A Gen Xer with a master's degree hasn't found work in 9 years. He says he's only landed four interviews.

-

Chris Putro, 55, has been struggling to find a job for the last nine years.

-

He has a master’s and over a decade of experience but says this hasn’t helped him get interviews.

-

He said he’s on track to run out of savings in a few years.

In 2013, Chris Putro got fired from his financial analyst job at a tech company. More than a decade later, he’s still looking for work.

Despite having a bachelor’s and master’s degree in chemistry — and sending out countless applications — Putro said he’s had little luck in the job market.

“I’ve gotten a total of four phone interviews,” the 55-year-old, who’s based in Los Angeles, told Business Insider via email. Three of these employers ended up “ghosting” him, while the other one ended the interview call early after deciding he was overqualified for the job.

When Putro lost his job, he was in his 16th year working for the same employer. After taking stock of his finances, he estimated that he had enough savings to get by for a little over a decade if necessary.

“I made enough in those 16 years to survive for another 11,” he said.

We want to hear from you. Are you struggling to find a job and would be comfortable sharing your story with a reporter? Please fill out this form.

Based on his initial forecast, he would have run out of money sometime this year. However, Putro said his stock market investments have performed better than he expected, which he thinks could buy him a “few more years.”

Putro said it’s been helpful financially that he has no student debt or children. However, he said the only source of income over the last decade has been the $50 a week he gets for producing a standup comedy show in the Los Angeles area. He considers this to be effectively “volunteer work” that helps him stay busy, but as things stand, it’s not doing much to slow the steady decline of his savings.

“Thinking about when I might run out of money and lose all my possessions is a very difficult thought process for me,” he said.

Putro is among the Americans who are having a hard time finding work. In large part, it’s because businesses across the US have significantly pulled back on hiring. The ratio of job openings to unemployed people — an indicator of job availability — has declined considerably over the past two years.

To be sure, both the unemployment rate and layoff rate remain low compared to historical levels. However, the hiring slowdown means that many of the people who are looking for work — whether it be because they were laid off, have just graduated from college, or are returning to the workforce — are having a much harder time than the job seekers of a few years ago.

Putro shared his job search strategies — and why he’s unsure whether his age is helping or hurting him on his job hunt.

Application burnout can make it harder to find a job

In the early 1990s, Putro earned a bachelor’s in chemistry from La Salle University and a master’s in chemistry from UCLA. He worked at a pharmacy for a couple of years until 1998, when he landed a customer service job at a tech company. In 2006, he began working as a financial analyst for the same employer — a position he held until he was fired.

After losing his job, Putro didn’t immediately start applying for jobs. He said he took about two years to think about what he wanted to do with the rest of his life. Then, about nine years ago, his job hunt officially began.

Over the past decade, Putro said he’s applied “irregularly” for jobs — anywhere between zero and 40 applications in a given month.

“I get burned out and wait a bit and hope that there’s turnover in a company’s HR, he said.

Putro said he generally looks for roles through Indeed, LinkedIn, and the websites of major local employers like CBS and NBCUniversal. Given his prior work experience, job platforms tend to nudge him to apply for financial analyst roles.

“I apply for jobs I’m qualified for,” he said. “People have told me to apply for minimum-wage jobs, but I don’t know how to find them.”

Despite his efforts, Putro hasn’t had much luck. He said he’s not sure whether being 55 years old is helping or hurting him in the job market.

“I keep reading that employers will absolutely not hire anyone my age because of false assumptions, but also that they prefer people my age because millennials and younger have a poor work ethic,” he said.

Going forward, Putro plans to continue sending out applications. He said October is typically the month when he begins applying more aggressively.

“I applied to two jobs this week that I was a great match for on paper, but no reply as usual,” he said.

Read the original article on Business Insider

Aeries Technology Reports Results for the Full Fiscal Year 2024

NEW YORK, Sept. 30, 2024 (GLOBE NEWSWIRE) — Aeries Technology AERT, a global professional services and consulting partner for businesses in transformation mode and their stakeholders, today announced financial results for the fiscal year ended March 31, 2024.

“We are pleased to release our results for the fiscal year, which were in-line with our expectations,” said Sudhir Panikassery, CEO of Aeries Technology. “Expansion within existing client engagements and new client relationships were the main performance drivers and reflects our continued focus on expanding our footprint within the addressable pool of private equity portfolio companies and mid-size businesses. Coupled with our technology driven, solution specific approach, we believe we will derive positive outcomes over the next few years as we progress in our current growth phase.”

Fiscal Year Ended March 31, 2024 (Fiscal Year 2024) Financial Highlights

Revenues: Revenues for fiscal year 2024 were $72.5 million, up 37% compared to $53.1 million for fiscal year 2023.

Income from Operations: Income from operations for fiscal year 2024 was $3.0 million, up 28% compared to $2.3 million for fiscal year 2023.

Net Income: Net income for fiscal year 2024 was $17.3 million compared to $1.7 million for fiscal year 2023. Net income included $16.2 million dollars in non-cash income related to the Forward Purchase Agreements in connection with our SPAC business combination.

Adjusted EBITDA: Adjusted EBITDA for fiscal year 2024 was $9.2 million compared to $8.7 million for fiscal year 2023.

About Aeries Technology

Aeries Technology AERT is a global professional services and consulting partner for businesses in transformation mode and their stakeholders, including private equity sponsors and their portfolio companies, with customized engagement models that are designed to provide the right mix of deep vertical specialty, functional expertise, and digital systems and solutions to scale, optimize and transform a client’s business operations. Founded in 2012, Aeries Technology now has over 1,700 professionals specializing in Technology Services and Solutions, Business Process Management, and Digital Transformation initiatives, geared towards providing tailored solutions to drive business success. Aeries Technology’s approach to staffing and developing its workforce has earned it the Great Place to Work Certification.

Non-GAAP Financial Measures

The Company uses non-GAAP financial information and believes it is useful to investors as it provides additional information to facilitate comparisons of historical operating results, identify trends in its underlying operating results and provide additional insight and transparency on how it evaluates the business. The Company uses non-GAAP financial measures to budget, make operating and strategic decisions, and evaluate its performance. The Company has detailed the non-GAAP adjustments that it makes in the non-GAAP definitions below. The adjustments generally fall within the categories of non-cash items. The Company believes the non-GAAP measures presented herein should always be considered along with, and not as a substitute for or superior to, the related GAAP financial measures. In addition, similarly titled items used by other companies may not be comparable due to variations in how they are calculated and how terms are defined. For further information, see “Reconciliation of Non—GAAP Financial Measures” below, including the reconciliations of these non-GAAP measures to their most directly comparable GAAP financial measures.

The Company defines Adjusted EBITDA as net income from operations before interest, income taxes, depreciation and amortization adjusted to exclude stock-based compensation and business combination related costs. Adjusted EBITDA is one of the key performance indicators the company uses in evaluating our operating performance and in making financial, operating, and planning decisions. The Company believes adjusted EBITDA is useful to investors in the evaluation of Aeries’ operating performance as such information was used by the Company’s management for internal reporting and planning procedures, including aspects of our consolidated operating budget and capital expenditures.

Forward-Looking Statements

All statements in this release that are not based on historical fact are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and the provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Words such as “anticipate,” “believe,” “continue,” “could,” “estimate”, “expect”, “hope”, “intend”, “may”, “might”, “should”, “would”, “will”, “understand” and similar words are intended to identify forward looking statements. These forward-looking statements include but are not limited to, statements regarding our future operating results, outlook, guidance and financial position, our business strategy and plans, our objectives for future operations, potential acquisitions and macroeconomic trends. While management has based any forward-looking statements included in this release on its current expectations, the information on which such expectations were based may change. These forward-looking statements rely on a number of assumptions concerning future events and are subject to a number of risks, uncertainties and other factors, many of which are outside of the control of Aeries and its subsidiaries, which could cause actual results to materially differ from such statements. Such risks, uncertainties, and other factors include, but are not limited to, changes in the business, market, financial, political and legal conditions in India, Singapore, the United States, Mexico, the Cayman Islands and other countries, including developments with respect to inflation, interest rates and the global supply chain, including with respect to economic and geopolitical uncertainty in many markets around the world, the potential of decelerating global economic growth and increased volatility in foreign currency exchange rates; the potential for our business development efforts to maximize our potential value; the ability to recognize the anticipated benefits of the business combination with Worldwide Webb Acquisition Corp., which may be affected by, among other things, competition, our ability to grow and manage growth profitably and retain its key employees; the ability to maintain the listing of our Class A ordinary shares and our public warrants on Nasdaq, and the potential liquidity and trading of our securities; changes in applicable laws or regulations and other regulatory developments in the United States, India, Singapore, Mexico, the Cayman Islands and other countries; our ability to develop and maintain effective internal controls, including our ability to remediate the material weakness in our internal controls over financial reporting; our success in retaining or recruiting, or changes required in, our officers, key employees or directors; our financial performance; our ability to continue as a going concern; our ability to make acquisitions, divestments or form joint ventures or otherwise make investments and the ability to successfully complete such transactions and integrate with our business; the period over which we anticipate our existing cash and cash equivalents will be sufficient to fund our operating expenses and capital expenditure requirements; the conflicts between Russia and Ukraine, and Israel and Hamas, and any restrictive actions that have been or may be taken by the U.S. and/or other countries in response thereto, such as sanctions or export controls; risks related to cybersecurity and data privacy; the impact of inflation; the impact of the COVID-19 pandemic and other similar pandemics and disruptions in the future; and the fluctuation of economic conditions, global conflicts, inflation and other global events on Aeries’ results of operations and global supply chain constraints. Further information on risks, uncertainties and other factors that could affect our financial results are included in Aeries’ periodic and current reports filed with the U.S. Securities and Exchange Commission. Furthermore, Aeries operates in a highly competitive and rapidly changing environment where new and unanticipated risks may arise. Accordingly, investors should not place any reliance on forward-looking statements as a prediction of actual results. Aeries disclaims any intention to, and undertakes no obligation to, update or revise forward-looking statements.

Contacts

Ryan Gardella

AeriesIR@icrinc.com

| CONDENSED CONSOLIDATED STATEMENTS OF INCOME (In thousands, except percentages) |

|||||||||||||||

| Year Ended March 31, |

|||||||||||||||

| 2024 | 2023 | $ Change | % Change | ||||||||||||

| Revenues, net | $ | 72,509 | $ | 53,099 | $ | 19,410 | 37 | % | |||||||

| Cost of Revenue | 50,868 | 39,442 | 11,426 | 29 | % | ||||||||||

| Gross Profit | 21,641 | 13,657 | 7,984 | 58 | % | ||||||||||

| Gross Profit Margin | 30 | % | 26 | % | 4 | % | |||||||||

| Operating expenses | |||||||||||||||

| Selling, general & administrative expenses | 18,654 | 11,326 | 7,328 | 65 | % | ||||||||||

| Total operating expenses | 18,654 | 11,326 | 7,328 | 65 | % | ||||||||||

| Income from operations | 2,987 | 2,331 | 656 | 28 | % | ||||||||||

| Other income / (expense) | |||||||||||||||

| Change in fair value of derivative liabilities | 16,167 | – | 16,167 | 100 | % | ||||||||||

| Interest income | 275 | 191 | 84 | 44 | % | ||||||||||

| Interest expense | (462 | ) | (185 | ) | (277 | ) | 150 | % | |||||||

| Other income, net | 160 | 429 | (269 | ) | (63 | )% | |||||||||

| Total other income / (expense), net | 16,140 | 435 | 15,705 | 3,610 | % | ||||||||||

| Income / (loss) before income taxes | 19,127 | 2,766 | 16,361 | 592 | % | ||||||||||

| Income tax expenses | (1,871 | ) | (1,060 | ) | (811 | ) | 77 | % | |||||||

| Net income | $ | 17,256 | $ | 1,706 | $ | 15,550 | 911 | % | |||||||

| Less: Net income attributable to noncontrolling interests | 202 | 260 | (58 | ) | (22 | )% | |||||||||

| Less: Net income attributable to redeemable noncontrolling interests | 1,397 | – | 1,397 | 100 | % | ||||||||||

| Net income attributable to the shareholders’ of Aeries Technology, Inc. | $ | 15,657 | $ | 1,446 | $ | 14,211 | 983 | % | |||||||

| RECONCILIATION OF NON-GAAP FINANCIAL MEASURES (In thousands, except percentages) |

|||||||

| Year Ended March 31, |

|||||||

| 2024 | 2023 | ||||||

| Net income | $ | 17,256 | $ | 1,706 | |||

| Income tax expense | 1,871 | 1,060 | |||||

| Interest income | (275 | ) | (191 | ) | |||

| Interest expenses | 462 | 185 | |||||

| Depreciation and amortization | 1,352 | 1,172 | |||||

| EBITDA | $ | 20,666 | $ | 3,932 | |||

| Adjustments | |||||||

| (+) Stock-based compensation | 1,626 | 3,805 | |||||

| (+) Business Combination related costs | 3,067 | 946 | |||||

| (+) Change in fair value of derivative liabilities | (16,167 | ) | – | ||||

| Adjusted EBITDA | $ | 9,192 | $ | 8,683 | |||

| (/) Revenue | 72,509 | 53,099 | |||||

| Adjusted EBITDA Margin | 12.7 | % | 16.4 | % | |||

| CASH FLOW (In thousands) |

|||||||||||||||

| Year Ended March 31, |

|||||||||||||||

| 2024 | 2023 | $ Change | % Change | ||||||||||||

| Cash at the beginning of period | $ | 1,131 | $ | 351 | $ | 780 | 222 | % | |||||||

| Net cash provided by operating activities | (4,299 | ) | 2,111 | (6,410 | ) | (304 | )% | ||||||||

| Net cash used in investing activities | (1,740 | ) | (1,557 | ) | (183 | ) | 12 | % | |||||||

| Net cash provided by financing activities | 7,056 | 252 | 6,804 | 2,700 | % | ||||||||||

| Effects of exchange rates on cash | (64 | ) | (26 | ) | (38 | ) | 146 | % | |||||||

| Cash at the end of period | $ | 2,084 | $ | 1,131 | $ | 953 | 84 | % | |||||||

| BALANCE SHEET (In thousands) |

|||||||

| As of March 31, |

|||||||

| 2024 | 2023 | ||||||

| (Restated) | |||||||

| ASSETS | |||||||

| Current assets: | |||||||

| Cash and cash equivalents | $ | 2,084 | $ | 1,131 | |||

| Accounts receivable, net of allowance of $1,263 and $0, as of March 31, 2024 and March 31, 2023, respectively | 23,757 | 13,416 | |||||

| Prepaid expenses and other current assets, net of allowance of $1 and $0, as of March 31, 2024 and March 31, 2023, respectively | 6,995 | 4,117 | |||||

| Deferred transaction costs | – | 1,921 | |||||

| Total current assets | $ | 32,836 | $ | 20,585 | |||

| Property and equipment, net | 3,579 | 3,125 | |||||

| Operating right-of-use assets | 7,318 | 5,627 | |||||

| Deferred tax assets | 1,933 | 1,237 | |||||

| Long-term investments, net of allowance of $126 and $0, as of March 31, 2024 and March 31, 2023, respectively | 1,612 | 1,564 | |||||

| Other assets, net of allowance of $1 and $0, as of March 31, 2024 and March 31, 2023, respectively | 2,129 | 2,259 | |||||

| Total assets | $ | 49,407 | $ | 34,397 | |||

| LIABILITIES, REDEEMABLE NONCONTROLLING INTEREST AND SHAREHOLDERS’ EQUITY (DEFICIT) | |||||||

| Current liabilities: | |||||||

| Accounts payable | $ | 6,616 | $ | 2,474 | |||

| Accrued compensation and related benefits, current | 3,119 | 2,823 | |||||

| Operating lease liabilities, current | 2,080 | 1,648 | |||||

| Short-term borrowings | 6,778 | 1,376 | |||||

| Forward purchase agreement put option liability | 10,244 | – | |||||

| Other current liabilities | 9,288 | 4,201 | |||||

| Total current liabilities | $ | 38,125 | $ | 12,522 | |||

| Long term debt | 1,440 | 969 | |||||

| Operating lease liabilities, noncurrent | 5,615 | 4,261 | |||||

| Derivative warrant liabilities | 1,367 | – | |||||

| Deferred tax liabilities | 92 | 168 | |||||

| Other liabilities | 3,948 | 3,008 | |||||

| Total liabilities | $ | 50,587 | $ | 20,928 | |||

| Commitments and contingencies (Note 17) | |||||||

| Redeemable noncontrolling interest | 734 | – | |||||

| Shareholders’ equity (deficit) | |||||||

| Preference shares, $0.0001 par value; 5,000,000 shares authorized; none issued or outstanding | – | – | |||||

| Class A ordinary shares, $0.0001 par value; 500,000,000 shares authorized; 15,619,004 shares issued and outstanding as of March 31, 2024 | 2 | – | |||||

| Common stock, no par value; 10,000 shares issued and paid-up as of March 31, 2024, no share issued and outstanding as of March 31, 2023 | – | – | |||||

| Class V ordinary shares, $0.0001 par value; 1 share authorized, issued and outstanding as of March 31, 2024 | – | – | |||||

| Net shareholders’ investment and additional paid-in capital | – | 7,221 | |||||

| Accumulated other comprehensive loss | (574 | ) | (1,349 | ) | |||

| (Accumulated deficit) retained earnings | (11,668 | ) | 6,318 | ||||

| Total Aeries Technology, Inc. shareholders’ equity (deficit) | $ | (12,240 | ) | $ | 12,190 | ||

| Noncontrolling interest | 10,326 | 1,279 | |||||

| Total shareholders’ equity (deficit) | (1,914 | ) | 13,469 | ||||

| Total liabilities, redeemable noncontrolling interest and shareholders’ equity (deficit) | $ | 49,407 | $ | 34,397 | |||

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Michael Dell Sells $1.2 Billion Worth Of Dell Stock, Reducing Stake Amid Company's Recent S&P 500 Relisting And AI Expansion

Michael Dell, the CEO of Dell Technologies Inc. DELL, has offloaded a significant portion of his shares in the company.

What Happened: According to a filing with the U.S. Securities and Exchange Commission on Thursday, Dell sold 10 million shares of Class C Common Stock at an average price of $122.4 per share.

This transaction amounts to a total value of over $1.2 billion. The sale was executed directly by Dell, reducing his holdings in the company to 16,912,241 shares.

Why It Matters: This significant sale comes on the heels of several notable events involving Michael Dell and Dell Technologies. Last week, Dell was included in the S&P 500 Index

In June, Dell expressed interest in Bitcoin BTC/USD, retweeting a message from Bitcoin advocate Michael Saylor, which sparked discussions about digital scarcity.

Additionally, Dell has been vocal about the rapid advancement of generative artificial intelligence, comparing its swift rise to the early days of the internet. He highlighted that AI’s adoption is happening at a pace much faster than previous technological waves.

In August, Jim Cramer called the bottom on Dell Technologies’ stock, emphasizing the company’s strong relationship with NVIDIA Corp NVDA and suggesting that the stock should be bought at that time.

Most recently, in September, a new analyst coverage began on a bullish note, reflecting positive sentiment around Dell Technologies.

Price Action: Dell Technologies Inc. stock closed at $118.54 on Monday, down 1.40% for the day. In after-hours trading, the stock dipped further by 0.33%. Year to date, Dell’s stock has surged by 58.50%, according to data from Benzinga Pro.

Read Next:

Image via Flickr

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

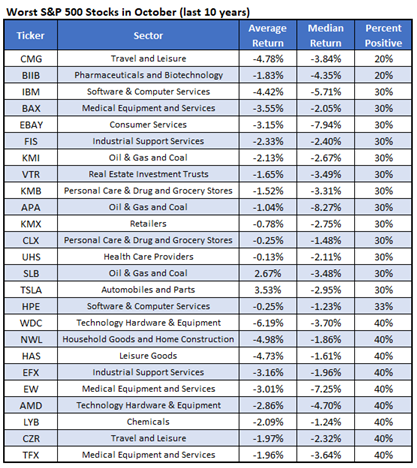

25 Worst Stocks to Own in October, Including CMG

September turned out to be a strong month for the market this year, despite its reputation as a historically weak period for stocks. October could bring its own challenges, however, as it’s been deemed volatile by several news sources, including MarketWatch.

With this backdrop in mind, we compiled a list of the worst stocks to own during this upcoming month, and Chipotle Mexican Grill Inc (NYSE:CMG) stands out amongst them. According to Schaeffer’s Senior Quantitative Analyst Rocky White, CMG finished the month of October lower eight times over the past 10 years, averaging a loss of 4.8%.

At last look today, CMG was down 0.4% at $57.56. The stock has been struggling to break out above the $58.50 region, and holds on to a 26% year-to-date lead.

Options traders have been betting on a move higher, and an unwinding of this optimism could provide headwinds. At the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), CMG’s 10-day call/put volume ratio of 3.56 ranks in the elevated 94th percentile of its annual range, showing a heavy penchant for calls lately.

Best-Performing ETF Areas Of September

Contrary to its odd reputation, Wall Street delivered an upbeat performance in September. The S&P 500 added 1.6%, the Dow Jones advanced 1.8%, the Nasdaq Composite gained 2.3% and the Russell 2000 ticked up 0.3% last month. The month can be easily marked by the first Fed rate cut in four years, ECB’s second rate cut and Chinese stimulus.

U.S. Economy Grows Faster Than Expected In Q2

The U.S. economy grew at an annualized rate of 3% in the second quarter of the year, surpassing Wall Street’s expectations. According to the Bureau of Economic Analysis’s third estimate, this growth rate remained unchanged from the previous estimate.

Economists had estimated the reading to show an annualized growth of 2.9%. The second-quarter growth marks a significant improvement from the 1.4% annualized growth seen in the first quarter (read: 4 Reasons to Buy Small-Cap ETFs Now).

Fed Rate Cut

The Federal Reserve kicked off the easing monetary era by slashing key interest rates by 50 bps to 4.75-5% after holding it at a 23-year high for 14 consecutive months since July 2023. This marked the first rate cut since 2020 to address slowing economic growth and showed greater confidence in the fact that inflation is moving sustainably toward the 2% target level.

Chinese Stimulus

On Sept. 24, 2024, China’s central bank, the People’s Bank of China (PBOC), announced a broad range of monetary stimulus measures aimed at boosting the world’s second-largest economy. This move indicates growing concerns within Xi Jinping’s administration over the nation’s slowing growth and declining investor confidence.

ECB Rate Cut

European Central Bank (ECB) slashed rates for the second time in three months in September. The reduction, from 3.75% to 3.5%, came on the heels of slowing inflation. The bank also intends to bolster the region’s sagging economy.

Best-Performing ETFs of September

Against this backdrop, below we highlight a few winning exchange-traded funds (ETFs) for the month of September.

China ETFs

Global X MSCI China Consumer Discretionary ETF CHIQ – Up 35%

KraneShares Hang Seng TECH Index ETF KTEC – Up 33.7%

China’s stimulus efforts boosted global markets, with mainland stocks notching their biggest weekly win since 2008. Shares of Alibaba BABA, JD.com JD, and Meituan jumped as investors showed renewed interest in Chinese equities (read: A Few Reasons to Buy China ETFs Now).

Technology ETFs

First Trust Dow Jones International Internet ETF FDNI – Up 24%

EMQQ The Emerging Markets Internet ETF EMQQ – Up 16.7%

International tech stocks have been in fine fettle due to global monetary policy easing. Since low rates are beneficial for growth sectors like technology, such an environment bodes well for international Internet stocks and ETFs. In general, Chinese stimulus and a Fed rate cut have favored the broader emerging market investing (read: Emerging Market ETFs Roar Back to New Heights).

Natural Gas

United States Natural Gas Fund LP UNG – Up 22.8%

The natural gas markets have rallied as traders worry that the refining and extraction of natural gas in the Gulf of Mexico could be hampered due to hurricanes. Total U.S. consumption of natural gas rose by 2.5% (1.7 Bcf/d) in the week ending Sept. 25, 2024 from the previous week, according to data from S&P Global Commodity Insights.

Lithium

iShares Lithium Miners and Producers ETF ILIT – Up 14.7%

Electric vehicle EV stocks gained momentum this month on speculation of higher EV sales. Electric car sales in the United States are on track for a record quarter, according to forecasts out Wednesday from Cox Automotive, as quoted on insideevs.com. Lithium-ion batteries are the most common type of battery used in electric vehicles. This fact explains the rally in ILIT ETF.

Airlines

U.S. Global Jets ETF JETS – Up 14.3%

Airlines stocks soared on strong demand, decelerating capacity and lower oil prices. The Airports Council International ACI World projects that global passenger volume will reach 9.5 billion in 2024, which is 104% of the 2019 level and a 10% increase from 2023, per Airport Council International.

U.S. Global Jets ETF provides exposure to the global airline industry, including airline operators and manufacturers from all over the world, by tracking the U.S. Global Jets Index. The product holds 60 securities and charges 60 bps on an annual basis.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Zefiro Methane Corp. Announces Year-End Earnings Report & Provides Corporate Activities Update

The Company generated record revenue of $32.8 million USD and positive adjusted EBITDA for FYE 2024

FORT LAUDERDALE, Fla., Sept. 30, 2024 (GLOBE NEWSWIRE) — ZEFIRO METHANE CORP. (Cboe Canada: ZEFI) (Frankfurt: Y6B) ZEFIF (the “Company”, “Zefiro”, or “ZEFI”) today announced the Company’s consolidated financial results for the fiscal year ended June 30, 2024 (“FYE 2024”). For the FYE 2024, the Company generated record consolidated revenues of $32.8 million USD.

For the quarter ended June 30, 2024, the Company generated record consolidated revenues of $9.4 million USD, an approximate 10% increase from the quarter ending March 31, 2024. The increase in revenue resulted in a record gross profit of $2.9 million USD (approximate 31% gross profit margin). ZEFI generated adjusted earnings before interest, taxes, depreciation, and amortization (“Adjusted EBITDA”) of $222,453 USD.

Please refer to Zefiro’s SEDAR+ profile at www.sedarplus.ca/ for full filings containing these financial results.

Zefiro Founder and Chief Executive Officer Talal Debs PhD commented, “Zefiro’s growth vector is expanding rapidly, and we have come a long way in the last year. Our corporate milestones, combined with our financial success, tell a story of momentum that is positioning the Company as a market leader driven by innovation, foresight, and impact. Our growing team brings the highest level of expertise to detecting and mitigating the large and often dangerous legacy problem of toxic methane emissions.”

In July 2024, Zefiro announced the appointment of Mohit Gupta as Chief Financial Officer. With over thirty years of experience in banking and energy trading, Gupta was one of the key founding members of J.P. Morgan’s Energy Trading business. He said, “Through Zefiro’s new partnerships and acquisitions, the Company now employs the most sophisticated capabilities in the industry and there is tremendous demand for it. Our forward momentum is accelerating swiftly on all fronts – acquisitions, client pipeline, talent acquisition – and we are having meaningful dialogues on global expansion. As an originator and distributor of quality carbon credits, we are positioned to capitalize on the growing need for offsets.”

Zefiro’s business strategy updates include:

1) Originating and distributing quality carbon offsets from reducing methane emissions

Zefiro announced the presale of a portion of its carbon offset portfolio to EDF Trading, a leading player in the international wholesale energy market and part of EDF Group, a global leader in low-carbon energies. Zefiro has expanded its efforts to seal potentially hazardous oil and gas wells and these credits, verified by certified third-party auditors, will be generated from this initiative.

The Company is also actively exploring commercialization opportunities to address the needs of corporate players who have committed to a carbon-neutral footprint by utilizing high-quality offsets such as those originated by Zefiro.

2) Expansion into new U.S. geographies

Zefiro expanded its oil and gas well-plugging operations into Oklahoma, which is expected to result in key growth within numerous markets critical to the environmental services industry, including Louisiana and other southern states, and the expansion of the Company’s portfolio of high-quality carbon offset products. ZEFI also continues to aggressively build out its business in Appalachia.

3) Participation in the allocation of infrastructure funds from federal and state governments to plug orphan wells

Zefiro successfully completed Pennsylvania’s first-ever Infrastructure Investment and Jobs Act (“Bipartisan Infrastructure Law“)-funded oil well remediation project. The federal legislation allocated $4.7 billion USD to help address the nationwide proliferation of abandoned oil and gas wells, including granting over $300 million USD to the Commonwealth of Pennsylvania alone.

4) Continuous evaluation of new products, offerings, and partnerships

ZEFI announced numerous commercial transactions to bolster the Company’s environmental services capabilities. This series of strategic transactions began with the acquisition of Appalachian Well Surveys, Inc. (“AWS”), a Cambridge, Ohio-based wireline company that has provided Zefiro the resources needed to expand their operational capacity within key markets and become the energy sector’s first comprehensive “end-of-life” provider for entities seeking to meet their well-retirement targets. ZEFI subsequently announced that the Company had purchased a minority ownership stake in Winterhawk Well Abandonment Ltd. (“Winterhawk”), a manufacturer of specialized downhole tools and technologies designed to expand casing in oil and gas wells. Specifically, Zefiro subsidiary Plants & Goodwin, Inc. (“P&G”) and Winterhawk entered into an exclusive patent license agreement for Winterhawk’s U.S. patents and the ability to sublicense Winterhawk Products to other entities operating in the United States.

In addition to these strategic investments in the Company’s well remediation services division, Zefiro also took steps to advance ZEFI’s accessibility throughout the global carbon offset marketplace. Specifically, Zefiro announced a strategic partnership with Fiùtur, a multi-party technology platform that provides digital measurement, verification, and Data Governance Framework services to environmental remediation companies. The agreement is aimed at expanding access to Zefiro products throughout the offering’s entire “lifecycle,” and stipulates that Zefiro will begin deploying its comprehensive methane leak abatement services through Fiùtur’s digital trust and verification platform during Q4 of 2024 and participate in Fiùtur’s Series A fundraising campaign.

5) Global expansion and development of a pipeline of opportunities

Zefiro is pursuing global initiatives to market its carbon credit portfolio to multinational corporations and global market participants, including through high-quality carbon offset exchanges.

Notable Highlights:

- The Company generated record consolidated revenues and Adjusted EBITDA for the year ended June 30, 2024.

- On April 23, 2024, the Company launched its Initial Public Offering on the Cboe Canada Inc. stock exchange. Zefiro shares also began trading on the Frankfurt Stock Exchange (“FSE”) under the symbol “Y6B” on May 2, 2024.

- On July 19, 2024, the Company announced that its common shares were listed in the U.S. on the OTCQB – “The Venture Market” – under the symbol “ZEFIF”.

Zefiro Founder and CEO Talal Debs (Left) is pictured with Zefiro CFO Mohit Gupta (Right) in a video recently posted to the Company’s YouTube channel. The video can be viewed by clicking here.

Readers using news aggregation services may be unable to view the media above. Please access SEDAR+ or the Investors section of the Company’s website for a version of this press release containing all published media.

Second Quarter 2024 Financial Highlights (in USD):

| For the three months ended | June 30, 2024 |

March 31, 2024 |

||

| Revenue | $9,385,282 | $8,539,165 | ||

| Gross profit | $2,937,349 | $2,657,229 | ||

| Total operating expenses | ($4,331,734) | ($3,448,913) | ||

| Net loss and comprehensive loss for the period | ($2,890,536) | ($885,370) | ||

| Basic and diluted loss per share for the period | ($0.04) | ($0.01) | ||

| Weighted average shares outstanding | 65,306,863 | 63,826,973 | ||

| Net loss for the period | ($2,916,263) | ($949,890) | ||

| Add: | ||||

| Amortization | 1,061,866 | 900,516 | ||

| Interest expense | 391,539 | 396,413 | ||

| Interest Income | (4,176) | – | ||

| Share-based compensation | 142,405 | 7,682 | ||

| Gain on debt modification | 30,559 | (73,737) | ||

| Settlement of convertible promissory note receivable | 87,500 | – | ||

| Loss on sale of equipment | (38,706) | 54,884 | ||

| Change in fair value of investments | – | 7,444 | ||

| Income tax recovery | 566,638 | (116,198) | ||

| Listing Fees | 415,379 | – | ||

| Foreign exchange gain (loss) | 37,995 | – | ||

| One-time transaction expenses | 729,789 | 280,187 | ||

| Adjustment for non-controlling interest | (281,509) | (198,423) | ||

| Adjusted EBITDA1 | $222,453 | $308,877 | ||

| As at | June 30, 2024 |

March 31, 2024 |

||

| Cash | $981,746 | $372,564 | ||

| Current assets | $10,223,370 | $8,469,797 | ||

| Total assets | $28,971,195 | $27,223,514 | ||

| Total liabilities | $20,288,328 | $18,258,775 | ||

| Total equity | $8,682,867 | $8,964,739 | ||

About Zefiro Methane Corp.

Zefiro is an environmental services company, specializing in methane abatement. Zefiro strives to be a key commercial force towards Active Sustainability. Leveraging decades of operational expertise, Zefiro is building a new toolkit to clean up air, land, and water sources directly impacted by methane leaks. The Company has built a fully integrated ground operation driven by an innovative monetization solution for the emerging methane abatement marketplace. As an originator of high-quality U.S.-based methane offsets, Zefiro aims to generate long-term economic, environmental, and social returns.

On behalf of the Board of Directors of the Company,

ZEFIRO METHANE CORP.

“Talal Debs”

Talal Debs, Founder & CEO

_________________________

1 See Non-IFRS Financial Measures

For further information, please contact:

Zefiro Investor Relations

1 (800) 274-ZEFI (274-9334)

investor@zefiromethane.com

For media inquiries, please contact:

Rich Myers – Profile Advisors (New York)

media@zefiromethane.com

+1 (347) 774-1125

Forward-Looking Statements

This news release contains “forward-looking information” within the meaning of applicable Canadian securities legislation. Forward-looking information is often, but not always, identified by the use of words such as “seeks”, “believes”, “plans”, “expects”, “intends”, “estimates”, “anticipates” and statements that an event or result “may”, “will”, “should”, “could” or “might” occur or be achieved and other similar expressions. In particular, this news release contains forward-looking information including statements regarding: the Company’s intention to reduce emissions from end-of-life oil and gas wells and eliminate methane gas; the Company’s partnerships with industry operators, state agencies, and federal governments; the Company’s expectations for continued increases in revenues and EBITDA growth as a result of these partnerships; the Company’s intentions to build out its presence in the United States; the anticipated federal funding for orphaned well site plugging, remediation and restoring activities; the Company’s expectations to become a growing environmental services company; the Company’s ability to provide institutional and retail investors alike with the opportunity to join the Active Sustainability movement; the Company’s ability to generate long-term economic, environmental, and social returns; and other statements regarding the Company’s business and the industry In which the Company operates. The forward-looking information reflects management’s current expectations based on information currently available and are subject to a number of risks and uncertainties that may cause outcomes to differ materially from those discussed in the forward-looking information. Although the Company believes that the assumptions and factors used in preparing the forward-looking information are reasonable, undue reliance should not be placed on such information and no assurance can be given that such events will occur in the disclosed timeframes or at all. Factors that could cause actual results or events to differ materially from current expectations include, but are not limited to: (i) adverse general market and economic conditions; (ii) changes to and price and volume volatility in the carbon market; (iii) changes to the regulatory landscape and global policies applicable to the Company’s business; (iv) failure to obtain all necessary regulatory approvals; and (v) other risk factors set forth in the Company’s Prospectus dated April 8, 2024 under the heading “Risk Factors”. The Company operates in a rapidly evolving environment where technologies are in the early stage of adoption. New risk factors emerge from time to time, and it is impossible for the Company’s management to predict all risk factors, nor can the Company assess the impact of all factors on Company’s business or the extent to which any factor, or combination of factors, may cause actual results to differ from those contained in any forward-looking information. Forward-looking information in this news release is based on the opinions and assumptions of management considered reasonable as of the date hereof, including, but not limited to, the assumption that general business and economic conditions will not change in a materially adverse manner. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information. The forward-looking information included in this news release is made as of the date of this news release and the Company expressly disclaims any intention or obligation to update or revise any forward-looking information whether as a result of new information, future events or otherwise, except as required by applicable law.

Non-IFRS Financial Measures

Zefiro has included certain performance measures in this press release that do not have any standardized meaning prescribed by International Financial Reporting Standards (IFRS) including: (a) Adjusted EBITDA. The Company believes that, in addition to conventional measures prepared in accordance with IFRS, certain investors use this information to evaluate the Company’s performance and ability to generate cash flow.

(a) Adjusted EBITDA

Adjusted EBITDA is a non-IFRS measure which excludes from net income (loss): amortization, interest expense, share-based compensation, gains or losses on debt modification, gains or losses on sale of equipment, changes in fair value of investments held, income tax expense or recovery, non-recurring expenses related to the Company’s IPO transaction, and net income (loss) attributable to the Company’s non-controlling interest in its subsidiaries. Management uses Adjusted EBITDA to evaluate the Company’s operating performance, to plan and forecast its operations, and assess leverage levels and liquidity measures. The Company presents Adjusted EBITDA as it believes that certain investors use this information to evaluate the Company’s performance in relation to its peers who present on a similar basis (though Adjusted EBITDA does not have a standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other issuers). However, Adjusted EBITDA does not represent and should not be considered an alternative to net income (loss) or cash flow provided by operating activities as determined under IFRS.

Statement Regarding Third-Party Investor Relations Firms

Disclosures relating to investor relations firms retained by Zefiro Methane Corp. can be found under the Company’s profile on SEDAR+ at www.sedarplus.ca/.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/485c53ef-3b95-4565-98f6-cd7d04b3a44c

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cohen & Steers Closed-End Funds Declare Distributions for October, November, and December 2024

NEW YORK, Sept. 30, 2024 /PRNewswire/ — The Boards of Directors of the Cohen & Steers Closed-End Funds announced today the monthly distributions for October, November, and December 2024, as summarized in the charts below:

|

Ticker |

Fund Name |

Monthly |

|

FOF |

Cohen & Steers Closed-End Opportunity Fund, Inc. |

$0.087 |

|

LDP |

Cohen & Steers Limited Duration Preferred and Income Fund, Inc. |

$0.131 |

|

PSF |

Cohen & Steers Select Preferred and Income Fund, Inc. |

$0.126 |

|

PTA |

Cohen & Steers Tax-Advantaged Preferred Securities and Income Fund |

$0.134 |

|

RFI |

Cohen & Steers Total Return Realty Fund, Inc. |

$0.080 |

|

RLTY |

Cohen & Steers Real Estate Opportunities and Income Fund |

$0.110 |

|

RNP |

Cohen & Steers REIT and Preferred and Income Fund, Inc. |

$0.136 |

|

RQI |

Cohen & Steers Quality Income Realty Fund, Inc. |

$0.080 |

|

UTF |

Cohen & Steers Infrastructure Fund, Inc. |

$0.155 |

Distributions will be made on the following schedule:

|

Month |

Ex-Dividend/ |

Payable Date |

|

October |

Oct. 15, 2024 |

Oct. 31, 2024 |

|

November |

Nov. 12, 2024 |

Nov. 29, 2024 |

|

December |

Dec. 10, 2024 |

Dec. 31, 2024 |

Cohen & Steers Tax-Advantaged Preferred Securities and Income Fund, Cohen & Steers Real Estate Opportunities and Income Fund, Cohen & Steers Limited Duration Preferred and Income Fund, Inc., and Cohen & Steers Select Preferred and Income Fund, Inc. pay regular monthly cash distributions to common shareholders at a level rate that may be adjusted from time to time. Each of these fund’s distributions reflect net investment income and may also include net realized capital gains and/or return of capital. Return of capital includes distributions paid by a fund in excess of its net investment income. Such excess is distributed from the fund’s assets. Under federal tax regulations, some or all of the return of capital distributed by a fund may be taxed as ordinary income. The amount of monthly distributions may vary depending on a number of factors, including changes in portfolio and market conditions.

______________________________________________________________________________

Cohen & Steers Closed-End Opportunity Fund, Inc., Cohen & Steers Total Return Realty Fund, Inc., Cohen & Steers REIT and Preferred and Income Fund, Inc., Cohen & Steers Infrastructure Fund, Inc., and Cohen & Steers Quality Income Realty Fund, Inc. only:

Cohen & Steers Closed-End Opportunity Fund, Inc., Cohen & Steers Total Return Realty Fund, Inc., Cohen & Steers REIT and Preferred and Income Fund, Inc., Cohen & Steers Infrastructure Fund, Inc., and Cohen & Steers Quality Income Realty Fund, Inc. (each, a “Fund” and collectively the “Funds”) declared their monthly distributions pursuant to such Fund’s managed distribution plans. Each Fund implemented a managed distribution policy in accordance with exemptive relief issued by the Securities and Exchange Commission. The policy gives each Fund greater flexibility to realize long-term capital gains throughout the year and to distribute those gains on a regular monthly basis to shareholders. Information can also be found on the Funds’ website at cohenandsteers.com. The Board of Directors of each Fund may amend, terminate or suspend the managed distribution policy at any time, which could have an adverse effect on the market price of each Fund’s shares.

Distributions of a fund’s investment in real estate investment trusts (REITs), master limited partnerships (MLPs) and/or closed-end funds (CEFs) may later be characterized as capital gains and/or a return of capital, depending on the character of the dividends reported to each fund after year-end by the REITs, MLPs and CEFs held by a fund.

Each Fund’s distributions may include net investment income, long-term capital gains, short-term capital gains and/or return of capital. Under the plan, prior to the payment date of the distribution every month, each Fund will issue a press release and a notice containing information about the amount and sources of the distribution and other related information to shareholders of record on the record date. Please note that the notice is not provided for tax reporting purposes but for informational purposes only. Information can also be found on the Funds’ website at cohenandsteers.com.

______________________________________________________________________________

Shareholders should not use the information provided in preparing their tax returns. Shareholders will receive a Form 1099-DIV for the calendar year indicating how to report Fund distributions for federal income tax purposes.

Investors should consider the investment objectives, risks, charges and expense of the fund carefully before investing. You can obtain the fund’s most recent periodic reports, when available, and other regulatory filings by contacting your financial advisor or visiting cohenandsteers.com. These reports and other filings can be found on the Securities and Exchange Commission’s EDGAR Database. You should read these reports and other filings carefully before investing.

Website: https://www.cohenandsteers.com/

Symbol: CNS

About Cohen & Steers. Cohen & Steers is a leading global investment manager specializing in real assets and alternative income, including listed and private real estate, preferred securities, infrastructure, resource equities, commodities, as well as multi-strategy solutions. Founded in 1986, the firm is headquartered in New York City, with offices in London, Dublin, Hong Kong, Tokyo, and Singapore.

Forward-Looking Statements

This press release and other statements that Cohen & Steers may make may contain forward looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, which reflect the company’s current views with respect to, among other things, its operations and financial performance. You can identify these forward-looking statements by the use of words such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates,” or the negative versions of these words or other comparable words. Such forward-looking statements are subject to various risks and uncertainties.

Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. The company undertakes no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise.

![]() View original content:https://www.prnewswire.com/news-releases/cohen–steers-closed-end-funds-declare-distributions-for-october-november-and-december-2024-302263236.html

View original content:https://www.prnewswire.com/news-releases/cohen–steers-closed-end-funds-declare-distributions-for-october-november-and-december-2024-302263236.html

SOURCE Cohen & Steers, Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Super Micro Computer's 10-for-1 Stock Split Is Happening Today. Here's What You Need to Know.

The big day has arrived for Super Micro Computer (NASDAQ: SMCI). The technology company’s stock split happens after the market close, and the shares will begin trading tomorrow at their new — and significantly lower — price. Supermicro joins the list of other high-flying artificial intelligence (AI) stocks — such as Nvidia and Broadcom — that have completed such operations in recent months.

These market giants have launched splits in order to make their shares more accessible to a broader range of investors. Supermicro shares have soared in recent years as the AI boom accelerated, helping revenue to climb in the triple digits. AI customers have rushed to Supermicro for its servers, workstations, and other products that it tailors to suit their data centers. As Supermicro shares climbed 188% in the first half, even surpassing gains of Nvidia and reaching beyond the $1,000 mark, investors speculated that a stock split may be next on the agenda. And Supermicro went on to announce a stock split when it reported quarterly earnings in August.

But unlike peers Nvidia and Broadcom, Supemicro shares haven’t climbed following the decision. That’s as other news in recent weeks weighed on the stock: Hindenburg Research published a short report alleging troubles at the company, and separately, Supermicro delayed the filing of its 10-K annual report. Finally, just last week, The Wall Street Journal reported that the Justice Department may have launched a probe into the company following the short report. All of this has left Supermicro shares down nearly 30% since Hindenburg’s publication in late August.

Today, though, Supermicro’s stock split is unfolding, and it’s a great time to take a closer look at the company. Here’s what you need to know.

Why companies launch stock splits

First, a bit of background on stock splits. As mentioned, these operations lower the per-share price of a stock to make it easier for more people to buy — and this is done by issuing additional shares to current holders. The move doesn’t change anything fundamental about a company, so valuation and market value remain the same. Though the per-share price declines, stock splits don’t make the shares any cheaper.

This also means a stock split, on its own, isn’t a reason to buy a particular stock and won’t act as a catalyst to drive the price higher. A stock split could be seen as a positive move for a company, though, since it may drive more investors to the stock over time. And it suggests that the company’s management is optimistic about the future, with the idea that the stock has what it takes to climb from its new lower price.

Now, let’s move on to the Supermicro operation. Supermicro is launching a 10-for-1 stock split, which means holders of one share will receive nine additional shares after the market close today.

The total value of the holding won’t change, though each share will be worth a tenth of its original value. So, using the current level of Supermicro stock as a guide, the value of one share should decline from about $400 to $40. And this means Supermicro stock will open at the new split-adjusted price of around $40 tomorrow, Oct. 1.

If you’re a Supermicro shareholder, you don’t have to do a thing. All of this will happen automatically, and the extra shares will appear in your brokerage account. If you’re not yet a Supermicro shareholder, you may be wondering what happens if you buy the stock today, right before the split. You, too, will receive the extra shares since the right to them transfers over from the seller. Finally, if you wait until tomorrow to buy the stock, you’ll get it at the split-adjusted price.

Should you buy Supermicro?

Is it a better idea to buy now or wait until after the split? It’s true the split will make it easier for you to buy Supermicro if you want to invest less than the current $400 share price. With $100, for example, you can easily pick up a couple of shares post-split. So, if this is your situation, for convenience, you may want to wait until after the split.

But aside from that particular scenario, it really doesn’t matter if you buy the stock before or after the operation — because, as I talked about above, this move only alters the per-share price.

Now let’s answer one more question: Considering the news I mentioned above, should you really buy Supermicro shares? It’s true that Supermicro is looking particularly cheap right now, trading at only 11x forward earnings estimates. Very aggressive investors may consider picking up a few shares at these levels.

It’s important to remember that Hindenburg Research holds a short position in Supermicro, meaning the firm benefits from a decline in the stock price. In short selling, investors borrow shares of a company, sell them, then purchase them once again — ideally at a lower price — to return to the original owner. This means Hindenburg has a bias, making it difficult to rely on the firm as a source of information. Meanwhile, a Justice Department probe hasn’t been confirmed — and if a probe is confirmed at some point, this doesn’t imply wrongdoing.

Earlier this month, Supermicro responded to concerns about the Hindenburg report and its own delayed annual report filing. The company called Hidenburg’s statements “false or inaccurate” and pledged to address them in “due course.” Supermicro also said it didn’t expect the delayed filing of its annual report to result in major changes to its earnings report. The company declined to comment on the Justice Department probe report, The Wall Street Journal said.

So from the information we have today, Supermicro’s story still looks solid, and considering the company’s leadership in the market and the demand from AI customers, its long-term prospects remain bright.

That said, uncertainty remains, and even post-split, the stock may remain volatile. For most investors, it’s a good idea to wait to buy until Supermicro fully addresses statements in the Hindenburg report or offers further clarifications. There’s reason to be optimistic about this company over the long term, but it’s best to gather all of the facts before making any moves — to buy or sell.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, Stock Advisor’s total average return is 773% — a market-crushing outperformance compared to 168% for the S&P 500.*

They just revealed what they believe are the 10 best stocks for investors to buy right now…

*Stock Advisor returns as of September 23, 2024

Adria Cimino has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

Super Micro Computer’s 10-for-1 Stock Split Is Happening Today. Here’s What You Need to Know. was originally published by The Motley Fool

2 Unstoppable Dividend Stocks Yielding More Than 9% That Income-Seeking Investors Will Want to Buy in October and Hold Forever

If you’re eager to build a passive income stream that can fuel your retirement dreams, you may have noticed it’s getting harder and harder to find stocks that pay satisfying dividend yields.

The S&P 500 has risen about 31% over the past 12 months. With prices going through the roof, the average dividend-paying stock in the benchmark index offers an unattractive 1.3% yield.

It’s harder to find high-yield stocks that investors can rely on, but it isn’t impossible. Right now, Ares Capital (NASDAQ: ARCC) and PennantPark Floating Rate Capital (NYSE: PFLT) offer yields above 9%, and there’s a pretty good chance that they’ll be able to maintain their payouts over the long term.

1. Ares Capital

Ares Capital is the world’s largest publicly traded business development company (BDC). These specialized entities are popular among income-seeking investors because they can avoid paying income taxes by distributing nearly all of their earnings to shareholders in the form of dividend payments.

Ares Capital’s dividend payout hasn’t risen in a straight line, but it is up by 60% since the company began distributing earnings in 2005. At recent prices, the stock offers an attractive 9.2% dividend yield.

North American banks have been dialing back their direct lending exposure to all but the largest companies for decades. As a result, heaps of well-run midsize businesses are starving for capital and willing to pay eye-popping interest rates.

In the second quarter, the average yield on debt securities in Ares Capital’s portfolio was 12.2% at cost. As a well-established BDC, it has a fairly low cost of capital. It paid an average interest rate of 5.3% on outstanding debt in the second quarter.

A wide gap between Ares Capital’s income and its interest expenses pushed second-quarter core earnings up by 5% year over year to $0.61 per share. That’s more than the company needs to meet a quarterly dividend obligation currently set at $0.48 per share.

The are no guarantees, but Ares Capital’s portfolio of debt securities seems highly likely to continue supporting its high-yield dividend payment. There were 525 borrowers in the BDC’s portfolio at the end of June, but hardly any are having trouble making ends meet. Loans on nonaccrual status represented just 1.5% of total investments at cost.

Severe economic downturns can pressure BDCs, but investors don’t have to worry that any single industry will tank Ares Capital. Its heaviest concentration was in the software and services industry, at 24% of the overall portfolio.

2. PennantPark Floating Rate Capital

PennantPark Floating Rate Capital is another BDC with a diverse portfolio and an attractive dividend. With a brief exception in 2018, it’s been making monthly dividend payments that have risen or remained steady since 2011. At recent prices, it offers a 10.7% yield.

This BDC is similar to Ares Capital, but there are some important differences. At the end of June, 50% of Ares Captial’s assets were first-lien senior secured loans. Nearly all of PennantPark Floating Rate Capital’s loans are first-lien senior secured debt, which means they’re first in line to be repaid in the unlikely event of bankruptcy.

Around 31% of Ares Capital’s investments are equity stakes or fixed-rate loans. Pennantark Floating Rate Capital doesn’t have any fixed-rate debt on its books, and equity stakes account for just 13% of its portfolio.

PennantPark Floating Rate Capital’s underwriting team isn’t as large as Ares Capital’s, but it’s big enough to do the job well. To date, it’s closed deals with midsize businesses represented by more than 230 private equity sponsors. At the end of June, just three of this BDC’s portfolio companies, representing 1.5% of the portfolio at cost, were on nonaccrual status.

PennantPark Floating Rate Capital’s operation is much smaller than Ares Capital’s, but it’s arguably more diversified. At the end of June, professional services was its largest industry concentration, at 7.8% of the portfolio. With a diverse portfolio of secured loans generating reliable cash flows, this BDC could maintain and raise its monthly dividend payment for many years to come.

Should you invest $1,000 in Ares Capital right now?

Before you buy stock in Ares Capital, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Ares Capital wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $743,952!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Cory Renauer has positions in Ares Capital. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

2 Unstoppable Dividend Stocks Yielding More Than 9% That Income-Seeking Investors Will Want to Buy in October and Hold Forever was originally published by The Motley Fool

Why Nio Stock Is Soaring: Tesla Rival's Latest EV Gets Nvidia 'AI Brain' With EV Sales Due

Nio (NIO) skyrocketed in September for their best month since June 2020. It’ll report monthly and third-quarter deliveries on Tuesday, with Li Auto (LI) and Zeekr (ZK) already reporting record deliveries.

On Monday, Nio stock rose after the Tesla (TSLA) challenger announced a big cash injection for its Nio China unit.

Further, China stocks rallied broadly in late September on Beijing’s latest stimulus measures. China’s central bank lowered interest rates to push economic growth toward a target of around 5%. This year, China plans to issue sovereign bonds worth about RMB 2 trillion ($284 billion) to stimulate the economy, reports said. On Sunday, the central bank ordered banks to lower rates on existing mortgages.

And not least, Nio has just begun deliveries of the Onvo L60, a more affordable Model Y rival that leverages Nvidia‘s (NVDA) artificial intelligence (AI) chips.

↑

X

Tesla’s Robotaxi Is Delayed. Will It Make A Difference For Tesla Stock?

China EV Sales

China’s EV makers are disclosing September and Q3 sales.

Li Auto delivered a record 53,709 EVs in September, up 48.9% vs. a year earlier and 11.6% vs. August. Q3 deliveries totaled 152,831, up 45.4% vs. a year earlier.

Zeeker delivered a record 21,333 EVs in September, up 79% vs. a year earlier and 18.4% vs. August. Q3 sales were 55,003, also an all-time best and up 51.1% vs. a year earlier.

Nio Onvo EV Powered by Nvidia AI Chip

“Nvidia Drive Orin serves as the AI brain of Onvo’s smart-driving system,” Nvidia, which has long partnered with Nio on chips to automate driving tasks, said in a Sept. 27 press release. The latest Drive Orin system-on-a-chip can perform 254 trillion operations per second, processing sensor data from the L60’s high-definition cameras and four-dimensional radar. The automotive-grade AI chip enables “highly automated driver assistance and autonomous driving systems,” according to the release.

“With the integration of Nvidia Drive, the Onvo L60 is poised to deliver an advanced driving experience at an affordable price,” the chipmaker said.

Nio has pitched the L60 as a higher-spec, lower-priced rival to the Model Y. The L60 starts as low as RMB 149,900, or $21,000, without a battery. Users can opt for Nio’s battery-as-a-service service. With an EV battery, the L60 starts at RMB 206,900.

Deliveries of the first vehicle from Nio’s new and cheaper Onvo sub-brand began Sept. 28. It’s expected to have a modest impact on September sales. But given the heavy L60 orders and Nio ramping up production, the new crossover should provide a big sales boost in October and beyond.

The Model Y, Tesla’s bestselling electric vehicle by far, starts around $35,000 in China after price cuts. That Tesla model is being challenged by several existing and forthcoming Chinese EVs, including options from XPeng (XPEV), Li Auto and Zeekr.

The EV startups are all set to release September and Q3 sales data on Tuesday, along with Nio stock. EV giants BYD (BYDDF) and Tesla will report global EV sales this week as well.

Electric cars now account for more than half of new car sales in mainland China, as a brutal price war continues. Only two U.S.-traded Chinese companies — BYD and Li Auto — are profitable, despite rising EV sales.

Nio Stock, Tesla Stock, China EV Stocks

Shares of Nio rose 2.5% to 6.68 on the stock market today, closing near the bottom of the day’s range. Nio stock jumped 66.4% in September, recovering the 10-week and 40-week moving averages. That’s after trading near four-year lows in August.

The Nio surge in September outpaced gains of 51.6% for XPeng, 37.8% for Zeekr and 31.8% for Li Auto. On Monday, XPEV stock and Zeekr reversed lower, while Li Auto slashed gains to trade back below its 200-day line.

Month to date, shares of EV giants BYD and Tesla have jumped 17% and 22%, respectively.

On Sunday, Nio said it will receive an RMB 13.3 billion (around $470 million) cash injection for its Nio China unit. It expects “strategic investors” to provide RMB 3.3 billion of that injection. Nio itself will provide the rest, with its stake in Nio China reduced to around 88%, down from 92%, CNBC said.

The transactions are set to wrap up by year end.

Despite September’s surge, Nio stock is down 26% in 2024 so far, as well as over the past 12 months.

Year to date, TSLA stock is up more than 5% with the Tesla robotaxi event due on Oct. 10. Shares are moving toward a 271 cup-base buy point.

BYD stock has rallied 28.5% in 2024. Shares cleared an early entry of 32 last week and flirted with a 13-month cup-base buy point of 36.27 on Monday.

YOU MAY ALSO LIKE:

Is Tesla Stock A Buy Or A Sell?

Uber Partners Up With Cruise. Why Analysts Expect More Self-Driving Deals.