Think Nvidia Stock Is Expensive? This Chart Might Change Your Mind

Nvidia (NASDAQ: NVDA) has been this year’s most influential stock, and it has posted huge gains in the process. The artificial intelligence (AI) leader’s sales and earnings have continued to expand at an impressive pace, and the company’s share price is up roughly 180% so far this year.

That is just the latest leg of an incredible run that has seen the company’s share price soar almost 860% since the beginning of 2023, and more than 2,650% over the last five years. Thanks to these explosive gains, the company’s price-to-earnings multiple has ballooned to 66 as of this writing.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Such a valuation comes with heavy expectations for growth, and it’s not unreasonable to have concerns the chip company’s stock price has climbed too far, too quickly. But there’s another valuation metric that suggests the red-hot AI stock still has upside potential.

The stock’s gains don’t look excessive in light of Nvidia’s recent business results. For example, revenue rose 205% year over year through the first half of fiscal 2025 (the six months ended July 28, 2024) — and earnings per share were up 285% over the same period.

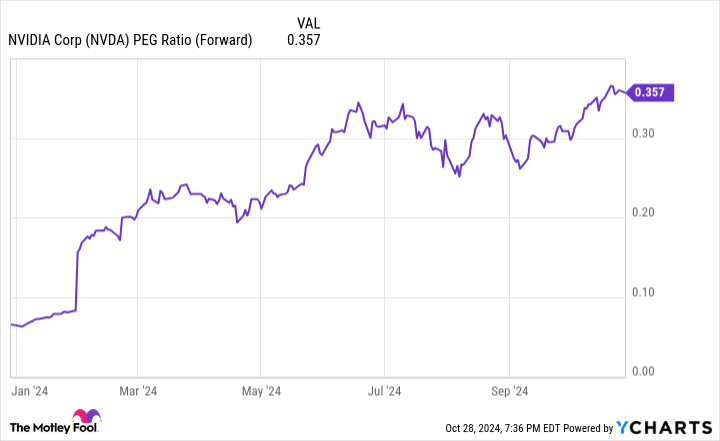

With expectations for its impressive growth to continue, Nvidia is trading at a forward price/earnings-to-growth (PEG) ratio of roughly 0.36. A PEG ratio of less than 1.0 is often viewed as a signal the stock is undervalued because its anticipated earnings growth is high relative to its earnings-based valuation.

While there’s no doubt Nvidia’s sales and earnings growth will have to decelerate eventually, the company’s leadership position, momentum, and PEG ratio suggest the stock still has room to run. With the launch of its next-generation Blackwell processors set for later this year, the company could have another major sales and earnings catalyst on the near horizon.

Spending on GPUs to power AI applications will undoubtedly go through some cyclical shifts, but the rise of artificial intelligence is still in its early innings — and Nvidia remains essential to that rise.

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

Leave a Reply