Biggest Gold ETF Posts Highest Monthly Inflows In 2.5 Years As Investors Rush To Safe Haven Ahead Of Presidential Election

The SPDR Gold Trust GLD, the largest physically backed gold ETF, saw a significant influx of capital this month as economic and policy uncertainties surrounding the upcoming U.S. presidential election drive investors toward safe-haven assets.

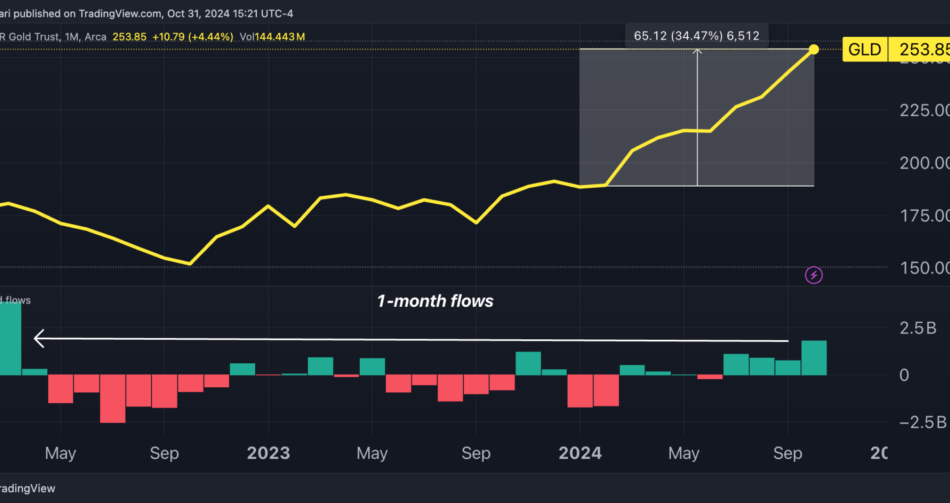

GLD’s assets under management reached $79.7 billion as of Oct. 30, bolstered by $1.8 billion in net inflows for October — the fund’s strongest monthly inflow since March 2022, data from TradingView shows.

Additionally, the ETF notched its fourth consecutive month of gains and its eleventh positive month out of the last 13, with a remarkable 50% rally from the lows of October 2023.

Gold Demand Surges As ETF Investments Soar

Global demand for gold surged 5% year-over-year in the third quarter of 2024, reaching 1,313 tonnes, a record level for the third quarter, according to a report from the World Gold Council released this week.

This increase reflects a rising appetite for the precious metal as macroeconomic concerns and market uncertainty drive both institutional and retail investors toward gold-backed assets.

Gold prices touched new record highs throughout the quarter as demand continued to build.

A key factor behind this growth was a resurgence in gold ETF investment, with global gold ETF inflows reaching 95 tonnes in the third quarter, the first quarter of positive inflows since the first quarter of 2022.

This marked a sharp year-over-year turnaround from the third quarter of 2023, when ETFs saw outflows of 139 tonnes.

“Gold is continuing its relentless rally and may even have the $3,000 level in its sights before too long,” said Michael Gayed, CFA.

The pace of central bank buying slowed to 186 tonnes in the third quarter, yet year-to-date purchases remain on track with 2022 levels, the World Gold Council wrote.

Central banks, particularly in emerging market economies, continue to diversify away from the U.S. dollar, reflecting a strong and steady institutional demand for gold as a reserve asset.

Fiscal, Geopolitical Uncertainty Sparks Investor Rush to Gold

Gold prices have surged 33% in 2024, positioning the commodity for its third-strongest year in the last 50. Notably, this rally has defied traditional drivers like falling Treasury yields or a weakening dollar that typically boost gold.

Instead, two primary factors are fueling investor demand for the safe-haven asset.

The first driver is concern over the U.S. government’s fiscal policies, which some fear could trigger renewed inflationary pressures.

“Gold is rising as the market begins to price in the likelihood of a Fed forced to cut rates further, despite persistent inflation,” said Otavio Costa, macro strategist at Crescat Capital.

Bank of America analysts agree, noting that regardless of the outcome of the upcoming presidential election, both political parties seem reluctant to tackle the precarious budget deficit and soaring national debt.

“Gold may be the last perceived safe haven asset standing,” wrote Bank of America commodity analyst Michael Widmer, emphasizing the risks posed by unchecked government spending.

A second key factor is the evolving role of gold as “a hedge against U.S. economic sanctions.”

Veteran Wall Street investor Ed Yardeni recently described gold as an asset that can protect nations from Western financial controls.

After Russia invaded Ukraine in February 2022, the U.S. and its allies froze Russia’s foreign exchange reserves held abroad. Since then, there have been proposals to seize nearly $300 billion of these assets to support Ukraine’s defense and reconstruction — a move that has sent a clear signal to other nations.

“China and other countries have been increasing their allocations of gold in their countries’ international reserves,” Yardeni added, suggesting that gold is becoming a preferred reserve asset for nations looking to insulate themselves from potential U.S.-led sanctions.

By holding more gold, countries can reduce their dependence on assets vulnerable to Western financial controls, diversifying away from the U.S. dollar.

Read Next:

Photo via Shutterstock.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Leave a Reply