the impact of a one-time income tax levied by the Turkish government in the prior period. |

Free cash flow (deficit) is a non-GAAP financial measure and can be reconciled as follows:

| Three months ended September 30, | ||||||||||||||||||||||||||||||

| Consolidated | Mount Milligan | Öksüt | Molybdenum | Other | ||||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | 2024 | 2023 | 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||||

| Cash provided by (used in) operating activities(1) | $ | 103.6 | $ | 166.6 | $ | 40.2 | $ | 35.6 | $ | 97.3 | $ | 143.9 | $ | (14.0 | ) | $ | 9.2 | $ | (19.9 | ) | $ | (22.1 | ) | |||||||

| Deduct: | ||||||||||||||||||||||||||||||

| Property, plant & equipment additions | (66.2 | ) | (22.1 | ) | (24.6 | ) | (10.4 | ) | (10.5 | ) | (10.1 | ) | (31.1 | ) | (0.4 | ) | — | (1.2 | ) | |||||||||||

| Free cash flow (deficit) | $ | 37.4 | $ | 144.5 | $ | 15.6 | $ | 25.2 | $ | 86.8 | $ | 133.8 | $ | (45.1 | ) | $ | 8.8 | $ | (19.9 | ) | $ | (23.3 | ) | |||||||

| (1) | As presented in the Company’s condensed consolidated statements of cash flows. |

| Nine months ended September 30, | ||||||||||||||||||||||||||||||

| Consolidated | Mount Milligan | Öksüt | Molybdenum | Other | ||||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | 2024 | 2023 | 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||||

| Cash provided by (used in) operating activities | $ | 205.6 | $ | 100.2 | $ | 99.3 | $ | 84.8 | $ | 196.6 | $ | 130.8 | $ | (28.7 | ) | $ | (36.7 | ) | $ | (61.6 | ) | $ | (78.7 | ) | ||||||

| Deduct: | ||||||||||||||||||||||||||||||

| Property, plant & equipment additions | (114.0 | ) | (51.0 | ) | (46.0 | ) | (26.2 | ) | (30.6 | ) | (20.5 | ) | (36.9 | ) | (0.5 | ) | (0.5 | ) | (3.8 | ) | ||||||||||

| Free cash flow (deficit) | $ | 91.6 | $ | 49.2 | $ | 53.3 | $ | 58.6 | $ | 166.0 | $ | 110.3 | $ | (65.6 | ) | $ | (37.2 | ) | $ | (62.1 | ) | $ | (82.5 | ) | ||||||

Sustaining capital expenditures and non-sustaining capital expenditures are non-GAAP measures and can be reconciled as follows:

| Three months ended September 30, | |||||||||||||||||||||||||||||

| Consolidated | Mount Milligan | Öksüt | Molybdenum | Other | |||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | 2024 | 2023 | 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||

| Additions to PP&E(1) | $ | 79.7 | $ | 25.0 | $ | 27.2 | $ | 9.3 | $ | 17.9 | $ | 12.7 | $ | 34.3 | $ | 0.5 | $ | 0.3 | $ | 2.5 | |||||||||

| Adjust for: | |||||||||||||||||||||||||||||

| Costs capitalized to the ARO assets | (17.8 | ) | 1.8 | (2.4 | ) | 3.1 | (6.4 | ) | (1.3 | ) | (9.0 | ) | — | — | — | ||||||||||||||

| Costs capitalized to the ROU assets | (0.3 | ) | (2.8 | ) | — | (0.2 | ) | (1.0 | ) | (1.2 | ) | — | — | 0.7 | (1.4 | ) | |||||||||||||

| Other(2) | (1.1 | ) | 0.7 | (0.1 | ) | 0.4 | — | (0.1 | ) | (0.1 | ) | — | (0.9 | ) | 0.4 | ||||||||||||||

| Capital expenditures | $ | 60.5 | $ | 24.6 | $ | 24.7 | $ | 12.5 | $ | 10.5 | $ | 10.1 | $ | 25.2 | $ | 0.5 | $ | 0.1 | $ | 1.5 | |||||||||

| Sustaining capital expenditures | 35.3 | 23.5 | 24.7 | 12.5 | 10.5 | 10.1 | — | 0.5 | 0.1 | 0.4 | |||||||||||||||||||

| Non-sustaining capital expenditures | 25.2 | 1.1 | — | — | — | — | 25.2 | — | — | 1.1 | |||||||||||||||||||

| (1) | As presented in note 16 of the Company’s condensed consolidated interim financial statements. |

| (2) | Includes reclassification of insurance and capital spares from supplies inventory to PP&E. |

| Nine months ended September 30, | |||||||||||||||||||||||||||||

| Consolidated | Mount Milligan | Öksüt | Molybdenum | Other | |||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | 2024 | 2023 | 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||

| Additions to PP&E(1) | $ | 132.9 | $ | 53.8 | $ | 46.8 | $ | 25.4 | $ | 39.5 | $ | 23.4 | $ | 44.8 | $ | 0.6 | $ | 1.8 | $ | 4.4 | |||||||||

| Adjust for: | |||||||||||||||||||||||||||||

| Costs capitalized to the ARO assets | (15.1 | ) | 1.0 | 1.7 | 2.5 | (7.3 | ) | (1.5 | ) | (9.0 | ) | — | (0.5 | ) | — | ||||||||||||||

| Costs capitalized to the ROU assets | (3.1 | ) | (2.7 | ) | (1.8 | ) | (0.1 | ) | (1.6 | ) | (1.2 | ) | — | — | 0.3 | (1.4 | ) | ||||||||||||

| Other(2) | (1.1 | ) | (0.2 | ) | (0.5 | ) | (0.2 | ) | — | (0.2 | ) | (0.1 | ) | — | (0.5 | ) | 0.2 | ||||||||||||

| Capital expenditures | $ | 113.6 | $ | 51.9 | $ | 46.2 | $ | 27.6 | $ | 30.6 | $ | 20.5 | $ | 35.7 | $ | 0.6 | $ | 1.1 | $ | 3.2 | |||||||||

| Sustaining capital expenditures | 82.1 | 49.0 | 46.2 | 27.6 | 30.6 | 20.5 | 4.9 | 0.6 | 0.4 | 0.3 | |||||||||||||||||||

| Non-sustaining capital expenditures | 31.5 | 2.9 | — | — | — | — | 30.8 | — | 0.7 | 2.9 | |||||||||||||||||||

| (1) | As presented in note 16 of the Company’s consolidated financial statements. |

| (2) | Includes reclassification of insurance and capital spares from supplies inventory to PP&E. |

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

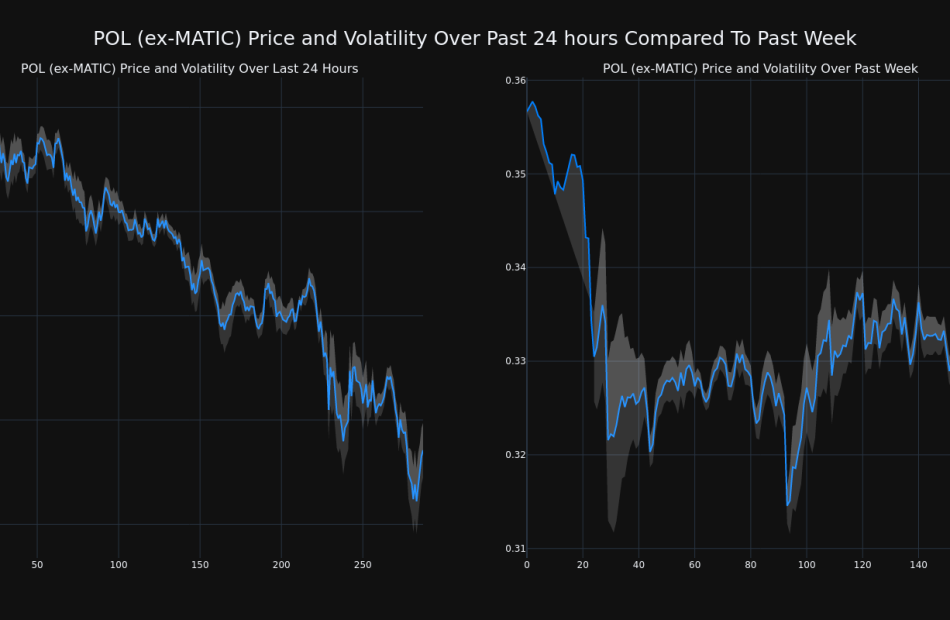

Cryptocurrency POL (ex-MATIC) Falls More Than 4% In 24 hours

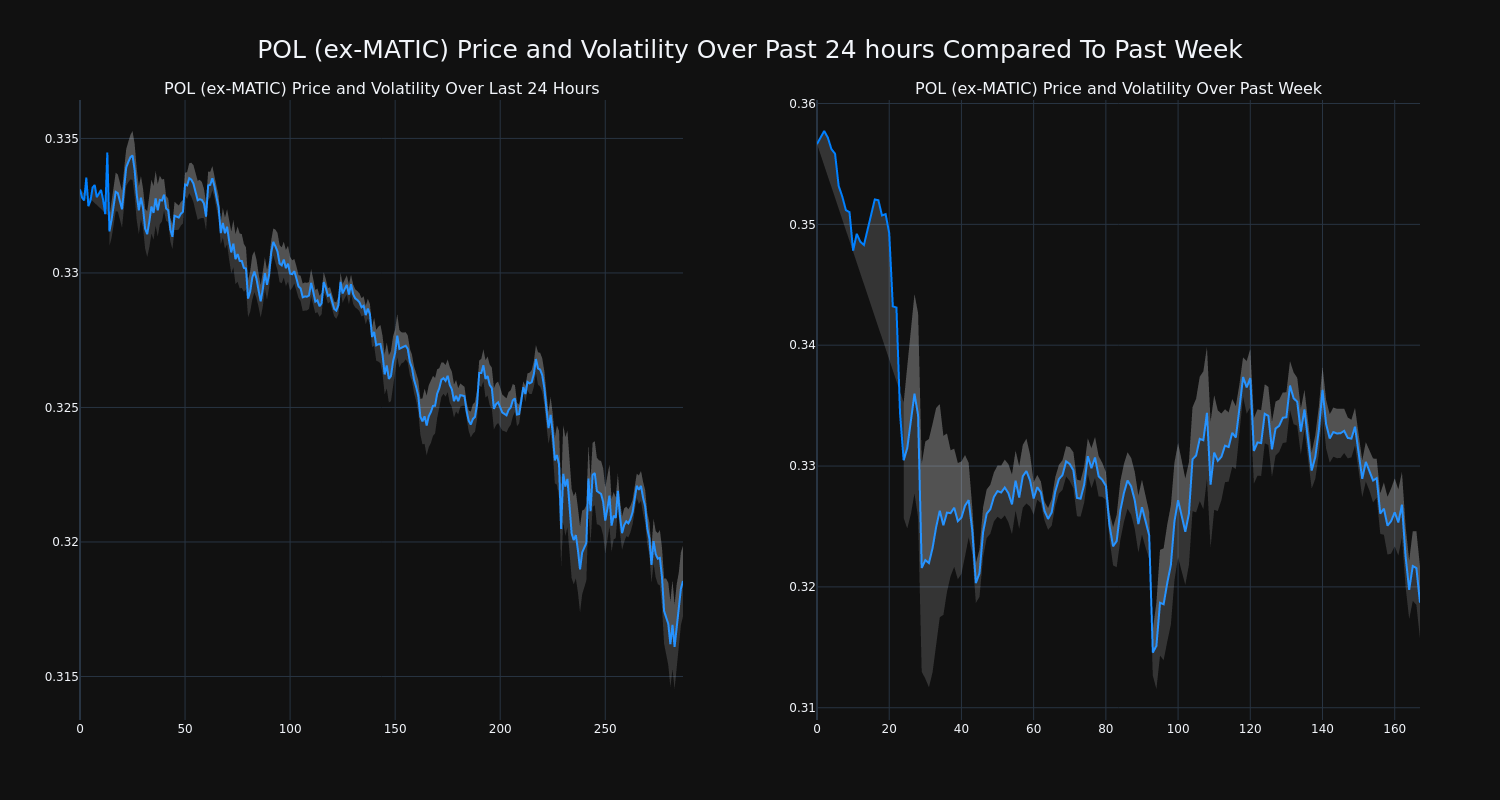

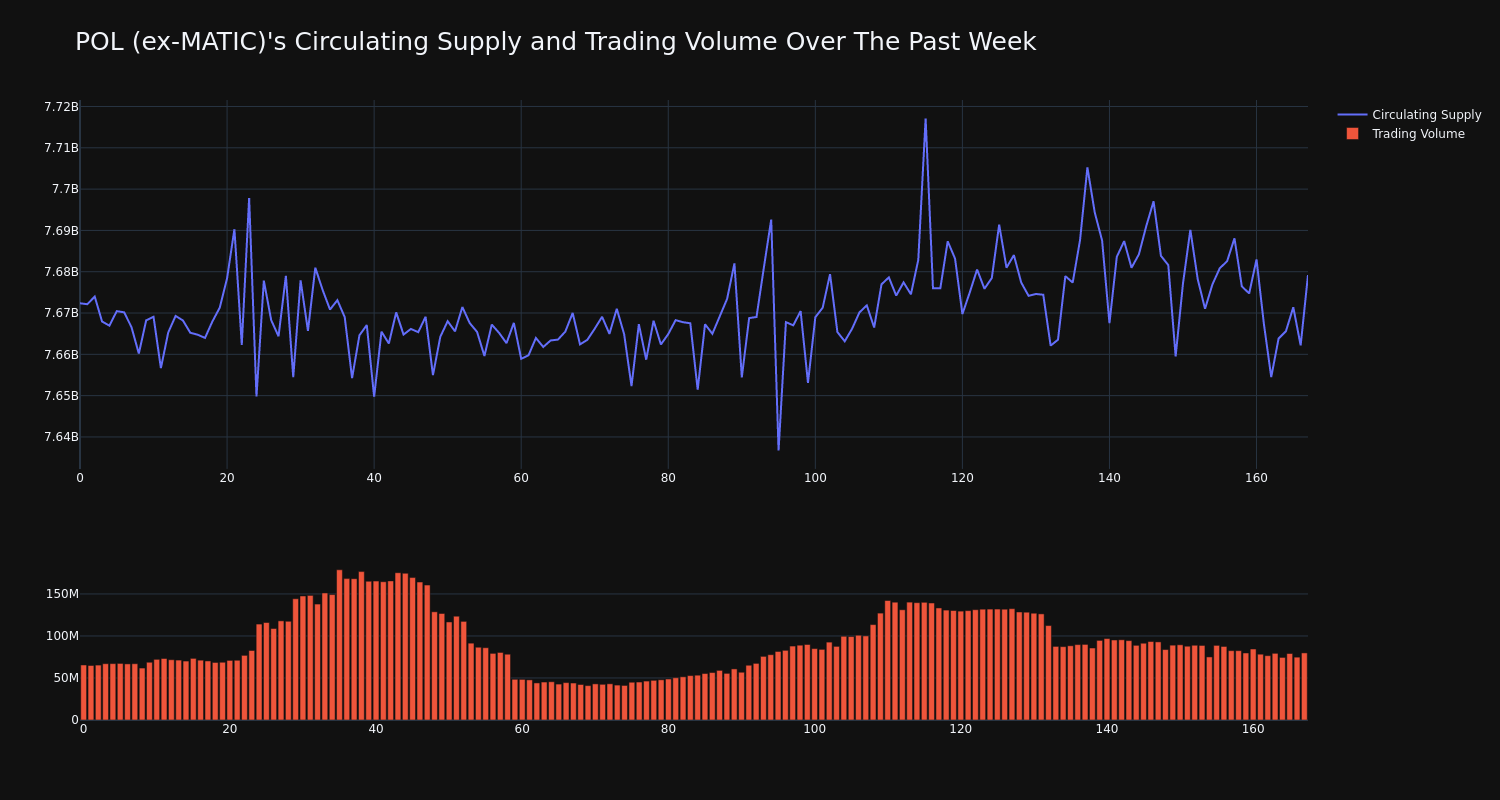

Over the past 24 hours, POL (ex-MATIC)’s POL/USD price has fallen 4.38% to $0.32. This continues its negative trend over the past week where it has experienced a 11.0% loss, moving from $0.36 to its current price.

The chart below compares the price movement and volatility for POL (ex-MATIC) over the past 24 hours (left) to its price movement over the past week (right). The gray bands are Bollinger Bands, measuring the volatility for both the daily and weekly price movements. The wider the bands are, or the larger the gray area is at any given moment, the larger the volatility.

POL (ex-MATIC)’s trading volume has climbed 22.0% over the past week, moving in tandem, directionally, with the overall circulating supply of the coin, which has increased 0.09%. This brings the circulating supply to 7.67 billion. According to our data, the current market cap ranking for POL is #42 at $2.44 billion.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

McGrath RentCorp Chief Strategy Officer Sold $605K In Company Stock

Making a noteworthy insider sell on October 31, Kristina Van Trease Whitney, Chief Strategy Officer at McGrath RentCorp MGRC, is reported in the latest SEC filing.

What Happened: Whitney’s recent Form 4 filing with the U.S. Securities and Exchange Commission on Thursday unveiled the sale of 5,176 shares of McGrath RentCorp. The total transaction value is $605,581.

Tracking the Thursday’s morning session, McGrath RentCorp shares are trading at $116.26, showing a down of 0.0%.

All You Need to Know About McGrath RentCorp

McGrath RentCorp is a rental company. It is comprised of four reportable business segments: Modular building and portable storage segment (Mobile Modular), Electronic test equipment segment (TRS-RenTelco), Containment solutions for the storage of hazardous and non-hazardous liquids and solids segment (Adler Tanks) and Classroom manufacturing division selling modular classrooms in California (Enviroplex). The company generates its revenues majorily from the rental of its equipment on operating leases with sales of equipment occurring in the normal course of business.

Financial Milestones: McGrath RentCorp’s Journey

Revenue Growth: McGrath RentCorp displayed positive results in 3 months. As of 30 September, 2024, the company achieved a solid revenue growth rate of approximately 9.55%. This indicates a notable increase in the company’s top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Industrials sector.

Interpreting Earnings Metrics:

-

Gross Margin: The company excels with a remarkable gross margin of 46.48%, indicating superior cost efficiency and profitability compared to its industry peers.

-

Earnings per Share (EPS): McGrath RentCorp’s EPS outshines the industry average, indicating a strong bottom-line trend with a current EPS of 6.08.

Debt Management: McGrath RentCorp’s debt-to-equity ratio is below the industry average. With a ratio of 0.56, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Market Valuation:

-

Price to Earnings (P/E) Ratio: The P/E ratio of 12.82 is lower than the industry average, implying a discounted valuation for McGrath RentCorp’s stock.

-

Price to Sales (P/S) Ratio: With a higher-than-average P/S ratio of 3.24, McGrath RentCorp’s stock is perceived as being overvalued in the market, particularly in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): McGrath RentCorp’s EV/EBITDA ratio, lower than industry averages at 7.51, indicates attractively priced shares.

Market Capitalization: Indicating a reduced size compared to industry averages, the company’s market capitalization poses unique challenges.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Understanding the Significance of Insider Transactions

Insider transactions, although significant, should be considered within the larger context of market analysis and trends.

In the context of legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as outlined by Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are obligated to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

Pointing towards optimism, a company insider’s new purchase signals their positive anticipation for the stock to rise.

Despite insider sells not always signaling a bearish sentiment, they can be driven by various factors.

Breaking Down the Significance of Transaction Codes

When dissecting transactions, the focal point for investors is often those occurring in the open market, meticulously detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C indicates the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of McGrath RentCorp’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.