What happens on 'the other side' of election uncertainty

History shows that the stock market usually performed well regardless of the U.S. president’s political party.

This suggests that there isn’t a political party that’s necessarily bad for the stock market. Maybe some presidents are better for the market than others, especially at the industry level. But there isn’t clear evidence showing that a particular president alone can have enough of a material, long-term impact that the fundamentals driving the market higher will turn unfavorably.

“Over time, the stock market’s strongest threads have been the economy and earnings, not who’s in the Oval Office,” Ritholtz Wealth Management’s Callie Cox said.

At the margin, however, the results of a presidential election can certainly cause market volatility to rise in the short-term. After all, each candidate comes with very different ideas for policies like the corporate tax rate. Over time, companies will adapt and adjust to new policies as they work to preserve earnings growth. But they need some clarity as to what those new policies could be before proceeding with changes.

As such, companies will often take a wait-and-see approach ahead of an uncertain election. That’s a headwind for economic activity in the short-term. And with polling data showing the presidential candidates neck and neck ahead of this year’s election, companies are once again saying that they’ll wait for election results to move forward with any changed business strategies.

“It was unsurprising that the U.S. election came up quite a bit in last week’s earnings calls,” RBC’s Lori Calvasina said on Monday. “As has been the case in recent quarters, there were numerous references to the uncertainty that the event has created and the adverse impact that uncertainty has had on business activity. Several companies noted the need to simply get to the other side.”

Uncertainty doesn’t only keep business executives on the sidelines. It keeps traders and investors on the sidelines too.

History shows that during election years, the stock market tends to deliver below-average returns ahead of Election Day. However, the rally tends to pick up once we “get to the other side” and the uncertainty wanes.

“[R]egardless of the election outcome, declining uncertainty typically lifts equity valuations and prices following Election Day by more than the typical seasonality would suggest,” Goldman Sachs’ Ben Snider wrote in a February note to clients.

The fact that the S&P 500 fell 1% in October is very much consistent with history.

Apple Begins Shifting iPhone 17 Production In India, Cook's China Optimism, And More: This Week In Appleverse

As we wrap up the week, it’s clear that Apple Inc. AAPL has been making significant strides on multiple fronts. From initiating the production of the iPhone 17 in India to CEO Tim Cook’s positive outlook on the company’s performance in China, the tech giant is not slowing down. Let’s dive into the top stories that have been making headlines.

Apple’s iPhone 17 Production Shifts to India

In a significant move, Apple has reportedly begun the initial manufacturing process for the iPhone 17 in India, breaking away from its traditional reliance on China. The development is currently taking place at Foxconn’s facility in Bengaluru, marking a new chapter in Apple’s production strategy. Read the full article here.

Tim Cook’s Optimism on Apple’s Performance in China

During Apple’s recent fourth-quarter earnings call, CEO Tim Cook expressed optimism about the company’s stable performance in China. While he refrained from commenting on the potential impact of the economic stimulus, Cook attributed some of the improvement to a sequential improvement in foreign exchange rates. Read the full article here.

See Also: Sundar Pichai Admits DOJ Proposals Could Have ‘Unintended Consequences’ — Google Mapping Out Plan B

Apple’s Mac Mini to Get a Major Upgrade

Apple is gearing up to integrate the powerful M4 processor into its Mac lineup, which could significantly boost the AI and gaming performance of new Macs. The new chip is expected to increase core counts compared to its predecessor, ensuring a marked improvement in daily usage from older models. Read the full article here.

Apple’s iOS 18.1 Adoption Rate Surpasses Predecessor

According to Tim Cook, the adoption rate of iOS 18.1 has outpaced its predecessor, iOS 17.1, by two-fold. During the fourth-quarter earnings call, Cook also addressed questions about the demand and supply balance for the iPhone 16, launched in September earlier this year. Read the full article here.

Unlocking Apple Intelligence with iOS 18.1

The release of iOS 18.1 brought Apple’s new AI-powered features, known as Apple Intelligence, to iPhone users. If you own an iPhone 15 Pro, iPhone 15 Pro Max, iPhone 16, iPhone 16 Plus, iPhone 16 Pro, or iPhone 16 Pro Max, here’s what you need to know to start using Apple Intelligence. Read the full article here.

Read Next:

Photo courtesy: Apple

This story was generated using Benzinga Neuro and edited by Rounak Jain

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Inflation Fears, Election Outcomes, And Market Uncertainties: This Week In Economics

The past week has been a whirlwind of economic debates, election predictions, and market uncertainties. From the public dispute between economist Justin Wolfers and Republican vice presidential candidate JD Vance over inflation and grocery prices to warnings about the potential inflationary impact of a Republican sweep in the upcoming elections, the week was rife with speculation and anticipation.

Here’s a quick recap of the top stories.

Wolfers Challenges Vance’s Inflation Promise

Economist Justin Wolfers publicly disputed claims made by JD Vance regarding the impact of former President Donald Trump’s policies on inflation and grocery prices. Vance had asserted that Trump would lower grocery prices and secure the southern border, a claim Wolfers countered by stating that economists anticipate Trump’s plans would lead to a significant inflation increase.

Republican Sweep Could Increase Inflation, Economists Warn

As the U.S. heads into the elections on Nov. 5, economists warn that a Republican victory across the White House and Congress could significantly increase inflationary pressures. The impact, they say, would stem primarily from higher tariffs, a swelling budget deficit, and restricted immigration policies.

Trump Tariffs Could Slow Global Growth, Warns Temasek

Singapore’s state-owned investment firm Temasek cautioned that a potential re-election of former President Donald Trump could lead to a slowdown in global growth, impacting U.S. companies and financial markets. Rohit Sipahimalani, Chief Investment Officer at Temasek International, expressed concerns about the long-term impact of a Trump presidency on the global economy.

Fed Interest Rate Cuts Expected Amid Cooling Inflation

A 0.25% interest rate cut at the Federal Reserve’s Nov. 7 meeting is almost fully priced in by markets, with another similar cut likely in December as cooling inflation allows the Fed to gradually ease its policy stance. The latest inflation data from September showed a deceleration that aligns with the Fed’s 2% target.

Shock October Jobs Report Leaves Fed In ‘Tight Spot’

The October employment report released Friday morning showed the U.S. economy added only 12,000 jobs in October, well below estimates of 113,000. Economists are weighing in on the impact of the hurricanes on the report and the potential for future interest rate cuts. Jeffrey Roach, chief economist for LPL Financial, sees the Fed cutting rates at its next two meetings as economic conditions weaken.

Read Next:

Photo courtesy: Shutterstock

This story was generated using Benzinga Neuro and edited by Ananya Gairola

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Is It Time to Buy October's Worst-Performing S&P 500 Stocks?

Generally speaking, when you buy a stock doesn’t really matter if it’s a good company and you are investing with a long-term mindset. But that doesn’t mean it doesn’t help your overall returns to buy a stock when it’s trading at a discount. Doing so helps you get more bang for your investment buck.

However, not all discounted stocks are necessarily worth buying. There’s always more to the story. Sometimes a stock’s setback is a warning of even more trouble ahead.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Before blindly diving into October’s worst-performing S&P 500 (SNPINDEX: ^GSPC) stocks just because they’re suddenly trading cheaper, here’s a look at the rest of the story. You may not want to scoop up any of them just yet.

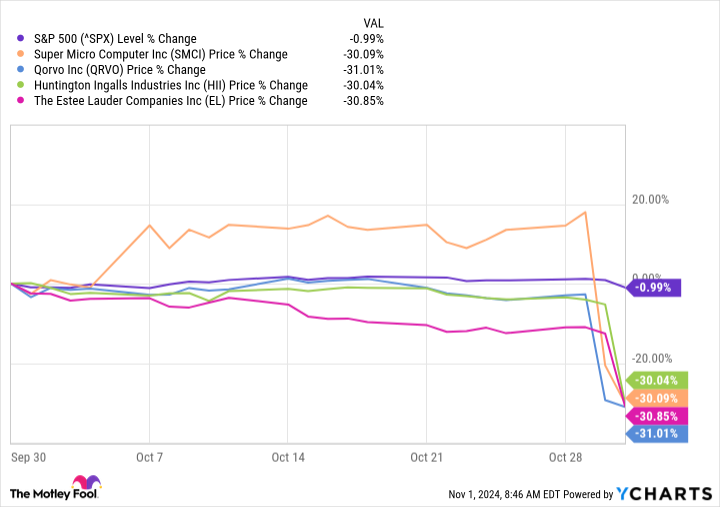

Getting straight to the point, last month’s biggest S&P 500 losers were Super Micro Computer (NASDAQ: SMCI), Qorvo (NASDAQ: QRVO), Huntington Ingalls Industries (NYSE: HII), and Estée Lauder (NYSE: EL). Each stock was downright boring for the better part of the month. In just the last two days of October, however, each ticker ended up losing on the order of 30% versus the index’s 1% dip.

There’s a common thread: last quarter’s earnings and/or guidance for the current quarter. Many companies in a wide range of industries are finally feeling the impact of economic challenges.

Take semiconductor company Qorvo as an example. Although it beat its top- and bottom-line estimates for the three-month stretch ending in September, its revenue guidance of about $900 million for the quarter now underway fell short of analysts’ consensus of $1.06 billion. The company cited stiff competition and tepid smartphone demand as the key cause for its lackluster outlook.

Estée Lauder’s story is a similar one, although arguably worse. While its fiscal first-quarter results were more or less in line with expectations, they were still down from year-ago comparisons. The crux of the stock’s steep sell-off, however, was the company’s decision to cut its dividend and withdraw guidance for the full year mostly due to uncertainty regarding its business in China. Despite the nation’s fresh stimulus efforts, CEO Fabrizio Freda explained, “Consumer sentiment in Mainland China weakened further in our first quarter.” He added, “We anticipate still strong declines near term for the industry.”

The underlying economic lethargy may even be undermining government spending to some degree. Not only did Huntington Ingalls’ quarterly earnings fall short of estimates, but the shipbuilder was forced to lower its five-year cash-flow outlook thanks to new doubts about a contract with the U.S. Navy and supply chain challenges.

Trump Meme Coins Soar, Bitcoin Breaks $70K, Cat-Themed Coins Rally And More: This Week In Crypto

The past week has been a rollercoaster ride in the world of cryptocurrency and politics. Trump-themed meme coins are making waves with impressive gains, leaving popular cryptos like Dogecoin and Shiba Inu in the dust. Meanwhile, the 2024 U.S. presidential race is heating up, with the odds favoring Donald Trump over Kamala Harris. In the crypto sphere, Bitcoin broke the $70k mark, and Gen-Z is redefining financial freedom. Let’s dive into the details.

Trump-Themed Meme Coins Rally

Tokens like Maga Memecoin TRUMP/USD, MAGA Hat MAGA/USD, and Donald Tremp TREMP/USD experienced a surge on Monday, thanks to Trump’s increasing election odds. Data from Coinmarketcap showed these political meme coins nearing a total market cap of $700 million, up 11% in just 24 hours. Trump currently holds a 66.1% chance of winning, with Kamala Harris trailing at 33.9%, according to Polymarket traders.

Nate Silver’s Election Forecast

American statistician Nate Silver sees the 2024 U.S. presidential race as “a near coin flip,” with Trump narrowly leading Harris. As of Oct. 31, Silver’s forecast gives Trump a 53.4% chance of winning, compared to Harris’s 46.2%. This tight margin underscores the intense polarization and competitiveness of this election.

Gen-Z’s Path to Financial Freedom

According to Chamath Palihapitiya, Gen Z is decoupling financial freedom from traditional 9-5 jobs. Palihapitiya noted that an increasing number of young men are engaging in side activities such as trading cryptocurrencies like Bitcoin BTC/USD and options on platforms like Robinhood and Coinbase. This shift signifies a departure from the traditional notion that wealth is primarily earned through one’s job.

Bitcoin Breaks $70K

Leading cryptocurrencies surged Monday, with Bitcoin breaking through $70,000 after an almost five-month hiatus. The world’s largest cryptocurrency breached this elusive level late evening, building on the positive momentum from the weekend. Ethereum also sailed to $2,585 after shifting sideways for the early part of the day.

Cat-Themed Coins Rally

Cat-themed coins like Mog Coin MOG/USD and Popcat POPCAT/USD rallied on Tuesday as the broader altcoin market cheered Bitcoin’s BTC/USD leap above $70,000. Coinmarketcap data showed cat-themed tokens coins approaching a total market capitalization of $5 billion, up 9.3% over 24 hours. Meme coin trader meme-millions predicted cat coins could reach a valuation of $20–$50 billion.

Read Next:

Photo courtesy: Shutterstock

This story was generated using Benzinga Neuro and edited by Anan Ashraf.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Chipotle's Hiring, Musk's Predictions, And Nvidia's Human-Like AI: This Week In Artificial Intelligence

The week was a whirlwind of AI-related news, with major companies like Chipotle Mexican Grill CMG, Nvidia Corp. NVDA, OpenAI, and Intel Corp. INTC making headlines. From AI-driven hiring strategies to bold predictions about the future of AI, the weekend was a testament to the growing influence of artificial intelligence in various sectors.

Chipotle Leverages AI To Boost Hiring Efficiency

Interim CEO of Chipotle Mexican Grill, Scott Boatwright, revealed that the company is using AI to reduce hiring time by 75% during the busy ‘Burrito Season’. The company’s initiatives to improve service times have significantly boosted revenue growth.

Elon Musk Foresees AI Matching Human Capabilities

Tesla CEO Elon Musk predicted that AI could reach human-level capabilities by 2029. Musk highlighted that AI is advancing at an impressive rate, improving roughly tenfold each year.

See Also: Elon Musk’s X Reportedly Hit With New Wave Of Layoffs: Engineering Department Faces Major Cuts

Nvidia Executive Predicts AI Taking Human Form

A top executive at Nvidia believes AI will soon take on a “human form.” Masataka Osaki, the Vice President of Worldwide Field Operations at Nvidia, made this bold prediction at the Global Management Dialogue event in Tokyo.

OpenAI Challenges Google With Chatgpt Search

OpenAI announced that its flagship product, ChatGPT, is now capable of crawling the web for up-to-date news, sports scores, stock quotes, and more, posing a potential challenge to Alphabet Inc.’s GOOG GOOGL search dominance.

Intel’s Gaudi AI Chips Fall Short Of Revenue Targets

Intel CEO Pat Gelsinger revealed that the Gaudi AI accelerator program will fall short of revenue targets due to a transition from second to third generation.

Read Next:

Photo courtesy: Shutterstock

This story was generated using Benzinga Neuro and edited by Rounak Jain

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

History Says the S&P 500 Could Jump in November: 2 No-Brainer Stocks to Buy With $100 Right Now

November has been the strongest month of the year for the U.S. stock market in the last decade. Specifically, the S&P 500 index (SNPINDEX: ^GSPC) returned an average of 3.8% during November over the last 10 years, while its next best month was July with an average return of 3.4%. Moreover, the index produced a positive return in nine of the last 10 Novembers.

Of course, past performance is never a guarantee of future results, and investors should never focus on short-term returns. But there is no harm in leaning into historical patterns, provided the goal is long-term capital appreciation. Shopify (NYSE: SHOP) and Uber Technologies (NYSE: UBER) are worthwhile investments today, and both stocks cost less than $100 per share.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Here are the important details.

Shopify provides a turnkey solution for retail and wholesale commerce. Its platform lets merchants manage sales and inventory across physical and digital storefronts from one dashboard. Its software integrates with online marketplaces like Amazon and social media like TikTok, but also supports the construction of custom websites.

Shopify also provides adjacent merchant solutions for marketing, payments, and logistics, as well as back office tools for money management, accounts payable, and tax reporting. The company has also introduced a suite of artificial intelligence (AI) features called Shopify Magic that automate workflows (like drafting product descriptions) and surface insights for merchants.

Additionally, its enterprise-grade platform Shopify Plus includes more sophisticated tools for data analytics and wholesale e-commerce. That last point is particularly important, because the wholesale e-commerce market is about three times larger and growing two times faster than the retail e-commerce market, according to Grand View Research.

Recently, consultancy Gartner named Shopify a leader in digital commerce, citing robust functionality across retail and wholesale channels, and its ability to innovate rapidly. Similarly, Forrester Research recognized Shopify as a leader in its most recent report on wholesale commerce solutions, citing its broad functionality and new AI tools as key strengths.

Shopify reported encouraging financial results in the second quarter despite a somewhat uncertain economic backdrop. Revenue increased 21% to $2 billion, and non-GAAP net income increased 85% to $0.26 per diluted share. Importantly, management highlighted momentum with large merchants, international merchants, and offline merchants, three areas where Shopify has focused its resources.

3 Top Dividend Stocks to Buy for Passive Income in November

Collecting passive income can help you gain more financial freedom. As your passive income grows, it will make you less reliant on your active income from working. That can help steadily reduce your stress level.

There are lots of great ways to increase passive income, including investing in dividend stocks. Realty Income (NYSE: O), Kinder Morgan (NYSE: KMI), and Verizon Communications (NYSE: VZ) are three top options to buy this November if you’re looking to make more passive income.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Realty Income is a real estate investment trust (REIT) with a mission to deliver dependable monthly dividends to its investors that grow over time. The REIT has certainly achieved that objective over the years. It has increased its payout for the last 30 straight years, including the past 108 quarters in a row.

The REIT currently offers a more than 5% yield. That’s several times higher than the average dividend stock (the S&P 500‘s dividend yield is less than 1.5%). Put another way, every $100 you invest into Realty Income would produce about $5 of annual passive income compared to less than $1.50 for a similar investment in the average dividend stock.

Realty Income should be able to continue increasing its dividend. The REIT expects to grow its adjusted funds from operations (FFO) by around 4% to 5% per share each year. Rent growth will supply around 1 percentage point, while acquisitions of income-producing real estate will help provide the rest.

The REIT has a strong financial profile and balance sheet, giving it ample flexibility to continue making acquisitions. Meanwhile, given the size of the commercial real estate market in the U.S. and Europe, it has a multitrillion-dollar investment opportunity.

Kinder Morgan is a leading pipeline company that operates the country’s largest natural gas pipeline system. It also owns product pipelines, terminals, and carbon dioxide infrastructure.

The company’s midstream assets produce very stable cash flows backed by government-regulated rate structures and long-term, fixed-rate contracts. Kinder Morgan pays out a little more than half its stable cash flow in dividends and retains the rest to pay for expansion projects and maintain a strong financial foundation.

The company currently has $5.2 billion of expansion projects in its backlog, including a large $1.7 billion natural-gas pipeline expansion that should enter commercial service in late 2028. And it has many more projects under development to support the expected surge in demand for electricity in the coming years. Those projects will grow the company’s cash flow, enhancing its ability to increase its dividend, which it has done in each of the last seven years.

1 Unstoppable Stock Set to Join Nvidia, Apple, Microsoft, Amazon, and Alphabet in the $2 Trillion Club by 2026

U.S. stock exchanges host seven companies with a valuation of $1 trillion or more, but only five are currently in the exclusive $2 trillion club:

-

Apple: $3.38 trillion

-

Nvidia: $3.32 trillion

-

Microsoft: $3.05 trillion

-

Alphabet: $2.10 trillion

-

Amazon: $2.07 trillion

I think Meta Platforms (NASDAQ: META) could be the next company to join that list. The social media giant is quickly becoming a leader in the artificial intelligence (AI) race, and it’s using that technology to create exciting new features for Facebook, Instagram, and WhatsApp.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Meta has a market capitalization of $1.45 trillion, so its stock has to gain 38% from here for the company to cross the $2 trillion milestone. Here’s how it could happen by 2026.

Meta has the largest audience in the world with 3.29 billion daily active users across its family of apps. The company generates most of its revenue by selling advertising slots to businesses that want to reach that audience, and the longer each user spends on platforms like Facebook and Instagram each day, the more ads they will see. That translates into more revenue for Meta.

AI-powered content recommendations are one way the company is increasing engagement. AI algorithms learn what each user likes to see, and it curates their Facebook and Instagram feeds accordingly. Meta CEO Mark Zuckerberg says this strategy led to an 8% increase in the amount of time users spend on Facebook this year, and a 6% increase for Instagram.

Meta also offers a suite of AI tools for advertisers, which helps them rapidly craft engaging campaigns. Zuckerberg says more than 1 million businesses used AI to create 15 million ads last month alone, which led to a 7% increase in conversions. Meta’s goal is to eventually have a prompt-based system where businesses can describe the type of ad they want to make, and the audience they wish to target, and AI will handle the entire process. That could turn even the smallest business into a marketing powerhouse.

Part of increasing user engagement and attracting advertisers also involves creating new features. Earlier this year, Meta launched an AI-powered virtual assistant called Meta AI, which users can access through all of its apps. It’s capable of answering complex questions, generating images, and it can even join your group chat to settle debates or recommend fun activities.

Meta AI already amassed over 500 million monthly active users. But more importantly, it lays the foundation for upcoming features like Business AI, which will provide a unique virtual agent to every merchant on Meta’s apps. Business AI will handle incoming messages from customers and potentially even process sales, which will create new opportunities for Meta to generate revenue.

2 Brilliant Artificial Intelligence (AI) Stocks to Buy Before They Soar 190% and 200%, According to Certain Wall Street Analysts

Generally speaking, Wall Street views Nvidia (NASDAQ: NVDA) and Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG) as two of the companies best positioned to benefit from artificial intelligence. But select analysts have set the stocks will especially optimistic price targets.

-

I/O Fund analyst Beth Kendig believes Nvidia will achieve a $10 trillion valuation by 2030 as demand for artificial intelligence accelerators increases. That forecast implies about 200% upside from its current market value of $3.3 trillion. It also implies a share price around $405.

-

Trefis analysts believe Alphabet could be a $500 stock by 2030 as its autonomous driving subsidiary Waymo becomes a larger part of the business. That forecast implies about 190% upside from its current share price of $172. It also implies a market value around $6 trillion.

Investors should always consider forecasts with skepticism. But Nvidia and Alphabet are undoubtedly major players in the burgeoning artificial intelligence market, so both stocks warrant further consideration. Here are the important details.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Nvidia graphics processing units (GPUs) are the gold standard in accelerated computing, a discipline that uses specialized hardware and software to speed up complex data center workloads like artificial intelligence (AI). Nvidia GPUs are not only the fastest accelerators on the market, but also are backed by a more robust suite of software development tools.

Consequently, the company accounts for 98% of data center GPU shipments, and it has more than 80% market share in AI chips. Nvidia has further cemented its leadership in accelerated computing with new hardware products like the Grace CPU and networking solutions. In fact, Nvidia is the market leader in AI networking.

Nvidia reported strong financial results in the second quarter of fiscal 2025 (ended July 2024). Revenue rose 122% to $30 billion and non-GAAP earnings surged 152% to $0.68 per dilute share. In the near term, Nvidia has a major catalyst in the coming launch of its next-generation Blackwell GPU, a chip that is already sold out for 12 months.

Beyond that, Nvidia sees a burgeoning opportunity in humanoid robots and physical AI. To elaborate, whereas generative AI can create text and images, physical AI can understand, navigate, and interact with the physical world. Straits Research estimates the humanoid robot market will increase at 34% annually through 2032, and Nvidia is well positioned to benefit.