Cryptocurrency Arbitrum Decreases More Than 6% Within 24 hours

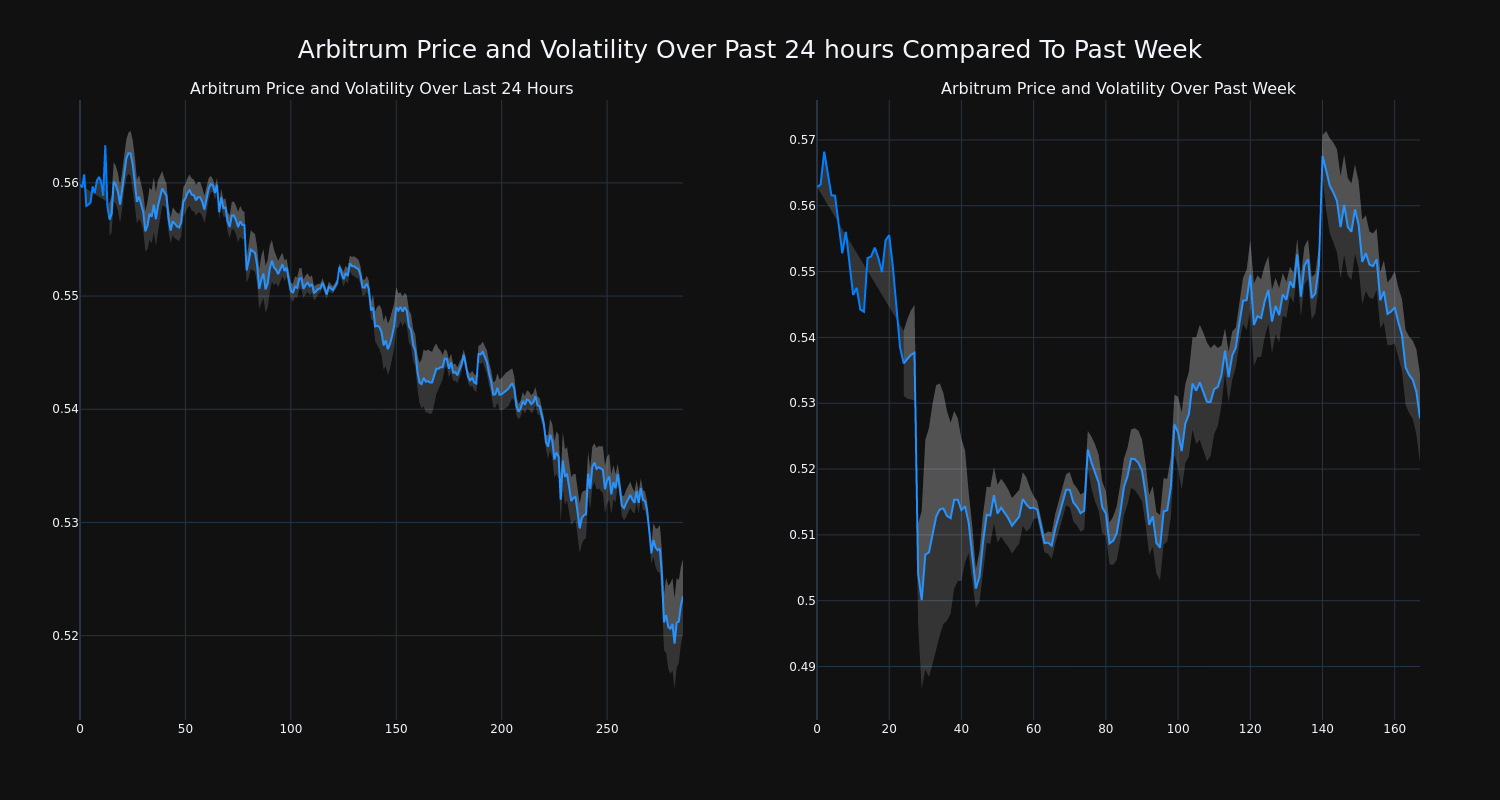

Over the past 24 hours, Arbitrum’s ARB/USD price has fallen 6.59% to $0.52. This continues its negative trend over the past week where it has experienced a 6.0% loss, moving from $0.56 to its current price.

The chart below compares the price movement and volatility for Arbitrum over the past 24 hours (left) to its price movement over the past week (right). The gray bands are Bollinger Bands, measuring the volatility for both the daily and weekly price movements. The wider the bands are, or the larger the gray area is at any given moment, the larger the volatility.

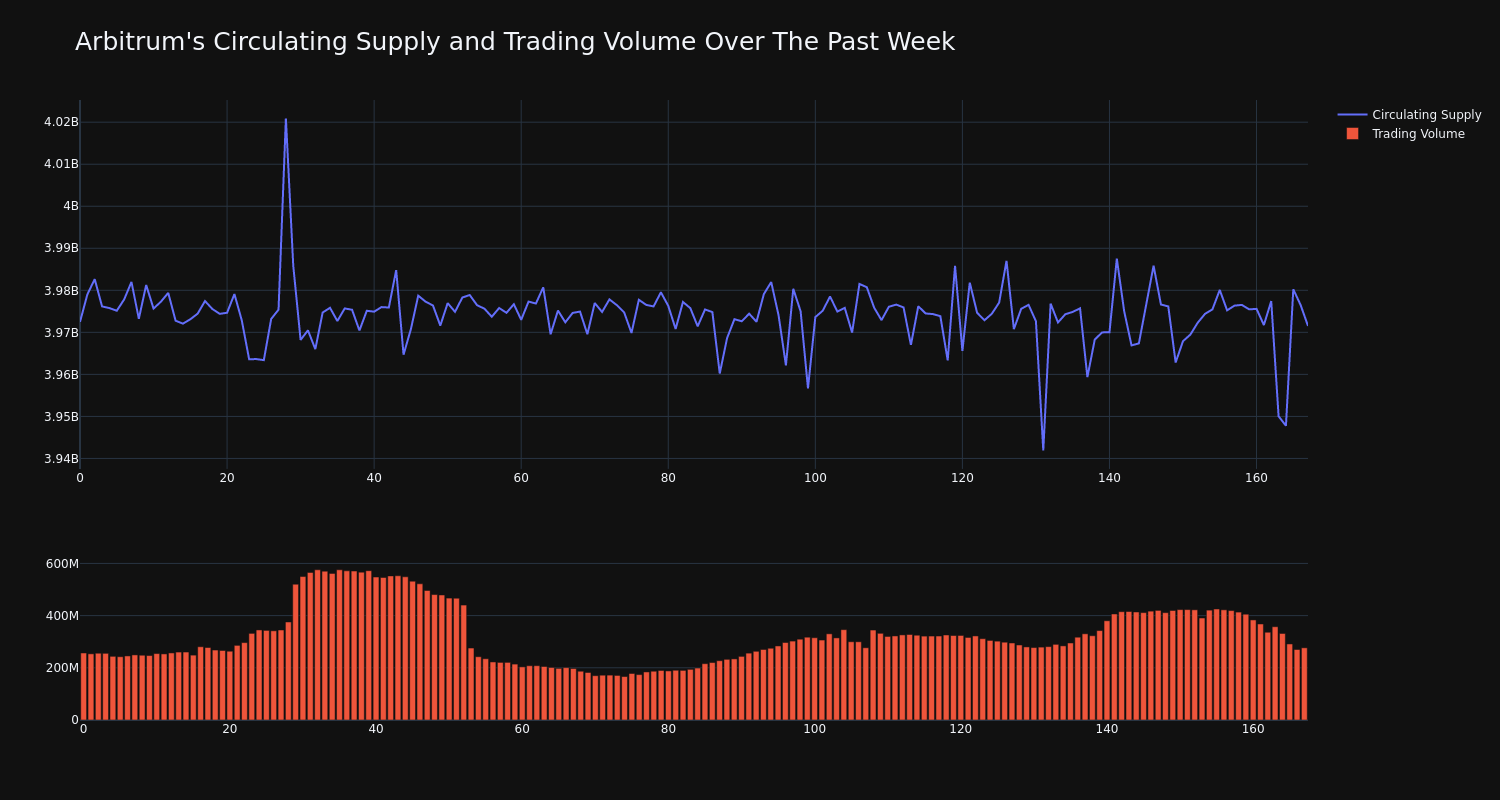

The trading volume for the coin has increased 8.0% over the past week. while the overall circulating supply of the coin has decreased 0.02% This puts its current circulating supply at an estimated 39.75% of its max supply, which is 10.00 billion. The current market cap ranking for ARB is #48 at $2.08 billion.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

SiriusPoint Announces Dividend on Series B Preference Shares

HAMILTON, Bermuda, Oct. 31, 2024 (GLOBE NEWSWIRE) — SiriusPoint Ltd. (“SiriusPoint” or the “Company”) SPNT, an international specialty insurer and reinsurer, has announced that the Audit Committee of the Board of Directors of SiriusPoint Ltd. approved a quarterly cash dividend of $0.50 per share on its 8.00% Resettable Fixed Rate Preference Shares, Series B, $0.10 par value, $25.00 liquidation preference per share payable on or prior to November 30, 2024 to Series B shareholders of record as of November 15, 2024.

About SiriusPoint

SiriusPoint is a global underwriter of insurance and reinsurance providing solutions to clients and brokers around the world. Bermuda-headquartered with offices in New York, London, Stockholm and other locations, we are listed on the New York Stock Exchange (SPNT). We have licenses to write Property & Casualty and Accident & Health insurance and reinsurance globally. Our offering and distribution capabilities are strengthened by a portfolio of strategic partnerships with Managing General Agents and Program Administrators. With over $3.0 billion total capital, SiriusPoint’s operating companies have a financial strength rating of A- (Stable) from AM Best, S&P and Fitch, and A3 (Stable) from Moody’s. For more information please visit www.siriuspt.com.

Contacts

Investor Relations

Liam Blackledge, SiriusPoint

Liam.Blackledge@siriuspt.com

+ 44 203 772 3082

Media

Sarah Hills, Rein4ce

Sarah.Hills@rein4ce.co.uk

+ 44 7718 882011

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

CrossCountry Mortgage Commits Over $15 Million in Down Payment Assistance, Helping More than 6,500 First-Time Homebuyers

CLEVELAND, Oct. 31, 2024 /PRNewswire/ — In a time when housing has become less and less affordable, CrossCountry Mortgage (CCM), the nation’s number one distributed retail mortgage lender, is staying firm on its commitment to making homeownership more attainable for first-time homebuyers. The company initially pledged $10 million to its down payment assistance programs and to date, has exceeded that commitment contributing over $15 million to assist over 6,500 first-time homebuyers.

“Everyone deserves to be a part of a neighborhood that provides a sense of belonging and security,” said Jayma Banks, Senior Vice President of Housing Initiatives. “Putting a down payment on a home remains one of the largest barriers to homeownership. We’re dedicated to developing unique solutions to overcome the challenges faced by first-time homebuyers, giving individuals the opportunity to build strong roots in the communities they desire.”

In 2023, CCM established a Housing Initiatives team focused on identifying ways CCM can provide affordable and equitable solutions to enhance access to sustainable homeownership for first-time homebuyers, minority homebuyers, and underrepresented communities.

CCM offers multiple down payment assistance programs with varying eligibility requirements including:

- Freddie Mac BorrowSmart AccessSM: An option that provides up to $4,000 in down payment assistance based on Area Median Income (AMI) and other eligibility criteria. It is available in select MSAs across the United States.

- CCM Smart Start: A program for first-time homebuyers that covers up to $5,250 of their down payment.

- CCM Community Promise: A program that provides $6,500 in down payment assistance to first-time homebuyers who live in qualifying neighborhoods in select cities.

CCM also has a digital, educational experience for first-time homebuyers that walks consumers step-by-step through the homebuyer process. The tool offers a comprehensive mortgage calculator, an option to easily connect with a nearby loan officer, and a library of real stories from other first-time homebuyers to learn about shared experiences.

About CrossCountry Mortgage

CrossCountry Mortgage (CCM) is the nation’s number one distributed retail mortgage lender with more than 7,000 employees operating over 700 branches and servicing loans across all 50 states, D.C. and Puerto Rico. Our company has been recognized ten times on the Inc. 5000 list of America’s fastest-growing private businesses and has received many awards for our standout culture. We offer more than 120 mortgage, refinance and home equity solutions – ranging from conventional and jumbo mortgages to government-insured programs from FHA and programs for Veterans and rural homebuyers – and we are a direct lender and approved seller and servicer by Freddie Mac, Fannie Mae, and Ginnie Mae. Through our dedication to getting it done, we make every mortgage feel like a win. Visit ccm.com.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/crosscountry-mortgage-commits-over-15-million-in-down-payment-assistance-helping-more-than-6-500-first-time-homebuyers-302293069.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/crosscountry-mortgage-commits-over-15-million-in-down-payment-assistance-helping-more-than-6-500-first-time-homebuyers-302293069.html

SOURCE CrossCountry Mortgage

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

VP Of McGrath RentCorp Makes $605K Sale

David Whitney, VP at McGrath RentCorp MGRC, reported an insider sell on October 31, according to a new SEC filing.

What Happened: After conducting a thorough analysis, Whitney sold 5,176 shares of McGrath RentCorp. This information was disclosed in a Form 4 filing with the U.S. Securities and Exchange Commission on Thursday. The total transaction value is $605,581.

The latest market snapshot at Thursday morning reveals McGrath RentCorp shares down by 0.0%, trading at $116.26.

Unveiling the Story Behind McGrath RentCorp

McGrath RentCorp is a rental company. It is comprised of four reportable business segments: Modular building and portable storage segment (Mobile Modular), Electronic test equipment segment (TRS-RenTelco), Containment solutions for the storage of hazardous and non-hazardous liquids and solids segment (Adler Tanks) and Classroom manufacturing division selling modular classrooms in California (Enviroplex). The company generates its revenues majorily from the rental of its equipment on operating leases with sales of equipment occurring in the normal course of business.

McGrath RentCorp: Delving into Financials

Revenue Growth: Over the 3 months period, McGrath RentCorp showcased positive performance, achieving a revenue growth rate of 9.55% as of 30 September, 2024. This reflects a substantial increase in the company’s top-line earnings. When compared to others in the Industrials sector, the company excelled with a growth rate higher than the average among peers.

Analyzing Profitability Metrics:

-

Gross Margin: The company excels with a remarkable gross margin of 46.48%, indicating superior cost efficiency and profitability compared to its industry peers.

-

Earnings per Share (EPS): McGrath RentCorp’s EPS is a standout, portraying a positive bottom-line trend that exceeds the industry average with a current EPS of 6.08.

Debt Management: McGrath RentCorp’s debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.56.

Valuation Metrics:

-

Price to Earnings (P/E) Ratio: The current P/E ratio of 12.82 is below industry norms, indicating potential undervaluation and presenting an investment opportunity.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 3.24 is above industry norms, reflecting an elevated valuation for McGrath RentCorp’s stock and potential overvaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): The company’s EV/EBITDA ratio of 7.51 trails industry averages, indicating a potential disparity in market valuation that could be advantageous for investors.

Market Capitalization Analysis: Falling below industry benchmarks, the company’s market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Insider Transactions Are Important

Insider transactions are not the sole determinant of investment choices, but they are a factor worth considering.

Exploring the legal landscape, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated by Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and major hedge funds. These insiders are required to report their transactions through a Form 4 filing, which must be submitted within two business days of the transaction.

Highlighted by a company insider’s new purchase, there’s a positive anticipation for the stock to rise.

But, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

Cracking Transaction Codes

Examining transactions, investors often concentrate on those unfolding in the open market, meticulously detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C indicates the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of McGrath RentCorp’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Fairfax India Holdings Corporation: Third Quarter Financial Results

NOT FOR DISTRIBUTION TO U.S. NEWS WIRE SERVICES OR DISSEMINATION IN THE UNITED STATES

(Note: All dollar amounts in this press release are expressed in U.S. dollars except as otherwise noted. The financial results are derived from financial statements prepared using the recognition and measurement requirements of International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS® Accounting Standards”), except as otherwise noted, and are unaudited. This press release contains certain non-GAAP and other financial measures, including book value per share and cash and marketable securities, that do not have a prescribed meaning under IFRS Accounting Standards and may not be comparable to similar financial measures presented by other issuers. See “Glossary of non-GAAP and other financial measures” in the company’s Interim Report for the three and nine months ended September 30, 2024 for further details.)

TORONTO, Oct. 31, 2024 (GLOBE NEWSWIRE) — Fairfax India Holdings Corporation FIH announces net earnings of $34.0 million in the third quarter of 2024 ($0.25 net earnings per diluted share), compared to net earnings of $133.0 million in the third quarter of 2023 ($0.93 net earnings per diluted share). At September 30, 2024 the company’s book value per share increased 0.7% to $21.67 from $21.52 at June 30, 2024 ($21.85 at December 31, 2023), primarily due to net gains on investments, partially offset by an increased provision for deferred income taxes.

Highlights for the third quarter of 2024 included the following:

- Net change in unrealized gains on investments of $83.4 million principally from an increase in the fair value of the company’s listed investment in IIFL Securities ($136.7 million) and private company investments in BIAL ($22.2 million), Maxop ($18.1 million) and Seven Islands ($9.3 million), partially offset by decreases in the fair values of the company’s listed investments in CSB Bank ($42.7 million), IIFL Finance ($41.2 million) and Fairchem Organics ($12.4 million) and its investment in private company Sanmar ($17.0 million).

- On October 11, 2024 the company completed its previously announced investment in Global Aluminium Private Limited (“Global Aluminium”) for approximately $83 million (7.0 billion Indian rupees) of which the company has retained approximately $8.3 million (700.0 million Indian rupees) until the sellers complete certain post-closing obligations.

Fairfax India is in strong financial health, with cash and marketable securities at September 30, 2024 of $285.7 million, prior to the acquisition of Global Aluminium described above.

There were 135.2 million and 136.5 million weighted average common shares outstanding during the third quarters of 2024 and 2023, respectively. At September 30, 2024 there were 105,152,447 subordinate voting shares and 30,000,000 multiple voting shares outstanding.

Unaudited balance sheets, earnings (loss) and comprehensive income (loss) information follow and form part of this press release. Fairfax India’s third quarter report can be accessed at its website www.fairfaxindia.ca.

Fairfax India Holdings Corporation is an investment holding company whose objective is to achieve long term capital appreciation, while preserving capital, by investing in public and private equity securities and debt instruments in India and Indian businesses or other businesses with customers, suppliers or business primarily conducted in, or dependent on, India.

| For further information, contact: | John Varnell, Vice President, Corporate Affairs (416) 367-4755 |

|

This press release may contain forward-looking statements within the meaning of applicable securities legislation. Forward-looking statements may relate to the company’s or an Indian Investment’s future outlook and anticipated events or results and may include statements regarding the financial position, business strategy, growth strategy, budgets, operations, financial results, taxes, dividends, plans and objectives of the company. Particularly, statements regarding future results, performance, achievements, prospects or opportunities of the company, an Indian Investment, or the Indian market are forward-looking statements. In some cases, forward-looking statements can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate” or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might”, “will” or “will be taken”, “occur” or “be achieved”.

Forward-looking statements are based on our opinions and estimates as of the date of this press release, and they are subject to known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking statements, including but not limited to the following factors: oil price risk; geographic concentration of investments; foreign currency fluctuation; volatility of the Indian securities markets; investments may be made in foreign private businesses where information is unreliable or unavailable; valuation methodologies involve subjective judgments; financial market fluctuations; pace of completing investments; minority investments; reliance on key personnel and risks associated with the Investment Advisory Agreement; disruption of the company’s information technology systems; lawsuits; use of leverage; significant ownership by Fairfax may adversely affect the market price of the subordinate voting shares; weather risk; taxation risks; emerging markets; MLI; economic risk; trading price of subordinate voting shares relative to book value per share risk; and economic disruptions from the after-effects of the COVID-19 pandemic and the conflicts in Ukraine and the Middle East. Additional risks and uncertainties are described in the company’s annual information form dated March 8, 2024 which is available on SEDAR+ at www.sedarplus.ca and on the company’s website at www.fairfaxindia.ca. These factors and assumptions are not intended to represent a complete list of the factors and assumptions that could affect the company. These factors and assumptions, however, should be considered carefully.

Although the company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The company does not undertake to update any forward-looking statements contained herein, except as required by applicable securities laws.

| Information on | ||||||

| CONSOLIDATED BALANCE SHEETS | ||||||

| as at September 30, 2024 and December 31, 2023 | ||||||

| (unaudited – US$ thousands) | ||||||

| September 30, 2024 |

December 31, 2023 |

|||||

| Assets | ||||||

| Cash and cash equivalents | 23,614 | 174,615 | ||||

| Short term investments | 62,446 | — | ||||

| Bonds | 231,176 | 63,263 | ||||

| Common stocks | 3,389,953 | 3,581,043 | ||||

| Total cash and investments | 3,707,189 | 3,818,921 | ||||

| Interest and dividends receivable | 6,080 | 1,367 | ||||

| Income taxes refundable | 178 | 220 | ||||

| Other assets | 840 | 1,027 | ||||

| Total assets | 3,714,287 | 3,821,535 | ||||

| Liabilities | ||||||

| Accounts payable and accrued liabilities | 975 | 912 | ||||

| Accrued interest expense | 2,361 | 8,611 | ||||

| Income taxes payable | 428 | — | ||||

| Payable to related parties | 10,345 | 120,858 | ||||

| Deferred income taxes | 144,738 | 108,553 | ||||

| Borrowings | 498,218 | 497,827 | ||||

| Total liabilities | 657,065 | 736,761 | ||||

| Equity | ||||||

| Common shareholders’ equity | 2,928,425 | 2,958,718 | ||||

| Non-controlling interests | 128,797 | 126,056 | ||||

| Total equity | 3,057,222 | 3,084,774 | ||||

| 3,714,287 | 3,821,535 | |||||

| Book value per share | $ | 21.67 | $ | 21.85 | ||

| Information on CONSOLIDATED STATEMENTS OF EARNINGS (LOSS) for the three and nine months ended September 30, 2024 and 2023 (unaudited – US$ thousands except per share amounts) |

||||||||||||

| Third quarter | First nine months | |||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||

| Income | ||||||||||||

| Interest | 5,687 | 4,128 | 15,455 | 13,322 | ||||||||

| Dividends | 1,639 | 8,333 | 9,177 | 16,623 | ||||||||

| Net realized gains (losses) on investments | 330 | (218 | ) | 218,654 | 47,445 | |||||||

| Net change in unrealized gains (losses) on investments | 83,390 | 177,463 | (143,725 | ) | 317,121 | |||||||

| Net foreign exchange losses | (2,322 | ) | (4,581 | ) | (2,334 | ) | (2,035 | ) | ||||

| 88,724 | 185,125 | 97,227 | 392,476 | |||||||||

| Expenses | ||||||||||||

| Investment and advisory fees | 10,384 | 10,376 | 29,990 | 28,662 | ||||||||

| Performance fee | — | 20,469 | — | 41,536 | ||||||||

| General and administration expenses | 1,698 | 1,126 | 6,342 | 10,788 | ||||||||

| Interest expense | 6,380 | 6,380 | 19,141 | 19,141 | ||||||||

| 18,462 | 38,351 | 55,473 | 100,127 | |||||||||

| Earnings before income taxes | 70,262 | 146,774 | 41,754 | 292,349 | ||||||||

| Provision for income taxes | 32,950 | 13,789 | 43,504 | 45,256 | ||||||||

| Net earnings (loss) | 37,312 | 132,985 | (1,750 | ) | 247,093 | |||||||

| Attributable to: | ||||||||||||

| Shareholders of Fairfax India | 33,971 | 132,954 | (5,391 | ) | 236,802 | |||||||

| Non-controlling interests | 3,341 | 31 | 3,641 | 10,291 | ||||||||

| 37,312 | 132,985 | (1,750 | ) | 247,093 | ||||||||

| Net earnings (loss) per share | $ | 0.25 | $ | 0.97 | $ | (0.04 | ) | $ | 1.73 | |||

| Net earnings (loss) per diluted share | $ | 0.25 | $ | 0.93 | $ | (0.04 | ) | $ | 1.65 | |||

| Shares outstanding (weighted average) | 135,152,447 | 136,461,692 | 135,223,349 | 137,274,424 | ||||||||

| Information on CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) for the three and nine months ended September 30, 2024 and 2023 (unaudited – US$ thousands) |

||||||||||||

| Third quarter | First nine months | |||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||

| Net earnings (loss) | 37,312 | 132,985 | (1,750 | ) | 247,093 | |||||||

| Other comprehensive loss, net of income taxes | ||||||||||||

| Item that may be subsequently reclassified to net earnings (loss) | ||||||||||||

| Unrealized foreign currency translation losses, net of income taxes of nil (2023 – nil) | (15,243 | ) | (35,672 | ) | (21,584 | ) | (12,129 | ) | ||||

| Comprehensive income (loss) | 22,069 | 97,313 | (23,334 | ) | 234,964 | |||||||

| Attributable to: | ||||||||||||

| Shareholders of Fairfax India | 19,365 | 98,788 | (26,075 | ) | 225,186 | |||||||

| Non-controlling interests | 2,704 | (1,475 | ) | 2,741 | 9,778 | |||||||

| 22,069 | 97,313 | (23,334 | ) | 234,964 | ||||||||

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Arbe Robotics, Ltd. Announces Proposed Public Offering

TEL AVIV, Israel, Oct. 31, 2024 /PRNewswire/ — Arbe Robotics Ltd. (NASDAQ, TASE: ARBE) (“Arbe” or the “Company”), a global leader in Perception Radar Solutions, today announced that it is proposing to offer and sell, subject to market conditions, its ordinary shares (or pre-funded warrants in lieu thereof) accompanied by Tranche A Warrants to purchase ordinary shares and Tranche B Warrants to purchase ordinary shares in an underwritten public offering. The offering is subject to market and other conditions, and there can be no assurance as to whether or when the offering may be completed, or as to the actual size or terms of the offering.

Canaccord Genuity is acting as the sole bookrunner for the offering.

Arbe intends to use the net proceeds from this offering for working capital and general corporate purposes.

The securities described above are being offered pursuant to a registration statement on Form F-3 (File No. 333-269235), as amended, originally filed on January 13, 2023, with the Securities and Exchange Commission (the “SEC”) and declared effective by the SEC on February 24, 2023. The offering is being made only by means of a prospectus and prospectus supplement which forms a part of the effective registration statement relating to the offering. A preliminary prospectus supplement and accompanying prospectus relating to the offering has been filed with the SEC. Electronic copies of the preliminary prospectus supplement and accompanying prospectus, when available, may be obtained on the SEC’s website at http://www.sec.gov and may also be obtained, when available, by contacting Canaccord Genuity LLC, Attn: Syndication Department, 1 Post Office Square, 30th Floor, Boston, MA 02109, or by email at prospectus@cgf.com.

This press release shall not constitute an offer to sell or a solicitation of an offer to buy any of the securities described herein, nor shall there be any sale of these securities in any state or other jurisdiction in which such an offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such state or other jurisdiction.

About Arbe Robotics, Ltd.

Arbe ARBE, a global leader in Perception Radar solutions, is spearheading a radar revolution, enabling safe driver-assist systems today while paving the way to full autonomous-driving. Arbe’s radar technology is 100 times more detailed than any other radar on the market and is a critical sensor for L2+ and higher autonomy. The company is empowering automakers, Tier 1 suppliers, autonomous ground vehicles, commercial and industrial vehicles, and a wide array of safety applications with advanced sensing and paradigm changing perception. Arbe is based in Tel Aviv, Israel, and has offices in China, Germany, and the United States.

Forward-Looking Statements

This press release contains or will contain “forward-looking statements” within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934, both as amended by the Private Securities Litigation Reform Act of 1995. contains “forward-looking statements” within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934, both as amended by the Private Securities Litigation Reform Act of 1995. The words “expect,” “believe,” “estimate,” “intend,” “plan,” “anticipate,” “may,” “should,” “strategy,” “future,” “will,” “project,” “potential” and similar expressions indicate forward-looking statements. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties, and include, but are not limited to, statements or expectations regarding the anticipated offering and the anticipated use of net proceeds from the offering. Actual events or results could differ materially from those discussed in the forward-looking statements as a result of various factors, including, but not limited to the effect on the Israeli economy generally and on the Company’s business resulting from the terrorism and the hostilities in Israel and with its neighboring countries including the effects of the continuing war with Hamas and any further intensification of hostilities with others, including Iran and Hezbollah, and the effect of the call-up of a significant portion of its working population, including the Company’s employees; the effect of any potential boycott both of Israeli products and business and of stocks in Israeli companies; the effect of any downgrading of the Israeli economy and the effect of changes in the exchange rate between the US dollar and the Israeli shekel; the Company’s ability to meet the conditions to the release from escrow of the proceeds from its recent sale of convertible debentures; the Company’s ability to generate additional OEM selections and substantial orders and the risk and uncertainties described in “Cautionary Note Regarding Forward-Looking Statements,” “Item 3. Key Information – D. Risk Factors” and “Item 5. Operating and Financial Review and Prospects” and in the Company’s Annual Report on Form 20-F for the year ended December 31, 2023, which was filed with the Securities and Exchange Commission (the “SEC”) on March 28, 2024, as well as other documents filed by the Company with the SEC. Accordingly, you are cautioned not to place undue reliance on these forward-looking statements. Forward-looking statements relate only to the date they were made, and the Company does not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made except as required by law or applicable regulation.

Information contained on, or that can be accessed through, the Company’s website or any other website or any social media is expressly not incorporated by reference into and is not a part of this press release.

Logo – https://stockburger.news/wp-content/uploads/2024/10/Arbe_Robotics_Logo.jpg

![]() View original content:https://www.prnewswire.com/news-releases/arbe-robotics-ltd-announces-proposed-public-offering-302293371.html

View original content:https://www.prnewswire.com/news-releases/arbe-robotics-ltd-announces-proposed-public-offering-302293371.html

SOURCE Arbe

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

McGrath RentCorp Insider Trades Send A Signal

Disclosed on October 30, William Dawson, Board Member at McGrath RentCorp MGRC, executed a substantial insider sell as per the latest SEC filing.

What Happened: Dawson’s decision to sell 20,000 shares of McGrath RentCorp was revealed in a Form 4 filing with the U.S. Securities and Exchange Commission on Wednesday. The total value of the sale is $2,300,052.

As of Thursday morning, McGrath RentCorp shares are down by 0.0%, currently priced at $116.26.

Get to Know McGrath RentCorp Better

McGrath RentCorp is a rental company. It is comprised of four reportable business segments: Modular building and portable storage segment (Mobile Modular), Electronic test equipment segment (TRS-RenTelco), Containment solutions for the storage of hazardous and non-hazardous liquids and solids segment (Adler Tanks) and Classroom manufacturing division selling modular classrooms in California (Enviroplex). The company generates its revenues majorily from the rental of its equipment on operating leases with sales of equipment occurring in the normal course of business.

Breaking Down McGrath RentCorp’s Financial Performance

Revenue Growth: McGrath RentCorp’s remarkable performance in 3 months is evident. As of 30 September, 2024, the company achieved an impressive revenue growth rate of 9.55%. This signifies a substantial increase in the company’s top-line earnings. When compared to others in the Industrials sector, the company excelled with a growth rate higher than the average among peers.

Interpreting Earnings Metrics:

-

Gross Margin: The company maintains a high gross margin of 46.48%, indicating strong cost management and profitability compared to its peers.

-

Earnings per Share (EPS): The company excels with an EPS that surpasses the industry average. With a current EPS of 6.08, McGrath RentCorp showcases strong earnings per share.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.56.

Valuation Analysis:

-

Price to Earnings (P/E) Ratio: McGrath RentCorp’s P/E ratio of 12.82 is below the industry average, suggesting the stock may be undervalued.

-

Price to Sales (P/S) Ratio: A higher-than-average P/S ratio of 3.24 suggests overvaluation in the eyes of investors, considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): At 7.51, McGrath RentCorp’s EV/EBITDA ratio reflects a below-par valuation compared to industry averages signalling undervaluation

Market Capitalization Analysis: The company’s market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Exploring the Significance of Insider Trading

Emphasizing the importance of a comprehensive approach, considering insider transactions is valuable, but it’s crucial to evaluate them in conjunction with other investment factors.

From a legal standpoint, the term “insider” pertains to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as outlined in Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and significant hedge funds. These insiders are mandated to inform the public of their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

A company insider’s new purchase is a indicator of their positive anticipation for a rise in the stock.

While insider sells may not necessarily reflect a bearish view and can be motivated by various factors.

Unlocking the Meaning of Transaction Codes

When analyzing transactions, investors tend to focus on those in the open market, detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase,while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of McGrath RentCorp’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Apple Q4 Earnings: Revenue Beat, EPS Beat, Installed Base Hits New Highs, iPhone Sales Rise As Apple Intelligence 'Supercharges' Product Lineup

Apple Inc AAPL reported financial results for the fourth quarter after the market close on Thursday. Here’s a look at the key details from the quarter.

Q4 Earnings: Apple reported fiscal fourth-quarter revenue of $94.9 billion, beating analyst estimates of $94.56 billion. The iPhone maker reported fourth-quarter adjusted earnings of $1.64 per share, beating analyst estimates of $1.60 per share.

Apple has now beat analyst estimates on the top and bottom lines in seven consecutive quarters, according to Benzinga Pro.

Total revenue was up 6% year-over-year. Products revenue came in at $69.96 billion, up from $67.18 billion year-over-year. Services revenue totaled $24.97 billion, up from $22.31 billion year-over-year. Here’s a breakdown of product sales by category:

- iPhone: $46.22 billion, versus $43.8 billion last year

- Mac: $7.74 billion, versus $7.61 billion last year

- iPad: $6.95 billion, versus $6.44 billion last year

- Wearables, Home and Accessories: $9.04 billion, versus $9.32 billion last year

Americas sales totaled $41.66 billion in the quarter, Europe sales came in at $24.92 billion, Greater China sales were $15.03 billion, Japan sales totaled $5.93 billion and the rest of Asia Pacific sales were $7.38 billion.

Apple noted that its active installed base of devices reached a new all-time high across all products and all geographic segments.

“Today Apple is reporting a new September quarter revenue record of $94.9 billion, up 6 percent from a year ago,” said Tim Cook, CEO of Apple.

“During the quarter, we were excited to announce our best products yet, with the all-new iPhone 16 lineup, Apple Watch Series 10, AirPods 4, and remarkable features for hearing health and sleep apnea detection. And this week, we released our first set of features for Apple Intelligence, which sets a new standard for privacy in AI and supercharges our lineup heading into the holiday season.”

Check This Out: Apple Refreshes MacBook Pro Lineup With M4 Pro and M4 Max 3Nm Chips

Apple’s board declared a quarterly cash dividend of 25 cents per share. The dividend is payable on Nov. 14 to shareholders of record as of Nov. 11.

Apple didn’t provide forward guidance in its fourth-quarter earnings release, but the company typically provides commentary on the conference call on how it generally expects its different product lines to perform moving forward. Apple’s conference call with analysts and investors is scheduled for 5 p.m. ET.

AAPL Price Action: Apple shares were up approximately 17.5% year-to-date heading into the print. The stock was down 0.91% in after-hours, trading at $223.85 at the time of publication, according to Benzinga Pro.

Read Next:

Photo: Shutterstock.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Lyons Small Cap Value Ranked #1 in Peer Group for Ten Year Performance

WINTER PARK, Fla., Oct. 31, 2024 /PRNewswire/ — Lyons Wealth Management is proud to announce that its Small Cap Value Strategy was rated by Morningstar as the best performing managed account composite for the past ten years in the Small Value category. On June 30, 2024, Morningstar ranked the Lyons Small Cap Value portfolio #1 out of 131 managed account composites for the ten years ending 6/30/24. The composite also carries a 5-Star Overall Morningstar Rating™. The composite is managed by our affiliate Lyons Investment Management.

“The past ten years have seen a variety of market conditions, and we are proud to have come out on top of the peer group in Small Cap Value”, said Sander Read, CEO of Lyons Wealth. “It’s a testament to our investment philosophy which seeks to outperform regardless of the market environment. The long and successful track record of this strategy demonstrates how a consistent process can win over time”.

“Our top performance in our category is a direct result of our disciplined stock selection process which we have honed over multiple decades”, added Mark Zavanelli, CFA, the strategy’s portfolio manager. “Small caps are where the market is least efficient, and there are thousands of candidates to choose from. This is where finding companies with the right profile for success can lead to an outperforming portfolio”.

The Lyons Small Cap Value portfolio is comprised of approximately 50 holdings selected from the mid, small, and micro-cap sections of the US equity market. Our strategy combines quantitative inputs, such as our proprietary GRAPES valuation model, with a fundamental analysis of each company.

Lyons SCV is available as a separately managed account at leading broker dealers and custodians as well as Turnkey Asset Management Platforms (TAMPs). We are currently active at US Bank Global Custody, Schwab, Interactive Brokers, Morgan Stanley, Envestnet, SmartX, and Amplify.

For more information about the Lyons Small Cap Value Portfolio, visit lyonswealth.com, view our fact sheet here or contact:

Mark Zavanelli

(407) 951-8710

mzavanelli@lyonsinvest.com

Past performance does not guarantee future results.

About Lyons Wealth Management, LLC

Lyons Wealth Management, LLC is a registered investment advisor based in Winter Park, Florida that serves as an asset manager and sub-advisor to a broad range of clients and investment professionals. The firm offers its investment strategies through managed accounts and mutual funds. Lyons Wealth seeks to innovate forward-thinking investment strategies that address the needs of the ever-changing investment environment.

About Lyons Investment Management, Inc

Lyons Investment Management, Inc. (“LIM”) is an SEC registered investment adviser managing separate accounts and model driven strategies. LIM is an affiliate of Lyons Wealth Management, LLC. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability.

Disclosures

No current or prospective client should assume future performance in any specific investment strategy will be profitable or equal to past performance levels. All investment strategies have the potential for profit or loss. Changes in investment strategies, contributions or withdrawals may cause performance results of your portfolio to differ materially from the reported composite return. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. Economic factors, market conditions, and investment strategies will affect the performance of any portfolio and there are no assurances that it will match or outperform any particular benchmark.

The Morningstar Rating™ for funds, or “star rating”, is calculated for separate accounts with at least a three-year history. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product’s monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. The top 10% of products in each product category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating for a managed product is derived from a weighted average of the performance figures associated with its three-, five-, and 10-year (if applicable) Morningstar Rating metrics. © 2024 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/lyons-small-cap-value-ranked-1-in-peer-group-for-ten-year-performance-302293406.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/lyons-small-cap-value-ranked-1-in-peer-group-for-ten-year-performance-302293406.html

SOURCE Lyons Wealth Management, LLC

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Koss Corporation Releases First Quarter Results

MILWAUKEE, Oct. 31, 2024 (GLOBE NEWSWIRE) — Koss Corporation KOSS (the “Company”), the U.S. based high-fidelity headphone company, has reported its results for the first quarter ended September 30, 2024.

Net sales for the first quarter ended September 30, 2024 were $3,201,868 compared to $3,373,938 for the same period in the prior year, a decline of $172,070 or 5.1%. The net loss for the three months ended September 30, 2024 was $419,535 compared to a net loss of $257,609 for the first quarter of the prior fiscal year. Basic and diluted loss per common share for the first quarter of fiscal year 2025 was $0.05 compared to basic and diluted loss per common share of $0.03 for the comparable three-month period one year ago.

“Sales to our domestic distributors were down versus the prior year mainly due to timing of orders. We also saw a decline in sales to our Education and Music customers,” Michael J. Koss, Chairman and CEO, said today. “Backed by the launch of the next generation Porta Pro Wireless 2.0 in September 2024, sales to our two largest European distributors surpassed last year’s levels by over 30%. The Company also had an increase in Direct-to-Consumer (DTC) sales compared to the prior year, driven by several record-setting daily sales on Amazon, as well as the success of the Company’s Porta Pro Wireless 2.0 launch.”

Koss went on to explain that a favorable mix of customer and product sales drove a gross margins improvement to 36.6% compared to 31.6% one year ago as higher margins on sales of the new product complemented a higher volume of higher margin DTC sales.

“The adverse impact of a write-off in the first quarter of fiscal 2025 of some older, excess inventory was partially mitigated by the capitalization of freight costs into inventory for product purchases for the coming season,” Koss continued. “We saw a slight increase in freight rates, along with extended lead times related to port congestion, throughout the first quarter of fiscal year 2025.” Koss also pointed out that the Company expects transit rate increases to continue into the next quarter. “We continue to monitor potential disruptions in the supply chain and will react as necessary to ensure adequate inventory levels in advance of the upcoming holiday season,” Koss said.

About Koss Corporation

Koss Corporation markets a complete line of high-fidelity headphones, wireless Bluetooth® speakers, computer headsets, telecommunications headsets, active noise canceling headphones, and wireless headphones.

Forward-Looking Statements

This press release contains forward-looking statements. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “aims,” “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “thinks,” “may,” “will,” “shall,” “should,” “could,” “would,” “forecasts,” “predicts,” “potential,” “continue,” or the negative of such terms and other comparable terminology. These statements are based on currently available operating, financial and competitive information and are subject to various risks and uncertainties. Actual events or results may differ materially. In evaluating forward-looking statements, you should specifically consider various factors that may cause actual results to vary from those contained in the forward-looking statements, such as general economic conditions, inflationary cost environment, supply chain disruption, the impacts of public health events, such as pandemics, geopolitical instability and war, consumer demand for the Company’s and its customers’ products, competitive and technological developments, foreign currency fluctuations, and costs of operations. Shareholders, potential investors and other readers are urged to consider these factors carefully in evaluating the forward-looking statements and are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements made herein are only made as of the date of this press release and the Company undertakes no obligation to publicly update such forward-looking statements to reflect subsequent events or circumstances or new information. In addition, such uncertainties and other operational matters are discussed further in the Company’s quarterly and annual filings with the Securities and Exchange Commission.

| KOSS CORPORATION CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited) |

|||||||

| Three Months Ended | |||||||

| September 30 | |||||||

| 2024 | 2023 | ||||||

| Net sales | $ | 3,201,868 | $ | 3,373,938 | |||

| Cost of goods sold | 2,028,942 | 2,306,248 | |||||

| Gross profit | 1,172,926 | 1,067,690 | |||||

| Selling, general and administrative expenses | 1,810,059 | 1,536,279 | |||||

| Loss from operations | (637,133 | ) | (468,589 | ) | |||

| Interest income | 220,358 | 212,859 | |||||

| Loss before income tax provision | (416,775 | ) | (255,730 | ) | |||

| Income tax provision | 2,760 | 1,879 | |||||

| Net loss | $ | (419,535 | ) | $ | (257,609 | ) | |

| Loss per common share: | |||||||

| Basic | $ | (0.05 | ) | $ | (0.03 | ) | |

| Diluted | $ | (0.05 | ) | $ | (0.03 | ) | |

| Weighted-average number of shares: | |||||||

| Basic | 9,310,002 | 9,234,795 | |||||

| Diluted | 9,310,002 | 9,234,795 | |||||

| CONTACT: | Michael J. Koss Chairman & CEO (414) 964-5000 mjkoss@koss.com |

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.