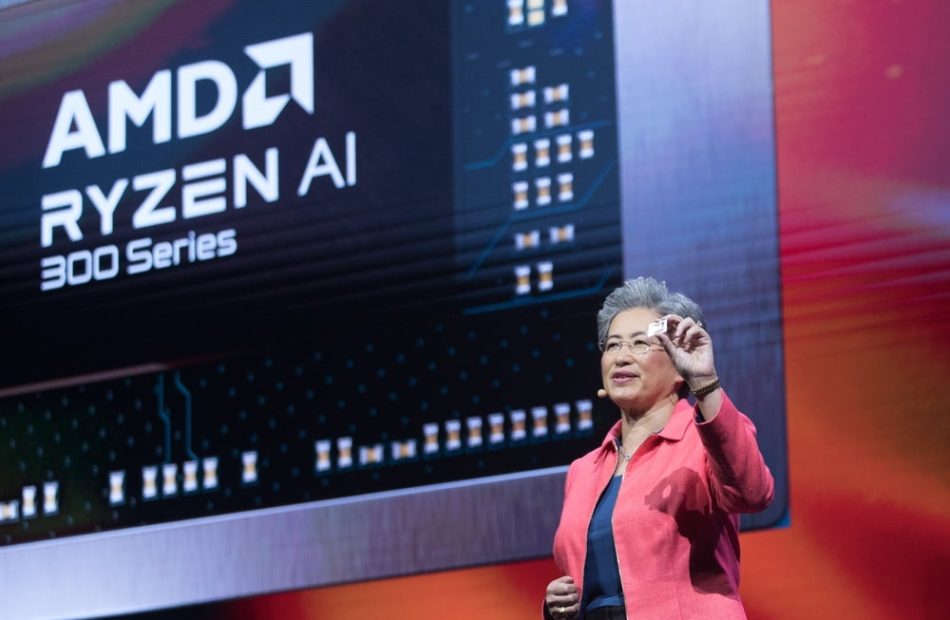

AMD CEO Lisa Su: No 'One Size Fits All' In $500B AI Computing Future

Lisa Su, CEO of Advanced Micro Devices Inc. AMD, provided an optimistic outlook for the company’s position in the burgeoning artificial intelligence market.

What Happened: Su emphasized the potential for AI compute technology to evolve, in a recent interview with CNBC’s Squawk on the Street, stating, “We really do believe that AI compute will enable the models to get even better, smarter…there is no one size fits all for compute.”

When asked about the changing landscape of AI, particularly regarding inference and the computing power required for various applications, Su acknowledged the complexities of the evolving technology.

“As you are really going through multiple steps, I mean these models are amazing. We made excellent progress when you think about where we are today with some of the OpenAI models or some of the Llama models; they’re great, but they can get better,” she noted.

Furthermore, Su shared an ambitious forecast regarding the total addressable market for data center AI, projecting it to reach $500 billion by 2028. This figure will encompass a variety of computing needs, including both training and inference processes.

Why It Matters: As AMD positions itself against major competitors like NVIDIA Corp (NASDAQ: NVDA), analysts are optimistic about the company’s potential to capture market share in several sectors. This sentiment is supported by AMD’s recent third-quarter results, which indicate a strong trajectory for its AI business.

Meta Platforms Inc. META CEO Mark Zuckerberg recently revealed that Meta is developing its next-generation AI model, Llama 4, using an unprecedented computing infrastructure of over 100,000 Nvidia H100 GPUs.

AMD’s progress in the AI space has been acknowledged by industry experts, including CNBC’s Jim Cramer, who believes that AMD will continue to see significant growth in the AI space, challenging Nvidia’s dominance.

Price Action: AMD’s stock closed at $148.60 on Wednesday, down 10.62%, for the day. In after-hours trading, the stock fell further 0.98%. Despite the recent declines, AMD’s stock has seen a year-to-date increase of 7.23%, according to data from Benzinga Pro.

Read Next:

Image Via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Ball Reports Third Quarter 2024 Results

Highlights

- Third quarter U.S. GAAP total diluted earnings per share of 65 cents vs. 64 cents in 2023

- Third quarter comparable diluted earnings per share of 91 cents vs. 83 cents in 2023

- Returned $1.25 billion to shareholders via share repurchases and dividends in the first nine months of 2024; on track to return in excess of $1.6 billion to shareholders by year-end

- In late-October, completed acquisition of Alucan Entec, S.A., a European impact extruded aluminum packaging business

- In 2024 and beyond, positioned to advance the use of sustainable aluminum packaging, grow comparable diluted earnings per share and EVA, generate strong free cash flow and expand long-term return of value to shareholders

WESTMINSTER, Colo., Oct. 31, 2024 /PRNewswire/ — Ball Corporation BALL today reported third quarter results. References to net sales and comparable operating earnings in today’s release do not include the company’s former aerospace business. Year-over-year net earnings attributable to the corporation and comparable net earnings do include the performance of the company’s former aerospace business through the sale date of February 16, 2024. On a U.S. GAAP basis, the company reported, third quarter 2024 net earnings attributable to the corporation of $197 million (including a net after-tax loss of $81 million, or 26 cents per diluted share for business consolidation and other non-comparable items) or total diluted earnings per share of 65 cents, on sales of $3.08 billion, compared to $203 million net earnings attributable to the corporation, or total diluted earnings per share of 64 cents (including a net after-tax loss of $60 million, or 19 cents per diluted share for business consolidation and other non-comparable items) on sales of $3.11 billion in 2023. Results for the first nine months of 2024 were net earnings attributable to the corporation of $4.04 billion (including a net after-tax gain of $3.31 billion for the aerospace business sale, business consolidation and other non-comparable items), or total diluted earnings per share of $12.96, on sales of $8.92 billion compared to $553 million, or total diluted earnings per share of $1.74, on sales of $9.16 billion for the first nine months of 2023.

Ball’s third quarter and year-to-date 2024 comparable earnings per diluted share were 91 cents and $2.33, respectively, versus third quarter and year-to-date 2023 comparable earnings per diluted share of 83 cents and $2.13, respectively.

“We delivered strong third quarter results and have returned $1.25 billion to shareholders in the first nine months of 2024. Leveraging our strong financial position and leaner operating model, the company remains uniquely positioned to enable our purpose of advancing the greater use of sustainable aluminum packaging, despite the current end consumer environment in certain geographies. We continue to complement our purpose by driving innovation and sustainability on a global scale, unlocking additional manufacturing efficiencies and enabling consistent delivery of high-quality, long-term shareholder value creation,” said Daniel W. Fisher, chairman and chief executive officer.

Details of reportable segment comparable operating earnings, business consolidation and other activities, business segment descriptions and other non-comparable items can be found in the notes to the unaudited condensed consolidated financial statements that accompany this news release. References to volume data represent units shipped.

Beverage Packaging, North and Central America

Beverage packaging, North and Central America, segment comparable operating earnings for third quarter 2024 were $203 million on sales of $1.46 billion compared to $196 million on sales of $1.54 billion during the same period in 2023. The decrease in third quarter sales reflects lower year-over-year volumes and price/mix.

Third quarter segment comparable operating earnings increased year-over-year primarily due to price/mix partially offset by lower volumes of 3.1 percent. Aluminum beverage cans continue to outperform other substrates despite continued economic pressure on the end consumer. Going forward, benefits from fixed and variable cost-out initiatives and improved operational efficiencies are expected to improve results throughout the remainder of 2024 and beyond.

Beverage Packaging, EMEA

Beverage packaging, EMEA, segment comparable operating earnings for third quarter 2024 were $128 million on sales of $950 million compared to $103 million on sales of $902 million during the same period in 2023. Third quarter sales primarily reflect higher volumes.

Third quarter comparable operating earnings reflect 6.7 percent higher volumes. Packaging mix shift to aluminum cans supported by ongoing packaging legislation in certain countries continues to be a driver of aluminum beverage packaging growth. Going forward, sustainability tailwinds and improved operational efficiencies are expected to improve results.

Beverage Packaging, South America

Beverage packaging, South America, segment comparable operating earnings for third quarter 2024 were $78 million on sales of $484 million compared to $61 million on sales of $489 million during the same period in 2023. Third quarter sales reflect lower volumes partially offset by price/mix.

Third quarter segment comparable operating earnings increased year-over-year driven by favorable price/mix partially offset by 10.0 percent lower volumes during the quarter. Volumes were driven by the ongoing impact of disruptive economic and operating conditions in Argentina and demand outstripping supply in Brazil late in the quarter. In Argentina, the company continues to serve customers and assess risks given the dynamic economic and policy environment. Across South America multi-year customer initiatives to increase the use of sustainable aluminum packaging are expected to continue.

Non-reportable

Non-reportable is comprised of undistributed corporate expenses, net of corporate interest income, the results of the company’s global aluminum aerosol business, beverage can manufacturing facilities in India, Saudi Arabia and Myanmar and the company’s aluminum cup business.

Third quarter 2024 improved results reflect higher comparable operating earnings for the aluminum packaging businesses partially offset by increased year-over-year undistributed corporate expenses. The company’s global aluminum aerosol, aluminum bottle and cups customers continue to collaborate with Ball to activate growth opportunities and tailored offerings for personal and home care brands, refill and reuse packaging for water, other beverages and venue specific needs to advance the circular economy.

In late-October, the company completed the acquisition of Alucan Entec, S.A., a European impact extruded aluminum packaging business, for the purchase price of €82 million (or $88 million using an exchange rate as of the date of close), subject to customary closing adjustments, which reflects an attractive EBITDA multiple of approximately 7.4x. The acquisition complements Ball’s existing global extruded aluminum aerosol and bottle business with the addition of two manufacturing facilities near Lummen, Belgium, and Llinars del Vallés, Spain, along with associated contracts and other related assets.

Outlook

“Our company is performing well and on track to deliver or exceed against our stated comparable earnings growth goal and on target to return in excess of $1.6 billion to shareholders in 2024. By consistently executing on our plans to drive continuous improvement and operational excellence, our resulting strong free cash flow will allow us to return significant value to shareholders while also prudently investing in our business over the years to come,” said Howard Yu, executive vice president and chief financial officer.

“Our global team is focused on executing our enterprise-wide strategy with purpose and pace to advance aluminum packaging and to consistently deliver high-quality results, products and returns. In 2024, we are positioned to achieve mid-single digit plus comparable diluted earnings per share growth, generate strong free cash flow and EVA while also returning significant value to shareholders through a combination of share repurchases and dividends. We will continue to leverage the strengths of our best-in-class footprint, product portfolio and operational talent. I want to thank our employees for their hard work to consistently deliver comparable diluted earnings per share growth greater than 10 percent per annum in 2025 and beyond,” Fisher said.

About Ball Corporation

Ball Corporation supplies innovative, sustainable aluminum packaging solutions for beverage, personal care and household products customers. Ball Corporation employs 16,000 people worldwide and reported 2023 net sales of $12.06 billion, which excludes the divested aerospace business. For more information, visit www.ball.com, or connect with us on Facebook or X (Twitter).

Conference Call Details

Ball Corporation BALL will hold its third quarter 2024 earnings call today at 9 a.m. Mountain time (11 a.m. Eastern). The North American toll-free number for the call is +1 877-497-9071. International callers should dial +1 201-689-8727. Please use the following URL for a webcast of the live call:

https://event.choruscall.com/mediaframe/webcast.html?webcastid=0McTrGVD

For those unable to listen to the live call, a webcast replay and written transcript of the call will be posted within 48 hours of the call’s conclusion to Ball’s website at www.ball.com/investors under “news and presentations.”

Forward-Looking Statement

This release contains “forward-looking” statements concerning future events and financial performance. Words such as “expects,” “anticipates,” “estimates,” “believes,” and similar expressions typically identify forward looking statements, which are generally any statements other than statements of historical fact. Such statements are based on current expectations or views of the future and are subject to risks and uncertainties, which could cause actual results or events to differ materially from those expressed or implied. You should therefore not place undue reliance upon any forward-looking statements, and they should be read in conjunction with, and qualified in their entirety by, the cautionary statements referenced below. Ball undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Key factors, risks and uncertainties that could cause actual outcomes and results to be different are summarized in filings with the Securities and Exchange Commission, including Exhibit 99 in Ball’s Form 10-K, which are available on Ball’s website and at www.sec.gov. Additional factors that might affect: a) Ball’s packaging segments include product capacity, supply, and demand constraints and fluctuations and changes in consumption patterns; availability/cost of raw materials, equipment, and logistics; competitive packaging, pricing and substitution; changes in climate and weather and related events such as drought, wildfires, storms, hurricanes, tornadoes and floods; footprint adjustments and other manufacturing changes, including the opening and closing of facilities and lines; failure to achieve synergies, productivity improvements or cost reductions; unfavorable mandatory deposit or packaging laws; customer and supplier consolidation; power and supply chain interruptions; changes in major customer or supplier contracts or loss of a major customer or supplier; inability to pass through increased costs; war, political instability and sanctions, including relating to the situation in Russia and Ukraine and its impact on Ball’s supply chain and its ability to operate in Europe, the Middle East and Africa regions generally; changes in foreign exchange or tax rates; and tariffs, trade actions, or other governmental actions, including business restrictions and orders affecting goods produced by Ball or in its supply chain, including imported raw materials; and b) Ball as a whole include those listed above plus: the extent to which sustainability-related opportunities arise and can be capitalized upon; changes in senior management, succession, and the ability to attract and retain skilled labor; regulatory actions or issues including those related to tax, environmental, social and governance reporting, competition, environmental, health and workplace safety, including U.S. Federal Drug Administration and other actions or public concerns affecting products filled in Ball’s containers, or chemicals or substances used in raw materials or in the manufacturing process; technological developments and innovations; the ability to manage cyber threats; litigation; strikes; disease; pandemic; labor cost changes; inflation; rates of return on assets of Ball’s defined benefit retirement plans; pension changes; uncertainties surrounding geopolitical events and governmental policies; reduced cash flow; interest rates affecting Ball’s debt; successful or unsuccessful joint ventures, acquisitions and divestitures, and their effects on Ball’s operating results and business generally.

|

Ball Corporation |

||||||||||||

|

Condensed Financial Statements (Third Quarter 2024) |

||||||||||||

|

Unaudited Condensed Consolidated Statements of Earnings |

||||||||||||

|

Three Months Ended |

Nine Months Ended |

|||||||||||

|

September 30, |

September 30, |

|||||||||||

|

($ in millions, except per share amounts) |

2024 |

2023 |

2024 |

2023 |

||||||||

|

Net sales |

$ |

3,082 |

$ |

3,111 |

$ |

8,915 |

$ |

9,159 |

||||

|

Cost of sales (excluding depreciation and amortization) |

(2,425) |

(2,512) |

(7,065) |

(7,450) |

||||||||

|

Depreciation and amortization |

(150) |

(152) |

(460) |

(449) |

||||||||

|

Selling, general and administrative |

(142) |

(133) |

(518) |

(409) |

||||||||

|

Business consolidation and other activities |

(85) |

(29) |

(171) |

(43) |

||||||||

|

Interest income |

14 |

12 |

58 |

23 |

||||||||

|

Interest expense |

(67) |

(122) |

(228) |

(351) |

||||||||

|

Debt refinancing and other costs |

— |

— |

(3) |

— |

||||||||

|

Earnings before taxes |

227 |

175 |

528 |

480 |

||||||||

|

Tax (provision) benefit |

(42) |

(45) |

(118) |

(107) |

||||||||

|

Equity in results of affiliates, net of tax |

8 |

3 |

21 |

13 |

||||||||

|

Earnings from continuing operations |

193 |

133 |

431 |

386 |

||||||||

|

Discontinued operations, net of tax |

6 |

71 |

3,613 |

171 |

||||||||

|

Net earnings |

199 |

204 |

4,044 |

557 |

||||||||

|

Net earnings attributable to noncontrolling interests, net of tax |

2 |

1 |

4 |

4 |

||||||||

|

Net earnings attributable to Ball Corporation |

$ |

197 |

$ |

203 |

$ |

4,040 |

$ |

553 |

||||

|

Earnings per share: |

||||||||||||

|

Basic – continuing operations |

$ |

0.63 |

$ |

0.42 |

$ |

1.38 |

$ |

1.22 |

||||

|

Basic – discontinued operations |

0.02 |

0.22 |

11.70 |

0.54 |

||||||||

|

Total basic earnings per share |

$ |

0.65 |

$ |

0.64 |

$ |

13.08 |

$ |

1.76 |

||||

|

Diluted – continuing operations |

$ |

0.63 |

$ |

0.42 |

$ |

1.37 |

$ |

1.20 |

||||

|

Diluted – discontinued operations |

0.02 |

0.22 |

11.59 |

0.54 |

||||||||

|

Total diluted earnings per share |

$ |

0.65 |

$ |

0.64 |

$ |

12.96 |

$ |

1.74 |

||||

|

Weighted average shares outstanding (000s): |

||||||||||||

|

Basic |

302,406 |

314,983 |

308,851 |

314,596 |

||||||||

|

Diluted |

305,219 |

317,296 |

311,674 |

316,938 |

||||||||

|

Ball Corporation |

||||||

|

Condensed Financial Statements (Third Quarter 2024) |

||||||

|

Unaudited Condensed Consolidated Statements of Cash Flows |

||||||

|

Nine Months Ended |

||||||

|

September 30, |

||||||

|

($ in millions) |

2024 |

2023 |

||||

|

Cash Flows from Operating Activities: |

||||||

|

Net earnings |

$ |

4,044 |

$ |

557 |

||

|

Depreciation and amortization |

469 |

509 |

||||

|

Business consolidation and other activities |

171 |

43 |

||||

|

Deferred tax provision (benefit) |

201 |

(87) |

||||

|

Gain on Aerospace disposal |

(4,694) |

18 |

||||

|

Pension contributions |

(24) |

(13) |

||||

|

Other, net |

78 |

71 |

||||

|

Changes in working capital components, net of dispositions |

(630) |

29 |

||||

|

Cash provided by (used in) operating activities |

(385) |

1,127 |

||||

|

Cash Flows from Investing Activities: |

||||||

|

Capital expenditures |

(377) |

(830) |

||||

|

Business dispositions, net of cash sold |

5,422 |

— |

||||

|

Other, net |

136 |

4 |

||||

|

Cash provided by (used in) investing activities |

5,181 |

(826) |

||||

|

Cash Flows from Financing Activities: |

||||||

|

Changes in borrowings, net |

(2,778) |

652 |

||||

|

Acquisitions of treasury stock |

(1,061) |

(3) |

||||

|

Dividends |

(185) |

(189) |

||||

|

Other, net |

26 |

30 |

||||

|

Cash provided by (used in) financing activities |

(3,998) |

490 |

||||

|

Effect of currency exchange rate changes on cash, cash equivalents and restricted cash |

(64) |

— |

||||

|

Change in cash, cash equivalents and restricted cash |

734 |

791 |

||||

|

Cash, cash equivalents and restricted cash – beginning of period |

710 |

558 |

||||

|

Cash, cash equivalents and restricted cash – end of period |

$ |

1,444 |

$ |

1,349 |

||

|

Ball Corporation |

||||||

|

Condensed Financial Statements (Third Quarter 2024) |

||||||

|

Unaudited Condensed Consolidated Balance Sheets |

||||||

|

September 30, |

||||||

|

($ in millions) |

2024 |

2023 |

||||

|

Assets |

||||||

|

Current assets |

||||||

|

Cash and cash equivalents |

$ |

1,440 |

$ |

1,335 |

||

|

Receivables, net |

2,655 |

1,785 |

||||

|

Inventories, net |

1,385 |

1,660 |

||||

|

Other current assets |

113 |

263 |

||||

|

Current assets held for sale |

14 |

365 |

||||

|

Total current assets |

5,607 |

5,408 |

||||

|

Property, plant and equipment, net |

6,550 |

6,606 |

||||

|

Goodwill |

4,244 |

4,182 |

||||

|

Intangible assets, net |

1,138 |

1,262 |

||||

|

Other assets |

1,285 |

1,635 |

||||

|

Noncurrent assets held for sale |

— |

839 |

||||

|

Total assets |

$ |

18,824 |

$ |

19,932 |

||

|

Liabilities and Equity |

||||||

|

Current liabilities |

||||||

|

Short-term debt and current portion of long-term debt |

$ |

452 |

$ |

2,108 |

||

|

Payables and other accrued liabilities |

4,672 |

4,212 |

||||

|

Current liabilities held for sale |

— |

395 |

||||

|

Total current liabilities |

5,124 |

6,715 |

||||

|

Long-term debt |

5,353 |

7,483 |

||||

|

Other long-term liabilities |

1,592 |

1,513 |

||||

|

Noncurrent liabilities held for sale |

— |

213 |

||||

|

Equity |

6,755 |

4,008 |

||||

|

Total liabilities and equity |

$ |

18,824 |

$ |

19,932 |

||

Ball Corporation

Notes to the Condensed Financial Statements (Third Quarter 2024)

1. U.S. GAAP Measures

Business Segment Information

Ball’s operations are organized and reviewed by management along its product lines and geographical areas.

On February 16, 2024, the company completed the divestiture of its aerospace business. The transaction represents a strategic shift; therefore, the company’s consolidated financial statements reflect the aerospace business’ financial results as discontinued operations for all periods presented. The aerospace business was historically presented as a reportable segment. Effective as of the first quarter of 2024, the company reports its financial performance in the three reportable segments outlined below: (1) beverage packaging, North and Central America; (2) beverage packaging, Europe, Middle East and Africa (beverage packaging, EMEA) and (3) beverage packaging, South America.

Beverage packaging, North and Central America: Consists of operations in the U.S., Canada and Mexico that manufacture and sell aluminum beverage containers throughout those countries.

Beverage packaging, EMEA: Consists of operations in numerous countries throughout Europe, as well as Egypt and Turkey, that manufacture and sell aluminum beverage containers throughout those countries.

Beverage packaging, South America: Consists of operations in Brazil, Argentina, Paraguay and Chile that manufacture and sell aluminum beverage containers throughout most of South America.

Other consists of a non-reportable operating segment (beverage packaging, other) that manufactures and sells aluminum beverage containers in India, Saudi Arabia and Myanmar; a non-reportable operating segment that manufactures and sells extruded aluminum aerosol containers and recloseable aluminum bottles across multiple consumer categories as well as aluminum slugs (aerosol packaging) throughout North America, South America, Europe, and Asia; a non-reportable operating segment that manufactures and sells aluminum cups (aluminum cups); undistributed corporate expenses; and intercompany eliminations and other business activities.

The company also has investments in operations in Guatemala, Panama, the U.S. and Vietnam that are accounted for under the equity method of accounting and, accordingly, those results are not included in segment sales or earnings.

In the third quarter of 2023, Ball entered into a Stock Purchase Agreement (Agreement) with BAE Systems, Inc. (BAE) and, for the limited purposes set forth therein, BAE Systems plc, to sell all outstanding equity interests in Ball’s aerospace business. On February 16, 2024, the company completed the divestiture of the aerospace business for a purchase price of $5.6 billion, subject to working capital adjustments and other customary closing adjustments under the terms of the Agreement. The company is in the process of finalizing the working capital adjustments and other customary closing adjustments with BAE, which is currently expected to be completed in 2024 and may adjust the final cash proceeds and gain on sale amounts. The divestiture resulted in a pre-tax gain of $4.67 billion, which is net of $20 million of costs to sell incurred and paid in 2023 related to the disposal. Cash proceeds received at close from the sale of $5.42 billion, net of the cash disposed, are presented in business dispositions, net of cash sold, in the unaudited condensed consolidated statement of cash flows for the nine months ended September 30, 2024. The company expects to pay approximately $950 million in income taxes related to the transaction throughout 2024, of which $484 million has been paid as of September 30, 2024. The remaining amount of income taxes related to the transaction is recorded in payables and other accrued liabilities in the unaudited condensed consolidated balance sheet. Additionally, the completion of the divestiture resulted in the removal of the aerospace business from the company’s obligor group, as the business no longer guarantees the company’s senior notes and senior credit facilities.

|

Three Months Ended |

Nine Months Ended |

||||||||||

|

September 30, |

September 30, |

||||||||||

|

($ in millions) |

2024 |

2023 |

2024 |

2023 |

|||||||

|

Net sales |

|||||||||||

|

Beverage packaging, North and Central America |

$ |

1,456 |

$ |

1,541 |

$ |

4,328 |

$ |

4,582 |

|||

|

Beverage packaging, EMEA |

950 |

902 |

2,640 |

2,656 |

|||||||

|

Beverage packaging, South America |

484 |

489 |

1,388 |

1,344 |

|||||||

|

Reportable segment sales |

2,890 |

2,932 |

8,356 |

8,582 |

|||||||

|

Other |

192 |

179 |

559 |

577 |

|||||||

|

Net sales |

$ |

3,082 |

$ |

3,111 |

$ |

8,915 |

$ |

9,159 |

|||

|

Comparable segment operating earnings |

|||||||||||

|

Beverage packaging, North and Central America |

$ |

203 |

$ |

196 |

$ |

605 |

$ |

554 |

|||

|

Beverage packaging, EMEA |

128 |

103 |

326 |

274 |

|||||||

|

Beverage packaging, South America |

78 |

61 |

170 |

141 |

|||||||

|

Reportable segment comparable operating earnings |

409 |

360 |

1,101 |

969 |

|||||||

|

Reconciling items |

|||||||||||

|

Other (a) |

4 |

— |

(66) |

7 |

|||||||

|

Business consolidation and other activities |

(85) |

(29) |

(171) |

(43) |

|||||||

|

Amortization of acquired Rexam intangibles |

(34) |

(34) |

(105) |

(102) |

|||||||

|

Interest expense |

(67) |

(122) |

(228) |

(351) |

|||||||

|

Debt refinancing and other costs |

— |

— |

(3) |

— |

|||||||

|

Earnings before taxes |

$ |

227 |

$ |

175 |

$ |

528 |

$ |

480 |

|||

|

____________ |

|

|

(a) |

Includes undistributed corporate expenses, net, of $32 million and $18 million for the three months ended September 30, 2024 and 2023, respectively, and $149 million and $60 million for the nine months ended September 30, 2024 and 2023, respectively. For the nine months ended September 30, 2024, undistributed corporate expenses, net, includes $82 million of incremental compensation cost from the successful sale of the aerospace business consisting of cash bonuses and stock based compensation. For the three and nine months ended September 30, 2024, undistributed corporate expenses, net, include $7 million and $36 million of corporate interest income, respectively. |

Discontinued Operations

The following table presents components of discontinued operations, net of tax for the three and nine months ended September 30, 2024 and 2023:

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||

|

($ in millions) |

2024 |

2023 |

2024 |

2023 |

||||||||

|

Net sales |

$ |

— |

$ |

460 |

$ |

261 |

$ |

1,467 |

||||

|

Cost of sales (excluding depreciation and amortization) |

— |

(382) |

(214) |

(1,205) |

||||||||

|

Depreciation and amortization |

— |

(21) |

(9) |

(60) |

||||||||

|

Selling, general and administrative |

— |

(11) |

(11) |

(42) |

||||||||

|

Interest expense |

— |

— |

— |

1 |

||||||||

|

Gain (loss) on disposition |

(1) |

(18) |

4,694 |

(18) |

||||||||

|

Tax (provision) benefit |

7 |

43 |

(1,108) |

28 |

||||||||

|

Discontinued operations, net of tax |

$ |

6 |

$ |

71 |

$ |

3,613 |

$ |

171 |

||||

2. Non-U.S. GAAP Measures

Non-U.S. GAAP Measures – Non-U.S. GAAP measures should not be considered in isolation. They should not be considered superior to, or a substitute for, financial measures calculated in accordance with U.S. GAAP and may not be comparable to similarly titled measures of other companies. Presentations of earnings and cash flows presented in accordance with U.S. GAAP are available in the company’s earnings releases and quarterly and annual regulatory filings. Information reconciling forward-looking U.S. GAAP measures to non-U.S. GAAP measures is not available without unreasonable effort. We have not provided guidance for the most directly comparable U.S. GAAP financial measures, as they are not available without unreasonable effort due to the high variability, complexity and low visibility with respect to certain special items, including restructuring charges, business consolidation and other activities, gains and losses related to acquisition and divestiture of businesses, the ultimate outcome of certain legal or tax proceedings and other non-comparable items. These items are uncertain, depend on various factors and could be material to our results computed in accordance with U.S. GAAP.

Comparable Earnings Before Interest, Taxes, Depreciation and Amortization (Comparable EBITDA) – Comparable EBITDA is earnings before interest expense, taxes, depreciation and amortization, business consolidation and other non-comparable items.

Comparable Operating Earnings – Comparable Operating Earnings is earnings before interest expense, taxes, business consolidation and other non-comparable items.

Comparable Net Earnings – Comparable Net Earnings is net earnings attributable to Ball Corporation before business consolidation and other non-comparable items after tax.

Comparable Diluted Earnings Per Share – Comparable Diluted Earnings Per Share is Comparable Net Earnings divided by diluted weighted average shares outstanding.

Net Debt – Net Debt is total debt less cash and cash equivalents, which are derived directly from the company’s financial statements.

Free Cash Flow – Free Cash Flow is typically derived directly from the company’s cash flow statements and is defined as cash flows from operating activities less capital expenditures; and, it may be adjusted for additional items that affect comparability between periods. Free Cash Flow is not a defined term under U.S. GAAP, and it should not be inferred that the entire free cash flow amount is available for discretionary expenditures.

Adjusted Free Cash Flow – Adjusted Free Cash Flow is defined as Free Cash Flow adjusted for payments made for income tax liabilities related to the Aerospace disposition and other material dispositions. Adjusted Free Cash Flow is not a defined term under U.S. GAAP, and it should not be inferred that the entire Adjusted Free Cash Flow amount is available for discretionary expenditures.

We use Comparable EBITDA, Comparable Operating Earnings, Comparable Net Earnings, and Comparable Diluted Earnings Per Share internally to evaluate the company’s operating performance. Ball management uses Interest Coverage (Comparable EBITDA to interest expense) and Leverage (Net Debt to Comparable EBITDA) as metrics to monitor the credit quality of Ball Corporation. Management internally uses free cash flow measures to: (1) evaluate the company’s liquidity, (2) evaluate strategic investments, (3) plan stock buyback and dividend levels and (4) evaluate the company’s ability to incur and service debt. Note that when non-U.S. GAAP measures exclude amortization of acquired Rexam intangibles, the measures include the revenue of the acquired entities and all other expenses unless otherwise stated and the acquired assets contribute to revenue generation.

Please see the company’s website for further details of the company’s non-U.S. GAAP financial measures at www.ball.com/investors under the “Financials” tab.

A summary of the effects of non-comparable items on after tax earnings is as follows:

|

Three Months Ended |

Nine Months Ended |

|||||||||||

|

September 30, |

September 30, |

|||||||||||

|

($ in millions, except per share amounts) |

2024 |

2023 |

2024 |

2023 |

||||||||

|

Net earnings attributable to Ball Corporation |

$ |

197 |

$ |

203 |

$ |

4,040 |

$ |

553 |

||||

|

Facility closure costs and other items (1) |

85 |

29 |

171 |

43 |

||||||||

|

Amortization of acquired Rexam intangibles |

34 |

34 |

105 |

102 |

||||||||

|

Debt refinancing and other costs |

— |

— |

3 |

— |

||||||||

|

Non-comparable tax items |

(39) |

(21) |

1,020 |

(42) |

||||||||

|

Gain on Aerospace disposal (2) |

1 |

18 |

(4,694) |

18 |

||||||||

|

Aerospace disposition compensation (3) |

— |

— |

82 |

— |

||||||||

|

Comparable Net Earnings |

$ |

278 |

$ |

263 |

$ |

727 |

$ |

674 |

||||

|

Comparable Diluted Earnings Per Share |

$ |

0.91 |

$ |

0.83 |

$ |

2.33 |

$ |

2.13 |

||||

|

(1) |

The charges for the three and nine months ended September 30, 2024, were primarily composed of costs related to plant closures in beverage packaging, South America and beverage packaging, North and Central America, and the company’s activities to establish its new operating model. For the three and nine months ended September 30, 2024, $94 million and $147 million, respectively, of costs were recorded for plant closures, primarily for employee severance and benefits, costs to scrap assets or write them down to their sellable value, accelerated depreciation and other shutdown costs. Additionally, for the three and nine months ended September 30, 2024, $6 million and $26 million, respectively, of costs were recorded to establish the new operating model, primarily related to employee severance, employee benefits and other related items. The charges for the three and nine months ended September 30, 2024, were partially offset by income of $16 million and $27 million, respectively, from the receipt of insurance proceeds for replacement costs related to the 2023 fire at the company’s Verona, Virginia extruded aluminum slug manufacturing facility. |

|

In the first quarter of 2023, Ball announced the planned closure of its aluminum beverage can manufacturing facility in Wallkill, New York. Production permanently ceased at this facility in the third quarter of 2023. The charges for the three and nine months ended September 30, 2023, primarily were composed of costs for employee severance and benefits, accelerated depreciation and other shutdown costs related to this closure. |

|

|

(2) |

In the first quarter of 2024, the company recorded a pre-tax gain for the sale of the aerospace business. In the third quarter of 2023, the company recorded costs to sell the business. |

|

(3) |

The charge for the nine months ended September 30, 2024, was composed of incremental compensation costs from the successful sale of the aerospace business, which consisted of cash bonuses and stock based compensation. This amount was recorded in selling, general and administrative in the unaudited condensed consolidated statement of earnings. |

A summary of the effects of non-comparable items on earnings before taxes is as follows:

|

Three Months Ended |

Nine Months Ended |

|||||||||||

|

September 30, |

September 30, |

|||||||||||

|

($ in millions) |

2024 |

2023 |

2024 |

2023 |

||||||||

|

Net earnings attributable to Ball Corporation |

$ |

197 |

$ |

203 |

$ |

4,040 |

$ |

553 |

||||

|

Net earnings attributable to noncontrolling interests, net of tax |

2 |

1 |

4 |

4 |

||||||||

|

Discontinued operations, net of tax |

(6) |

(71) |

(3,613) |

(171) |

||||||||

|

Earnings from continuing operations |

193 |

133 |

431 |

386 |

||||||||

|

Equity in results of affiliates, net of tax |

(8) |

(3) |

(21) |

(13) |

||||||||

|

Tax provision (benefit) |

42 |

45 |

118 |

107 |

||||||||

|

Earnings before taxes |

227 |

175 |

528 |

480 |

||||||||

|

Interest expense |

67 |

122 |

228 |

351 |

||||||||

|

Debt refinancing and other costs |

— |

— |

3 |

— |

||||||||

|

Business consolidation and other activities |

85 |

29 |

171 |

43 |

||||||||

|

Aerospace disposition compensation |

— |

— |

82 |

— |

||||||||

|

Amortization of acquired Rexam intangibles |

34 |

34 |

105 |

102 |

||||||||

|

Comparable Operating Earnings |

$ |

413 |

$ |

360 |

$ |

1,117 |

$ |

976 |

||||

A summary of Comparable EBITDA, Net Debt, Interest Coverage and Leverage is as follows:

|

Twelve |

Less: Nine |

Add: Nine |

|||||||||||

|

Months Ended |

Months Ended |

Months Ended |

Year Ended |

||||||||||

|

December 31, |

September 30, |

September 30, |

September 30, |

||||||||||

|

($ in millions, except ratios) |

2023 |

2023 |

2024 |

2024 |

|||||||||

|

Net earnings attributable to Ball Corporation |

$ |

707 |

$ |

553 |

$ |

4,040 |

$ |

4,194 |

|||||

|

Net earnings attributable to noncontrolling interests, net of tax |

4 |

4 |

4 |

4 |

|||||||||

|

Discontinued operations, net of tax |

(223) |

(171) |

(3,613) |

(3,665) |

|||||||||

|

Earnings from continuing operations |

488 |

386 |

431 |

533 |

|||||||||

|

Equity in results of affiliates, net of tax |

(20) |

(13) |

(21) |

(28) |

|||||||||

|

Tax provision (benefit) |

146 |

107 |

118 |

157 |

|||||||||

|

Earnings before taxes |

614 |

480 |

528 |

662 |

|||||||||

|

Interest expense |

460 |

351 |

228 |

337 |

|||||||||

|

Debt refinancing and other costs |

— |

— |

3 |

3 |

|||||||||

|

Business consolidation and other activities |

133 |

43 |

171 |

261 |

|||||||||

|

Aerospace disposition compensation |

— |

— |

82 |

82 |

|||||||||

|

Amortization of acquired Rexam intangibles |

135 |

102 |

105 |

138 |

|||||||||

|

Comparable Operating Earnings |

1,342 |

976 |

1,117 |

1,483 |

|||||||||

|

Depreciation and amortization |

605 |

449 |

460 |

616 |

|||||||||

|

Amortization of acquired Rexam intangibles |

(135) |

(102) |

(105) |

(138) |

|||||||||

|

Comparable EBITDA |

$ |

1,812 |

$ |

1,323 |

$ |

1,472 |

$ |

1,961 |

|||||

|

Interest expense |

$ |

(460) |

$ |

(351) |

$ |

(228) |

$ |

(337) |

|||||

|

Total debt at period end |

$ |

5,805 |

|||||||||||

|

Cash and cash equivalents |

(1,440) |

||||||||||||

|

Net Debt |

$ |

4,365 |

|||||||||||

|

Interest Coverage (Comparable EBITDA/Interest Expense) |

5.8 |

x |

|||||||||||

|

Leverage (Net Debt/Comparable EBITDA) |

2.2 |

x |

|||||||||||

A summary of free cash flow and adjusted free cash flow is as follows:

|

Nine Months Ended |

|||

|

September 30, |

|||

|

($ in millions) |

2024 |

||

|

Total cash provided by (used in) operating activities |

$ |

(385) |

|

|

Less: Capital expenditures |

(377) |

||

|

Free Cash Flow |

(762) |

||

|

Add: Cash taxes paid for Aerospace disposition |

484 |

||

|

Adjusted Free Cash Flow |

$ |

(278) |

|

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/ball-reports-third-quarter-2024-results-302292238.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/ball-reports-third-quarter-2024-results-302292238.html

SOURCE Ball Corporation

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Meta's Core Business 'Doing Great' With 19% Growth, AI Push Signals Search Monetization Ambitions, Says Gene Munster

Deepwater Asset Management‘s Managing Partner Gene Munster offered a detailed analysis of Meta Platforms Inc‘s META third-quarter performance, highlighting the company’s strong core business and ambitious AI investments.

What Happened: “Following the Meta call, the key takeaway is the core business is doing great and they’re aggressively investing in AI to become the next big thing,” Munster wrote on X. “My guess is that big thing is related to monetizing search.”

In his analysis, Munster emphasized several key points:

- Revenue Growth: Meta achieved 19% year-over-year growth in the September quarter, slightly exceeding expectations of 18%. The company’s guidance suggests further acceleration to 20% growth in December.

- User Engagement: Daily active users reached 3.29 billion, growing at 5% year-over-year. While slightly below estimates of 3.31 billion, Munster noted this growth is impressive given Meta’s already massive user base, with approximately half of the world’s population using a Meta property daily.

- Capital Expenditure: Meta’s aggressive infrastructure investment could see an 87% increase in the December quarter, significantly higher than competitor Alphabet Inc GOOGL GOOG owned Google‘s projected 19% increase. Munster supported this strategy, calling it “absolutely the right thing for the company to do.”

- Competitive Position: Meta’s growth outpaces its tech peers, with Munster comparing the company’s projected 20% December growth to Microsoft Corp.‘s MSFT 14% and Google’s search business at 12%.

See Also: AMD CEO Lisa Su: No ‘One Size Fits All’ In $500B AI Computing Future

Why It Matters: Despite positive fundamentals, Meta’s stock declined 3% in after-hours trading, which Munster attributed to high pre-earnings expectations. He noted the stock had already risen 20% in the previous three months, compared to the NASDAQ’s rise of just over 5%.

Looking ahead, Munster believes Meta’s massive user base positions the company well for AI implementation, potentially leading to “growth rates that are higher than what most people think for the next couple years.”

The analysis also touched on Meta’s AI ambitions, with the company reporting a 7% improvement in advertising conversion rates through AI-powered targeting tools. According to Munster, Meta aims to have the most widely used generative AI chat service by year-end.

Price Action: Meta stock closed at $591.80, down 0.25% on Wednesday. In after-hours trading, the stock declined further, dropping 3.18%. Year to date, Meta has shown substantial growth, surging by 70.90%, according to data from Benzinga Pro.

Read Next:

Image Via Pixabay

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Elon Musk Slams Zoox Co-Founder Over FSD Criticism: Your Company 'Would Be Dead Already' If Not For Amazon

Zoox co-founder Jesse Levinson on Wednesday dismissed the possibility of Tesla Inc TSLA deploying autonomous vehicles without safety drivers in California next year, alleging that the EV giant lacks a technology that works.

What Happened: Tesla is faced with a lot of regulatory hurdles that they haven’t even started trying to climb yet, Levinson said at TechCrunch Disrupt 2024 event in San Francisco. But the fundamental problem, he said, is that Tesla doesn’t have a “technology that worked.”

“By works, I want to differentiate between a driver assistance system that drives most the time except when it doesn’t and then you have to take over versus a system that’s so reliable and robust that you don’t need a person in it,” Levinson said.

Levinson said that he drives a Tesla and uses its full self-driving (FSD) driver assistance system “every couple of weeks.” While the system is “impressive,” it is also a bit “stressful”, he said.

“…usually it does the right thing and then it sort of lulls you into this false sense of complacency and then it does the wrong thing. You’re like “oh my god.” They are about 100 times less safe than a human,” Levinson said while also pinning it down to the company’s use of just cameras and AI to enable self-driving.

“…you really do need significantly more hardware than Tesla is putting in the vehicles to build a robotaxi that’s not just as safe but especially safer than a human,” he opined while adding that there is a need for sensor data despite advancements in AI to protect against camera malfunctions and ensure fully safe rides.

Musk Responds: Tesla CEO Elon Musk, however, is optimistic that FSD technology can ensure full vehicle autonomy with future versions of the software.

Musk hit back at Levinson on Wednesday for his comments on the company’s capability to deploy autonomous vehicles.

“If he hadn’t gotten bailed out by Amazon, his company would be dead already,” Musk wrote on social media platform X, referring to Amazon.com‘s AMZN acquisition of the robotaxi company in 2020 for over $1.2 billion.

Why It Matters: During Tesla’s third-quarter earnings call earlier this month, Musk said that the company expects to start a ride-hail service in Texas and California starting next year, subject to regulatory approval.

However, the vehicles might not all operate as driverless robotaxis but with a driver as some states demand it until the company touches certain milestones in terms of miles and hours driven, the company then said.

However, Musk expressed confidence about the company operating driverless paid rides sometime next year.

Tesla also unveiled a no-pedal, no-steering wheel dedicated robotaxi product earlier this month called the Cybercab. Cybercab, Musk then said, will enter production ‘before 2027′ and will be priced below $30,000. Until then, Tesla’s ride-hail fleet will be composed of the company’s Model 3 and Model Y.

Zoox, meanwhile, will launch its custom-built robotaxi with no pedals or steering wheel in San Francisco and Las Vegas in the coming weeks, Levinson said on Wednesday. The company will start taking members of the public for rides in the vehicle starting next year, he added.

Image via Shutterstock

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

New York Mortgage Trust Reports Third Quarter 2024 Results

NEW YORK, Oct. 30, 2024 (GLOBE NEWSWIRE) — New York Mortgage Trust, Inc. NYMT (“NYMT,” the “Company,” “we,” “our” or “us”) today reported results for the three and nine months ended September 30, 2024.

Summary of Third Quarter 2024:

(dollar amounts in thousands, except per share data)

| Net income attributable to Company’s common stockholders | $ | 32,410 | |

| Net income attributable to Company’s common stockholders per share (basic) | $ | 0.36 | |

| Undepreciated earnings(1) | $ | 34,941 | |

| Undepreciated earnings per common share(1) | $ | 0.39 | |

| Comprehensive income attributable to Company’s common stockholders | $ | 32,410 | |

| Comprehensive income attributable to Company’s common stockholders per share (basic) | $ | 0.36 | |

| Yield on average interest earning assets(1) (2) | 6.69 | % | |

| Interest income | $ | 108,361 | |

| Interest expense | $ | 88,124 | |

| Net interest income | $ | 20,237 | |

| Net interest spread(1) (3) | 1.32 | % | |

| Book value per common share at the end of the period | $ | 9.83 | |

| Adjusted book value per common share at the end of the period(1) | $ | 10.87 | |

| Economic return on book value(4) | 3.51 | % | |

| Economic return on adjusted book value(5) | 0.45 | % | |

| Dividends per common share | $ | 0.20 |

| (1) | Represents a non-GAAP financial measure. A reconciliation of the Company’s non-GAAP financial measures to their most directly comparable GAAP measure is included below in “Reconciliation of Financial Information.” |

| (2) | Calculated as the quotient of our adjusted interest income and our average interest earning assets and excludes all Consolidated SLST assets other than those securities owned by the Company. |

| (3) | Our calculation of net interest spread may not be comparable to similarly-titled measures of other companies who may use a different calculation. |

| (4) | Economic return on book value is based on the periodic change in GAAP book value per common share plus dividends declared per common share, if any, during the period. |

| (5) | Economic return on adjusted book value is based on the periodic change in adjusted book value per common share, a non-GAAP financial measure, plus dividends declared per common share, if any, during the period. |

Key Developments:

Investing Activities

- A joint venture in which we held a common equity investment sold its multi-family apartment community for approximately $56.4 million. The sale generated a net gain attributable to the Company’s common stockholders of approximately $8.7 million.

- A joint venture in which we hold a combined preferred equity and common equity investment sold a multi-family apartment community for approximately $43.5 million. The sale generated a net gain attributable to the Company’s common stockholders of approximately $1.5 million.

- Purchased approximately $372.2 million of Agency RMBS with an average coupon of 5.33%.

- Purchased approximately $624.2 million in residential loans with an average gross coupon of 9.72%.

Financing Activities

- Completed a securitization of business purpose loans, resulting in approximately $235.8 million in net proceeds to us after deducting expenses associated with the transaction. We utilized a portion of the net proceeds to repay approximately $184.6 million on outstanding repurchase agreements related to residential loans.

- Completed a re-securitization of our investment in certain subordinated securities issued by Consolidated SLST, resulting in approximately $73.0 million in net proceeds to us after deducting expenses associated with the transaction. We utilized a portion of the net proceeds to repay approximately $48.8 million on outstanding repurchase agreement financing related to our investment in Consolidated SLST.

Management Overview

Jason Serrano, Chief Executive Officer, commented: “The Company reported sharply higher earnings per share of $0.36 in the third quarter. The improved earnings were the result of a portfolio rotation which began over a year ago. As part of the plan, we focused on acquisitions that can deliver high recurring interest income by rotating from under-performing, total return opportunities. Consequently, the Company reported Total Adjusted Net Interest Income of $29 million in the third quarter, up 39% year-over-year.

Over the year, we maintained a deliberate approach to balance sheet growth by prioritizing investments containing fundamentally stable income and did not veer from our objective. Going forward, we intend to unlock the Company’s excess liquidity for continued portfolio growth to further enhance Company earnings, particularly without any corporate debt maturity until 2026. We believe a patient approach for earnings growth is prudent in this market environment to increase stockholder value.”

Capital Allocation

The following table sets forth, by investment category, our allocated capital at September 30, 2024 (dollar amounts in thousands):

| Single-Family(1) | Multi- Family |

Corporate/ Other |

Total | ||||||||||||

| Residential loans | $ | 3,777,144 | $ | — | $ | — | $ | 3,777,144 | |||||||

| Consolidated SLST CDOs | (845,811 | ) | — | — | (845,811 | ) | |||||||||

| Investment securities available for sale | 3,036,182 | — | 349,088 | 3,385,270 | |||||||||||

| Multi-family loans | — | 87,614 | — | 87,614 | |||||||||||

| Equity investments | — | 100,378 | 46,455 | 146,833 | |||||||||||

| Equity investments in consolidated multi-family properties(2) | — | 154,462 | — | 154,462 | |||||||||||

| Equity investments in disposal group held for sale(3) | — | 17,831 | — | 17,831 | |||||||||||

| Single-family rental properties | 144,736 | — | — | 144,736 | |||||||||||

| Total investment portfolio carrying value | 6,112,251 | 360,285 | 395,543 | 6,868,079 | |||||||||||

| Liabilities: | |||||||||||||||

| Repurchase agreements | (3,258,175 | ) | — | (352,940 | ) | (3,611,115 | ) | ||||||||

| Collateralized debt obligations | |||||||||||||||

| Residential loan securitization CDOs | (1,883,817 | ) | — | — | (1,883,817 | ) | |||||||||

| Non-Agency RMBS re-securitization | (72,638 | ) | — | — | (72,638 | ) | |||||||||

| Senior unsecured notes | — | — | (159,587 | ) | (159,587 | ) | |||||||||

| Subordinated debentures | — | — | (45,000 | ) | (45,000 | ) | |||||||||

| Cash, cash equivalents and restricted cash(4) | 104,220 | — | 221,582 | 325,802 | |||||||||||

| Cumulative adjustment of redeemable non-controlling interest to estimated redemption value | — | (48,282 | ) | — | (48,282 | ) | |||||||||

| Other | 111,504 | (1,306 | ) | (39,493 | ) | 70,705 | |||||||||

| Net Company capital allocated | $ | 1,113,345 | $ | 310,697 | $ | 20,105 | $ | 1,444,147 | |||||||

| Company Recourse Leverage Ratio(5) | 2.6x | ||||||||||||||

| Portfolio Recourse Leverage Ratio(6) | 2.5x | ||||||||||||||

| (1) | The Company, through its ownership of certain securities, has determined it is the primary beneficiary of Consolidated SLST and has consolidated the assets and liabilities of Consolidated SLST in the Company’s condensed consolidated financial statements. Consolidated SLST is primarily presented on our condensed consolidated balance sheets as residential loans, at fair value and collateralized debt obligations, at fair value. Our investment in Consolidated SLST as of September 30, 2024 was limited to the RMBS comprised of first loss subordinated securities and certain IOs issued by the respective securitizations with an aggregate net carrying value of $157.5 million. |

| (2) | Represents the Company’s equity investments in consolidated multi-family properties that are not in disposal group held for sale. See “Reconciliation of Financial Information” section below for a reconciliation of equity investments in consolidated multi-family properties and disposal group held for sale to the Company’s condensed consolidated financial statements. |

| (3) | Represents the Company’s equity investments in consolidated multi-family properties that are held for sale in disposal group. See “Reconciliation of Financial Information” section below for a reconciliation of equity investments in consolidated multi-family properties and disposal group held for sale to the Company’s condensed consolidated financial statements. |

| (4) | Excludes cash in the amount of $9.2 million held in the Company’s equity investments in consolidated multi-family properties and equity investments in consolidated multi-family properties in disposal group held for sale. Restricted cash of $136.9 million is included in the Company’s accompanying condensed consolidated balance sheets in other assets. |

| (5) | Represents the Company’s total outstanding recourse repurchase agreement financing, subordinated debentures and senior unsecured notes divided by the Company’s total stockholders’ equity. Does not include non-recourse repurchase agreement financing amounting to $34.6 million, Consolidated SLST CDOs amounting to $845.8 million, residential loan securitization CDOs amounting to $1.9 billion, non-Agency RMBS re-securitization CDOs amounting to $72.6 million and mortgages payable on real estate, including mortgages payable on real estate of disposal group held for sale, totaling $662.6 million as they are non-recourse debt. |

| (6) | Represents the Company’s outstanding recourse repurchase agreement financing divided by the Company’s total stockholders’ equity. |

The following table sets forth certain information about our interest earning assets by category and their related adjusted interest income, adjusted interest expense, adjusted net interest income (loss), yield on average interest earning assets, average financing cost and net interest spread for the three months ended September 30, 2024 (dollar amounts in thousands):

Three Months Ended September 30, 2024

| Single-Family(8) | Multi- Family |

Corporate/Other | Total | ||||||||||||

| Adjusted Interest Income(1) (2) | $ | 97,233 | $ | 2,699 | $ | 1,054 | $ | 100,986 | |||||||

| Adjusted Interest Expense(1) | (66,297 | ) | — | (5,999 | ) | (72,296 | ) | ||||||||

| Adjusted Net Interest Income (Loss)(1) | $ | 30,936 | $ | 2,699 | $ | (4,945 | ) | $ | 28,690 | ||||||

| Average Interest Earning Assets(3) | $ | 5,841,444 | $ | 91,164 | $ | 103,275 | $ | 6,035,883 | |||||||

| Average Interest Bearing Liabilities(4) | $ | 4,976,522 | $ | — | $ | 379,590 | $ | 5,356,112 | |||||||

| Yield on Average Interest Earning Assets(1) (5) | 6.66 | % | 11.84 | % | 4.08 | % | 6.69 | % | |||||||

| Average Financing Cost(1) (6) | (5.30 | )% | — | (6.29 | )% | (5.37 | )% | ||||||||

| Net Interest Spread(1) (7) | 1.36 | % | 11.84 | % | (2.21 | )% | 1.32 | % | |||||||

| (1) | Represents a non-GAAP financial measure. A reconciliation of the Company’s non-GAAP financial measures to their most directly comparable GAAP measure is included below in “Reconciliation of Financial Information.” |

| (2) | Includes interest income earned on cash accounts held by the Company. |

| (3) | Average Interest Earning Assets for the period include residential loans, multi-family loans and investment securities and exclude all Consolidated SLST assets other than those securities owned by the Company. Average Interest Earning Assets is calculated based on the daily average amortized cost for the period. |

| (4) | Average Interest Bearing Liabilities for the period include repurchase agreements, residential loan securitization and non-Agency RMBS re-securitization CDOs, senior unsecured notes and subordinated debentures and exclude Consolidated SLST CDOs and mortgages payable on real estate as the Company does not directly incur interest expense on these liabilities that are consolidated for GAAP purposes. Average Interest Bearing Liabilities is calculated based on the daily average outstanding balance for the period. |

| (5) | Yield on Average Interest Earning Assets is calculated by dividing our annualized adjusted interest income relating to our portfolio of interest earning assets by our Average Interest Earning Assets for the period. |

| (6) | Average Financing Cost is calculated by dividing our annualized adjusted interest expense by our Average Interest Bearing Liabilities. |

| (7) | Net Interest Spread is the difference between our Yield on Average Interest Earning Assets and our Average Financing Cost. |

| (8) | The Company has determined it is the primary beneficiary of Consolidated SLST and has consolidated Consolidated SLST into the Company’s condensed consolidated financial statements. Our GAAP interest income includes interest income recognized on the underlying seasoned re-performing and non-performing residential loans held in Consolidated SLST. Our GAAP interest expense includes interest expense recognized on the Consolidated SLST CDOs that permanently finance the residential loans in Consolidated SLST and are not owned by the Company. We calculate adjusted interest income by reducing our GAAP interest income by the interest expense recognized on the Consolidated SLST CDOs and adjusted interest expense by excluding, among other things, the interest expense recognized on the Consolidated SLST CDOs, thus only including the interest income earned by the SLST securities that are actually owned by the Company in adjusted net interest income. |

Conference Call

On Thursday, October 31, 2024 at 9:00 a.m., Eastern Time, New York Mortgage Trust’s executive management is scheduled to host a conference call and audio webcast to discuss the Company’s financial results for the three and nine months ended September 30, 2024. To access the conference call, please pre-register using this link. Registrants will receive confirmation with dial-in details. A live audio webcast of the conference call can be accessed via the Internet, on a listen-only basis, at the Investor Relations section of the Company’s website at http://www.nymtrust.com or using this link. Please allow extra time, prior to the call, to visit the site and download the necessary software to listen to the Internet broadcast. A webcast replay link of the conference call will be available on the Investor Relations section of the Company’s website approximately two hours after the call and will be available for 12 months.

In connection with the release of these financial results, the Company will also post a supplemental financial presentation that will accompany the conference call on its website at http://www.nymtrust.com under the “Investors — Events and Presentations” section. Third quarter 2024 financial and operating data can be viewed in the Company’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2024, which is expected to be filed with the Securities and Exchange Commission on or about November 1, 2024. A copy of the Form 10-Q will be posted at the Company’s website as soon as reasonably practicable following its filing with the Securities and Exchange Commission.

About New York Mortgage Trust

New York Mortgage Trust, Inc. is a Maryland corporation that has elected to be taxed as a real estate investment trust (“REIT”) for federal income tax purposes. NYMT is an internally-managed REIT in the business of acquiring, investing in, financing and managing primarily mortgage-related single-family and multi-family residential assets. For a list of defined terms used from time to time in this press release, see “Defined Terms” below.

Defined Terms

The following defines certain of the commonly used terms that may appear in this press release: “RMBS” refers to residential mortgage-backed securities backed by adjustable-rate, hybrid adjustable-rate, or fixed-rate residential loans; “Agency RMBS” refers to RMBS representing interests in or obligations backed by pools of residential loans guaranteed by a government sponsored enterprise (“GSE”), such as the Federal National Mortgage Association (“Fannie Mae”) or the Federal Home Loan Mortgage Corporation (“Freddie Mac”), or an agency of the U.S. government, such as the Government National Mortgage Association (“Ginnie Mae”); “ABS” refers to debt and/or equity tranches of securitizations backed by various asset classes including, but not limited to, automobiles, aircraft, credit cards, equipment, franchises, recreational vehicles and student loans; “non-Agency RMBS” refers to RMBS that are not guaranteed by any agency of the U.S. Government or any GSE; “IOs” refers collectively to interest only and inverse interest only mortgage-backed securities that represent the right to the interest component of the cash flow from a pool of mortgage loans; “POs” refers to mortgage-backed securities that represent the right to the principal component of the cash flow from a pool of mortgage loans; “CMBS” refers to commercial mortgage-backed securities comprised of commercial mortgage pass-through securities issued by a GSE, as well as PO, IO or mezzanine securities that represent the right to a specific component of the cash flow from a pool of commercial mortgage loans; “multi-family CMBS” refers to CMBS backed by commercial mortgage loans on multi-family properties; “CDO” refers to collateralized debt obligation and includes debt that permanently finances the residential loans held in Consolidated SLST, the Company’s residential loans held in securitization trusts and a non-Agency RMBS re-securitization that we consolidate or consolidated in our financial statements in accordance with GAAP; “Consolidated SLST” refers to Freddie Mac-sponsored residential loan securitizations, comprised of seasoned re-performing and non-performing residential loans, of which we own the first loss subordinated securities and certain IOs, that we consolidate in our financial statements in accordance with GAAP; “Consolidated VIEs” refers to variable interest entities (“VIE”) where the Company is the primary beneficiary, as it has both the power to direct the activities that most significantly impact the economic performance of the VIE and a right to receive benefits or absorb losses of the entity that could be potentially significant to the VIE and that we consolidate in our financial statements in accordance with GAAP; “Consolidated Real Estate VIEs” refers to Consolidated VIEs that own multi-family properties; “business purpose loans” refers to (i) short-term loans that are collateralized by residential properties and are made to investors who intend to rehabilitate and sell the residential property for a profit or (ii) loans that finance (or refinance) non-owner occupied residential properties that are rented to one or more tenants; “Mezzanine Lending” refers, collectively, to preferred equity and mezzanine loan investments; “Multi-Family” portfolio includes multi-family CMBS, Mezzanine Lending and certain equity investments in multi-family assets, including joint venture equity investments; “Single-Family” portfolio includes residential loans, Agency RMBS, non-Agency RMBS and single-family rental properties; and “Other” portfolio includes other investment securities and an equity investment in an entity that originates residential loans.

Cautionary Statement Regarding Forward-Looking Statements

When used in this press release, in future filings with the Securities and Exchange Commission (the “SEC”) or in other written or oral communications, statements which are not historical in nature, including those containing words such as “will,” “believe,” “expect,” “anticipate,” “estimate,” “plan,” “continue,” “intend,” “could,” “would,” “should,” “may” or similar expressions, are intended to identify “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and, as such, may involve known and unknown risks, uncertainties and assumptions.

Forward-looking statements are based on estimates, projections, beliefs and assumptions of management of the Company at the time of such statements and are not guarantees of future performance. Forward-looking statements involve risks and uncertainties in predicting future results and conditions. Actual results and outcomes could differ materially from those projected in these forward-looking statements due to a variety of factors, including, without limitation: changes in the Company’s business and investment strategy; inflation and changes in interest rates and the fair market value of the Company’s assets, including negative changes resulting in margin calls relating to the financing of the Company’s assets; changes in credit spreads; changes in the long-term credit ratings of the U.S., Fannie Mae, Freddie Mac, and Ginnie Mae; general volatility of the markets in which the Company invests; changes in prepayment rates on the loans the Company owns or that underlie the Company’s investment securities; increased rates of default, delinquency or vacancy and/or decreased recovery rates on or at the Company’s assets; the Company’s ability to identify and acquire targeted assets, including assets in its investment pipeline; the Company’s ability to dispose of assets from time to time on terms favorable to it, including the disposition over time of its joint venture equity investments; changes in relationships with the Company’s financing counterparties and the Company’s ability to borrow to finance its assets and the terms thereof; changes in the Company’s relationships with and/or the performance of its operating partners; the Company’s ability to predict and control costs; changes in laws, regulations or policies affecting the Company’s business; the Company’s ability to make distributions to its stockholders in the future; the Company’s ability to maintain its qualification as a REIT for federal tax purposes; the Company’s ability to maintain its exemption from registration under the Investment Company Act of 1940, as amended; impairments in the value of the collateral underlying the Company’s investments; the Company’s ability to manage or hedge credit risk, interest rate risk, and other financial and operational risks; the Company’s exposure to liquidity risk, risks associated with the use of leverage, and market risks; and risks associated with investing in real estate assets, including changes in business conditions and the general economy, the availability of investment opportunities and the conditions in the market for investment securities, residential loans, structured multi-family investments and other mortgage-, residential housing- and credit-related assets.

These and other risks, uncertainties and factors, including the risk factors and other information described in the Company’s reports filed with the SEC pursuant to the Exchange Act, could cause the Company’s actual results to differ materially from those projected in any forward-looking statements the Company makes. All forward-looking statements speak only as of the date on which they are made. New risks and uncertainties arise over time and it is not possible to predict those events or how they may affect the Company. Except as required by law, the Company is not obligated to, and does not intend to, update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

For Further Information

FINANCIAL TABLES FOLLOW

| NEW YORK MORTGAGE TRUST, INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE SHEETS (Dollar amounts in thousands, except share data) |

|||||||

| September 30, 2024 |

December 31, 2023 |

||||||

| (unaudited) | |||||||

| ASSETS | |||||||

| Residential loans, at fair value | $ | 3,777,144 | $ | 3,084,303 | |||

| Investment securities available for sale, at fair value | 3,385,270 | 2,013,817 | |||||

| Multi-family loans, at fair value | 87,614 | 95,792 | |||||

| Equity investments, at fair value | 146,833 | 147,116 | |||||

| Cash and cash equivalents | 195,066 | 187,107 | |||||

| Real estate, net | 755,702 | 1,131,819 | |||||

| Assets of disposal group held for sale | 197,665 | 426,017 | |||||

| Other assets | 360,620 | 315,357 | |||||

| Total Assets(1) | $ | 8,905,914 | $ | 7,401,328 | |||

| LIABILITIES AND EQUITY | |||||||

| Liabilities: | |||||||

| Repurchase agreements | $ | 3,611,115 | $ | 2,471,113 | |||

| Collateralized debt obligations ($1,900,228 at fair value and $902,038 at amortized cost, net as of September 30, 2024 and $593,737 at fair value and $1,276,780 at amortized cost, net as of December 31, 2023) | 2,802,266 | 1,870,517 | |||||

| Senior unsecured notes ($60,900 at fair value and $98,687 at amortized cost, net as of September 30, 2024 and $98,111 at amortized cost, net as of December 31, 2023) | 159,587 | 98,111 | |||||

| Subordinated debentures | 45,000 | 45,000 | |||||

| Mortgages payable on real estate, net | 492,321 | 784,421 | |||||

| Liabilities of disposal group held for sale | 177,869 | 386,024 | |||||

| Other liabilities | 145,794 | 118,016 | |||||

| Total liabilities(1) | 7,433,952 | 5,773,202 | |||||

| Commitments and Contingencies | |||||||

| Redeemable Non-Controlling Interest in Consolidated Variable Interest Entities | 21,826 | 28,061 | |||||

| Stockholders’ Equity: | |||||||

| Preferred stock, par value $0.01 per share, 31,500,000 shares authorized, 22,164,414 shares issued and outstanding ($554,110 aggregate liquidation preference) | 535,445 | 535,445 | |||||