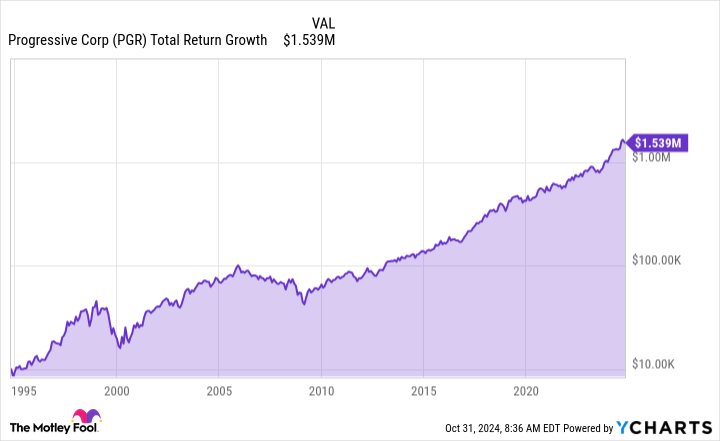

This Stock Turned $10,000 Into $1.5 Million Over the Past 3 Decades. Here's Why It's a Smart Buy Today.

The stock market is one of the greatest wealth creators out there. Over the long run, the S&P 500 index has returned about 10% annually during the past century, rewarding patient investors who take a buy-and-hold approach to investing.

Some companies outperform the S&P 500 over extended periods. These companies have strong business models and capital and risk management, which allows them to produce stellar cash flows no matter what the economy does.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

One excellent company that continues to show strength is Progressive (NYSE: PGR). The insurance company has delivered phenomenal returns of 18.3% compounded annually during the past three decades. Put differently, patient investors who invested $10,000 in the insurer three decades ago would be sitting on more than $1.5 million today. Here’s why Progressive can keep delivering.

Investing in insurance stocks isn’t as exciting as investing in next-generation technology, but they can be an important part of your diversified portfolio. That’s because insurance companies can provide steady cash flow thanks to consistent demand as people and businesses look to protect themselves from catastrophic losses. Even the legendary investor, Berkshire Hathaway Chief Executive Officer Warren Buffett, has said that insurance is a crucial part of Berkshire’s business.

However, investing in just any insurance company isn’t good enough. The industry is extremely competitive, and it can be difficult for companies to stand out. When you look at the industry, insurers, on average, barely break even. In other words, insurers collect just enough premiums to pay out claims and other expenses. This is where Progressive differentiates itself.

In 1965, Peter B. Lewis, the son of one of Progressive’s founders, took over as CEO of the insurance company. Lewis made a commitment that the company would grow by consistently underwriting profitable insurance policies. This differed from the commonly accepted practice that insurance companies should break even on policies and make their profit from their investment portfolios instead.

Progressive set a goal to make $4 in profit for every $100 in premiums it received, and it continues to strive for this goal today. In other words, the company aims to achieve a combined ratio of 96%, which measures the ratio of a company’s claims costs plus expenses divided by premiums collected.

Leave a Reply