Palantir raises 2024 revenue forecast again on robust AI adoption; shares surge

By Arsheeya Bajwa

(Reuters) -Palantir Technologies (PLTR)on Monday raised its annual revenue forecast for the third time, betting on strong spending from governments and rising demand for its software services from businesses looking to adopt generative AI technology.

Shares of the data analytics company rose about 13% in extended trading.

Palantir has benefited from a boom in GenAI technology, as more companies turn to its AI platform, which is used to test, debug code and evaluate AI-related scenarios.

The company now expects 2024 revenue in a range of $2.805 billion to $2.809 billion, up from its prior expectation of $2.742 billion to $2.750 billion.

The company is among the largest beneficiaries of a rally in AI-linked stocks, with its shares up more than 140% so far this year. It was added to the S&P 500 in September and has outperformed the index’s 20% year-to-date gain.

It also raised its annual forecast range for adjusted income from operations to between about $1.05 billion and $1.06 billion. It earlier forecast $966 million to $974 million.

“Top line growth, which is driven by the demand for AI, (is) flowing through to the bottom line,” CFO David Glazer told Reuters.

While businesses are increasingly using Palantir’s services, a large chunk of its revenue comes from government spending.

Palantir, whose services include providing software to governments that visualizes army positions, posted a 40% rise in U.S. government revenue in the third quarter, which made up more than 44% of total sales of $725.5 million.

Analysts on average had expected total sales of $701.1 million, according to data compiled by LSEG.

Still, Palantir’s commercial business, which includes sales to businesses will likely overtake the government business as early as next year, said Gil Luria, head of technology research at D.A. Davidson.

“Government agencies take a lot longer to make decisions, while commercial customers can make much faster decisions to buy software, which is what we’re seeing right now.”

The company also forecast fourth-quarter revenue above estimates.

(Reporting by Arsheeya Bajwa in Bengaluru; Editing by Maju Samuel)

Nuclear Giant Surprises With 30% EPS Growth. Regulators Turn Cool On Amazon Nuke Deal

S&P 500 nuclear energy giant Constellation Energy (CEG) reported better-than-expected third-quarter earnings and revenue while also narrowing its 2024 profit expectations early Monday even as energy regulators rejected a nuclear deal between Amazon.com (AMZN) and Talen Energy (TLNE) late Friday.

Constellation Energy saw Q3 earnings grow 28% to $2.74 per share while sales totaled $6.55 billion, up 7% compared to a year ago. Prior to Monday, analysts predicted third-quarter EPS earnings of $2.66 and revenue coming in at $5.71 billion.

The company on Monday also raised the midpoint and narrowed full-year 2024 earnings guidance to between $8.00 – $8.40 per share. In early August, Constellation Energy increased its full-year profit guidance to between $7.60-$8.40 per share for 2024. Constellation Energy’s previous view was $7.23-$8.03 per share.

The company said Monday that its Q3 earnings increase was primarily due to its nuclear energy offerings and “favorable net market and portfolio conditions.” The company’s nuclear fleet produced 45,510 gigawatt-hours in Q3, up 3% compared Q3 2023.

↑

X

2024 Election Investing Strategies: How To Prepare Your Portfolio

“The importance of AI and the data economy to America’s economic competitiveness and national security can’t be overstated, and Constellation will do our part to meet the moment,” Constellation Energy Chief Executive Joe Dominguez said in the earnings release Monday.

Dominguez added on the conference call with analysts Monday that the “intensity of our negotiations with hyperscalers and others keeps going up and up.”

“Our entire team is focused on executing transactions and supporting data centers development,” the Constellation Energy head said.

Constellation management also said on the earnings call Monday that base earnings will grow by at least 13% through 2030. In May, Constellation said it would grow profit by at least 10% through the end of the decade.

S&P 500 Catches Nuclear Fever

Nuclear energy-related plays have been on a tear since late September when Constellation Energy announced a two-decade contract with Microsoft (MSFT) to provide nuclear power for the tech giant’s data centers.

Then in October, Amazon.com (AMZN) and Alphabet (GOOGL) also announced decisions to invest in developing the emerging small modular reactors, or SMRs, technology. SMRs do not currently exist but there are a number of companies working to develop the technology.

Amazon in March made an early move toward nuclear, paying $650 million for a Talen Energy (TLNE) nuclear-powered data center campus in Pennsylvania. However, the Federal Energy Regulatory Commission on Friday rejected the deal, citing possible “huge ramifications for both grid reliability and consumer costs,” FERC Commissioner Mark Christie.

Electric utilities, especially those with nuclear power plants have seen demand and prices soar amid energy-intensive AI data centers. The FERC order suggests that regulators, worried about the “ramifications,” may block or restrict even co-location deals.

Nuclear stocks broadly lost ground Monday on the news. Constellation Energy sank 12.5% to 225.95 during market trade on Monday after closing on Friday down 1.9%. The stock advanced 1% in October after rallying 32% in September.

Meanwhile, S&P 500 leader Vistra (VST) reports earnings early Thursday, along with several other nuclear-related companies. Analyst consensus puts Vistra Q3 EPS ahead 9% to $1.64 on revenue of $5.01 billion, up 22% vs. Q3 2023. Vistra, a nuclear power utilities play, reports before the market opens on Thursday.

Vistra dropped 3.2% to 115.71 Monday. The stock fell 4.4% on Friday. VST has also been in reported discussions for power deals at both its nuclear and natural gas-powered plants.

Dominguez said on Monday’s earnings call that the ruling is “not the final word from FERC on co-location” of data centers at nuclear power plants.

“We know this co-location and competitive markets remains one of the best ways for the U.S. to quickly build the large data centers that are necessary to lead on AI,” Dominguez said.

Going into Monday’s market trade, shares of Constellation Energy and Vistra had surged around 26% and 30%, respectively, since the Microsoft-Constellation Energy deal on Sept. 20.

VST stock is up 210% on the year while Constellation Energy has advanced about 120%.

AI And Nuclear Energy

So far in 2024, nuclear power and utility stocks have been riding the artificial intelligence energy wave.

Artificial intelligence — and the data centers needed to train the systems — are expected to boost energy demand throughout this decade. In the U.S., McKinsey & Co. projects that data center energy demand will grow from around 4% currently, as percentage of total energy demand, to 11%-12% by 2030.

Bitcoin Miners Forge Lucrative AI Deals. They Have A Big Advantage.

Many technology companies are investing in or partnering with nuclear power providers to ensure energy supplies for their data centers.

Morgan Stanley analysts have proclaimed in recent months that a “nuclear renaissance” is underway.

They wrote that nuclear power, while still a divisive issue, is making a comeback. The firm sees $1.5 trillion in investment in new capacity through 2050.

Meanwhile, Morgan Stanley analysts wrote that the Constellation-Microsoft deal “proves out the value of nuclear power for hyperscalers, with higher prices for future deals.”

The Microsoft Deal

Constellation Energy said in September it will fire back up Pennsylvania’s Three Mile Island Unit 1, which ended operation in 2019, to provide the necessary energy to meet Microsoft’s needs over the life span of the 20-year contract. The company estimates the reactor will add 835 megawatts to the grid.

The Three Mile Island Unit 1 reactor is adjacent to the Unit 2 reactor, which shut down in 1979 after a partial meltdown at the nuclear power plant.

Accidents at Three Mile Island, Chernobyl and Fukushima loom large in the minds of utilities and their insurers. In addition, long-term safety and environmental concerns over storing and disposing of spent radioactive fuel rods create resistance to new nuclear development. Nuclear power has declined in recent years, with 13 plants closing since 2013.

Constellation Energy announced at the time that to restart the Three Mile Island reactor, “significant investments will be made to restore the plant, including the turbine, generator, main power transformer and cooling and control systems.”

The process also requires U.S. Nuclear Regulatory Commission approval following a comprehensive safety and environmental review, as well as permits from relevant state and local agencies.

Constellation Energy said Monday it expects the project to require around $1.6 billion of cash from operations for capital expenditures, with an estimated in-service date of 2028.

Founded in 1999, Constellation Energy has gone through several phases. After an earlier stint as a public company, it merged with Exelon in 2012 as part of a deal worth roughly $8 billion. While with Exelon, the company’s moniker became Constellation Energy Generation. It then split from the utility giant in early 2022.

Constellation Energy owns 25% of U.S. nuclear power reactors. Further, it provides energy to more than 20% of the major commercial and industrial customers in the country.

Nuclear Power Stocks Skid On This Regulatory Move

Nuclear Stocks Take Off

Small modular reactor-focused companies have taken off recently. Shares of Oklo (OKLO) — the nuclear power startup backed by OpenAI head Sam Altman — surged 177% in October. Nano Nuclear Energy (NNE) advanced 35% last month.

Meanwhile, NuScale Power (SMR) gained 65.3% in October.

NuScale Power reports third-quarter earnings and revenue late Thursday with analysts expecting a loss of 14 cents, down from a 22-cents per share loss a year ago. Sales are expected to fall 44% to $3.9 million.

Constellation Energy executives on Monday told analysts that they “continue to lead research on new nuclear energy designs such as our SMRs and for natural gas with sequestration.”

Uranium refiner Cameco (CCJ) also announces third-quarter earnings on Thursday. Analyst consensus projects Q3 EPS declining 17% to 19 cents with revenue totaling $562 million, up 36% compared to a year ago.

Canada-based Cameco is one of the world’s largest providers of uranium with utilities around the globe relying on the company to provide nuclear fuel solutions.

Constellation Energy stock has an 89 Composite Rating out of a best-possible 99. The S&P 500 stock also has a 97 Relative Strength Rating and a 54 EPS Rating.

Please follow Kit Norton on X @KitNorton for more coverage.

YOU MAY ALSO LIKE:

Is Tesla Stock A Buy Or A Sell?

Get Full Access To IBD Stock Lists And Ratings

Learning How To Pick Great Stocks? Read Investor’s Corner

AI Is Fueling A ‘Nuclear Renaissance.’ Bill Gates And Jeff Bezos Are In The Mix.

EcoSynthetix Reports 2024 Third Quarter Results

BURLINGTON, ON, Nov. 4, 2024 /CNW/ – EcoSynthetix Inc. ECO (“EcoSynthetix” or the “Company”), a renewable chemicals company that produces a portfolio of commercially proven bio-based products, today announced its financial and operational results for the three months (Q3 2024) and nine months (YTD 2024) ended September 30, 2024. Financial references are in U.S. dollars unless otherwise indicated.

Highlights

(Comparison periods in each case are the three months ended September 30, 2023)

- Recorded net sales of $5.2 million, up 38%, compared to the prior period, enabled by 56% higher volumes from increased demand.

- Recorded an Adjusted EBITDA1 of $0.4 million, an improvement of $0.6 million from the prior period.

- Experienced increased demand in the wood composites end market from higher usage at commercial mills.

- Successful extended trials continue in pulp applications with a leading international pulp manufacturer.

- Purchased and cancelled 178,300 common shares in Q3 2024 under the normal course issuer bid for total consideration of $0.6 million.

- Maintained a strong balance sheet with cash and term deposits of $33.5 million as at September 30, 2024.

“Our innovative biopolymers continue to gain traction in the market with a nearly 50% increase in demand in 2024 year-to-date, underpinning our strong top line growth and improvements in the bottom line,” said Jeff MacDonald, CEO of EcoSynthetix. “Our key accounts and prospects remain highly engaged, with positive momentum across tissue, paperboard and pulp, wood composites and personal care. One of the leading global pulp producers continues its extended commercial trials with our strength aid, SurfLock™, with large scale trials continuing through the end of the year. Our strength aid offers material economic and performance benefits for producers of pulp and pulp-based products like tissue and packaging. Our no-added formaldehyde binders offer significant carbon reduction benefits in wood panel production to our key strategic account which is backward integrated with an international retailer. Our film forming polymers are helping our marketing and development partner, Dow, offer an all-natural label and performance benefits across new applications and customers in the personal care end market. The momentum we are building is a result of our success diversifying across these key end markets. We are engaged with the right partners, accounts, and prospects to continue this growth into 2025.”

Financial Summary

Net Sales

Net sales were $5.2 million and $13.1 million for Q3 2024 and YTD 2024, respectively, compared to $3.8 million and $9.8 million for the corresponding periods in 2023. The 38% increase in the quarterly period was due to higher volumes, which increased sales $2.1 million, or 56%, partly offset by a lower average selling price which decreased sales $0.7 million or 18%. The higher volumes were primarily due to improved demand. The 33% increase in the YTD period was due to higher volumes of $4.7 million, or 47%, partly offset by a lower average selling price of $1.4 million, or 14%. The higher volumes were primarily due to improved demand including $0.7 million in sales of SurfLock™ for extended trials in a pulp application with a leading global pulp producer. The lower average selling price during both periods was primarily due to lower manufacturing costs which were partially passed on to customers, as well as product mix.

Gross Profit

Gross profit was $1.7 million and $3.7 million for Q3 2024 and YTD 2024, respectively, compared to $1.2 million and $2.3 million for the corresponding periods in 2023. The increase in both periods was primarily due to higher volumes and lower manufacturing costs, including lower manufacturing depreciation, partially offset by a lower average selling price.

Gross profit as a percentage of sales was 33.3% and 28.5% for Q3 2024 and YTD 2024, respectively, compared to 30.3% and 23.6% in the corresponding periods last year. Gross profit as a percentage of sales adjusted for manufacturing depreciation was 36.8% and 32.7% for Q3 2024 and YTD 2024, respectively, compared to 34.0% and 30.9% for the corresponding periods in 2023. The increase in each period for both metrics was primarily due to lower manufacturing costs, partially offset by a lower average selling price.

Selling, General and Administrative

Selling, general and administrative expenses (SG&A) were $1.5 million and $4.6 million for Q3 2024 and YTD 2024, respectively, compared to $1.2 million and $3.6 million for the corresponding periods in 2023. The increase during the quarterly period was due to an increase in variable based compensation. The increase in the YTD period was due to variable based compensation and asset relocation costs associated with the Company’s manufacturing footprint realignment project.

Research and Development

Research and development (R&D) costs were $0.6 million for Q3 2024 and $1.7 million for YTD 2024, relatively unchanged from prior periods. R&D expense as a percentage of sales was 11% and 13% for Q3 2024 and YTD 2024, respectively, compared to 14% and 18% in the corresponding periods in 2023. The Company’s R&D efforts continue to focus on further enhancing value for our existing products and expanding addressable opportunities.

Adjusted EBITDA1

Adjusted EBITDA was $0.4 million for Q3 2024, a $0.6 million improvement compared to an Adjusted EBITDA loss of $0.2 million in the same period last year. Adjusted EBITDA loss was $1.0 million for YTD 2024, a $0.6 million improvement compared to $1.6 million in the same period last year. The improvement in each period was due to higher gross profit partially offset by higher operating expenses adjusted for non-cash items.

Net Income

Net income was $0.1 million, or $0.00 per common share, for Q3 2024, compared to a net loss of $0.3 million, or $0.00 per common share, in the same period last year. Net loss was $1.2 million, or $0.02 per common share, for YTD 2024, compared to $2.2 million, or $0.04 per common share for the corresponding period in 2023. The $0.4 million improvement in the quarterly period was primarily due to a $0.3 million lower loss from operations and $0.1 million in higher net interest income. The $1.1 million improvement in the YTD period was primarily due to a $0.5 million lower loss from operations, $0.5 million in higher net interest income and a $0.1 million gain on the sale of redundant equipment. The higher net interest income during each period was due to an increase in interest rates on cash and term deposits.

Liquidity

Cash on hand and term deposits were $33.5 million as at September 30, 2024, compared to $33.3 million as at December 31, 2023. The Company purchased and cancelled 178,300 and 504,500 common shares under the NCIB during Q3 2024 and YTD 2024, respectively, for consideration of $0.6 million and $1.7 million.

Notice of Conference Call

EcoSynthetix will host a conference call Tuesday, November 5, at 8:30 am ET to discuss its financial results. Jeff MacDonald, CEO, and Robert Haire, CFO, will co-chair the call. All interested parties can instantly join the call by phone, by following the URL https://emportal.ink/4eA6VKl to easily register and be connected into the conference call automatically or the conventional method by dialling (416) 945- 7677 or (888) 699-1199 with the conference identification of 97178. Please dial in 15 minutes prior to the call to secure a line. A live audio webcast of the conference call will also be available at www.ecosynthetix.com or https://app.webinar.net/7je0kVJkmn6. The presentation will be accompanied by slides, which will be available via the webcast link and the Company’s website. Please connect at least 15 minutes prior to the conference call to ensure adequate time for any software download that may be required to join the webcast.

1Non-IFRS Financial Measures

This press release makes reference to certain non-IFRS measures. These non-IFRS measures are not recognized measures under IFRS, do not have a standardized meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other companies. Rather, these measures are provided as additional information to complement those IFRS measures by providing a further understanding of results of operations of EcoSynthetix from management’s perspective. Accordingly, they should not be considered in isolation nor as a substitute for analysis of the financial information of EcoSynthetix reported under IFRS. The Company uses non-IFRS measures such as Adjusted EBITDA to provide investors with a supplemental measure of operating performance and thus highlight trends in its core business that may not otherwise be apparent when relying solely on IFRS financial measures. Management also believes that securities analysts, investors and other interested parties frequently use non-IFRS measures in the evaluation of issuers. Management also uses non-IFRS measures in order to facilitate operating performance comparisons from period to period, prepare annual operating budgets and assess the Company’s ability to meet its capital expenditure and working capital requirements.

Adjusted EBITDA is not a measure recognized under IFRS and does not have a standardized meaning prescribed by IFRS. See “IFRS and Non-IFRS Measures.” The Company presents Adjusted EBITDA because the Company believes it facilitates investors’ use of operating performance comparisons from period to period and company to company by backing out potential differences caused by variations in capital structures (affecting relative interest expense), the book amortization of intangibles (affecting relative amortization expense) and the age and book value of property and equipment (affecting relative depreciation expense). The Company also presents Adjusted EBITDA because it believes it is frequently used by securities analysts, investors and other interested parties as a measure of financial performance. Adjusted EBITDA as presented herein are not recognized measures under IFRS and should not be considered as an alternative to operating income or net income as measures of operating results or an alternative to cash flows as measures of liquidity. Adjusted EBITDA is defined as consolidated net income (loss) before net interest expense, income taxes, depreciation, amortization, gain or loss on disposals of property, plant and equipment and other non-cash expenses and charges deducted in determining consolidated net income (loss).

The following table reconciles net loss to Adjusted EBITDA loss for the three months and nine months ended September 30, 2024, and September 30, 2023:

|

Three months ended |

Three months ended |

Nine months ended |

Nine months ended |

|

|

Net income (loss) |

143,191 |

(267,947) |

(1,160,042) |

(2,236,423) |

|

Depreciation |

269,945 |

234,516 |

812,577 |

1,021,295 |

|

Share-based compensation |

394,724 |

165,084 |

796,143 |

491,308 |

|

Gain on disposal of property, plant and equipment |

– |

– |

(90,000) |

– |

|

Interest income |

(443,146) |

(320,755) |

(1,309,064) |

(829,891) |

|

Adjusted EBITDA (loss) |

364,714 |

(189,102) |

(950,386) |

(1,553,711) |

About EcoSynthetix Inc. (www.ecosynthetix.com)

EcoSynthetix offers a range of sustainable engineered biopolymers that allow customers to reduce their use of harmful materials, such as formaldehyde and styrene-based chemicals. The Company’s flagship products, DuraBind™, Surflock™, Bioform™, and EcoSphere®, are used to manufacture wood composites, personal care, paper, tissue and packaging products, and enable performance improvements, economic benefits and carbon footprint reduction. The Company is publicly traded on the Toronto Stock Exchange ECO.

Forward-Looking Statements

Certain statements in this Press Release constitute “forward-looking” statements that involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance, objectives or achievements of the Company, or industry results, to be materially different from any future results, performance, objectives or achievements expressed or implied by such forward looking statements. The forward-looking statements in this Press Release include, but are not limited to, statements regarding the Company’s plans to execute its commercial strategy, deliver meaningful growth across all three product categories, convert high-value strategic prospects into customers, and other statements regarding the Company’s plans and expectations in 2024. These statements reflect our current views regarding future events and operating performance and are based on information currently available to us, and speak only as of the date of this Press Release. These forward-looking statements involve a number of risks, uncertainties and assumptions and should not be read as guarantees of future performance or results, and will not necessarily be accurate indications of whether or not such performance or results will be achieved. Those assumptions and risks include, but are not limited to, the Company’s ability to successfully allocate capital as needed and to develop new products, as well as the fact that our results of operations and business outlook are subject to significant risk, volatility and uncertainty. Many factors could cause our actual results, performance or achievements to be materially different from any future results, performance or achievements that may be expressed or implied by such forward-looking statements, including the factors identified in the “Risk Factors” section of the Company’s Annual Information Form dated February 27, 2024. Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described in this Press Release as intended, planned, anticipated, believed, estimated or expected. Unless required by applicable securities law, we do not intend and do not assume any obligation to update these forward-looking statements.

|

EcoSynthetix Inc. |

||

|

Consolidated Balance Sheets |

||

|

(expressed in US dollars) |

||

|

September 30, |

Decemebr 31, |

|

|

Assets |

||

|

Current assets |

||

|

Cash |

5,599,875 |

4,915,445 |

|

Term deposits |

27,897,307 |

28,366,765 |

|

Accounts receivable |

2,247,494 |

1,549,443 |

|

Inventory |

2,232,970 |

3,642,923 |

|

Prepaid expenses |

160,351 |

91,917 |

|

38,137,997 |

38,566,493 |

|

|

Non-current assets |

||

|

Property, plant and equipment |

4,231,339 |

4,268,820 |

|

Total assets |

42,369,336 |

42,835,313 |

|

Liabilities |

||

|

Current liabilities |

||

|

Trade accounts payables and accrued liabilities |

2,714,379 |

1,607,140 |

|

Non-current liabilities |

||

|

Lease liability |

– |

258,278 |

|

Total liabilities |

2,714,379 |

1,865,418 |

|

Shareholders’ Equity |

||

|

Common shares |

489,685,821 |

490,263,781 |

|

Contributed surplus |

10,676,475 |

10,253,411 |

|

Accumulated deficit |

(460,707,339) |

(459,547,297) |

|

Total shareholders’ equity |

39,654,957 |

40,969,895 |

|

Total liabilities and shareholders’ equity |

42,369,336 |

42,835,313 |

|

EcoSynthetix Inc. |

|||||

|

Consolidated Statements of Operations and Comprehensive Income (Loss) |

|||||

|

For the three and nine months ended September 30, 2024 and September 30, 2023 |

|||||

|

(expressed in US dollars) |

|||||

|

Three months ended September 30, |

Nine months ended September 30, |

||||

|

2024 |

2023 |

2024 |

2023 |

||

|

Net sales |

5,233,974 |

3,800,564 |

13,103,754 |

9,816,186 |

|

|

Cost of sales |

3,491,521 |

2,648,579 |

9,368,132 |

7,498,403 |

|

|

Gross profit on sales |

1,742,453 |

1,151,985 |

3,735,622 |

2,317,783 |

|

|

Expenses |

|||||

|

Selling, general and administrative |

1,479,267 |

1,226,127 |

4,642,440 |

3,638,671 |

|

|

Research and development |

563,141 |

514,560 |

1,652,288 |

1,745,426 |

|

|

2,042,408 |

1,740,687 |

6,294,728 |

5,384,097 |

||

|

Loss from operations |

(299,955) |

(588,702) |

(2,559,106) |

(3,066,314) |

|

|

Net interest income |

443,146 |

320,755 |

1,309,064 |

829,891 |

|

|

Gain on disposal of property, plant and equipment |

– |

– |

90,000 |

– |

|

|

443,146 |

320,755 |

1,399,064 |

829,891 |

||

|

Net income (loss) and comprehensive income (loss) |

143,191 |

(267,947) |

(1,160,042) |

(2,236,423) |

|

|

Basic and diluted loss per common share |

0.00 |

(0.00) |

(0.02) |

(0.04) |

|

|

Weighted average number of common shares outstanding |

58,758,013 |

58,711,122 |

58,692,474 |

59,024,253 |

|

|

EcoSynthetix Inc. |

|||||

|

Interim Consolidated Statements of Cash Flows |

|||||

|

For the three and nine months ended September 30, 2024 and September 30, 2023 |

|||||

|

(expressed in US dollars) |

|||||

|

Three months ended September 30, |

Nine months ended September 30, |

||||

|

2024 |

2023 |

2024 |

2023 |

||

|

Cash provided by (used in) |

|||||

|

Operating activities |

|||||

|

Net income (loss) and comprehensive income (loss) |

143,191 |

(267,947) |

(1,160,042) |

(2,236,423) |

|

|

Items not affecting cash |

|||||

|

Depreciation |

269,945 |

234,516 |

812,577 |

1,021,295 |

|

|

Share-based compensation |

394,724 |

165,084 |

796,143 |

491,308 |

|

|

Other |

(12,711) |

69,672 |

(24,368) |

28,520 |

|

|

Gain on disposal of property, plant and equipment |

– |

– |

(90,000) |

– |

|

|

Changes in non-cash working capital |

|||||

|

Accounts receivable |

(776,092) |

(314,010) |

(698,051) |

1,386,447 |

|

|

Inventory |

253,148 |

(638,361) |

1,349,274 |

1,271,071 |

|

|

Prepaid expenses |

10,404 |

(306) |

(68,434) |

(81,808) |

|

|

Trade accounts payables and accrued liabilities |

928,942 |

769,268 |

1,097,867 |

(639,055) |

|

|

Interest on term deposits |

|||||

|

Interest received on term deposits |

772,812 |

371,064 |

1,174,974 |

743,536 |

|

|

Accrued interest on term deposits |

(408,296) |

(261,305) |

(1,205,516) |

(691,502) |

|

|

1,576,067 |

127,675 |

1,984,424 |

1,293,389 |

||

|

Investing activities |

|||||

|

Purchase of property, plant and equipment |

(301,224) |

(154,748) |

(713,939) |

(676,444) |

|

|

Proceeds on disposal of property, plant and equipment |

– |

– |

90,000 |

– |

|

|

Receipts on mature term deposits |

12,500,000 |

13,416,140 |

27,800,000 |

27,093,884 |

|

|

Purchase of term deposits |

(11,500,000) |

(12,500,000) |

(27,300,000) |

(23,982,840) |

|

|

698,776 |

761,392 |

(123,939) |

2,434,600 |

||

|

Financing activities |

|||||

|

Payments made on lease liability |

(77,536) |

(73,158) |

(238,509) |

(214,519) |

|

|

Common shares repurchased |

(550,794) |

(749,239) |

(1,661,498) |

(1,677,206) |

|

|

Exercise of common share options |

– |

– |

710,459 |

26,867 |

|

|

(628,330) |

(822,397) |

(1,189,548) |

(1,864,858) |

||

|

Effect of exchange rate changes on cash |

14,749 |

(92,965) |

13,493 |

(56,665) |

|

|

Change in cash during the period |

1,661,262 |

(26,295) |

684,430 |

1,806,466 |

|

|

Cash – Beginning of period |

3,938,613 |

6,641,367 |

4,915,445 |

4,808,606 |

|

|

Cash – End of period |

5,599,875 |

6,615,072 |

5,599,875 |

6,615,072 |

|

SOURCE EcoSynthetix Inc.

![]() View original content: http://www.newswire.ca/en/releases/archive/November2024/04/c9771.html

View original content: http://www.newswire.ca/en/releases/archive/November2024/04/c9771.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

S&P 500 Edges Lower; Yum China Earnings Top Views

U.S. stocks traded mostly lower toward the end of trading, with the S&P 500 slipping around 0.1% on Monday.

The Dow traded down 0.53% to 41,828.27 while the NASDAQ fell 0.04% to 18,230.05. The S&P 500 also fell, dropping, 0.11% to 5,722.67.

Check This Out: Top 2 Real Estate Stocks You May Want To Dump This Quarter

Leading and Lagging Sectors

Energy shares rose by 1.7% on Friday.

In trading on Friday, utilities shares fell by 1.2%.

Top Headline

Yum China Holdings, Inc. YUMC shares gained more than 8% on Monday after the company reported better-than-expected third-quarter EPS and revenues.

Revenue increased 5% year over year to $3.07 billion, beating the consensus of $3.05 billion. Adjusted EPS of 77 cents surpassed the street view of 68 cents.

Equities Trading UP

- Nuwellis, Inc. NUWE shares shot up 90% to $2.5803 after the company announced preliminary third-quarter financial results.

- Shares of Neurogene Inc. NGNE got a boost, surging 43% to $65.71 after the company entered a securities purchase agreement for a PIPE investment, expected to bring in gross proceeds of $200 million.

- Advent Technologies Holdings, Inc. ADN shares were also up, gaining 62% to $3.07 after the company announced its RHyno project secured a €34.5 million grant from the EU Innovation Fund to advance fuel cell and hydrogen technology.

Equities Trading DOWN

- 1847 Holdings LLC EFSH shares dropped 36% to $0.2974. The company on Friday announced a 1-for-15 reverse stock split of its common shares, effective November 11.

- Shares of The E.W. Scripps Company SSP were down 38% to $2.2000 following downbeat quarterly earnings.

- Centrus Energy Corp. LEU was down, falling 27% to $80.50 after the company announced an offering of $350 million in convertible senior notes due 2030.

Commodities

In commodity news, oil traded up 2.7% to $71.38 while gold traded down 0.1% at $2,748.10.

Silver traded down 0.1% to $32.660 on Monday, while copper rose 1.4% to $4.4340.

Euro zone

European shares closed mostly lower today. The eurozone’s STOXX 600 fell 0.33%, Germany’s DAX fell 0.44% and France’s CAC 40 fell 0.37%. Spain’s IBEX 35 Index fell 0.32%, while London’s FTSE 100 rose 0.29%.

Asia Pacific Markets

Asian markets closed mixed on Monday, with Hong Kong’s Hang Seng Index gaining 0.30%, China’s Shanghai Composite Index gaining 1.17% and India’s BSE Sensex falling 1.18%.

Economics

U.S. factory orders declined by 0.5% from the previous month to $584.2 billion in September compared to a revised 0.8% fall in August.

Now Read This:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Boeing Strike Vote Due, 38% Pay Hike On The Line; Time To 'Declare Victory'

Boeing aims to get back to work as the machinist union tallies striking workers’ votes on Monday. An affirmative vote, supported by the union after reaching a tentative agreement with the Dow Jones manufacturer on Thursday, would end the seven-week strike.

“It is time for our members to lock in these gains and confidently declare victory,” the IAM Union District 751 posted on Thursday. “We believe asking members to stay on strike longer wouldn’t be right as we have achieved so much success.”

↑

X

Short-Term Floor Flips To Short-Term Ceiling; Reddit, Netflix, DocuSign In Focus

The current deal is the first offer that union leaders have endorsed. The IAM leadership did not provide a recommendation for the previous proposal for a 35% pay hike on Oct. 23, which was rejected with 64% of members voting against it.

Boeing’s latest offer includes a 38% general wage increase over four years, which compounds to 43.65% over the lifetime of the agreement. The new offer includes a $12,000 ratification bonus, up from $7,000 for the prior deal.

The latest proposal also increases Boeing’s 401(k) contribution to its union members’ retirement plans. But Boeing did not restore its traditional pension plan that was terminated in 2014, which was a priority for striking workers. Boeing previously stated that its old pension agreement was financially “unsustainable” and removed the plan in 2014 as part of a deal with union machinists to build its 777x jetliner in Washington.

“It’s time we all come back together and focus on rebuilding the business and delivering the world’s best airplanes,” CEO Kelly Ortberg wrote on Nov. 1.

The latest agreement comes after Boeing posted a $6 billion net loss for its Q3 results. The Dow Jones manufacturer is also looking to raise about $21 billion to plug its cash drain.

Boeing Stock

Boeing stock rose slightly on Monday.

BA shares have tumbled about 40% so far in 2024, just behind Intel (INTC) among this year’s worst-performing Dow Jones Industrial Average names.

You can follow Harrison Miller for more stock news and updates on X/Twitter @IBD_Harrison

YOU MAY ALSO LIKE:

Best Growth Stocks To Buy And Watch: See Updates To IBD Stock Lists

Looking For The Next Big Stock Market Winners? Start With These 3 Steps

Join IBD Live And Learn Top Chart Reading And Trading Techniques From Pros

Palantir Stock Pops as Earnings Blow Past Expectations

Palantir Technologies (PLTR) delivered third-quarter earnings that came in well ahead of analysts’ expectations, sending shares higher in extended trading Monday.

The analytics software provider reported revenue of $725.52 million, up 30% year-over-year and above expectations from analysts polled by Visible Alpha. Net income at $143.53 million or 6 cents per share compared to $71.51 million or 3 cents per share a year earlier, beating projections.

The company’s U.S. commercial revenue grew 54% to $179 million. Palantir CEO Alexander C. Karp said the strong results were “driven by unrelenting AI demand.”

The company said it anticipates fourth-quarter revenue of $767 million to $771 million, and raised its full-year forecast to revenue of between $2.805 billion and $2.809 billion, up from $2.742 billion to $2.75 billion previously.

Shares of Palantir jumped over 11% in extended trading following the release. They were up 141% for the year through Monday’s close.

AKITA announces third quarter results and net income of $1.1 million for the quarter

CALGARY, AB , Nov. 4, 2024 /CNW/ – AKITA Drilling Ltd. AKT

AKITA Drilling Ltd. (“AKITA” or the “Company”) announces results for the nine months ended September 30, 2024.

The Company’s net income decreased to $1,106,000 in the third quarter of 2024 from $3,880,000 during the same period of 2023. Adjusted funds flow from operations decreased to $8,435,000 in the third quarter of 2024, from $10,566,000 in the same period of 2023. Results in the third quarter of 2024 were down compared to the same period of 2023 due to reduced operating margin per day in the Company’s Canadian division due to rig mix and reduced activity in the US division.

Net cash from operations increased to $6,458,000 for the three months ended September 30, 2024, compared to $2,308,000 in the same period of 2023, due to the positive change in non-cash working capital. Total debt decreased to $55,551,000 at the end of the third quarter of 2024 from $79,223,000 at the same time in 2023.

In contrast to the continuing decrease in the US industry active rig count, AKITA’s US active rig count increased through the quarter, from 8 rigs at the start of July to 12 active rigs at the end of September, equivalent to 80% utilization compared to a utilization rate of 40% for the industry as a whole at the end of the quarter. A similar increase occurred in Canada where AKITA’s active rig count increased from 9 rigs at the start of the quarter to 12 rigs at the end of the quarter, equivalent to 71% utilization compared to 57% in the Canadian industry at quarter end.

Colin Dease, AKITA’s Chief Executive Officer stated: “We are extremely proud of the debt repayment we have achieved year to date and of our success in reactivating rigs in the US despite challenging market conditions. With 12 active rigs in each division, our activity is now strong and balanced between Canada and the US, and we anticipate a strong fourth quarter for the Company.”

CONSOLIDATED FINANCIAL HIGHLIGHTS

|

($Thousands except per share amounts) |

For the three months ended September 30, |

For the nine months ended September 30, |

|||||||||

|

2024 |

2023 |

Change |

% Change |

2024 |

2023 |

Change |

% Change |

||||

|

Revenue |

45,828 |

54,813 |

(8,985) |

(16 %) |

130,469 |

178,162 |

(47,693) |

(27 %) |

|||

|

Operating and maintenance expenses |

35,727 |

41,387 |

(5,660) |

(14 %) |

99,044 |

128,801 |

(29,757) |

(23 %) |

|||

|

Operating margin |

10,101 |

13,426 |

(3,325) |

(25 %) |

31,425 |

49,361 |

(17,936) |

(36 %) |

|||

|

Margin % |

22 % |

24 % |

(2 %) |

(8 %) |

24 % |

28 % |

(4 %) |

(14 %) |

|||

|

Net cash from operating activities |

6,458 |

2,308 |

4,150 |

180 % |

24,318 |

18,044 |

6,274 |

35 % |

|||

|

Adjusted funds flow from operations(1) |

8,435 |

10,566 |

(2,131) |

(20 %) |

26,080 |

38,346 |

(12,266) |

(32 %) |

|||

|

Per share |

0.21 |

0.27 |

(0.06) |

(22 %) |

0.66 |

0.97 |

(0.31) |

(32 %) |

|||

|

Net income (loss) |

1,106 |

3,880 |

(2,774) |

(71 %) |

3,254 |

19,580 |

(16,326) |

(83 %) |

|||

|

Per share |

0.03 |

0.10 |

(0.07) |

(70 %) |

0.08 |

0.49 |

(0.41) |

(84 %) |

|||

|

Capital expenditures |

7,378 |

4,566 |

2,812 |

62 % |

18,439 |

11,770 |

6,669 |

57 % |

|||

|

Weighted average shares outstanding |

39,734 |

39,650 |

84 |

0 % |

39,728 |

39,650 |

78 |

0 % |

|||

|

Total assets |

251,486 |

267,061 |

(15,575) |

(6 %) |

251,486 |

267,061 |

(15,575) |

(6 %) |

|||

|

Total debt |

55,551 |

79,223 |

(23,672) |

(30 %) |

55,551 |

79,223 |

(23,672) |

(30 %) |

|||

|

(1) See “Non-GAAP and Supplementary Financial Measures” near the end of this release for further detail. |

|||||||||||

Canadian Drilling Division

|

$Thousands except per day amounts |

2024 |

2023 |

Change |

% Change |

2024 |

2023 |

Change |

% Change |

||

|

Revenue Canada |

14,842 |

15,104 |

(262) |

(2 %) |

40,211 |

44,237 |

(4,026) |

(9 %) |

||

|

Revenue from joint venture drilling rigs |

11,038 |

11,099 |

(61) |

(1 %) |

33,185 |

27,990 |

5,195 |

19 % |

||

|

Flow through charges(1) |

(855) |

(3,117) |

2,262 |

73 % |

(2,539) |

(5,126) |

2,587 |

50 % |

||

|

Adjusted revenue Canada(1) |

25,025 |

23,086 |

1,939 |

8 % |

70,857 |

67,101 |

3,756 |

6 % |

||

|

Operating and maintenance |

11,577 |

10,226 |

1,351 |

13 % |

30,057 |

32,621 |

(2,564) |

(8 %) |

||

|

Operating and maintenance expenses from joint venture drilling rigs |

7,989 |

8,641 |

(652) |

(8 %) |

23,250 |

21,015 |

2,235 |

11 % |

||

|

Flow through charges(1) |

(855) |

(3,117) |

2,262 |

73 % |

(2,539) |

(5,126) |

2,587 |

50 % |

||

|

Adjusted operating and maintenance expenses Canada(1) |

18,711 |

15,750 |

2,961 |

19 % |

50,768 |

48,510 |

2,258 |

5 % |

||

|

Adjusted operating margin Canada(1) |

6,314 |

7,336 |

(1,022) |

(14 %) |

20,089 |

18,591 |

1,498 |

8 % |

||

|

Margin %(1) |

25 % |

32 % |

(7 %) |

(22 %) |

28 % |

28 % |

0 % |

0 % |

||

|

Operating days |

698 |

583 |

115 |

20 % |

1,819 |

1,774 |

45 |

3 % |

||

|

Adjusted revenue per operating day(1) |

35,852 |

39,599 |

(3,747) |

(9 %) |

38,954 |

37,825 |

1,129 |

3 % |

||

|

Adjusted operating and maintenance |

26,807 |

27,015 |

(208) |

(1 %) |

27,910 |

27,345 |

565 |

2 % |

||

|

Adjusted operating margin per operating day(1) |

9,045 |

12,584 |

(3,539) |

(28 %) |

11,044 |

10,480 |

564 |

5 % |

||

|

Utilization(1) |

38 % |

32 % |

6 % |

19 % |

33 % |

32 % |

1 % |

3 % |

||

|

Rig count |

17 |

20 |

(3) |

(15 %) |

17 |

20 |

(3) |

(15 %) |

||

|

(1) See “Non-GAAP and Supplementary Financial Measures” near the end of this release for further detail. |

||||||||||

During the third quarter of 2024, AKITA achieved 698 operating days in Canada, which corresponds to a utilization rate of 38%, compared to 32% (583 days) in the third quarter of 2023, and compared to an industry average of 49%. AKITA’s single and double rigs had a combined increase of 184 operating days in the third quarter of 2024 when compared to the same period in 2023. This was offset by fewer operating days for AKITA’s oilsands triple rigs in the quarter. AKITA lagged industry utilization in the quarter as the Company’s ramp up after spring breakup was pushed further into the quarter than expected due to operator delays. At the end of the third quarter 2024, AKITA was at 71% utilization compared to industry utilization of 57%. Although activity increased in the quarter when compared to the prior year, the adjusted operating margin in Canada decreased to $6,314,000 in 2024 compared to $7,336,000 in the same period of 2023.

Adjusted revenue per operating day led to the decrease in adjusted operating margin in Canada, despite increased activity. In the third quarter of 2024, adjusted revenue per day decreased to $35,852 from $39,599 in the third quarter of 2023. This decline resulted from a change in the mix of rigs operating, with a higher concentration of high-margin rigs working in the third quarter of 2023. Adjusted operating and maintenance expenses per operating day decreased slightly to $26,807 in the third quarter of 2024, from $27,015 in the same period of 2023. This decrease, similar to the change in revenue per day, is the result of the change in rig mix but is offset by escalating costs including labour, maintenance and other ancillary costs.

United States Drilling Division

|

For the three months ended September 30, |

For the nine months ended September 30, |

|||||||||

|

$Thousands except per day amounts |

2024 |

2023 |

Change |

% Change |

2024 |

2023 |

Change |

% Change |

||

|

Revenue US |

30,986 |

39,709 |

(8,723) |

(22 %) |

90,258 |

133,925 |

(43,667) |

(33 %) |

||

|

Flow through charges(1) |

(3,310) |

(4,355) |

1,045 |

24 % |

(10,652) |

(13,427) |

2,775 |

21 % |

||

|

Adjusted revenue US(1) |

27,676 |

35,354 |

(7,678) |

(22 %) |

79,606 |

120,498 |

(40,892) |

(34 %) |

||

|

Operating and maintenance expenses US |

24,150 |

31,161 |

(7,011) |

(22 %) |

68,987 |

96,180 |

(27,193) |

(28 %) |

||

|

Flow through charges(1) |

(3,310) |

(4,355) |

1,045 |

24 % |

(10,652) |

(13,427) |

2,775 |

21 % |

||

|

Adjusted operating and maintenance expenses US(1) |

20,840 |

26,806 |

(5,966) |

(22 %) |

58,335 |

82,753 |

(24,418) |

(30 %) |

||

|

Adjusted operating margin US(1) |

6,836 |

8,548 |

(1,712) |

(20 %) |

21,271 |

37,745 |

(16,474) |

(44 %) |

||

|

Margin %(1) |

25 % |

24 % |

1 % |

4 % |

27 % |

31 % |

(4 %) |

(13 %) |

||

|

Operating days |

713 |

908 |

(195) |

(21 %) |

2,056 |

3,041 |

(985) |

(32 %) |

||

|

Adjusted revenue per operating day(1) |

38,816 |

38,936 |

(120) |

(0 %) |

38,719 |

39,624 |

(905) |

(2 %) |

||

|

Adjusted operating and maintenance expenses per operating day(1) |

29,229 |

29,522 |

(293) |

(1 %) |

28,373 |

27,212 |

1,161 |

4 % |

||

|

Adjusted operating margin per operating day(1) |

9,587 |

9,414 |

173 |

2 % |

10,346 |

12,412 |

(2,066) |

(17 %) |

||

|

Utilization(1) |

52 % |

66 % |

(14 %) |

(21 %) |

50 % |

74 % |

(24 %) |

(32 %) |

||

|

Rig count |

15 |

15 |

– |

0 % |

15 |

15 |

– |

0 % |

||

|

(1) See “Non-GAAP and Supplementary Financial Measures” near the end of this release for further detail. |

||||||||||

In the US, the active rig count declined from 650 average active rigs in the third quarter of 2023, to 601 active rigs at the start of 2024 and then further declined to 566 active rigs at the end of the third quarter of 2024. AKITA’s active rig count initially followed a similar pattern, dropping from an average of 12 active rigs in the third quarter of 2023 to an average of 9.5 active rigs in the third quarter of 2024, however ending the quarter at 12 active rigs. Operating days decreased from 908 operating days in the third quarter of 2023 to 713 operating days in the third quarter of 2024.

This reduction in activity resulted in adjusted operating margin decreasing to $6,836,000 in the third quarter of 2024, from $8,548,000 in the same period of 2023.

Adjusted operating and maintenance expense per operating day decreased slightly to $29,229 per day in the third quarter of 2024, from $29,522 in the third quarter of 2023, changing 1% quarter-over-quarter despite increasing costs throughout the industry.

Adjusted operating margin per operating day increased 2% for third quarter of 2024, compared to the same period for 2023. This is a combination of a slight decrease in adjusted revenue per operating day, offset by a larger decrease in adjusted operating margin per operating day.

FURTHER INFORMATION

This news release shall be used as preparation for reading the full disclosure documents. AKITA’s unaudited interim condensed consolidated financial statements and management’s discussion and analysis for the quarter ended September 30, 2024 will be available on the AKITA website (www.akita-drilling.com) or via SEDAR (www.sedar.com) or can be requested in print from the Company.

Non-GAAP and Supplementary Financial Measures

Non-GAAP Financial Measures

Adjusted Revenue and Adjusted Operating and Maintenance Expenses

Revenue and operating and maintenance expenses in AKITA’s Canadian operating segment include revenue and expenses from AKITA’s wholly-owned drilling rigs as well as its share of joint venture revenue and expenses.

Excluded from the revenue and expenses in AKITA’s Canadian and US operating segment are flow through charges that are billed to operators and repaid to the Company. The volume and timing of the flow through charges can artificially impact the operational per day analysis and as a result management and certain investors may find the comparability between periods is improved when these flow through charges are excluded from revenue per day and operating and maintenance expense per day. The flow through charges do not have any impact on the Company’s net earnings as the amounts offset each other.

Adjusted Funds Flow from Operations

Adjusted funds flow from operations is not a recognized GAAP measure under IFRS and readers should note that AKITA’s method of determining adjusted funds flow from operations may differ from methods used by other companies, and includes cash flow from operating activities before working capital changes, equity income from joint ventures, and income tax amounts paid or recovered during the period. Nonetheless, management and certain investors may find adjusted funds flow from operations to be a useful measurement to evaluate the Company’s operating results at year-end and within each year, since the seasonal nature of the business affects the comparability of non-cash working capital changes both between and within periods.

|

$Thousands |

For the three months ended |

For the nine months ended |

||

|

2024 |

2023 |

2024 |

2023 |

|

|

Net cash from operating activities |

6,458 |

2,308 |

24,318 |

18,044 |

|

Interest paid |

935 |

1,340 |

3,320 |

5,049 |

|

Interest expense |

(984) |

(1,393) |

(3,467) |

(5,208) |

|

Post-employment benefits paid |

78 |

78 |

236 |

243 |

|

Equity income from joint ventures |

2,918 |

2,361 |

9,592 |

6,696 |

|

Change in non-cash working capital |

(970) |

5,872 |

(7,919) |

13,522 |

|

Adjusted funds flow from operations |

8,435 |

10,566 |

26,080 |

38,346 |

Non-GAAP Ratios

“Adjusted funds flow from operations per share” is calculated on the same basis as net loss per class A and class B share basic and diluted, utilizing the basic and diluted weighted average number of class A and class B shares outstanding during the periods presented.

“Adjusted revenue per operating day” may be useful to analysts, investors, other interested parties and management as a measure of pricing strength and is calculated by dividing adjusted revenue by the number of operating days for the period.

“Adjusted operating and maintenance expenses per operating day” may be useful to analysts, investors, other interested parties and management as it demonstrates a degree of cost control and provides a proxy for specific inflation rates incurred by the Company

FORWARD-LOOKING INFORMATION:

Certain statements contained in this news release may constitute forward-looking information. Forward-looking information is often, but not always, identified by the use of words such as “anticipate”, “plan”, “estimate”, “expect”, “may”, “will”, “intend”, “should”, and similar expressions. In particular, forward-looking information in this news release includes, but is not limited to, references to the outlook for the drilling industry (including activity levels and day rates), the Company’s relationships and customers and vendors, advantages associated with the percentage of pad drilling rigs in the Company’s Canadian drilling fleet, the renewal of drilling contracts, and debt repayment.

Forward-looking information involves known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking information.

Although the Company believes that the expectations reflected in the forward-looking information are reasonable based on the information available on the date such statements are made and processes used to prepare the information, such statements are not guarantees of future performance and no assurance can be given that these expectations will prove to be correct. By their nature, these forward-looking statements involve numerous assumptions, inherent risks and uncertainties, both general and specific, and therefore carry the risk that the predictions and other forward-looking statements will not be realized. Readers of this news release are cautioned not to place undue reliance on these statements as a number of important factors could cause actual future results to differ materially from the plans, objectives, estimates and intentions expressed in such forward-looking statements.

The Company’s actual results could differ materially from those anticipated in these forward-looking statements as a result of, among other things, prevailing economic conditions; the level of exploration and development activity carried on by AKITA’s customers, world crude oil prices and North American natural gas prices; global liquefied natural gas (LNG) demand, weather, access to capital markets; and government policies. We caution that the foregoing list of factors is not exhaustive and that while relying on forward-looking statements to make decisions with respect to AKITA, investors and others should carefully consider the foregoing factors, as well as other uncertainties and events, prior to making a decision to invest in AKITA. Except where required by law, the Company does not undertake to update any forward-looking statement, whether written or oral, that may be made from time to time by it or on its behalf

SOURCE AKITA Drilling Ltd.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/04/c4626.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2024/04/c4626.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Market Whales and Their Recent Bets on DVN Options

Deep-pocketed investors have adopted a bearish approach towards Devon Energy DVN, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in DVN usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 17 extraordinary options activities for Devon Energy. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 41% leaning bullish and 47% bearish. Among these notable options, 9 are puts, totaling $1,291,495, and 8 are calls, amounting to $361,816.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $30.0 to $47.5 for Devon Energy over the recent three months.

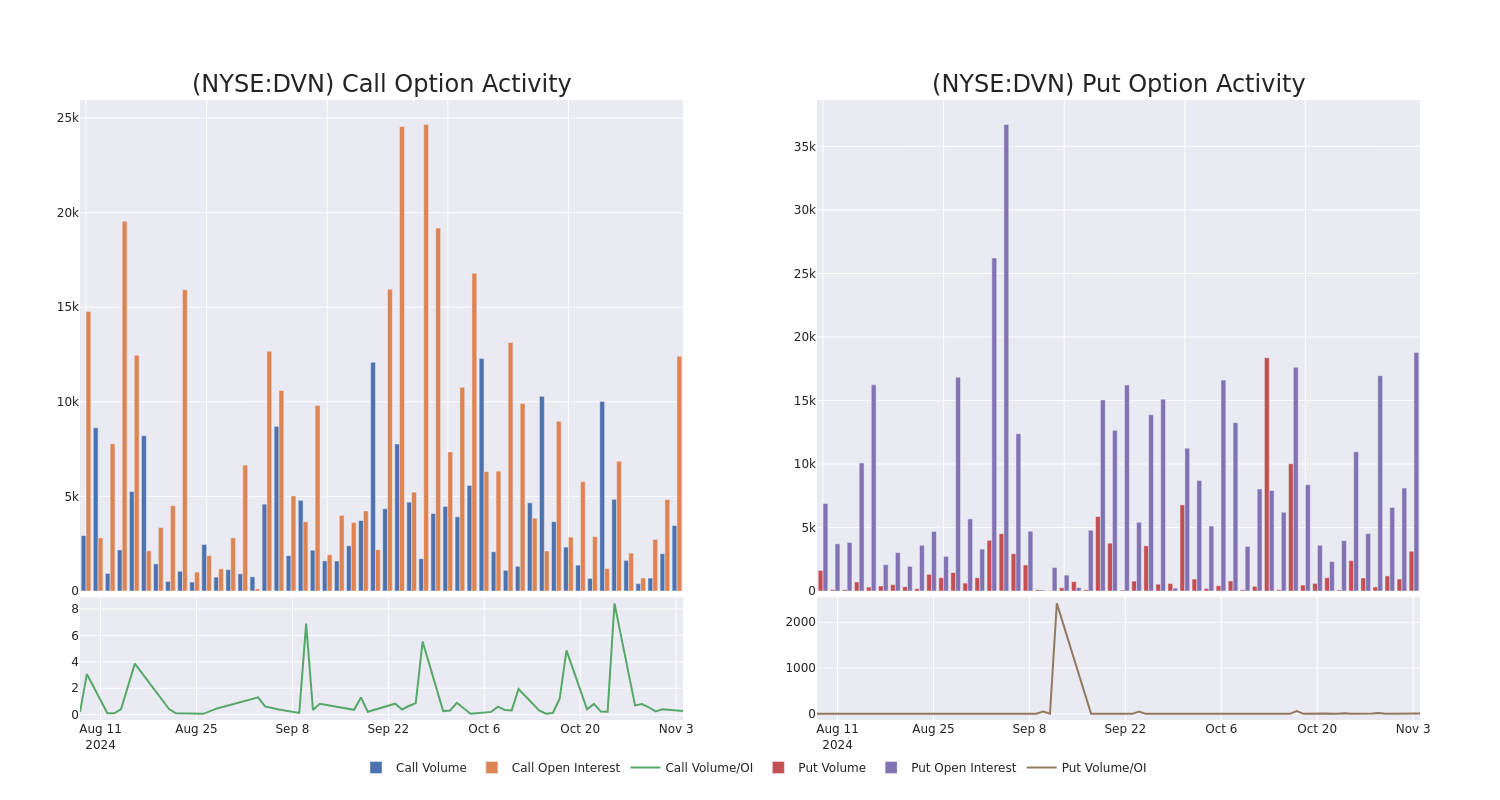

Insights into Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Devon Energy’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Devon Energy’s whale activity within a strike price range from $30.0 to $47.5 in the last 30 days.

Devon Energy Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DVN | PUT | TRADE | BULLISH | 01/15/27 | $8.4 | $6.35 | $6.5 | $37.50 | $487.5K | 113 | 750 |

| DVN | PUT | SWEEP | BEARISH | 04/17/25 | $7.3 | $7.2 | $7.3 | $45.00 | $218.2K | 791 | 320 |

| DVN | PUT | TRADE | BULLISH | 06/20/25 | $4.85 | $4.6 | $4.7 | $40.00 | $166.8K | 4.3K | 545 |

| DVN | PUT | SWEEP | BEARISH | 06/20/25 | $6.1 | $6.0 | $6.1 | $42.50 | $162.8K | 7.5K | 268 |

| DVN | PUT | TRADE | BULLISH | 06/20/25 | $4.75 | $4.65 | $4.65 | $40.00 | $88.3K | 4.3K | 190 |

About Devon Energy

Devon Energy is an oil and gas producer with acreage in several top US shale plays. While roughly two thirds of its production comes from the Permian Basin, it also holds a meaningful presence in the Anadarko, Eagle Ford, and Bakken basins. At the end of 2023, Devon reported net proved reserves of 1.8 billion barrels of oil equivalent. Net production averaged roughly 658,000 barrels of oil equivalent per day in 2023 at a ratio of 73% oil and natural gas liquids and 27% natural gas.

After a thorough review of the options trading surrounding Devon Energy, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is Devon Energy Standing Right Now?

- Currently trading with a volume of 4,525,218, the DVN’s price is up by 2.39%, now at $39.23.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 1 days.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Devon Energy, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

AI Stock Astera Labs Jumps On Beat-And-Raise Third-Quarter Report

Astera Labs (ALAB) late Monday beat Wall Street’s targets for the third quarter and with the chipmaker’s guidance for the current period. Astera Labs stock rocketed in extended trading.

The Santa Clara, Calif.-based company earned an adjusted 23 cents a share on sales of $113.1 million in the September quarter. Analysts polled by FactSet had expected earnings of 17 cents a share on sales of $97.5 million.

↑

X

The Chip War With China Is Heating Up. Who’s Winning?

Astera Lab’s revenue rose 47% from the June quarter and 206% from the September quarter last year.

“Our business has now entered a new growth phase with multiple product families ramping across AI platforms based upon both third-party GPUs (graphics processing units) and internally developed AI accelerators,” Chief Executive Jitendra Mohan said in a news release.

He added, “With (an) expanding product portfolio including the new Scorpio Fabric Switches, we are cementing our position as a critical part of AI connectivity infrastructure, delivering increased value to our hyperscaler customers, and unlocking additional multiyear growth trajectories for Astera.”

Astera Labs Stock Blasts Off

In after-hours trading on the stock market today, Astera Labs stock rose more than 18% to 82.76. During the regular session Monday, Astera Labs stock fell 4.1% to close at 69.65.

For the current quarter, Astera Labs expects to earn an adjusted 26 cents a share on sales of $128 million. That’s based on the midpoint of its guidance. Wall Street was modeling earnings of 18 cents a share on sales of $107.9 million in the fourth quarter.

Astera Labs makes connectivity chips for cloud and artificial intelligence data centers. Astera’s products are focused on high-speed data transfer and overall system bandwidth expansion in data center computing systems. Its products address critical bottlenecks in AI infrastructure.

Astera’s products span multiple form factors including integrated circuits, boards and modules that are built upon a software architecture called Cosmos. Cosmos is an acronym for its Connectivity System Management and Optimization Software.

Astera Labs started trading on March 20 at an initial public offering price of 36. It notched a record high of 95.21 on March 26 before retreating.

Follow Patrick Seitz on X, formerly Twitter, at @IBD_PSeitz for more stories on consumer technology, software and semiconductor stocks.

YOU MAY ALSO LIKE:

Will Super Micro Stock Get Delisted? Dell Stock Gains Amid Uncertainty.

Is AMD Stock A Buy After Its Q3 Earnings Report?

IBD Digital: Unlock IBD’s Premium Stock Lists, Tools And Analysis Today

Find Winning Stocks With MarketSurge Pattern Recognition & Custom Screens