Shell announces commencement of a share buyback programme

Shell plc

Shell announces commencement of a share buyback programme

October 31, 2024

Shell plc (the ‘Company’) today announces the commencement of a $3.5 billion share buyback programme covering an aggregate contract term of approximately three months (the ‘programme’). The purpose of the programme is to reduce the issued share capital of the Company. All shares repurchased as part of the programme will be cancelled. It is intended that, subject to market conditions, the programme will be completed prior to the Company’s Q4 2024 results announcement, scheduled for January 30, 2025.

The Company has entered into an arrangement with a single broker consisting of two irrevocable, non-discretionary contracts, to enable the purchase of ordinary shares on both London market exchanges (the London Stock Exchange and/or on BATS and/or on Chi-X) (pursuant to one ‘London contract’) and Netherlands exchanges (Euronext Amsterdam and/or on CBOE Europe DXE and/or on Turquoise Europe) (pursuant to one ‘Netherlands contract’) for a period up to and including January 24, 2025. The aggregate maximum consideration for the purchase of ordinary shares under the London contract is $2.1 billion and the maximum consideration for the purchase of ordinary shares under the Netherlands contract is $1.4 billion. Purchases under the London contract will be carried out in accordance with the Company’s authority1 to repurchase shares on-market and will be effected within certain contractually agreed parameters. Purchases under the Netherlands contract will be carried out in accordance with the Company’s authority1 to repurchase shares off-market pursuant to the off-market share buyback contract approved by its shareholders and the parameters set out therein.

The maximum number of ordinary shares which may be purchased or committed to be purchased by the Company under the programme (across both contracts) is 525,000,000, which is the maximum number remaining as of the date of this announcement pursuant to the relevant authorities granted by shareholders at the Company’s 2024 Annual General Meeting1.

The broker will make its trading decisions in relation to the Company’s securities independently of the Company.

The programme will be conducted in accordance with Chapter 9 of the UK Listing Rules, Article 5 of the Market Abuse Regulation 596/2014/EU dealing with buy-back programmes (‘EU MAR’) and EU MAR as “onshored” into UK law from the end of the Brexit transition period (at 11:00 pm on 31 December 2020) through the European Union (Withdrawal) Act 2018 (as amended by the European Union (Withdrawal Agreement) Act 2020), and as amended, supplemented, restated, novated, substituted or replaced including by relevant statutory instruments (including, The Market Abuse (Amendment) (EU Exit) Regulations (SI 2019/310)), from time to time and the Commission Delegated Regulation (EU) 2016/1052 (the ‘EU MAR Delegated Regulation’) and the EU MAR Delegated Regulation as “onshored” into UK law from the end of the Brexit transition period (at 11:00 pm on 31 December 2020) through the European Union (Withdrawal) Act 2018 (as amended by the European Union (Withdrawal Agreement) Act 2020), and as amended, supplemented, restated, novated, substituted or replaced, including by relevant statutory instruments (including, The Market Abuse (Amendment) (EU Exit) Regulations (SI 2019/310)), from time to time.

1 The existing shareholder authorities to buy back shares granted at the Company’s 2024 Annual General Meeting will expire at the earlier of the close of business on August 20, 2025, and the end of the date of the Company’s 2025 Annual General Meeting. The Company expects to seek renewal of shareholder authority to buy back shares at subsequent Annual General Meetings.

Enquiries

Media International: +44 (0) 207 934 5550

Media Americas: +1 832 337 4355

Cautionary Note

The companies in which Shell plc directly and indirectly owns investments are separate legal entities. In this announcement “Shell”, “Shell Group” and “Group” are sometimes used for convenience where references are made to Shell plc and its subsidiaries in general. Likewise, the words “we”, “us” and “our” are also used to refer to Shell plc and its subsidiaries in general or to those who work for them. These terms are also used where no useful purpose is served by identifying the particular entity or entities. ‘‘Subsidiaries”, “Shell subsidiaries” and “Shell companies” as used in this announcement refer to entities over which Shell plc either directly or indirectly has control. The term “joint venture”, “joint operations”, “joint arrangements”, and “associates” may also be used to refer to a commercial arrangement in which Shell has a direct or indirect ownership interest with one or more parties. The term “Shell interest” is used for convenience to indicate the direct and/or indirect ownership interest held by Shell in an entity or unincorporated joint arrangement, after exclusion of all third-party interest.

Forward-Looking Statements

This announcement contains forward-looking statements (within the meaning of the U.S. Private Securities Litigation Reform Act of 1995) concerning the financial condition, results of operations and businesses of Shell. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements. Forward-looking statements are statements of future expectations that are based on management’s current expectations and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in these statements. Forward-looking statements include, among other things, statements concerning the potential exposure of Shell to market risks and statements expressing management’s expectations, beliefs, estimates, forecasts, projections and assumptions. These forward-looking statements are identified by their use of terms and phrases such as “aim”; “ambition”; ‘‘anticipate”; ‘‘believe”; “commit”; “commitment”; ‘‘could”; ‘‘estimate”; ‘‘expect”; ‘‘goals”; ‘‘intend”; ‘‘may”; “milestones”; ‘‘objectives”; ‘‘outlook”; ‘‘plan”; ‘‘probably”; ‘‘project”; ‘‘risks”; “schedule”; ‘‘seek”; ‘‘should”; ‘‘target”; ‘‘will”; “would” and similar terms and phrases. There are a number of factors that could affect the future operations of Shell and could cause those results to differ materially from those expressed in the forward-looking statements included in this announcement, including (without limitation): (a) price fluctuations in crude oil and natural gas; (b) changes in demand for Shell’s products; (c) currency fluctuations; (d) drilling and production results; (e) reserves estimates; (f) loss of market share and industry competition; (g) environmental and physical risks; (h) risks associated with the identification of suitable potential acquisition properties and targets, and successful negotiation and completion of such transactions; (i) the risk of doing business in developing countries and countries subject to international sanctions; (j) legislative, judicial, fiscal and regulatory developments including regulatory measures addressing climate change; (k) economic and financial market conditions in various countries and regions; (l) political risks, including the risks of expropriation and renegotiation of the terms of contracts with governmental entities, delays or advancements in the approval of projects and delays in the reimbursement for shared costs; (m) risks associated with the impact of pandemics, such as the COVID-19 (coronavirus) outbreak, regional conflicts, such as the Russia-Ukraine war, and a significant cybersecurity breach; and (n) changes in trading conditions. No assurance is provided that future dividend payments will match or exceed previous dividend payments. All forward-looking statements contained in this announcement are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. Readers should not place undue reliance on forward-looking statements. Additional risk factors that may affect future results are contained in Shell plc’s Form 20-F for the year ended December 31, 2023 (available at www.shell.com/investors/news-and-filings/sec-filings.html and www.sec.gov). These risk factors also expressly qualify all forward-looking statements contained in this announcement and should be considered by the reader. Each forward-looking statement speaks only as of the date of this announcement, October 31, 2024. Neither Shell plc nor any of its subsidiaries undertake any obligation to publicly update or revise any forward-looking statement as a result of new information, future events or other information. In light of these risks, results could differ materially from those stated, implied or inferred from the forward-looking statements contained in this announcement.

Shell’s Net Carbon Intensity

Also, in this announcement we may refer to Shell’s “Net Carbon Intensity” (NCI), which includes Shell’s carbon emissions from the production of our energy products, our suppliers’ carbon emissions in supplying energy for that production and our customers’ carbon emissions associated with their use of the energy products we sell. Shell’s NCI also includes the emissions associated with the production and use of energy products produced by others which Shell purchases for resale. Shell only controls its own emissions. The use of the terms Shell’s “Net Carbon Intensity” or NCI are for convenience only and not intended to suggest these emissions are those of Shell plc or its subsidiaries.

Shell’s net-zero emissions target

Shell’s operating plan, outlook and budgets are forecasted for a ten-year period and are updated every year. They reflect the current economic environment and what we can reasonably expect to see over the next ten years. Accordingly, they reflect our Scope 1, Scope 2 and NCI targets over the next ten years. However, Shell’s operating plans cannot reflect our 2050 net-zero emissions target, as this target is currently outside our planning period. In the future, as society moves towards net-zero emissions, we expect Shell’s operating plans to reflect this movement. However, if society is not net zero in 2050, as of today, there would be significant risk that Shell may not meet this target.

Forward-Looking non-GAAP measures

This announcement may contain certain forward-looking non-GAAP measures such as cash capital expenditure and divestments. We are unable to provide a reconciliation of these forward-looking non-GAAP measures to the most comparable GAAP financial measures because certain information needed to reconcile those non-GAAP measures to the most comparable GAAP financial measures is dependent on future events some of which are outside the control of Shell, such as oil and gas prices, interest rates and exchange rates. Moreover, estimating such GAAP measures with the required precision necessary to provide a meaningful reconciliation is extremely difficult and could not be accomplished without unreasonable effort. Non-GAAP measures in respect of future periods which cannot be reconciled to the most comparable GAAP financial measure are calculated in a manner which is consistent with the accounting policies applied in Shell plc’s consolidated financial statements.

The contents of websites referred to in this announcement do not form part of this announcement.

We may have used certain terms, such as resources, in this announcement that the United States Securities and Exchange Commission (SEC) strictly prohibits us from including in our filings with the SEC. Investors are urged to consider closely the disclosure in our Form 20-F, File No 1-32575, available on the SEC website www.sec.gov.

LEI number of Shell plc: 21380068P1DRHMJ8KU70

Classification: Acquisition or disposal of the issuer’s own shares.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Industrial Co-warehousing Brand Debuts First Location in Atlanta

Co-warehousing Location Offers Small Businesses, Ecommerce Brands and Entrepreneurs a New Home to Run Their Business

ATLANTA, Oct. 31, 2024 /PRNewswire/ — SHIFT, a leading provider of innovative, easy-to-rent warehouse units, is excited to announce the grand opening of its first location in Atlanta, set for November 19th, 2024. The opening of the new location at 575 Wharton Dr. SW marks a significant development for the company and the South Fulton community, as it now offers a modern solution to meet the growing local demand for flexible and collaborative industrial workspaces.

To celebrate the grand opening, the new location is offering a Battle of the Brands Pitch Competition, where a local Atlanta-area based business will receive one year of warehouse space. Participants can apply for the contest at https://hello.shifthq.com/battle-of-the-brands, where 5 finalist brands will have the opportunity to pitch and showcase their business in front of judges at the grand opening event. The event takes place from 6 p.m. to 9 p.m. and is also offering food, drinks, and entertainment, along with the brand pitching competition.

SHIFT South Fulton offers over 100,000 square feet of space and a variety of warehousing options to suit the needs of entrepreneurial individuals and businesses of all sizes. The new location provides 67 warehouse spaces that can be used for storage or workspaces, and 13 office spaces, both of which are rentable. Membership with the facility also provides meeting rooms, loading docks, and common areas that are all shared within the community space. Members also receive amenities and access to advanced security, 24/7 access, and mail and package handling that is targeted to make their business run smoother. SHIFT South Fulton is where productivity meets innovation, setting a new standard for business environments.

“We’re excited to bring the SHIFT brand to Atlanta’s growing community of small businesses,” said Alex Woodard, Chief Executive Officer of SHIFT. “Finding the right warehouse space can be a major hurdle for small businesses. SHIFT makes it easy by providing affordable, flexible spaces without the hassle of long-term commitments or hidden fees. We’re here to help entrepreneurs access the space they need to grow without the stress.”

SHIFT South Fulton is proud to leave a lasting positive impact on the Atlanta community, contributing to the local economy by spurring small business growth and helping aspiring entrepreneurs start their dream businesses off on the right foot. Additionally, the facility fosters a sense of community and collaboration among its members, leading to increased networking opportunities, knowledge sharing, and overall innovation. By offering a vibrant and inclusive workspace, SHIFT South Fulton aims to be a catalyst for growth and development in the Atlanta community for years to come.

The idea behind the concept revolves around the founders, who had spent their careers in the self-storage industry, seeing a void for people looking to kick off their entrepreneurial journey. They saw a need for small business owners who didn’t want to lease property of their own due to the additional fees that come along with it and the finances that go along with maintaining it but needed space to be able to run the business of their dreams. Becoming a member with SHIFT allows business owners to avoid the massive warehouses and offers them space to work and store products in a location that is built around their needs.

For more information about SHIFT South Fulton and to schedule a tour, please visit https://shifthq.com/locations/south-fulton/, or call (470) 748-6706.

About SHIFT

SHIFT is a leading provider of innovative easy-to-rent warehouse solutions that empower individuals and businesses to thrive in today’s dynamic and interconnected world. With a focus on flexibility, affordability, and security, Shift offers a wide range of warehouse spaces from 300-5,000 sq ft, blending industrial amenities like loading docks, electric pallet jacks, and daily carrier pickups, with modern amenities like meeting rooms, coworking areas, and craft coffee and tea. Our facilities are designed to inspire creativity, foster collaboration, and provide a supportive environment for growth and development. By combining, exceptional service, and a commitment to community, Shift aims to be the workspace and storage of choice for businesses seeking an affordable and flexible warehouse experience. For more information, please visit https://shifthq.com/.

Media Contact: Evan Hensley | Fishman PR | ehensley@fishmanpr.com

![]() View original content:https://www.prnewswire.com/news-releases/industrial-co-warehousing-brand-debuts-first-location-in-atlanta-302293102.html

View original content:https://www.prnewswire.com/news-releases/industrial-co-warehousing-brand-debuts-first-location-in-atlanta-302293102.html

SOURCE SHIFT

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Robert G Brown Executes Sell Order: Offloads $51K In SPAR Group Stock

Making a noteworthy insider sell on October 30, Robert G Brown, 10% Owner at SPAR Group SGRP, is reported in the latest SEC filing.

What Happened: According to a Form 4 filing with the U.S. Securities and Exchange Commission on Wednesday, Brown sold 21,221 shares of SPAR Group. The total transaction value is $51,991.

The latest update on Thursday morning shows SPAR Group shares down by 0.0%, trading at $2.43.

Discovering SPAR Group: A Closer Look

SPAR Group Inc is a supplier of merchandising and other marketing services. It also provides range of services to retailers, consumer goods manufacturers and distributors around the globe. The company divides its operations into three reportable regional segments: Americas, which is comprised of United States, Canada, Brazil and Mexico; Asia-Pacific (APAC), which is comprised of Japan, China, and India; and Europe, Middle East and Africa (EMEA), which is comprised of South Africa. It generates maximum revenue from Americas.

Key Indicators: SPAR Group’s Financial Health

Decline in Revenue: Over the 3 months period, SPAR Group faced challenges, resulting in a decline of approximately -13.11% in revenue growth as of 30 June, 2024. This signifies a reduction in the company’s top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Communication Services sector.

Interpreting Earnings Metrics:

-

Gross Margin: The company shows a low gross margin of 19.19%, suggesting potential challenges in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): SPAR Group’s EPS is notably higher than the industry average. The company achieved a positive bottom-line trend with a current EPS of 0.15.

Debt Management: SPAR Group’s debt-to-equity ratio is notably higher than the industry average. With a ratio of 0.73, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

Financial Valuation:

-

Price to Earnings (P/E) Ratio: With a lower-than-average P/E ratio of 4.55, the stock indicates an attractive valuation, potentially presenting a buying opportunity.

-

Price to Sales (P/S) Ratio: The P/S ratio of 0.23 is lower than the industry average, implying a discounted valuation for SPAR Group’s stock in relation to sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With a below-average EV/EBITDA ratio of 2.51, SPAR Group presents an opportunity for value investors. This lower valuation may attract investors seeking undervalued opportunities.

Market Capitalization Analysis: Positioned below industry benchmarks, the company’s market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Pay Attention to Insider Transactions

In the complex landscape of investment decisions, investors should approach insider transactions as part of a comprehensive analysis, considering various elements.

When discussing legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated in Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are required to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

A new purchase by a company insider is a indication that they anticipate the stock will rise.

On the other hand, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

Breaking Down the Significance of Transaction Codes

Investors prefer focusing on transactions that take place in the open market, indicated in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S indicates a sale. Transaction code C indicates the conversion of an option, and transaction code A indicates grant, award or other acquisition of securities from the company.

Check Out The Full List Of SPAR Group’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

ReposiTrak Recent Insider Activity

Making a noteworthy insider sell on October 30, Randall K Fields, Chief Executive Officer at ReposiTrak TRAK, is reported in the latest SEC filing.

What Happened: According to a Form 4 filing with the U.S. Securities and Exchange Commission on Wednesday, Fields sold 7,500 shares of ReposiTrak. The total transaction value is $143,870.

The latest market snapshot at Thursday morning reveals ReposiTrak shares down by 0.0%, trading at $19.18.

Unveiling the Story Behind ReposiTrak

ReposiTrak Inc is a software as a service provider with extensive capabilities that gives their customers an easy, cost-efficient way to expand their services to their benefit. The company and its subsidiaries develop, market, and support proprietary software products. These products assist the management of business operations, which helps clients to make more informed decisions. The company also provides a cloud-based solution to remain in compliance with business records and regulatory requirements. The firm’s services comprise implementation, business optimization, outsourcing, technical services, education, and application hosting.

ReposiTrak’s Financial Performance

Revenue Growth: Over the 3 months period, ReposiTrak showcased positive performance, achieving a revenue growth rate of 7.88% as of 30 June, 2024. This reflects a substantial increase in the company’s top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Information Technology sector.

Exploring Profitability:

-

Gross Margin: The company sets a benchmark with a high gross margin of 83.7%, reflecting superior cost management and profitability compared to its peers.

-

Earnings per Share (EPS): ReposiTrak’s EPS lags behind the industry average, indicating concerns and potential challenges with a current EPS of 0.08.

Debt Management: ReposiTrak’s debt-to-equity ratio is below the industry average at 0.01, reflecting a lower dependency on debt financing and a more conservative financial approach.

Analyzing Market Valuation:

-

Price to Earnings (P/E) Ratio: The current Price to Earnings ratio of 67.76 is higher than the industry average, indicating the stock is priced at a premium level according to the market sentiment.

-

Price to Sales (P/S) Ratio: A higher-than-average P/S ratio of 18.19 suggests overvaluation in the eyes of investors, considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Boasting an EV/EBITDA ratio of 43.87, ReposiTrak demonstrates a robust market valuation, outperforming industry benchmarks.

Market Capitalization Analysis: Positioned below industry benchmarks, the company’s market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Uncovering the Importance of Insider Activity

Insider transactions serve as a piece of the puzzle in investment decisions, rather than the entire picture.

In legal terms, an “insider” refers to any officer, director, or beneficial owner of more than ten percent of a company’s equity securities registered under Section 12 of the Securities Exchange Act of 1934. This can include executives in the c-suite and large hedge funds. These insiders are required to let the public know of their transactions via a Form 4 filing, which must be filed within two business days of the transaction.

When a company insider makes a new purchase, that is an indication that they expect the stock to rise.

Insider sells, on the other hand, can be made for a variety of reasons, and may not necessarily mean that the seller thinks the stock will go down.

A Closer Look at Important Transaction Codes

Investors prefer focusing on transactions that take place in the open market, indicated in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S indicates a sale. Transaction code C indicates the conversion of an option, and transaction code A indicates grant, award or other acquisition of securities from the company.

Check Out The Full List Of ReposiTrak’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

[Latest] Global Trade Finance Market Size/Share Worth USD 157,172.1 Million by 2033 at a 9.2% CAGR: Custom Market Insights (Analysis, Outlook, Leaders, Report, Trends, Forecast, Segmentation, Growth, Growth Rate, Value)

Austin, TX, USA, Oct. 31, 2024 (GLOBE NEWSWIRE) — Custom Market Insights has published a new research report titled “Trade Finance Market Size, Trends and Insights By Product Type (Commercial Letters of Credit (LCs), Standby Letters of Credit (LCs), Guarantees, others), By Provider (Banks, Trade Finance Houses, Others), By Application (Domestic, International), By End User (Traders, Importers, Exporters), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ in its research database.

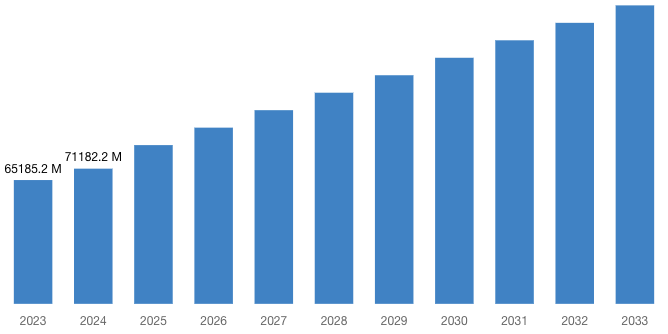

“According to the latest research study, the demand of global Trade Finance Market size & share was valued at approximately USD 65,185.2 Million in 2023 and is expected to reach USD 71,182.2 Million in 2024 and is expected to reach a value of around USD 157,172.1 Million by 2033, at a compound annual growth rate (CAGR) of about 9.2% during the forecast period 2024 to 2033.”

Click Here to Access a Free Sample Report of the Global Trade Finance Market @ https://www.custommarketinsights.com/request-for-free-sample/?reportid=53018

Trade Finance Market: Growth Factors and Dynamics

- Global Trade Expansion: Increasing globalization and international trade agreements drive the growth of the trade finance market. Expansion into new markets and the rise of emerging economies contribute to higher demand for trade finance solutions.

- Need for Working Capital: Businesses require working capital to facilitate trade transactions, including purchasing inventory and fulfilling orders. Trade finance products such as letters of credit and trade credit insurance provide liquidity and mitigate risks associated with international trade.

- Technological Innovation: Advances in financial technology (fintech) streamline trade finance processes, reducing paperwork and transaction times. Blockchain technology improves transparency and security in trade finance, enabling real-time tracking of transactions and reducing fraud.

- Regulatory Environment: Compliance with regulatory requirements, such as Basel III and anti-money laundering (AML) regulations, shapes the trade finance landscape. Adherence to trade finance regulations ensures trust and reliability in cross-border transactions, influencing market dynamics.

- Access to Finance: Access to trade finance is critical for small and medium-sized enterprises (SMEs) to participate in global trade. Initiatives by multilateral development banks and governments to enhance access to finance for SMEs stimulate market growth.

- Risk Management Needs: Volatility in commodity prices, exchange rates, and geopolitical tensions underscores the importance of effective risk management in trade finance. Trade finance instruments such as trade credit insurance and credit risk mitigation tools help businesses manage risks associated with international trade transactions.

- Supply Chain Disruptions and Resilience: Disruptions in global supply chains, such as those caused by natural disasters or geopolitical events, highlight the importance of supply chain resilience. Trade finance solutions play a vital role in supporting supply chain resilience by providing financing options to manage disruptions and ensure the smooth flow of goods and services.

- Shifts in Trade Patterns and Economic Trends: Changes in trade patterns, such as the growth of e-commerce and shifts in manufacturing locations, impact the demand for trade finance services. Economic trends, including changes in interest rates, inflation rates, and currency valuations, influence the availability and cost of trade finance products, shaping market dynamics.

Request a Customized Copy of the Trade Finance Market Report @ https://www.custommarketinsights.com/inquire-for-discount/?reportid=53018

Trade Finance Market: Partnership and Acquisitions

- In 2022, Mitsubishi UFJ Financial Group Inc. will provide a USD 54.3 million sustainable trade finance facility to Tata Power for two solar power projects in India. This marks MUFG’s inaugural sustainable trade finance offering in India, supporting TPKL’s renewable energy initiatives.

- In 2023, Standard Chartered Bank introduced a sustainable trade loan product tailored for financial institutions, bolstering its sustainable trade finance portfolio. The initiative aims to enhance liquidity for financial entities, enabling them to facilitate sustainable development-focused trade transactions in critical areas.

Report Scope

| Feature of the Report | Details |

| Market Size in 2024 | USD 71,182.2 Million |

| Projected Market Size in 2033 | USD 157,172.1 Million |

| Market Size in 2023 | USD 65,185.2 Million |

| CAGR Growth Rate | 9.2% CAGR |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Key Segment | By Product Type, Provider, Application, End User and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Regional Scope | North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America |

| Buying Options | Request tailored purchasing options to fulfil your requirements for research. |

(A free sample of the Trade Finance report is available upon request; please contact us for more information.)

Our Free Sample Report Consists of the following:

- Introduction, Overview, and in-depth industry analysis are all included in the 2024 updated report.

- The COVID-19 Pandemic Outbreak Impact Analysis is included in the package.

- About 220+ Pages Research Report (Including Recent Research)

- Provide detailed chapter-by-chapter guidance on the Request.

- Updated Regional Analysis with a Graphical Representation of Size, Share, and Trends for the Year 2024

- Includes Tables and figures have been updated.

- The most recent version of the report includes the Top Market Players, their Business Strategies, Sales Volume, and Revenue Analysis

- Custom Market Insights (CMI) research methodology

(Please note that the sample of the Trade Finance report has been modified to include the COVID-19 impact study prior to delivery.)

Request a Customized Copy of the Trade Finance Market Report @ https://www.custommarketinsights.com/report/trade-finance-market/

Trade Finance Market: COVID-19 Analysis

The COVID-19 pandemic has significantly impacted the Trade Finance Market, with the industry experiencing both positive and negative effects. Here are some of the key impacts:

- Supply Chain Disruptions: COVID-19 led to widespread disruptions in global supply chains, causing delays in production, shipping, and delivery of goods. Uncertainty and disruptions in supply chains resulted in increased demand for trade finance solutions to mitigate risks and ensure continuity of trade operations.

- Reduced Trade Volumes and Payment Delays: Declines in global trade volumes due to lockdowns and travel restrictions affected trade finance activity. Payment delays and defaults increased as businesses faced liquidity challenges, impacting the demand for trade finance products such as letters of credit and trade credit insurance.

- Government Support and Stimulus Packages: Governments may provide financial support and stimulus packages to revive trade and support businesses, including measures to facilitate access to trade finance for SMEs. Policy interventions and incentives could encourage banks and financial institutions to extend trade finance facilities to businesses affected by the pandemic.

- Digital Transformation and Fintech Adoption: Accelerated digitalization and adoption of fintech solutions in trade finance processes improve efficiency, transparency, and accessibility. Investments in digital platforms for trade finance, including blockchain-based solutions, enhance resilience and enable remote access to trade finance services.

- Resilience Planning and Supply Chain Optimization: Businesses and financial institutions focus on enhancing supply chain resilience and diversification to mitigate future disruptions. Integration of risk management tools and scenario planning techniques into trade finance practices helps stakeholders better anticipate and manage risks.

- Partnerships and Collaboration: Collaboration among banks, financial institutions, government agencies, and multilateral organizations strengthens trade finance infrastructure and facilitates cross-border trade. Partnerships with fintech firms and technology providers enable traditional financial institutions to innovate and offer more efficient trade finance solutions.

In conclusion, the COVID-19 pandemic has had a mixed impact on the Trade Finance Market, with some challenges and opportunities arising from the pandemic.

Request a Customized Copy of the Trade Finance Market Report @ https://www.custommarketinsights.com/report/trade-finance-market/

Key questions answered in this report:

- What is the size of the Trade Finance market and what is its expected growth rate?

- What are the primary driving factors that push the Trade Finance market forward?

- What are the Trade Finance Industry’s top companies?

- What are the different categories that the Trade Finance Market caters to?

- What will be the fastest-growing segment or region?

- In the value chain, what role do essential players play?

- What is the procedure for getting a free copy of the Trade Finance market sample report and company profiles?

Key Offerings:

- Market Share, Size & Forecast by Revenue | 2024−2033

- Market Dynamics – Growth Drivers, Restraints, Investment Opportunities, and Leading Trends

- Market Segmentation – A detailed analysis by Types of Services, by End-User Services, and by regions

- Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Buy this Premium Trade Finance Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/trade-finance-market/

Trade Finance Market – Regional Analysis

The Trade Finance Market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

- North America: In North America, trade finance trends include a focus on technology-driven solutions such as blockchain and fintech to enhance efficiency and transparency in trade transactions. There is a growing demand for supply chain finance solutions to optimize working capital and mitigate risks. Additionally, trade finance providers in North America are increasingly integrating sustainability criteria into their offerings to align with environmental and social objectives.

- Europe: Europe leads in trade finance innovation, with trends focusing on sustainability-linked financing and green trade finance initiatives. European financial institutions are at the forefront of adopting blockchain technology for trade finance to improve transparency and reduce fraud. Supply chain finance solutions are popular in Europe, with a strong emphasis on supporting small and medium-sized enterprises (SMEs) and promoting inclusive trade finance practices.

- Asia-Pacific: In the Asia-Pacific region, trade finance trends are driven by the rapid digitization of trade finance processes and the adoption of fintech solutions. There is a growing demand for trade finance products tailored to the needs of SMEs, particularly in emerging economies. Asian financial institutions are also leading the way in offering innovative supply chain finance solutions and trade credit insurance to support exporters and importers.

- LAMEA (Latin America, Middle East, and Africa): In LAMEA, trade finance trends vary across regions. In Latin America, there is a growing interest in trade finance solutions that support sustainable trade practices and promote inclusive growth. Middle Eastern countries are investing in digital trade finance infrastructure and Islamic trade finance products to cater to the needs of their diverse economies. In Africa, trade finance trends focus on improving access to trade finance for small businesses and promoting intra-regional trade through regional trade finance initiatives.

Request a Customized Copy of the Trade Finance Market Report @ https://www.custommarketinsights.com/report/trade-finance-market/

(We customized your report to meet your specific research requirements. Inquire with our sales team about customizing your report.)

Still, Looking for More Information? Do OR Want Data for Inclusion in magazines, case studies, research papers, or Media?

Email Directly Here with Detail Information: support@custommarketinsights.com

Browse the full “Trade Finance Market Size, Trends and Insights By Product Type (Commercial Letters of Credit (LCs), Standby Letters of Credit (LCs), Guarantees, others), By Provider (Banks, Trade Finance Houses, Others), By Application (Domestic, International), By End User (Traders, Importers, Exporters), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033“ Report at https://www.custommarketinsights.com/report/trade-finance-market/

List of the prominent players in the Trade Finance Market:

- HSBC Holdings plc

- Standard Chartered PLC

- BNP Paribas SA

- Citigroup Inc.

- JPMorgan Chase & Co.

- Bank of America Corporation

- Wells Fargo & Company

- Mizuho Financial Group Inc.

- Société Générale SA

- Deutsche Bank AG

- Barclays PLC

- UBS Group AG

- Credit Agricole Group

- Mitsubishi UFJ Financial Group Inc.

- Sumitomo Mitsui Financial Group Inc.

- Others

Click Here to Access a Free Sample Report of the Global Trade Finance Market @ https://www.custommarketinsights.com/report/trade-finance-market/

Spectacular Deals

- Comprehensive coverage

- Maximum number of market tables and figures

- The subscription-based option is offered.

- Best price guarantee

- Free 35% or 60 hours of customization.

- Free post-sale service assistance.

- 25% discount on your next purchase.

- Service guarantees are available.

- Personalized market brief by author.

Browse More Related Reports:

B2B Payments Market: B2B Payments Market Size, Trends and Insights By Payment Type (Domestic Payments, Cross-Border Payments), By Enterprise Size (Large Enterprises, Small and Medium Sized Enterprises), By Payment Mode (Traditional, Digital), By Industry Vertical (BFSI, Manufacturing, Metals & Mining, IT & Telecom, Energy & Utilities, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

NBFC Market: NBFC Market Size, Trends and Insights By Type (NBFCs Accepting Public Deposit (NBFCs-D), NBFCs Not Accepting/Holding Public Deposit (NBFCs-ND)), By Service Type (Lending Services, Investment Services, Insurance Services, Leasing Services, Others), By Deployment Mode (Online Deployment, Branch-Based Deployment, Hybrid Deployment, Agent-Based Deployment, Others), By Application (Consumer, SME & Commercial Lending, Wealth Management, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Banking as a Service Market: Banking as a Service Market Size, Trends and Insights By Component (Platform, Services), By Product Type (API-Based Banking-as-a-Service, Cloud-Based Banking-as-a-Service), By Enterprise Size (Large Enterprises, Small & Medium Enterprises), By End Users (Banks, NBFC, Government, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Europe B2B Payments Market: Europe B2B Payments Market Size, Trends and Insights By Payment Methods (Traditional Payment Methods, Digital Payment Methods), By Type (Domestic Payments, Cross-Border Payments), By Enterprise Size (Small and Medium Enterprises (SMEs), Large Enterprises), By End User (Manufacturing, Retail and E-commerce, Healthcare, IT and Telecom, Banking, Financial Services, and Insurance (BFSI), Energy and Utilities, Transportation and Logistics, Travel and Hospitality, Others), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

US B2B Payments Market: US B2B Payments Market Size, Trends and Insights By Payment Methods (Traditional Payment Methods, Digital Payment Methods), By Type (Domestic Payments, Cross-Border Payments), By Enterprise Size (Small and Medium Enterprises (SMEs), Large Enterprises), By End User (Manufacturing, Retail and E-commerce, Healthcare, IT and Telecom, Banking, Financial Services, and Insurance (BFSI), Energy and Utilities, Transportation and Logistics, Travel and Hospitality, Others), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

India B2B Payments Market: India B2B Payments Market Size, Trends and Insights By Payment Method (Electronic Funds Transfer (EFT), Credit/Debit Cards, Automated Clearing House (ACH) Transfers, Wire Transfers, Checks, Virtual Cards, Others), By Application (Retail, Manufacturing, Healthcare, IT & Telecommunications, Automotive, Construction, Energy & Utilities, Others), By Service Provider (Banks, Payment Processors, FinTech Companies, Payment Gateways, Software Providers), By End User (Small and Medium Enterprises (SMEs), Large Enterprises), and By Region – Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Financial Guarantee Market: Financial Guarantee Market Size, Trends and Insights By Product Type (Bank Guarantees, Documentary Letter of Credit, Standby Letter of Credit (SBLC), Receivables Financing, Others), By Enterprise Size (Small Enterprises, Medium-sized Enterprises, Large Enterprises), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

Mutual Fund Assets Market: Mutual Fund Assets Market Size, Trends and Insights By Fund Type (Equity Funds, Bond Funds, Money Market Funds, Hybrid & Other Funds), By Investor Type (Institutional, Individual), By Distribution Channel (Banks, Financial Advisors/Brokers, Direct Sellers, Others), and By Region – Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2024–2033

The Trade Finance Market is segmented as follows:

By Product Type

- Commercial Letters of Credit (LCs)

- Standby Letters of Credit (LCs)

- Guarantees

- Others

By Provider

- Banks

- Trade Finance Houses

- Others

By Application

By End User

- Traders

- Importers

- Exporters

Click Here to Get a Free Sample Report of the Global Trade Finance Market @ https://www.custommarketinsights.com/report/trade-finance-market/

Regional Coverage:

North America

- U.S.

- Canada

- Mexico

- Rest of North America

Europe

- Germany

- France

- U.K.

- Russia

- Italy

- Spain

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Taiwan

- Rest of Asia Pacific

The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America

This Trade Finance Market Research/Analysis Report Contains Answers to the following Questions.

- Which Trends Are Causing These Developments?

- Who Are the Global Key Players in This Trade Finance Market? What are Their Company Profile, Product Information, and Contact Information?

- What Was the Global Market Status of the Trade Finance Market? What Was the Capacity, Production Value, Cost and PROFIT of the Trade Finance Market?

- What Is the Current Market Status of the Trade Finance Industry? What’s Market Competition in This Industry, Both Company and Country Wise? What’s Market Analysis of Trade Finance Market by Considering Applications and Types?

- What Are Projections of the Global Trade Finance Industry Considering Capacity, Production and Production Value? What Will Be the Estimation of Cost and Profit? What Will Be Market Share, Supply and Consumption? What about imports and exports?

- What Is Trade Finance Market Chain Analysis by Upstream Raw Materials and Downstream Industry?

- What Is the Economic Impact On Trade Finance Industry? What are Global Macroeconomic Environment Analysis Results? What Are Global Macroeconomic Environment Development Trends?

- What Are Market Dynamics of Trade Finance Market? What Are Challenges and Opportunities?

- What Should Be Entry Strategies, Countermeasures to Economic Impact, and Marketing Channels for Trade Finance Industry?

Click Here to Access a Free Sample Report of the Global Trade Finance Market @ https://www.custommarketinsights.com/report/trade-finance-market/

Reasons to Purchase Trade Finance Market Report

- Trade Finance Market Report provides qualitative and quantitative analysis of the market based on segmentation involving economic and non-economic factors.

- Trade Finance Market report outlines market value (USD) data for each segment and sub-segment.

- This report indicates the region and segment expected to witness the fastest growth and dominate the market.

- Trade Finance Market Analysis by geography highlights the consumption of the product/service in the region and indicates the factors affecting the market within each region.

- The competitive landscape incorporates the market ranking of the major players, along with new service/product launches, partnerships, business expansions, and acquisitions in the past five years of companies profiled.

- Extensive company profiles comprising company overview, company insights, product benchmarking, and SWOT analysis for the major market players.

- The Industry’s current and future market outlook concerning recent developments (which involve growth opportunities and drivers as well as challenges and restraints of both emerging and developed regions.

- Trade Finance Market Includes in-depth market analysis from various perspectives through Porter’s five forces analysis and provides insight into the market through Value Chain.

Reasons for the Research Report

- The study provides a thorough overview of the global Trade Finance market. Compare your performance to that of the market as a whole.

- Aim to maintain competitiveness while innovations from established key players fuel market growth.

Buy this Premium Trade Finance Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/trade-finance-market/

What does the report include?

- Drivers, restrictions, and opportunities are among the qualitative elements covered in the worldwide Trade Finance market analysis.

- The competitive environment of current and potential participants in the Trade Finance market is covered in the report, as well as those companies’ strategic product development ambitions.

- According to the component, application, and industry vertical, this study analyzes the market qualitatively and quantitatively. Additionally, the report offers comparable data for the important regions.

- For each segment mentioned above, actual market sizes and forecasts have been given.

Who should buy this report?

- Participants and stakeholders worldwide Trade Finance market should find this report useful. The research will be useful to all market participants in the Trade Finance industry.

- Managers in the Trade Finance sector are interested in publishing up-to-date and projected data about the worldwide Trade Finance market.

- Governmental agencies, regulatory bodies, decision-makers, and organizations want to invest in Trade Finance products’ market trends.

- Market insights are sought for by analysts, researchers, educators, strategy managers, and government organizations to develop plans.

Request a Customized Copy of the Trade Finance Market Report @ https://www.custommarketinsights.com/report/trade-finance-market/

About Custom Market Insights:

Custom Market Insights is a market research and advisory company delivering business insights and market research reports to large, small, and medium-scale enterprises. We assist clients with strategies and business policies and regularly work towards achieving sustainable growth in their respective domains.

CMI provides a one-stop solution for data collection to investment advice. The expert analysis of our company digs out essential factors that help to understand the significance and impact of market dynamics. The professional experts apply clients inside on the aspects such as strategies for future estimation fall, forecasting or opportunity to grow, and consumer survey.

Follow Us: LinkedIn | Twitter | Facebook | YouTube

Contact Us:

Joel John

CMI Consulting LLC

1333, 701 Tillery Street Unit 12,

Austin, TX, Travis, US, 78702

USA: +1 801-639-9061

India: +91 20 46022736

Email: support@custommarketinsights.com

Web: https://www.custommarketinsights.com/

Blog: https://www.techyounme.com/

Blog: https://atozresearch.com/

Blog: https://www.technowalla.com/

Blog: https://marketresearchtrade.com/

Buy this Premium Trade Finance Research Report | Fast Delivery Available – [220+ Pages] @ https://www.custommarketinsights.com/report/trade-finance-market/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Global Digital Twin Market Set to Soar: A 45.7% Annual Growth Ahead

Boston, Oct. 31, 2024 (GLOBE NEWSWIRE) — According to the latest study from BCC Research, Global Digital Twin Market, the market for digital twins was valued at $11.5 billion in 2023 and is expected to grow from $18.2 billion in 2024 to $119.3 billion by the end of 2029, at a compound annual growth rate (CAGR) of 45.7% from 2024 to 2029.

The report gives a clear overview of the global digital twin market, looking at its current value and key trends. Starting with 2023 as the baseline, it forecasts market data from 2024 to 2029, breaking down revenue projections by solution type, application, industry, company size, and region. It also discusses the major trends and challenges impacting the market, finishing with an analysis of key players in the digital twin space.

Additionally, the report analyzes emerging technologies and the competitive landscape, examining the strategic moves made by leading firms in the digital twin market. The report also includes an environmental, social and governance (ESG) analysis.

Interesting and surprising facts:

Digital twins are already being used in the manufacturing, aerospace, and automotive industries, but they’re now branching out into a new model called Digital Twin as a Service (DTaaS). This development represents a significant leap in how we manage and utilize complex systems and data in real-time. DTaaS takes the concept of digital twins and offers them as a managed service, changing how organizations approach system management and digital simulations. The integration of DTaaS is expected to be transformative, providing fresh insights into both our physical and digital environments.

To gain a deeper understanding of the market’s dynamics and growth opportunities, click here.

Factors contributing to the growth of the digital twin market include:

- Industry 4.0. The manufacturing shift toward Industry 4.0 represents a transformation in how factories operate, integrating advanced technologies such as automation, AI and the Internet of Things (IoT). This new approach focuses on creating smart factories where machines and systems communicate and collaborate seamlessly, leading to increased efficiency, reduced costs and greater flexibility. With real-time data and analytics, manufacturers can optimize processes, improve product quality, and respond quickly to market changes. Industry 4.0 is about using technology to create a more connected manufacturing environment.

- Real-time data generated from sensors. Real-time data generated from sensors and other smart devices is collected and transmitted instantly from machines, vehicles and wearable technology. These sensors monitor conditions such as temperature, pressure, or location, providing up-to-the-minute insights into what’s happening in a system or environment. This immediate feedback allows businesses and individuals to make informed decisions quickly, improve efficiency, and respond to issues as they arise. By harnessing this data, organizations can optimize their operations, enhance safety, and deliver better products and services.

- Growing adoption of IoT devices. These devices, which include smart home appliances, wearable fitness trackers and industrial sensors, allow users to monitor and control various aspects of their lives and businesses more efficiently and conveniently by making environments smarter and more connected, this trend is transforming industries and people’s everyday lives.

Request a Sample Copy of the Global Digital Twin Market Report.

Report Synopsis

| Report Metric | Details |

| Base year considered | 2023 |

| Forecast period considered | 2024-2029 |

| Base year market size | $11.5 billion |

| Market size Forecast | $119.3 billion |

| Growth rate | CAGR of 45.7% from 2024 to 2029 |

| Segments covered | Solution type, application, enterprise size and Industry |

| Regions covered | Americas, Europe, Asia-Pacific, and the Middle East and Africa (MEA) |

| Countries covered | U.S., Canada, Mexico, U.K., Germany, France, Italy, China, Japan, South Korea, and India |

| Market Drivers |

|

Some of the Key Market Players Are:

- ABB

- ALTAIR ENGINEERING INC.

- ANSYS INC.

- AUTODESK INC.

- BENTLEY SYSTEMS INC.

- BOSCH REXROTH AG

- DASSAULT SYSTEMES

- GE VERNOVA

- HEXAGON AB

- IBM CORP.

- MICROSOFT

- ORACLE

- ROCKWELL AUTOMATION

- SCHNEIDER ELECTRIC

- SIEMENS

Other related reports include:

Sensors: Technologies and Global Markets: The study of the many types of sensors and their applications in different industries is crucial for many sectors, including healthcare, manufacturing, and smart homes. The global market for sensors is driven by advances in technology and the growing demand for smart, connected devices.

Industrial IoT (IIoT): Global Markets: IIoT involves connecting machines, sensors and devices in factories and other facilities to collect and analyze data in real time. This connectivity enhances operational efficiency, improves safety, and reduces costs by enabling better decision-making and predictive maintenance.

Directly Purchase a copy of the report from BCC Research.

For further information on these reports or to purchase one, please get in touch with info@bccresearch.com.

About BCC Research

BCC Research market research reports provide objective, unbiased measurement and assessment of market opportunities. Our experienced industry analysts’ goal is to help readers make informed business decisions, free of noise and hype.

Corporate HQ: 50 Milk St. Ste 16, Boston, MA 02109, USA Email: info@bccresearch.com, Phone: +1 781-489-7301 For media inquiries, email press@bccresearch.com or visit our media page for access to our market research library. Any data and analysis extracted from this press release must be accompanied by a statement identifying BCC Research LLC as the source and publisher.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Deepfake Fraud Costs the Financial Sector an Average of $600,000 for Each Company, Regula's Survey Shows

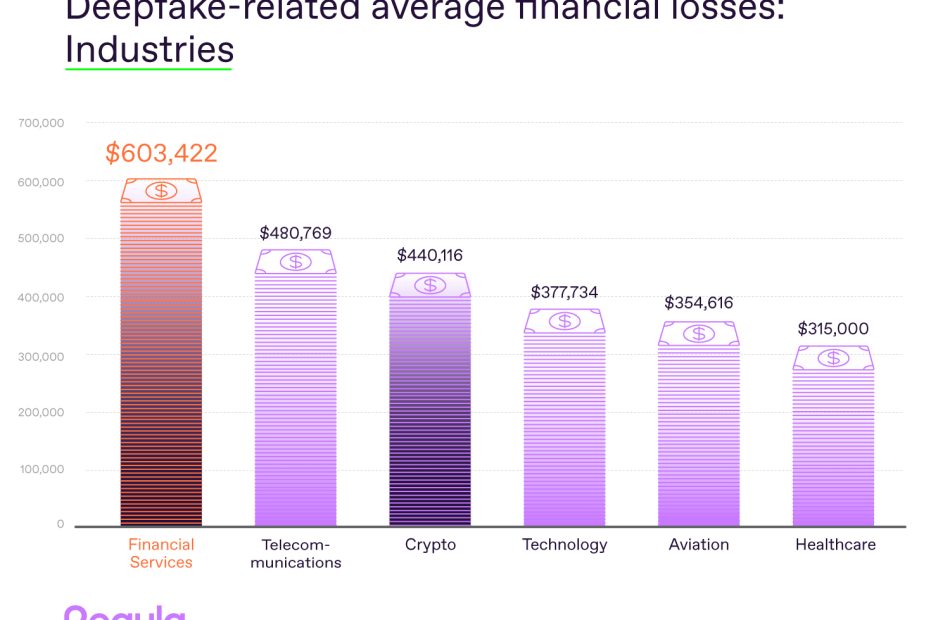

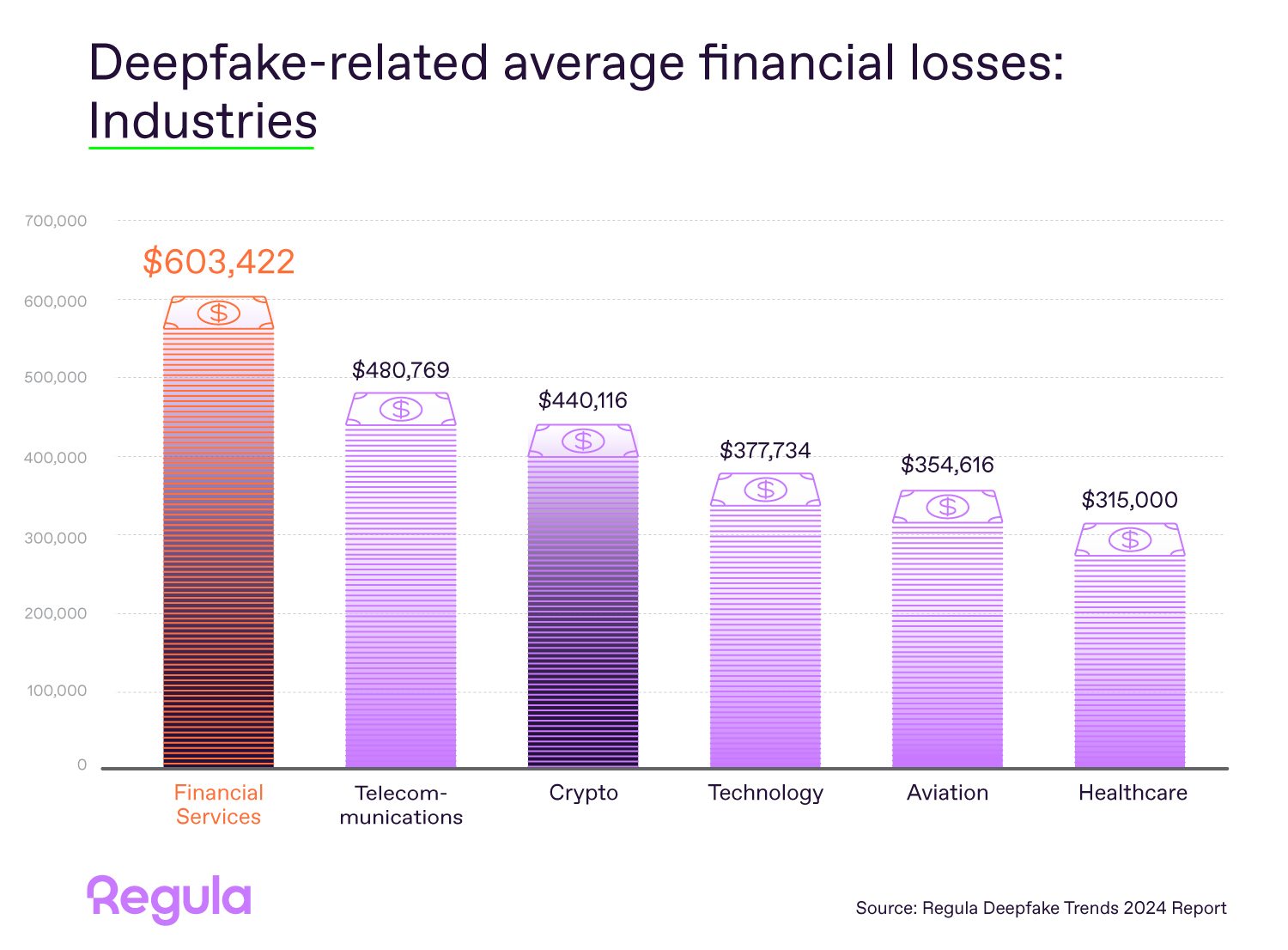

RESTON, Va., Oct. 31, 2024 (GLOBE NEWSWIRE) — Regula, a global developer of forensic devices and identity verification solutions, reveals new survey findings, “The Deepfake Trends 2024.” The stats highlight the financial impact deepfake fraud has on businesses across industries and countries. While the average loss for most organizations reached $450,000, the Financial Services sector experienced a greater burden, exceeding $603,000.

Losses of up to $450,000 appeared to be a reality for 92% of surveyed businesses. Moreover, 10% of organizations reported losses exceeding $1 million, underscoring how severe the problem is.

Image: Regula’s study shows that nearly a quarter of Fintech organizations report losses over $1 million from deepfake fraud – double the global average.

What is more alarming, Regula’s earlier research from 2022 indicated that the average financial burden of identity fraud was around $230,000 — almost half the current figure. This sharp increase in just two years illustrates the rapid evolution of the threat landscape, and highlights the urgency for organizations to strengthen their defenses against deepfakes.

Breakdown by industry and geography

Among all the surveyed industries, Finance was found to be the most affected by video and audio deepfakes: 23% of surveyed organizations in this sector reported more than $1,000,000 in losses due to AI-generated fraud; meanwhile, the global average is half as much.

Notably, Fintech experiences more losses than Traditional Banking: the mean amount for these industries reached $637,000 and $570,000, respectively.

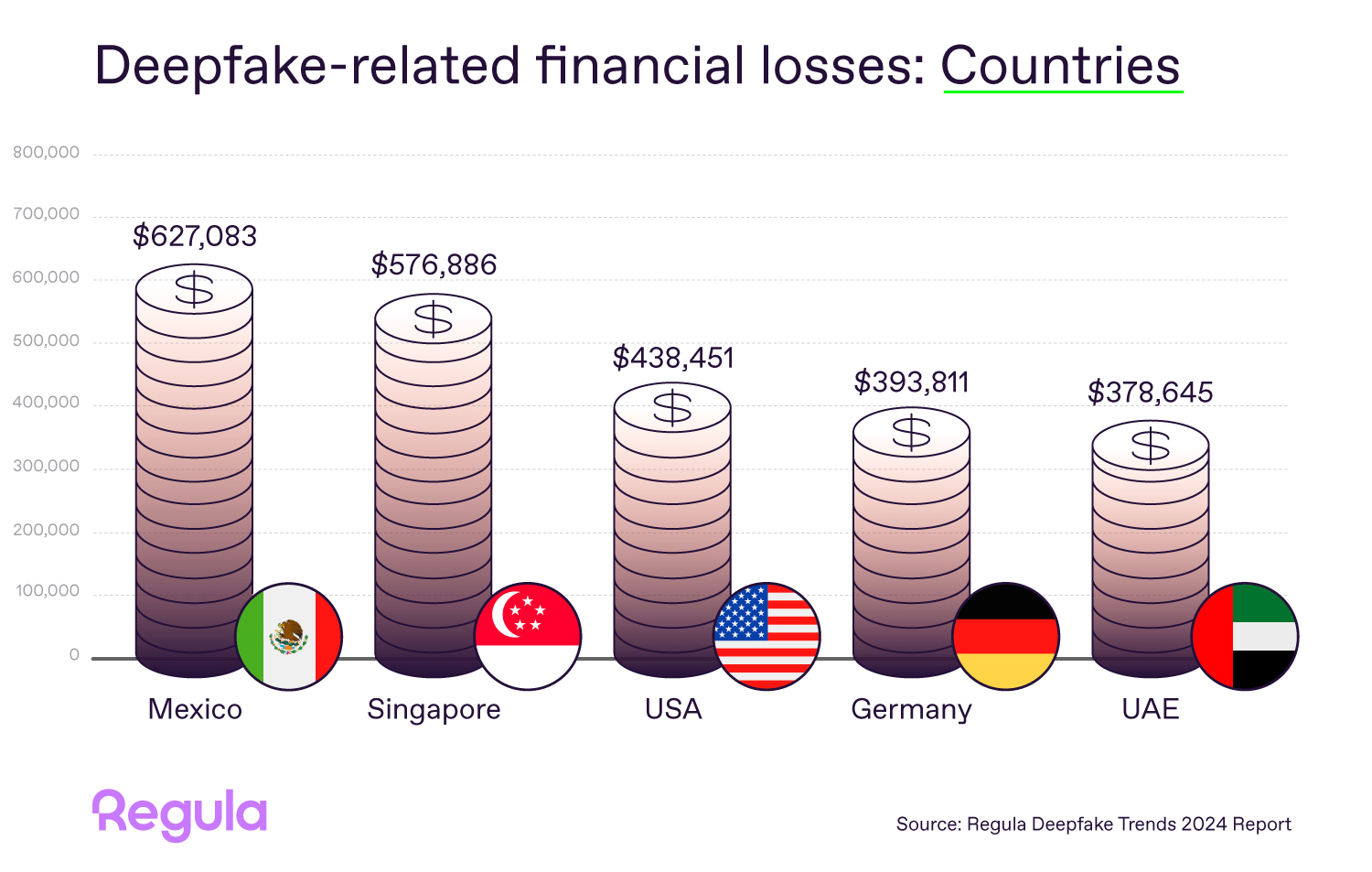

Financial losses also vary significantly not only by industry, but also by region. Mexico reported the highest average losses at $627,000, followed by Singapore with $577,000, and the USA at $438,000. Meanwhile, Germany and the UAE reported a slightly lower, but still significant, burden of $394,000 and $379,000, respectively.

Image: Regula’s study shows Mexico faces the highest average losses from deepfake fraud, while Germany and the UAE report impacts nearly half that amount.

False confidence?

The study also reveals a concerning gap between organizations’ confidence and competence. While 56% of businesses claim they are very confident in their ability to detect deepfakes, only 6% report having avoided financial losses from these attacks.

“The significant gap between confidence in detecting deepfakes and the reality of financial losses, particularly in Financial Services, shows that many organizations are underprepared for the sophistication of these attacks. As the threat evolves, it’s crucial for companies to switch to a liveness-centric approach, which we adhere to at Regula. This approach is focused on dealing with physical objects only — both faces and documents, as well as their dynamic parameters — in real time, which can significantly decrease the chances of falling victim to a deepfake attack. Additionally, it’s advisable to use multiple layers of identity verification and choose highly reliable technologies, like secure server-side reprocessing of all document and biometric checks,” says Ihar Kliashchou, Chief Technology Officer at Regula.

Find more insights on deepfake fraud in the survey report. Read the full version on our website.

Additional resources:

*The research was initiated by Regula and conducted by Sapio Research in August 2024 using an online survey of 575 business decision-makers across the Financial Services (including Traditional Banking and Fintech), Crypto, Technology, Telecommunications, Aviation, Healthcare, and Law Enforcement sectors. The respondent geography included Germany, Mexico, the UAE, the US, and Singapore.

About Regula

Regula is a global developer of forensic devices and identity verification solutions. With our 30+ years of experience in forensic research and the largest library of document templates in the world, we create breakthrough technologies in document and biometric verification. Our hardware and software solutions allow over 1,000 organizations and 80 border control authorities globally to provide top-notch client service without compromising safety, security or speed. Regula was repeatedly named a Representative Vendor in the Gartner® Market Guide for Identity Verification.

Learn more at www.regulaforensics.com.

Contact:

Kristina – ks@regulaforensics.com

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/654178d0-62b2-450a-a5a2-413e22edb093

https://www.globenewswire.com/NewsRoom/AttachmentNg/8690ca11-e69a-4461-b1be-e71098cf84f8

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Fed's Favorite Inflation Metric Accelerates In September, Personal Income Rises More Than Expected (UPDATED)

Traders faced an unwelcome Halloween threat on Thursday as the Federal Reserve’s favored inflation measure accelerated, raising some concerns on the likelihood of back-to-back interest rate cuts going into the final two monetary policy meetings of the year.

The PCE price index rose 2.1% year-over-year, in line with analyst forecasts. Yet the core PCE index — which strips out volatile food and energy prices and gives a better indication of underlying price pressures — rose 2.7%, slightly above the expected 2.6%.

The latter stronger-than-expected inflation figure could keep the Fed on alert as it weighs its next policy moves. While a 25-basis-point rate cut at next week’s Fed meeting is widely seen as a done deal as per the CME FedWatch tool, market expectations for another cut in December could face some setbacks.

Personal Income And Outlays Report For September: Key Highlights

- The PCE price index rose 0.2% month-over-month in September, matching the predicted 0.2% and accelerating from the previous 0.1%.

- The core PCE price index rose 0.3% from the previous month, accelerating from 0.1% and matching estimates.

- On an annual basis, the headline PCE price index surged 2.1%, down from August’s upwardly revised 2.3%.

- The core PCE price index held at 2.7% year-over-year, as in August.

- Personal income increased by $71.6 billion, or 0.3%, in September, matching expectations of 0.3% and above the previous month’s 0.2% growth.

- Personal saving rate eased from 4.8% to 4.6%, with personal savings down from $1.05 trillion to $1 trillion in September.

- Personal spending increased by $105.8 billion, or 0.5%, surpassing estimates of 0.4% and accelerating from the previous 0.2%.

Market Reactions

Markets showed minimal reaction to the latest PCE inflation report, with the U.S. dollar index (DXY)—tracked by the Invesco DB USD Index Bullish Fund ETF UUP—largely maintaining its morning losses of 0.2%.

Treasury yields were steady, with the 2-year yield, sensitive to rate changes, holding at 4.17%.

As of 8:50 a.m. in New York, S&P 500 futures were down 0.6%, while Nasdaq 100 contracts also dipped by 0.6%. Yet, both held broadly steady after the inflation data release.

On Wednesday, the SPDR S&P 500 ETF Trust SPY fell 0.3%, ending a two-day winning streak.

Read Next:

Photo via Shutterstock.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Shell Plc 2025 Interim Dividend Timetable

SHELL PLC 2025 INTERIM DIVIDEND TIMETABLE

London, October 31, 2024

The Board of Shell plc today announced the intended timetable for the 2025 quarterly interim dividends.

2025 Interim Dividend Timetable

| Event | 4th Quarter 2024 | 1st Quarter 2025 | 2nd Quarter 2025 | 3rd Quarter 2025 |

| Announcement date | January 30, 2025 | May 2, 2025 | July 31, 2025 | October 30, 2025 |

| Ex- Dividend Date for ADSs | February 14, 2025 | May 16, 2025 | August 15, 2025 | November 14, 2025 |

| Ex- Dividend Date for ordinary shares | February 13, 2025 | May 15, 2025 | August 14, 2025 | November 13, 2025 |

| Record date | February 14, 2025 | May 16, 2025 | August 15, 2025 | November 14, 2025 |

| Closing date for currency election (see Note below) | February 28, 2025 | June 2, 2025 | September 1, 2025 | November 28, 2025 |

| Pounds sterling and euro equivalents announcement date | March 10, 2025 | June 9, 2025 | September 8, 2025 | December 8, 2025 |

| Payment date | March 24, 2025 | June 23, 2025 | September 22, 2025 | December 18, 2025 |

Note

A different currency election date may apply to shareholders holding shares in a securities account with a bank or financial institution ultimately holding through Euroclear Nederland. This may also apply to other shareholders who do not hold their shares either directly on the Register of Members or in the corporate sponsored nominee arrangement. Shareholders can contact their broker, financial intermediary, bank or financial institution for the election deadline that applies.

The 2025 interim dividend timetable is also available on www.shell.com/dividend.

Enquiries

Media International: +44 207 934 5550

Media Americas: +1 832 337 4355

Cautionary Note

The companies in which Shell plc directly and indirectly owns investments are separate legal entities. In this announcement “Shell”, “Shell Group” and “Group” are sometimes used for convenience where references are made to Shell plc and its subsidiaries in general. Likewise, the words “we”, “us” and “our” are also used to refer to Shell plc and its subsidiaries in general or to those who work for them. These terms are also used where no useful purpose is served by identifying the particular entity or entities. ‘‘Subsidiaries”, “Shell subsidiaries” and “Shell companies” as used in this announcement refer to entities over which Shell plc either directly or indirectly has control. The term “joint venture”, “joint operations”, “joint arrangements”, and “associates” may also be used to refer to a commercial arrangement in which Shell has a direct or indirect ownership interest with one or more parties. The term “Shell interest” is used for convenience to indicate the direct and/or indirect ownership interest held by Shell in an entity or unincorporated joint arrangement, after exclusion of all third-party interest.

Forward-Looking Statements

This announcement contains forward-looking statements (within the meaning of the U.S. Private Securities Litigation Reform Act of 1995) concerning the financial condition, results of operations and businesses of Shell. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements. Forward-looking statements are statements of future expectations that are based on management’s current expectations and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in these statements. Forward-looking statements include, among other things, statements concerning the potential exposure of Shell to market risks and statements expressing management’s expectations, beliefs, estimates, forecasts, projections and assumptions. These forward-looking statements are identified by their use of terms and phrases such as “aim”; “ambition”; ‘‘anticipate”; ‘‘believe”; “commit”; “commitment”; ‘‘could”; ‘‘estimate”; ‘‘expect”; ‘‘goals”; ‘‘intend”; ‘‘may”; “milestones”; ‘‘objectives”; ‘‘outlook”; ‘‘plan”; ‘‘probably”; ‘‘project”; ‘‘risks”; “schedule”; ‘‘seek”; ‘‘should”; ‘‘target”; ‘‘will”; “would” and similar terms and phrases. There are a number of factors that could affect the future operations of Shell and could cause those results to differ materially from those expressed in the forward-looking statements included in this announcement, including (without limitation): (a) price fluctuations in crude oil and natural gas; (b) changes in demand for Shell’s products; (c) currency fluctuations; (d) drilling and production results; (e) reserves estimates; (f) loss of market share and industry competition; (g) environmental and physical risks; (h) risks associated with the identification of suitable potential acquisition properties and targets, and successful negotiation and completion of such transactions; (i) the risk of doing business in developing countries and countries subject to international sanctions; (j) legislative, judicial, fiscal and regulatory developments including regulatory measures addressing climate change; (k) economic and financial market conditions in various countries and regions; (l) political risks, including the risks of expropriation and renegotiation of the terms of contracts with governmental entities, delays or advancements in the approval of projects and delays in the reimbursement for shared costs; (m) risks associated with the impact of pandemics, such as the COVID-19 (coronavirus) outbreak, regional conflicts, such as the Russia-Ukraine war, and a significant cybersecurity breach; and (n) changes in trading conditions. No assurance is provided that future dividend payments will match or exceed previous dividend payments. All forward-looking statements contained in this announcement are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. Readers should not place undue reliance on forward-looking statements. Additional risk factors that may affect future results are contained in Shell plc’s Form 20-F for the year ended December 31, 2023 (available at www.shell.com/investors/news-and-filings/sec-filings.html and www.sec.gov). These risk factors also expressly qualify all forward-looking statements contained in this announcement and should be considered by the reader. Each forward-looking statement speaks only as of the date of this announcement, October 31, 2024. Neither Shell plc nor any of its subsidiaries undertake any obligation to publicly update or revise any forward-looking statement as a result of new information, future events or other information. In light of these risks, results could differ materially from those stated, implied or inferred from the forward-looking statements contained in this announcement.

Shell’s Net Carbon Intensity

Also, in this announcement we may refer to Shell’s “Net Carbon Intensity” (NCI), which includes Shell’s carbon emissions from the production of our energy products, our suppliers’ carbon emissions in supplying energy for that production and our customers’ carbon emissions associated with their use of the energy products we sell. Shell’s NCI also includes the emissions associated with the production and use of energy products produced by others which Shell purchases for resale. Shell only controls its own emissions. The use of the terms Shell’s “Net Carbon Intensity” or NCI are for convenience only and not intended to suggest these emissions are those of Shell plc or its subsidiaries.

Shell’s net-zero emissions target

Shell’s operating plan, outlook and budgets are forecasted for a ten-year period and are updated every year. They reflect the current economic environment and what we can reasonably expect to see over the next ten years. Accordingly, they reflect our Scope 1, Scope 2 and NCI targets over the next ten years. However, Shell’s operating plans cannot reflect our 2050 net-zero emissions target, as this target is currently outside our planning period. In the future, as society moves towards net-zero emissions, we expect Shell’s operating plans to reflect this movement. However, if society is not net zero in 2050, as of today, there would be significant risk that Shell may not meet this target.

Forward-Looking non-GAAP measures

This announcement may contain certain forward-looking non-GAAP measures such as cash capital expenditure and divestments. We are unable to provide a reconciliation of these forward-looking non-GAAP measures to the most comparable GAAP financial measures because certain information needed to reconcile those non-GAAP measures to the most comparable GAAP financial measures is dependent on future events some of which are outside the control of Shell, such as oil and gas prices, interest rates and exchange rates. Moreover, estimating such GAAP measures with the required precision necessary to provide a meaningful reconciliation is extremely difficult and could not be accomplished without unreasonable effort. Non-GAAP measures in respect of future periods which cannot be reconciled to the most comparable GAAP financial measure are calculated in a manner which is consistent with the accounting policies applied in Shell plc’s consolidated financial statements.

The contents of websites referred to in this announcement do not form part of this announcement.

We may have used certain terms, such as resources, in this announcement that the United States Securities and Exchange Commission (SEC) strictly prohibits us from including in our filings with the SEC. Investors are urged to consider closely the disclosure in our Form 20-F, File No 1-32575, available on the SEC website www.sec.gov.

LEI number of Shell plc: 21380068P1DRHMJ8KU70

Classification: Additional regulated information required to be disclosed under the laws of a Member State

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cavan Companies Secures $87.5 Million Loan for Build-to-Rent Developments in Omaha, Nebraska

PHOENIX, Oct. 31, 2024 /PRNewswire/ — Cavan Companies, a leading Build-To-Rent real estate development firm based in Phoenix, Arizona, is proud to announce the closing of two construction loans totaling $87.5 million with ORIX Corporation USA’s Real Estate Capital Group for the development of two luxury Build-to-Rent (BTR) communities in Omaha, Nebraska – The Bungalows on Honeysuckle and The Bungalows at Whitehawk Lake.

In a tight lending market, experience and a proven track record are invaluable assets.

The financing will support the construction and development of two separate housing communities designed to meet the growing demand for rental homes in Omaha, and specifically the desirable and rapidly expanding Elkhorn submarket and West Dodge Corridor. These communities will feature a blend of thoughtfully designed single story apartment homes with modern amenities tailored for today’s lifestyle, offering residents the best of both worlds—luxury, space, and convenience without the burdens of ownership.

“In a tight lending market, experience and a proven track record are invaluable assets. Lenders are more cautious, and having a history of successfully navigating real estate investments builds confidence and trust,” said Dave Cavan, Chairman and Owner. “Our ability to demonstrate a solid performance over time, coupled with our deep industry expertise, positioned us to secure the financing needed, even in challenging conditions. It’s our track record that sets us apart and reassures lenders that we will deliver.”

Each community will include a variety of floor plans to cater to young professionals, families, and empty nesters, along with amenities such as: