Stocks Fall on Tech Results Ahead of US Jobs Data: Markets Wrap

(Bloomberg) — Asian equities fell after US stocks dropped on lackluster tech results. A rally in Treasuries favored the long end of the curve ahead of US jobs data due later Friday.

Most Read from Bloomberg

Shares in Japan, South Korea and Australia declined, while a gauge of US-listed Chinese companies dropped for a third straight day on Thursday. The S&P 500 lost 1.9% and the Nasdaq 100 dropped 2.4% Thursday, their worst sessions since early September. Elsewhere, oil extended gains on a report Iran may be planning fresh attacks on Israel.

Declines for US equities reflected investor unease over tech giants, including Microsoft Corp and Meta Platforms Inc. Apple Inc. shares were slightly softer in post-market trading after reporting weaker-than-anticipated sales in China. Amazon.com Inc. and Intel Corp. bucked the trend, rising in after-hours trade on optimistic outlooks, supporting a small advance for US stock futures early Friday.

“It makes some sense to trim some from those names that have worked so well over the past 12-18 months and look for AI laggards as well as other tech themes like cybersecurity, robotics and automation,” said Michael Landsberg, chief investment officer, Landsberg Bennett Private Wealth Management.

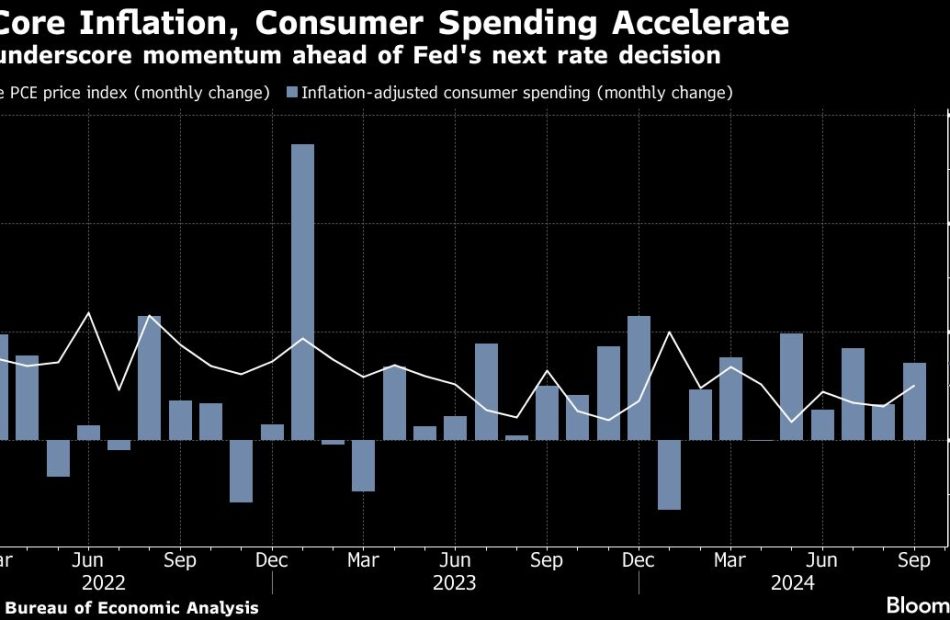

Treasuries were steady after minor gains Thursday. This did little to reverse the heavy selling of the past few weeks that left October as the worst month for Treasuries in two years. Those losses reflected a rethink on US interest rates given signs of resilience in the economy. An index of dollar strength was little changed after falling Thursday.

Australia’s 10-year bond yield rose to an 11-month high.

Weekly US jobless claims fell more than expected, according to figures released Thursday, indicating a robust employment market, and less reason for the Federal Reserve to cut rates. Friday’s nonfarm payroll figures are expected to show 100,000 jobs added to the US economy in October.

The pound was steady Friday after weakening alongside UK bonds and stocks Thursday as investors dumped British assets on inflation fears following the new Labour government’s budget.

Back in Asia, the yen was steady Friday after climbing as much as 1% against the greenback Thursday. The gains followed comments from Bank of Japan Governor Kazuo Ueda that currency markets have had a major impact on the economy, pointing to another potential rate hike in coming months.

Leave a Reply